Sending money across borders shouldn't feel like a trip through a financial labyrinth. Traditional methods are often plagued by hidden fees, unfavourable exchange rates, and frustrating delays, leaving South African businesses and individuals paying more than they should. The true cost of an international transfer isn't just the upfront fee; it's often buried in the exchange rate spread, which is the difference between the rate you're offered and the real mid-market rate.

This guide cuts through the complexity. We're here to reveal the cheapest way to transfer money internationally by providing a side-by-side breakdown of seven leading platforms available right here in South Africa, including Zaro, Wise, and Shyft. We analyse their fee structures, transfer speeds, and unique features, giving you the clarity needed to make informed financial decisions.

Inside, you will find a detailed look at each option, complete with direct links and screenshots to simplify your selection process. Whether you're a small business paying global suppliers, a BPO managing payroll, or a freelancer receiving payments from overseas clients, this article will equip you to save money, avoid hidden charges, and streamline your global transactions effectively.

1. Zaro

For South African businesses navigating the complexities of global commerce, Zaro presents a revolutionary solution that redefines the standards for international payments. It stands as a formidable contender for the cheapest way to transfer money internationally, specifically because it targets the core pain points businesses face: exorbitant fees, slow processing times, and opaque exchange rates. Zaro directly challenges the traditional banking model by offering unparalleled cost-efficiency and speed, making it an essential tool for any South African enterprise engaged in cross-border trade.

What truly sets Zaro apart is its transparent and radically low-cost fee structure. The platform operates on a lean 3-cent spread (approximately 0.17%) from the real, mid-market exchange rate you see on Google. This approach eliminates the hidden markups and hefty SWIFT charges that typically inflate the cost of international transfers through legacy banks, providing businesses with predictable and significantly lower transaction costs.

Key Features and Capabilities

Zaro is engineered with the specific needs of modern finance teams in mind, offering a suite of powerful, enterprise-grade tools.

- Ultra-Low FX Costs: By sidestepping hidden fees and offering a minimal spread, Zaro ensures businesses retain more of their money with every transaction. This is particularly impactful for companies with high-volume international payments, such as importers paying overseas suppliers or exporters repatriating revenue.

- Rapid Transfer Speeds: Time is critical in business, and Zaro delivers exceptional speed. Transfers from the US to South Africa can be completed in as little as 30 minutes, a stark contrast to the multi-day waiting periods common with traditional bank wires. This rapid settlement improves cash flow and operational agility.

- Enterprise-Grade Controls: Security and governance are paramount. Zaro provides a robust platform with multi-user access, customisable permissions, and detailed audit trails. This allows CFOs and finance managers to delegate tasks securely while maintaining complete oversight and control over company funds.

- Streamlined Onboarding: Zaro simplifies the compliance process with a streamlined Know Your Business (KYB) verification. Funding ZAR and USD accounts is straightforward, requiring only standard bank transfers, which reduces administrative friction and gets businesses transacting faster.

- Integrated Debit Cards: The platform issues both ZAR and USD debit cards, empowering businesses to make purchases abroad directly. This feature provides direct access to Zaro's low-cost foreign exchange rates for everyday expenses, further reducing operational overhead.

Practical Application: An SME in Cape Town that imports electronic components from the United States can use Zaro to pay its supplier invoices. Instead of losing 3-5% on currency conversion through a bank, they pay a mere 0.17% spread. On a $50,000 payment, this translates to savings of up to R45,000, and the funds arrive in under an hour, solidifying supplier relationships.

Who Is It Best For?

Zaro is meticulously tailored for the South African business market. It is an ideal solution for:

- SMEs and Enterprises: Any business paying international suppliers, receiving payments from overseas clients, or managing a global workforce.

- CFOs and Finance Teams: Professionals seeking greater FX transparency, cost control, and operational efficiency in their financial workflows.

- BPO and Tech Companies: Businesses that outsource services to South Africa or employ international contractors, enabling them to make fast, low-cost payroll and service payments.

Pros:

- Unbeatable cost-efficiency with a tiny 0.17% FX spread and no hidden fees.

- Extremely fast international settlements, especially from the US (under 30 minutes).

- Robust, bank-level security with customisable multi-user permissions for team management.

- Simple onboarding and account funding process.

- Provides ZAR and USD debit cards for low-cost international spending.

Cons:

- Exclusively focused on South African businesses, so it is not accessible to international companies without a South African presence.

