Sending Money Abroad Made Easy

Transferring money overseas shouldn't be a headache. This list presents eight of the best ways to transfer money overseas in 2025, streamlining the process for South African businesses and individuals. Discover which platform best suits your needs, whether you're a small export company seeking the best way to transfer money overseas, a CFO prioritizing FX transparency, or a BPO managing international payroll. We compare Zaro, Wise, Xoom, OFX, WorldRemit, Revolut, Western Union, and Remitly, highlighting their pros and cons to simplify your international money transfers.

1. Zaro: Revolutionizing International Payments for South African Businesses

For South African businesses navigating the complexities of international payments, finding the best way to transfer money overseas is crucial for success. Zaro emerges as a leading contender, offering a streamlined and cost-effective solution specifically designed for the South African market. This platform promises to simplify cross-border transactions, minimize fees, and enhance financial control for SMEs, CFOs, and export-driven companies. Whether you're paying international suppliers, repatriating export revenue, or settling contractor invoices, Zaro aims to make the process faster, cheaper, and more transparent.

Zaro distinguishes itself by eliminating traditional banking pain points associated with international transfers. By leveraging real exchange rates with zero spread and abolishing SWIFT fees, Zaro drastically reduces the cost of sending and receiving money across borders. Compared to traditional banks that often incorporate hidden markups and hefty transaction fees, Zaro provides significant cost savings, directly impacting your bottom line. This is particularly beneficial for South African businesses operating on tight margins in the competitive global marketplace.

One of Zaro's key strengths lies in its streamlined Know Your Business (KYB) verification process. This ensures secure and efficient onboarding, allowing companies to quickly set up and fund their ZAR and USD accounts via simple bank transfers. Once onboard, users enjoy transparent, real-time spot exchange rates with no surprise fees, simplifying financial planning and forecasting. The platform also offers enterprise-grade security features like multi-user access and customizable team permissions, providing enhanced control and governance over financial flows. Furthermore, Zaro-issued debit cards in both ZAR and USD allow businesses to make direct foreign currency purchases at competitive exchange rates, bypassing inflated FX charges often levied by traditional financial institutions.

Pros:

- Zero spread on currency exchange: Trade at true spot rates with no hidden markup or fees.

- No SWIFT or transactional fees: Significantly lowering cross-border payment costs compared to traditional banks.

- Enterprise-grade controls: Including multi-user access and customizable permissions for robust team governance.

- Secure and streamlined onboarding: Via KYB verification ensuring compliance and peace of mind.

- Issued debit cards in ZAR and USD: Providing direct access to low-cost foreign exchange when making international purchases.

Cons:

- South Africa focus: Currently tailored for South African businesses, limiting applicability for companies outside this region.

- Limited pricing transparency: Details beyond zero fees and no spread are not readily available, requiring contact for specific pricing tiers.

While Zaro's focus on transparency is commendable, more detailed pricing information on their website would further enhance user experience. Potential users may need to book a call to clarify any additional costs or service tiers. However, the benefits of zero spread, no SWIFT fees, and streamlined account management make Zaro a compelling option for South African businesses looking to optimize their international payment processes. If you're a South African SME, CFO, or involved in export-driven activities, exploring Zaro (https://www.usezaro.com) could be a valuable step towards achieving more efficient and cost-effective cross-border transactions.

2. Wise (formerly TransferWise)

When searching for the best way to transfer money overseas, especially for businesses in South Africa, Wise consistently ranks high on the list. Wise offers a compelling combination of transparent pricing, speed, and convenience that makes it a popular choice for individuals and businesses alike. It's particularly attractive for South African SMEs, executives, CFOs focused on FX transparency, and BPOs operating within the country.

Wise distinguishes itself by using the mid-market exchange rate – the same rate you see on Google or Reuters – without any markup. This ensures you get the fairest possible exchange rate when transferring money. Instead of hiding fees within the exchange rate, Wise charges a transparent, upfront fee, typically between 0.5% and 1.5% of the transfer amount, depending on the currency corridor. This transparency is a significant advantage over traditional banks, which often obscure their fees within less favourable exchange rates, making it difficult to understand the true cost.

For South African businesses managing international payments, Wise's multi-currency account feature can be a game-changer. This feature allows businesses to hold and manage money in over 50 different currencies, simplifying international transactions and reducing the need for multiple bank accounts. You can pay invoices in local currencies, receive payments like a local, and avoid costly currency conversions. This is particularly useful for South African export companies dealing with clients across multiple regions or BPOs managing payroll in various currencies.

While Wise shines with smaller to medium-sized transfers, it might not be the optimal solution for very large transfers (over $10,000 USD equivalent in ZAR), where specialized FX brokers might offer better rates. Transfer speeds, although typically fast (80% within 24 hours), can vary depending on the specific countries and payment methods involved. While coverage is broad (transfers to 160+ countries), it's not universally available, and cash pickup is not generally an option. However, for the majority of business needs, particularly for South African businesses seeking efficient and cost-effective cross-border payments, Wise presents a strong solution.

