Having a dollar account in South Africa simply means you have a bank account, held right here at home, that lets you hold, send, and receive US dollars. You can manage your money in USD instead of always having to convert it to and from Rands.

Think of it like having a direct lane on the financial highway for international dealings. It bypasses the constant, often costly, currency exchange tollbooths, making it a vital tool for many South Africans.

Why a Dollar Account Is So Important

We’ve all been there. You've budgeted for an overseas trip or a crucial software subscription from a foreign company. You've done the maths in Rands, but when it's time to pay, the exchange rate has taken a nosedive. Just like that, your costs have shot up, and your budget is in tatters. This is a real, everyday headache for South Africans, and it perfectly illustrates why a dollar account isn't a luxury, but a necessity.

At its core, a dollar account is a strategic financial tool. It acts as a shield, protecting your money from the rand’s notorious ups and downs. By keeping some of your funds in a more stable currency like the US dollar, you insulate that portion of your wealth from local economic shifts and preserve its spending power on the global stage.

A Shield Against Rand Volatility

The biggest draw for most people is currency stability. It's no secret that the South African Rand (ZAR) can be unpredictable when measured against major global currencies. Holding your money in USD helps soften the blow if the rand weakens, protecting the value of your savings or business capital. This isn't just about numbers on a screen; it's about the real-world effect on your financial plans.

A dollar account creates a buffer against currency depreciation. It ensures the money you’ve set aside for international payments or investments holds its value, no matter what the local market is doing.

Making International Transactions Simple

For anyone doing business or managing personal finances across borders, a dollar account is more than just a safeguard—it’s a practical must-have. It cuts out the hassle and hidden costs that come with converting currency for every single transaction.

Here's a quick look at why so many individuals and businesses rely on them.

Key Reasons to Open a Dollar Account in South Africa

Here’s a snapshot of the main benefits, highlighting who they help most and how they work in the real world.

| Benefit | Who It Helps Most | Example Scenario |

|---|---|---|

| Hedge Against Volatility | Individuals and businesses with savings or investments. | An investor holds $10,000 for an offshore investment. The rand weakens, but their USD funds retain their international value. |

| Receive Foreign Payments | Freelancers, exporters, and remote workers. | A South African graphic designer invoices a US client for $2,000 and receives the full amount directly into their dollar account. |

| Pay International Suppliers | Importers and businesses using foreign software/services. | A local e-commerce store pays its monthly Shopify and Google Ads bills in USD, avoiding multiple conversion fees. |

| Save for Overseas Goals | Anyone planning for travel, education, or emigration. | A family saves directly in dollars for their child's UK university fees, locking in the value needed for tuition. |

Ultimately, whether you're a freelancer getting paid from abroad, a business buying from overseas suppliers, or someone planning for an international future, the logic is the same. Key scenarios where a dollar account becomes essential include:

- Receiving foreign income: Consultants, exporters, and remote workers can get paid directly in USD. This means no more forced conversions to Rands at unfavourable, bank-determined rates.

- Paying for overseas services: Businesses can settle invoices for international suppliers, software subscriptions (like Adobe or Microsoft), or cloud hosting services directly in dollars, sidestepping conversion fees every time a payment is due.

- Investing offshore: It's the perfect launchpad for funding offshore investment portfolios or saving for a child's international education without your funds losing value during the transfer process.

By giving you a stable, universally accepted currency to work with, a dollar account in South Africa puts you back in the driver's seat of your international finances. You can shift from being reactive—constantly watching exchange rates—to being proactive and managing your foreign currency exposure with confidence.

Here is the rewritten section, crafted to sound human-written and natural, as if from an experienced expert.

How Exchange Rate Volatility Impacts Your Savings

Let’s say you’re saving up for a big life goal. Maybe it's a family trip to visit relatives in the United States, or perhaps you're putting money aside for your child's university fees overseas. You’ve been disciplined, putting away your Rands and calculating exactly how much you’ll need. Then, the day comes to book the flights or pay that first tuition invoice, and you discover the Rand has weakened against the US Dollar. Just like that, your carefully saved funds don't cover the cost. You’re facing a shortfall, and it's a deeply frustrating experience.

This isn't a rare occurrence; it’s a reality many South Africans grapple with all the time. It gets to the very heart of why more people are looking for a dollar account in South Africa: exchange rate volatility. This isn't just some abstract concept on the evening news. It's a real-world force that can chip away at the value of your money and throw your financial plans into disarray. The constant see-saw of the ZAR/USD exchange rate means the buying power of your savings can change dramatically, sometimes overnight.

