Navigating the Current: A Lifeline for South Africa's Global SMEs

For South African small and medium-sized enterprises (SMEs) operating in the global market, mastering cash flow is not just an accounting task-it's the key to survival and growth. Exporting presents immense opportunities, but it also introduces complexities like fluctuating exchange rates, delayed international payments, and opaque banking fees that can cripple liquidity. In a challenging economic climate, having robust cash flow management strategies is more critical than ever.

This guide moves beyond generic advice to offer nine specific, actionable strategies tailored for the unique challenges faced by South African exporters. We will explore how to build financial resilience, enhance predictability in your revenue streams, and unlock vital working capital.

Central to these strategies is leveraging modern fintech solutions. For instance, using a platform like Zaro can revolutionise cross-border transactions by offering transparent, real-time exchange rates and eliminating hidden fees. This gives you the control needed to confidently manage your international financial operations. Prepare to transform your approach from reactive cash-crunch management to proactive financial optimisation. This article will show you how.

1. Adopt Dynamic Cash Flow Forecasting

Static annual budgets are a relic of a more predictable era. For a modern South African exporter grappling with market volatility and currency swings, they are simply inadequate. Effective cash flow management strategies demand a more agile approach: dynamic cash flow forecasting. This involves creating a living financial model, most practically a rolling 13-week forecast, that you update weekly.

This short-term financial roadmap provides a near-real-time view of your liquidity, allowing you to anticipate challenges before they escalate into crises. It is particularly crucial for businesses managing cross-border transactions.

How to Implement a Rolling Forecast

- Gather Your Data: Start by collating all expected cash inflows (e.g., confirmed customer payments in USD or EUR) and outflows (e.g., supplier invoices, payroll, operational costs).

- Model Currency Impact: Instead of using a single exchange rate, model best-case, worst-case, and most-likely scenarios for the ZAR. This helps you understand how currency fluctuations will affect your rand-denominated profits and purchasing power.

- Integrate Payment Timelines: Factor in the settlement times for international payments. When receiving funds from an overseas client, using a transparent, low-cost platform like Zaro can reduce settlement delays and fees, making your inflow forecasts more accurate and improving your available cash.

- Update Weekly: Dedicate time each week to update the forecast with actual figures and revise projections for the coming weeks. This disciplined process turns forecasting from a static exercise into a powerful, real-time decision-making tool.

By adopting this strategy, you move from reacting to financial surprises to proactively managing your liquidity, ensuring you have the capital needed to pay suppliers and seize growth opportunities.

2. Optimise Accounts Receivable

The gap between delivering goods and receiving payment is a critical pressure point for any business, especially for South African exporters managing international clients. Waiting 30, 60, or even 90 days for payment can severely strain your liquidity. A core pillar of effective cash flow management strategies is therefore to systematically shorten this cycle through accounts receivable (AR) optimisation. This involves refining your credit policies, invoicing procedures, and collection efforts to reduce your Days Sales Outstanding (DSO).

A shorter DSO means cash enters your business faster, providing the working capital needed for operations, supplier payments, and growth investments without relying on expensive debt. For example, many software companies slash their AR balances by implementing automated payment collection for subscriptions, ensuring immediate cash inflow.

How to Implement AR Optimisation

- Invoice Immediately and Accurately: Don't wait until the end of the month. Send a clear, detailed invoice as soon as the goods are shipped or services are rendered. Ensure all details, like purchase order numbers and banking information, are correct to prevent payment delays.

- Offer Diverse and Simple Payment Methods: Accommodate your international clients by offering multiple payment options. For overseas customers, providing a straightforward, low-cost payment route is crucial. Using a platform like Zaro allows them to pay you easily, avoiding the high fees and slow processing times of traditional banks, which often cause hesitation and delays.

- Establish Clear Credit and Collection Policies: Define your payment terms upfront and communicate them clearly. Implement a systematic follow-up process for overdue accounts, starting with automated reminders and escalating to personal calls for significantly late payments.

