Sending money across borders shouldn't mean losing a significant portion to hidden fees and confusing exchange rates. For South African businesses and individuals, finding the cheapest way to send money overseas is vital, whether you're paying international invoices, supporting family abroad, or managing BPO payroll.

The traditional banking route, with its high costs and slow processing, is no longer the only option. A new generation of fintech platforms now offers greater transparency, speed, and significantly lower costs, but navigating these choices can be overwhelming. This guide is designed to cut through the noise.

We will provide a detailed, ranked breakdown of the top platforms available in 2025, offering a clear path to the most cost-effective solution for your needs. We'll dive deep into the fee structures, real exchange rates, and unique features of each service.

Inside, you will find a direct comparison of Wise, Mama Money, Shyft, WorldRemit, and others, complete with screenshots and direct links. This roundup delivers the actionable insights you need to choose the right platform, ensuring your money arrives quickly and affordably. We’ll help you understand precisely what you're paying for and how to avoid unnecessary charges.

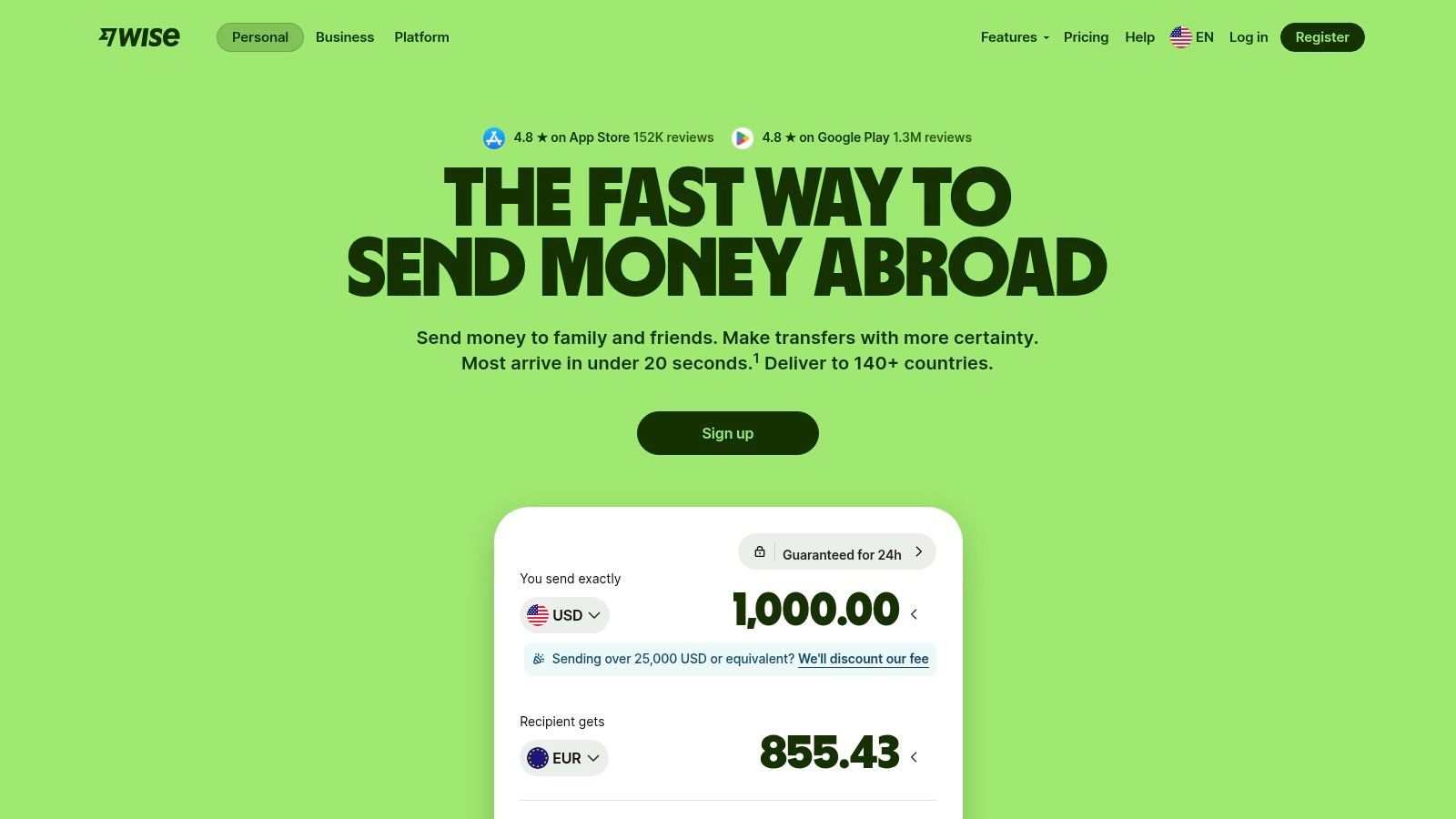

1. Wise (formerly TransferWise)

Wise, which you might remember as TransferWise, has built its reputation on radical transparency, making it a top contender for the cheapest way to send money overseas. The platform’s core promise is to eliminate the hidden fees and inflated exchange rates common in traditional banking. Instead, it offers the real mid-market exchange rate, the one you see on Google or Reuters, and charges a small, upfront fee.

This approach is particularly beneficial for South African businesses that need clarity and predictability in their international transactions. You always know exactly how much your recipient will get before you commit to the transfer.

