If you're looking for the cheapest way to send money abroad from South Africa, you need to look past the advertised fees. In my experience, the most budget-friendly options are nearly always the specialised online platforms, not the big banks. They just offer better exchange rates and much lower overall costs.

Finding the Best Rates for International Transfers

When your business needs to pay an overseas supplier or bring export revenue back home, every cent really does count. The real secret to finding the cheapest way to send money isn't just about spotting a low transfer fee; it's about locking in an exchange rate that's as close to the real one as possible.

For years, traditional banks were the only game in town. The problem is, their business model often buries the true cost of a transfer inside a poor exchange rate. This hidden markup quietly eats away at your profits, making what looks like a low-fee transaction surprisingly expensive. For a South African business trading globally, this can easily mean losing thousands of Rands on every large invoice.

Why Modern Platforms Beat the Banks

This is exactly where dedicated fintech platforms have completely changed the game. They work differently by giving you access to the mid-market rate—that's the real, live exchange rate you see on Google, with no hidden spread added on top.

So, what does this actually mean for your business?

- You see the real cost: No more deceptive "zero fee" claims that just hide expensive rate markups. The cost is clear and upfront.

- Your supplier gets more: A better exchange rate means more of your money arrives at the other end, which is great for building strong supplier relationships.

- Your cash flow is more predictable: When you avoid the big, fluctuating markups from banks, you can forecast your international payment costs with far more accuracy.

The core issue with banks is that you get hit twice: first with high transfer fees, and then again with a significant exchange rate margin. Traditional banks in South Africa can slap a margin on the exchange rate anywhere from 1.2% to 5%. That adds up fast. In contrast, modern online transfer platforms often bypass the old, expensive SWIFT system, making transactions both faster and cheaper. You can discover more insights about these international transfer methods and their real costs.

This guide will walk you through how to compare these modern services, so you can make the smartest financial decision for every single transfer your business makes.

Uncovering the Hidden Costs of Sending Money Overseas

It’s an easy trap to fall into. You see a low advertised transfer fee for sending money internationally and think you’ve found a great deal. Unfortunately, this is often a costly mistake.

The biggest expense is almost always hidden in plain sight: an unfavourable exchange rate. This quietly eats away at your profits with every single payment you make.

Let's say your export business needs to pay an American supplier $5,000 USD. A traditional bank might proudly advertise a "low R150 transfer fee," which sounds perfectly reasonable. What they don't advertise is the 3-5% markup they build into the exchange rate. This "hidden" fee can easily add thousands of Rands to your final cost.

This is exactly why your search for the cheapest way to send money abroad has to go deeper than just the upfront fee. You have to focus on the final amount your supplier will actually receive.

The Mid-Market Rate: What You Need to Know

To really get a grip on your costs, you need to understand the mid-market rate. Think of this as the "real" exchange rate. It's the midpoint between what buyers are willing to pay and what sellers are willing to accept for a currency on the global market.

This is the rate banks use when they trade among themselves, and it has no hidden markup.

When a provider gives you a rate that's worse than the mid-market rate, the difference is called the spread or markup. This is pure profit for them and a direct cost to you. It's often the single largest fee you'll pay, yet it’s rarely spelled out.

A simple rule of thumb: The true cost of your transfer is the upfront fee PLUS the cost hidden in the exchange rate spread. Prioritising the final received amount over any advertised fee is the only way to ensure you're getting the best deal.

Calculating the Real Cost of Your Transfer

Let's look at a practical example. Imagine you need to send R100,000 to a supplier in the United States. The current mid-market rate is R18.50 to $1 USD.

Here’s how two different providers might stack up:

- Your Bank: Offers you a rate of R19.15 to $1 (that's a 3.5% markup) plus a R200 transfer fee.

- Your R100,000 is converted to $5,221.93 (R100,000 ÷ 19.15).

- The hidden cost from the weak exchange rate alone is over R3,500.

- A Fintech Platform (like Zaro): Uses the real mid-market rate of R18.50 to $1 and charges a small, transparent fee.

