That small monthly bank fee might seem harmless, but have you ever stopped to calculate its real long-term cost? A proper bank fee comparison often reveals a startling truth: those seemingly minor charges can silently snowball into thousands of Rands over your lifetime, quietly eating away at your savings.

The Real Cost of Your Bank Account

It’s all too easy to shrug off a R50 or R100 monthly account fee. Next to your other expenses, it probably feels like a drop in the ocean. But when you zoom out and look at that cost over your entire financial life, the picture changes dramatically. It’s not just a small leak; it's a slow, steady drain that can cost you tens of thousands.

This is a particularly sore point for South Africans. Research consistently shows that banking fees are a major concern, with the cumulative effect leading to huge, often unnoticed, expenses. For instance, if you started paying a modest R100 monthly fee at age 16, you would have spent R58,800 by the time you turn 65. And that’s before factoring in the typical annual fee increases of 2-5% that banks quietly introduce every few years. Getting a handle on these long-term effects is the first step toward smarter banking. You can dig deeper into a detailed banking fee guide to see just how these costs stack up over time.

How Small Fees Become a Major Burden

To really understand the impact, let's break down what different monthly fees actually add up to. This isn't just abstract maths; it's real money that could have been invested, saved for a deposit on a home, or put towards your family's future.

Think about these real-world scenarios:

- A R50 Monthly Fee: Seems manageable, doesn't it? But over five years, that’s R3,000 gone. Over a 30-year period, it swells to R18,000.

- A R100 Monthly Fee: This is a common charge for many mid-tier accounts. It costs you R6,000 in just five years and an incredible R36,000 over three decades.

- A R200 Monthly Fee: Often tied to "premium" or "private" accounts. After five years, you've handed over R12,000. Stretch that out to 30 years, and that single fee has cost you R72,000.

The numbers don't lie. What looks like a small, consistent fee today creates a massive financial hole over the decades. This really drives home the importance of knowing exactly what you're paying for and finding lower-cost alternatives.

The whole point of a thorough bank fee comparison is to plug this slow leak in your finances. By looking beyond just the monthly account cost to include all the little transactional charges, you can see where your money is really going. Making an informed switch could mean having an extra R50,000 or more in your pocket by the time you retire.

How to Read Your Bank Statement

Before you can properly compare bank accounts, you first need to know exactly what you’re paying right now. The truth is buried in your bank statement, but let's be honest, those documents can be a maze of jargon and confusing layouts. Learning to read it is the first real step to getting a handle on your banking costs.

Most statements follow a similar structure: credits (money coming in), debits (money going out), and a separate, often overlooked, section that details all the service fees for the month. This fee summary is your starting point. It’s where the banks list the real costs of your account, far beyond the single monthly fee they advertise.

Finding Your Fixed Fees

The easiest charge to spot is the fixed monthly account fee. This is the predictable amount you pay every month just to keep the account active, whether you use it or not. On your statement, it might be called a “service fee,” “admin fee,” or even a “maintenance fee.”

While it's a simple figure, this fee often acts as a smokescreen, drawing your attention away from the other costs that quickly add up. Think of it as your baseline expense. Is the service you're getting actually worth this non-negotiable monthly cost?

Identifying Your Variable Fees

Here’s where the real damage is often done, usually without you even noticing. Variable fees, or transactional costs, are tied directly to how you use your account. These seemingly small charges can snowball, often costing you more than the fixed monthly fee itself.

Keep an eye out for these common culprits on your statement:

- Withdrawal Fees: Every time you take cash from an ATM, there's likely a fee, and it's usually higher if you use another bank's machine.

- Payment Fees: The cost for every electronic payment (EFT) you make to another account.

- Debit Order Charges: A fee for each debit order that successfully goes off your account.

The crucial point here is that your total monthly cost isn't the advertised account fee. It’s that fixed fee plus the sum of all your variable transaction costs, which can swing wildly from one month to the next.

