Streamlining Your Forex Needs in South Africa

Managing foreign exchange in South Africa efficiently is crucial for businesses and individuals alike. This list of top 8 foreign exchange providers in South Africa simplifies your search for the best solution. Discover tools that offer competitive rates, secure transactions, and streamlined processes for sending and receiving money internationally, whether you're a small business managing imports/exports or a CFO seeking better foreign exchange transparency. We've compiled the leading platforms, including banks like ABSA, Standard Bank, FirstRand (FNB), and Nedbank, along with specialized providers like Zaro and Travelex, to help you navigate the complexities of foreign exchange South Africa.

1. Zaro: Revolutionizing Foreign Exchange for South African Businesses

For South African businesses navigating the complexities of foreign exchange (FX), Zaro emerges as a game-changing fintech solution. Designed to simplify and optimize cross-border payments, Zaro offers a compelling alternative to traditional banking, promising speed, transparency, and significant cost savings. This platform tackles the challenges of high fees, opaque exchange rates, and cumbersome processes, making it an invaluable tool for businesses involved in international trade.

Zaro distinguishes itself through its commitment to eliminating hidden costs and providing access to the true spot exchange rate. This means businesses transacting internationally pay zero spread and no SWIFT fees, resulting in substantial savings compared to traditional banks that often incorporate markups and unpredictable charges. This transparent pricing structure provides businesses with greater control over their finances and allows for more accurate forecasting.

Imagine a small South African business exporting handcrafted goods to the United States. Using traditional banking methods, each payment received would be subject to various fees, including SWIFT charges and exchange rate markups. These costs can significantly erode profit margins. With Zaro, this same business can receive payments at the true spot exchange rate with no added fees, maximizing their revenue and enhancing their competitiveness in the global market.

Beyond cost savings, Zaro offers a streamlined and secure platform for managing foreign exchange. Businesses can hold and manage both ZAR and USD accounts within the platform, funded through standard bank transfers. The Know Your Business (KYB) onboarding process is designed to be seamless and efficient, allowing businesses to quickly get up and running. Zaro also provides robust security features, including multi-user access, customizable team permissions, and bank-level security protocols, ensuring complete transparency and control over all transactions. This is particularly crucial for businesses handling sensitive financial information and requiring strict compliance measures.

One of the standout features of Zaro is the provision of issued debit cards denominated in both ZAR and USD. This empowers businesses to make international purchases directly at the advantageous low-cost FX rates offered by the platform. Consider a South African company importing raw materials from China. Using a Zaro USD debit card, they can bypass the costly FX conversions typically associated with traditional banking and pay their suppliers directly at the optimal exchange rate, further optimizing their expenses.

While Zaro's pricing is highly competitive with its zero spread and no SWIFT fees, specific pricing details are not readily available on the website. Interested businesses are encouraged to contact Zaro directly to discuss their specific needs and obtain tailored pricing information. Regarding technical requirements, Zaro operates as a web-based platform, accessible through any modern web browser. There are no specific software installations or hardware requirements, making it a highly accessible solution for businesses of all sizes.

For South African businesses seeking to optimize their foreign exchange operations, Zaro offers a compelling solution. From SMEs exporting goods to larger enterprises managing international payments, Zaro's transparent pricing, robust features, and user-friendly platform provide significant advantages over traditional banking methods. While the platform currently focuses primarily on South African businesses and may lack some advanced integrations required by larger corporations, its core offering represents a significant step forward in simplifying and democratizing access to cost-effective foreign exchange in South Africa. For CFOs seeking FX transparency, business owners aiming to streamline operations, and export companies looking to maximize their revenues, Zaro presents a powerful tool worth exploring. You can learn more and get started by visiting their website at https://www.usezaro.com.

2. ABSA Bank Foreign Exchange

ABSA Bank, a cornerstone of South Africa's financial landscape, stands as a major player in the foreign exchange market. For South African businesses navigating the complexities of international trade, ABSA offers a comprehensive suite of foreign exchange services designed to facilitate smooth cross-border transactions and manage currency risk. This makes them a significant consideration for businesses engaged in foreign exchange South Africa. Their offerings cater to both corporate and individual clients, providing a one-stop shop for all foreign exchange needs. Whether you're a small business making your first international sale or a large corporation managing complex currency portfolios, ABSA aims to provide the tools and expertise to support your foreign exchange requirements.

ABSA provides a range of services, including spot transactions for immediate currency exchange, forward contracts to lock in future exchange rates, and hedging solutions to mitigate currency risk. Their broad network of branches across South Africa ensures accessibility for clients, while their dedicated dealing room offers 24/7 support for time-sensitive transactions. For corporate clients, ABSA provides an online FX trading platform, enabling convenient access to real-time exchange rates and streamlined transaction processing. This digital platform is particularly beneficial for CFOs in South Africa seeking greater FX transparency and control over their international transactions.

