Paying Global Talent: A 2025 Guide

Finding the best way to pay international contractors is crucial for South African businesses expanding globally. This guide provides six efficient methods for optimizing cross-border payments in 2025. Learn how to simplify transactions, ensuring timely and cost-effective payments for your international workforce, whether you're using bank transfers or exploring options like Wise, PayPal, Payoneer, cryptocurrency, or Employer of Record (EOR) services. We'll cover the pros and cons of each, empowering you to make informed decisions that benefit both your bottom line and your contractors.

1. Wise (formerly TransferWise)

For South African businesses navigating the complexities of international contractor payments, finding a cost-effective and efficient solution is paramount. Wise (formerly TransferWise) has emerged as a leading contender in this space, offering a streamlined digital platform for sending money across borders. It distinguishes itself by leveraging the mid-market exchange rate – the same rate you see on Google or Reuters – and applying a transparent, low-fee structure, making it a significantly more affordable option than traditional banks. This makes Wise an excellent choice for businesses looking for the best way to pay international contractors.

Wise operates on a peer-to-peer model, matching transfers going in opposite directions whenever possible. This innovative approach avoids the costly international SWIFT system often used by banks, significantly reducing fees and often accelerating transfer speeds. Instead of physically moving money across borders, Wise utilizes a network of local bank accounts, meaning your money often stays within the country, further contributing to lower costs.

Features that make Wise attractive for South African businesses include:

- Real exchange rates with no markup: This translates to substantial savings compared to banks that often add a margin to the exchange rate.

- Multi-currency business accounts: Hold and manage funds in over 50 currencies, simplifying international payments and minimizing conversion fees. This is particularly beneficial for South African businesses dealing with contractors in multiple countries.

- Batch payment capabilities: Pay multiple contractors at once, streamlining your payment process and saving valuable time. This is a game-changer for businesses with a large international workforce.

- API integration for automated payments: Integrate Wise with your accounting software for seamless and automated recurring payments, reducing manual effort and potential errors.

- Local bank details in 10+ countries: Pay your contractors as if you were making a local transfer, further reducing fees and making the process smoother.

- Transparent fee structure: Know exactly what you’re paying upfront, without any hidden charges or surprises.

Pros:

- Up to 8x cheaper than traditional banks: Significant cost savings, especially for regular international payments.

- Fast transfers (usually within 24 hours): Quick turnaround times ensure timely payments to your contractors.

- Transparent pricing with no hidden fees: Clear and predictable costs for better budgeting.

- Strong regulatory compliance: Operates under strict regulatory oversight in multiple jurisdictions, providing peace of mind.

- Easy integration with accounting software: Streamlines your financial processes.

- Multi-currency holding and conversion: Manage international finances efficiently.

Cons:

- Not available in all countries: While Wise covers a wide range of countries, it's crucial to verify availability for your specific needs.

- Daily and annual transfer limits: May require alternative solutions for very large transfers.

- May require additional verification for large amounts: Standard security procedures can sometimes prolong processing times.

- Limited customer support hours: Consider the time difference when seeking support.

Examples of successful implementation:

Globally recognized companies like Shopify and GitLab rely on Wise for international vendor and contractor payments. E-commerce businesses also leverage Wise to pay overseas suppliers efficiently. These examples highlight the platform's reliability and suitability for diverse business models.

Tips for South African businesses using Wise:

- Set up a business account for better rates and features: Unlock additional benefits tailored for businesses.

- Use batch payments for multiple contractors: Streamline payments and save time.

- Take advantage of API integration for automated recurring payments: Reduce manual effort and errors.

- Keep funds in a multi-currency account to avoid repeated conversion fees: Optimize your international finances.

