Feeling bogged down by cross-border invoices and supplier payments? If you're a South African exporter, you know the feeling. Managing money across different currencies and regulations can feel like you're trying to navigate a complex maze with a crumpled, old paper map.

Think of accounts payable automation as the modern-day GPS for your company's finances. It gives you a clear, real-time path forward, putting you back in control and boosting your efficiency.

Why Exporters Need Accounts Payable Automation

For an exporter, handling accounts payable manually isn't just a tedious administrative chore—it's a serious business risk. The old way of doing things is slow, riddled with potential errors, and lacks transparency. These aren't small hiccups; they're problems that can send disruptive ripples across your entire operation.

Picture your team buried under a mountain of paper invoices from suppliers all over the world. They're trying to match them to purchase orders, confirm deliveries, and manually convert currencies on the fly. It's a recipe for disaster.

This manual approach creates several critical challenges that directly hit your bottom line and blunt your competitive edge:

- Costly Late Payment Fees: Juggling various payment terms and currency conversion delays makes it incredibly easy to miss deadlines. These aren't just minor slip-ups; they lead to expensive late fees and can tarnish your hard-earned reputation.

- Strained Supplier Relationships: Your international suppliers rely on you for prompt payment to keep their own businesses running. When your internal processes cause constant delays, it puts a real strain on these crucial relationships. This could lead to less favourable terms or, worse, losing a key partner altogether.

- High Risk of Human Error: Every time someone types in a number, there's a chance for a mistake. A misplaced decimal point or an incorrect currency code on a cross-border payment can result in major financial losses and compliance headaches.

- Navigating Complex Regulations: As an exporter, you have to stay on top of South African tax laws and international trade regulations. Manual systems simply don't have the built-in safeguards or digital audit trails you need to ensure you're always compliant, which ratchets up your risk.

The Shift to a Competitive Necessity

In today’s global market, accounts payable automation has moved from a "nice-to-have" to a "must-have" for survival and growth. It's like finally ditching that paper map for a live, intelligent GPS that reroutes you around traffic jams. It gives you the clear view and smooth workflow you need to truly master international trade.

The move to digital finance isn't new. For over a decade, South African businesses have been adopting AP automation to dramatically reduce how long it takes to process an invoice and make their operations run smoother. This is part of a bigger digital shift where automation has proven its worth time and again—it cuts down on manual work, clears up bottlenecks in payment approvals, and gives you a much firmer grip on your spending.

In fact, by automating their workflows, South African firms can slash their invoice processing costs by up to 60%. You can learn more about the growth of AP automation in the region.

For exporters, this shift is all about gaining control. A solution like Zaro is designed specifically for these cross-border challenges. It can take your accounts payable department from a chaotic cost centre to a strategic, well-oiled machine that actively supports your global ambitions.

Manual vs. Automated Accounts Payable at a Glance

To truly grasp the difference, it helps to see the two approaches side-by-side. The old manual method is fraught with slow, risky steps, while a modern automated system brings speed, accuracy, and peace of mind.

| Feature | Manual AP Process | Automated AP Process (with Zaro) |

|---|---|---|

| Invoice Entry | Someone manually types in data from paper or PDF invoices. | Invoices are captured automatically using smart technology. |

| Approval Routing | Invoices are physically passed around or emailed for approval. | Workflows automatically send invoices to the right person for approval. |

| Payment Processing | Payments are created one-by-one in a banking portal. | Approved invoices are paid in batches with just a few clicks. |

| Error Rate | High, due to manual data entry and complex calculations. | Very low, as the system validates data and flags inconsistencies. |

| Supplier Relations | At risk due to slow payments and lack of visibility. | Strong, built on reliable, on-time payments and clear communication. |

| Compliance | Difficult to track and prove, increasing audit risk. | Built-in digital audit trails make compliance simple and verifiable. |

This table makes it clear: sticking with a manual system means accepting inefficiency and risk as part of your daily operations. Embracing automation is a proactive step towards building a more resilient and competitive export business.

How Accounts Payable Automation Actually Works

So, what does accounts payable automation look like in practice? The best way to think about it is like hiring a hyper-efficient digital assistant for your finance team. This isn't just one magic button; it's a smart system of connected technologies that handles the entire invoice lifecycle with incredible speed and precision.