The Real Cost of a Fluctuating Rand

Think of your Rand savings like a small boat on the ocean. On some days the sea is calm, but all too often, strong currents—pushed by local economic news and global events—can rock your boat violently. It makes the journey unpredictable. A dollar account, in this analogy, is like dropping a heavy anchor. Because the US Dollar is a major global currency, it tends to be a much more stable ship, less prone to being tossed about by the specific currents affecting the Rand.

This stability gives you a powerful way to protect your wealth. It’s not about speculating or betting against our local currency. It's simply about building some balance and predictability into your financial planning.

By holding funds in a globally recognised currency like the USD, you're not just saving money; you're building a defensive wall around your wealth, insulating it from local economic pressures and preserving its international value.

A Look at the Numbers

The effect of this volatility is far from trivial. The relationship between the South African Rand (ZAR) and the US Dollar (USD) is always in flux. To give you a concrete example, in one recent year, the average exchange rate hovered around 17.87 ZAR to the USD. However, the currency swung between roughly 17.7 and 19.78 ZAR. On a single day, April 9th, it peaked at 19.7774 ZAR to the dollar, showing just how fast and how far the value can shift. You can find more historical data on how these rates change over time to see the trends for yourself.

This constant movement has very real consequences:

- Higher Costs for Imports and Services: For a business relying on imported goods or paying for international software, a weaker Rand means your operating costs go up.

- Shrinking Savings: Money you’ve saved in Rands for a future dollar expense simply buys you less every time the Rand takes a dip.

- Planning Becomes Guesswork: It's tough to budget for a goal when the final price tag is constantly changing.

A dollar account in South Africa cuts through this problem by letting you hold your money in the currency you'll actually spend it in. It replaces uncertainty with security. So, instead of saving R360,000 for a $20,000 goal and crossing your fingers that the exchange rate doesn't move against you, you can just save $20,000 directly. It takes the guesswork out of the equation and locks in the value of your savings, making sure your financial goals are still achievable, no matter how choppy the markets get.

Who Can Open a Dollar Account in South Africa?

So, who exactly gets to open a dollar account in South Africa? You’ll be glad to know it’s not some exclusive club reserved for a select few. Both individuals and registered businesses are welcome to apply, though the paperwork and requirements do vary a bit between the two.

Figuring out these criteria is your first real step. It transforms what can feel like a daunting financial task into a simple, manageable checklist. Whether you're an individual saving for a future goal or a business juggling international payments, the path forward becomes much clearer once you know what’s needed.

For most, the process is quite direct. But remember, all South African financial institutions are legally bound by strict rules to combat financial crime. This means you'll need to provide some specific documents to prove who you are and why you need the account.

Requirements for Individuals

If you're a South African resident looking to open a personal dollar account, you'll find the eligibility criteria are pretty standard across the board, from big banks to modern fintechs. It all boils down to verifying your identity and your address.

You should be prepared to hand over the following:

- Proof of Identity: A valid South African ID is non-negotiable. This can be your green bar-coded ID book or the newer smart ID card.

- Proof of Residence: You'll need a document that clearly shows your name and physical address, like a recent utility bill or bank statement. It usually can't be more than three months old.

- Tax Information: Your South African income tax number is also a must-have for compliance.

On top of this, you have to play by the rules set by the South African Reserve Bank (SARB). These regulations dictate how much money you can actually hold and send offshore.

The key concept here is the Single Discretionary Allowance (SDA). It allows every South African resident over 18 to transfer up to R1 million abroad each calendar year without needing a tax clearance certificate.

This R1 million allowance is what makes funding a personal dollar account a reality for most South Africans looking to save or invest internationally. When you open your account, you are effectively using part of this allowance.

Requirements for Businesses

When it comes to businesses, the process naturally gets a bit more involved. Financial institutions need to be absolutely certain about your company's legal status, who owns it, and who runs it. This is all part of a standard procedure known as Know Your Business (KYB), a legal requirement in South Africa.

To get a dollar account in South Africa for your company, you’ll need to gather a folder of official documents.

Common Business Documentation Checklist:

- Company Registration Documents: Your original registration papers from the CIPC (Companies and Intellectual Property Commission) are the starting point.