For South African export companies, particularly SMEs, ABSA's foreign exchange services can prove invaluable. Successfully navigating fluctuating exchange rates is crucial for profitability, and ABSA's forward contracts allow businesses to lock in favourable rates, protecting their margins against adverse currency movements. Similarly, BPO businesses that outsource to South Africa can leverage ABSA's multi-currency accounts and international payment solutions to streamline their payment processes and minimize transaction costs.

While pricing details aren't publicly available and often depend on transaction volume and client relationship, ABSA is generally known for offering competitive rates, especially for larger transactions. This makes them a particularly attractive option for larger corporations and businesses with substantial foreign exchange needs. However, smaller businesses might find their fees slightly higher compared to some other providers. This is something to be mindful of and to compare against other options.

Implementing ABSA's foreign exchange services usually involves opening a business account and completing the necessary KYC (Know Your Customer) procedures. For more complex solutions like hedging and forward contracts, businesses will typically work with a dedicated relationship manager to tailor a strategy to their specific needs. While ABSA boasts a strong corporate banking reputation and comprehensive risk management tools, it's worth noting that approvals for large transactions can sometimes involve a more complex process. Additionally, weekend trading hours are limited, which might be a constraint for businesses operating in time zones with significant weekend activity.

Compared to other banks offering foreign exchange in South Africa, such as Standard Bank and FNB, ABSA's strengths lie in its extensive branch network and robust corporate banking infrastructure. While other banks might offer specialized solutions for certain niches, ABSA provides a comprehensive suite of services under one roof. This is particularly advantageous for businesses seeking a single provider for all their banking and foreign exchange requirements.

In conclusion, ABSA Bank Foreign Exchange offers a compelling solution for businesses in South Africa operating within the global marketplace. Their extensive network, comprehensive services, and strong corporate banking relationships make them a reliable partner for managing foreign exchange needs. While fees for smaller transactions might be higher and approval processes for large amounts can be complex, the bank's overall offering, particularly for larger businesses, positions them as a key player in the foreign exchange South Africa landscape. You can explore their services further on their website: https://www.absa.co.za

3. Standard Bank Foreign Exchange

Standard Bank, recognized as Africa's largest bank by assets, offers a robust suite of foreign exchange (FX) services tailored to businesses operating within South Africa and internationally. Their Global Markets division caters to a diverse clientele, including corporations, institutions, and high-net-worth individuals, providing access to major global currency pairs and sophisticated treasury solutions. This makes them a prominent player in the foreign exchange South Africa landscape.

For South African businesses engaged in international trade, navigating the complexities of foreign exchange is crucial for profitability and growth. Standard Bank aims to address these complexities with a comprehensive offering. Their services are particularly relevant for small and medium-sized export companies, business owners and executives, CFOs seeking FX transparency, and Business Process Outsourcing (BPO) businesses operating within South Africa.

Standard Bank's Global Markets FX trading platform offers real-time market data and analytics, empowering businesses to make informed decisions in the dynamic FX market. This feature is especially valuable for South African businesses dealing with fluctuating exchange rates, as it allows them to monitor market movements and mitigate potential risks. Cross-border payment solutions streamline international transactions, facilitating efficient and secure movement of funds. For South African businesses with international clients or suppliers, this feature simplifies payment processes and reduces administrative burdens.

Furthermore, Standard Bank provides currency options and structured products, enabling businesses to hedge against currency risk and optimize their FX strategies. These sophisticated tools can be particularly beneficial for South African businesses operating in volatile markets. Dedicated relationship managers are assigned to large clients, offering personalized support and guidance. This high-touch approach can be invaluable for navigating complex FX transactions and developing tailored solutions.

Standard Bank's position as the largest African bank with a global reach provides access to a vast network of financial institutions and counterparties. This extensive reach translates into competitive pricing, especially for high-volume trades, making them an attractive option for larger South African businesses. Their advanced trading technology platforms provide clients with cutting-edge tools and resources for managing their FX exposures. Strong institutional relationships further enhance their capabilities in providing comprehensive FX solutions.

While Standard Bank offers a compelling suite of services, it’s important to consider the potential drawbacks. Minimum transaction requirements may pose a challenge for smaller businesses with limited FX needs. The onboarding process for retail clients can be complex, potentially creating a barrier to entry for individuals or small businesses new to foreign exchange South Africa. Additionally, costs for basic services might be higher compared to some other providers, requiring careful consideration of overall cost-effectiveness.