This digital assistant works around the clock, taking an invoice from the moment it lands in your inbox right through to the final payment confirmation. The goal is simple: to swap out the slow, mistake-prone manual steps for a fast, reliable, and completely transparent workflow.

Let’s walk through how this works for a typical South African exporter.

Step 1: Digital Invoice Capture and Data Extraction

It all starts the moment a supplier invoice arrives. It could be a PDF in an email, a scanned paper document, or an electronic invoice. Manually typing this information into your accounting system is tedious and, let's be honest, where most errors creep in. This is where automation first steps in.

The system uses something called Optical Character Recognition (OCR). Think of OCR as a set of smart eyes that can instantly read any invoice, no matter the layout. It intelligently identifies and extracts the crucial details: the supplier’s name, invoice number, date, line items, and the total amount due.

OCR technology isn't just about reading text; it's about understanding context. Intelligent systems learn to recognise different invoice layouts from various suppliers, becoming more accurate over time and reducing the need for manual review to nearly zero.

This means an invoice from a supplier in Germany, priced in Euros, gets captured just as effortlessly as a logistics bill from a local Durban firm in Rand. The data is digitised and fed directly into the system, ready for the next stage, without anyone on your team having to type a single character.

Step 2: Automated Three-Way Matching

With the invoice data captured, the system moves on to a critical verification step: three-way matching. This is where it cross-references three key documents to make absolutely sure an invoice is legitimate and correct before a cent is paid.

The system automatically checks that the supplier's invoice lines up with:

- The Purchase Order (PO): Did you actually order these goods or services at this price?

- The Goods Receipt Note (GRN): Did you actually receive what you ordered?

For a South African exporter, this is a game-changer. Imagine you've ordered 1,000 units of specialised packaging from a European supplier. The automation platform instantly checks if the invoice for 1,000 units matches your original PO and the delivery confirmation from your warehouse.

If everything lines up perfectly, the invoice is marked as "matched" and sails through to the next step. But if there’s a mismatch—say, the invoice is for 1,100 units—the system immediately flags it as an exception and notifies the right person to investigate. This simple check stops overpayments in their tracks and helps you resolve supplier issues fast.

Step 3: Dynamic and Automated Approval Workflows

Once an invoice is verified, it needs to be approved for payment. In the old manual world, this part of the process often turns into a frustrating paper chase, hunting for signatures and waiting on managers who might be travelling or buried in meetings.

Accounts payable automation brings order to this chaos with structured, dynamic approval workflows. You set the rules of the game upfront, based on your company’s policies. For instance:

- Invoices under R10,000 can be approved automatically.

- Invoices between R10,000 and R50,000 need a sign-off from the department manager.

- Anything over R50,000 requires approval from both the manager and the CFO.

The system then takes over, automatically routing the invoice to the correct person's dashboard or mobile device. They can see all the matched documents and approve or reject the payment with a single click, no matter where they are. This slashes approval times, helps you secure early payment discounts, and keeps your supplier relationships strong.

Real-World Benefits for South African Exporters

Understanding the mechanics of accounts payable automation is one thing, but what really matters is how it translates into tangible results for your business. For South African exporters, the benefits are far more profound than just efficiency. It’s about tackling the unique, high-stakes challenges of global trade and turning your AP function from a simple cost centre into a strategic powerhouse.

Let's get past the generic talking points and look at the genuine impact this can have on your business, using relatable scenarios you probably face every day.

Enhanced Cash Flow Visibility and Control

For any exporter, cash flow isn't just important—it's everything. Trying to manage funds across multiple currencies, all while dealing with volatile exchange rates, can feel like you're flying blind. A manual system gives you a delayed, fragmented picture of your financial obligations, making it nearly impossible to make smart, forward-thinking decisions.

This is precisely where accounts payable automation platforms like Zaro make a world of difference. They provide a single, real-time dashboard showing every outstanding invoice, its due date, and its value in both the original currency and ZAR. This crystal-clear visibility means you can forecast your cash needs with incredible accuracy. You can strategically time your payments and currency conversions to lock in favourable rates, rather than being cornered into a bad transaction just to meet a deadline.

Think about it: you have a large invoice due to a US supplier. With a clear view of all your upcoming payments, you can fund your USD account when the ZAR/USD exchange rate is in your favour, directly protecting your profit margins.

This level of control transforms your AP department from a reactive administrative function into a strategic hub for optimising your working capital.