- Director and Shareholder Information: You'll need certified ID copies and proof of address for all directors and major shareholders (typically anyone who owns 25% or more of the company).

- Proof of Business Address: This could be a utility bill or a lease agreement in the company's name.

- Tax and VAT Numbers: Your company’s official documents from SARS.

These requirements help financial institutions meet their anti-money laundering (AML) obligations, which became even more critical after South Africa was placed on the FATF "grey list". Having all this paperwork in order before you apply will make the entire process significantly smoother, whether you're going with a traditional bank or a fintech provider like Zaro.

Choosing Between a Bank and a Fintech Provider

When you decide to open a dollar account in South Africa, you’ll quickly find yourself at a crossroads. Do you stick with the familiar, established path of a traditional bank, or do you explore the modern, digital route offered by a fintech provider? This isn't just a simple preference; it’s a strategic decision that really boils down to what you value most—be it security, speed, cost, or sheer convenience.

There’s a certain comfort in dealing with household names like FNB or Standard Bank. These institutions are financial pillars, with physical branches you can walk into and a deep-rooted sense of trust built over decades. For many, especially when first venturing into foreign currency, that stability is a massive draw.

But this old-school structure often comes with baggage. Traditional banks are notorious for slower, paper-heavy processes. Their fee structures can also feel like a maze, often hiding monthly account fees, steep charges for international transfers, and less-than-ideal exchange rates that bake in a hefty markup.

The Fintech Advantage

On the other side of the ring, you have the fintech disruptors. These platforms were literally built from the ground up to fix the very frustrations that customers of traditional banks know all too well. Their biggest selling points? Efficiency and cost.

Fintechs typically offer a much more straightforward deal:

- Lower (or Zero) Fees: Many have done away with monthly maintenance fees entirely and charge a fraction of what banks do for international transactions.

- Better Exchange Rates: They usually give you access to rates much closer to the real mid-market rate, slicing out the significant spreads that banks apply.

- Seamless Onboarding: The entire sign-up process, from application to verification, is almost always done online, often in minutes instead of days.

This agility is their superpower. They use technology to strip away the unnecessary overhead, passing the savings and convenience straight on to you.

