Navigating South Africa's Exchange Rate Landscape

Finding the best exchange rates South Africa offers is crucial for businesses and individuals involved in international transactions. This listicle presents the top tools for securing optimal rates when sending or receiving money across borders, helping South African companies minimize costs and maximize returns. These tools provide much-needed FX transparency, helping you avoid unfavorable exchange rates offered by some traditional institutions. Discover which provider—from established banks like Standard Bank and FNB to specialized platforms like Zaro, Wise, and Remitly—best suits your needs in 2025.

1. Zaro: Revolutionizing International Payments for South African Businesses

For South African businesses navigating the complexities of international payments, securing the best exchange rates is paramount. Zaro emerges as a powerful solution, offering a fintech platform specifically designed to optimize cross-border transactions and minimize costs. By eliminating traditional banking fees and offering real-time exchange rates with zero spread, Zaro presents a compelling alternative to conventional methods, particularly for SMEs, CFOs, and business owners engaged in global trade, export, or outsourcing. If you're seeking the best exchange rates South Africa has to offer, Zaro deserves a close look.

Zaro distinguishes itself by focusing on transparency and efficiency. Traditional international transfers often involve hidden markups and hefty SWIFT fees, significantly impacting a business's bottom line. Zaro tackles this issue head-on by offering zero spread on exchange rates and eliminating SWIFT fees altogether. This translates to substantial cost savings, particularly for businesses regularly conducting cross-border transactions. Imagine the cumulative savings for a South African SME consistently paying overseas suppliers or a BPO business receiving payments from international clients.

The platform's streamlined Know Your Business (KYB) verification process ensures a smooth and secure onboarding experience. This balances the need for regulatory compliance with the demand for a quick and efficient setup. Once onboard, businesses gain access to a suite of enterprise-grade controls, including multi-user access and customizable team permissions. This level of control enhances transparency and security, vital for businesses managing multiple international transactions and requiring clear oversight of financial flows.

Zaro further simplifies international payments by offering ZAR and USD business accounts and issuing debit cards in both currencies. This allows businesses to make transactions at actual spot rates and manage foreign exchange with minimal fees, providing a practical solution for direct overseas purchases and payments. This feature proves especially beneficial for businesses importing goods or services, offering a direct and cost-effective way to settle invoices in foreign currency.

For South African export companies, Zaro presents a significant advantage in managing incoming payments. Receiving funds in USD and converting them to ZAR at the real-time exchange rate with zero spread maximizes the value of each transaction. This can significantly impact profitability, particularly in industries with tight margins. Furthermore, the speed of transactions through Zaro minimizes delays, improving cash flow and operational efficiency.

While Zaro offers a highly compelling proposition, some considerations are worth noting. As a relatively new fintech player, its global banking integration might be less extensive than that of established traditional banks. However, its focus on South African businesses suggests a strong and growing network within the region. Also, while Zaro emphasizes zero fees on cross-border payments, specific pricing details for higher volume transactions or custom enterprise solutions are not readily available on the website. Businesses with substantial transaction volumes should contact Zaro directly to discuss tailored pricing options.

Implementing Zaro is relatively straightforward. Businesses can sign up online through the website (https://www.usezaro.com), completing the necessary KYB verification process. Once approved, businesses can fund their ZAR and USD accounts and begin making international transactions. The platform’s intuitive interface makes navigating the system and managing transactions easy, even for those unfamiliar with fintech platforms.

In conclusion, Zaro offers South African businesses a compelling solution for securing the best exchange rates and optimizing international payments. By eliminating SWIFT fees, offering real-time exchange rates with zero spread, and providing robust security features, Zaro positions itself as a viable and potentially cheaper alternative to traditional banking methods. While the platform’s relative novelty and limited publicly available pricing information require further investigation for larger businesses, its focus on transparency, speed, and cost-effectiveness makes it a valuable tool for South African businesses seeking to streamline their cross-border transactions and enhance their financial performance.

2. Wise (formerly TransferWise)

For South African businesses navigating the complexities of international payments, securing the best exchange rates is paramount. Wise (formerly TransferWise) stands out as a leading contender in this arena, offering a compelling combination of transparency, competitive rates, and efficient service. Whether you're a small export company dealing with regular international transactions, a larger corporation managing overseas payments, a CFO prioritizing FX transparency, or a BPO business operating in South Africa, Wise offers a modern solution to traditional banking woes. Their focus on providing the real mid-market exchange rate, combined with a transparent fee structure, makes them a strong choice for those seeking the best exchange rates South Africa has to offer.