- The platform-based approach may require a brief adjustment period for teams accustomed to legacy banking systems.

Website: https://www.usezaro.com

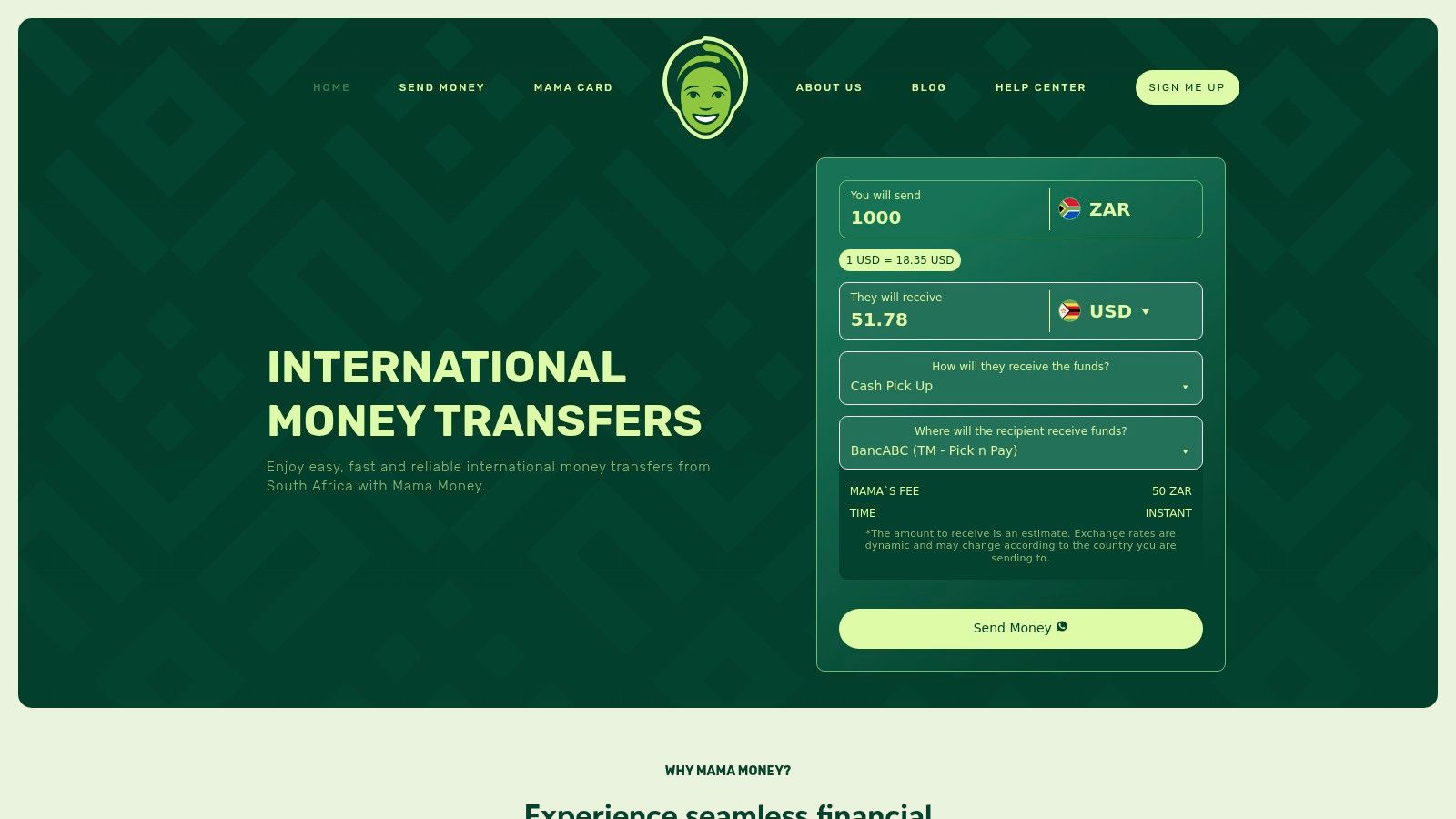

2. Mama Money

Mama Money is a South African-based social impact fintech company designed to offer a more affordable and accessible way for individuals to send money abroad. Its primary focus is on empowering migrant workers in South Africa, providing a reliable channel to send remittances to over 50 countries across Africa, Asia, and Europe. This focus makes it a strong contender for those looking for the cheapest way to transfer money internationally, especially for smaller, frequent payments.