Uncovering Penalty Fees

Lastly, do a quick scan for any penalty fees. These are the charges that pop up when something goes wrong. A classic example is an “unpaid debit order fee” or a “declined payment charge,” where the bank actually charges you money because you didn't have enough funds for a transaction.

If you have an overdraft, it comes with its own collection of fees, like initiation costs and steep interest rates on the negative balance. Spotting these penalties reveals the hidden financial sting of small mistakes.

Once you’ve added up all three types of fees—fixed, variable, and penalty—you'll finally have the true total of what your banking is costing you. That number is your benchmark, giving you a solid foundation to start your bank fee comparison.

Comparing Traditional vs. Digital Bank Fees

Putting traditional and digital banks side-by-side is where a fee comparison really comes to life. The difference isn't just a few Rands here and there; it's about two completely different philosophies on how banking should be priced. Your classic high-street banks often have complex, tiered fee structures, whereas the digital challengers tend to favour radical simplicity.

Getting to grips with these opposing approaches is the secret to finding an account that actually fits your financial habits. It’s the difference between navigating a confusing maze of potential charges and enjoying predictable, straightforward costs.

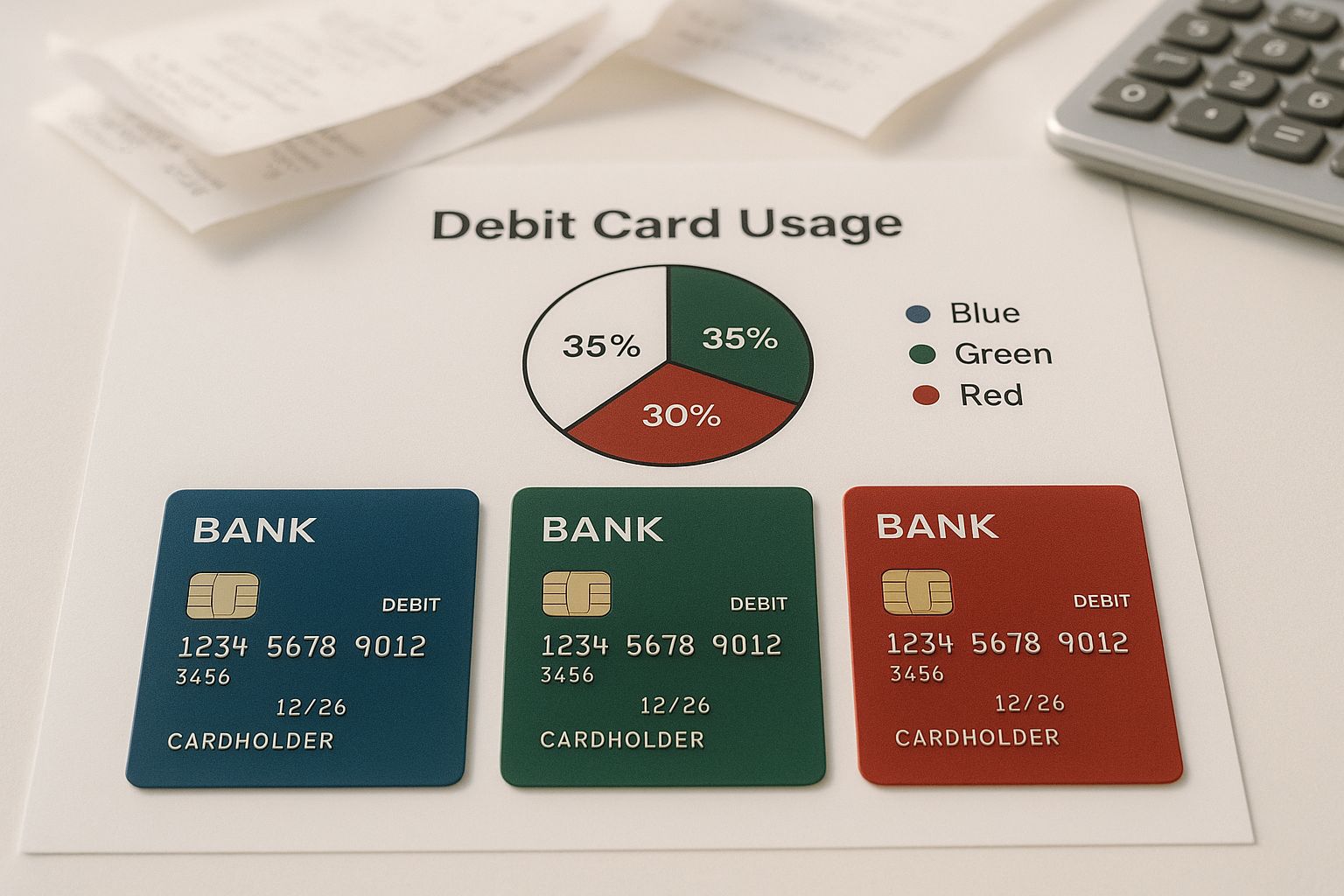

This infographic gives a great overview of the typical items you'll come across when comparing bank accounts.

As you can see, the total cost isn't just about the monthly fee. It’s a combination of that fixed cost and all the variable transaction charges, which you have to look at together.

The Core Philosophies: Monthly vs. Transactional Fees

At the heart of it all are two things: the monthly account fee and what you pay for everyday transactions. Historically, traditional banks have bundled their services. This means your monthly fee might cover a set number of "free" transactions before per-item charges start kicking in. If your banking behaviour fits neatly into one of their packages, this can work out well.