Key Features and Benefits

What sets Wise apart is its fee structure and speed. The fees are not only low, starting from around 0.43%, but they are also dynamic. As you send larger amounts, the percentage-based fee often decreases, making it cost-effective for substantial business payments. Many transfers are completed very quickly, often within seconds or hours, depending on the currency corridor and payment method.

The user experience on both the web platform and mobile app is exceptionally clean and straightforward. Setting up a transfer takes minutes, and you can track its progress in real-time. This ease of use minimises the administrative burden for busy finance teams and business owners.

Practical Tips for Using Wise

- Lock In Your Rate: For volatile currencies, use Wise’s feature to lock in an exchange rate for a set period (typically 24-48 hours). This protects your business from unfavourable market fluctuations while you finalise the payment.

- Utilise the Multi-Currency Account: For businesses dealing with multiple currencies, the Wise multi-currency account is a game-changer. You can hold and manage funds in over 50 currencies, receive payments like a local in major economies (e.g., USD, EUR, GBP), and convert between balances at the mid-market rate.

- Batch Payments: If you have multiple overseas payments to make, such as for international suppliers or remote staff, use the batch payment tool to upload a single file and process up to 1,000 transfers at once.

| Feature | Details |

|---|---|

| Pricing | Transparent, low fees from ~0.43% + mid-market rate |

| Best For | Bank-to-bank transfers, freelancers, SMEs |

| Speed | Often instant or same-day |

| Cons | No cash pickup; digital-only transfers |

Wise is an excellent choice for businesses prioritising transparency and low costs over physical cash services.