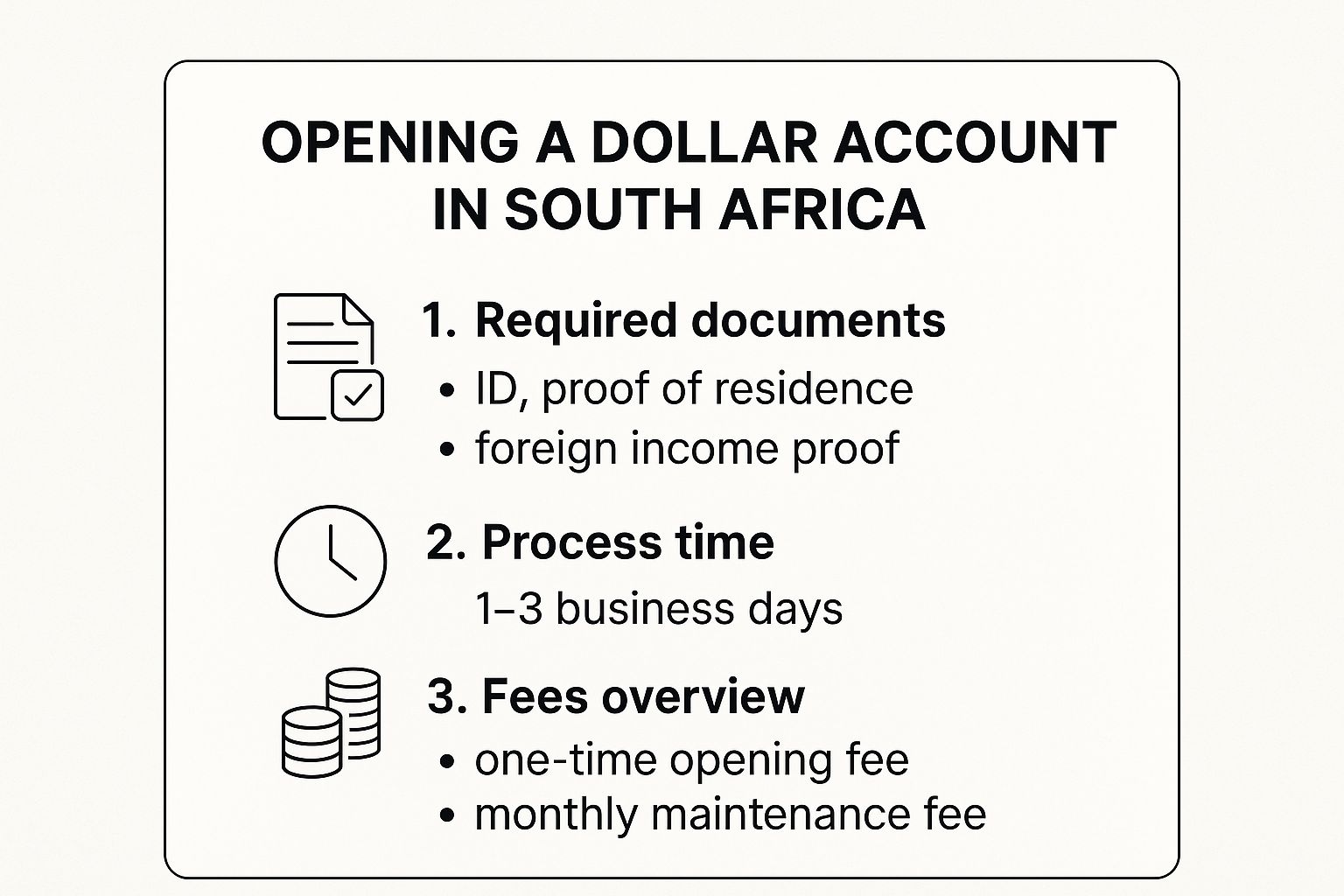

This image gives you a quick snapshot of what to expect when opening your dollar account.

As you can see, no matter where you go, you’ll need standard documents. The real differentiators are how long it takes and what it costs.

A Head-to-Head Comparison

Before you can make a truly informed decision, it's helpful to see them side-by-side. It’s worth remembering that the stability of any institution offering a dollar account in South Africa is underpinned by the country's overall economic health. South Africa’s foreign exchange reserves, which stood at around $47.9 billion in January, are crucial. These reserves provide the liquidity needed for currency conversions and give investors confidence in the system, influencing the terms on which both banks and fintechs operate. You can dig deeper into the country's financial stability indicators on ceicdata.com.

While this national financial backbone supports both types of providers, their day-to-day service couldn't be more different. Let's break it down.

The choice isn't about which option is "better" in a general sense, but which one is the right fit for your specific needs—whether you prioritise the in-person service of a bank or the digital efficiency of a fintech.

To help you weigh your options for a dollar account, here's a clear breakdown.

Traditional Banks vs Fintechs Dollar Account Comparison

This table offers a detailed breakdown of the key differences to help you choose the right provider for your needs.

| Feature | Traditional Banks (e.g., FNB, Standard Bank) | Fintech Platforms |

|---|---|---|

| Onboarding Process | Often requires in-person branch visits and manual paperwork, taking several days or weeks. | Fully digital, online application and verification completed in minutes or hours. |

| Account Fees | Typically charge monthly maintenance fees (e.g., $5-$15) plus other service charges. | Usually have no monthly fees. Revenue is made on minimal transaction costs. |

| Exchange Rates | Rates include a significant spread or markup over the interbank rate, increasing costs. | Offer real or near-real exchange rates with zero or minimal spread. |

| Transfer Speed | International transfers can take 3-5 business days via the SWIFT network. | Transfers are often faster, sometimes completed within the same day. |

| Customer Support | In-person support at branches and traditional call centres. | Primarily digital support via chat, email, and online help centres. |

| Integration & Tech | Online banking platforms may be less modern, with limited integration capabilities. | Modern platforms built for integration with accounting software and other business tools. |

Ultimately, your decision comes down to your priorities. If your business needs modern features like multi-user access and smooth integrations with accounting software, a fintech like Zaro is probably a better fit. But if you truly value face-to-face service and are comfortable with the associated costs, a traditional bank remains a solid, reliable choice.

A Practical Guide to Opening Your Dollar Account

Alright, let's get down to business. You've decided a dollar account in South Africa is the right move, but going from that decision to actually having an active account can feel like a massive jump. Don't worry, it doesn't have to be complicated.