The platform's standout feature is its transparent pricing and competitive exchange rates, which are often better than traditional banks. It was built with simplicity in mind, targeting users who may not have easy access to conventional banking services but have a smartphone.

Why Mama Money is a Great Choice

Mama Money has carved out a niche by prioritising speed and user experience. The registration process is notably fast, often taking just a few minutes, with verification completed through a simple photo of your ID and a selfie. This quick setup is a significant advantage over services that require in-person visits or extensive paperwork.

Once registered, sending money is straightforward via their mobile app (available for both Android and iOS). Payout options are flexible, supporting bank accounts, mobile wallets, and cash pickup points, depending on the destination country. This flexibility ensures recipients can access funds in the most convenient way for them.

Key Insight: Mama Money's fee structure is particularly beneficial for transfers to key African corridors. For instance, sending money to countries like Zimbabwe, Nigeria, and Ghana often incurs a flat fee, which is highly competitive for smaller remittance amounts.

Practical Tips for Using Mama Money

- Verify Your Account Fully: To increase your transaction limits, complete the full verification process. The initial limit is R10,000 per day (up to R25,000 per month), but this can be increased by providing proof of address.

- Check Daily Rates: Exchange rates fluctuate. Use the in-app calculator to check the final amount the recipient will get before confirming your transfer.

- Use a Supported Payment Method: You can pay for your transfers using EFT or by paying in cash at major retailers like Pick n Pay, Boxer, Makro, or Game, which adds a layer of convenience.

Pros & Cons

| Pros | Cons |

|---|---|

| Rapid Transfers: Funds often arrive within minutes. | Sending Country is Limited: You can only send from South Africa. |

| Simple Registration: Quick and easy digital verification. | Transaction Limits: Lower limits until fully verified. |

| Excellent Support: Customer service is available via WhatsApp. | Limited Destinations: Primarily serves Africa, Asia, and Europe. |

Website: https://www.mamamoney.co.za/

3. Shyft by Standard Bank

Shyft is a powerful foreign exchange app developed by Standard Bank, one of South Africa's largest financial institutions. It moves beyond simple remittances, offering a comprehensive platform for buying, storing, and sending foreign currency. This makes it an excellent choice for individuals and businesses who need more than just a one-off transfer, integrating payments with multicurrency accounts and international spending capabilities.

The platform allows users to manage multiple currencies, including USD, GBP, EUR, and AUD, directly from their smartphones. This integration provides a seamless way to handle international finances, positioning Shyft as a strong contender for the cheapest way to transfer money internationally when considering overall value and features.

Why Shyft is a Great Choice

Shyft's strength lies in its backing by Standard Bank, which offers users a high level of security and reliability. The app provides competitive exchange rates and a transparent fee structure, which typically consists of a flat transaction fee depending on the currency being sent. This clarity helps users avoid the hidden costs often associated with traditional bank transfers.

One of its most compelling features is the ability to perform instant, free transfers between Shyft users globally. Additionally, users can order both virtual and physical multicurrency cards, allowing them to spend directly from their foreign currency wallets online or while travelling abroad, effectively bypassing costly conversion fees.

Key Insight: Shyft is particularly advantageous for those who frequently transact in foreign currencies. The ability to buy and hold currencies like USD or EUR when the exchange rate is favourable provides a strategic edge for managing international expenses or investments.

Practical Tips for Using Shyft

- Leverage User-to-User Transfers: If your recipient also has a Shyft account, you can send money to them instantly and for free, which is an unbeatable offer for regular payments.

- Plan for Flat Fees: Shyft's flat transaction fee is more cost-effective for larger transfers. For very small amounts, the fee might seem high relative to the total, so it's wise to consolidate payments where possible.

- Order a Physical Card for Travel: Before travelling, order a Shyft physical card. This allows you to spend like a local from your foreign currency balance, avoiding poor exchange rates at points of sale.