- Review an Aged Debtors Report Weekly: Make reviewing your aged debtors list a non-negotiable weekly task. This report highlights which accounts are overdue and for how long, allowing you to prioritise collection efforts where they are most needed.

By actively managing your receivables, you transform a passive waiting game into a proactive process that directly injects cash into your business, strengthening your financial stability.

3. Inventory Management and Optimization

For South African exporters, inventory represents a significant portion of tied-up capital. Holding excess stock ties up cash that could be used for growth, while insufficient stock can lead to lost sales and damaged client relationships. Strategic cash flow management strategies must therefore include rigorous inventory optimisation, a discipline perfected by global giants like Toyota with its Just-in-Time (JIT) model.

The goal is to strike a delicate balance: minimising carrying costs without compromising your ability to meet customer demand, especially when dealing with international lead times. This transforms inventory from a passive cost centre into an active component of your liquidity strategy.

How to Optimise Your Inventory

- Implement ABC Analysis: Categorise your inventory into three groups. 'A' items are high-value, low-quantity products that require tight control. 'B' items are moderate in value and quantity, and 'C' items are low-value, high-quantity products. Focus your management efforts on the 'A' items to have the biggest impact on cash flow.

- Establish Reorder Points: Use historical sales data and lead times to calculate minimum stock levels that trigger a new order. This data-driven approach prevents both stockouts and overstocking, ensuring capital is deployed efficiently.

- Negotiate Supplier Terms: Explore consignment arrangements where you only pay for goods after they are sold. For imported components, work with suppliers on flexible payment terms that align with your own sales cycle. Reducing upfront cash outlay for inventory is a direct boost to your liquidity.

- Conduct Regular Audits: Don't wait for year-end to count stock. Regular cycle counting helps identify slow-moving or obsolete items quickly. You can then run promotions or bundle these items to liquidate them and recover the cash, rather than letting them depreciate in the warehouse.

By actively managing your stock levels, you free up vital working capital, reduce storage and insurance costs, and create a more resilient and cash-efficient operation.

4. Optimise Accounts Payable

Paying suppliers too early can needlessly deplete your cash reserves, while paying them too late damages crucial relationships and incurs penalties. Strategic cash flow management strategies involve optimising your accounts payable (AP) process. This means paying your bills at the most advantageous time to hold onto your cash for as long as possible without harming your business reputation. For a South African exporter, this practice provides vital liquidity to navigate currency volatility.

Managing your payment timing effectively is not about avoiding obligations; it is about controlling your outflow to match your inflow cycle, ensuring you always have the working capital needed to operate and grow. Giants like Apple are masters of this, often negotiating payment terms extending beyond 120 days while receiving customer payments almost instantly.

How to Implement Accounts Payable Optimisation

- Negotiate Favourable Terms: Don't passively accept standard payment terms. During contract negotiations or renewals, proactively ask for extended terms (e.g., 60 or 90 days instead of 30). Frame it as a way to strengthen a long-term partnership.

- Analyse Early Payment Discounts: A 2% discount for paying 20 days early might seem attractive, but it translates to a high annualised interest rate. Calculate whether the cash retained by paying on the due date could generate a higher return for your business.

- Schedule Payments Strategically: Use accounting software to schedule payments for their exact due dates, not as soon as the invoice arrives. This simple discipline maximises your cash-in-hand period without risking late fees or supplier goodwill.

- Leverage Technology for Global Payments: When paying international suppliers, use a platform like Zaro to minimise transfer fees and gain clarity on exchange rates. Predictable, low-cost international payments make it easier to schedule outflows precisely, avoiding the hidden costs that erode your cash position.

By treating accounts payable as a strategic tool rather than a mere administrative task, you can unlock significant working capital, improve your financial stability, and enhance your overall liquidity management.

5. Optimise Working Capital Management

Relying solely on revenue figures provides an incomplete picture of your company’s financial health. A more holistic approach involves optimising your working capital, which is the difference between current assets and current liabilities. This strategy focuses on shortening the time it takes to convert investments in inventory and other resources into cash from sales. For a South African exporter, efficient working capital is one of the most powerful cash flow management strategies for unlocking liquidity trapped in the operational cycle.

