In the fast-paced world of fintech, compliance process automation has quickly gone from a nice-to-have to an absolute must. Think of it as using smart technology to handle the nitty-gritty of your regulatory duties—managing, monitoring, and reporting—without the endless manual grind and the risk of human error.

Why Compliance Automation Is No Longer Optional

For any fintech in South Africa today, trying to manage compliance manually is like navigating Johannesburg's CBD during rush hour with a torn, outdated paper map. It’s not just slow and frustrating; it's a recipe for disaster. In a sector where speed and accuracy are everything, sticking to old-school methods is a massive business risk.

The pressure is definitely on. Regulators, like the Financial Intelligence Centre (FIC), are watching more closely than ever, expecting faster and more accurate reporting. This isn't just a trend; it's the new standard. Suddenly, compliance automation isn't just a smart move, but a core part of building a business that can last.

The Force Multiplier for Your Team

This is where automation becomes a game-changer—it acts as a "force multiplier" for your compliance team. It takes over the soul-destroying, repetitive tasks that drain your best people, things like mind-numbing data entry, document checks, and routine monitoring.

This frees up your experts to do what they were actually hired for: high-stakes strategic work, deep-diving into complex risks, and getting ahead of potential threats.

Instead of being buried in paperwork, your team can now focus on:

- Investigating the tricky alerts that need a real human brain to solve.

- Building stronger compliance systems to handle whatever comes next.

- Guiding the business on big decisions with a crystal-clear understanding of the risks involved.

This flips the script entirely. Your compliance function stops being a reactive cost centre and becomes a proactive, strategic partner that actively helps the company grow securely.

Navigating South Africa's Intense Regulatory Climate

South Africa’s regulatory scene is getting tougher by the day. The landscape is shifting fast, pushed by intense scrutiny around Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) rules. A major new requirement is the submission of Beneficial Ownership (BO) Declarations with Annual Returns, which puts enormous pressure on having accurate ownership data ready at a moment's notice.

This strict climate has forced local companies to embrace automation simply to cope with the sheer volume and complexity of it all. We've already seen several institutions hit with sanctions for AML failures, which serves as a stark reminder of what's at stake. Automating not only makes things more efficient but also dramatically improves the accuracy of what you report, keeping bodies like the FIC satisfied. For a deeper dive, KPMG offers great insights into these key regulatory challenges.

For South African fintechs, automation is the only practical way to handle complex AML and Beneficial Ownership rules with the speed and accuracy regulators now expect. It makes your reporting faster, more transparent, and completely auditable.

At the end of the day, compliance process automation isn’t about replacing your team; it’s about empowering them. It gives them the tools they need to confidently navigate a ridiculously complex environment. It ensures your business isn't just ticking the compliance boxes but is also competitive and built to last. The real question isn't if you should automate, but how fast you can get it done.

Deconstructing Compliance Process Automation

Let's cut through the buzzwords and get straight to what compliance process automation really is. At its core, it’s about using technology to build a digital compliance officer that works around the clock, tirelessly keeping your fintech safe and on the right side of the rules.

This isn't about a single, magic piece of software. It’s better to think of it as a coordinated team of digital specialists. This team takes on the repetitive, rule-based jobs that bury human teams in paperwork, ensuring nothing important gets missed. The result is a solid framework that not only manages today’s complex regulations but is also flexible enough to adapt to whatever changes come next.

The Core Technological Pillars

To really get your head around how compliance automation works, you need to understand the three technologies that power it. These components work together, creating a powerful system that completely changes how you handle your regulatory duties.

The key technologies are:

- Robotic Process Automation (RPA)

- Artificial Intelligence (AI)

- Machine Learning (ML)

They might sound complicated, but their roles are quite distinct and make perfect sense when you see how they operate. Each one has a specific job in building a fully automated compliance engine.

Compliance process automation isn't about one single tool; it's the intelligent combination of technologies that gives your fintech a 24/7, always-on digital compliance officer.