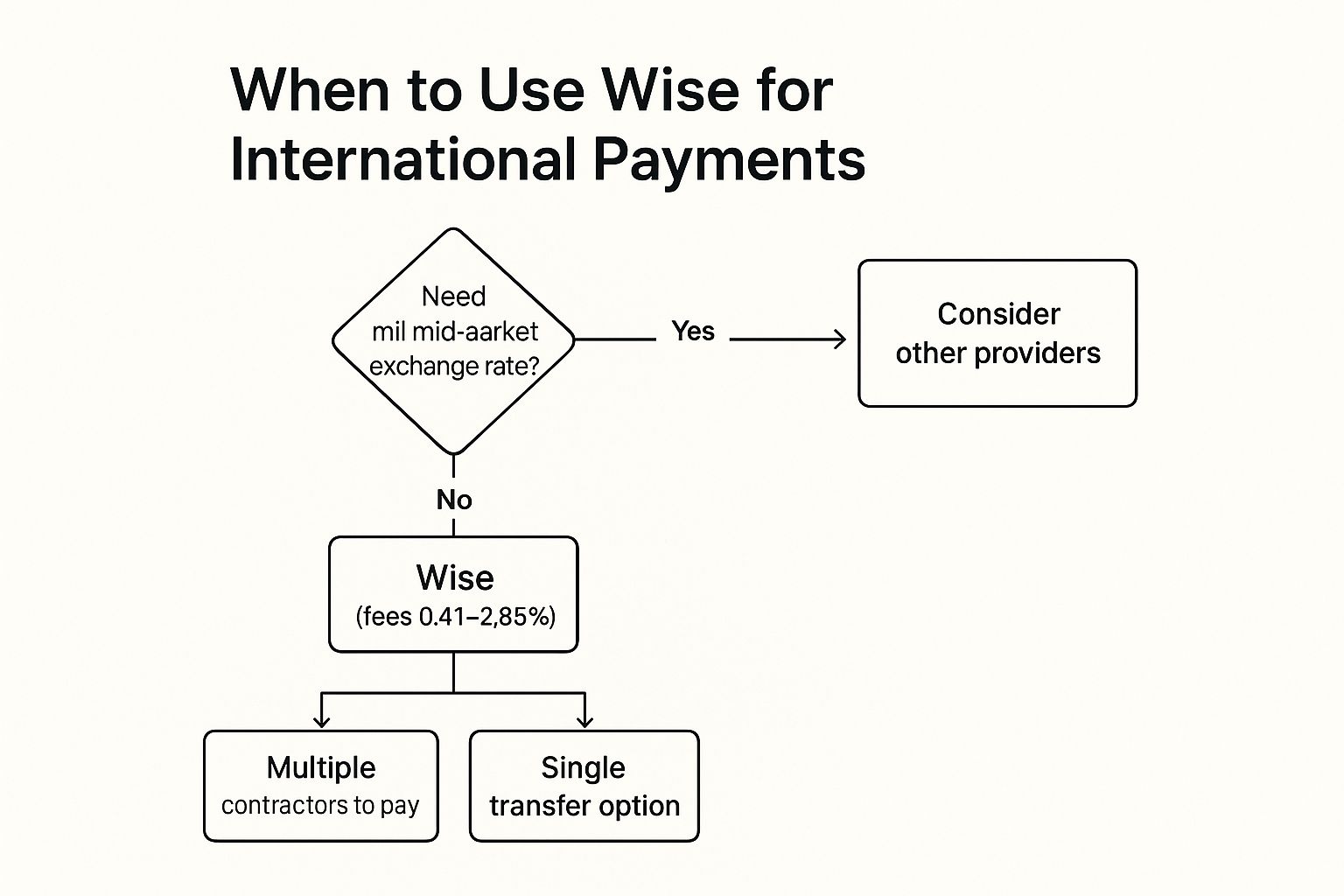

The following decision tree infographic provides a quick guide on when to use Wise for your international payments.

This infographic guides users through key decisions, starting with the need for the real mid-market exchange rate. If this is a priority, Wise is recommended. The infographic then guides users on choosing the right transfer method within Wise based on the number of contractors they need to pay.

Popularized by: Kristo Käärmann and Taavet Hinrikus.

For South African businesses seeking the best way to pay international contractors, particularly SMEs and BPOs that outsource to South Africa, Wise presents a compelling solution. Its commitment to transparency, cost-effectiveness, and efficient multi-currency management makes it a valuable tool for navigating the intricacies of global payments. You can explore Wise's services and offerings further on their website: https://wise.com/.