Implementation Tip: Setting up a Wise account is straightforward. You'll need to provide some standard identification documentation for verification purposes, similar to opening a bank account. Once verified, you can start sending and receiving money internationally. The user-friendly mobile app and website make managing transactions and tracking transfers easy and convenient.

Wise in Comparison: While other online money transfer services exist, Wise often stands out due to its transparent fee structure and the use of the mid-market exchange rate. This combination often results in lower overall costs compared to traditional banks and some other online providers.

Website: https://wise.com

3. Xoom (PayPal service)

Xoom, a service offered by PayPal, presents a convenient option for transferring money overseas, especially for businesses in South Africa dealing with international transactions. Its speed and varied delivery options make it a compelling choice for certain use cases, particularly for those already integrated into the PayPal ecosystem. This makes it worth considering when looking for the best way to transfer money overseas. Think of scenarios where you need to quickly pay a supplier in India or send funds to a contractor in the Philippines; Xoom's established network within these remittance corridors allows for fast and efficient transfers. For South African exporters dealing with clients in Latin America, Xoom’s strong presence in that region could prove beneficial.

Xoom offers multiple delivery options, including bank deposits, cash pickups, and even mobile reloads in certain regions. This flexibility can be particularly attractive for businesses that need to cater to different recipient preferences. For example, a BPO business outsourcing to South Africa might find the mobile reload option useful for quickly distributing payments to employees. While Xoom boasts fast transfer speeds, often within minutes, it’s important to be aware that the actual transfer time can vary based on the destination country, the chosen delivery method, and any required security checks.

While the integration with existing PayPal accounts is a plus for users already familiar with the platform, South African CFOs focused on FX transparency should be aware that Xoom's exchange rates might not be as competitive as those offered by specialized money transfer services like Wise. This is a crucial factor to consider when evaluating the overall cost of the transfer. Similarly, while Xoom serves over 160 countries, transfer limits can be restrictive depending on the specific corridor. South African businesses handling larger transactions should carefully review these limits to avoid potential delays or complications.

Pros:

- Very fast transfer speeds, often within minutes.

- Multiple payout options, including cash pickup and mobile reload.

- Good coverage in major remittance corridors, particularly beneficial for businesses dealing with Latin America, India, and the Philippines.

- Convenient PayPal integration for existing users.

Cons:

- Higher fees than some specialized money transfer services. Less favorable exchange rates compared to competitors.

- Transfer limits can be restrictive in certain corridors.

- Customer service reputation is mixed.

Website: https://www.xoom.com

For South African businesses looking for the best way to transfer money overseas, Xoom can be a viable option for smaller, time-sensitive transfers, particularly within its stronger remittance corridors. However, larger businesses or those requiring the most competitive exchange rates should compare Xoom's offering with other services before making a decision. Always factor in the fees and exchange rates to ensure you are getting the best overall value for your international money transfer needs.

4. OFX

When it comes to transferring substantial sums of money overseas, especially for business purposes, OFX emerges as a leading contender. This global money transfer service specializes in larger transfers, making it an excellent option for South African businesses engaged in international trade, property investments abroad, or regular payments to overseas suppliers. OFX distinguishes itself by offering highly competitive exchange rates, particularly for transfers exceeding ZAR 75,000 (approximately USD 5,000), which is a common scenario for many South African businesses operating internationally. This focus on larger transactions makes OFX a compelling choice for those seeking the best way to transfer money overseas while minimizing costs.

For South African SMEs, CFOs focused on FX transparency, and BPO businesses dealing with cross-border payments, OFX's transparent pricing model and dedicated customer support are particularly valuable. While they don't charge transfer fees on most transactions, their revenue is generated through the exchange rate margin. This model incentivizes them to offer competitive rates, particularly on larger amounts. The absence of a maximum transfer limit provides further flexibility for businesses handling substantial international transactions. Moreover, their 24/7 customer support, coupled with dedicated account managers for larger clients, ensures personalized assistance and prompt query resolution, crucial for time-sensitive international payments.

OFX provides a suite of advanced tools tailored for businesses, including risk management options to help mitigate the impact of currency fluctuations. Features such as regular transfer scheduling streamline recurring payments, simplifying financial administration for South African businesses dealing with international suppliers or payroll. Compared to banks or some other transfer services that might impose hefty fees and less favourable exchange rates, especially for larger amounts, OFX stands out as a cost-effective and efficient solution. However, it's important to be aware that OFX might not be the most economical choice for smaller transfers under ZAR 75,000. Additionally, they don't offer cash pickup or mobile wallet delivery options, and transfers typically take 1-2 business days to complete.