Pros & Cons

| Pros | Cons |

|---|---|

| Reliable & Secure: Backed by Standard Bank for peace of mind. | Standard Bank Account Needed: Full features require a Standard Bank account. |

| Competitive Rates: Transparent fees and good exchange rates. | Flat Fees for Small Transfers: May not be the cheapest for minor amounts. |

| Free Shyft-to-Shyft Transfers: Instant and free transfers to other users. | Limited to App-Based Use: The platform is primarily a mobile application. |

Website: https://getshyft.co.za/

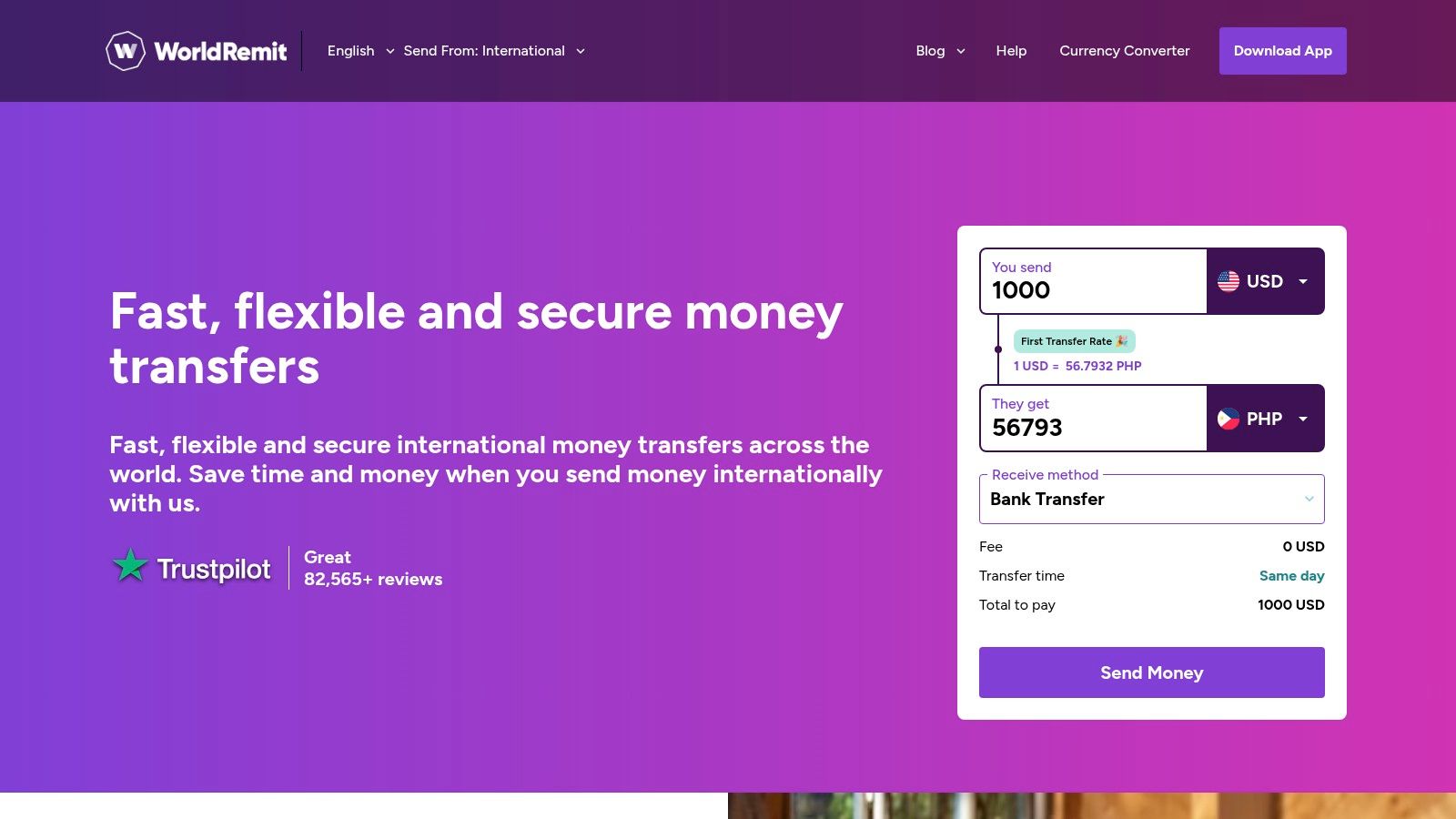

4. WorldRemit

WorldRemit is a global money transfer service that stands out for its extensive reach and flexibility, offering the ability to send funds from South Africa to over 130 countries. It provides multiple payout options, including bank deposits, cash pickups, and mobile money, catering to a wide range of recipient needs. This versatility, combined with its emphasis on fast transfer times, makes it a powerful option for finding the cheapest way to transfer money internationally.

The platform is designed for convenience, offering a user-friendly website and mobile app that show transparent fees and competitive exchange rates upfront. This clarity allows senders to see exactly how much their recipient will get before committing to the transfer.

