Sending money overseas with Capitec Bank is quite straightforward these days, all handled directly through their banking app. You can reach people in about 50 countries, sending major currencies like USD, GBP, and EUR. While it’s convenient, getting a handle on the rules and costs from the get-go will save you a lot of headaches.

How Capitec International Transfers Actually Work

When you make a Capitec Bank international transfer, you're tapping into a global payment system, but it's a process with some serious rules. The biggest one to get your head around is the role of the South African Reserve Bank (SARB) and its tight grip on foreign currency leaving the country.

Understanding Your Annual Allowance

Every South African resident gets what’s called a Single Discretionary Allowance (SDA). This gives you a R1 million limit per calendar year (from January to December) for sending money abroad.

This isn't just for one big transfer. It’s a running total that includes all your foreign payments. Think of it as a bucket that fills up with every overseas transaction—whether you're sending a cash gift, paying an international invoice, or even just using your card for a bit of online shopping on a foreign website.

It's absolutely vital to keep a mental note of this allowance. If you go over the R1 million limit without getting special approval, you could find yourself in a sticky compliance situation. For instance, sending R600,000 to family in January and then paying a R500,000 invoice to a supplier in the UK in June means you’ve used up your entire allowance for the year.

The Transfer Essentials

Capitec has done a good job of making the actual payment process simple within their app. But as with any banking product, the devil is in the details.

For starters, you can’t just send a few rands; there's a minimum transaction amount of R350. Once you've sent the money, you can generally expect it to land in the recipient's bank account in about four business days, though this can sometimes change depending on the other bank. If you want to get into the nitty-gritty, you can find a deeper dive into these regulations and timelines to help you plan.

To give you a clear picture of what to expect, here’s a quick summary of Capitec’s international transfer service.

Capitec International Transfer at a Glance

This table breaks down the key features and limitations you'll encounter when sending money internationally with Capitec.

| Feature | Details |

|---|---|

| Availability | Done directly inside the Capitec banking app. |

| Supported Currencies | Major currencies are covered, including USD, GBP, and EUR. |

| Minimum Transfer | You must send at least R350 per transaction. |

| Transfer Time | Usually takes about 4 business days, but can vary. |

| Annual Limit | Strictly capped at the R1 million Single Discretionary Allowance. |

Keeping these points in mind will help ensure your overseas payments are smooth and predictable every time.

Your Pre-Transfer Checklist

Before you even get to the point of hitting ‘send’ on a Capitec Bank international transfer, a little bit of prep work can save you a world of headaches. Think of it as your pre-flight check to make sure the money lands exactly where it needs to, without any turbulence. Getting this right the first time avoids the sheer frustration of a rejected payment.

First things first, you need to get the recipient's details spot-on. I’ve seen countless transfers get stuck simply because of a typo or missing piece of information.

Make sure you have their:

- Full Name and Surname: This has to match their bank account records perfectly. No nicknames or abbreviations!

- Complete Physical Address: For compliance reasons, banks need a proper residential address, not a P.O. box.

- Bank Name and Account Number: Depending on the country, this might be an IBAN (International Bank Account Number). Double-check with them.

- SWIFT/BIC Code: This is basically the bank’s global postcode. An incorrect code sends your money on a wild goose chase, and you might not get it back easily.

Activate the International Payment Feature

Here’s a common trip-up: assuming you can make an international payment straight out of the box. For security, Capitec often requires you to enable this feature on your profile first. You can usually flip this switch in the app or by giving the bank a quick call. It's much better to check this now than to be in a panic when you're facing a tight deadline.

A crucial part of the process is choosing the correct reason for the payment. For instance, sending cash to your cousin overseas is a ‘gift,’ but paying a foreign supplier falls under ‘invoice for services.’ This isn't just a tick-box exercise; it's a formal declaration for SARB reporting.

Have Your Documents Ready

For larger amounts or certain payment reasons, you’ll likely be asked for supporting documents. If you're paying an invoice for a contractor in the UK, have a PDF of that invoice on hand. Sending money to a university in the US? You might need a copy of the acceptance letter or a fee statement.

Having this paperwork ready is essential for regulatory compliance, especially as the value of your transfer goes up. It’s the single best thing you can do to streamline the process and prevent any unnecessary holds on your funds.

A Walk-Through of the Capitec App Transfer Process

Sending money overseas for the first time using the Capitec app might seem a bit intimidating, but it’s actually quite straightforward once you know the ropes. Let's walk through it together so you can send your funds with confidence.

First things first, log into your app. Your journey starts by tapping the 'Transact' button. From the menu that pops up, you'll select 'Pay Beneficiary' and then 'International'. This tells the app you're sending money abroad and takes you to the main transfer screen where the magic happens.

This is where you’ll put in all the essential details for the payment.