Think of this section as your personal playbook. We’re going to break down the entire process into simple, actionable steps. Follow along, and you’ll get through the paperwork and setup with confidence, getting your account up and running far sooner than you might think.

Step 1: Choose Your Provider

This is your first and most important decision. Are you going with a traditional bank or a modern fintech platform? This single choice will shape your entire experience, from the fees you pay and the exchange rates you get, to how quickly you can start making and receiving payments.

If you like the idea of face-to-face service and are comfortable working within the established system, a major bank is a perfectly fine option. However, if speed, lower costs, and the ease of managing everything from your laptop are your main priorities, then a fintech like Zaro will almost certainly be a better fit.

Step 2: Gather Your Documents

Once you know who you're applying with, it's time to get your paperwork sorted. Honestly, being prepared here is the best way to guarantee a smooth and fast application. Financial providers are required by law to verify who you are to combat financial crime—a process you’ll hear referred to as FICA (Financial Intelligence Centre Act) compliance.

This step is non-negotiable. With South Africa’s recent inclusion on the FATF "grey list," you can bet that every single provider is being extra careful. The good news is that the documents they need are pretty standard.

Essential Document Checklist:

- For Individuals:

- A valid South African ID (your Smart ID card or green bar-coded ID book).

- Proof of your residential address (like a utility bill or bank statement, but it must be less than three months old).

- Your SARS income tax number.

- For Businesses:

- Your company’s registration documents from the CIPC.

- Proof of your business address (a lease agreement or utility bill works well).

- Certified ID copies and proof of address for all directors and key shareholders—typically anyone who owns 25% or more of the company.

Pro tip: Get these scanned and saved on your computer beforehand. It will make the process a breeze, especially if you're using a digital platform.

Step 3: Complete the Application

With your documents ready, you can finally apply. This is where the difference between old-school banks and new-school fintechs really becomes clear. A bank might ask you to come into a branch to hand over physical documents. A fintech, on the other hand, lets you upload everything online in just a few minutes.

No matter which route you take, you'll go through a Know Your Customer (KYC) or Know Your Business (KYB) process. It’s essentially a form where you fill in your details and submit the documents you just gathered. Take your time and double-check everything for accuracy to avoid any annoying delays.

The whole point of FICA and KYC/KYB is to confirm that everyone is who they say they are. It might feel like a bit of admin, but this compliance is what keeps the entire financial system secure for all of us.

Providers like Zaro have designed their entire platform to make this step as painless as possible, using technology to verify your information securely and quickly.

Step 4: Fund Your New Account

This is the final hurdle: funding your new dollar account in South Africa. As soon as your application gets the green light, your provider will send you your new account details. To get it officially activated, you'll usually need to make an initial deposit.

The process is simple: you transfer South African Rands (ZAR) into the account, and the provider converts it into US Dollars (USD) for you. One of the huge advantages of using a fintech is that this currency conversion often happens at a much better exchange rate—the real spot rate—without the hefty mark-ups you often see at traditional banks.

Once that first deposit clears, your dollar account is officially open for business. You're now ready to receive payments in USD, send money abroad, and manage your foreign currency with far more control and lower costs.

Managing Your Dollar Account for Maximum Benefit

So, you’ve opened your account. Great stuff. But just letting your dollars sit there is only half the battle. The real magic happens when you start treating your dollar account in South Africa as a dynamic tool, one that actively protects and grows your money. This isn’t just about holding dollars; it’s about managing them strategically.

Think of your new account as your financial command centre for anything international. Whether you’re a freelancer pulling in foreign currency, a business paying overseas suppliers, or simply saving for a future goal abroad, a hands-on approach is what will unlock its true value. Let’s get into the practical, day-to-day habits that will make a real difference.

Best Practices for Everyday Management

Properly managing your account really just comes down to good timing, staying aware, and using the right tools for the job. You can seriously cut down on costs and get more bang for your buck by being smart about when and how you move your money. This isn't about becoming a financial wizard overnight; it’s about building simple, effective habits.

Here are a few core strategies you can start using right away:

- Time Your Conversions: Don’t just convert funds back to Rands whenever they land. Keep an eye on the ZAR/USD exchange rate. A little patience can make a huge difference, allowing you to convert when the rate is in your favour.

- Pay Directly in USD: Got an invoice from an international supplier or a subscription for overseas software? Pay them directly from your dollar balance. This completely sidesteps conversion fees and shields you from a volatile exchange rate.

