Sending Money Abroad Without Breaking the Bank

Transferring money internationally shouldn't cost a fortune. This list presents eight of the cheapest ways to send money internationally, specifically curated for South African businesses like yours. Discover how these tools can minimize transfer fees and offer competitive exchange rates, putting more money back in your pocket. We'll compare Wise, Revolut, Xoom, Remitly, WorldRemit, Currencyfair, MoneyGram, and OFX, highlighting the pros and cons of each to help you find the cheapest way to send money internationally for your specific needs.

1. Wise (formerly TransferWise)

When searching for the cheapest way to send money internationally, especially from South Africa, Wise (formerly TransferWise) consistently emerges as a top contender. This global technology company specializes in international money transfers, offering a refreshing level of transparency and often beating traditional banks and other money transfer services on price. For South African businesses, particularly SMEs involved in exporting, BPOs operating across borders, and executives seeking transparent FX solutions, Wise presents a compelling proposition. Wise's focus on utilizing the real mid-market exchange rate eliminates the hidden markups often embedded in traditional bank transfers, resulting in significant savings, especially for regular international transactions.

Wise distinguishes itself through its transparent fee structure, typically ranging between 0.5% and 1.5% of the transfer amount, which is clearly displayed upfront. This predictability makes it easier for businesses to budget for international payments and compare costs effectively. Furthermore, Wise offers a multi-currency account, allowing South African businesses to hold and manage funds in over 50 different currencies. This feature is particularly beneficial for companies dealing with multiple international clients or suppliers, streamlining payment processes and minimizing exchange rate fluctuations. The speed of transfers is also a key advantage, with 80% of Wise's transfers arriving within 24 hours.

Features and Benefits for South African Businesses:

- Mid-market exchange rates: Get the real exchange rate with no hidden markups, maximizing your ZAR when sending money abroad.

- Transparent fees: Understand exactly what you're paying, with a clear breakdown of fees upfront. This is crucial for South African CFOs looking for FX transparency.

- Multi-currency account: Hold and manage funds in various currencies, simplifying international transactions for exporters and BPOs working with global partners.

- Fast transfers: Expedite payments and improve cash flow with quicker transfer speeds compared to traditional banking methods.

- User-friendly platform: Easily manage transfers online or through the mobile app, simplifying the process for businesses of all sizes.

Pros:

- Consistently low fees for international transfers.

- No hidden fees or exchange rate markups.

- User-friendly mobile app and website.

- Fast transfer speeds.

Cons:

- While available in over 80 countries, it's not available everywhere. Transfer times may vary depending on the destination country.

- The initial verification process for new users might take some time.

Implementation Tips:

- Ensure you have the necessary documentation for verification, including proof of address and identification.

- Compare the fees and transfer speeds with your current banking solutions for specific destinations to see the potential savings.

- Utilize the multi-currency account to manage international funds and mitigate exchange rate risks.

Website: https://wise.com

Wise offers a compelling solution for South African businesses looking for the cheapest way to send money internationally. Its transparency, speed, and competitive pricing make it a valuable tool for managing international finances efficiently and maximizing your ZAR.

2. Revolut

Revolut offers a compelling solution for South African businesses looking for a cheaper way to send money internationally, particularly for those dealing with frequent transactions and multiple currencies. It functions as a digital banking alternative, providing various financial services, including international money transfers, with a focus on competitive exchange rates and a user-friendly experience. This makes it a potentially valuable tool for small and medium-sized export companies, business owners, CFOs seeking FX transparency, and BPO businesses operating in South Africa.

One of Revolut's key strengths lies in its use of the interbank exchange rate for currency conversions. This means you're getting a rate much closer to the mid-market rate, as opposed to inflated rates often offered by traditional banks. For standard users, this advantageous rate applies up to a certain monthly limit (which varies depending on your chosen plan), after which a small fee is added. Premium and Metal subscribers enjoy significantly higher limits, making Revolut particularly appealing for businesses with higher transaction volumes. Crucially, transfers between Revolut users are entirely free, regardless of location, simplifying international payments within your network. This is a huge advantage for South African companies working with international partners or clients who also use Revolut.