Website: https://wise.com

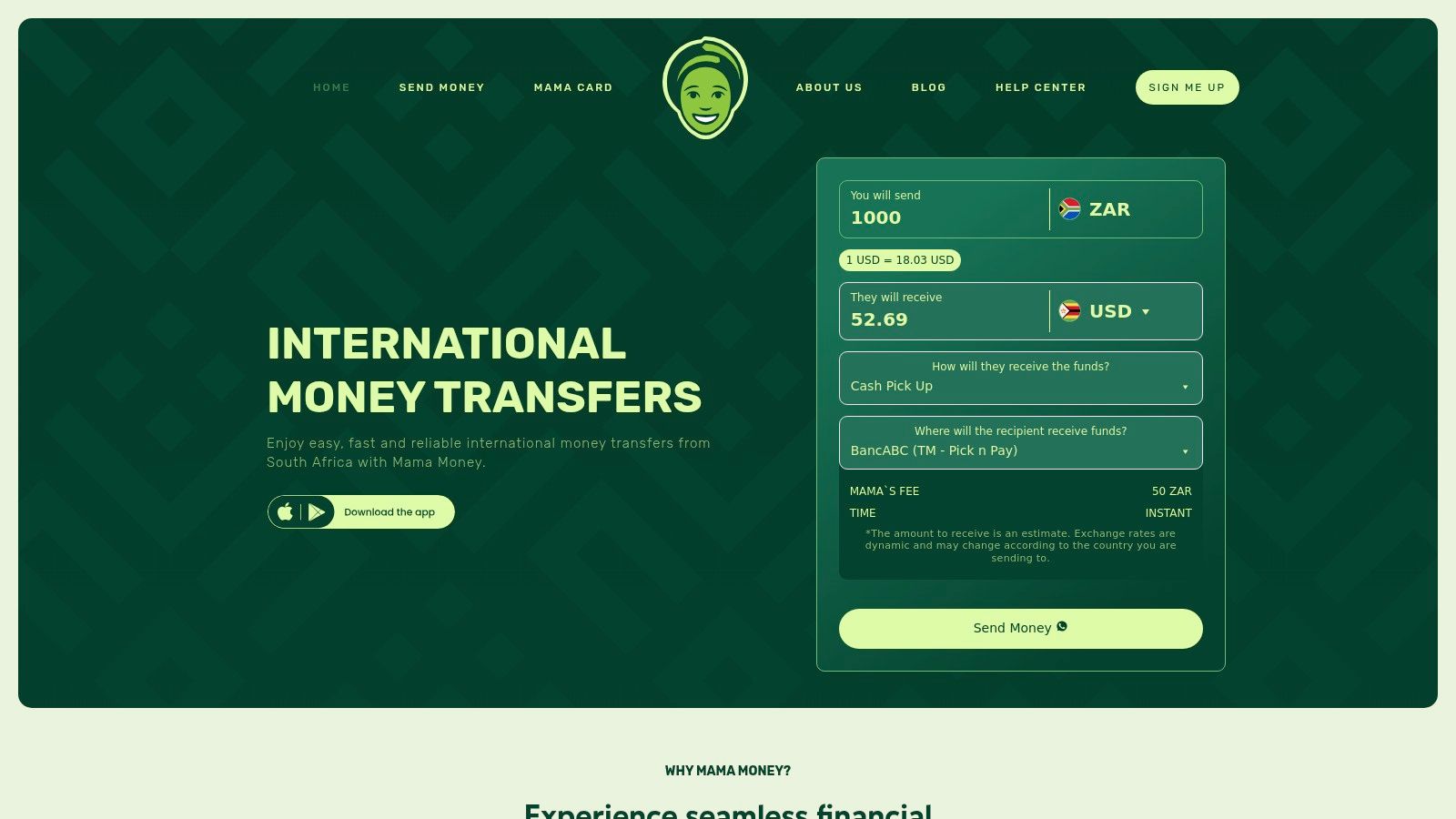

2. Mama Money

Mama Money is a proudly South African fintech service that has carved out a niche by focusing on accessibility and simplicity, making it a strong candidate for the cheapest way to send money overseas, especially for those supporting family. It enables users to send money to over 50 countries across Africa, Asia, and Europe, with a model that caters to individuals who may not have traditional bank accounts.

The platform is designed to be incredibly straightforward, from registration to the final transaction. Its major advantage lies in its flexibility, offering payment options that go beyond bank transfers, including cash deposits at major retail partners like Pick n Pay, Shoprite, and Checkers.

Key Features and Benefits

What makes Mama Money stand out is its vast network of payout partners. This allows recipients to collect funds as cash or receive them directly into a mobile money wallet, which is essential in many African and Asian countries. This makes it an invaluable service for South African residents and businesses paying individuals who are unbanked.

The fees are competitive, typically around 5% or less, and clearly stated before you confirm the transfer. Processing times are also a significant benefit, with many transactions completed within minutes. The user-friendly mobile app, available for both Android and iOS, simplifies the process, allowing you to initiate and track transfers on the go.

Practical Tips for Using Mama Money

- Choose the Right Payout Method: Before sending, confirm with your recipient which payout method is most convenient for them. The choice between a bank account, mobile wallet, or cash pickup can significantly impact their ease of access to the funds.