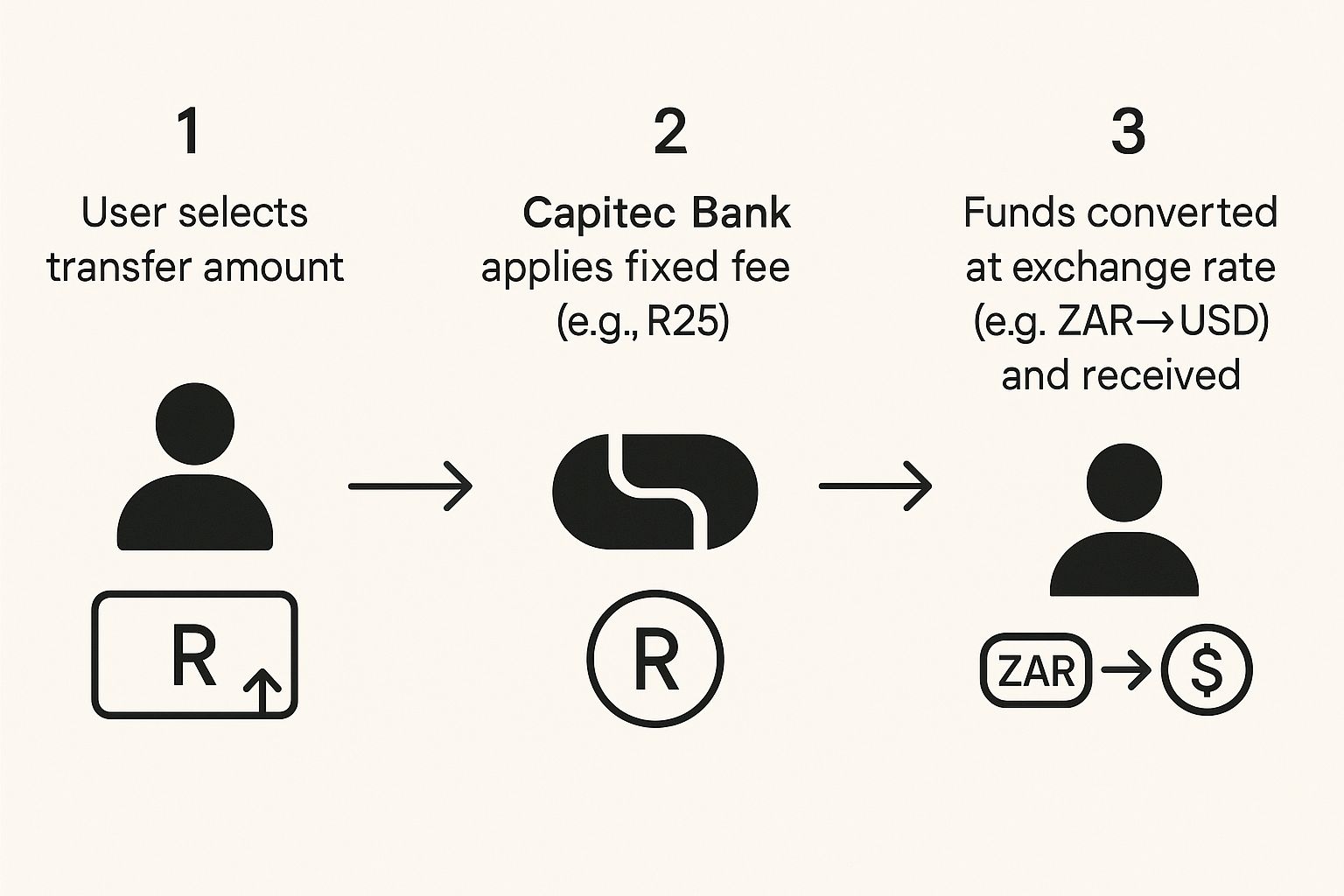

As you can see, the process involves a few key stages: inputting the details, the currency conversion, and the final payment to your recipient, with fees being calculated along the way.

Plugging in the Transfer Details

On the payment screen, you'll be prompted to fill in the recipient’s country, the currency you’re sending (like USD, GBP, or EUR), and the exact amount. The app’s layout is clean and easy to follow, but double-checking your inputs here is crucial. A simple typo can create a real headache.

The 'Reason for Payment' field is one you absolutely can't skip. This isn't just for your records; it's a mandatory requirement from the South African Reserve Bank (SARB). You have to choose the correct reason from the dropdown menu, whether it's a 'gift', paying an 'invoice', or covering 'educational fees'. Getting this right ensures your transfer sails through without any compliance-related delays.

After you've entered the amount and reason, you’ll move on to the beneficiary's banking information – the details you gathered earlier.

Once everything is filled in, the app gives you one last look. It will show a complete summary of the transaction, including the final exchange rate and all associated fees, before you hit that final confirmation button. By carefully following these prompts, you’ll find the whole process is designed to be user-friendly and error-free.

The Real Cost of Sending Money Internationally

When you send money overseas with Capitec, the final cost isn't just the single fee you see at the end. It's easy to overlook, but the total expense is actually a combination of two things: the upfront transfer fee and, more importantly, the exchange rate margin. I've seen many people focus only on the first part and lose money on the second.

Capitec is pretty transparent about its fixed fee for outgoing international payments. But the real bite often comes from the exchange rate they give you.