Sharply Reduced Operational Costs

The true cost of a manual AP process is often much higher than businesses realise. It's not just about paper and printer ink. The real expense is buried in the countless hours your team spends on repetitive tasks like manual data entry, chasing down approvals, and fixing inevitable errors.

Automation zeroes in on these hidden costs. By digitising invoices and automating the matching and approval process, you can slash the time it takes to handle a single invoice from days or weeks down to just a few hours. This frees up your finance team to focus on work that actually adds value, like analysing financial data, negotiating better terms with suppliers, and supporting the company's growth.

- Real-World Example: A Cape Town-based wine exporter had two full-time employees dedicated to processing invoices from international distributors and logistics partners. After implementing an automation solution, one team member now manages the entire workflow in a few hours a week. The other has been retrained to analyse freight costs, uncovering new savings for the business.

This isn't just about cutting costs; it's about reallocating your most valuable resources to work that actively drives the business forward.

Stronger and More Reliable Supplier Relationships

In the world of exporting, your international suppliers are your lifeline. Nothing builds a strong, trusting relationship better than consistent, on-time payments. When manual processes cause delays, mix-ups, and payment errors, it creates friction and can seriously damage your reputation as a reliable partner.

Automation ensures your suppliers get paid accurately and on schedule, every single time. The system flags potential issues early, speeds up internal approvals, and executes payments reliably. That consistency builds immense trust. A happy supplier is far more likely to offer you better payment terms, prioritise your orders, and be more flexible when you're in a pinch.

Advanced Fraud Prevention

International transactions come with an inherent risk of fraud. It's a sad reality. Manipulated PDFs, sophisticated fake invoices, and duplicate payment requests are common threats that are incredibly difficult to spot in a busy, paper-based system.

Accounts payable automation acts as a powerful digital line of defence. Every invoice is captured and stored in a secure, tamper-proof system, creating an unbreakable audit trail. The automated three-way matching process guarantees you only pay for what you actually ordered and received. On top of that, enterprise-grade platforms like Zaro add extra layers of security with customisable user permissions, preventing unauthorised people from approving or making payments. This digital fortress drastically reduces your exposure to both external fraud and internal mistakes.

The shift to these secure, streamlined solutions is more than just a trend; it's becoming a necessity. In the Middle East and Africa (MEA) market, where South Africa is a major player, AP automation generated around USD 266.6 million in revenue in 2023. This is projected to soar to an estimated USD 615.6 million by 2030, highlighting just how essential this technology is for modern, competitive businesses. You can learn more about these market projections and their drivers.

A Practical Roadmap to Implementing AP Automation

Thinking about switching to accounts payable automation can feel overwhelming, like you're about to tackle a massive IT project. The good news is, you don't have to. When you break it down into manageable steps, it stops being a technical headache and becomes a smart business move with clear, achievable goals.

This roadmap is designed to guide you through a smooth and successful implementation, one phase at a time. The first step, surprisingly, has nothing to do with software. It starts with a frank look at how you're doing things right now.

Phase 1: Assess Your Current Process

Before you can fix the problem, you need to understand it intimately. Start by mapping out your current accounts payable workflow from the moment an invoice arrives to the final payment confirmation. Get granular. Document every single step, because this is where you'll find your biggest bottlenecks and most frustrating pain points.

Get your team together and ask some tough questions:

- On average, how long does it take to process one invoice?

- Where do invoices get stuck? Is there a particular desk they always land on waiting for approval?

- What are our most frequent mistakes? Things like typos in data entry or, worse, paying the same invoice twice.

- How much are we really losing to late payment penalties or by missing out on early payment discounts?

Gathering this information isn't just a paper exercise. It gives you a solid baseline—hard data that builds a compelling business case for making a change. More importantly, it gives you concrete metrics to measure your success against later. You’ll be able to prove the value of the project instead of just guessing.

Phase 2: Choose the Right Solution

With a clear picture of your challenges, you can now start looking for the right tool to solve them. For South African exporters, this is a critical step. Not all accounts payable automation platforms are built the same, and a generic solution simply won't cut it when you're dealing with global trade.

A platform might be brilliant for local invoices, but if it stumbles on multiple currencies or doesn't play well with your existing systems, it’s the wrong choice. You need a partner who genuinely understands the complexities of the export market.

When evaluating a platform like Zaro, look for these non-negotiable features:

- Multi-Currency Support: Your system must be able to process and pay invoices in different currencies without forcing your team into complex manual calculations.