Wise’s core strength lies in its commitment to using the mid-market exchange rate – the same rate you see on Google or Reuters. This eliminates the markups often hidden within traditional bank exchange rates, resulting in significant savings, especially for larger transactions. Unlike banks that often obscure their fees within less favourable exchange rates, Wise charges a small, upfront fee, clearly displayed before you initiate a transfer. This transparent pricing structure allows you to accurately calculate the total cost and compare it with other providers, ensuring you're getting the best possible deal.

One of Wise’s standout features is its multi-currency account. This allows South African businesses to hold and manage funds in over 40 different currencies, complete with local bank details in several countries. Imagine needing to pay suppliers in Euros, US Dollars, and British Pounds. With Wise, you can hold balances in each currency, making payments as if you had a local bank account in those regions. This simplifies international transactions, minimizes transfer fees, and allows you to take advantage of favourable exchange rates when they arise. It's particularly beneficial for businesses operating in multiple countries or dealing with frequent international payments.

For businesses dealing with time-sensitive transactions, Wise offers fast transfer speeds, with many transfers arriving the same day or even instantly. Their mobile app further enhances convenience by providing real-time rate tracking and enabling you to manage transfers on the go. This real-time tracking is invaluable in volatile markets, allowing you to monitor exchange rate fluctuations and execute transactions at the optimal time.

While Wise presents a highly competitive offering for achieving the best exchange rates South Africa offers, it's important to consider its limitations. The transfer fees, while transparent, can become less advantageous for smaller transactions. Compared to traditional money transfer services, Wise has limited cash pickup options, making it more suitable for businesses conducting electronic transfers. Their customer support is primarily online-based, which might not suit everyone.

Setting up a Wise account is straightforward, requiring standard KYC (Know Your Customer) documentation. South African businesses will need to provide proof of business registration and director identification. Once your account is verified, you can begin making international transfers and taking advantage of their competitive exchange rates.

Compared to traditional banks and some other money transfer operators, Wise consistently delivers better exchange rates for South African businesses. While banks often bake their profit margin into the exchange rate, Wise’s transparent, fee-based model offers greater clarity and often results in significant cost savings, especially for larger transfers. This transparency, combined with the convenience of a multi-currency account and fast transfer speeds, makes Wise a compelling choice for businesses striving to optimize their international payments and secure the best exchange rates South Africa can offer. You can visit their website at https://wise.com.

3. Remitly

Remitly is a digital remittance service specifically designed for international money transfers, making it a strong contender for businesses in South Africa seeking the best exchange rates. It caters to a global audience but holds particular relevance for South African businesses dealing with cross-border transactions. Its focus on emerging markets makes it particularly appealing for companies working with partners or clients in these regions. Whether you're a small export company sending payments to suppliers, a BPO business managing offshore teams, or a CFO looking for greater FX transparency, Remitly offers a streamlined approach to managing international payments. By leveraging technology, Remitly aims to simplify the complexities often associated with traditional banking methods for international transfers, offering a potentially more cost-effective and efficient solution. This makes it a valuable tool for businesses seeking to optimize their financial operations in the global marketplace.

One of the key features attracting South African businesses to Remitly is its competitive exchange rates, especially advantageous for larger transfers. The "rate lock" feature provides predictability and helps businesses budget effectively by fixing the exchange rate at the time of the transaction. This is particularly important in volatile markets and allows for better financial planning. Compared to traditional banks, which often incorporate hidden fees and markups within their exchange rates, Remitly offers a more transparent approach, clarifying the total cost upfront. This transparency is vital for CFOs and business owners in South Africa who prioritize accurate financial reporting and cost control.

Remitly supports multiple delivery options tailored to the recipient's location and preferences. These include bank deposits, cash pickup, and mobile money transfers. The extensive cash pickup network across various recipient countries is particularly useful for businesses working with partners in regions with limited access to traditional banking. Mobile money transfers are increasingly popular in many emerging markets and provide a fast and convenient way to send funds. The availability of both Express and Economy transfer options provides flexibility for businesses to choose the speed that best suits their needs, balancing speed with cost-effectiveness.

For South African companies managing numerous international transactions, Remitly's user-friendly mobile app and web platform simplify the transfer process. The app offers real-time transfer tracking, providing visibility and control over payments. This level of transparency is crucial for businesses managing their cash flow effectively. The 24/7 multilingual customer support is another significant advantage, offering assistance to businesses operating across different time zones and dealing with international partners.

While Remitly provides a competitive offering, it's essential to be aware of certain limitations. Express transfers, while offering speed, come with higher fees. Businesses need to weigh the urgency of the transfer against the added cost. Another point to consider is that Remitly operates within specific corridors and isn’t available for transfers to all countries. Before committing to Remitly, it’s important to ensure it supports the specific countries you need to send money to. Finally, the exchange rates offered can vary depending on the chosen transfer method (Express vs. Economy), so comparing these options is crucial.