2. PayPal and Payoneer

When it comes to paying international contractors, established digital payment platforms like PayPal and Payoneer offer convenient and relatively straightforward solutions, particularly attractive for South African businesses navigating the complexities of cross-border transactions. These platforms offer a valuable bridge between South African businesses and their global workforce, facilitating seamless and efficient payments. This makes them a strong contender for one of the best ways to pay international contractors, particularly for smaller businesses or those starting out with international hiring.

How They Work:

Both platforms function as online accounts that hold funds, allowing users to send and receive money electronically. You can link your South African bank account or credit card to your PayPal or Payoneer account, enabling you to fund transfers. Contractors, in turn, can receive payments directly into their respective accounts and then withdraw funds to their local bank accounts or linked cards. While both platforms offer similar core functionality, they cater to slightly different needs.

PayPal, co-founded by Peter Thiel, Max Levchin, and renowned for its ease of use and widespread adoption, is a familiar name in online transactions. It’s a convenient option for quick payments, especially for smaller amounts or one-off projects.

Payoneer, spearheaded by Yuval Tal, takes a more specialized approach, focusing on cross-border B2B payments. It boasts features tailored for businesses regularly paying international contractors and freelancers, making it a robust solution for ongoing working relationships.

Features and Benefits:

Both platforms offer a suite of features that simplify international payments:

- Global Reach and High Adoption Rates: Both PayPal (www.paypal.com) and Payoneer (www.payoneer.com) operate in numerous countries, facilitating payments to contractors almost anywhere in the world. This broad reach simplifies cross-border transactions, especially for South African businesses engaging with a globally distributed workforce.

- Multiple Payment Methods: Fund your transfers via bank accounts, credit cards, or existing balances within your PayPal or Payoneer wallet. This flexibility allows you to choose the most convenient and cost-effective funding method.

- Invoice and Payment Tracking: Both platforms provide tools for creating and managing invoices and tracking payment status, simplifying accounting and administrative processes for your South African business.

- Mass Payment Capabilities: Payoneer particularly excels in this area, making it easier to manage payroll for multiple contractors simultaneously, a significant advantage for South African BPOs and other companies with large remote teams.

- Mobile Apps and Web Platforms: Access and manage your accounts on the go or from your desktop, providing flexibility and convenience for busy business owners.

- Integration with Major Freelance Platforms: Payoneer's integration with platforms like Upwork and Fiverr streamlines payments for businesses working with freelancers through these platforms.

Pros and Cons:

Pros:

- Widely Recognized and Trusted: Both platforms enjoy global recognition and trust, assuring both payers and recipients of a secure transaction environment.

- Easy Setup and User-Friendly Interface: Getting started is straightforward, and both platforms offer intuitive interfaces, reducing the administrative burden on your South African team.

- Quick Transfers (Especially Between Wallet Holders): Transfers between accounts on the same platform are typically very fast, facilitating prompt payment to your contractors.

- Strong Buyer/Payer Protection: Both platforms offer dispute resolution mechanisms and buyer/payer protection policies, providing a safety net for both parties involved.

- Extensive Integration Ecosystem: Especially Payoneer, seamlessly integrates with numerous other platforms and services, simplifying workflow management for businesses.

- 24/7 Customer Support: Access support when you need it, addressing any queries or issues promptly.

Cons:

- Higher Fees Compared to Specialized Services: While convenient, both platforms can incur higher fees, especially for international transfers and currency conversions, compared to specialized FX providers. For South African businesses sensitive to FX transparency and costs, this is a crucial consideration.

- Exchange Rate Markups: Be aware of potential markups on exchange rates, which can impact the final amount received by your contractors.

- Account Freezing/Holding Policies: Both platforms have policies regarding account holds and freezes, which can disrupt payments if triggered. Familiarize yourself with these policies to avoid potential issues.

- Tax Reporting Complications: Navigating international tax reporting can be complex. While these platforms provide some support, consulting with a tax professional is recommended for South African businesses.