- Seamless ERP Integration: To avoid creating data silos, the platform has to connect effortlessly with your accounting or ERP software. This ensures everyone is working from a single, reliable source of financial truth.

- Strong Security Protocols: When you’re making cross-border payments, enterprise-grade security is paramount. Look for features like data encryption and customisable user permissions to protect your sensitive financial information.

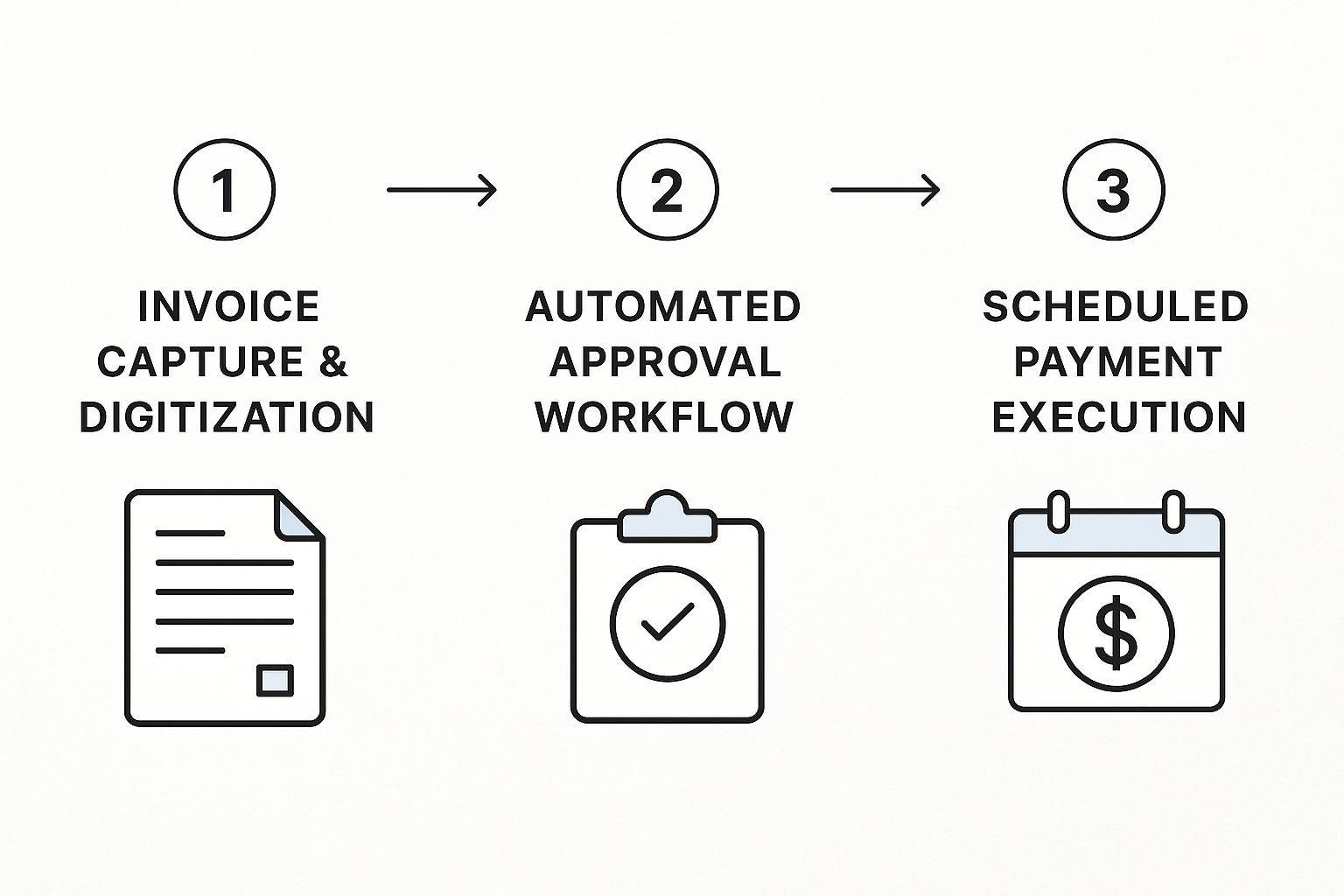

This infographic paints a clear picture of the workflow you should expect from a modern AP automation system.

As you can see, it visualises how an invoice can move smoothly from capture and validation right through to payment, getting rid of the manual touchpoints that cause delays and errors.