Digital banks, on the other hand, often unbundle everything. They draw you in with incredibly low (or even zero) monthly fees and then charge a simple, flat rate for each transaction you make. This pay-as-you-go model is incredibly transparent and can be much, much cheaper if you don't transact very often.

The real choice is this: do you prefer a bundled, all-in price that might include services you'll never use, or an unbundled, a la carte model where you only pay for exactly what you need? Your personal banking habits will give you the answer.

A quick scan of fees across major South African banks shows just how much things can vary. For instance, Capitec charges a monthly fee of only R7.50, with internal transfers costing R1 and payments to other banks costing between R2 and R6. In contrast, Absa's Basic Banking Transact Account has a monthly fee of R6.50, but its immediate payment fee shoots up to R7.50 for amounts under R3,000 and a hefty R40 for anything over that. This just goes to show that while one bank might have a lower monthly fee, another can sting you on transaction costs. It's critical to assess both, as this article on understanding banking fees in South Africa explains.

A Closer Look at Common Charges

To make this truly practical, let's see how these different models stack up with everyday banking. The table below puts the entry-level accounts from a traditional bank (Absa) and a digital-first bank (Capitec) head-to-head.

Side-by-Side Fee Comparison: Traditional vs. Digital Banks

Here’s a direct comparison of some of the most common fees you’ll encounter. Notice how a small difference in the monthly fee can be completely overshadowed by the cost of a single transaction.

| Fee Type | Absa Basic Transact Account | Capitec Global One Account |

|---|---|---|

| Monthly Fee | R6.50 | R7.50 |

| Cash Withdrawal (Own ATM) | R10 per R1,000 (up to R2,000), then R2.60 per R100 | R10 per R1,000 |

| Immediate Interbank Payment | R7.50 (< R3,000), R40 (> R3,000) | R6 |

| Debit Orders (External) | R3.50 | R3.00 |

As the table clearly shows, the real story isn't in the monthly fee—it's in the transactions. The cost difference for an immediate payment is staggering. An Absa customer sending R4,000 would pay a massive R40, whereas a Capitec customer pays just R6 for the exact same thing. This is precisely why a detailed bank fee comparison is so valuable.

So, Why Are Digital Banks Cheaper?