Robotic Process Automation: The Digital Hands

Think of Robotic Process Automation (RPA) as the busy ‘digital hands’ of your compliance team. RPA software is designed to copy human actions to carry out high-volume, repetitive tasks with perfect accuracy. It's brilliant for rule-based jobs that don’t need any complex decision-making.

For example, you can program an RPA 'bot' to handle tasks like:

- Data Entry and Migration: Automatically pulling customer details from an onboarding form and placing them into your core compliance database.

- Document Verification: Checking if a new client has submitted all the necessary FICA documents.

- Routine Reporting: Gathering data from different systems at the end of each day to create a standard transaction monitoring report.

RPA takes care of the grunt work, freeing up your team from mind-numbing copy-and-paste tasks. It guarantees data consistency and makes sure processes are followed in the exact same way, every single time. This drastically cuts down the risk of human error in those fundamental compliance checks, where even a small mistake can have big consequences.

AI and ML: The Digital Brain

If RPA gives you the hands, then Artificial Intelligence (AI) and Machine Learning (ML) provide the ‘digital brain’. This is where the system goes from simply doing tasks to actually thinking about them.

AI is the analytical engine, able to understand context and make judgements. In the world of compliance, its main job is to sift through enormous amounts of data to find patterns, anomalies, and potential risks that a person could easily miss. For example, an AI system can analyse thousands of transactions in real-time to flag activity that looks suspicious or doesn't match a customer's usual behaviour.

Machine Learning (ML), which is a part of AI, goes one step further. ML algorithms learn from data over time, getting smarter and more precise with every transaction they analyse. This ability to adapt is absolutely vital for staying ahead of sophisticated financial crime.

Imagine your system flags a transaction as potentially fraudulent. Your compliance officer investigates and confirms it's actually legitimate. They then feed this outcome back to the ML model. The system learns from this feedback, refining its understanding of what normal activity looks like for that client. This helps reduce false alarms in the future. It’s a continuous learning loop that ensures your compliance framework evolves right alongside new threats.

The Real-World Benefits for Your Fintech

Let's move past the technical jargon. What does compliance process automation actually do for your business on the ground? The results aren't just theoretical; they are tangible, powerful, and can turn compliance from a cost centre into a genuine competitive advantage.

When you bring automation into the fold, your fintech can operate faster, more securely, and with a much healthier bottom line. It directly strengthens your client relationships and your ability to scale without being tripped up by regulatory red tape.

Let’s dig into the four core benefits you can expect.

Achieve Near-Perfect Accuracy and Eliminate Human Error

Let's be honest: manual compliance is a minefield of potential errors. A simple typo during data entry, a missed document in a client’s file—these small slips can quickly escalate into serious compliance breaches and attract hefty fines from regulators. No matter how diligent your team is, human error is an unavoidable reality in repetitive, detail-oriented work.

Automation sidesteps this risk almost entirely. By programming software to handle data validation, cross-referencing, and reporting, you guarantee that tasks are performed with machinelike precision every single time. It's a level of consistency that even the best manual team simply can't match, especially as your business grows.

Imagine a South African fintech automating its Know Your Customer (KYC) checks. Instead of an employee manually verifying ID numbers against proof of address documents—a process ripe for mistakes—the system validates the data against official sources in real-time. It ensures accuracy and instantly flags any problems.

This precision creates a rock-solid foundation you can build your entire compliance framework on.

Realise Significant Operational Cost Reductions

Your compliance team’s time is one of your most valuable—and expensive—assets. When they're bogged down with routine, low-impact tasks, you're not just paying for their hours; you're missing out on their strategic insights. Manual compliance is a huge operational cost.

Compliance process automation flips this script. It takes over the grunt work, freeing your experts to focus on what humans do best: complex investigations, strategic risk planning, and improving the overall compliance health of the business.

Here’s where you’ll see the savings:

- Reduced Labour Costs: Far fewer hours are needed for manual data entry, document checks, and report generation. One study found automation helps finish these processes at least 5 times faster.

- Lower Remediation Expenses: By catching potential non-compliance issues early, you avoid the painful costs of fixing mistakes, responding to regulatory audits, and paying penalties.

- Increased Productivity: Your team can handle a much larger volume of work without you needing to hire more people, allowing you to grow much more efficiently.