Why WorldRemit is a Great Choice

WorldRemit's key advantage is its vast global payout network. Whether you are sending money to a relative in a rural village who needs cash pickup or paying a supplier directly into their bank account in a major city, the platform likely has a suitable option. This adaptability is crucial for South African businesses and individuals with diverse international connections.

Transfers are often processed within minutes, especially for cash pickup and mobile money destinations, which is significantly faster than traditional bank wires. The platform also provides 24/7 customer support, offering peace of mind for users sending funds across different time zones.

Key Insight: WorldRemit frequently runs promotional offers for new customers, such as zero-fee transfers for the first few transactions. This can make it one of the most cost-effective choices for your initial international payments.

Practical Tips for Using WorldRemit

- Select the Right Payout Method: Compare the costs and speeds of different payout options. A bank deposit might have a lower fee but take slightly longer, while a cash pickup could be faster but cost more.

- Check for Promotions: Before your first transfer, check the WorldRemit website or app for any active promotional codes for new users to minimise your costs.

- Prepare Recipient Details: To ensure a smooth process, have all the recipient’s necessary details ready, such as their full name, address, and bank account or mobile money information, as required by the destination country.

Pros & Cons

| Pros | Cons |

|---|---|

| Extensive Global Reach: Send to over 130 countries. | Variable Fees: Costs change based on destination and payout method. |

| Diverse Payout Options: Supports bank, cash, and mobile money. | Transaction Limits: Limits can vary depending on the destination. |

| Quick Transfer Processing: Many transfers are instant. | Rate Mark-up: Exchange rates include a margin over the mid-market rate. |