- Your R100,000 is converted to $5,405.40 (R100,000 ÷ 18.50), before their small fee is deducted.

The difference is stark. On this single transaction, the bank's hidden markup costs your business nearly $200 more. If you're making these kinds of payments regularly, these hidden costs quickly compound, eroding your profit margins and putting you at a competitive disadvantage.

This is precisely why finding a platform that gives you access to the true mid-market rate is the cornerstone of any cost-effective international payment strategy.

A Look at the Top Low-Cost Money Transfer Services for South Africans

Now that you know how hidden fees and sneaky exchange rate markups can eat into your profits, let's get practical. It's time to actually compare the leading low-cost platforms available to South African businesses. The goal isn't just to find the cheapest option on a given day; it's about finding the right partner that truly fits how your business operates.

The world of digital transfers is crowded, and each service has its own personality. Some are brilliant for zapping small, frequent payments across the globe, while others are built to give you the best bang for your buck on those big, one-off transactions. I'll break down some of the top contenders to help you discover the cheapest way to send money abroad for your specific needs.

Who Are the Key Players in the South African Market?

When you start looking, you’ll see a few names pop up again and again: Wise (which you might remember as TransferWise), XE, OFX, and Remitly. These platforms have really shaken up the old way of doing things by being upfront with their fees and offering exchange rates much closer to the real mid-market rate you see on Google.

For a South African business, this transparency is a breath of fresh air. Instead of the confusing, often opaque process you get with a bank, these services show you exactly what you'll pay and, crucially, what your supplier or partner will receive before you hit send. This makes financial planning so much easier and helps you maintain trust with your international partners.

The real power of these digital-first providers lies in their cost structure. On average, you can expect digital transfer services to be 3.5% – 4% cheaper than a traditional bank transfer. That might sound like a small percentage, but believe me, it adds up to massive savings over a year of trading.