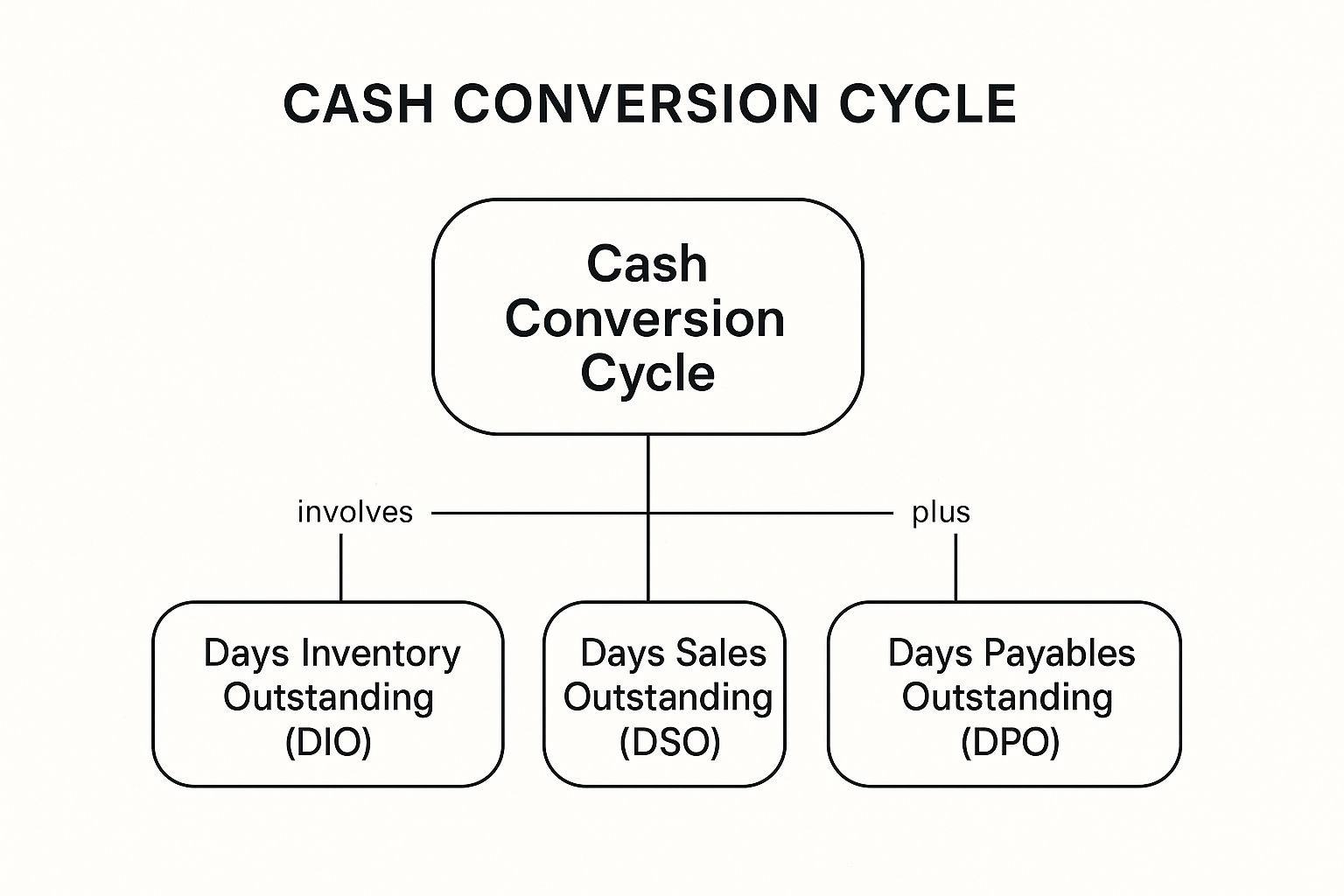

This focus on the cash conversion cycle (CCC) ensures you minimise the cash required to run operations, freeing up capital for growth, debt servicing, or navigating unforeseen market shifts. It’s about making your existing assets work harder for you.