Specific Use Cases for South African Businesses:

- Exporters: Mitigate currency risk and optimize profits when receiving payments in foreign currencies. Utilize the platform’s real-time data and analytics to make informed pricing decisions.

- Importers: Secure favorable exchange rates for purchasing goods and services from international suppliers. Streamline cross-border payments with efficient payment solutions.

- CFOs: Gain transparency into FX transactions and manage currency exposures effectively. Leverage reporting tools to track FX performance and optimize treasury strategies.

- BPOs: Facilitate seamless cross-border payments to and from international clients. Benefit from competitive pricing for high-volume transactions.

Implementation and Setup:

While specific pricing and technical requirements aren't readily available publicly, businesses can initiate contact through the Standard Bank website (https://www.standardbank.co.za) to discuss their specific needs and obtain detailed information on onboarding procedures and applicable fees. This personalized approach ensures that businesses receive tailored solutions aligned with their individual requirements.

Standard Bank's comprehensive offering in foreign exchange South Africa positions them as a strong contender for businesses seeking robust FX solutions. Their sophisticated platform, combined with their extensive network and expertise, caters to the complex needs of businesses operating in the global marketplace. However, businesses should carefully consider the minimum transaction requirements and potential higher costs for basic services before making a decision. By weighing the pros and cons, South African businesses can determine if Standard Bank's services align with their specific FX needs and strategic objectives.

4. FirstRand Bank (FNB) ForexOnline

FirstRand Bank (FNB), a prominent player in the South African financial landscape, offers a comprehensive suite of foreign exchange services through its ForexOnline platform. Catering to both retail and corporate clients, FNB ForexOnline provides convenient digital solutions for various foreign exchange needs, making it a compelling option for businesses engaged in international trade or those requiring foreign currency for travel. This platform is particularly useful for small and medium-sized South African export companies, business owners and executives, CFOs seeking FX transparency, and BPO businesses operating within South Africa.

FNB ForexOnline stands out for its integration with existing FNB banking services, creating a seamless experience for existing customers. For businesses already utilizing FNB for their banking needs, managing foreign exchange transactions within the same ecosystem simplifies operations and streamlines financial management. CFOs, in particular, will appreciate the transparency and control afforded by this integration, allowing for a clearer overview of all financial activities within a single platform.

The platform offers a robust digital experience through its online portal and mobile app, enabling users to conduct foreign exchange transactions conveniently from anywhere, anytime. This accessibility is particularly valuable for business owners and executives who require flexibility in managing their finances. Whether it's making international payments to suppliers or receiving payments from clients overseas, FNB ForexOnline provides a convenient and efficient solution.

For those needing foreign currency for travel, FNB ForexOnline provides travel money cards and cash collection services. Travel money cards offer a secure and convenient alternative to carrying large amounts of cash, while the option to collect foreign currency from FNB branches provides a tangible solution for those preferring physical currency. This caters to a wide range of travel needs, making it an attractive option for both business and leisure travelers.

FNB ForexOnline also offers international payment services, facilitating seamless cross-border transactions for businesses. This is particularly beneficial for South African export companies dealing with international clients and suppliers. The platform allows for efficient transfer of funds, simplifying payment processes and reducing the complexities associated with international trade.

Furthermore, the platform provides valuable market insights and rate alerts. Staying informed about currency fluctuations is critical for businesses engaged in foreign exchange, and FNB ForexOnline empowers users with the necessary information to make informed decisions. Rate alerts can be customized to notify users of specific exchange rate movements, enabling them to capitalize on favorable market conditions.

While FNB ForexOnline offers numerous advantages, it's important to consider some limitations. Individual users are subject to daily transaction limits, which may be restrictive for some. The platform also offers a limited selection of exotic currencies, potentially posing a challenge for businesses dealing with less common currencies. Additionally, accessing FNB ForexOnline requires an existing FNB banking relationship. While this integration offers advantages for existing customers, it may deter those who prefer to maintain their banking and foreign exchange services with separate institutions.

Regarding pricing, FNB applies specific margins to the prevailing exchange rates, varying depending on the currency pair and transaction volume. While FNB promotes competitive retail exchange rates, it's essential to compare these rates with other providers to ensure you're getting the best deal. For larger corporate transactions, contacting FNB directly is recommended to negotiate tailored pricing based on your specific needs.

For implementing FNB ForexOnline, existing FNB customers can easily access the service through their online banking portal or mobile app. New customers will need to open an FNB account before accessing ForexOnline. The setup process is generally straightforward, involving registering for the service and completing the necessary KYC (Know Your Customer) requirements.