Accelerate Onboarding and Reporting Cycles

In the fintech world, speed is everything. A clunky, slow client onboarding process is a sure-fire way to lose customers to a faster rival. Likewise, if your internal reporting is slow, a risk might become a full-blown crisis by the time you spot it.

Automation puts a jetpack on these critical cycles. For example, automating KYC and AML checks can shrink client onboarding from days to mere minutes. A new customer can submit their info and be fully verified almost instantly. That's a huge win for customer experience.

This speed also applies to regulatory reporting. Instead of your team spending weeks manually pulling data together for a report to the FIC, an automated system can generate it on demand with current, accurate information. You become audit-ready and can respond to regulators with confidence.

The difference between the old way and the new way is night and day.

Manual vs Automated Compliance: A Clear Comparison

This table shows just how stark the contrast is between handling compliance tasks manually versus with automation. The benefits of technology become crystal clear when you see the outcomes side-by-side.

| Compliance Task | Manual Process Outcome | Automated Process Outcome |

|---|---|---|

| Client Onboarding | Slow, often taking days, with a high risk of document errors. | Fast, completed in minutes with instant data validation. |

| Transaction Monitoring | Batch-based analysis, creating delays in detecting suspicious activity. | Real-time monitoring and immediate alerts for high-risk transactions. |

| Audit Preparation | A frantic, time-consuming scramble to gather siloed evidence. | An always-on, centralised audit trail with instantly accessible reports. |

As you can see, automation doesn't just make things a little better; it fundamentally changes the nature of the work, moving from reactive and risky to proactive and secure.

Your Roadmap to Implementing Automation

Making the switch to compliance process automation can feel like a huge project, but when you break it down into a clear roadmap, it becomes far more manageable. This isn't about flipping a switch and causing chaos overnight. Instead, think of it as a strategic journey where you build momentum, one phase at a time. By following a structured path, your fintech can bring in automation smoothly and start seeing the benefits without derailing your day-to-day work.

The journey starts with getting a really good handle on where you are right now and ends with building a culture that’s always looking to improve. Each step is designed to build on the last, creating a solid, scalable compliance framework that grows with you.