Setting up an account with OFX is straightforward and involves providing necessary identification and business documentation for verification. Once your account is activated, you can initiate transfers online or through their mobile app, providing recipient details and the transfer amount. The platform provides real-time exchange rate quotes and allows you to lock in favourable rates. For South African businesses looking for a reliable, cost-effective, and feature-rich solution for larger international transfers, OFX offers a robust platform with excellent customer support and tailored business tools. You can explore their services and offerings further by visiting their website: https://www.ofx.com

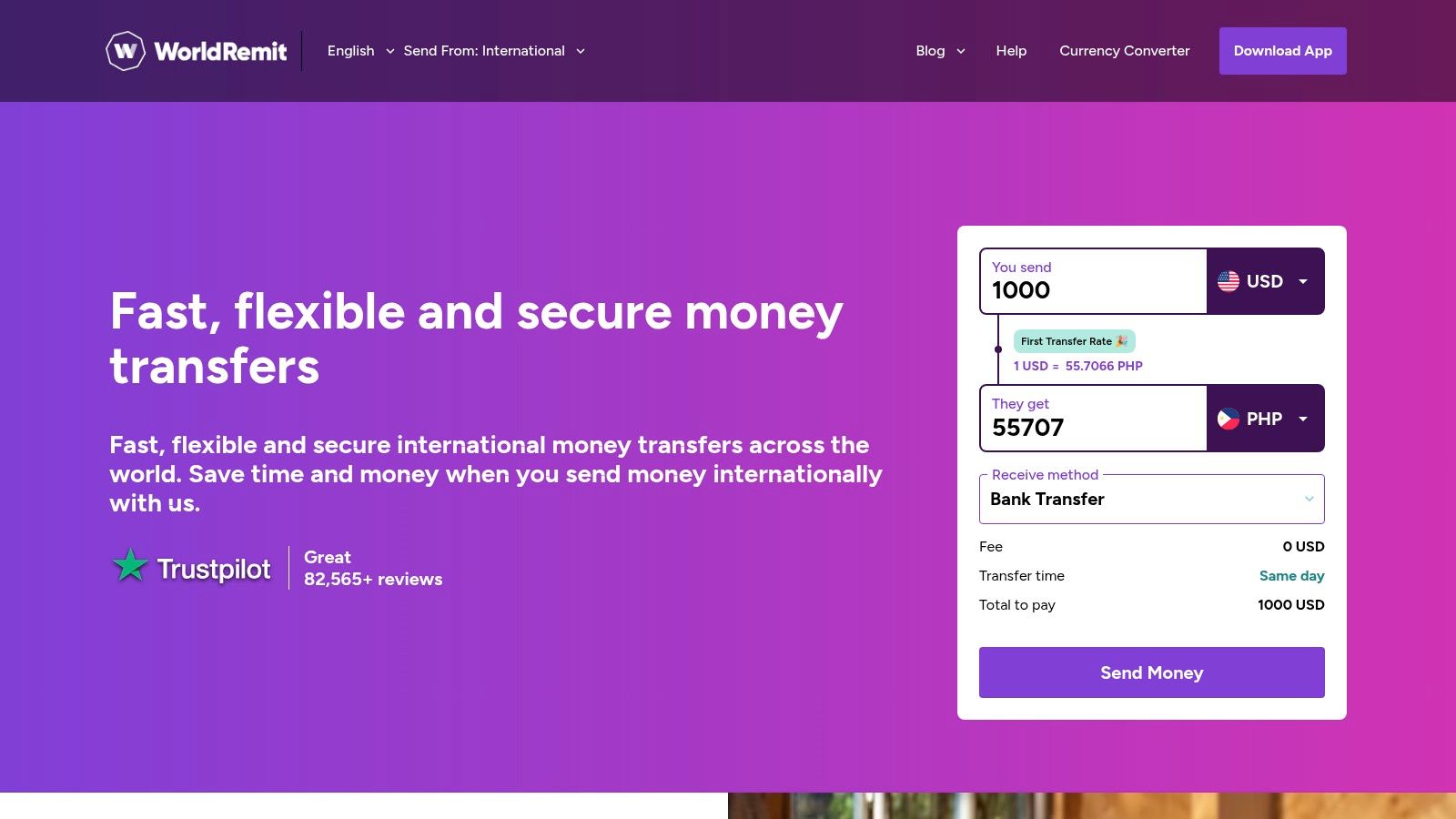

5. WorldRemit

WorldRemit offers a convenient way to transfer money overseas, especially for smaller remittances to various destinations. It's a particularly attractive option for South African businesses with operations or suppliers in Africa and Asia, thanks to its extensive network and focus on these regions. Whether you need to pay freelancers in Nigeria, send funds to a partner in India, or cover expenses for a project in Kenya, WorldRemit's diverse payout options make it a valuable tool for managing cross-border transactions. This service earns its place on our list due to its speed, accessibility, and focus on mobile money transfers, making it a practical solution for reaching recipients even in areas with limited banking infrastructure.