Compared to similar tools like Standard Bank’s Shyft and Nedbank’s Money app, FNB ForexOnline’s key differentiator is its tight integration with the FNB banking ecosystem. This makes it a particularly compelling option for existing FNB customers, providing a seamless and unified banking experience. However, those without an FNB account might find other platforms offering a wider range of currency options or more competitive pricing for specific needs.

In conclusion, FNB ForexOnline offers a comprehensive and convenient solution for foreign exchange needs in South Africa, especially for those already within the FNB banking ecosystem. Its user-friendly digital platforms, convenient branch collection points, and integrated banking services make it a valuable tool for businesses and individuals alike. However, it's crucial to consider the limitations regarding daily transaction limits, exotic currency options, and the requirement of an existing FNB account before making a decision. By weighing the pros and cons and comparing with similar tools, you can determine if FNB ForexOnline is the right fit for your specific foreign exchange requirements.

5. Nedbank Capital Foreign Exchange

Navigating the complexities of foreign exchange in South Africa is a crucial aspect of success for businesses engaged in international trade. For companies seeking robust and sophisticated foreign exchange solutions, Nedbank Capital Foreign Exchange stands out as a prominent player, catering primarily to the needs of institutional and corporate clients. Their offerings extend beyond basic currency exchange, encompassing a suite of treasury and risk management tools designed to optimize financial performance in the volatile global marketplace. This makes them a compelling choice for South African businesses operating within the global landscape. Specifically, small and medium-sized South African export companies, business owners and executives, CFOs seeking FX transparency, and BPO businesses outsourcing to South Africa can benefit from Nedbank Capital’s comprehensive services.

Nedbank Capital’s strength lies in its provision of institutional-grade foreign exchange services. These include spot transactions for immediate currency exchange, forward contracts to lock in future exchange rates, and options trading for more complex hedging strategies. These tools are particularly relevant for South African businesses managing fluctuating Rand values. For example, an exporting company can use a forward contract to secure a favourable exchange rate for a future payment, mitigating the risk of adverse currency movements. Similarly, importing businesses can utilize these tools to manage their import costs effectively.

Beyond basic currency exchange, Nedbank Capital offers sophisticated treasury solutions tailored to the South African market. Their dedicated FX specialists provide personalized service and guidance, helping clients navigate the intricacies of foreign exchange management. This personalized approach is particularly beneficial for businesses needing tailored solutions for specific international trade challenges. Further reinforcing their commitment to client success, they offer comprehensive risk management expertise, empowering businesses to identify, assess, and mitigate FX risks effectively. This expertise is especially crucial in the current volatile global market, providing South African businesses with the tools they need to navigate uncertainty.

Key features of Nedbank Capital Foreign Exchange include professional FX dealing services, treasury risk management solutions, electronic trading platforms for efficient trade execution, market research and analysis to inform strategic decisions, and structured FX products and derivatives for advanced hedging strategies. Their electronic trading platform provides clients with real-time market data and streamlined execution capabilities. The market research and analysis offered by Nedbank Capital provides valuable insights into current and projected market trends, enabling businesses to make informed decisions regarding their foreign exchange strategies.

While Nedbank Capital’s focus on corporate clients offers significant advantages in terms of service depth and expertise, it also means there are certain considerations. Their services are generally geared towards larger transaction volumes, with higher minimum transaction amounts than retail-focused providers. This focus might make them less suitable for smaller businesses or individuals with limited foreign exchange needs. Furthermore, their retail FX services are more limited compared to some other institutions. However, for businesses that meet their client profile, the pros significantly outweigh the cons.

Pros:

- Strong local market expertise: Deep understanding of the South African market dynamics, regulations, and challenges.

- Personalized service approach: Dedicated FX specialists provide tailored guidance and support.

- Competitive institutional pricing: Access to potentially more favourable exchange rates for larger transactions.

- Comprehensive risk management tools: Robust solutions for mitigating FX risks and optimizing financial performance.

Cons:

- Focus primarily on corporate clients: May not be ideal for individuals or small businesses with limited FX needs.

- Higher minimum transaction amounts: Larger transaction volumes are generally required.

- Limited retail FX services: Fewer options for individuals compared to retail-focused banks.

For South African businesses engaged in substantial international trade, Nedbank Capital Foreign Exchange (https://www.nedbank.co.za) offers a compelling suite of services. Their focus on corporate clients, combined with their deep local market expertise, personalized service, and comprehensive risk management tools, makes them a valuable partner for navigating the complexities of foreign exchange in South Africa. While their services are primarily tailored to larger corporations, their sophisticated offerings and expert guidance can significantly benefit eligible businesses seeking to optimize their foreign exchange operations.