Website: https://www.worldremit.com/

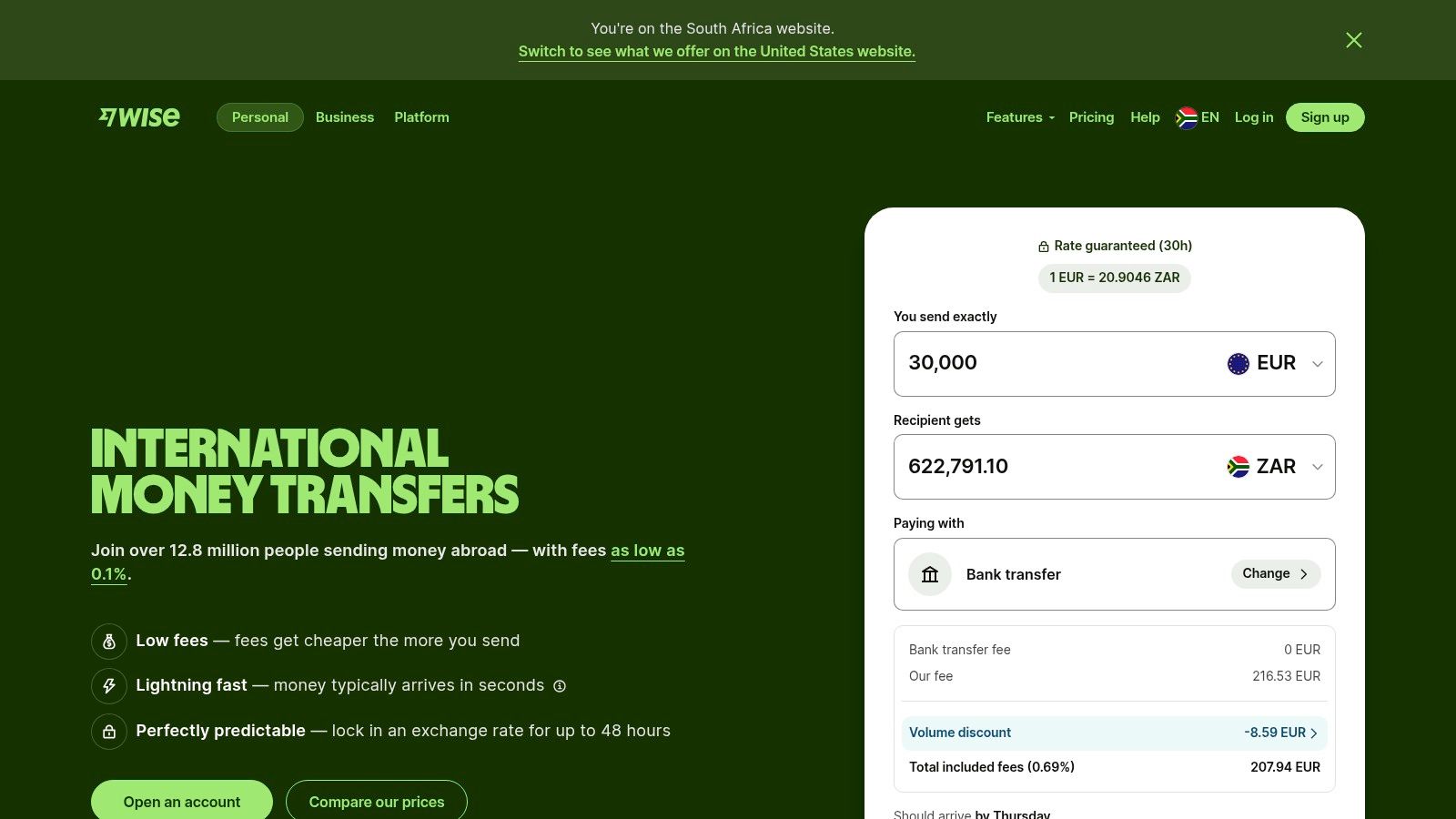

5. Wise (formerly TransferWise)

Wise, formerly known as TransferWise, has built a global reputation on transparency and fairness. It offers one of the cheapest ways to transfer money internationally by using the real, mid-market exchange rate without adding hidden markups. The platform is designed for anyone from individuals to businesses who want a straightforward and cost-effective method to send money to over 70 countries.

Its core promise is simple: what you see is what you get. The fee structure is shown upfront before you commit to a transfer, ensuring there are no surprises. This dedication to clarity and low costs makes it a powerful alternative to traditional banks, which often obscure their charges within poor exchange rates.

Why Wise is a Great Choice

Wise stands out because of its commitment to the mid-market exchange rate, which is the rate banks use to trade currencies between themselves. While most services add a markup to this rate, Wise passes the true rate directly to you and charges a small, transparent fee. Fees start from as low as 0.41% and often become proportionally cheaper for larger transfers.

The user experience is seamless, with a clean interface on both its website and mobile app. Setting up a transfer is quick, and the platform provides real-time tracking so you always know where your money is. For businesses and frequent travellers, the Wise multi-currency account is a game-changer, allowing you to hold, manage, and convert funds in over 50 currencies.

Key Insight: Wise's fee structure is dynamic. The small, fixed fee covers the cost of the transaction, while a variable fee is a percentage of the amount being converted. This makes it highly competitive for a wide range of transfer amounts.

Practical Tips for Using Wise

- Use the Multi-Currency Account: If you frequently deal with multiple currencies, open a Wise multi-currency account. It allows you to receive payments in different currencies without conversion fees and hold balances to convert when the rate is favourable.

- Plan for Verification: For your first transfer, allow extra time for the identity verification process. Submitting clear photos of your ID will speed this up.

- Compare Transfer Types: Wise offers different transfer types (e.g., 'Low-cost transfer' vs. 'Fast and easy transfer') with varying fees and speeds. Choose the one that best suits your needs for cost or urgency.

Pros & Cons

| Pros | Cons |

|---|---|

| Highly Transparent: Uses mid-market rate with clear fees. | Limited Cash Pickup Options: Primarily a bank-to-bank service. |

| Fast and Reliable: Transfers are often completed within a day. | Variable Fees: Fees can be higher for less common currency routes. |

| Multi-Currency Account: Excellent for managing global finances. | No In-Person Service: The platform is entirely digital. |

Website: https://wise.com/za/send-money/

6. Grey

Grey is a modern financial platform built specifically for Africa's growing community of freelancers, remote workers, and digital nomads. It tackles the challenge of receiving international payments by providing users with virtual foreign bank accounts in USD, EUR, and GBP. This allows individuals and businesses to get paid by international clients as if they were locals, bypassing exorbitant intermediary bank fees and poor exchange rates.

The platform’s core strength lies in bridging the gap between African talent and the global economy. By offering a streamlined way to receive, hold, and exchange foreign currency, Grey presents an innovative and often cheaper way to manage international funds compared to traditional banking systems. Its focus on the creator and remote work economy makes it a unique contender for the cheapest way to transfer money internationally.

Why Grey is a Great Choice

Grey’s main advantage is its virtual account feature. South African freelancers or businesses can receive payments in major currencies directly into their Grey accounts, avoiding the typical high costs associated with SWIFT transfers. Once the funds arrive, users can hold them in their original currency or convert them to South African Rand (ZAR) at competitive rates.