- Prepare Your FICA Documents: To increase your sending limits beyond the standard R5,000 per transaction, you’ll need to complete a quick FICA verification. Have your South African ID or foreign passport with a valid permit and proof of address ready to upgrade your account.

- Pay at a Retail Partner: If you don't want to use a bank transfer or card, the retail payment option is highly practical. Simply place your order on the app, get a reference code, and pay in cash at a till point at thousands of store locations.

| Feature | Details |

|---|---|

| Pricing | Competitive fees, typically around 5% or less |

| Best For | Sending to mobile wallets & cash pickup locations |

| Speed | Often within minutes; can take up to 48 hours |

| Cons | Transfer limits apply (R25,000/month standard); fees can be higher than digital-only services |

Mama Money is ideal for users who prioritise accessibility and multiple payout options, particularly cash-based services.

Website: https://mamamoney.co.za

3. Shyft by Standard Bank

Shyft, a powerful fintech platform backed by Standard Bank, offers a comprehensive solution that goes beyond simple money transfers. It integrates international payments, foreign exchange purchases, and virtual card services, making it an excellent choice for individuals and businesses looking for an all-in-one financial tool. This backing from a major bank provides a layer of security and trust that many users value.

Its approach to pricing is what makes it a contender for the cheapest way to send money overseas, especially for those who prefer predictability. Instead of a percentage, Shyft uses a transparent flat-fee structure, allowing you to know the exact cost of your transfer upfront, regardless of exchange rate fluctuations.

Key Features and Benefits

The standout feature of Shyft is its predictable, flat-fee pricing model. International transfers cost a fixed amount based on the currency being sent, such as USD 14 or GBP 10. This transparency is ideal for businesses that need to budget precisely for international payments. For smaller amounts, this might be less competitive, but for larger transfers, it can be highly cost-effective.

Another significant advantage is the "Shyft to Shyft" feature, which allows for instant and completely free transfers between any two Shyft users globally. This is a game-changer for businesses paying remote employees or contractors who also use the platform. The ability to hold multiple currencies and use virtual or physical cards adds to its versatility as a financial management hub.

Practical Tips for Using Shyft

- Optimise for Larger Transfers: Since Shyft uses flat fees, you can maximise your savings by sending larger sums of money. Consolidate several smaller payments into one larger transfer to make the fixed fee more economical.

- Leverage Shyft-to-Shyft: Encourage your regular international payees, like freelance staff or suppliers, to open a Shyft account. This will allow you to send them money instantly and with zero transfer fees, dramatically reducing costs.

- Use the Multi-Currency Wallet: Pre-purchase foreign currency when the exchange rate is favourable and hold it in your Shyft wallet. This allows you to lock in a good rate and protect your funds from market volatility before you need to make a payment.

| Feature | Details |

|---|---|

| Pricing | Flat fees per transfer (e.g., USD 14, GBP 10) |

| Best For | Users wanting bank-backed security, flat-fee transfers |

| Speed | Standard transfers take a few days; instant for Shyft-to-Shyft |

| Cons | Flat fees can be expensive for small amounts; requires ID verification |

Shyft is an ideal platform for those who value the security of a major bank and the clarity of flat-fee pricing.