- Withdrawal Fees for Recipients: Contractors may incur fees when withdrawing funds to their local bank accounts, which should be considered and communicated transparently.

Examples in Action:

- South African marketing agencies using PayPal for quick payments to international content creators.

- Small South African export businesses leveraging Payoneer for more cost-effective payments to suppliers in other African countries.

- South African BPO companies using Payoneer’s mass payment features to manage payroll for their international customer service teams.

Tips for South African Businesses:

- Use Business Accounts: Opt for business accounts on both platforms for better rates, features, and reporting capabilities tailored to your business needs.

- Consider Payoneer for Larger Volumes and Potentially Better Exchange Rates: If you regularly make large payments or require more competitive exchange rates, Payoneer might be a more suitable option. Research current exchange rates and fees to make informed decisions.

- Set Up Automated Payments for Regular Contractors: Simplify recurring payments with automated payment schedules.

- Be Aware of Recipient Fees and Communicate Clearly: Transparency is key. Discuss fees with your contractors upfront to avoid misunderstandings.

- Compare Fees and Exchange Rates with Specialized FX Providers: For larger volumes or regular transactions, consider comparing PayPal and Payoneer with dedicated FX providers catering specifically to South African businesses for potentially better exchange rates and lower fees.

By carefully considering the features, pros, and cons of both PayPal and Payoneer, and implementing the tips outlined, South African businesses can effectively leverage these platforms to streamline their international contractor payments and foster productive working relationships with their global workforce.

3. Cryptocurrency Payments (Bitcoin, Ethereum, Stablecoins)

Cryptocurrency payments offer a modern alternative for paying international contractors, particularly relevant for South African businesses navigating the complexities of cross-border transactions. This method involves using digital currencies like Bitcoin, Ethereum, or stablecoins (such as USDC and USDT) to pay contractors directly. Leveraging blockchain technology, these payments bypass traditional banking intermediaries, potentially leading to lower fees, faster settlement times, and increased transparency. This can be a particularly attractive option for South African SMEs looking to streamline their international payment processes and potentially reduce forex costs.

Cryptocurrency transactions are decentralized, meaning they don't rely on banks or other financial institutions. Instead, they operate on a distributed ledger technology called blockchain, which records every transaction publicly and securely. This allows for 24/7 global availability, making it convenient to pay contractors regardless of their location or time zone. This is a significant advantage for South African companies working with contractors in different time zones. Furthermore, the transparent nature of blockchain records provides a clear audit trail, simplifying reconciliation and enhancing accountability.

Several successful examples demonstrate the viability of cryptocurrency payments for international contractors. Platforms like Gitcoin utilize Ethereum and other cryptocurrencies to compensate developers. Increasingly, Web3 companies are opting for stablecoins like USDC for contractor payments. Even remote software development teams and digital marketing agencies in the crypto space are leveraging Bitcoin and stablecoins for seamless cross-border transactions.

Why Cryptocurrency Payments Deserve a Place on this List: For South African businesses, especially those involved in the tech sector or working with international clients, cryptocurrency offers a compelling solution to the challenges of traditional cross-border payments. The potential for lower fees on large transactions, faster settlement times, and protection against currency fluctuations makes it an attractive option for CFOs looking for enhanced FX transparency.

Benefits for South African Businesses:

- Lower Fees: Cryptocurrency transactions can significantly reduce transaction fees, especially for large payments, compared to traditional banking methods.

- Faster Settlement: Payments can be settled in minutes or hours, eliminating the delays often associated with international bank transfers.

- No Banking Restrictions: Bypass traditional banking systems and their associated restrictions, facilitating smoother cross-border payments.

- Transparency: Blockchain technology ensures complete transaction transparency, providing a clear audit trail for both parties.

- Currency Devaluation Protection: Especially relevant in the context of the South African Rand, cryptocurrencies, particularly stablecoins pegged to the US dollar, can offer a hedge against currency devaluation.

Considerations for South African Businesses:

- Volatility: While stablecoins offer price stability, other cryptocurrencies like Bitcoin and Ethereum are subject to price fluctuations.