WorldRemit distinguishes itself through its wide array of payout methods. Beyond standard bank deposits, users can send money via mobile money platforms like M-Pesa and Airtel Money, facilitating quick and easy access for recipients. This is especially crucial in many African and Asian markets where mobile money penetration is significantly higher than traditional banking. Additionally, airtime top-up and cash pickup options cater to the needs of unbanked individuals, broadening the reach of your transfers. For South African businesses dealing with suppliers or partners in these regions, this flexibility proves invaluable. WorldRemit’s fixed fee structure, based on the transfer amount, destination, and delivery method, offers transparency, although it’s important to note that exchange rates include a markup.

While WorldRemit shines with its speed and extensive mobile money network, particularly in remittance-heavy corridors, some limitations exist. The exchange rates offered are less favorable than the mid-market rate, which can impact the overall cost, especially for regular or larger transfers. The fees, while fixed, can accumulate for smaller transactions. Furthermore, WorldRemit imposes relatively low maximum transfer limits, which may not be suitable for larger business payments. Finally, some users have reported slower customer service response times during peak periods.

Implementation Tips for South African Businesses:

- Verify recipient details carefully: Ensure the recipient's mobile money account details or other payout information are accurate to avoid delays or failed transfers.

- Compare exchange rates and fees: While WorldRemit provides a fixed fee structure, compare the overall cost, including the exchange rate markup, with other services before initiating a transfer. This is particularly important for South African businesses sensitive to fluctuating FX rates.

- Consider transfer limits: Be aware of the maximum transfer limits and plan accordingly if your transaction exceeds them. You might need to break down larger payments into smaller ones or explore alternative transfer methods.

- Factor in transfer speeds: While WorldRemit boasts fast transfer speeds, especially for mobile money, consider potential delays during peak periods. Plan your transfers in advance to avoid any disruptions to your business operations.

WorldRemit provides a practical solution for South African businesses needing to transfer money overseas, especially to Africa and Asia. Its strength lies in its mobile money partnerships, speed, and diverse payout options, making it an excellent choice for reaching recipients, even those without bank accounts. However, be mindful of the exchange rate markup and transfer limits when planning your international transactions. You can explore their services further on their website: https://www.worldremit.com