For businesses in South Africa dealing with regular international transactions, Revolut's multi-currency accounts are a significant benefit. You can hold and manage funds in various currencies, minimizing the need for repeated conversions and potentially saving on fees. The platform also supports cryptocurrency exchange, offering further flexibility for businesses exploring digital assets. The availability of both virtual and physical debit cards simplifies online and in-person spending in foreign currencies, streamlining expense management for businesses with international operations. While Revolut offers a great way to manage multiple currencies, it's important to note the weekend surcharge (0.5-1%) on currency exchanges. This needs to be factored into your calculations when considering the overall cost of using the platform. Another potential limitation for standard account holders is the monthly cap on fee-free currency exchange.

Setting up a Revolut account is generally straightforward. You download the app, follow the registration process, and verify your identity. The app's intuitive interface makes it easy to navigate and manage your finances. Instant notifications keep you informed of transactions, enhancing financial control and transparency.

While Revolut offers a compelling package, some drawbacks are worth noting. Customer service response times can sometimes be slow, which can be frustrating for businesses needing urgent assistance. Furthermore, Revolut's services aren't available in all countries, so it's essential to check availability for your specific needs. For South African businesses specifically, the limited local support infrastructure compared to established banks might be a consideration.

Despite these limitations, Revolut remains a powerful tool for those seeking the cheapest way to send money internationally. Its competitive exchange rates, fee-free transfers between Revolut users, and versatile multi-currency accounts make it a compelling option, especially for businesses navigating the complexities of international finance. Visit their website at https://www.revolut.com to learn more.

3. Xoom (PayPal service)

Xoom, a service offered by PayPal, provides international money transfers to over 160 countries. This makes it a potentially useful tool for South African businesses operating globally, particularly SMEs dealing with cross-border payments. Whether you need to pay suppliers in another country, receive payments from international clients, or manage offshore employee payroll, Xoom offers multiple delivery methods, including direct bank deposits, cash pickups, and even home delivery in select locations. Its integration with PayPal can also streamline transactions for businesses already utilizing that platform. While not always the absolute cheapest way to send money internationally, its speed and wide reach make it a strong contender depending on your specific needs.

For South African businesses looking for a cheapest way to send money internationally, Xoom can be a viable option, especially for larger transactions where its competitive exchange rates become more apparent. For instance, a South African BPO outsourcing to other countries might find Xoom's fast transfer speeds and multiple payout options advantageous for paying international employees. Similarly, small to medium-sized export companies in South Africa dealing with international clients could utilize Xoom for receiving payments, though it's crucial to be aware of potential transaction limits in certain countries. CFOs looking for FX transparency should carefully compare Xoom's exchange rates and fees against other providers before making a decision, particularly for smaller transfers where fees can be relatively higher.

Xoom offers several key features: transfers to 160+ countries, multiple delivery options (bank deposit, cash pickup, home delivery), transfer tracking, and integration with PayPal accounts. The ability to track transfers is particularly useful for businesses needing to monitor payments. While Xoom promotes fast transfer speeds, often within minutes, it's important to note that this can vary depending on the destination and chosen delivery method. Funding via a bank account is generally cheaper than using a credit card but may result in slower processing times.

Pros:

- Fast Transfers: Get money to recipients quickly, sometimes within minutes, which is crucial for time-sensitive business transactions.

- Wide Global Coverage: Send money to a vast network of countries, facilitating international business operations.

- Multiple Payout Options: Cater to different recipient needs with bank deposits, cash pickups, or home delivery.

- Easy PayPal Integration: Streamlined experience for businesses already using PayPal.

Cons:

- Higher Fees for Smaller Amounts: Less cost-effective for smaller transactions compared to some competitors. Carefully evaluate the fee structure for your specific transfer amount.

- Exchange Rate Markups: Be mindful of potential markups on the exchange rate, which can impact the overall cost. Compare with other services to ensure you're getting a competitive rate.

- Slower Bank Account Funding: While cheaper, funding via bank account can take longer than credit card transactions.

- Transaction Limits: Some countries have transaction limits, which may restrict larger business payments. Check the limits for your destination country beforehand.

Website: https://www.xoom.com

4. Remitly

Remitly is a strong contender for those seeking the cheapest way to send money internationally, particularly if you're sending money to family or friends in developing countries. It caters specifically to the needs of immigrants and expats, offering a streamlined process for remittances to over 170 countries. If you're a South African business owner with suppliers or contractors in these regions, Remitly could be a cost-effective solution for smaller, more frequent payments. Its focus on specific remittance corridors often results in competitive exchange rates and lower fees, especially when transferring from developed nations like the US, Canada, UK, or Australia – which can be advantageous for South African businesses receiving payments from these locations.