How to Implement Working Capital Optimisation

- Calculate Your Cash Conversion Cycle: Regularly calculate and monitor your CCC, which is Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) - Days Payables Outstanding (DPO). This single metric reveals how long your cash is tied up in operations. Aim to reduce it month on month.

- Target Each Component: Set specific, aggressive targets for each part of the cycle. For example, aim to reduce DSO by offering early payment discounts. When dealing with international clients, using a platform like Zaro accelerates payment settlements, directly lowering your DSO and improving your rand-based cash flow.

- Negotiate Supplier Terms: Actively negotiate longer payment terms (increasing DPO) with your suppliers. This allows you to use the cash generated from sales before you need to pay for the raw materials or goods, effectively using your suppliers’ capital to fund your operations.

- Align Department Incentives: Ensure that sales, procurement, and finance teams are all incentivised to support working capital goals. For instance, link a portion of the sales team’s commission to the speed of customer payment, not just the sale itself.

This infographic illustrates the relationship between the key components of the cash conversion cycle.

As the visualisation shows, achieving a shorter cash conversion cycle requires a balanced effort to speed up receivables and inventory turnover while strategically extending payables.

6. Build Strategic Cash Reserves

While optimising for lean operations is smart, holding insufficient cash is a significant risk, especially for South African exporters facing currency volatility and unpredictable payment cycles. Building strategic cash reserves is one of the most fundamental cash flow management strategies. This isn't just about saving for a rainy day; it's about creating a buffer that provides financial stability and strategic flexibility.

This reserve acts as your business's financial shock absorber, enabling you to cover unexpected expenses, weather economic downturns, or seize sudden growth opportunities without taking on expensive debt. For SMEs, a common benchmark is to hold three to six months of operating expenses in a readily accessible account.

How to Build and Manage Your Reserves

- Define Your Minimum Threshold: Analyse your monthly operating expenses, including payroll, rent, and supplier costs. Establish a minimum cash balance that you will not drop below, considering potential revenue dips or payment delays.

- Make Reserves Work for You: Your entire reserve doesn't need to sit idle. Keep a portion highly liquid for immediate needs and place the rest in low-risk, interest-earning accounts like money market funds or short-term fixed deposits to generate a modest return.

- Stress-Test Your Liquidity: Regularly model "what-if" scenarios. For example, how would a 15% drop in the rand's value or the loss of a key client affect your cash position? This helps you refine how large your reserve needs to be.

- Diversify Funding Sources: Beyond your own reserves, maintain strong relationships with multiple banks and explore alternative funding lines. This creates a safety net, ensuring you can access capital quickly if your primary reserves are depleted.

By strategically managing your cash reserves, you insulate your business from external shocks and empower yourself to make decisions from a position of strength, not desperation.

7. Accelerate Revenue and Collection Cycles

Waiting for lengthy payment cycles to complete can starve your business of essential cash, even when sales are strong. For a South African exporter, this delay is compounded by currency risk. Powerful cash flow management strategies involve proactively shortening the time between invoicing and receiving payment. This means optimising your contracts, billing processes, and collection methods to get cash in the door faster.

This approach isn't about pressuring clients; it's about creating a systematic, efficient, and mutually beneficial collection framework. By reducing your days sales outstanding (DSO), you directly improve liquidity, decrease reliance on external financing, and gain greater control over your financial stability in a volatile global market.

How to Implement Faster Collection Cycles

- Offer Prepayment Incentives: Encourage upfront cash flow by providing a small but meaningful discount for annual or semi-annual payments. Many SaaS companies use this model successfully, securing a full year's revenue in advance.

- Implement Milestone Billing: For long-term projects or large export orders, structure contracts with progress-based payments. Bill clients upon reaching specific milestones, ensuring cash flows consistently throughout the project lifecycle rather than only at the end.

- Automate and Simplify Payments: Remove friction from the payment process. Implement automated billing for recurring services and offer multiple convenient payment options. For international clients, using a platform like Zaro allows them to pay you easily, while ensuring you receive the funds quickly and transparently, without high intermediary bank fees eating into your revenue.

