For any South African business dealing internationally, the Bidvest foreign exchange rate you see on a quote isn't just a number. It's the live market rate plus a service fee, known as a spread, baked right in. This markup won't show up as a line item on your invoice, but it quietly chips away at the cost of every single cross-border payment you make.

Understanding this hidden cost is the first real step to protecting your bottom line.

What You Actually Pay for Bidvest Foreign Exchange Rates

When you need to pay a supplier in another country or receive funds from an overseas client, the exchange rate you get from a bank is almost never the "real" one.

It’s a bit like buying fruit. You can get it directly from the farm at a wholesale price, or you can buy it from a supermarket. The supermarket adds a markup to cover its own costs and turn a profit. The price you end up paying is higher than the original farm price.

In the world of currency, the mid-market rate (or interbank rate) is the "farm price"—the wholesale cost. The Bidvest foreign exchange rate offered to you is the "supermarket price," which includes their markup. This markup is called the spread, and it’s how the bank makes its money on the transaction.

The Hidden Cost of the Spread

On paper, a small percentage might not look like much. But for a business that handles international payments regularly, these spreads add up to a serious expense.

Let’s say you have a $50,000 invoice to pay. A 2% spread on that payment translates to an extra R18,000 in hidden costs, assuming a ZAR/USD rate of 18.00. That's money straight from your profit margin that never appears as a separate fee.

The crucial takeaway for any financial manager is this: the quoted exchange rate is not the true cost. The spread is a variable, often invisible, fee that erodes the value of your international payments and receipts.

Why This Model Is Standard Practice

This spread-based model is the traditional way banks have always done business in foreign exchange. Bidvest Bank has carved out a niche as a leading second-tier bank in South Africa, with a strong focus on providing these services to corporate clients.

Their expertise means they can offer valuable solutions, like helping businesses lock in forex rates to protect them from market volatility. You can find out more about how Bidvest’s financial services are structured.

But for a business owner or CFO, transparency is everything. Simply knowing that the rate you’re quoted includes a spread is the first, most important step. It gives you the power to find more cost-effective solutions that can save your company a small fortune over time. It means you can start asking the right questions and properly compare what different forex providers are really offering.

How Banks Actually Calculate the Foreign Exchange Rate You're Quoted

Ever wondered what goes into the Bidvest foreign exchange rate you see on your statement? It’s not just the number you might see on Google. To really get a handle on your international payment costs, you need to pull back the curtain on how banks, including Bidvest, build their rates.

It all starts with something called the interbank rate, or the mid-market rate. Think of this as the wholesale price of a currency—it’s the rate at which massive banks trade with each other. It’s the purest, most direct reflection of global supply and demand for that currency at that exact moment.

But here’s the crucial part: that’s not the rate your business gets. Banks add their own margin, known as a spread, on top of this wholesale rate. This new, marked-up rate is what they offer you, the customer.

Breaking Down the Customer Rate

That gap between the pure interbank rate and the customer rate is the bank's profit centre. For your business, this spread is a direct cost, even if it feels invisible. It’s a percentage that quietly eats into every single international transaction, whether you're paying an overseas supplier or getting paid by a foreign client.