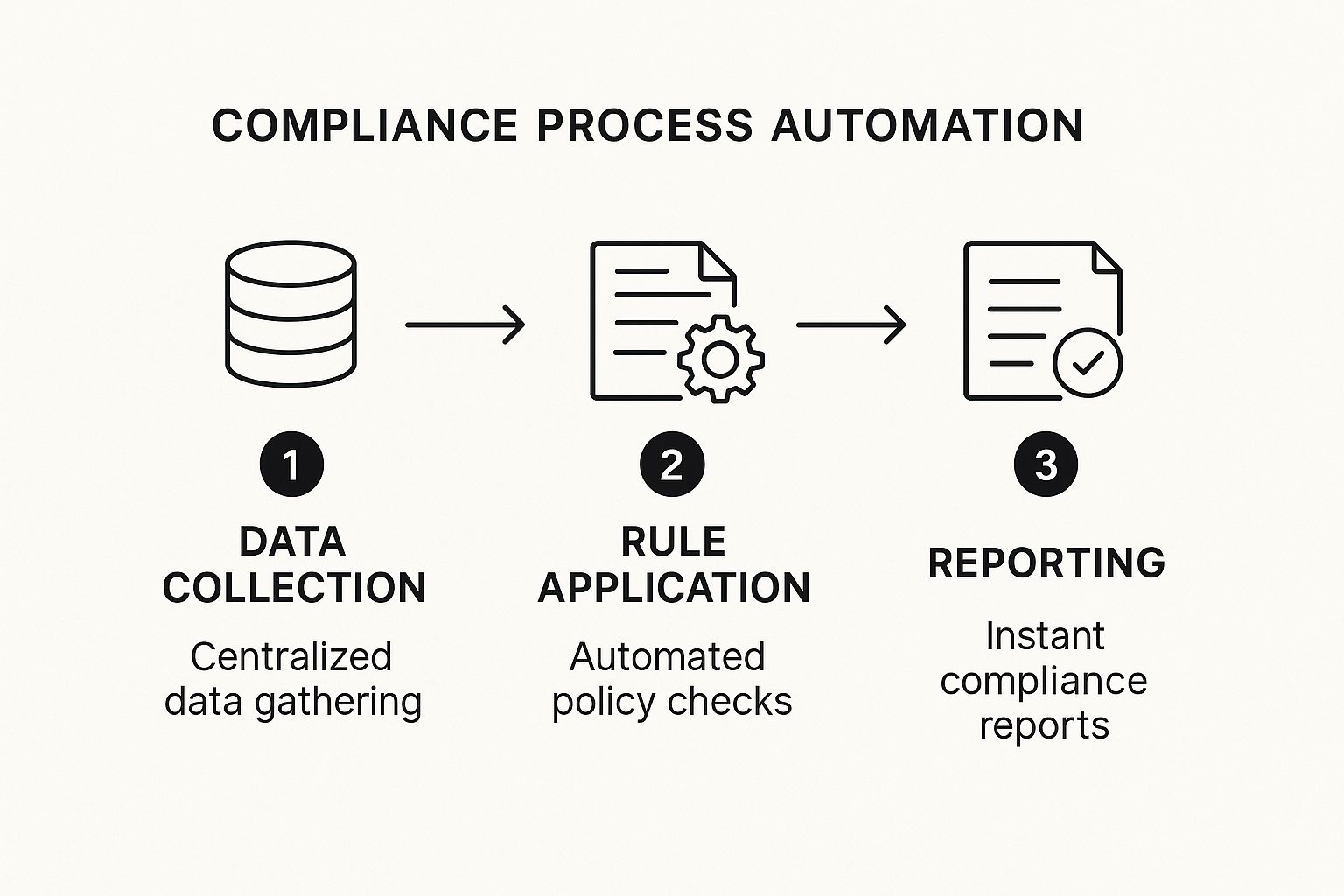

This infographic shows the core engine of compliance process automation in action—from gathering data all the way through to generating reports.

As you can see, the process flows from a central point of data collection, moves to the automatic application of rules, and finishes with instant reporting. It’s a seamless, end-to-end automated system.

Phase 1: Audit Your Current Workflows

Before you can automate a single thing, you need to know exactly what you’re working with. The very first step is to conduct a thorough audit of your existing compliance processes. Think of it as drawing a detailed map of your current compliance landscape, complete with all the roadblocks, detours, and bottlenecks.

Document every single step, from client onboarding and KYC checks to transaction monitoring and regulatory reporting. Ask the tough questions: Where do tasks get stuck? Which processes are most prone to human error? Where is your team burning the most time on repetitive, low-value work? Pinpointing these pain points is absolutely critical for spotting the biggest opportunities for automation.

Phase 2: Set Clear Objectives

Once you have a clear picture of your challenges, it’s time to define what success actually looks like. What do you really want to achieve with automation? Vague goals like “improve efficiency” just won’t cut it. You need specific, measurable objectives.

For instance, your goals could be:

- Reduce client onboarding time by 70%.

- Eliminate 95% of manual data entry errors in reporting.

- Cut the time spent preparing for audits by half.

These sharp, clear targets will guide your entire implementation. They help you prioritise what to tackle first and, down the line, make it easy to measure your return on investment.

Phase 3: Decide on Your Tech Stack

Now for a critical decision: do you build your own solution or buy one off the shelf? For most fintechs, especially small to medium-sized ones, buying a specialised, ready-made platform is the most practical choice. Building from scratch demands a huge investment of time, money, and specialised expertise that could be better spent on your core business.

When you’re looking at third-party tools, find platforms that are scalable, play nicely with your current systems (like your CRM), and are built to handle South African regulatory details like FICA and POPIA.

Phase 4: Launch a Pilot Project

Whatever you do, don't try to automate everything all at once. Start small. Pick a single, high-impact process that is relatively self-contained—like automating the initial stages of your KYC verification—and launch a pilot project to prove the concept.