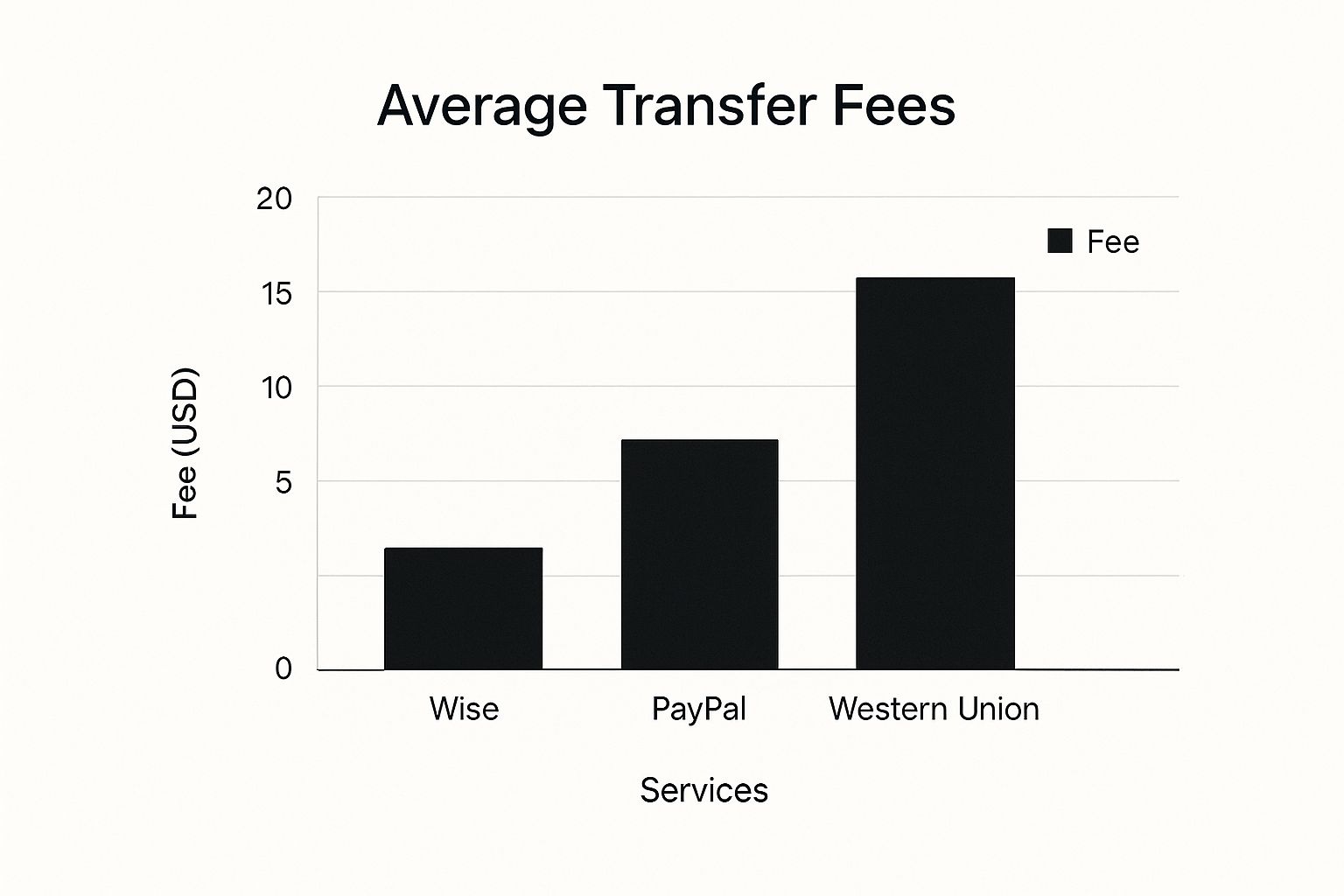

This chart drives the point home, showing just how different the upfront fees can be.

As you can see, the difference is stark. Specialised services like Wise often have dramatically lower fixed fees compared to platforms like PayPal or legacy wire services like Western Union.

To give you a clearer picture, let's look at a real-world scenario. Imagine your business needs to send R50,000 to a supplier in the United Kingdom. How much would they actually receive with different providers?

Cost Comparison Sending R50,000 to the UK

| Service Provider | Upfront Fee (ZAR) | Exchange Rate (ZAR to GBP) | Total Received (GBP) | Total Cost (ZAR) |

|---|---|---|---|---|

| Zaro | R0.00 | £1 = R22.80 | £2,192.98 | R50,000.00 |

| Wise | R336.17 | £1 = R22.82 | £2,176.32 | R50,000.00 |

| Traditional Bank | R450.00 | £1 = R23.50 (incl. markup) | £2,108.51 | R50,000.00 |

Disclaimer: Rates and fees are illustrative and were accurate at the time of writing. They fluctuate constantly.

This table makes it obvious: the headline fee is only part of the story. The exchange rate markup applied by traditional banks can cost you far more than any upfront fee, resulting in hundreds of pounds less for your recipient.

So, Which Service Is Right for Your Business?

Honestly, the "best" platform depends entirely on your payment habits. A business paying multiple small invoices to freelancers has very different needs from one making a huge payment for a container of goods.

Here’s a quick breakdown based on my experience:

- For small, regular payments: A service like Wise is often a fantastic choice. Its fee structure is crystal clear and very competitive for smaller amounts. You get the real mid-market exchange rate, and their small percentage-based fee is easy to plan for.

- For large, one-off transfers: Platforms such as OFX or XE can have the edge here. They often waive their fees entirely for large transfers (think above R100,000) and provide competitive exchange rates that get even better the more you send.

It's also worth noting that the best service can depend on the direction of the transfer. For payments coming into South Africa, recent analysis showed XE to be particularly cost-effective for USD to ZAR transfers. In one comparison, using XE could have saved a business over $150 USD versus a more expensive provider like Currencies Direct. You can see the full research on these transfer cost comparisons for a more detailed look.