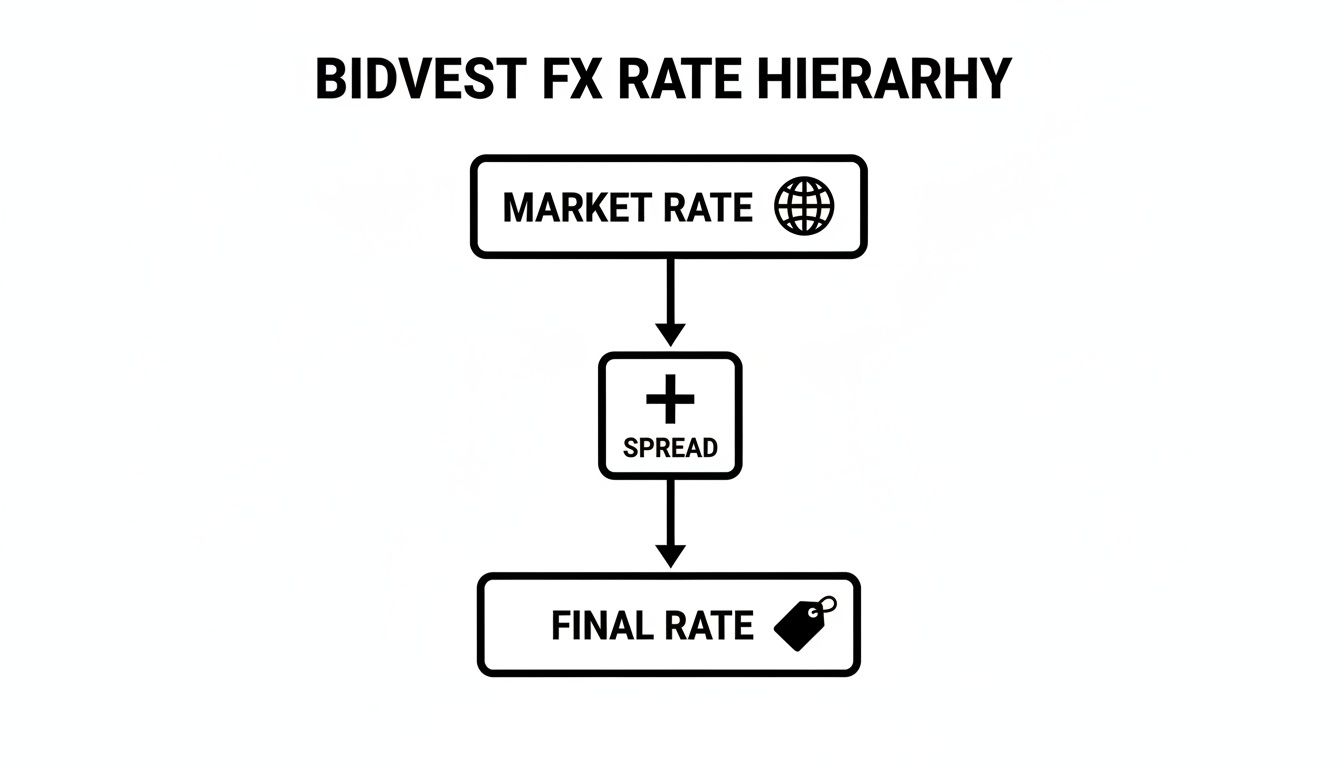

This simple flowchart shows how the rate you end up paying is constructed.

As you can see, the final rate is a stack: the real market rate at the bottom, with the bank's spread layered on top. This spread is the first hidden cost, but unfortunately, it’s rarely the last.

Uncovering the Extra Transaction Fees

Beyond the spread, a whole host of other fees can inflate the final cost of your international payment. These are often itemised separately, but they all add up to reduce your bottom line.

You’ll typically run into a few common culprits:

- Administrative Fees: This is a fixed charge the bank levies just for handling the transaction.

- SWIFT Fees: Payments are sent internationally via the SWIFT network, and banks charge for using this service. These fees can easily range from R250 to over R750 for a single payment.

- Intermediary Bank Fees: Your money doesn't always go directly from your bank to the recipient's. It often has to pass through one or more correspondent banks, and each one might skim a fee off the top along the way.

All these costs stack on top of each other, meaning the final amount that leaves your account is often much higher than you first anticipated.

For any CFO or business owner trying to manage costs, the only number that matters is the "all-in" cost. You have to look past the advertised exchange rate and account for every admin fee, SWIFT charge, and hidden spread to understand what a transaction is truly costing your business.

A Practical Example of How These Costs Compound

Let's walk through a real-world scenario. Imagine your South African business needs to pay a US supplier an invoice for $10,000.

Here’s a typical breakdown from a traditional bank:

- The real mid-market exchange rate is 18.00 ZAR to 1 USD.

- Your bank quotes you a customer rate of 18.36 ZAR to 1 USD, which includes their 2% spread.

- They also add a R450 admin fee and a R250 SWIFT fee.

At the real market rate, the payment should cost R180,000. But thanks to the spread, the cost immediately jumps to R183,600. Now, tack on the R700 in combined fees, and your total cost balloons to R184,300.

That’s an extra R4,300 gone from your profit margin on just one payment. It’s a perfect illustration of how these "small" costs can have a massive impact over time.

Navigating Rand Volatility for Your Business Finances

It’s not just the spreads and fees you need to watch out for. There's another, often bigger, force at play that can wreak havoc on your bottom line: Rand volatility. If your South African business deals with international clients or suppliers, you're already familiar with the rollercoaster ride of the ZAR against currencies like the US dollar, euro, or pound.

These aren't just abstract numbers on a screen; they have a very real impact on your cash flow, profit margins, and ability to plan for the future.

Let's walk through a common scenario. Say you're an exporter and you've just sent a $20,000 invoice to a customer in the US. At the time of invoicing, the exchange rate is a comfortable R18.50/USD, which means you’re expecting to bank R370,000. But the payment terms are 30 days.

In that month, the market shifts. The Rand strengthens to R17.90/USD by the time your client’s payment hits your account. That same $20,000 now only converts to R358,000. Just like that, you’ve lost R12,000 in revenue before your bank has even taken its cut.