A successful pilot project is your best tool for getting company-wide buy-in. It provides concrete proof of the value of automation, making it much easier to secure the resources needed for a broader rollout.

This controlled test run lets you iron out any kinks in a low-risk environment and show tangible, positive results to key stakeholders.

Phase 5: Scale and Expand

Once your pilot project has delivered the goods, it's time to scale. Take what you’ve learned and begin methodically rolling out automation to other parts of your compliance framework. This could mean automating transaction monitoring, risk assessments, or generating reports for the Financial Intelligence Centre (FIC).

As you expand, remember that this is more than just a technological shift—it's a cultural one. The adoption of AI and automation in South African compliance is accelerating. In fact, one report found that 92% of CIOs in South Africa expect to have AI widely implemented by 2025. This shows that automation is fast becoming a key competitive advantage, not just for fixing workflows but for creating new opportunities. You can read more about the trends shaping AI and automation in South Africa to get a fuller picture.

Phase 6: Monitor and Optimise Continuously

Finally, compliance automation is not a “set it and forget it” solution. Regulations change, new risks pop up, and your business will evolve. You have to build a system for continuous monitoring and optimisation.

Regularly review how your automated workflows are performing. Are they still hitting your objectives? Are new bottlenecks creeping in? Use the data and analytics from your automation platform to spot areas for improvement and fine-tune your processes. This creates a powerful cycle of continuous enhancement, ensuring your compliance framework stays effective, sharp, and agile for years to come.

Selecting the Right Automation Tools

Picking the right software for your compliance process automation is one of the biggest decisions you'll make. This isn't just about buying a tool; it's about choosing a digital partner that will shape how your fintech manages risk, scales its operations, and stays on the right side of regulators for years to come.

The market is crowded with options, and every provider will claim they have the perfect solution. Your job is to cut through the marketing noise and find a platform that genuinely fits your business—not just for today, but for where you're headed tomorrow.

That means finding something that can grow with you, plug neatly into your existing tech stack, and understand the specific regulatory maze of the South African market.

Core Factors to Evaluate

When you start comparing tools, your evaluation should boil down to three non-negotiable pillars: scalability, integration, and features built for local rules. Get these right, and you're setting yourself up for success.

Scalability for Growth: Your fintech is designed for growth, and your compliance tool has to keep pace. A system that works well for 100 clients can easily grind to a halt when you reach 10,000. You need to ask potential vendors how their platform copes with a serious increase in transaction volumes and user loads.

Seamless System Integration: The most effective automation tools don't work in isolation. They need to connect smoothly with the systems you already rely on, like your Customer Relationship Management (CRM) or core banking platform. This is crucial for avoiding data silos and ensuring you have one single, reliable source of truth across the business.

Specialised Local Features: South Africa has its own unique regulatory hurdles, from FICA to POPIA. A generic, one-size-fits-all tool won't cut it. Your chosen platform must have features specifically designed to handle these local requirements, especially for critical Anti-Money Laundering (AML) and Know Your Customer (KYC) checks.

The Advantage of Cloud-Based Platforms

For the vast majority of fintechs, a cloud-based Software-as-a-Service (SaaS) platform is the way to go. These solutions offer far more flexibility, get you up and running faster, and are usually more cost-effective than building or hosting something yourself on-premise.

Cloud-based compliance tools level the playing field. They give growing fintechs access to enterprise-grade security and functionality without the massive upfront investment, allowing you to pay for what you use and scale as your needs evolve.

The global market for these tools is booming for a reason. Projections show it growing at a compound annual growth rate (CAGR) of 19.7% from 2025 to 2030, a trend fuelled by tightening regulations worldwide. For South African firms navigating complex rules around AML and ESG, the scalability and cost-efficiency of the cloud make it the logical choice for moving from manual processes to smart, automated compliance. You can learn more about how compliance automation is reshaping business strategies in this fast-moving space.

A Practical Checklist for Vendor Selection

To bring this all together, here’s a practical checklist of questions to put to every potential vendor. Their answers will tell you a lot about whether they’re a good fit for your business and your long-term goals.

- Does your platform support South African-specific regulations like FICA and POPIA out of the box?