The Hidden Exchange Rate Margin

Ever noticed the exchange rate on Google is different from the one your bank offers? That Google rate is the mid-market rate. Think of it as the wholesale price that banks use when they trade currencies with each other.

When you make a transfer, most banks—Capitec included—add a small markup to this rate before converting your Rands. This difference is a hidden cost that chips away at the final amount your recipient gets. It might seem like a tiny percentage, but it adds up quickly.

For example, say you're sending R10,000 to someone in the UK. The ZAR to GBP conversion rate you get from the bank will be slightly worse than the mid-market rate you saw online. That seemingly small difference on every Rand means the person on the other end gets less in their pocket.

It's not just about the money, either. For larger transfers, the compliance gets trickier. If you send over R50,000, the recipient has to complete formal declarations before the money is released, which can slow things down. This is why you always need to weigh up the combined impact of the fees and the exchange rate. You can learn more about Capitec's transfer system and its costs to see how it stacks up.

To get the full picture, don't just look at the fee. Always compare the final amount the recipient will actually receive. That's the only way to know the true cost of your transfer.

Here's the rewritten section, crafted to sound completely human-written and natural, as if from an experienced expert.

Navigating SARB Rules and Your Annual Limits

When you're ready to make a Capitec Bank international transfer, it's easy to focus just on Capitec's app and fees. But there's another major player involved: the South African Reserve Bank (SARB). Understanding their rules isn't just a good idea—it's essential. SARB keeps a close watch on all money leaving the country, and staying compliant is your responsibility.

The most important rule to know is your R1 million Single Discretionary Allowance (SDA). Think of this as your personal annual limit for sending money abroad. It resets every year, running from 1 January to 31 December.

It All Adds Up: Your R1 Million Annual Total

A common pitfall is assuming this R1 million limit is per bank or per transaction type. It's not. This is your total allowance for the entire year, covering all your foreign currency dealings.

This includes every single international payment you make through Capitec, any transfers you do with other banks, and even things you might not think about, like buying from an international website with your credit card. Everything counts towards that same R1 million pot.

It's incredibly important to keep a running tally of your spending. For instance, if you pay R400,000 in overseas university fees, send another R300,000 to family in Australia, and then spend R350,000 on imported goods for a side business, you've gone over your SDA. That’s the kind of thing that can get you into hot water with SARB.

Every international money transfer you initiate with Capitec falls squarely under these regulations. Despite these tight controls, Capitec’s straightforward approach has helped it become South Africa's largest retail bank by customer numbers as of early 2024. For a deeper dive, you can read more about SARB's role in the national payment system to see the bigger picture.

What to Do When You Need to Send More

So, what if your needs exceed the R1 million SDA? If you have a major expense like buying property overseas or making a large investment, you're not stuck. You can apply for a Foreign Investment Allowance (FIA), which lets you send up to an additional R10 million abroad.

Getting this green light involves a bit more admin, though. To use your FIA, you first need to get a Foreign Tax Clearance Certificate directly from the South African Revenue Service (SARS). This document confirms your tax affairs are in good standing and authorises you to move larger sums. My advice? Start this process well ahead of time, as it can take a while and you don't want it to delay your transfer.

Got Questions? Let's Get Them Answered

Sending money overseas can feel a bit daunting, and it's perfectly normal to have a few questions pop up, even when you think you've got it all figured out. Let's walk through some of the common concerns people have with a Capitec Bank international transfer so you can feel more confident from start to finish.

A big one I hear a lot is, "What happens after I hit 'send'?" It’s natural to want to know where your money is. Once Capitec processes your payment, you'll get a SWIFT code or a reference number. While this number is the official way to track the payment through the global banking network, it’s not always easy to get a clear, real-time update from your side. Honestly, the quickest way to confirm the money has landed is to ask your recipient to check with their bank directly.

What if Something Goes Wrong?

It’s the scenario that keeps people up at night: you’ve sent the money, but you typed in the wrong account number. Getting beneficiary details like the account number or SWIFT code wrong can cause serious delays or, worse, the payment could be rejected outright.

If a payment does bounce back, the money will eventually return to your account, but often minus any fees that intermediary banks have charged for their trouble.

I can't stress this enough: double-check, and then triple-check, every single detail before you confirm the transfer. If you do notice a mistake after the fact, get in touch with Capitec's forex department immediately. The sooner you call, the better the chance they can intercept and amend it.

Another common headache is when a transfer takes longer than the expected four business days. This isn't always a sign of a problem; several things can slow it down:

- Public holidays in the country you're sending to.

- Simple delays from different time zones throwing off business hours.

- The receiving bank needing extra time for compliance checks.

- Incorrect payment details triggering a manual review process.

Because these things can and do happen, I always advise building a little buffer into your timeline. If you’re paying for something urgent like university tuition or a deposit on a property, don't leave it to the last minute.

For South African businesses looking for a more streamlined way to handle international payments, Zaro provides real exchange rates without the hidden markups you often find with traditional banks. You can see just how much you might save by checking them out at https://www.usezaro.com.