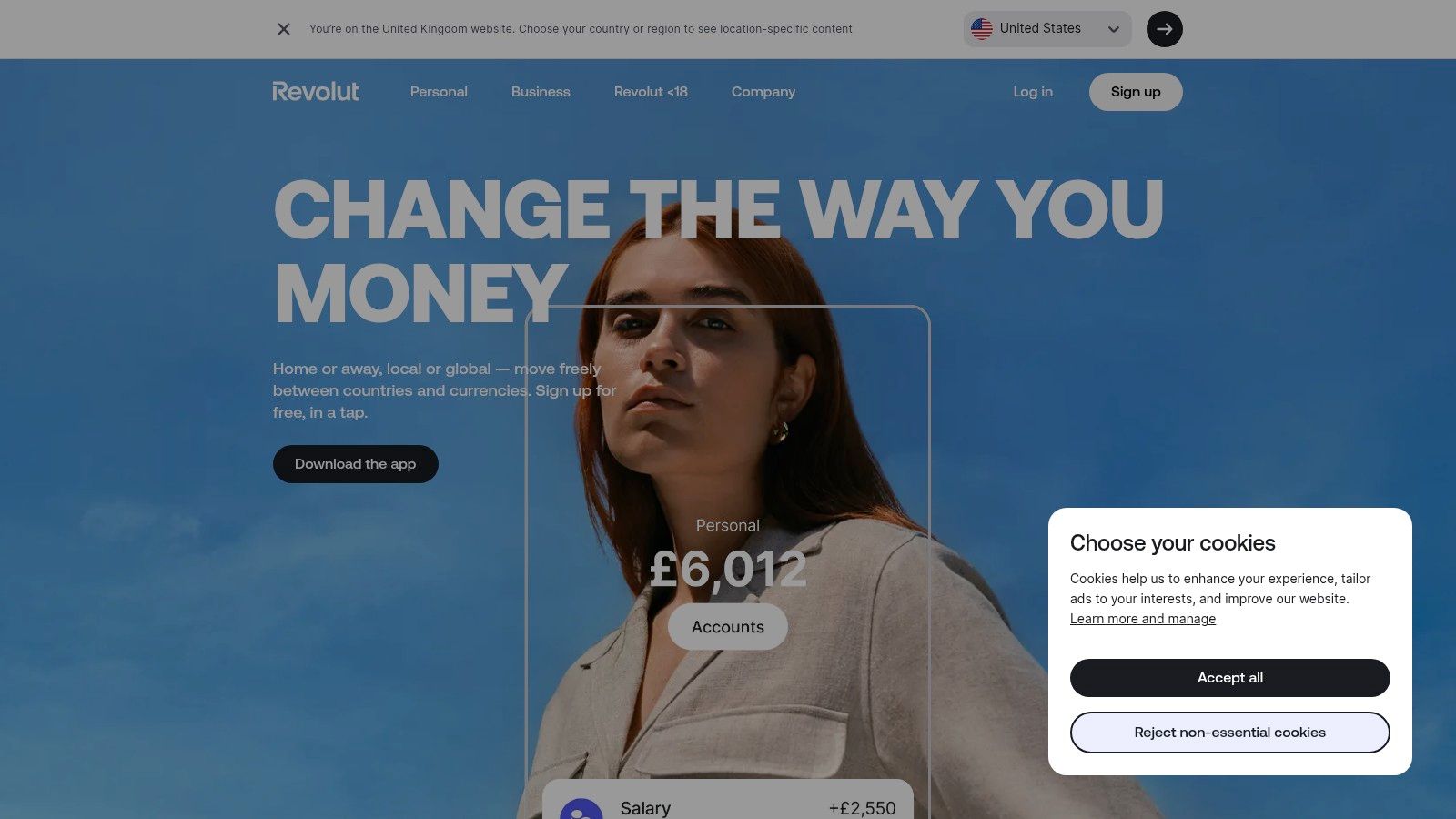

6. Revolut

Revolut offers a compelling digital banking alternative for South African businesses looking for a streamlined way to transfer money overseas. It integrates international money transfers seamlessly into its broader financial services platform, making it a potentially valuable tool for managing various aspects of your finances, especially if you regularly transact internationally. One of its major selling points is fee-free currency exchange at the interbank rate on weekdays, up to certain limits depending on your chosen plan. This can represent significant savings compared to traditional banks, particularly for small and medium-sized export companies, business owners, executives, and CFOs in South Africa seeking FX transparency. Revolut operates in over 35 countries and allows transfers to more than 150 countries, offering valuable flexibility for businesses with global reach, including BPO businesses that outsource to South Africa. For those needing rapid transactions, instant transfers are available between Revolut users.

Revolut's multi-currency accounts, available with both physical and virtual debit cards, simplify managing funds in different currencies, a significant advantage for businesses operating across borders. This feature is particularly beneficial for handling supplier payments and receiving payments from international clients, streamlining operations and reducing the complexities often associated with international transactions. The user-friendly mobile app further enhances its appeal, providing budgeting features and convenient access to your financial information on the go. This all-in-one financial solution also offers additional services such as crypto trading and savings accounts, making it a potentially centralized platform for managing your business finances.

While Revolut provides a compelling solution for many, it's essential to consider the potential drawbacks. Weekend transfers incur a markup of 0.5-1.5% on the exchange rate for standard accounts, which can erode some of the cost savings achieved during weekday transfers. The monthly limits on fee-free exchanges for standard accounts might be restrictive for businesses with high transfer volumes, necessitating an upgrade to a higher-tier plan. It's also important to note that transfer capabilities and features can vary by region. Finally, while generally efficient, customer support can sometimes be slow, particularly for free-tier users. Before committing, consider your specific business needs and transfer volume to determine if Revolut is the best way to transfer money overseas for you.

Implementation Tips:

- Compare account tiers: Revolut offers various account tiers with different limits and features. Carefully evaluate your transaction volume and required features to select the most cost-effective option.

- Factor in weekend markups: If you frequently make weekend transfers, factor in the additional exchange rate markup when comparing Revolut with other providers.

- Check regional availability: Ensure that all the required features and transfer capabilities are available in your region and the regions you'll be transacting with.