Phase 3: Plan and Execute the Rollout

You’ve found your solution. Now it's time to bring it to life. A well-thought-out rollout is the secret to minimising disruption and getting your team excited about the change. The biggest mistake you can make is trying to switch everything at once. A phased approach is always better.

Start small with a pilot project. Pick a single department or even just a specific group of suppliers. This gives you a safe space to test the new workflow, gather real feedback, and iron out any wrinkles before you go company-wide. A successful pilot creates internal champions who will naturally help drive adoption across the business.

Your implementation plan should focus on three key areas:

- Data Migration: Your chosen provider should help you plan how to move existing supplier details, open invoices, and payment histories into the new system. A clean, accurate data migration is absolutely crucial for a smooth start.

- Team Training: Even the most intuitive software requires some training. Make sure your provider offers comprehensive onboarding and support. Your team needs to feel confident and capable from day one.

- Communication Plan: Don't leave anyone in the dark. Be upfront about why you’re making the change, what the benefits are for them and the company, and what the timeline looks like. An informed team is an engaged team.

By following this structured roadmap, you can take the risk out of implementing accounts payable automation. You’ll be set up to start seeing the benefits—from lower costs to happier suppliers—much sooner than you think.

Measuring the ROI of Your Automation Investment

https://www.youtube.com/embed/ebi9XerTilU

When you’re thinking about bringing in new technology, it all boils down to one simple question: is it worth it? For accounts payable automation, the answer is a firm yes, but proving it means looking at more than just the monthly subscription cost. To build a solid business case, you need to show the full financial impact across your entire export operation, not just a line item on a budget.

Calculating the return on investment (ROI) for a platform like Zaro isn’t a guessing game; it’s about watching the right numbers. We can break these down into two main groups: the direct, easy-to-measure "hard savings" and the equally valuable, though less obvious, "soft savings" that set you up for long-term growth.

When you track both, you can walk into any leadership meeting with a powerful, data-driven argument that shows how automation pays for itself many times over.

Calculating Your Hard Savings

Hard savings are the tangible, real-money wins you can see right on your profit and loss statement. These are the most straightforward benefits to calculate and offer immediate proof of value.

Here’s where you should start looking:

- Cost-Per-Invoice Reduction: This is the bedrock of your ROI calculation. First, get a real sense of what it costs you to process one invoice by hand. Remember to include staff time (salaries and benefits), printing supplies, postage, and any physical storage costs. After automating, this cost drops dramatically as most of the manual work disappears.

- Eliminated Late Payment Fees: This one is easy. Dig through your payment records from the last year and add up every single Rand you paid in late fees to international suppliers. With automated workflows and reminders, that number should fall straight to zero.

- Captured Early Payment Discounts: How much money are you leaving on the table? Many suppliers offer a 1-2% discount for paying them ahead of schedule. Automation gives you the visibility and speed to grab these discounts consistently, effectively turning your AP function from a cost centre into a profit-generating one.

These numbers give your business case a rock-solid foundation with clear, undeniable financial gains.

Uncovering the Value of Soft Savings

Soft savings are all about boosting efficiency and cutting down on risk. While it’s tougher to stick an exact Rand value on them, their impact on your export business is huge. This is where you find the strategic value that automation unlocks.

For many businesses, the "soft" benefits—like sharper decision-making and stronger supplier trust—end up delivering more long-term value than the initial hard cost savings. Automation isn't just about saving money; it's about building a more resilient business.

Here are the key soft benefits to consider:

- Increased Team Productivity: Think about the hours your finance team gets back when they aren't buried in data entry, chasing approvals, or fixing errors. That time can be channelled into high-value work like cash flow forecasting, financial analysis, or negotiating better terms with logistics partners.

- Improved Supplier Satisfaction: Paying your suppliers on time, every time, builds incredible trust. You can't put a price tag on a strong relationship, but it often translates into better service, priority treatment for your orders, and more flexibility when you really need it.

- Enhanced Data for Strategic Decisions: When all your payables data is in one clean, accurate, centralised place, you suddenly have a goldmine of insights into your spending. This data helps you create smarter budgets, spot trends, and find new opportunities to save money.