Remitly offers two transfer speed options: Express, which delivers funds within minutes to hours, and Economy, which takes 3-5 business days. While the Economy option often comes with lower fees, making it potentially the cheapest way to send money internationally for less urgent transfers, the Express option caters to those needing immediate transfers, albeit at a higher cost. Keep in mind that specific fees and exchange rates will depend on the countries involved in the transfer and the chosen speed.

For South African BPO businesses receiving payments from abroad, Remitly's focus on digital transfers and mobile experience offers a convenient way to manage payroll and other payments. Its delivery tracking feature provides transparency and peace of mind, ensuring funds reach their intended recipients. The first transfer fee waiver for new customers is a welcome bonus for businesses exploring this option.

While Remitly excels in certain areas, it does have limitations. The primary drawback for South African businesses is the limited number of sending countries. While receiving payments from clients in supported countries like the US, UK, Canada, and Australia is feasible, sending payments outwards from South Africa directly is currently not supported. For businesses requiring transfers to a wider range of countries, exploring alternative options may be necessary. Furthermore, while Remitly offers competitive rates for popular remittance corridors, specialized forex providers might offer even better rates for larger transactions or specific currencies. Finally, customer service consistency can be an area for improvement.

Key Features and Benefits:

- Two Transfer Speed Options: Choose between Express (fast) and Economy (cheaper).

- Destination-Specific Promotions: Look out for special rates and promotions based on the destination country.

- First Transfer Fee Waived: New customers can enjoy a fee-free first transfer.

- Delivery Tracking: Monitor your transfers in real-time for enhanced transparency.

- Focus on Remittance Corridors: Benefit from competitive rates for popular remittance routes.

Pros:

- Specializes in immigrant remittance needs.

- Competitive rates for popular corridors.

- Good mobile experience.

- Money-back guarantee.

Cons:

- Limited sending countries (primarily US, Canada, UK, Australia, and parts of Europe).

- Express transfers have higher fees.

- Exchange rates might not be as competitive as specialized forex providers.

- Customer service can be inconsistent.