The Double Impact on Profit Margins

This kind of market movement, especially when combined with a bank’s own spread, can seriously eat into your profits. And it’s a problem that cuts both ways, causing major headaches for importers and exporters alike.

- For Importers: If the Rand weakens, the cost of your imported goods or services suddenly shoots up between the time you place an order and the day you have to pay for it. You’re left with a tough choice: absorb the loss yourself or push the higher costs onto your customers.

- For Exporters: If the Rand strengthens, the foreign currency you’ve earned from sales suddenly buys you fewer Rands. This directly reduces your revenue and can make your products seem more expensive on the global market.

This is the day-to-day reality for South African SMEs. In fact, data from the South African Reserve Bank recently showed the rand-to-dollar rate swinging by about 11.5% between its high and low points within a single six-month period. For businesses pricing in USD, those kinds of shifts can decimate ZAR-denominated revenue.

For any business, cost predictability is essential for strategic planning and growth. Rand volatility, combined with opaque banking fees, turns what should be a straightforward transaction into a financial gamble.

Tackling currency volatility means getting proactive. It starts with a solid financial review and understanding your exposure. Resources like a comprehensive guide to modern risk analysis for businesses can give your finance team the framework to build a more resilient strategy.

Without a plan to manage your foreign exchange, your business is left at the mercy of market forces completely outside your control, making it almost impossible to budget with any real confidence.

A Modern Alternative to Old-School Forex

If you've ever dealt with hidden spreads, surprise fees, and the gut-wrenching volatility of the Rand, you know the traditional banking model for foreign exchange feels broken. For South African businesses, this system creates a constant state of financial uncertainty and quietly eats away at the bottom line. But what if you could just sidestep that entire structure?

This is where modern financial technology platforms come in. They’re not just offering a slightly better service; they’re challenging the very foundation of how banks handle forex. Instead of baking in a hidden markup, these platforms are built from the ground up on total transparency.

The idea is straightforward but incredibly powerful. Imagine being able to buy foreign currency at the exact same wholesale price—the real, mid-market exchange rate—that banks trade at among themselves. That’s the core promise of a truly modern alternative.

A New Model Built on Transparency

This new approach gets rid of the hidden spread completely. The rate you see is the rate you get. No smoke and mirrors, no surprise markups. Think of it like buying your produce directly from the farmer instead of the supermarket; you cut out the intermediary and their added costs, which means you get a much fairer price.

This model gives your business absolute clarity on transaction costs right from the start.

On top of that, many of these platforms are dismantling the fee structure that’s so common in banking. By using far more efficient payment networks, they can do away with SWIFT fees, which can easily add hundreds of Rands to every single international payment you make.

By offering the real mid-market rate with no spread and no SWIFT fees, modern fintech platforms transform foreign exchange from a confusing cost centre into a predictable, manageable business expense. This shift gives financial managers unprecedented control over their international payments.

Enterprise-Grade Tools for Professional Teams

Of course, saving money is only half the battle. Any modern platform worth its salt must also meet the operational and security demands of a professional finance team. These solutions are designed with robust, enterprise-level features that traditional banking often struggles to deliver in a user-friendly package.

Key capabilities usually include:

- Multi-User Access: Lets you assign specific roles and permissions to different team members.

- Bank-Level Security: Employs advanced encryption and security protocols to keep company funds safe.

- Painless Compliance: Automates the Know Your Business (KYB) and reporting processes, cutting down on administrative headaches.

- Centralised Control: Gives you a single dashboard to manage all your international transactions, balances, and reporting.

For businesses looking to move past the limitations of traditional currency exchange, exploring modern international B2B payment solutions can be a game-changer. These platforms offer the security and control finance teams need while fundamentally rewriting the cost structure of cross-border commerce, putting money back into your business where it belongs.

Practical Steps to Lower Your Foreign Exchange Costs

Knowing about the hidden costs in foreign exchange is one thing; actually doing something about them is what will protect your bottom line. For any South African business owner or CFO, it’s time to get practical. You can start cutting your international payment costs right now by running a simple but revealing audit on your current forex provider.

This isn’t about becoming a forex expert overnight. It’s simply about asking the right questions and knowing where to find the real numbers. That clarity is what allows you to make smarter financial decisions.

Perform a Quick FX Cost Audit

Your main goal here is to figure out the genuine 'all-in' cost of a transaction. That means looking past the headline Bidvest foreign exchange rates you’re quoted and digging up every single fee, both the obvious and the hidden ones.

Here’s a straightforward, three-step process you can use:

Find the Real Rate: Before you even ask for a quote, find the live mid-market exchange rate. Use an independent source like Google, Reuters, or Bloomberg to get the true wholesale rate for your currency pair (e.g., ZAR to USD). Think of this as your benchmark for a fair price.