For small and medium-sized South African export businesses frequently sending payments to international suppliers, Remitly offers a practical solution. The platform's focus on emerging markets aligns well with the growing trade relationships between South Africa and other developing economies. Similarly, for BPO businesses with teams based outside South Africa, Remitly streamlines salary payments and other operational expenses. Implementing Remitly is straightforward; simply create an account on their website (https://www.remitly.com), verify your identity, and set up your preferred transfer methods. The intuitive interface makes it easy to initiate and track transfers. By offering a combination of competitive exchange rates, flexible delivery options, and a user-friendly platform, Remitly presents a compelling option for South African businesses looking to optimize their international money transfers and secure the best exchange rates.

4. WorldRemit

WorldRemit stands out as a strong contender for businesses seeking the best exchange rates South Africa has to offer, particularly for those dealing with international payments. This cross-border digital payments service allows users to send money from South Africa to over 150 countries worldwide, a significant advantage for businesses operating in diverse global markets. Their commitment to competitive exchange rates, coupled with a variety of payout options, makes them a versatile tool for managing cross-border transactions efficiently. This is especially relevant for South African export companies, business owners, CFOs, and BPO businesses looking for competitive rates and transparent FX processes.

WorldRemit's appeal lies in its broad reach and flexible payout methods. Unlike traditional banking systems, which can be slow and expensive for international transfers, WorldRemit offers a streamlined digital process. You can send money via bank transfer, facilitate cash pickup, top-up airtime, and even utilize mobile money services. This wide range of options caters to various business needs. For example, a South African BPO outsourcing payroll to a country with limited banking infrastructure could leverage mobile money for efficient salary disbursements. Similarly, an export company could utilize bank transfers for larger supplier payments while using airtime top-ups as incentives for overseas partners. The platform offers real-time transfer tracking, providing transparency and peace of mind, particularly crucial for time-sensitive business operations.

For South African CFOs looking to optimize FX transparency and gain better control over international payments, WorldRemit offers a viable alternative to traditional banking. While banks often have opaque fee structures and fluctuating exchange rates, WorldRemit promotes transparent pricing, although fees can be higher for smaller transfer amounts. It’s crucial to compare the total cost, including the exchange rate and any associated fees, with other services and banks before making a transfer. Understanding the total cost allows for informed decisions and ensures you secure the best possible deal for your business. For example, a small export business sending frequent, smaller payments might find the fees outweigh the benefits of the exchange rate, while a larger company making less frequent, larger payments might find WorldRemit highly cost-effective.

Setting up an account with WorldRemit is generally straightforward. The technical requirements are minimal, primarily requiring a device with internet access and a valid South African bank account or credit card. Users need to register on the website, providing necessary identification details to comply with regulatory requirements in both South Africa and the recipient country. This adherence to regulatory compliance across its operating markets offers businesses an additional layer of security and trustworthiness. While WorldRemit boasts good exchange rates for most corridors, they can vary depending on the destination country. It is therefore essential to check the prevailing rates for your specific transfer route before initiating a transaction.

While WorldRemit offers numerous advantages, it's important to be aware of its limitations. As mentioned, transfer fees can be relatively high for smaller amounts, making it less suitable for businesses dealing with micro-transactions. Additionally, customer service hours might be limited in some regions, a factor to consider if your business operates across multiple time zones. Despite these drawbacks, WorldRemit's wide global coverage, innovative payout options, competitive exchange rates for many corridors, and strong security features position it as a valuable tool for South African businesses seeking efficient and cost-effective ways to manage their international payments. Its user-friendly platform and digital-first approach cater to the evolving needs of modern businesses in an increasingly globalized marketplace. For businesses looking for the best exchange rates South Africa has to offer combined with a range of payout options, WorldRemit is definitely worth exploring. Visit their website at https://www.worldremit.com to find out more.