Website: https://www.remitly.com

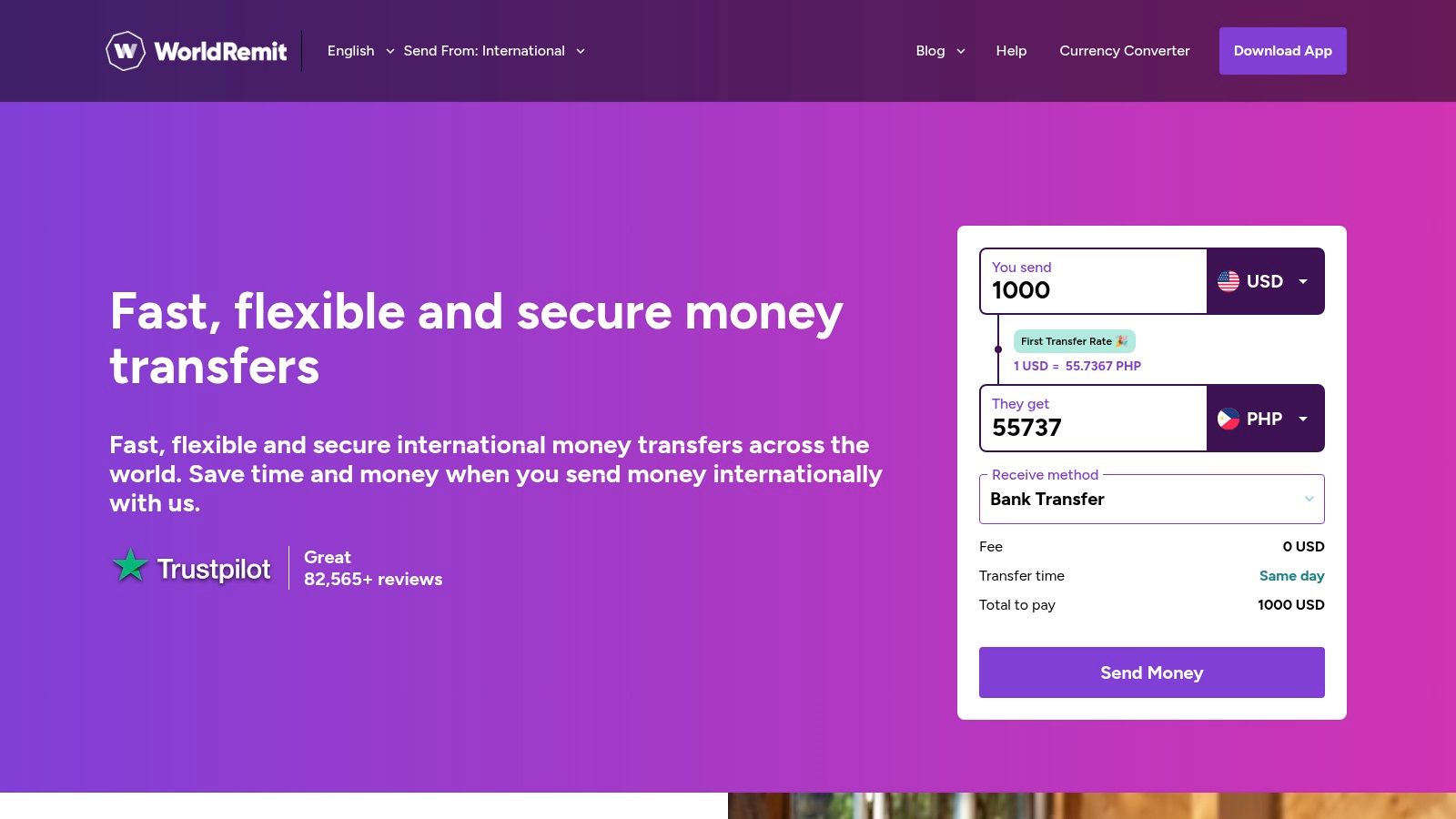

5. WorldRemit

WorldRemit is a strong contender when searching for the cheapest way to send money internationally, especially for South African businesses with ties to developing countries. This online money transfer service offers a convenient way to send money abroad directly from your computer, smartphone, or tablet, eliminating the need for traditional, often more expensive, money transfer agents. Founded in 2010, WorldRemit's focus on remittances to developing nations makes it particularly relevant for South African companies working with suppliers or outsourcing partners in these regions.

One of the key advantages of WorldRemit is the diverse range of payout options. Beyond standard bank deposits, they offer mobile money transfers, cash pickup services, and even airtime top-ups. This flexibility is particularly valuable for South African businesses operating in countries with limited banking infrastructure, where recipients may not have readily accessible bank accounts. For example, paying freelancers in countries with nascent banking systems becomes significantly easier with mobile money options. This versatility can be a crucial factor in deciding the cheapest way to send money internationally when factoring in accessibility for recipients.

WorldRemit operates on a fixed fee structure, which is calculated based on the transfer amount, destination country, and payment method. While the fees are transparently displayed upfront before you confirm the transaction, it’s essential to compare these costs against other providers, especially for frequent or high-value transfers. While WorldRemit often offers competitive rates, particularly for smaller amounts and specific corridors, the exchange rates do include a markup, which can impact the overall cost. This is a critical factor for South African CFOs and business owners seeking FX transparency.

For South African BPO businesses outsourcing tasks to individuals in other countries, WorldRemit’s fast transfer speeds, with many transactions completed within minutes, and real-time tracking capabilities offer considerable benefits. This speed and transparency can streamline payment processes and ensure timely compensation for overseas workers. Small and medium-sized South African export companies can also leverage WorldRemit’s fast transfers and varied payout methods to quickly settle invoices with international suppliers.

However, WorldRemit does have some limitations. While it supports transfers to over 150 countries, sending options from certain countries might be restricted. Additionally, maximum transfer limits may not be suitable for larger business transactions. Before committing to WorldRemit, confirm that your desired transfer route is supported and the transfer limits meet your business needs.

In summary: WorldRemit earns its place on this list due to its versatile payout methods, speed, and focus on developing economies. While the fees and exchange rates should be carefully compared with competitors to ensure you are getting the cheapest way to send money internationally for your specific needs, the platform provides a valuable tool for South African businesses operating in diverse international markets. You can explore their services further at https://www.worldremit.com.