My final piece of advice? Always do a quick comparison right before you send money. Rates are always moving, and last month's champion might not be today's. This is precisely why using a platform like Zaro is so powerful—it guarantees the real spot rate with zero hidden markups, giving you consistent value and taking the guesswork out of your international payments.

A Practical Walkthrough to Minimise Your Transfer Costs

Finding the cheapest way to send money abroad isn’t about luck. It’s about having a smart process you follow every single time. A few deliberate steps can save your business a surprising amount of money, turning what feels like a painful cost into a streamlined part of your operations.

First things first: get your recipient's details perfectly organised and ready to go. This means their full name, physical address, and the correct banking information like an IBAN or SWIFT code. I've seen simple typos cause delays or, even worse, failed transfers where the fees are gone for good. Double-checking takes seconds but can save you hundreds of Rands.

With your details in hand, it’s time to compare your options in real-time. Exchange rates are constantly moving, so the provider who was cheapest last week might not be the best choice today. Before you hit send, check a reliable comparison tool or just open tabs for your top two or three preferred platforms. This simple habit ensures you’re always getting the most competitive rate available at that very moment.

Timing Your Transfer for Maximum Savings

One strategy that’s so often overlooked is timing. Currency values shift throughout the week, and you can sometimes find more favourable rates mid-week. Why? The foreign exchange markets are most active from Monday to Friday, which usually means tighter spreads and better liquidity for you.

Weekends, on the other hand, can be a bit of a gamble. Some providers will lock in a rate on Friday that might not look so great come Monday morning. While it’s not a hard and fast rule, I generally advise businesses to avoid making transfers over the weekend if they can help it.

Another huge factor, especially for us in South Africa, is protecting your business from the Rand's famous volatility. This is where rate-locking becomes your best friend.

Real-World Scenario: Picture an export business in Cape Town that needs to pay a UK-based marketing agency £10,000. They start the transfer with their bank, but it takes two days to process. In that time, the Rand weakens. That small shift ends up costing them an extra R2,500 they hadn't budgeted for.

Had they used a service that lets you lock in the exchange rate, they could have secured the exact rate they saw at the start. This completely removes the currency risk and gives you predictability—something absolutely essential for managing cash flow.

Using Volume and Transparency to Your Advantage

If your business makes larger or frequent international payments, it really pays to look into volume discounts. Some platforms will actually reward you for sending more money. A service like Wise, for instance, often has a fee structure that gets cheaper as the transfer amount goes up.

A transfer of British Pounds to South African Rand might start with a fee around 0.59%, but this can drop with larger amounts. I’ve seen fees as low as £4.97 GBP on substantial transfers.

Crucially, they also let you lock in your exchange rate for up to 48 hours, which is a key feature for sidestepping those costly currency swings. It's well worth your time to read more about how Wise structures their fees and uses rate-locking.

This combined approach—careful prep, smart timing, and picking a transparent provider—is the most reliable way I know to consistently keep your international transfer costs as low as possible.

Common Mistakes to Avoid When Sending Money Abroad

When you're trying to find the cheapest way to send money internationally, it’s easy to get caught in a cycle of trial and error. I’ve seen it countless times. But you can skip the painful learning curve by simply understanding the most common pitfalls from the get-go. This is one of the smartest ways to protect your profit margins and keep your payments moving smoothly.

Even a tiny slip-up can have surprisingly big financial consequences. A simple typo in a recipient’s name or one wrong digit in a bank account number can cause a transfer to bounce. When that happens, you’re not just wasting time. You often lose the transfer fees, and your cash can be stuck in limbo for days—or even weeks—while everyone tries to figure out what went wrong.

Looking Beyond the Advertised Fee

One of the biggest traps businesses fall into is getting fixated on the upfront transfer fee. Many services bait you with eye-catching "zero fee" or "low-fee" offers. But more often than not, this is just a smokescreen for the real cost: a bloated markup on the exchange rate.