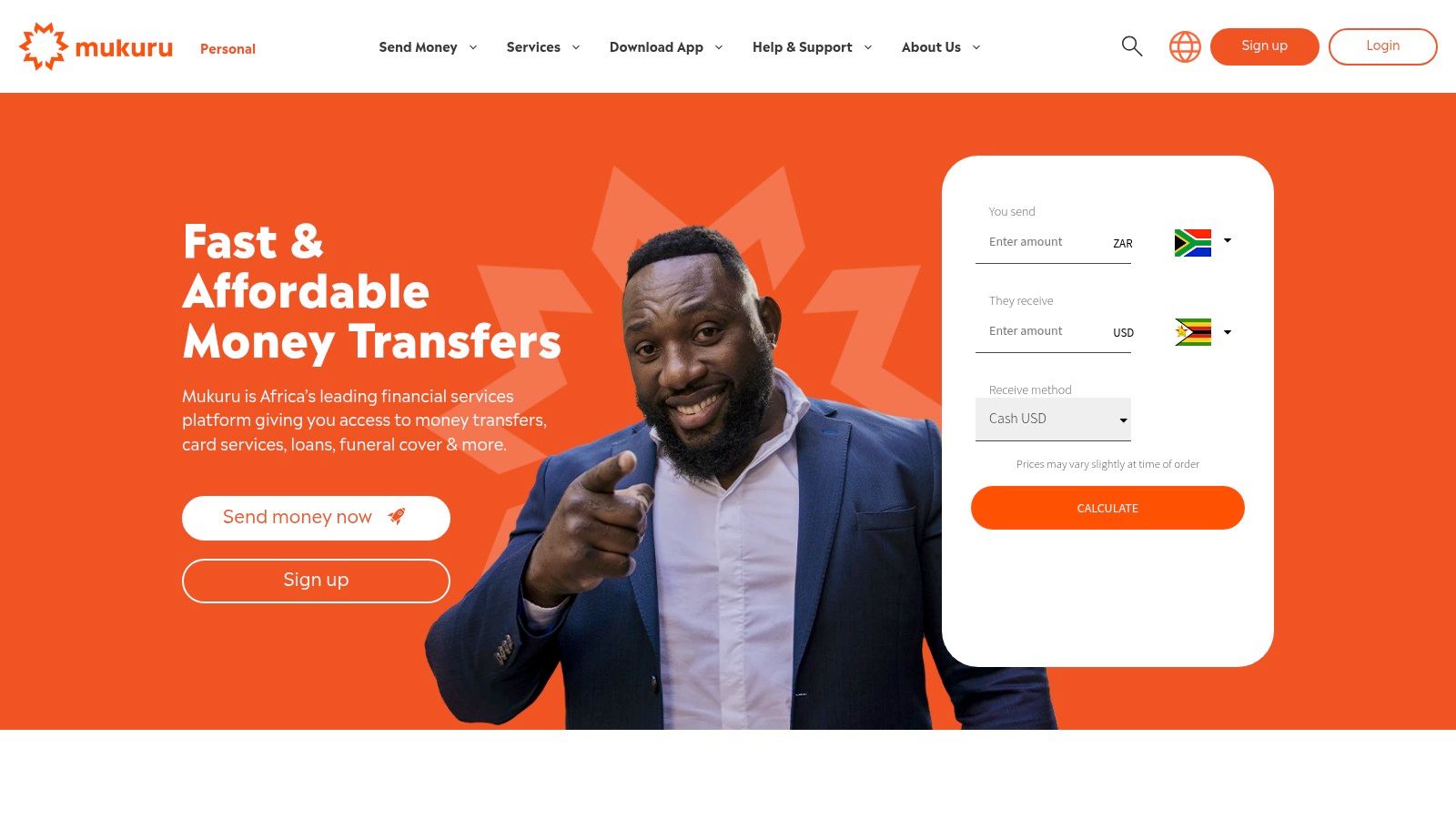

5. Mukuru

Mukuru is a South African-born fintech company specializing in money transfers within Africa and to select international destinations. Initially focused on the crucial South Africa to Zimbabwe corridor, Mukuru has broadened its reach to serve numerous African countries and offers highly competitive exchange rates, particularly for regional transfers. This makes it a compelling option for South African businesses operating within the continent, especially SMEs engaged in cross-border trade and those managing payroll for employees based in other African countries. For South African businesses looking for the best exchange rates for transactions within Africa, Mukuru is certainly worth considering.

Mukuru's deep understanding of the African market is one of its key strengths. This localized expertise translates into services tailored to the specific needs of the region, including cash-based transactions, which are still prevalent in many African countries. Beyond simple money transfers, Mukuru offers a suite of additional services, including bill payments, airtime top-ups, and the purchase of grocery and retail vouchers. This broadened service offering provides added convenience, particularly for businesses managing remote teams or supporting employees across borders. Imagine a South African BPO with a significant workforce in Kenya: Mukuru can facilitate salary payments and even allow the company to provide grocery vouchers as employee benefits.

While exact pricing isn't readily available on the website and depends on the specific transfer corridor and amount, Mukuru’s competitive edge lies in its focus on intra-African transfers. For transactions within the continent, their exchange rates often outperform traditional banks and some international money transfer operators. This is crucial for South African export companies seeking to maximize their profit margins when dealing with regional partners. CFOs and business owners looking for FX transparency will appreciate the clear breakdown of fees and exchange rates provided before each transaction.

For setup and implementation, Mukuru utilizes a primarily agent-based model, with a vast network of physical agents across key African countries. This allows for cash send and receive services, catering to the needs of individuals and businesses in areas with limited access to formal banking infrastructure. While Mukuru does offer digital platforms for sending money, including a mobile app and online portal, the core of its operations remains rooted in this agent network.