6. Forex Club South Africa

Forex Club South Africa distinguishes itself as a specialist in the crowded field of foreign exchange providers by offering competitive rates, personalized service, and a focus on efficiency. This makes them a valuable resource for individuals and businesses navigating the complexities of foreign exchange in South Africa, particularly for those prioritizing transparent pricing and streamlined transactions. For South African businesses engaged in international trade, managing foreign exchange effectively is crucial for profitability and smooth operations. Forex Club offers tailored solutions that can alleviate the challenges of currency fluctuations and international payments, making them a worthy contender for your foreign exchange needs.

This provider shines in several key areas relevant to South African businesses, especially SMEs and those involved in import/export: international money transfers, travel money, and general currency exchange. They offer a transparent pricing structure, meaning you know exactly what you're paying for, a significant advantage in a market often obfuscated by hidden fees. Their focus on efficient processing times is also a plus, ensuring your transactions are completed swiftly.

Practical Applications and Use Cases:

- South African Export Companies: For businesses exporting goods or services, Forex Club offers competitive exchange rates when converting foreign currency earnings back into South African Rand (ZAR). This helps maximize profits and mitigate losses due to unfavourable exchange rate fluctuations. Their personalized service can assist in navigating the complexities of international payments and managing currency risk.

- Business Owners and Executives: Frequent international travel often necessitates exchanging currency. Forex Club’s travel money services provide competitive rates and access to foreign cash, making it convenient for business trips abroad. Their online platform allows for quick rate quotes and booking, streamlining the process.

- CFOs in South Africa Seeking FX Transparency: Transparency in foreign exchange transactions is paramount for sound financial management. Forex Club’s transparent fee structure allows CFOs to accurately track FX costs and make informed decisions. This clarity is essential for budgeting and forecasting.

- BPO Businesses Outsourcing to South Africa: For businesses outsourcing operations to South Africa, Forex Club facilitates efficient cross-border payments to South African employees or contractors. Their competitive exchange rates and swift processing times contribute to streamlined payroll and operational expenses.

Features and Benefits:

- Competitive Exchange Rates with Low Margins: Forex Club emphasizes offering highly competitive exchange rates, ensuring that clients receive the best possible value for their money. This is particularly advantageous for businesses dealing with significant transaction volumes.

- International Money Transfer Services: Facilitating seamless cross-border payments, Forex Club simplifies the process of sending and receiving money internationally. Their specialized expertise ensures compliance and efficiency.

- Travel Money and Foreign Cash: For individuals and businesses travelling abroad, Forex Club provides access to foreign currency at competitive rates. Their online platform allows for pre-ordering and collection, making it a convenient solution for travel money needs.

- Online Rate Quotes and Booking: The online platform offers real-time rate quotes and allows clients to book transactions online, offering convenience and transparency.

- Personalized Customer Service: Forex Club emphasizes personalized service, providing dedicated support to clients navigating foreign exchange transactions.

Pros:

- Highly Competitive Exchange Rates: Their focus on competitive pricing makes them a strong choice for cost-conscious businesses.

- Transparent Fee Structure: Clarity in pricing builds trust and allows for accurate financial planning.

- Specialized FX Expertise: Their specialized focus on foreign exchange translates to efficient and reliable service.

- Quick Processing Times: Efficient processing minimizes delays and keeps business operations running smoothly.

Cons:

- Limited Physical Branch Locations: While they offer online services, their limited physical presence might be a drawback for clients who prefer in-person interactions.

- Smaller Transaction Volumes: Compared to larger banks, they may have limitations on the size of transactions they can handle.

- Less Comprehensive Banking Services: They focus specifically on FX and don't offer a full suite of banking services like loans or accounts.

Comparison with Similar Tools:

While banks offer foreign exchange services, Forex Club differentiates itself through specialized expertise and often more competitive rates. Other online FX platforms exist, but Forex Club focuses on personalized service, which can be invaluable for businesses navigating complex international transactions.

Implementation or Setup Tips:

Visit the Forex Club South Africa website (https://www.forexclub.co.za) to get a quote, compare rates, and initiate transactions. Contact their customer service team to discuss your specific requirements and tailor a solution that meets your business needs.

For businesses operating in the South African context, especially those dealing with international trade, Forex Club offers a compelling proposition. Their focus on competitive pricing, transparency, and efficient processing, combined with personalized service, makes them a viable option for managing foreign exchange needs effectively. They deserve a spot on this list because they cater to a specific niche within the broader FX market, offering tailored solutions for businesses seeking specialized expertise and competitive rates.