Website: https://shyft.africa

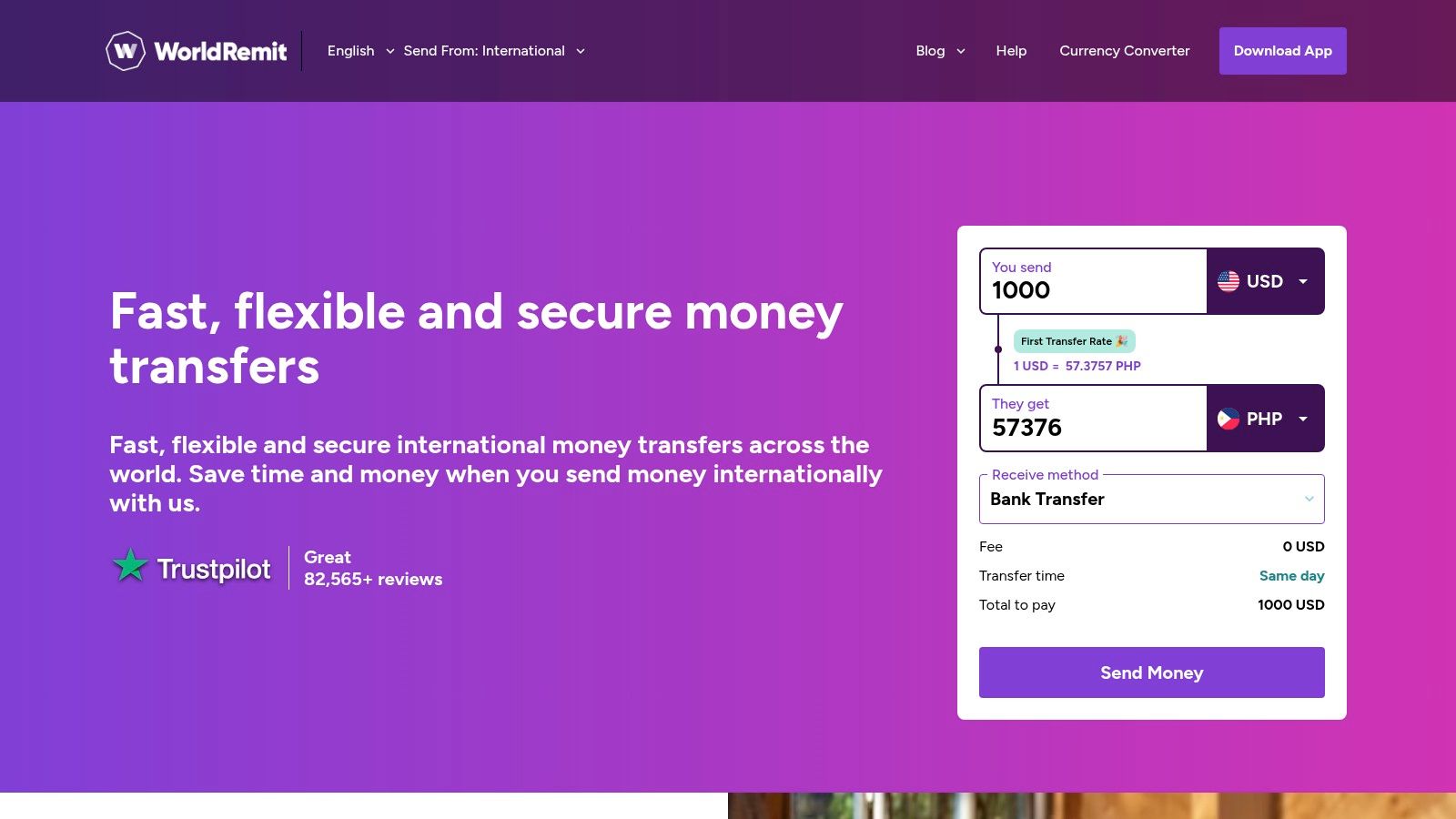

4. WorldRemit

WorldRemit excels in offering flexibility, making it a strong contender for the cheapest way to send money overseas when your recipient needs options beyond a simple bank deposit. It bridges the gap between digital convenience and physical access, catering to a wide range of needs across its network of over 150 countries. This makes it particularly useful for South African businesses paying individuals or partners who may not have easy access to traditional banking services.

The platform clearly displays its fees and exchange rates upfront, so you know the total cost before finalising a transaction. This transparency is crucial for businesses managing their budgets and looking to avoid the unpredictable charges often associated with international transfers.

Key Features and Benefits

The standout feature of WorldRemit is its extensive range of payout methods. While competitors may focus solely on bank-to-bank transfers, WorldRemit allows you to send funds for cash pickup, direct to a mobile money wallet, or even as an airtime top-up. This versatility is invaluable for businesses operating in or paying individuals in emerging markets where mobile money is prevalent.