Compared to international money transfer giants like WorldRemit or TransferWise (now Wise), Mukuru’s focus is distinctly regional. While WorldRemit and Wise offer broader global coverage, their exchange rates for intra-Africa transfers might not be as competitive as Mukuru's. For South African businesses primarily operating within Africa, this specialized focus is a significant advantage. However, if your business needs to make frequent transactions to destinations outside of Africa, exploring other options might be necessary.

Pros:

- Strong understanding of African market needs: Services tailored to the unique requirements of the region.

- Competitive rates for intra-Africa transfers: Potentially significant savings for businesses operating within the continent.

- Extensive agent network in key African countries: Convenient cash send and receive options.

- Additional services: Bill payments, airtime, and vouchers offer added value.

Cons:

- Limited global coverage outside Africa: Not ideal for businesses with significant international transactions outside the continent.

- Primarily cash-based service model: While digital options exist, the agent network remains central to operations.

- Exchange rates may not be as competitive for non-African destinations: Explore alternative solutions for global transfers.

Website: https://www.mukuru.com

For South African businesses actively involved in cross-border trade within Africa, Mukuru offers a valuable solution for efficient and cost-effective money transfers. Its strong regional focus, competitive exchange rates for intra-Africa transactions, and extensive agent network make it a practical choice, particularly for SMEs and businesses operating in areas with limited banking infrastructure. However, businesses requiring global reach should consider supplementing Mukuru with other international money transfer services.

6. Standard Bank Cross Border Payments

For South African businesses engaged in international trade, securing the best exchange rates is paramount. While specialized money transfer services often boast competitive rates, the familiarity and integrated services of a major bank can be a significant draw. Standard Bank, one of South Africa’s largest financial institutions, offers cross-border payment solutions that cater to businesses needing international money transfers. This makes them a relevant option when considering the best exchange rates South Africa has to offer, especially for businesses already deeply embedded within the Standard Bank ecosystem. While their exchange rates might not consistently undercut specialized providers, the convenience and added benefits they offer deserve consideration.

Standard Bank's cross-border payment platform provides a range of services, including foreign exchange services and international wire transfers. This allows businesses to manage their international payments directly through their existing Standard Bank accounts, simplifying accounting and reconciliation processes. For businesses with a high volume of international transactions, this integration can save significant time and administrative overhead.

One of the key advantages of using Standard Bank for cross-border payments is the access to a comprehensive suite of financial services. This can be especially beneficial for businesses looking to streamline their operations and consolidate their banking relationships. For premium customers, relationship banking benefits can offer additional perks and preferential pricing. Small and medium-sized South African export companies, as well as BPO businesses operating in South Africa, can leverage these benefits to manage their international payments more efficiently.

While convenience and integration are major selling points, it's important to be aware of the potential drawbacks. Standard Bank’s exchange rates are typically less competitive than those offered by dedicated money transfer services. This difference, although sometimes marginal, can accumulate significantly for businesses conducting frequent or high-value transactions. Furthermore, their fee structures can be more complex and generally higher than those of digital-only services. CFOs in South Africa seeking maximum FX transparency might find the comparative analysis between Standard Bank and specialist providers necessary to determine the most cost-effective solution. Processing times for international transfers through Standard Bank can also be slower compared to some faster, digital alternatives.

Features and Benefits:

- Integration with Standard Bank accounts: Streamlines payments and reconciliation.

- Branch and online transfer options: Provides flexibility for different operational preferences.

- Foreign exchange services: Facilitates currency conversion for international transactions.

- International wire transfers: Enables secure transfer of funds across borders.

- Relationship banking benefits: Offers additional perks for premium customers.

Pros:

- Established bank with a strong reputation: Provides a sense of security and reliability.

- Integration with existing banking services: Simplifies financial management.

- Physical branch support available: Offers personalized assistance and support.

- Comprehensive financial services: Provides a one-stop shop for various business banking needs.

Cons:

- Exchange rates typically less competitive than specialist services: May not offer the absolute best exchange rates.

- Higher fees compared to digital-only services: Can increase the overall cost of international transfers.

- Slower processing times for international transfers: May not be suitable for time-sensitive transactions.

- Complex fee structures: Can be challenging to understand and compare.

Implementation and Setup:

For existing Standard Bank business account holders, accessing cross-border payment services is typically straightforward. Contact your relationship manager or visit a branch to activate the service and discuss specific requirements. The bank will guide you through the necessary documentation and procedures.