Think about it this way. A South African company needs to pay an international supplier. They find a service advertising a flat R50 transfer fee and think they’ve scored a bargain. What they miss is that the provider is offering an exchange rate that's 3% worse than the actual mid-market rate. On a R200,000 payment, that hidden cost eats up an extra R6,000. Suddenly, that R50 fee seems pretty insignificant, doesn't it?

Here’s the single most important lesson: Always, always look at the final amount your recipient will get. This number tells the true story because it includes both the fee and the exchange rate. Ignore the marketing hype and focus on that final figure. It’s the easiest way to see the real cost of your transfer.

Another mistake that's just as costly—though less obvious—is failing to follow compliance rules. Using a personal account for business payments might feel like a harmless shortcut, but it's a huge risk.

The Dangers of Mixing Business with Personal

Paying your international suppliers from your personal bank account is a major red flag for banks and regulators. It can easily lead to your account being frozen, payments getting held up, and a mountain of paperwork to sort out.

For any South African business, keeping your finances separate is non-negotiable. Here's why:

- Clean Books: It makes financial audits and tax time infinitely simpler. Your bookkeeper will thank you.

- Compliance: You’ll stay on the right side of Know Your Business (KYB) regulations, which are a legal requirement.

- Professionalism: It sends a clear message to your international partners that you're a serious, legitimate operation.

This is where dedicated business accounts come in. Platforms like Zaro are built from the ground up to manage the complexities of international trade. They give you the compliance framework and financial controls that a personal account just can't provide.

Steering clear of these common mistakes isn't just about saving a few rand. It's about protecting your business from serious operational headaches and unnecessary risk.

Got Questions About Sending Money Abroad? We’ve Got Answers.

Even once you’ve got the basics down, sending money across borders can feel a bit daunting. There are always a few lingering questions. Let’s tackle some of the most common ones we hear from South African business owners, so you can make your next international payment with complete confidence.

Is the Fastest Transfer Also the Cheapest?

In a word? No. It's a classic trade-off.

Think of it like shipping a parcel – you pay a premium for express, same-day delivery. The same logic applies to money transfers. Instant and express options almost always carry higher fees or a less favourable exchange rate. Providers know that urgency comes at a price, and they charge for that convenience.

If your payment isn't desperately urgent, opting for a standard transfer that lands in a day or two will almost always save you money. You can have speed, or you can have low cost, but it’s incredibly rare to get the best of both in a single transaction.

How Safe Are These Online Money Transfer Services?

This is a big one, and rightly so. The good news is that yes, reputable online services are extremely secure. In South Africa, any legitimate provider must be an authorised financial services provider, regulated by the Financial Sector Conduct Authority (FSCA). This isn't just a rubber stamp; it means they have to follow strict rules on security and protecting your money.

On top of that, these platforms use the same high-level encryption that major banks do. Your financial data and your funds are protected every step of the way.

My advice is simple: always stick to well-known, regulated providers. A quick search for their FSCA licence and a look at recent customer reviews will tell you everything you need to know. For all practical purposes, they are just as safe as your bank.

Can My Business Actually Use These Services?

Absolutely. In fact, they’re designed for it. This is a game-changer for any South African business that deals with international clients or suppliers. Most leading platforms offer dedicated business accounts built specifically for commercial needs.

These accounts are set up to handle the real work of global trade:

- Paying invoices to your overseas suppliers.

- Running payroll for international team members.

- Bringing your hard-earned export revenue back home to South Africa.

Business accounts often pack in features you won’t find on a personal account, like tools for making batch payments, nifty integrations with accounting software like Xero, and better pricing as your transfer volumes grow. They are consistently a smarter, more cost-effective choice than relying on a traditional bank’s corporate forex desk.

Ready to stop overpaying on international transfers and take control of your global payments? With Zaro, you get the real mid-market exchange rate every single time—no hidden markups, no surprise fees. See how much your business can save by switching to the most transparent and cost-effective solution for South African exporters. Explore Zaro today.