Transfers are often very fast, with many transactions completed within minutes, especially for cash pickup and mobile money destinations. The user-friendly mobile app and website simplify the process, allowing for quick setup and real-time tracking, which is a significant advantage for busy finance departments.

Practical Tips for Using WorldRemit

- Compare Payout Costs: Before sending, compare the fees for different payout methods (bank deposit vs. cash pickup). Sometimes, one method may be slightly cheaper or faster than another for the same destination country.

- Utilise Mobile Money: If you are paying freelancers or suppliers in regions like East Africa or parts of Asia, sending directly to their mobile money account (e.g., M-Pesa) is often the quickest and most convenient option for the recipient.

- Check First-Time Transfer Offers: WorldRemit frequently runs promotions for new customers, such as zero-fee first transfers. For a new business account, this can be a great way to test the service and save on your initial transaction.

| Feature | Details |

|---|---|

| Pricing | Upfront fees and competitive exchange rates |

| Best For | Cash pickups, mobile money transfers, speed |

| Speed | Often within minutes for non-bank transfers |

| Cons | Rates vary by payout method; not always the cheapest for large bank-to-bank transfers |

WorldRemit is an excellent choice for businesses that need flexible and fast payment options beyond traditional bank accounts.

Website: https://www.worldremit.com

5. VALR Pay

For businesses and individuals comfortable with cryptocurrency, VALR Pay presents a modern and potentially the cheapest way to send money overseas. This South African-based platform leverages blockchain technology to facilitate international payments, allowing users to send stablecoins like USDT (Tether), USDC (USD Coin), or EURC (Euro Coin) to anyone in the world instantly and, crucially, with no transfer fees charged by VALR.

This crypto-native approach bypasses the traditional financial systems, offering a fee-free alternative for cross-border transactions. It's particularly appealing for tech-savvy users who are looking to avoid the costs associated with conventional remittance services and are already familiar with digital assets.

Key Features and Benefits

The standout feature of VALR Pay is its zero-fee structure for sending stablecoins. Because the transfers happen on the blockchain, they are typically completed in minutes, regardless of the destination country or the time of day. The platform secures transactions using the inherent security of blockchain, providing a high degree of confidence and transparency.

The primary benefit is cost savings, especially on smaller, frequent payments where traditional percentage-based fees can accumulate. For a South African business paying international contractors or suppliers who accept crypto, this method eliminates a significant operational cost. The process is streamlined within the VALR app, making it accessible for those already in the crypto ecosystem.

Practical Tips for Using VALR Pay

- Ensure Recipient is Crypto-Ready: Before initiating a transfer, confirm that your recipient has a compatible cryptocurrency wallet and understands how to receive stablecoins. They will also need access to a local exchange in their country to convert the stablecoins into their local fiat currency.

- Understand Stablecoin Pegs: While stablecoins like USDT and USDC are designed to maintain a 1:1 peg with a fiat currency (e.g., the US Dollar), minor fluctuations can occur. Be aware of this, although significant de-pegging events are rare for major stablecoins.

- Account for Network Fees: While VALR itself charges no fee for the transfer, a small "gas" or network fee may be required by the underlying blockchain (e.g., Ethereum or Tron) to process the transaction. This is typically a very small amount but is important to factor in.

| Feature | Details |

|---|---|

| Pricing | No transfer fees from VALR; minor blockchain network fees apply |

| Best For | Tech-savvy users, businesses paying crypto-friendly contractors |

| Speed | Near-instant |

| Cons | Requires both parties to use crypto; potential conversion hurdles for recipient |

VALR Pay is an innovative option for those looking to leverage digital assets for fee-free international payments.

Website: https://www.valr.com

6. Grey

Grey is a modern financial platform specifically engineered for Africa's growing community of freelancers, digital nomads, and remote workers. It directly addresses the challenge of receiving international payments and managing foreign currencies, positioning itself as a strong contender for the cheapest way to send money overseas for this niche but expanding market. The platform allows users to receive foreign payments, hold multiple currencies, and make international transfers with ease.

This is particularly valuable for South African freelancers and small businesses that work with international clients. Grey provides virtual foreign bank accounts (e.g., in USD, EUR, GBP), which means clients can pay you as if you were a local, avoiding hefty international wire fees on their end and ensuring you receive the full payment amount.