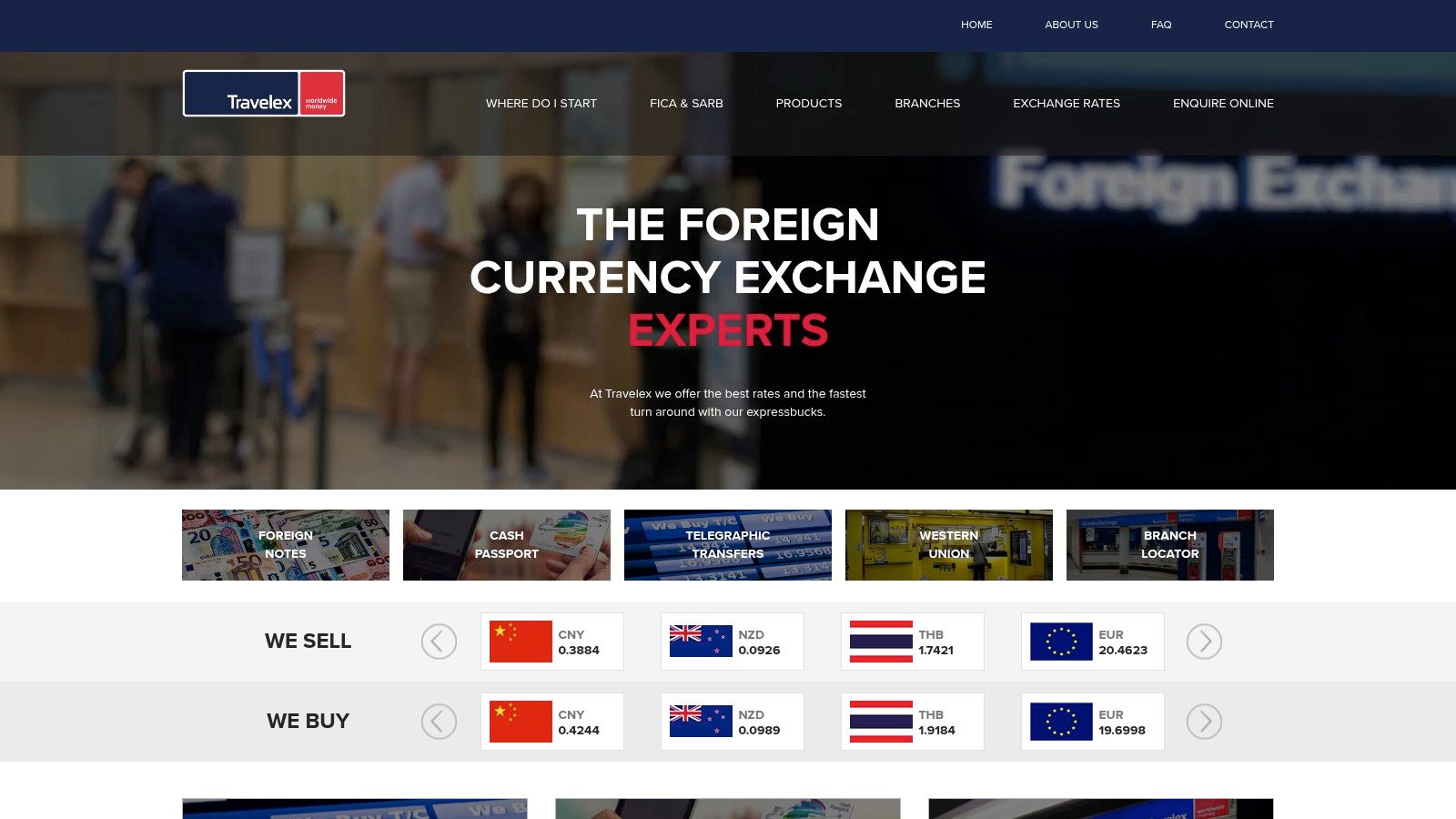

7. Travelex South Africa

Travelex South Africa is a prominent player in the South African foreign exchange landscape, offering a comprehensive suite of services for individuals and businesses needing to navigate the complexities of international currencies. As a global specialist with a significant local presence, Travelex provides convenient access to foreign exchange services through its network of physical branches and online platforms. This makes them a valuable resource for South African businesses engaging in international trade and requiring efficient, reliable foreign exchange solutions. For South Africans travelling abroad, Travelex offers a familiar and trusted option for obtaining foreign currency.

Travelex’s strength lies in its diverse offerings, catering to various foreign exchange needs. From procuring travel money and prepaid travel cards to facilitating international money transfers, Travelex aims to be a one-stop shop for foreign exchange in South Africa. Their services are particularly useful for SMEs exporting goods or services, enabling them to receive payments in foreign currencies and convert them to Rand efficiently. Business owners, executives, and CFOs seeking greater transparency in their FX transactions can benefit from Travelex's clearly outlined fees and exchange rates. Even BPO businesses outsourcing to South Africa can leverage Travelex's services to manage payroll and other cross-border transactions.