- Can you show us a demo of how your tool integrates with our current CRM and core banking software?

- What is your pricing model, and how does it scale as our transaction volume and user base grow?

- How do you keep your platform updated with the latest changes in financial regulations?

- What kind of technical support and training do you offer, both during and after implementation?

By taking this structured approach, you can see past the sales pitch and choose a genuine partner for your compliance process automation—one that will empower your growth and protect your operations.

Common Questions About Compliance Automation

Even with a clear plan, diving into compliance process automation can feel like a big step. It’s completely normal to have a few nagging questions, especially for fintech leaders in South Africa who need to get the practical details right before committing.

Think of this section as a candid chat. I’m going to tackle the most common queries we hear from businesses just like yours, giving you straight answers to help you move forward with confidence. We’ll cover everything from that crucial first step to making sure the tech actually fits your budget and plays nicely with your existing systems.

What Is the Most Effective First Step?

The best way to start is always with a focused internal audit. Seriously, don’t try to boil the ocean by automating everything at once. The key is to find one specific process that’s a real headache—something repetitive, tedious, and where human error keeps cropping up.

Good candidates for a first project usually look something like this:

- Capturing initial client data during onboarding.

- Running basic FICA document verification checks.

- Generating a routine daily transaction summary report.

By tackling a small but high-impact area first, you can score a quick win. This does wonders for proving the value of automation to your team and getting the buy-in you need for bigger projects down the line. It's about showing tangible results, not just implementing technology for its own sake.

How Does Automation Help with Changing Regulations?

Regulatory goalposts are always moving, especially in the South African financial space. Trying to keep up manually is a constant struggle, with every rule change forcing you to retrain staff and overhaul clunky, paper-based workflows. Automation gives you a much more agile and robust way to handle this.

When a regulation is updated, you don't have to re-educate your entire team. Instead, you just update the rules inside the software. The system then instantly applies that new logic to every single transaction or check, consistently and without fail.

Think of your automation software as a central rulebook. When a new directive from the Financial Intelligence Centre (FIC) comes out, you update that one digital rulebook. Immediately, every automated process adheres to the new standard. This is how you stay aligned with the latest requirements, almost in real-time.

This kind of agility means your fintech can adapt to new demands in hours or days, not the weeks or months it takes with manual systems. It turns compliance from a slow, rigid bottleneck into a dynamic and responsive part of your business.

Is This Technology Affordable for a Startup?

This is a huge concern for growing fintechs, but the answer is a definite yes. The world of cloud-based, Software-as-a-Service (SaaS) platforms has made compliance process automation far more accessible than it used to be. You no longer need a massive upfront investment in servers or custom software development.

Today’s tools typically work on a subscription model. You pay a predictable monthly or annual fee that often scales with your usage or the number of people on your team. This model gives you access to powerful, enterprise-level technology for a fraction of what it would have cost in the past.

When you sit down and weigh this subscription fee against the ongoing costs of manual labour, the huge risk of fines for non-compliance, and the operational drag from slow processes, the return on investment becomes clear very quickly. For a startup, automation isn't just an expense; it's a smart way to control costs.

Can Automation Integrate with Legacy Systems?

The fear of being stuck with incompatible tech is completely valid. Luckily, the best modern automation platforms are built specifically with integration in mind. They come equipped with powerful Application Programming Interfaces (APIs) and pre-built connectors that let them "talk" to a whole range of other software, including the older legacy systems you might be running.

The goal here isn't to rip and replace everything you've built. It's to create a seamless flow of information. For instance, an automation tool can pull customer data from your existing CRM, run it through the necessary compliance checks, and then push the results straight back into your core database—all without a single person having to step in.

Before you commit to any vendor, always ask for a demo showing how their tool integrates with systems like yours. A good partner will be keen to work with you, making sure their solution plugs neatly into your current tech stack to create one unified, efficient ecosystem.

Ready to eliminate hidden fees and bring transparency to your international payments? Zaro offers South African businesses access to real exchange rates with zero spread, all managed on a secure, automated platform. Discover how Zaro can transform your cross-border payments.