Key Features and Benefits

Grey’s standout feature is its multi-currency functionality tailored for the African market. It simplifies what is often a complex and expensive process. By providing foreign currency accounts, it eliminates the reliance on traditional banks that often apply poor exchange rates and high receiving fees for international payments.

The platform offers competitive exchange rates and transparent fees, which are crucial for freelancers managing tight budgets. Its user-friendly mobile app and web interface make it simple to receive funds, convert them to South African Rand (ZAR) at a fair rate, and withdraw to a local bank account or use the funds for other international payments.

Practical Tips for Using Grey

- Invoice with Your Virtual Account Details: When invoicing international clients, provide them with your Grey virtual account details for their respective country (e.g., your USD account for a US client). This makes payment seamless for them and cheaper for you.

- Time Your Currency Conversions: Keep an eye on exchange rate fluctuations. Since you can hold funds in foreign currencies within your Grey wallet, you can wait for a favourable rate before converting to ZAR to maximise your earnings.

- Streamline Client Payments: If you work with multiple clients in different regions (e.g., Europe and the UK), you can receive payments into separate EUR and GBP wallets, keeping your finances organised and avoiding forced conversions.

| Feature | Details |

|---|---|

| Pricing | Transparent, with competitive exchange rates; receiving fees may apply |

| Best For | Freelancers, remote workers, and digital nomads receiving international payments |

| Speed | Dependent on client's payment method; conversions are fast |

| Cons | Primarily focused on receiving funds; limited to specific user types |

Grey is an indispensable tool for South African independent professionals who need a reliable and cost-effective way to manage their international income.

Website: https://www.grey.co

7. Fivewest Forex

Fivewest Forex positions itself as a competitive South African-based option for international money transfers, focusing on providing low fees and favourable exchange rates. The service aims to deliver value by constantly comparing its rates against major banks and other platforms, ensuring users get a cost-effective deal. This makes it a strong candidate for anyone looking for the cheapest way to send money overseas from South Africa.

The platform is particularly well-suited for users who appreciate dedicated support alongside competitive pricing. It combines the low-cost benefits of a modern fintech service with a more hands-on approach to customer service, appealing to those who may need guidance through their transactions.

Key Features and Benefits

What makes Fivewest Forex stand out is its transparent pricing model, which often involves a small, fixed fee per transaction rather than a percentage. This structure can be highly economical for larger transfers, as the fee doesn't scale with the amount sent. They also offer flexible payment options, including standard bank transfers and integrations with digital wallets.

Another significant advantage is the provision of a dedicated account manager. This personalised support helps users navigate the complexities of foreign exchange and ensures transactions are managed smoothly from start to finish. This feature is especially valuable for businesses or individuals making regular or high-value payments who want a reliable point of contact.

Practical Tips for Using Fivewest Forex

- Request a Comparative Quote: Before committing to a transfer, contact their team to get a direct comparison against a quote you've received from your bank. This is where Fivewest often demonstrates its value.

- Clarify All Fees Upfront: While they pride themselves on transparency, always confirm the fixed fee and the exact exchange rate with your account manager before proceeding. This ensures there are no surprises.

- Plan for Transfer Times: Since transfers can take 2-3 business days, plan your payments accordingly. Avoid using the service for urgent, same-day needs and instead leverage it for planned expenses where you can maximise cost savings.

| Feature | Details |

|---|---|

| Pricing | Small fixed fee per transaction; competitive rates |

| Best For | Individuals and businesses needing personalised support |

| Speed | 2-3 business days |

| Cons | Slower than instant providers; limited public fee data |

Fivewest Forex is an excellent choice for those who value both low costs and dedicated human support in their international transfers.