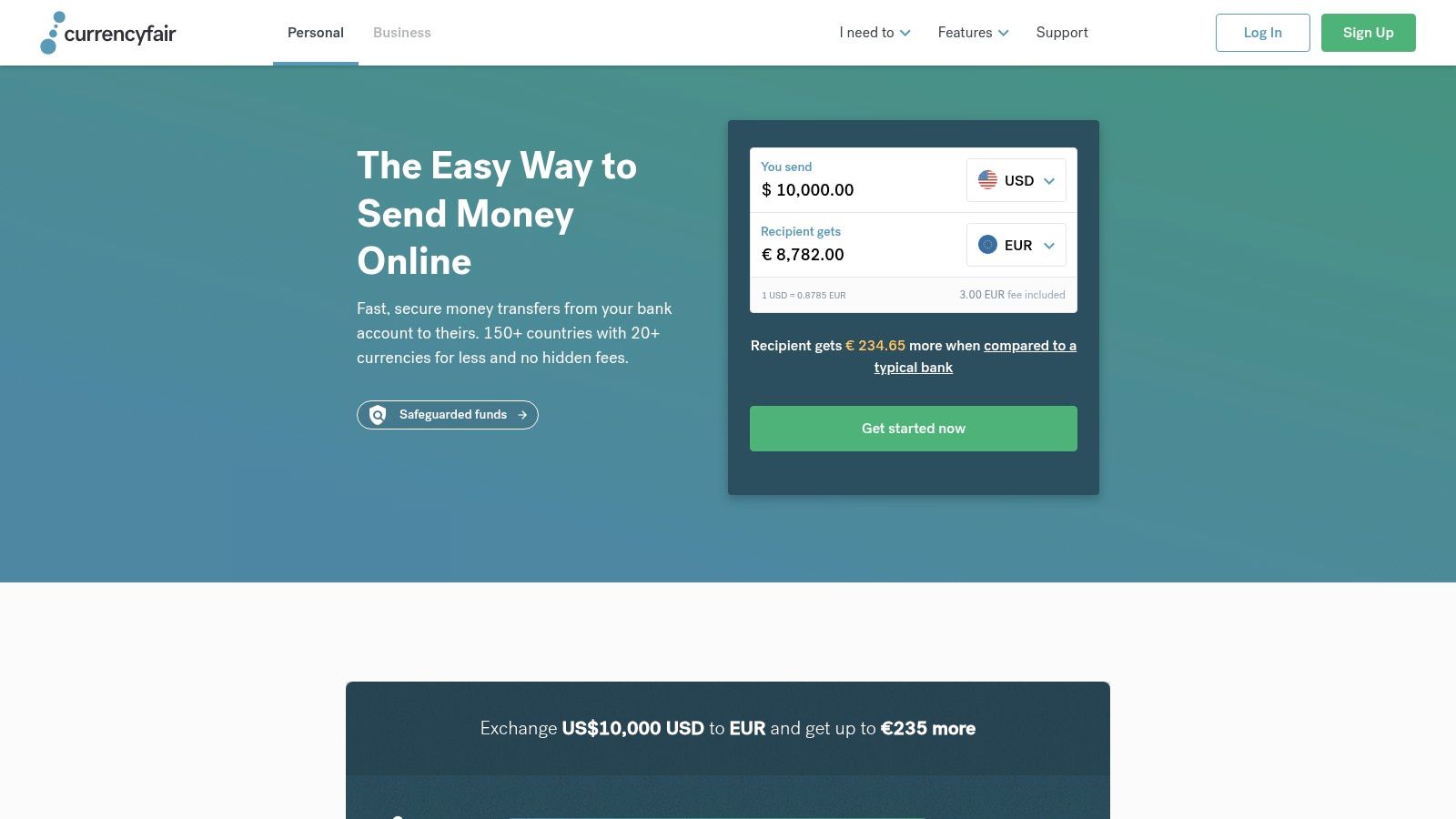

6. Currencyfair

When exploring the cheapest way to send money internationally, especially for larger sums, Currencyfair emerges as a strong contender. This platform distinguishes itself through its peer-to-peer (P2P) exchange model. Instead of going through a traditional bank, your transfer is matched with someone looking to exchange currency in the opposite direction. This often results in significantly better exchange rates than those offered by banks, making it a cost-effective choice for South African businesses engaged in international trade. Currencyfair is particularly popular among expats, property buyers, and businesses – precisely the groups most likely to benefit from its unique approach.

For South African SMEs, BPO businesses, and CFOs seeking FX transparency, Currencyfair offers a refreshing alternative. Imagine you're a South African export company regularly sending payments to suppliers in Europe. With Currencyfair, you can potentially bypass unfavourable bank rates and secure a more advantageous exchange rate through the P2P marketplace. This translates directly into cost savings, boosting your bottom line. Similarly, for BPO businesses operating in South Africa and paying overseas employees, Currencyfair can optimize international payroll expenses.