The platform is designed for digital-first users, with a fast, entirely online registration and verification process. Sending money out is just as simple, with options to transfer funds directly to a local South African bank account. This end-to-end digital experience removes the friction common in cross-border financial transactions.

Key Insight: Grey is not just for sending money out; it's a powerful tool for receiving it cheaply. For BPOs, exporters, or freelancers invoicing clients in Europe or the US, receiving payments into a Grey virtual account can save a significant percentage that would otherwise be lost to wire transfer fees and poor bank exchange rates.

Practical Tips for Using Grey

- Understand the Use Case: Grey is ideal for receiving payments from clients abroad. Have your international clients pay directly into your provided USD, EUR, or GBP account details.

- Time Your Conversions: Keep an eye on currency exchange rates. Since you can hold foreign currency in your Grey wallet, you can wait for a favourable rate before converting to ZAR.

- Complete Verification Promptly: To access all features and higher transaction limits, ensure you complete the identity verification process as soon as you sign up.

Pros & Cons

| Pros | Cons |

|---|---|

| Ideal for Freelancers: Specifically designed to receive global payments. | Limited Currencies: Fewer currencies than larger platforms. |

| Virtual Foreign Accounts: Get paid like a local in USD, EUR, and GBP. | Newer Platform: Still building its user base and track record. |

| Transparent Fees: Clear fee structure and competitive exchange rates. | Focus is on Receiving: Less optimised for personal remittances. |

Website: https://grey.co/

7. VALR Pay

VALR Pay, a service from the prominent South African cryptocurrency exchange VALR, offers a modern, blockchain-based solution for international payments. It enables users to send stablecoins like USDT, USDC, and EURC across borders, bypassing traditional banking infrastructure. This method leverages the speed and low cost of crypto, making it a powerful tool for those seeking the cheapest way to transfer money internationally, particularly when speed is a priority and traditional bank accounts aren't an option for the recipient.

The platform is designed for those comfortable with digital assets, providing an almost instantaneous and secure way to move value globally. Because it operates on the blockchain, it circumvents the high fees and lengthy processing times often associated with conventional wire transfers.

Why VALR Pay is a Great Choice

VALR Pay's primary advantage is its use of stablecoins for cross-border transactions, which often incurs no sending fees from VALR itself. Transfers are exceptionally fast, typically completed within minutes, a stark contrast to the multi-day waiting periods of bank-based systems. This makes it ideal for urgent payments or for businesses needing to move funds quickly.

The service is also a fantastic alternative for sending money to individuals who may not have a bank account but do have a smartphone and internet access. All they need is a compatible crypto wallet to receive the funds. The process is managed entirely within the VALR app, which requires identity verification (KYC), ensuring a secure transaction environment for both sender and receiver.

Key Insight: The "no sending fee" model is a game-changer. While standard network fees for crypto transactions exist, VALR Pay simplifies this, allowing free transfers to other VALR users or to external wallets, making it highly competitive for any transfer amount.

Practical Tips for Using VALR Pay

- Educate the Recipient: Ensure your recipient has a crypto wallet and understands how to access and convert the stablecoins into their local currency. This may involve using a local exchange, which could have its own fees.

- Start with a Small Test Transaction: If you or the recipient are new to crypto, send a small amount first to ensure the entire process works smoothly from end to end.

- Understand Stablecoins: Familiarise yourself with stablecoins like USDT or USDC. They are pegged to fiat currencies (like the US Dollar), which minimises the price volatility common with other cryptocurrencies like Bitcoin.

Pros & Cons

| Pros | Cons |

|---|---|

| Very Fast Transfers: Funds arrive in minutes. | Requires Crypto Wallets: Both parties need a crypto wallet. |

| No Sending Fees: VALR does not charge a fee to send. | Recipient Conversion Fees: Fees may apply when cashing out. |

| Alternative to Banking: Great for unbanked recipients. | Learning Curve: Requires basic knowledge of cryptocurrency. |