Website: https://fivewest.co.za

Cost & Features Comparison of Top 7 Money Transfer Services

| Service | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Wise (formerly TransferWise) | Low - straightforward bank-to-bank transfers | Moderate - bank accounts needed | Fast, transparent transfers with low fees | Users wanting transparent fees and real exchange rates | Transparent pricing, low fees, rapid transfers |

| Mama Money | Low - easy registration, multiple payout options | Low - supports cash and mobile wallets | Quick transfers with cash pickup flexibility | Sending money to unbanked recipients via cash/mobile wallets | Accessible for unbanked, many cash pickup points |

| Shyft by Standard Bank | Moderate - requires ID verification | Moderate - multi-service fintech platform | Instant free transfers within platform, flat fees | Users seeking integrated finance & international transfers | Flat fees, strong bank backing, virtual cards |

| WorldRemit | Low - online setup with various payout methods | Moderate - multiple payout and payment options | Fast transfers with flexible payout methods | Users needing payout flexibility and speed | Wide payout network, transparent fees |

| VALR Pay | High - requires crypto wallets | Moderate - crypto knowledge & wallets needed | Instant, fee-free stablecoin transfers | Tech-savvy users comfortable with cryptocurrency | No fees, immediate transfer, blockchain security |

| Grey | Low - user-friendly apps for specific users | Moderate - multi-currency wallets | Competitive exchange rates, multi-currency handling | Freelancers and remote workers managing multiple currencies | Tailored for freelancers, transparent pricing |

| Fivewest Forex | Low - simple fee structure, multiple payment options | Moderate - requires transaction management | Low-cost transfers with competitive rates | Users seeking low-cost international transfers | Transparent pricing, flexible payments |

Making the Smartest Choice for Your International Payments

Navigating the world of international payments can feel complex, but as we've explored, the landscape has evolved far beyond the slow and costly services of traditional banks. Finding the cheapest way to send money overseas is no longer a trade-off between cost and reliability. Modern fintech platforms have revolutionised how South African businesses and individuals manage cross-border transactions.

We've covered a range of powerful tools, from the accessible cash-pickup networks of Mama Money and WorldRemit to the user-friendly digital wallets of Shyft and Wise. These options provide excellent value for personal remittances, freelance payments, and smaller transfers, each with unique strengths in speed, reach, and user experience. For those dealing with cryptocurrency, VALR Pay offers an innovative bridge between digital and traditional finance.

Key Takeaways for Selecting Your Platform

Your final decision hinges on a clear understanding of your specific needs. Before you commit to a service, evaluate your priorities by asking these critical questions:

- What is my primary use case? Are you a business paying international suppliers, a freelancer receiving client payments, or an individual sending money to family? The needs of a CFO differ greatly from those of a private user.

- How much am I sending, and how often? The fee structure of some platforms favours large, infrequent transfers, while others are more cost-effective for smaller, regular payments. Always calculate the total cost, including fees and the exchange rate margin.

- How important is speed? Do you need instant delivery, or can you wait a few business days for a lower fee? Platforms offer various delivery speeds, so match the service to your urgency.

- What are the destination and currency? Not all services cover every country or currency pair. Ensure your chosen platform supports your required payment corridor efficiently and cost-effectively.

Moving Beyond Simple Transfers to Strategic Financial Management

For small and medium-sized South African enterprises, the conversation extends beyond just finding the cheapest one-off transfer. The real goal is to implement a sustainable, transparent, and secure financial strategy for all overseas payments. This involves looking for solutions that offer more than just a good rate; it requires a platform built for business.

This is where the distinction becomes crucial. While many services are excellent for personal use, businesses require features like multi-user access for finance teams, robust Know Your Business (KYB) compliance, and integrations that streamline accounting. Most importantly, they need absolute transparency on the exchange rate. The hidden costs in exchange rate spreads can erode profits far more than a visible transfer fee.

Ultimately, choosing the cheapest way to send money overseas means empowering yourself with information. By comparing the platforms we've detailed, from Fivewest Forex's specialised services to the broad appeal of Wise, you can move away from opaque, expensive banking systems. The right tool will not only save you money but also provide the security, speed, and control necessary to operate confidently in the global market.

Ready to eliminate hidden fees and take control of your business's international payments? Zaro offers South African companies access to the real exchange rate with zero spread and no SWIFT fees, delivering unparalleled cost savings. Discover how Zaro can transform your cross-border finance today.