- Tax Implications: Navigating the tax implications of cryptocurrency transactions can be complex and requires careful consideration. Consult with a tax professional familiar with cryptocurrency regulations in South Africa.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving in many countries, including South Africa. Staying informed about local regulations is crucial.

- Technical Complexity: While user-friendly wallets and exchanges are available, there's still a learning curve associated with using cryptocurrencies.

Tips for South African Businesses:

- Start with Stablecoins: Mitigate volatility risks by using stablecoins like USDC or USDT for payments.

- Tax Tracking and Reporting: Implement robust systems for tracking and reporting cryptocurrency transactions for tax purposes.

- Small Test Transactions: Begin with small test transactions to familiarize yourself with the process and ensure everything works smoothly.

- Contractor Comfort: Confirm that your contractors are comfortable receiving payments in cryptocurrency and have the necessary wallets set up.

- Reputable Exchanges and Wallets: Use well-established and secure cryptocurrency exchanges and wallets.

- Local Regulations: Research and comply with cryptocurrency regulations in both South Africa and the contractor's country.

Cryptocurrency payments offer a forward-thinking approach to paying international contractors, providing potential benefits for South African businesses seeking efficient, transparent, and cost-effective cross-border payment solutions. By understanding the features, benefits, and potential drawbacks, and by following the tips provided, South African businesses can effectively leverage this innovative payment method.

4. Traditional Bank Wire Transfers

For South African businesses engaged in international trade, choosing the right payment method for international contractors is crucial. One of the oldest and most established methods is the traditional bank wire transfer, leveraging the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. While newer fintech solutions have emerged, bank wire transfers remain a relevant and often preferred option, especially for larger transactions and situations demanding heightened security and regulatory compliance, making them worthy of consideration when exploring the best way to pay international contractors.

Bank wire transfers involve a direct transfer of funds from your South African bank account to the recipient's bank account overseas. This process utilizes the SWIFT network, a secure messaging system that facilitates communication and instructions between banks globally. This direct bank-to-bank transfer minimizes intermediaries, providing a clear and auditable transaction flow.

How Bank Wire Transfers Work:

- Initiating the Transfer: You provide your bank with the recipient's bank details, including their name, account number, SWIFT code (BIC), and the receiving bank's address.

- Verification and Processing: Your bank verifies the information and debits your account for the transfer amount, including any fees.

- SWIFT Messaging: Your bank sends a secure message through the SWIFT network to the recipient's bank, containing instructions for crediting the contractor's account.

- Funds Received: The recipient's bank receives the message, verifies the details, and credits the contractor's account with the transferred funds.

Why Bank Wire Transfers Deserve a Place on the List:

Several key features position bank wire transfers as a viable option for South African businesses, particularly for substantial payments:

- High Transaction Limits: Unlike some digital payment platforms, bank wire transfers typically have no upper limit, making them suitable for paying large invoices to international contractors.

- Strong Regulatory Compliance: Bank wire transfers adhere to strict international banking regulations, providing a secure and compliant method for cross-border payments, particularly important for CFOs in South Africa seeking FX transparency.

- Universal Bank Acceptance: Virtually every bank worldwide participates in the SWIFT network, ensuring your international contractors can receive payments regardless of their location.

- Detailed Transaction Documentation: The comprehensive documentation associated with bank wire transfers simplifies accounting and auditing processes, a significant benefit for South African export companies.

Pros and Cons for South African Businesses:

Pros:

- Highest Security and Reliability: Direct bank-to-bank transfers within the regulated SWIFT network offer robust security and minimize the risk of fraud or errors.

- No Limits on Transaction Amounts: This flexibility is particularly advantageous for larger payments to international contractors, as seen with South African construction companies paying overseas teams.

- Universal Acceptance: The global reach of the SWIFT network ensures seamless payments to contractors worldwide.

- Strong Legal Framework and Protections: Established banking regulations provide legal recourse in case of disputes or errors.

Cons:

- High Fees: Bank wire transfer fees, typically ranging from ZAR 250 to ZAR 850 per transfer, can significantly impact smaller transactions.