Comparison:

Compared to specialist online money transfer platforms, Standard Bank offers the advantage of integrated banking services and physical branch support. However, businesses prioritizing speed and the most competitive exchange rates might find dedicated money transfer services more suitable. Carefully evaluate your priorities and transaction volumes to determine the optimal solution.

Website: https://www.standardbank.co.za

7. FNB Cross Border Payments

First National Bank (FNB), a cornerstone of South Africa's "Big Four" banks, offers cross-border payment services, providing foreign exchange solutions to its clientele. This makes them a familiar and accessible option for South African businesses already operating within the FNB ecosystem. While they provide the convenience of integrated banking services, it’s important to weigh this against the often more competitive offerings found within the fintech landscape. For businesses seeking the reassurance of a well-established banking partner, FNB offers a traditional route for international transfers.

FNB's cross-border payment service integrates seamlessly with existing FNB business accounts, facilitating international transfers directly through online banking. This offers convenience for businesses already utilizing FNB's suite of products. They provide both SWIFT wire transfers and multi-currency accounts (for qualifying customers), catering to various international transaction needs. The bank's established correspondent banking relationships globally ensure relatively smooth processing of transactions. For South African SMEs exporting goods or services, this offers a reliable, if not always the most cost-effective, method for receiving payments. BPO businesses outsourcing to South Africa can leverage FNB’s services to manage payroll and other operational expenses in ZAR.

While FNB's position as a trusted South African bank offers peace of mind, especially for businesses prioritizing stability and established relationships, their pricing structure generally sits at a higher point than many digital alternatives. CFOs and business owners aiming for FX transparency should carefully scrutinize the exchange rates and fees associated with FNB’s cross-border payments, comparing them against specialist fintech providers who often offer more competitive rates and lower transaction fees. Similarly, the processing times for international transfers via FNB tend to be longer than those facilitated by fintech platforms that leverage newer technologies for faster settlement.

Features and Benefits Breakdown:

- Integration with FNB banking products: Streamlines international payments for existing FNB customers.

- Online banking international transfers: Enables convenient management of cross-border transactions.

- Foreign exchange services: Provides access to foreign currency exchange for various business needs.

- SWIFT wire transfers: Facilitates traditional international payments to a wide range of countries.

- Multi-currency accounts: Allows eligible businesses to hold and manage funds in multiple currencies (subject to qualifying criteria).

- Branch support and relationship banking: Provides personalized assistance and support through FNB's branch network.

Practical Applications & Use Cases:

- Paying international suppliers: Settling invoices with suppliers based outside of South Africa.

- Receiving payments from international clients: Collecting payments for exported goods and services.

- Managing overseas investments: Transferring funds for investment purposes.

- Salary payments for overseas employees: Facilitating payroll for employees located in different countries.

Pricing & Technical Requirements:

Specific pricing details for FNB's cross-border payment services are typically available upon request and may vary based on transaction volume, currency, and destination. Businesses will need an active FNB business account and online banking access to utilize the service. For multi-currency accounts, specific eligibility criteria may apply.

Implementation & Setup Tips:

- Consult with an FNB business advisor: Discuss your specific international payment requirements and explore the most suitable solutions.

- Understand the fee structure: Carefully review the associated fees, including transfer fees, exchange rate margins, and any correspondent bank charges.

- Verify beneficiary details: Ensure accuracy of recipient information to avoid delays or complications.

- Explore alternative options: Compare FNB's offering with other international money transfer providers, particularly fintech solutions, to ensure you're receiving the most competitive rates and efficient service.

While FNB offers a familiar and arguably reliable option for South African businesses needing to make international payments, the relative lack of innovative features and potentially higher costs compared to fintech alternatives warrant careful consideration. Businesses, particularly those focusing on cost optimization and faster transfer speeds, should thoroughly evaluate their options before settling on FNB. However, for existing FNB customers who prioritize the convenience of integrated banking and value established relationships, the platform provides a functional solution for managing cross-border transactions. Website