Currencyfair's fee structure is also transparent and competitive. They charge a flat fee (typically €3 or equivalent) plus a small margin on the exchange rate. This makes it particularly attractive for larger transfers, where the flat fee becomes less impactful. For example, sending ZAR 100,000 internationally would incur the same flat fee as sending ZAR 20,000, making it proportionately much cheaper for larger sums. However, for small, frequent transactions, this flat fee might make other options on this list more appealing.

Another compelling feature is the option to set your own desired exchange rate. If you're not in a rush, you can specify the rate you're aiming for and the platform will automatically match your transfer when that rate becomes available. This allows for greater control over your FX costs and aligns perfectly with a CFO’s need for financial control and predictability.

While Currencyfair offers compelling advantages for the cheapest way to send money internationally, it's essential to consider the following:

- Limited currency support: While supporting over 20 currencies, it might not cover every currency needed by South African businesses operating in niche markets.

- Not ideal for small transfers: The flat fee structure makes it less cost-effective for smaller, frequent transactions.

- Potential delays: Opting for a specific exchange rate can delay the transfer until a match is found.

- Steeper learning curve: The platform may not be as intuitive for first-time users compared to some simpler alternatives.

Despite these limitations, Currencyfair’s unique P2P model, transparent pricing, and potential for significant cost savings, especially on larger transfers, secure its place as a valuable tool for South African businesses looking for the cheapest way to send money internationally. You can explore their platform and offerings further at https://www.currencyfair.com.

7. MoneyGram

MoneyGram is a well-established player in the international money transfer arena, boasting a vast network of over 350,000 agent locations in more than 200 countries and territories. This extensive reach makes it a practical option for South African businesses, particularly SMEs exporting goods and services, needing to send or receive money across borders, especially to regions with limited banking infrastructure. While not always the absolute cheapest way to send money internationally, MoneyGram's accessibility and diverse transfer methods offer a valuable solution in certain contexts.

For South African businesses working with partners in countries where access to traditional banking is limited, MoneyGram's cash pickup service can be a lifesaver. Imagine a scenario where you need to quickly pay a supplier in a remote area. MoneyGram facilitates this by allowing the recipient to collect cash from a nearby agent location, often within minutes of the transfer being initiated. This is crucial for maintaining smooth operations and fostering trust with international partners. For South African BPO businesses outsourcing to or from regions with less developed financial systems, MoneyGram offers a vital channel for salary payments and other operational expenses.

MoneyGram allows you to send money online via their website or mobile app, or in person at one of their numerous agent locations. This flexibility caters to varying needs and preferences. The MoneyGram loyalty program can also provide cost savings for frequent users, which is particularly attractive to South African companies regularly engaging in international transactions. While online transfers typically offer better exchange rates than in-store transactions, the convenience of a physical location might be preferable for some.

However, it's essential to be aware of MoneyGram's fee structure. While its global reach is a significant advantage, its fees are generally higher than those of digital-only competitors specializing in online money transfers. Also, the exchange rate markups can be substantial, potentially impacting the overall cost, a key consideration for CFOs in South Africa seeking FX transparency. MoneyGram often imposes maximum sending limits which may vary depending on the destination country. Be sure to verify these limits beforehand to avoid any disruptions to your transactions.

Key Features for South African Businesses:

- Extensive Network: Particularly beneficial for reaching partners in countries with limited banking infrastructure.

- Multiple Transfer Options: Online, in-person, and mobile app options cater to diverse needs.

- Cash Pickup: Crucial for payments in regions with limited banking access.

- Fast Transfer Speeds: Enables quick payments to suppliers and partners.

- Loyalty Program: Potential cost savings for frequent international transactions.

Pros:

- Widespread physical presence

- Reliable service

- No bank account needed in many cases

- Available in locations where other services aren't

Cons:

- Higher fees than digital-only competitors

- Significant exchange rate markups

- Online rates better than in-store rates

- Maximum sending limits may apply

Website: https://www.moneygram.com

In conclusion, MoneyGram isn't necessarily the cheapest way to send money internationally in every scenario, but its comprehensive network and versatile transfer options, particularly the cash pickup service, offer significant value for South African businesses operating in diverse global markets. Weigh the pros and cons carefully, considering your specific needs and the recipient's location, to determine if MoneyGram is the right fit for your international money transfer requirements.