Ever look at your bank statement and wonder why the new digital-first banks seem to have a knack for keeping fees low? It’s not magic. The secret is baked right into their business model, and it’s the main reason they come out on top in any serious bank fee comparison.

Think about your traditional bank. They have hundreds of physical branches dotted across the country. Each one comes with a hefty price tag for rent, electricity, security, and staff. All those massive operational costs have to be covered somehow, and they usually find their way back to you through higher account fees, confusing transaction charges, and all sorts of penalties.

Digital banks, on the other hand, built their foundations on technology, not brick and mortar. By ditching the sprawling network of physical branches, they slash their operating expenses right from the start. This lean approach, combined with clever automation for everything from opening an account to processing payments, means big savings for them – and ultimately, for you.

A Move Towards Clear and Simple Fees

Having a lower cost base doesn't just mean cheaper fees; it allows digital banks to completely rethink how they charge you. Instead of making you decipher a long, complicated list of charges for every little thing, they can offer a simple, predictable fee schedule that you can actually understand. This push for transparency is starting to change what we expect from banks here in South Africa.

"A huge part of this shift comes from realising that confusing and hidden fees are a real obstacle for many people. Simple, low-cost banking opens the door for more South Africans to manage their money effectively."

Take Capitec Bank as a prime example. They recently took a bold step by collapsing over 30 different fee types into just five straightforward tiers. Now, a debit order is a flat R3, an immediate payment costs R6, and the basic monthly account fee is only R7.50. It’s a game-changer that makes their accounts some of the most affordable around, and they’re applying this logic to their business clients too.

This is exactly why digital challengers are gaining ground so quickly. They aren't just a bit cheaper; they're fundamentally easier to use and budget for. It removes that feeling of dread when your bank statement arrives, giving you fewer nasty surprises and a much clearer picture of where your money is going.

Finding the Right Bank for Your Lifestyle

When you line up all the bank fees side-by-side, one thing becomes crystal clear: there’s no single "best" bank for everyone. The right choice for you boils down to one simple question: how do you actually use your money? It's about moving past a basic checklist of charges and matching your own financial habits to the right kind of account.

This is where thinking in terms of "personas" or banking styles really helps. Once you understand your own patterns, you can zero in on the fees that will hit you the hardest and ignore the noise. It’s what turns a confusing spreadsheet of numbers into a clear, confident decision.

The Frequent Cash User

If you're someone who's regularly pulling cash from an ATM or depositing notes at a branch, your main goal is to keep those physical transaction costs down. A bank might lure you in with a low monthly fee, but a few expensive cash withdrawals can easily erase those savings.

For this type of user, a traditional bank with its own extensive ATM network often makes the most sense. Forget the digital-first hype for a moment and focus on these costs:

- Own ATM Withdrawal Fees: Find an account that gives you a set number of free withdrawals each month or has the lowest possible fee at their own machines.

- Other Bank ATM Fees: Always check the penalty for using another bank’s ATM. It’s almost guaranteed to be higher, and it adds up quickly.

- Cash Deposit Fees: If you're also depositing cash from a side hustle or your job, find out what it costs to do so at a branch or a smart ATM.

In this case, it might be smarter to pay a slightly higher monthly fee for an account bundle that includes plenty of free cash transactions. You could end up saving a fair bit over the year.

The Digital Professional

If your financial life happens almost entirely online, your priorities are flipped on their head. You probably can't remember the last time you handled cash, relying instead on EFTs, debit orders, and app payments. Your perfect bank is one that masters digital transactions and charges next to nothing for just holding your account.

Your focus should be laser-sharp on the cost of digital transactions. A pay-as-you-use model, which many fintechs and digital banks offer, is often the winner here because you aren't paying for services you simply don't need.

Look for accounts that champion:

- Low or Zero-Cost EFTs: Sending money is likely your most common transaction, so this is where you can save the most.

- No Monthly Account Fee: Why pay a fixed cost for a network of branches you never set foot in?