- Poor Exchange Rates: Banks often apply a markup of 2-4% on the exchange rate, leading to higher costs compared to some alternative payment methods. This is a key consideration for South African businesses focused on cost optimization.

- Slow Processing: Transfers can take 2-5 business days to complete, potentially impacting project timelines.

- Complex Process: The process can involve multiple forms and approvals, which can be time-consuming.

Examples of Successful Implementation:

- A South African manufacturing company paying a large sum to an international supplier for raw materials.

- A South African BPO business outsourcing significant portions of work and using wire transfers for reliable contractor payments.

- A South African law firm paying international legal counsel for specialized services.

Tips for South African Businesses:

- Use for Large Transactions: The high fixed fees become proportionally smaller with larger transfer amounts, making wire transfers cost-effective for substantial payments.

- Ensure Accuracy: Double-check all recipient bank details to avoid delays or returned transfers.

- Consider Timing: Account for banking holidays in both South Africa and the recipient's country, as these can impact processing times.

- Negotiate Rates: If you frequently make international payments, negotiate with your bank for better exchange rates and potentially lower fees.

- Maintain Records: Keep meticulous records of all wire transfer transactions for tax and auditing purposes.

While traditional bank wire transfers may not be the most agile or cost-effective solution for every situation, they remain a reliable and secure option for South African businesses dealing with large international payments where security and compliance are paramount. By carefully considering the pros and cons and implementing the tips provided, you can make informed decisions about when this established method offers the best way to pay international contractors.

5. Remitly and Similar Digital Remittance Services

When seeking the best way to pay international contractors, particularly for regular, smaller payments, digital remittance services like Remitly, Western Union Digital, and WorldRemit emerge as a strong contender. These platforms represent a significant evolution from traditional money transfer operators, offering South African businesses a streamlined, technology-driven solution for paying overseas contractors efficiently and affordably. They bridge the gap between the established reliability of older services and the speed and convenience demanded by today's globalized marketplace.

These services function by allowing you to send money online or via a mobile app directly to your contractor’s bank account, mobile wallet, or even for cash pickup in their local currency. They leverage real-time exchange rates and often provide transparent fee structures, enabling you to calculate the exact cost of each transfer. This transparency is particularly valuable for South African businesses navigating the complexities of foreign exchange and seeking to optimize their cross-border payment processes.

How it Works:

The process is generally straightforward. You create an account, verify your identity (a crucial step for compliance and security), input the recipient’s details, choose the amount and payment method, and initiate the transfer. The funds are then sent electronically, often arriving within minutes or hours, depending on the recipient's location and chosen payout method. The entire process is managed through a user-friendly interface, either on a website or, more commonly, via a mobile application. This mobile-first approach is particularly beneficial for busy executives and business owners constantly on the move.

Examples of Successful Implementation:

The versatility of digital remittance services makes them suitable for various South African businesses with international contractors. Imagine a Cape Town-based e-commerce business paying its customer service representatives in Mauritius, or a Johannesburg-based marketing agency settling invoices with graphic designers in India. Consider a Durban-based startup compensating its virtual assistant team in the Philippines. These are just a few examples of how these platforms facilitate smooth cross-border payments for diverse needs and industries.

Why Remitly and Similar Services Deserve a Place on This List:

These platforms are specifically designed for international money transfers, unlike broader payment gateways that might tack on international transaction fees. They offer a unique blend of competitive exchange rates, fast transfer speeds, and multiple payout options, making them a compelling alternative to traditional banking methods which can be slow and expensive for international transfers. For CFOs in South Africa focused on FX transparency, the clear fee structures and real-time exchange rates offered by these services are invaluable.

Pros:

- Competitive Exchange Rates and Fees: These services often offer better rates than traditional banks, saving your business money on each transaction.

- Fast Transfers: Payments can reach recipients within minutes to hours, essential for time-sensitive projects.

- User-Friendly Mobile Applications: The mobile-first approach makes sending and tracking payments convenient.

- Multiple Payout Options: Recipients can choose the most convenient method, whether bank deposit, cash pickup, or mobile wallet.

- Strong Compliance and Security: These platforms adhere to strict regulations, safeguarding your transactions.