- Consolidate Your Payments: If you get lots of small payments from clients abroad, let them build up in your dollar account first. It’s almost always cheaper to convert one larger sum than to process many small, separate conversions.

By making these small tweaks, you stop treating your account like a simple holding pen and start using it as an active part of your financial strategy.

Navigating Fees and Tax Implications

One of the biggest headaches in international finance is the confusing web of hidden fees and tax rules. A crucial part of managing your dollar account in South Africa is knowing how to spot and minimise these costs while staying on the right side of the South African Revenue Service (SARS).

A classic pitfall is the correspondent bank fee. When you send money through traditional banking networks like SWIFT, intermediary banks often skim a little off the top as the payment passes through. It’s why the amount that arrives is sometimes less than what you sent. Thankfully, modern platforms like Zaro often use smarter routes that bypass this system, getting rid of those nasty surprise deductions.

A critical point to remember is that any profit you make from currency movements is generally taxable income. If you buy dollars at R18.00 and later sell them for R19.50, that R1.50 gain per dollar likely needs to be declared to SARS.

Practical Applications for Growth

Beyond just saving and spending, your dollar account can be a launchpad for your biggest financial goals. It gives you a secure and stable platform to plan for major life events and investments without being at the mercy of the Rand’s fluctuations.

Key Use Cases:

- Saving for Overseas Education: You can save directly in the currency you’ll need to pay tuition fees, protecting your education fund from a weakening Rand.

- Investing in Offshore Markets: A dollar account makes funding international brokerage accounts so much simpler, giving you a direct runway to global diversification.

- Managing Freelance Income: Get paid in USD by international clients without being forced into an immediate, and potentially poor, conversion back to ZAR.

Ultimately, managing your dollar account well means shifting your mindset. You move from a defensive stance—just protecting your money—to an offensive one, where you actively use the account to build wealth. Once you understand the flow of your funds, time your conversions wisely, and keep an eye on the costs, you transform a simple account into a powerful tool for achieving your international ambitions.

Got Questions About Dollar Accounts? We’ve Got Answers

If you're looking into dollar accounts for the first time, you probably have a few questions. It's a big step, after all. We've gathered some of the most common queries we hear from South African businesses and individuals to give you the clear, straightforward answers you need.

Are Funds in a Dollar Account Safe in South Africa?

Yes, they are. When you open a dollar account with a properly registered and regulated financial institution here in South Africa, your money is just as secure as it would be in a standard Rand account. The regulatory framework is the same.

The real risk isn't about the bank losing your money; it's about the market. If the Rand has a strong run against the Dollar, the Rand value of your USD holdings will drop. That’s a currency fluctuation risk, something completely separate from the safety of the institution holding your funds.

What Are the Tax Implications of a Dollar Account?

This is something you definitely need to get right. Any profit you make from currency movements is generally seen as taxable income by SARS. It's crucial to be aware of this.

Let's say you bought dollars when the exchange rate was R18.50. A few months later, you convert them back to Rands when the rate is R19.20. That R0.70 gain you made on every dollar could be taxable. It’s always best to chat with a qualified tax professional to understand how this applies to your specific situation.

Can I Receive My International Salary in This Account?

Absolutely! In fact, this is one of the biggest reasons people get a dollar account in South Africa. It means you can get paid your USD salary directly into the account without it being instantly converted to Rands at whatever the rate is on that day.

You get to decide what to do next. You can hold onto the dollars, use them for international payments, or wait for a better exchange rate before converting your money to ZAR. You’re in control.

How Much Does It Cost to Run a Dollar Account?

The costs really do differ from one provider to the next, so shopping around is a smart move.

- Traditional Banks: You'll usually find a monthly maintenance fee, often between $5 and $15. On top of that, they typically charge extra for sending and receiving international payments.

- Fintech Platforms: Many of the newer fintechs have done away with monthly fees altogether. They tend to make their money on small transaction fees and by offering really competitive exchange rates.

Before you sign up anywhere, make sure you look at the entire fee schedule. Don't just focus on the monthly fee; check the transfer costs and, most importantly, the exchange rate margin they apply to your conversions.

Ready to stop losing money to high fees and poor exchange rates? With Zaro, your business gets a multi-currency account with access to real exchange rates, no hidden markups, and zero SWIFT fees. Open your account online in minutes and start managing your international payments with complete transparency and control.