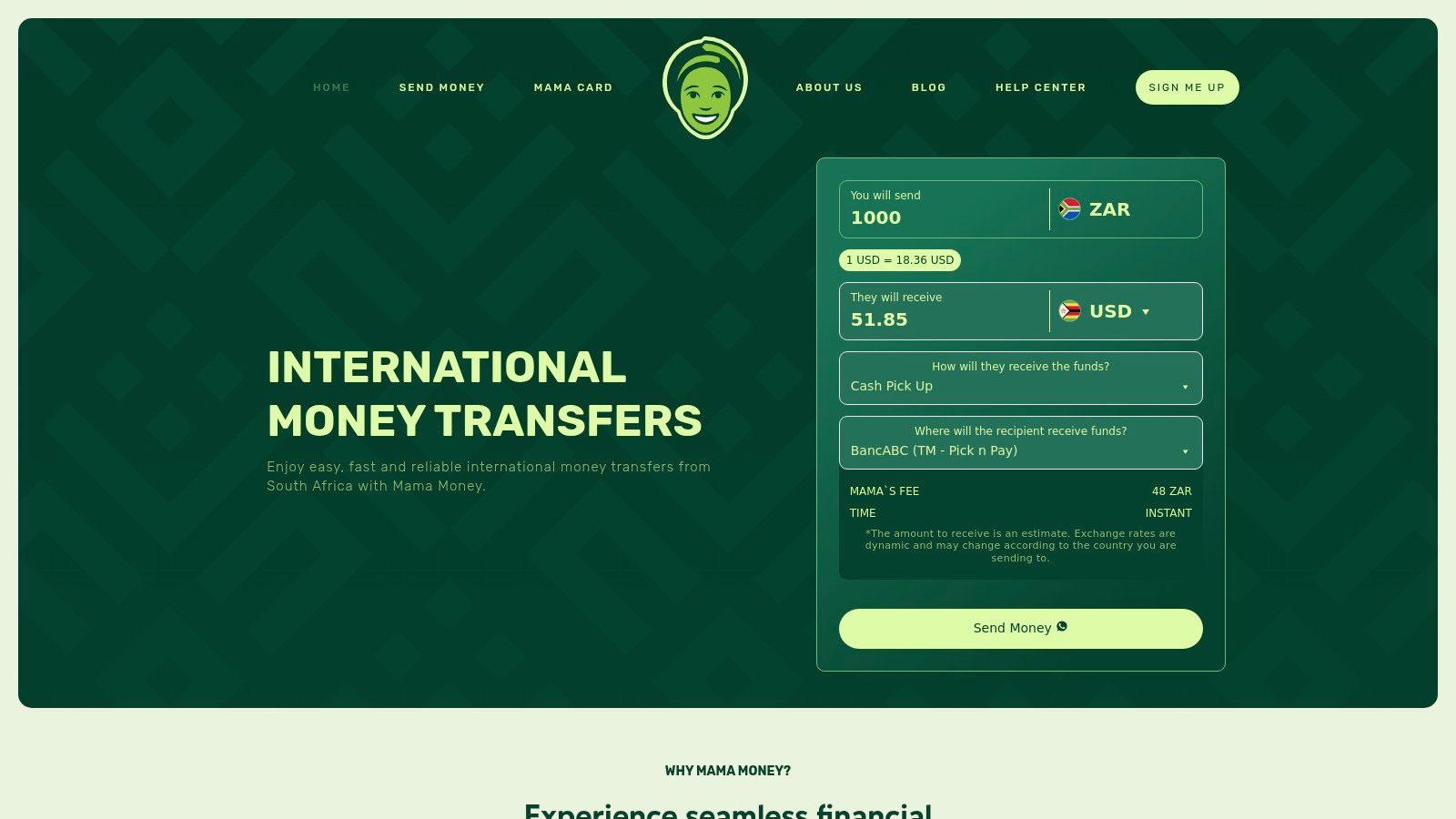

8. Mama Money

For South African businesses, particularly those with operations or clients in other African countries or developing markets, finding a cost-effective way to send and receive money is crucial. Fluctuating exchange rates and hefty transfer fees can significantly impact the bottom line. This is where Mama Money comes in, offering a compelling solution for businesses seeking the best exchange rates South Africa has to offer within its niche. Mama Money is a South African-based fintech company specifically designed to provide affordable money transfers, primarily catering to the African diaspora. Their focus allows them to offer competitive exchange rates and low fees, particularly for transactions within Africa and to other developing markets, making them a strong contender for businesses needing these specific corridors.

Consider a South African SME exporting goods to Zimbabwe. Using a traditional bank might involve high transfer fees and less favourable exchange rates, eating into profit margins. Mama Money's focus on African corridors allows them to provide a more competitive exchange rate for the South African Rand to the Zimbabwean Dollar, directly benefiting the business. Similarly, a BPO business outsourcing to South Africa can utilise Mama Money to pay its South African workforce efficiently and cost-effectively, ensuring employees receive their payments quickly and with minimal deductions. For CFOs striving for FX transparency, Mama Money's simple and transparent pricing structure eliminates hidden fees, providing a clear overview of transaction costs.

Mama Money distinguishes itself through its mobile-first platform. This accessibility is particularly beneficial in regions with limited internet access. Users can initiate transfers and receive SMS notifications, ensuring they stay updated on the transaction status. This is a practical advantage for businesses operating in areas with less developed digital infrastructure. They offer both cash pickup and bank deposit options, catering to the diverse needs of recipients.