Revolut

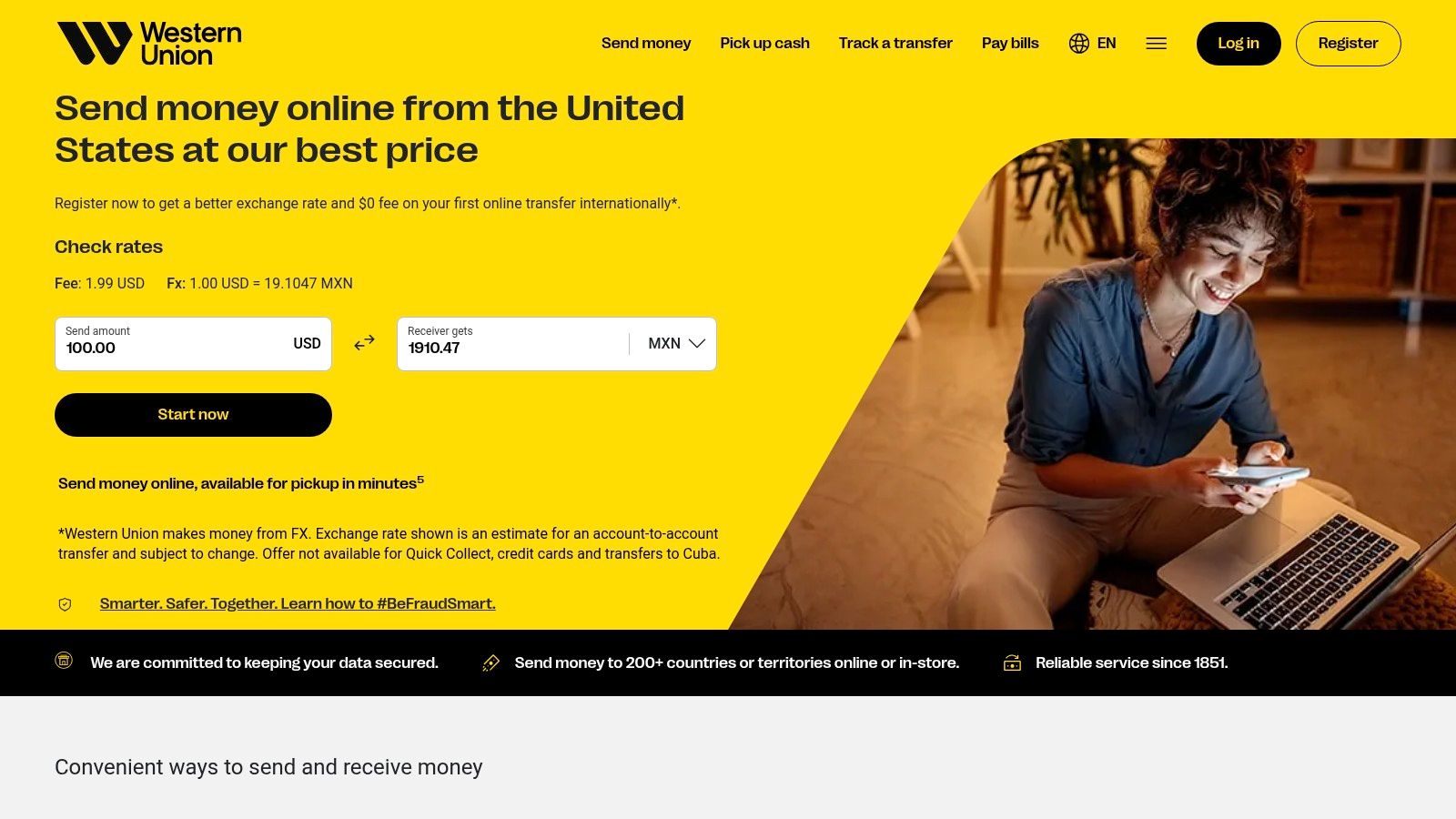

7. Western Union

Western Union is a well-established player in the international money transfer arena, offering a robust network and diverse transfer options that make it a viable choice for certain overseas transactions, particularly for those needing cash pickups. It earns its place on this list due to its extensive reach, especially valuable in regions where digital banking infrastructure may be limited. This is particularly relevant for South African businesses dealing with partners in less digitally connected African markets or other parts of the world where cash is still king.

For South African businesses, particularly SMEs and BPOs dealing with cross-border payments, Western Union offers the advantage of facilitating payments to individuals who may not have bank accounts. For instance, if you are a South African company outsourcing tasks to freelancers in other African countries, Western Union's vast network and cash pickup options can be a practical solution for paying them. The ability to send money for cash pickup in almost every country distinguishes Western Union from many digital-first competitors, potentially simplifying payment logistics for businesses dealing with partners in remote areas. You can initiate transfers online, via their mobile app, over the phone, or in person at one of their numerous agent locations. Transfers are typically available within minutes for cash pickup, providing a speedy solution for time-sensitive payments. You can also track your transfers in real-time, providing peace of mind.

However, while Western Union's global presence is unparalleled, South African businesses, particularly those focused on FX transparency and cost-effectiveness, should carefully consider the pricing structure. Western Union's fees are generally higher than those offered by digital transfer services, and their exchange rates often include significant markups. This can impact your bottom line, especially for regular or high-volume transactions. Furthermore, the fee structure can be complex and vary depending on the specific currency corridor, making it essential to calculate the total cost before initiating a transfer. The online experience, while functional, is not as user-friendly or streamlined as some newer competitors, which could be a factor for businesses looking for seamless digital integration.

Key Features for South African Businesses:

- Extensive Network: 500,000+ agent locations globally, making it particularly helpful for reaching recipients in remote areas or countries with limited banking infrastructure.

- Multiple Transfer Methods: Send money online, via the mobile app, by phone, or in person.

- Cash Pickup: Recipients can collect funds in cash, eliminating the need for a bank account.

- Real-Time Tracking: Monitor the status of your transfers.

- Fast Transfers: Money is typically available for cash pickup within minutes.

Pros:

- Unmatched global reach for cash pickups

- Reliable service with a long history

- Often the only viable option for cash payments in remote locations

Cons:

- Higher fees and less favorable exchange rates compared to digital competitors

- Complex and variable fee structure

- Online platform not as user-friendly as some alternatives

Website: https://www.westernunion.com

If you're a South African business considering Western Union, it's crucial to weigh the benefits of its extensive network and cash pickup options against the higher fees and less advantageous exchange rates. For payments to individuals without bank accounts or in areas with limited digital access, Western Union can be a practical solution. However, for regular, high-value transfers, exploring digital alternatives offering better exchange rates and lower fees is recommended. Always compare the total cost of the transfer, including fees and exchange rate markups, before making a decision.