One of the key features of Travelex is the convenience it offers. With branches strategically located at airports, shopping centers, and other key locations across South Africa, accessing foreign currency cash is relatively straightforward. This is especially beneficial for travellers needing foreign currency before departure or upon arrival. The online platform further enhances convenience, allowing users to order currency online and have it delivered to their doorstep. For businesses, this online functionality can streamline currency exchange processes, saving valuable time and resources.

While Travelex boasts an extensive network and a wide range of services, it’s crucial to understand the associated pricing structures. Travelex typically operates with higher margins on smaller transactions, which can impact the overall cost-effectiveness for individuals exchanging smaller amounts of currency. Similarly, premium pricing for the convenience offered at airport locations is a factor to consider. While competitive for larger transactions, smaller exchanges might be more economically handled elsewhere. Additionally, while Travelex offers international money transfer services, their focus primarily lies in travel money, and their corporate services are somewhat limited compared to dedicated corporate FX providers. Businesses with more complex FX needs might find specialized providers offering more tailored solutions and potentially more favourable rates for larger volumes.

For those seeking to implement Travelex’s services, the process is relatively simple. For travel money, individuals can visit a Travelex branch with their identification documents and exchange Rand for their desired foreign currency. Alternatively, they can utilize the online platform to order currency for delivery or collection. For international money transfers, users will need to register on the Travelex platform, provide the necessary recipient details, and initiate the transfer. The specific requirements and documentation might vary depending on the type and amount of the transaction.

Compared to banks and other foreign exchange providers in South Africa, Travelex occupies a specific niche. Banks generally offer competitive exchange rates, especially for larger sums, but might lack the specialized travel money services and the widespread physical presence that Travelex offers. Other online FX platforms might provide lower margins on smaller transactions but might not have the convenience of physical branches for cash withdrawals. Thus, Travelex provides a balanced approach, offering both online and offline services with a focus on travel-related foreign exchange needs, which solidifies its position on this list.

In conclusion, Travelex South Africa serves as a valuable resource for individuals and businesses needing foreign exchange services in South Africa. Its convenient locations, online platform, and comprehensive service offerings make it a practical option for various foreign exchange requirements, particularly for travel-related currency exchange. However, users should be aware of the potential premium pricing for smaller transactions and consider comparing rates with other providers, especially for larger sums and corporate transactions. The website (https://www.travelex.co.za) provides detailed information on services, rates, and locations.

8. African Bank Foreign Exchange

African Bank has carved a niche for itself in the South African foreign exchange market by focusing on accessibility and affordability. This makes them a compelling option for individuals and small businesses navigating the complexities of international transactions. Their streamlined processes and competitive exchange rates provide a simplified approach to foreign exchange, particularly beneficial for those new to international trade or remittances. While they may not offer the breadth of services found in larger institutions, their focus on core FX needs positions them as a valuable tool for specific segments within the South African market. For those prioritising simplicity and cost-effectiveness in their foreign exchange dealings, African Bank offers a practical solution. This makes them particularly appealing to smaller businesses, entrepreneurs, and individuals needing to send money abroad or access foreign currency for travel.

Focusing primarily on retail clients, African Bank provides competitive exchange rates for everyday transactions. This is a significant advantage, especially for small and medium-sized export companies (SMEs) in South Africa dealing with smaller transaction volumes. Where larger banks might impose higher minimums or less favourable rates for smaller deals, African Bank’s structure allows them to cater specifically to this market segment. Business owners and executives, particularly in cost-conscious environments, will find this focus on competitive retail rates beneficial for managing their foreign exchange needs.

African Bank’s foreign exchange services are centred around two key offerings: international money transfers and travel money. International money transfers are straightforward, allowing users to send funds abroad with relative ease. This is particularly useful for South African businesses outsourcing to other countries or individuals with family overseas. The simplified application process, coupled with lower minimum transaction amounts, ensures accessibility for a broader market, including those who may be excluded by the stricter requirements of larger banks. For those seeking foreign exchange for travel, African Bank offers competitive rates on travel money, enabling South Africans to obtain foreign currency conveniently.

The bank prioritises simplicity and accessibility. Their branch-based service delivery model makes foreign exchange services readily available to a wider audience, especially in areas where digital access might be limited. While their technology platform may be considered basic compared to some competitors, this streamlined approach allows for simpler processes and requirements. This is particularly advantageous for those less familiar with complex online banking systems.