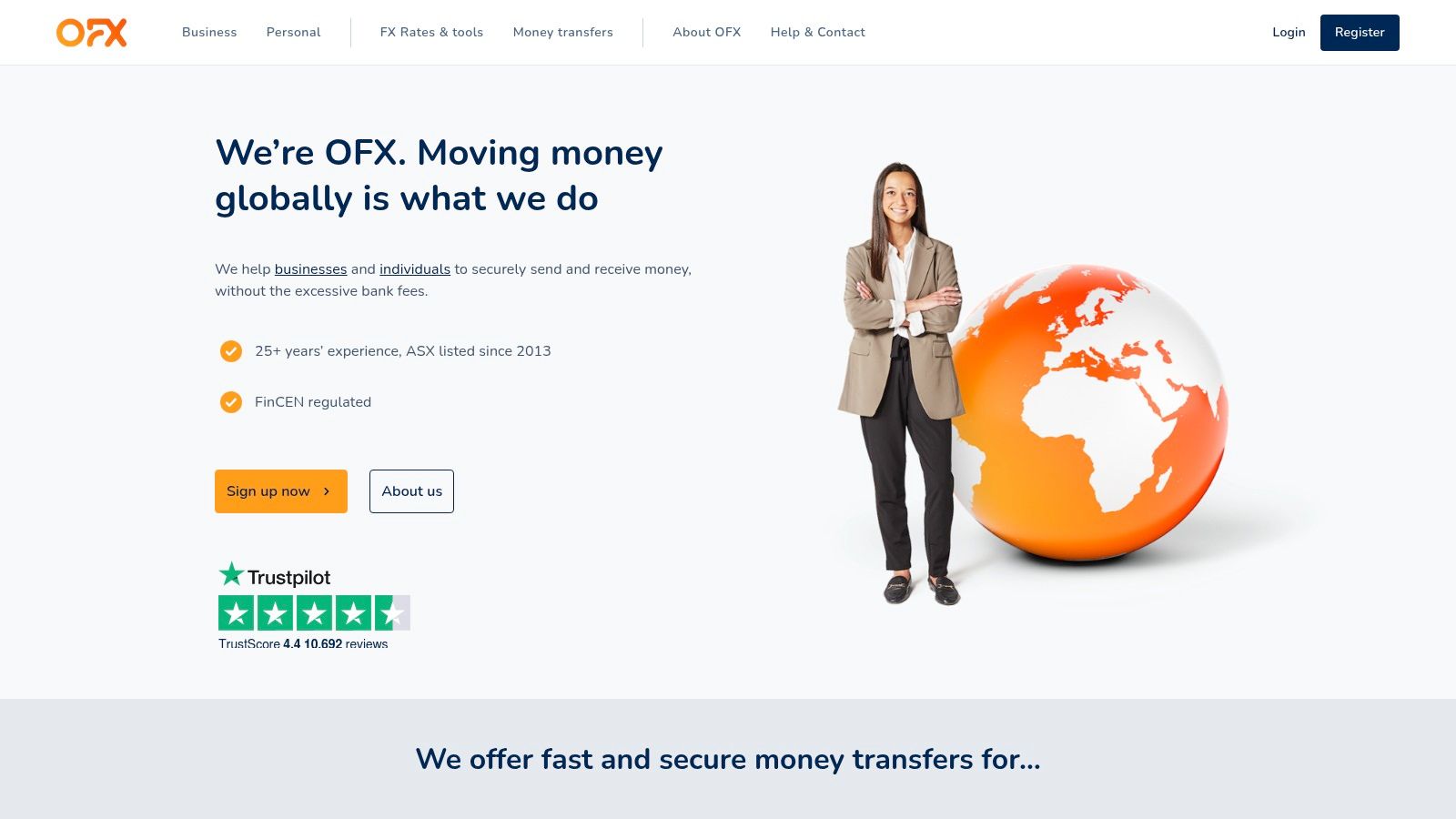

8. OFX

OFX (formerly OzForex) stands out as a strong contender for businesses, especially those in South Africa dealing with larger international money transfers. While it might not be the cheapest way to send money internationally for small, casual transactions, OFX carves its niche by offering highly competitive exchange rates and no transfer fees on transfers exceeding $10,000. This makes it particularly attractive for South African businesses engaged in import/export, those receiving foreign investment, or BPOs managing cross-border payments. Think substantial invoice payments to international suppliers, receiving payments from overseas clients, or managing payroll for offshore teams – these are the scenarios where OFX truly shines.