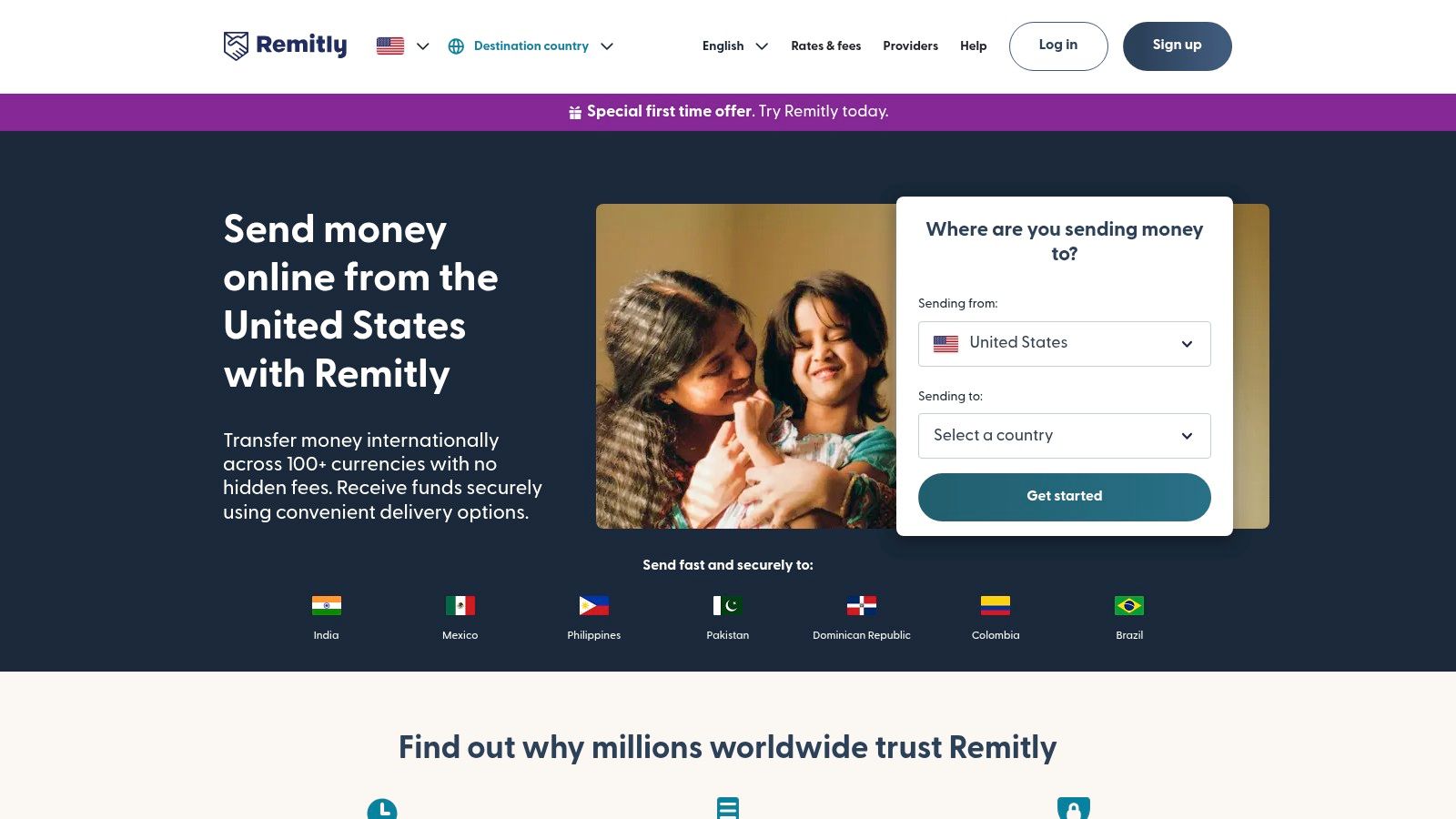

8. Remitly

Remitly is a strong contender for one of the best ways to transfer money overseas, especially if you're sending funds to family or friends in specific remittance corridors. Its focus on immigrant communities makes it particularly appealing for South Africans with ties to the Philippines, India, Latin America, and Africa, aligning well with common expat destinations. This specialized approach translates to competitive exchange rates and often lower fees within these corridors, a significant advantage over more generalized transfer services. Whether you're supporting loved ones or paying for services rendered overseas, Remitly's user-friendly platform and tailored services warrant a closer look.

Remitly offers two distinct service tiers: Express and Economy. Express delivers your funds within minutes but carries higher fees. Economy transfers typically take 3-5 business days, allowing you to prioritize cost savings over speed. This flexibility allows you to tailor your transfer to your specific needs, offering a balance often missing in other services. You can choose between bank deposits, cash pickup, and mobile wallet deliveries, providing convenient options for recipients. For South African businesses, particularly BPOs outsourcing to countries within Remitly’s strong corridors, this can streamline payments to overseas staff or contractors.