While African Bank’s focus on accessibility brings many benefits, it's crucial to acknowledge its limitations. The bank's product range is currently focused on core FX services, meaning they do not offer the advanced foreign exchange products often required by larger corporations. Products like forward contracts, options, or hedging solutions are generally not available. Their branch network, while expanding, is still smaller than some of the major banks in South Africa, potentially posing an inconvenience for clients in certain locations. CFOs in South Africa looking for advanced FX transparency and reporting tools might find African Bank’s current offerings insufficient for their sophisticated needs. Similarly, BPO businesses handling high-volume or complex transactions will likely require a provider with more comprehensive corporate FX solutions.

In summary, African Bank deserves its place on this list due to its dedication to serving the South African market with accessible and affordable foreign exchange services. For individuals, SMEs, and those new to international transactions, their simplified processes, competitive retail exchange rates, and focus on core FX needs offer a valuable tool. While it may not cater to the complex requirements of larger corporations or those needing advanced FX products, its strength lies in providing a straightforward and cost-effective solution for a significant portion of the South African market. You can explore their foreign exchange services further by visiting their website: https://www.africanbank.co.za.

Top 8 South Africa Forex Providers Comparison

| Provider | Core Features & Security | User Experience & Quality ★★★★☆ | Value Proposition & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 Zaro | True spot FX rate, zero spread, no SWIFT fees, multi-user controls, KYB onboarding | Fast, transparent, secure with enterprise-grade controls | Lowest cost cross-border payments, no hidden fees | SA SMEs, Exporters, CFOs | Debit cards in ZAR/USD, zero transaction fees, real exchange rates |

| ABSA Bank Foreign Exchange | Spot & forward FX, hedging, multi-currency accounts, 24/7 support | Competitive rates for bulk transactions, branch network | Higher fees on small deals | Corporate clients & individuals | Extensive branches, comprehensive risk management |

| Standard Bank FX | Global markets platform, real-time data, structured FX products | Advanced tech, strong global & institutional reach | Competitive pricing for high volumes | Corporates, institutions, HNWIs | Largest African bank, dedicated relationship managers |

| FirstRand Bank (FNB) ForexOnline | Digital & mobile FX platform, travel cards, rate alerts | User-friendly app & online platforms, good retail rates | Competitive for retail, daily limits apply | Retail & corporate customers | Integrated banking services, convenient cash collections |

| Nedbank Capital FX | Institutional FX, risk management, electronic trading | Personalized service for corporates with strong expertise | Competitive institutional pricing | Corporate clients | Treasury solutions, derivatives, FX specialists |

| Forex Club South Africa | Competitive rates, international transfers, online booking | Transparent fees, quick processing times | Highly competitive rates | Individuals & SMEs | Personalized service, low margins |

| Travelex South Africa | Travel money, prepaid cards, online ordering, airport retail | Convenient airport/retail locations, multiple currencies | Premium pricing for convenience | Travelers & individuals | Specialist travel money services, wide currency variety |

| African Bank FX | Retail FX, money transfers, travel money, simple processes | Accessible with simplified procedures | Affordable rates, lower minimums | Broader SA market, retail customers | Simplified processes, focus on affordability |

Making Informed Forex Decisions

Navigating the world of foreign exchange in South Africa can be complex, but with the right tools and information, you can make informed decisions that benefit your business. This guide has explored eight key players in the foreign exchange South Africa market, from established banks like ABSA, Standard Bank, FirstRand (FNB), and Nedbank, to specialized providers like Zaro, Forex Club, Travelex, and African Bank. Each offers unique features and caters to different needs within the South African forex landscape.

Key takeaways include understanding the importance of comparing transaction fees, evaluating exchange rates offered by different providers, prioritising the speed and security of transactions, and considering the level of customer support available. For South African businesses, particularly SMEs, export companies, and BPOs operating within South Africa, choosing the right forex partner can significantly impact profitability and operational efficiency. CFOs seeking greater FX transparency will also benefit from thoroughly researching these providers.

When selecting a foreign exchange tool, consider your specific requirements. High-volume traders might prioritize competitive exchange rates and robust platforms like those offered by major banks. Businesses needing quick and convenient transfers for smaller amounts might find solutions like Travelex more suitable. Those focused on cost-effectiveness should carefully compare transaction fees across all providers. Implementing these tools effectively requires careful planning and integration with existing financial processes.

Empower your business with the knowledge and tools to optimize your foreign exchange transactions. Take control of your international payments and unlock greater financial potential. For a seamless and transparent foreign exchange experience in South Africa, explore Zaro, a modern solution designed to meet the evolving needs of businesses. Simplify your cross-border transactions and experience competitive rates with Zaro. Visit Zaro to learn more and open your free account today.