Request a Full Quote: Now, go to your bank and ask for a complete cost breakdown for an international payment. Be specific. You want the customer exchange rate they're offering you, plus an itemised list of all administrative and SWIFT fees.

Calculate the Total Cost: It’s time for a little bit of maths. Compare their customer rate to the mid-market rate you found earlier. The difference is their spread. Now, add the cost of this spread to all the other itemised fees to get your true 'all-in' cost for that single payment.

Doing this quick audit reveals exactly how much you’re paying on top of the real market price. If you repeat this for a few recent transactions, you'll get a very clear picture of your annual FX costs.

Ask Your Provider the Right Questions

Once you have this data, you can have a much more productive conversation with your provider. Don't be shy about challenging the way things are done and pushing for more transparency.

Here are a few direct questions to get you started:

- "Can you confirm the exact percentage spread you add to the mid-market rate for our transactions?"

- "Could you provide a complete list of all fees, including any SWIFT and intermediary bank charges that might apply?"

- "What is the total Rand amount that will leave our account, and what is the exact foreign currency amount that will arrive in the beneficiary's account?"

How they answer—or don't answer—will tell you everything you need to know about their pricing model.

A provider that can't or won't answer these questions clearly is probably relying on a lack of transparency to protect their profit margins. For any business focused on controlling costs, that’s a major red flag.

Even massive, well-capitalised South African companies feel the sting of currency exposure. Take Bidvest Group, for example. Their own financial reports show net finance charges shot up by 28.2% in a recent fiscal year, driven partly by exchange rate movements. If a giant like Bidvest feels that pressure, imagine the impact on smaller export companies without the same resources. It makes proactive cost management absolutely essential. You can read more about these financial dynamics in Bidvest's presentation.

Ultimately, platforms built on a foundation of transparency make this entire evaluation effortless. They show you the all-in cost upfront, giving you the power to improve your company’s financial health without the guesswork.

Got Questions About Forex Rates in South Africa? We Have Answers.

If you’re a busy financial manager or business owner, getting a straight answer about foreign exchange can feel like pulling teeth. To cut through the noise, we’ve put together the most common questions we hear from South African businesses about forex rates, spreads, and fees.

Think of this as your quick-reference guide—the essential information you need to challenge the status quo and find a better, more cost-effective way to handle your international payments.

How Can I Find the Real Rand Exchange Rate?

The "real" exchange rate is what the industry calls the mid-market rate. It’s the true midpoint between what buyers are willing to pay and what sellers are asking for a currency on the global markets. You'll see this rate on neutral financial sources like Google Finance, Reuters, or Bloomberg. It's the only benchmark that matters.

To figure out what you’re really paying, just compare this mid-market rate to the "customer rate" your bank offers you. The gap between those two numbers is their hidden fee—the spread. Modern platforms are now giving businesses direct access to this real rate without adding any markup at all.

Are Bidvest Foreign Exchange Rates Competitive for SMEs?

When you stack them up against other traditional South African banks, Bidvest foreign exchange rates play in the same ballpark. They offer reliable services, but like their peers, they build their profit into a variable spread. That's just standard practice in the banking world.

But when you compare that model to newer fintech alternatives, any system with a built-in spread is, by its very nature, more expensive for you. For a small or medium-sized business making regular international payments, even a seemingly small spread of 1-2% can quietly drain tens of thousands of Rands from your bottom line over the year.

The most competitive option is always the one that gives you total transparency and access to the real market rate. It’s the only way to get complete certainty on your costs for every single transaction.

What Is a SWIFT Fee and Is It Unavoidable?

A SWIFT fee is a charge for sending money through the global communication network that most traditional banks rely on. This fee can sting, often costing anywhere from R250 to over R750 per payment. Worse, it can be charged by both the sending and receiving banks, sometimes without any warning.

The good news? This fee is absolutely not unavoidable. Many modern payment platforms have developed smarter, more efficient payment networks that bypass the old SWIFT system entirely. This means they can get rid of these charges for their customers, bringing down the total cost of your transaction even further.

How Does Locking in an Exchange Rate Help My Business?

Locking in an exchange rate is usually done with a Forward Exchange Contract (FEC). It lets you agree on a rate today for a payment that will happen in the future, which is a popular strategy for managing the risks of a volatile Rand.

For instance, if you need to pay a supplier $50,000 in three months, an FEC tells you the exact ZAR cost today. It’s a great tool for budget certainty. But be aware that banks often build an extra premium into the forward rate they offer you. So while it provides stability, it doesn't get rid of the hidden costs. Always look at the all-in cost before you commit.

At Zaro, we believe South African businesses deserve complete transparency. We offer the real mid-market exchange rate with zero spread and no SWIFT fees, giving you full control over your international payments. See how much you can save with Zaro today.