Key Metrics for Tracking AP Automation Success

To truly grasp the impact of automation, you need to track key performance indicators (KPIs) before and after you make the switch. This data gives you a clear picture of the transformation.

| KPI | What It Measures | Why It Matters for Exporters |

|---|---|---|

| Invoice Processing Time | The average time from receiving an invoice to it being approved for payment. | Faster processing means avoiding late fees on international shipments and keeping your supply chain moving smoothly. |

| Cost Per Invoice | The total cost (labour, materials, overhead) to process a single invoice. | A lower cost per invoice directly boosts your bottom line, freeing up cash for growth or other operational needs. |

| Early Payment Discount Capture Rate | The percentage of available early payment discounts that are successfully taken. | Capturing these discounts turns your AP department into a profit centre and improves your working capital. |

| Invoice Exception Rate | The percentage of invoices that require manual correction or investigation. | A lower rate means fewer errors, less rework for your team, and more reliable financial data for forecasting. |

| Supplier Inquiry Volume | The number of calls or emails from suppliers asking about payment status. | A drop in inquiries signals that suppliers are being paid on time and trust your process, strengthening relationships. |

By monitoring these metrics, you move beyond guesswork and create a tangible record of your ROI, proving that your investment in automation was a strategic success.

While the market for accounts payable automation was once dominated by huge corporations, things have changed. In South Africa, small and medium-sized businesses are quickly adopting cloud-based solutions because they are affordable and can grow with the business. This reflects a global trend where smaller companies are embracing these tools at a growth rate of around 18.7% annually. You can learn more about the growth of AP automation for SMEs here. This shift in technology access means South African exporters can now compete more effectively on the world stage.

Common Questions About AP Automation

Making the jump to accounts payable automation is a big step, so it’s completely normal to have a few questions. This is especially true for South African exporters who are already navigating the complexities of international trade. Getting straight answers is the only way to feel confident about making a change.

Let’s tackle some of the most common queries we hear from businesses thinking about modernising their AP process. Our aim is to cut through the jargon and show you what this technology really means for your day-to-day operations.

Is Accounts Payable Automation Secure for International Transactions?

This is often the first question, and for good reason. The answer is a definite yes. Leading platforms are built with bank-grade security at their core, using tools like data encryption and strict access controls to lock down your financial information.

Beyond that, every single action—from receiving an invoice to approving a payment—creates a permanent, unchangeable digital audit trail. Frankly, this is worlds more secure than relying on paper files that can get lost or emails that can be intercepted. For exporters, this robust security isn't just a nice-to-have; it's essential for preventing fraud and staying compliant.

Security in automation isn't just about defence; it's about transparency. An immutable digital trail means every action is recorded, providing a single source of truth that is invaluable during audits and for internal governance.

Will an AP Automation System Work with Our Existing Accounting Software?

Absolutely. Modern accounts payable automation platforms are designed to play nicely with the tools you already use. Most, including Zaro, have ready-made integrations for the popular accounting systems in South Africa, like Sage, Xero, and QuickBooks.

This connection creates a seamless bridge for your financial data. It stops the soul-destroying task of entering the same information in multiple places and ensures your books are always synchronised and accurate. You get a real-time, reliable view of your company's financial standing without the manual legwork.

Is AP Automation Affordable for an SME?

It is, and it’s more accessible today than ever before. Gone are the days of needing a massive upfront investment in servers and complicated software licenses. Thanks to cloud-based, Software-as-a-Service (SaaS) models, you can get started with a simple, predictable monthly subscription.

When you start to add up the savings, the business case becomes crystal clear. Think about the costs you'll cut by:

- Reducing hours of manual work

- Wiping out late payment penalties

- Taking advantage of early payment discounts

For most small and medium-sized enterprises (SMEs), the return on investment is surprisingly quick. It's a smart financial move, even for smaller export businesses looking to become more efficient and gain better control over their cash flow.

How Much Training Will My Team Need?

Much less than you probably think. Today's platforms are designed to be as intuitive as the apps your team uses on their phones every day. The goal is to make the software easy to adopt, not to create another technical headache.

Of course, there's a short learning curve as your team gets used to the new way of working. But good providers offer excellent onboarding support, helpful tutorials, and responsive customer service to make the transition smooth. The aim is to get your team comfortable and seeing the benefits right away.

Ready to gain complete control over your cross-border payments? With Zaro, South African exporters can access real exchange rates and eliminate hidden fees, turning their accounts payable process into a strategic advantage. See how much you can save and simplify your global finances by visiting https://www.usezaro.com today.