- Formalise Your Collections Process: Don't let collections be an afterthought. Establish a clear, professional process for following up on overdue invoices, including automated reminders and a defined escalation path. This consistency improves collection rates without damaging customer relationships.

By systematically accelerating your revenue cycle, you turn strong sales figures into tangible working capital, empowering your business to invest, grow, and navigate economic uncertainties with confidence.

8. Implement Strategic Expense Management and Cost Control

Unchecked spending can silently drain your cash reserves, undermining even the most successful sales efforts. For a South African SME navigating thin margins and operational pressures, a systematic approach to cost control is not about penny-pinching; it's a core component of sustainable cash flow management strategies. This involves scrutinising every rand spent, prioritising value, and aligning outflows with your actual cash position.

Strategic expense management ensures that your hard-earned revenue isn't wasted on inefficiencies but is instead preserved to fuel growth, manage payroll, and maintain operational stability. It moves your business from a reactive spending culture to one of deliberate, forward-thinking financial discipline.

How to Implement Strategic Cost Control

- Categorise and Prioritise: Separate expenses into three categories: essential (e.g., rent, payroll), growth-enabling (e.g., marketing, R&D), and non-essential (e.g., discretionary perks). This allows you to identify areas for reduction without harming core operations.

- Establish Approval Hierarchies: Implement clear spending limits and approval processes. For example, any expenditure over R5,000 might require manager approval, while anything over R25,000 needs executive sign-off. This prevents unauthorised or impulsive spending.

- Negotiate Supplier Terms: Proactively renegotiate payment terms with your regular suppliers. Extending payment cycles from 30 to 45 or 60 days can significantly improve your cash position, giving you more breathing room between inflows and outflows.

- Leverage Technology for Tracking: Use expense management software to automate the tracking, submission, and approval of business expenses. This reduces administrative burden, minimises errors, and provides real-time visibility into company-wide spending patterns.

By embedding these cost-control measures into your daily operations, you transform expense management from a periodic cost-cutting exercise into a continuous strategy for maximising liquidity and building financial resilience.

9. Explore Alternative Financing and Credit Facilities

Relying solely on a traditional overdraft or bank loan can be restrictive, especially for a growing South African exporter. A more robust approach to cash flow management strategies involves diversifying your funding sources through alternative financing and establishing multiple credit facilities. This strategy ensures you have access to capital when needed to bridge cash flow gaps, fund large orders, or invest in new equipment without disrupting day-to-day operations.

For SMEs, alternative financing options like invoice financing, asset-based lending, or lines of credit from fintech lenders provide flexibility that traditional institutions often lack. For instance, an e-commerce business can use inventory financing to stock up for the festive season, while a manufacturer can use equipment financing to upgrade machinery without draining working capital.

How to Diversify Your Funding Sources

- Establish Facilities Proactively: The best time to secure a line of credit or financing facility is when your business is financially healthy, not when you are desperate for cash. Apply before you need the funds.

- Build Multiple Relationships: Don’t rely on a single bank or lender. Cultivate relationships with several providers, including traditional banks, alternative lenders, and fintech platforms, to compare terms and have backup options.

- Understand the Covenants: Before signing any agreement, thoroughly review all terms, conditions, interest rates, and covenants. Breaching a covenant can have serious consequences, so ensure you understand your obligations.

- Use Financing Strategically: Match the financing type to its purpose. Use asset-based lending for specific capital expenditures and reserve more flexible lines of credit for managing unexpected shortfalls in working capital.