For South African CFOs and business owners seeking FX transparency, OFX offers a compelling proposition. Their dedicated currency specialists can provide expert guidance on navigating the complexities of foreign exchange, helping businesses optimize their international transactions and potentially save significantly on larger sums. This personalized service, coupled with 24/7 customer support, provides an added layer of assurance for businesses managing substantial cross-border payments. Furthermore, features like forward contracts can help South African businesses mitigate exchange rate risks, providing greater predictability in their financial planning.

While the minimum transfer amount (typically $1,000 in most countries) may exclude smaller transactions, the lack of a maximum transfer limit positions OFX as an ideal solution for high-value transfers. For South African companies involved in property purchases abroad or other large international payments, this flexibility is invaluable. However, it's important to note that while OFX doesn’t charge transfer fees, recipient banks might, so factoring in potential receiving bank charges is crucial for accurate cost assessment. Additionally, transfers can take 1-2 business days to process, which is a factor to consider for time-sensitive payments.

Compared to other services that may be more cost-effective for small transfers, OFX prioritizes delivering excellent exchange rates and specialized support for larger transactions. This focus, along with its robust security measures and regulatory compliance, makes OFX a reliable and potentially cost-saving solution for South African businesses managing significant international money flows. For South African SMEs, export companies, and businesses dealing with larger international payments, exploring OFX as a part of their FX strategy could be a valuable step towards optimizing their cross-border transactions and achieving cost efficiencies. You can learn more and set up an account on their website: https://www.ofx.com

Cost & Features Comparison of Top 8 Money Transfer Services

| Service | Core Features ✨ | User Experience ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| Wise | Mid-market rates, multi-currency | Fast transfers, easy interface | Low fees, transparent pricing | Individuals & SMEs | Real mid-market rate, no hidden fees |

| Revolut | Interbank rates, crypto, cards | Versatile app, instant alerts | Free transfers between users | Digital banking users | Banking + investing features, fee-free user transfers |

| Xoom | 160+ countries, multiple payout | Fast, PayPal integration | Wide reach, fast delivery | Remitters, PayPal users | Cash pickup & home delivery |

| Remitly | Express/Economy speeds, delivery tracking | Mobile-friendly, guarantees | Promotions for remittance corridors | Immigrants & expatriates | Money-back guarantee, remittance focus |

| WorldRemit | 150+ countries, airtime top-up | Real-time tracking, mobile app | Transparent fixed fees | Developing countries’ diaspora | Multiple payout methods, fast transfers |

| Currencyfair | P2P marketplace, set own rate | Regulated, less beginner-friendly | Competitive for large transfers | Expats, businesses, property buyers | Peer-to-peer rates, flat fees |

| MoneyGram | Large agent network, cash pickup | Reliable, widespread locations | Convenient for cash transfer | Unbanked users, global senders | Extensive physical locations, loyalty program |

| OFX | No transfer fees, forward contracts | 24/7 support, personal managers | Best for large transfers | Businesses, large transfers | No max limits, excellent rates for >$10K transfers |

Making the Right Choice for Your International Transfers

Finding the cheapest way to send money internationally isn't a one-size-fits-all solution. As we've explored, the optimal choice depends on a variety of factors, including the transfer amount, the destination country, the desired transfer speed, and your specific business requirements. For smaller transfers, options like Wise and Revolut frequently offer competitive exchange rates and low fees. However, when dealing with larger transactions, platforms like OFX and Currencyfair might provide more favourable pricing. MoneyGram and Xoom are worth considering for sending money to individuals, while businesses may benefit from platforms tailored to corporate transactions.

For South African businesses navigating the complexities of international finance, understanding these nuances is crucial. Whether you're a small exporter, a large corporation, or a BPO managing cross-border payments, selecting the right tool can significantly impact your bottom line. Consider your priorities, compare the features and fees of each platform discussed above, and choose the best fit for your needs. Efficient communication is key when managing international transfers. Just as clear appointment reminder text message templates can streamline appointment setting, maintaining open communication with recipients regarding transfer details, expected arrival times, and any necessary documentation ensures a smooth process. These principles, as discussed in the 20 Proven Appointment Reminder Text Message Sample Templates That Reduce No-Shows from CartBoss, can be adapted to improve international transfer coordination.

The cheapest way to send money internationally involves more than just low fees; it's about finding the right balance between cost, speed, security, and convenience. Empower your business with the knowledge to make informed decisions and optimize your international transfer strategy. Looking for a cost-effective and transparent solution specifically designed for South African businesses? Explore how Zaro leverages real exchange rates and eliminates SWIFT fees to simplify and streamline your international transactions.

Article created using Outrank