While Mama Money doesn't publicly list specific pricing tiers, their business model centers around low fees and competitive exchange rates, particularly for frequent users. This makes them an attractive option for businesses with regular transfer needs within their focused corridors. Technical requirements are minimal, requiring only a mobile phone with SMS capability or access to their website. The setup process is straightforward, involving creating an account and verifying your identity. This ease of use makes it a practical solution for businesses looking for a quick and simple way to manage international transfers.

Compared to larger international money transfer operators, Mama Money’s global reach is admittedly more limited. Their agent network might also be smaller in some less common destinations. Furthermore, as a relatively younger company, their brand recognition is less established than international players. Their technology platform, while functional and user-friendly, may lack some of the advanced features offered by larger competitors. However, these limitations are often offset by their highly competitive rates and low fees for African and developing market transfers, making them a valuable tool for businesses operating within these specific regions.

For South African businesses regularly transacting with partners and clients in other African countries or developing markets, Mama Money offers a compelling proposition. Their focus on these corridors, combined with their low-cost model and transparent pricing, makes them an excellent option for businesses seeking the best exchange rates South Africa offers within this specific niche. Visit their website at https://www.mamamoney.co.za to explore their services and see if they meet your business needs. For businesses prioritising cost-effectiveness and simplicity within these specific regions, Mama Money is definitely worth considering.

Exchange Rate Comparison of Top 8 Providers

| Platform | Core Features & Security | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 Zaro | Real exchange rates, zero spread, no SWIFT fees, multi-user | Enterprise-grade controls, streamlined KYB | Cheapest cross-border fees, no hidden costs | SMEs, CFOs, export/import firms | Debit cards in ZAR/USD, centralized cash flow |

| Wise (formerly TransferWise) | Mid-market rates, multi-currency accounts, licensed globally | Transparent fees, real-time tracking, fast transfers | Low, transparent fees upfront | Global SMEs, frequent transfer users | Local bank details in 40+ countries |

| Remitly | Competitive rates, multiple delivery options, mobile app | 24/7 multilingual support, transfer tracking | Variable fees, express transfer premium | Emerging markets, remittance senders | Rate lock, cash pickup, mobile money options |

| WorldRemit | Transfers to 150+ countries, airtime/mobile top-ups | Reliable service, real-time tracking | Competitive rates, some high fees for small | Diaspora, large payout networks | Innovative payout choices, strong compliance |

| Mukuru | African corridor focus, cash-based, agent network | Simple cash services, bill payments | Competitive intra-Africa | African regional users | Extensive African agent network, vouchers |

| Standard Bank Cross Border | Bank integration, foreign exchange, wire transfers | Physical branches, relationship banking | Higher fees, less competitive rates | Traditional bank clients | Established reputation, comprehensive services |

| FNB Cross Border Payments | Integrated with FNB accounts, multi-currency accounts | Branch support, secure SWIFT transfers | Higher fees, slower transfers | FNB customers, corporate users | Trusted major bank, correspondent banking |

| Mama Money | Low-cost transfers, mobile-first, SMS notifications | Simple platform, transparent pricing | Very low fees, especially for regular users | African diaspora, low-volume users | African focus, competitive African rates |

Making Informed Decisions for Your International Transfers

Finding the best exchange rates South Africa has to offer is crucial for maximizing the value of your international transfers. This article explored several leading providers, from dedicated transfer services like Zaro, Wise (formerly TransferWise), Remitly, WorldRemit, and Mukuru, to traditional banking options like Standard Bank and FNB Cross Border Payments, and mobile-first solutions such as Mama Money. Each platform presents a unique combination of features, fees, and exchange rates, catering to different needs and transfer corridors.

Key takeaways to remember when choosing the best service for your South African business are the transparency of fees, the speed of the transfer, and the security measures in place. For businesses managing frequent international transactions, consider the tools offering business-specific features such as bulk payments or API integration. CFOs looking for FX transparency will find platforms that provide real-time rate information particularly beneficial. Similarly, BPO businesses outsourcing to South Africa should prioritize services offering competitive rates and efficient transfers to ensure timely payments to their South African workforce.

Selecting the right tool ultimately depends on your specific requirements. If speed is your priority, platforms like WorldRemit or Mama Money might be suitable. For those seeking the best exchange rates South Africa can provide alongside robust security, consider options like Wise or Zaro. Traditional banks may be preferable for established businesses comfortable with existing banking relationships, but often come with higher fees.

Navigating the landscape of international finance doesn't have to be daunting. By understanding the available options and considering your unique needs, you can confidently make informed decisions that optimize your transfers and protect your bottom line. Want to experience seamless and cost-effective international transfers with competitive exchange rates? Explore Zaro, a leading provider committed to offering the best exchange rates South Africa has to offer. Visit Zaro today to learn more and discover how we can help you optimize your cross-border transactions.