Cash Flow Management Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cash Flow Forecasting and Budgeting | Moderate to High: requires data integration, continuous updates, scenario modeling | Moderate: reliable historical data, automation tools | Improved cash visibility, early shortfalls detection, better planning | Companies with predictable revenue cycles and historical data | Enables proactive decisions, supports investment timing |

| Accounts Receivable Optimization | Moderate: involves process changes and technology adoption | Moderate to High: invoicing automation, credit scoring | Accelerated cash collections, reduced DSO, lower bad debt risk | B2B service firms and manufacturers | Improves working capital efficiency, predictable cash flow |

| Inventory Management and Optimization | High: needs forecasting, vendor coordination, demand sensing | High: forecasting tech, audits, vendor management | Reduced carrying costs, improved turnover, minimized obsolescence | Retailers, manufacturers, companies with complex inventory | Balances cash tied-up and operational readiness |

| Accounts Payable Optimization | Moderate: negotiation and payment strategy needed | Moderate: payment system, supplier management | Extended cash availability, maintained supplier relations | Companies managing supplier cash flows | Maximizes cash retention while preserving vendor ties |

| Working Capital Management | High: cross-department coordination, complex process changes | High: collaborative planning, financing facilities | Optimized cash conversion cycle, improved asset returns | Large organizations with multiple cash flow components | Holistic cash flow management, supports growth |

| Cash Reserves and Liquidity Management | Low to Moderate: policy setting, liquidity monitoring | Moderate: cash holdings, investment vehicles | Financial stability, rapid opportunity response | Businesses needing financial buffer and stress preparedness | Enhances stability, reduces reliance on external funds |

| Revenue Acceleration and Collection Strategies | Moderate to High: may require business model shifts | Moderate: billing automation, payment systems | Faster revenue recognition, improved cash predictability | Subscription models, project-based revenue businesses | Accelerates collections, increases customer lifetime value |

| Expense Management and Cost Control | Moderate: requires process controls and monitoring | Moderate: expense tracking technology | Preserved cash, improved operational efficiency | Businesses facing financial pressures or growth constraints | Immediate cash flow improvement, better spend visibility |

| Alternative Financing and Credit Facilities | Moderate to High: requires credit arrangements, relationship management | Moderate to High: lender engagement, collateral management | Flexible funding, reduced dependency on banks | Businesses needing diverse or quick funding sources | Access to varied funds, preserves operational cash |

From Strategy to Action: Securing Your Financial Future

Navigating the complexities of the global market requires more than just a great product or service; it demands financial resilience. Throughout this guide, we have explored nine essential cash flow management strategies, moving from foundational practices like meticulous forecasting to sophisticated techniques in working capital optimisation. The journey from theory to tangible results begins with a commitment to actively managing the lifeblood of your business: its cash.

The strategies we’ve detailed are not isolated tactics but interconnected components of a robust financial framework. Effective accounts receivable optimisation, for instance, is amplified by clear, proactive revenue collection policies. Similarly, disciplined expense control and strategic accounts payable management work in tandem to protect your liquidity, ensuring you have the cash reserves necessary to seize opportunities or weather economic downturns. For a South African SME competing on a global stage, mastering these elements is not optional; it is the core determinant of sustainable growth and long-term success.

The Power of Visibility and Control

A recurring theme across all these strategies is the critical importance of visibility. You cannot manage what you cannot see. This is especially true in the realm of cross-border transactions, where outdated banking systems often create a fog of hidden fees, unpredictable settlement times, and frustrating administrative hurdles. These small, seemingly minor frictions accumulate, creating significant drags on your cash flow and undermining your carefully laid plans.

Implementing these cash flow management strategies effectively means shifting your business from a reactive stance, where you are a victim of market volatility and opaque financial systems, to a proactive one. It is about becoming the architect of your financial destiny. By combining diligent forecasting, disciplined management of receivables and payables, and the strategic adoption of modern financial tools, you build a business that is not just profitable but also predictable and resilient.

Your Next Step Towards Financial Mastery

The power to transform your cash flow is within your reach. The difference between struggling with liquidity and achieving financial stability often comes down to the tools you use and the processes you implement. By taking deliberate, informed action on even a few of the strategies discussed, you can create a powerful, positive impact on your business’s bottom line and overall health. The time to transition from strategy to action is now, because the future of your business depends on the health of its cash flow today.

Ready to eliminate the hidden fees and delays in your cross-border payments that are eroding your cash flow? Zaro provides transparent, low-cost international payment solutions designed to give South African businesses the control and predictability they need. Take the first step towards optimising your financial operations and see how much you can save with Zaro.