- Good Customer Support: Multi-lingual support is frequently available, assisting users with any issues.

Cons:

- Limited Country Corridors: Not all services operate in every country, so check availability before committing.

- Transfer Limits: There might be limits on the amount you can send per transaction or within a specific timeframe.

- Fewer Business-Specific Features: While improving, these platforms might lack advanced features found in corporate banking solutions.

- Less Suitable for Large Amounts: For very large sums, other methods might be more cost-effective.

- Variable Fees Based on Payment Method: Fees can differ depending on how the recipient receives the funds, so comparison is key.

Tips for South African Businesses:

- Compare Rates Across Different Services: Don't settle for the first option. Compare exchange rates and fees from Remitly, WorldRemit, Western Union Digital, and others to find the best deal.

- Check Available Payout Methods in the Recipient Country: Confirm the most convenient and accessible payout options for your contractor.

- Use Bank Transfers for Better Rates: Bank transfers typically incur lower fees compared to cash pickups or mobile wallets.

- Set Up Regular Payments for Consistent Contractors: Automate recurring payments to simplify your payroll process.

- Verify Recipient Details Carefully: Double-check all information to avoid delays or misdirected funds.

Remitly Website (Example - Check for availability in relevant corridors for South Africa)

By carefully considering these factors, South African businesses can leverage the power of digital remittance services like Remitly to optimize their international contractor payments and contribute to a more efficient, connected global workforce.

6. Employer of Record (EOR) Services

One of the most comprehensive solutions for paying international contractors, especially for businesses in South Africa navigating the complexities of cross-border payments and compliance, is using an Employer of Record (EOR) service. EOR providers like Deel (www.deel.com), Remote (www.remote.com), and Papaya Global (www.papayaglobal.com) act as the legal employer for your international contractors, handling everything from payroll and taxes to compliance with local labor laws. They effectively convert contractor relationships into compliant employment arrangements, taking the administrative and legal burden off your shoulders. This is particularly valuable for South African companies looking to expand their global reach while minimizing risk and administrative overhead.

Here’s how it works: You engage an EOR provider and identify the contractor you wish to hire. The EOR then legally employs the contractor in their respective country, ensuring compliance with all local employment regulations. They manage payroll, deduct and remit the correct taxes and social security contributions, and handle all necessary paperwork. This allows you, the South African company, to focus on the contractor's work output rather than navigating the complexities of international employment law.

EOR services offer a range of features tailored for international hiring, including:

- Legal employment in the contractor's country: EORs establish a compliant employment relationship in the contractor's jurisdiction, mitigating legal risks for your South African business.

- Automated tax and social contribution handling: They handle all tax calculations, deductions, and remittances, ensuring compliance with local regulations and relieving you of this complex task.

- Compliance with local labor laws: EORs ensure adherence to local labor laws regarding contracts, working hours, leave entitlements, and termination procedures.

- Multiple payment methods and currencies: They facilitate payments in various currencies and through different methods, simplifying cross-border transactions for South African companies.

- HR and benefits administration: EORs often provide HR support, including onboarding, performance management, and access to local benefits packages.

- Contract and document management: They manage all employment-related contracts and documentation, ensuring compliance and reducing administrative burdens.

For South African businesses seeking the best way to pay international contractors, EORs offer significant advantages:

- Complete compliance and legal protection: EORs shield your company from legal and financial risks associated with international employment law.

- Simplified tax and administrative handling: They take over complex tax and administrative processes, freeing up your internal resources.

- Access to local benefits and protections: Contractors gain access to local benefits and employment protections, enhancing their job satisfaction.

- Reduced legal and financial risks: EORs mitigate the risks associated with misclassification of workers and non-compliance with local laws.

- Professional HR support: Access to HR expertise simplifies onboarding, performance management, and other HR processes.

- Streamlined onboarding process: EORs streamline the onboarding process for international contractors, reducing administrative delays.

However, EOR services are not without their drawbacks:

- Higher costs: EOR fees typically range from 15-25% of the contractor's salary, which can be a significant expense.