Website: https://blog.valr.com/blog/send-money-overseas-south-africa

Cost Comparison of Top 7 International Money Transfers

| Platform | 🔄 Implementation Complexity | ⚡ Resource Requirements | ⭐ Expected Outcomes | 💡 Ideal Use Cases | 📊 Key Advantages |

|---|---|---|---|---|---|

| Zaro | Moderate (streamlined KYB, enterprise-grade security) | Requires bank transfers, enterprise-level setup | Fast, low-cost cross-border payments (30 mins transfers) | South African SMEs & enterprises | Ultra-low spread, fast transfers, multi-user controls |

| Mama Money | Low (quick registration, mobile app) | Smartphone, basic verification | Fast remittances to select countries | South African residents sending to Africa, Asia | Competitive rates, mobile app, quick transfers |

| Shyft by Standard Bank | Moderate (Standard Bank account needed, multi-currency) | Requires Standard Bank account and app | Instant transfers between users, integrated offshore accounts | Users with Standard Bank accounts worldwide | Instant user transfers, virtual/physical cards |

| WorldRemit | Low to Moderate (simple app/website, multiple payout methods) | Smartphone or PC | Fast global transfers with diverse payout options | Global senders needing wide country & payout coverage | Extensive reach, multiple payout options, fast transfers |

| Wise | Low (simple web/mobile interface, bank transfers) | Bank account for funding, multi-currency accounts | Transparent, cost-effective transfers in 1 business day | International bank transfers with focus on transparency | Mid-market rates, low fees, multi-currency accounts |

| Grey | Low to Moderate (mobile app, virtual accounts) | Smartphone, account verification | Simplified currency conversion & receipts for freelancers | Freelancers and remote workers | Virtual accounts, app-based FX management |

| VALR Pay | Moderate to High (cryptocurrency wallets and accounts) | Crypto wallets, VALR account | Instant, fee-free stablecoin transfers | Crypto users sending stablecoins internationally | No sending fees, blockchain security, fast transfers |

Making the Smartest Choice for Your International Transfers

Navigating the world of international money transfers can feel overwhelming, but as we've explored, the power to choose the most efficient and affordable method is firmly in your hands. Gone are the days of accepting opaque fees and unfavourable exchange rates from traditional banks as the only option. The modern financial landscape, particularly for South African businesses, is rich with specialised tools designed to save you money and time.

Finding the cheapest way to transfer money internationally isn't about locating one single "best" platform for everyone. Instead, it's about identifying the service that aligns perfectly with your specific priorities. Your decision-making process should be a strategic evaluation of your unique needs against what each platform offers.

Key Takeaways for Smart Transfers

To synthesise the information from our deep dive, keep these core principles at the forefront of your strategy:

- Look Beyond the Advertised Fee: The most critical lesson is that the upfront transfer fee is only one part of the total cost. The exchange rate markup is often the hidden cost that significantly impacts the final amount your recipient gets. Always calculate the total cost by comparing the final receivable amount.

- Speed vs. Cost: Often, there's a trade-off between transfer speed and cost. While services like WorldRemit may offer near-instant options, others might provide better rates for transfers that take a day or two. Determine what's more critical for your specific transaction.

- Recipient Convenience Matters: How will your recipient access the funds? Options range from bank deposits (Zaro, Wise), to cash pickups (Mama Money, WorldRemit), to mobile money wallets or even cryptocurrency wallets (VALR Pay). The best choice often depends on the recipient’s location and banking access.

- Business vs. Personal Needs: The requirements for a business are fundamentally different from those of an individual. A freelancer might find Grey’s virtual accounts ideal, while a growing export company needs the robust treasury management, multi-user controls, and superior pricing that a platform like Zaro provides.

Your Action Plan for Selecting a Provider

Before you initiate your next transfer, follow these actionable steps to ensure you're making the most cost-effective choice:

- Define Your Priorities: Are you sending a large B2B payment where a small percentage difference in the rate means thousands of Rands saved? Or is it a small, urgent payment to a family member?

- Get Real-Time Quotes: Use the calculators on at least two or three shortlisted platforms. Enter the exact amount you want to send and compare the final amount the recipient will receive. This is the only way to see the true cost.

- Factor in Non-Financials: Consider the user experience, customer support quality, and any value-added features like invoicing or batch payments that could streamline your operations.

Ultimately, the power to revolutionise how you move money across borders is at your fingertips. By moving away from outdated, costly methods and embracing these modern, transparent solutions, you are not just saving money on a single transaction. You are implementing a smarter financial strategy that can boost your profitability, improve cash flow, and strengthen your international relationships.

Ready to stop overpaying on international business payments and gain full control over your company's forex? Discover how Zaro offers South African businesses access to near-spot exchange rates, transparent pricing, and a powerful treasury platform. Visit Zaro to see how you can significantly cut your international transfer costs today.