- A Solid Banking App: A slick, reliable app isn’t a nice-to-have; it’s the main tool you’ll use to manage your money.

The Student or Young Professional

When you're a student or just kicking off your career, keeping fixed costs to an absolute minimum is the name of the game. Your budget is tight, and your transactions can be unpredictable. You need an account that’s simple, forgiving, and doesn’t have a high barrier to entry.

This is where digital banks really come into their own, with accounts that often feature no monthly fees and rock-bottom transaction costs. Another huge factor is avoiding nasty surprises. Look for a bank that has scrapped penalty fees for things like bounced debit orders, which can be a serious financial blow when you're just starting out.

The Small Business Owner

Running a small business brings a whole new layer of complexity to banking. You need the digital efficiency to pay suppliers and staff, but you might also need to deposit cash from daily sales. A personal account just won't cut it; you need a proper business account that strikes the right balance between cost and features.

For South African businesses, especially those that buy from or sell to international clients, the game changes completely. Hidden markups on the exchange rate and steep SWIFT fees for sending money overseas can quietly eat away at your profits. This is where a platform like Zaro becomes incredibly valuable. By offering the real exchange rate and getting rid of those cross-border fees, it can offer far more value than a traditional business account with a low monthly fee. Your bank fee comparison has to include these bigger, often hidden, international costs.

Got Questions About Bank Fees? Let's Get Them Answered.

After looking at a detailed comparison of bank fees, you're probably wondering what your next move should be. Seeing the numbers is one thing, but actually doing something about them is how you save real money. Let's tackle some of the most common questions people have, giving you the confidence to switch, negotiate, or simply protect your finances better.

Making a change might seem like a huge task, but it’s usually much less painful than you’d imagine. The trick is to be organised and take it step-by-step.

How Hard Is It to Actually Switch Banks?

Honestly, it's easier than ever to switch banks in South Africa. Regulations and improved systems have smoothed out the process considerably. Most banks now have dedicated teams whose entire job is to help you move your debit orders and other scheduled payments across. It usually just involves opening the new account, giving them your old account details, and they'll take care of the rest.

Here's a pro tip, though: don't close your old account right away. Leave it open with a small balance for a month or two. This acts as a safety net to catch any straggler debit orders that didn't transfer correctly. It's a simple step that can save you the headache of declined transaction fees and prevent any of your services from being cut off by mistake.

Can I Really Negotiate My Bank Fees?

For a standard personal account, probably not. But if you’re a business owner or a high-net-worth individual, you absolutely can—and should—give it a try. Banks place a lot of value on these relationships and tend to be much more flexible with their private clients and business accounts.

If you're going to have that conversation, you need to go in prepared.

- Bring the proof: Show them the bank fee comparison you did. Have a direct competitor's offer ready.

- Show your value: Gently remind them how long you've been a client, the total value of your portfolio, or the volume of transactions your business runs through their system.

- Ask for something specific: Don't just ask for a "discount." Ask them to waive the monthly account fee or give you a better rate on your international transfers.

The worst they can do is say no. But just by asking, you show them you're a clued-up client who pays attention. That alone can lead to better service and future savings.

What Hidden Costs Should I Be Looking Out For?

Beyond the monthly fee and cost-per-transaction, there are a few sneaky costs that can really add up. Overdraft fees are a big one. Many banks will hit you with a hefty fee, sometimes around $35 (over R600) internationally, for even a tiny overdraft. In contrast, some of the newer digital banks offer a fee-free buffer zone.

The other major culprit is the exchange rate markup on international payments. Your bank almost never gives you the real mid-market exchange rate. Instead, they build their own margin into the rate they offer you. That "small" percentage can end up costing your business thousands on larger transactions. It's these less obvious charges that you really need to scrutinise, as they often do the most financial damage.

Ready to eliminate hidden international fees and get the real exchange rate? Zaro offers transparent, cost-effective cross-border payments designed for South African businesses. See how much you can save by visiting https://www.usezaro.com.