While Remitly’s focus on individual remittances makes it less suitable for large corporate transfers, its features can still benefit small and medium-sized South African export companies. For instance, smaller businesses dealing with suppliers or clients in supported countries can leverage Remitly’s competitive exchange rates and flexible delivery options. However, be mindful of sending limits, especially for new users. Verification is required to increase these limits, a standard practice for money transfer services aimed at preventing fraud. CFOs looking for FX transparency will appreciate the clear fee structure and real-time tracking available through SMS and app notifications.

Pros:

- Competitive exchange rates, particularly within key remittance corridors.

- Flexible transfer options that balance speed and cost.

- User-friendly mobile app with positive user reviews.

- Multilingual customer service, catering to a diverse user base.

Cons:

- Limited sending countries (primarily US, UK, Canada, Australia, Europe), which may restrict usage for some South African businesses.

- Express transfers can become expensive for larger sums, making the Economy option more cost-effective for higher amounts.

- Sending limits apply to new customers until verification is completed.

- Not designed for business or large transfers, limiting its suitability for some corporate needs.

Website: https://www.remitly.com

While not ideal for all international money transfer scenarios, Remitly’s focus on specific remittance corridors, competitive rates within those corridors, and convenient features make it a viable option for individuals and smaller South African businesses sending money to supported countries. Its ease of use and tailored services position it as a valuable tool in the right circumstances. For South Africans needing to send funds to family overseas or smaller businesses operating within Remitly's focused geographic areas, its services provide a compelling alternative to traditional banking or less specialized money transfer platforms.

Overseas Money Transfer Services Comparison

| Platform | Core Features / Highlights | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 Zaro | Zero spread FX, no SWIFT fees, enterprise controls | ★★★★★ Fast & transparent | 💰 Lowest cost, zero hidden fees | 👥 South African SMEs & exporters | ✨ Real spot rates, multi-user access, debit cards in ZAR & USD |

| Wise (formerly TransferWise) | Mid-market rates, multi-currency accounts, fast transfers | ★★★★ Transparent & reliable | 💰 Low fees (0.5-1.5%) | 👥 Global individuals & SMEs | ✨ Multi-currency wallets, 80+ countries |

| Xoom (PayPal) | Multiple payout options, PayPal integration, fast transfers | ★★★★ Quick with multiple delivery | 💰 Moderate fees | 👥 Remittance senders, PayPal users | ✨ Cash pickup & home delivery options |

| OFX | No fees on large transfers, 24/7 support, business tools | ★★★★ Good support for big transfers | 💰 Competitive rates on large sums | 👥 Businesses & large transfers | ✨ No max limit, risk management options |

| WorldRemit | Mobile money, multiple payout methods, fast | ★★★★ Strong in Africa & Asia | 💰 Fixed fees, but with markup | 👥 Remittance senders, unbanked recipients | ✨ Extensive mobile money network |

| Revolut | Fee-free FX up to limits, multi-currency accounts | ★★★★ User-friendly, varied tiers | 💰 Free fees within limits | 👥 Digital-savvy users & fintech adopters | ✨ Instant Revolut-to-Revolut transfers |

| Western Union | Huge agent network, cash pickups, multiple transfer methods | ★★★ Reliable, broad physical presence | 💰 Higher fees, notable markups | 👥 Global users needing cash pickups | ✨ Largest physical network |

| Remitly | Express & economy tiers, multi-delivery methods | ★★★★ Flexible speed & cost | 💰 Competitive on remittance corridors | 👥 Immigrant community senders | ✨ Delivery tracking, strong mobile app |

Making the Right Choice for Your Overseas Transfers

Finding the best way to transfer money overseas isn't a one-size-fits-all solution. As a business owner or executive in South Africa, particularly in the export sector, choosing the right international money transfer service is crucial for managing your finances efficiently and maintaining FX transparency. This listicle has explored eight leading options—Zaro, Wise, Xoom, OFX, WorldRemit, Revolut, Western Union, and Remitly—each with its own strengths and weaknesses. Key takeaways include considering the speed of transfer, associated fees, exchange rates offered, the security of the platform, and the specific countries you're dealing with. For South African businesses, including CFOs looking for better FX solutions and BPOs working with international clients, these factors can significantly impact your bottom line.

For time-sensitive updates about your international money transfer, consider incorporating SMS notifications into your strategy. When used effectively, SMS messages can provide immediate confirmation and updates, keeping you informed on the status of your transactions. To learn more, check out these SMS marketing best practices.

By carefully evaluating these factors, you can select the platform best suited to your unique needs. Whether you prioritize speed with WorldRemit, low fees with Wise, or the robust features of established players like Western Union, the right choice empowers your business to operate effectively in the global marketplace. Efficient international money transfers are vital for growth and success, particularly for South African businesses navigating the complexities of international trade.

Looking for a streamlined and efficient way to manage your international transfers? Explore Zaro, a platform designed to simplify overseas transactions and provide competitive exchange rates. Start optimizing your international payments today.

Article created using Outrank