- Less flexibility in payment terms: Payment terms are often dictated by the EOR's processes, potentially limiting flexibility.

- May convert contractors to employees: This can have implications for your overall workforce management strategy.

- Limited control over local processes: While the EOR handles local processes, you may have less direct control over them.

- Potential over-engineering for simple contractor relationships: For short-term or low-value contracts, EOR services might be overly complex and expensive.

Examples of successful EOR implementation: Tech startups in South Africa are using Deel for hiring international developers, while scale-ups are leveraging Remote for global team expansion. Consulting firms often use Papaya Global for managing international consultants, and companies hiring full-time contractors benefit from converting them into compliant employees through EORs.

Tips for South African businesses:

- Use EORs for long-term, significant contractor relationships: The cost-benefit ratio is more favorable for long-term engagements.

- Compare different EOR providers: Evaluate providers based on their country coverage, pricing, and services offered.

- Understand the employment vs. contractor implications: Be aware of the legal and tax ramifications of converting contractors to employees.

- Factor in the total cost including EOR fees: Accurately budget for the total cost, including the EOR's percentage fee.

- Ensure contractors are comfortable with employee status: Communicate clearly with contractors about the change in their employment status.

By carefully considering the pros and cons and following these tips, South African businesses can leverage EOR services as a valuable tool for paying international contractors compliantly and efficiently, ultimately enabling smoother global expansion and access to a wider talent pool.

Top 6 International Contractor Payment Methods Compared

| Method | 🔄 Implementation Complexity | ⚡ Resource Requirements | ⭐ Expected Outcomes | 💡 Ideal Use Cases | 📊 Key Advantages |

|---|---|---|---|---|---|

| Wise (formerly TransferWise) | Moderate - API integration available | Low to moderate - internet access, API | High - low fees, fast transfers, mid-market rates | International payments with multiple contractors | Transparent fees, fast, multi-currency accounts |

| PayPal and Payoneer | Low - user-friendly platforms | Low - web/mobile access | Medium - convenient but higher fees | Quick contractor/vendor payments, freelance platforms | Global reach, strong support, widespread adoption |

| Cryptocurrency Payments | High - technical setup and knowledge needed | Moderate - wallets, exchanges, security | Variable - fast, low cost but volatile | Crypto-savvy users, high-value or programmable payments | Low fees, transparency, fast settlements |

| Traditional Bank Wire Transfers | High - formal banking procedures | High - banks, compliance, paperwork | Reliable - secure, universally accepted | Large sums needing maximum security and compliance | Highest security, no transaction limits |

| Remitly and Similar Services | Low - mobile-first, simple interfaces | Low - mobile/internet | Good - affordable, fast for small amounts | Small businesses, remittances, regular small payments | Fast, user-friendly, multiple payout options |

| Employer of Record (EOR) Services | High - legal, tax, compliance complexity | High - administrative and legal support | Very high - compliant employment, risk-free | Long-term, large contractor engagement | Full compliance, risk mitigation, HR support |

Optimizing Your Global Payment Strategy

Finding the best way to pay international contractors is crucial for South African businesses expanding their global reach. We've explored various options, from established platforms like Wise and PayPal to emerging solutions like cryptocurrency and specialized services like Remitly and Employer of Record (EOR). Each method has its own advantages and disadvantages, depending on factors such as transaction fees, speed, security, and the location of your contractors. Remember, the optimal approach balances cost-effectiveness with ease of use and compliance. For South African companies dealing with fluctuating exchange rates and cross-border complexities, selecting the right payment method can significantly impact your bottom line.

Mastering these payment strategies empowers your business to navigate the intricacies of international finance with confidence. It allows you to build trust with your global team by ensuring timely and reliable payments, fostering a positive working relationship. Ultimately, optimizing your global payment strategy unlocks the full potential of your international workforce, enabling you to achieve your business objectives more efficiently and effectively.

Taking control of your international contractor payments doesn't have to be complex. Streamline your processes and unlock better FX rates with Zaro, a platform designed to simplify cross-border payments for businesses like yours. Visit Zaro today to explore how we can help you optimize your global payment strategy and empower your international team.