Before you ever risk a single Rand, a forex profit calculator gives you a clear snapshot of a trade's potential outcome. You simply plug in the currency pair, your intended lot size, and your entry and exit points, and it instantly crunches the numbers for you. It shows you exactly what you stand to gain or lose in your own account currency.

Why Smart Traders Rely on a Profit Calculator

Trading successfully isn't about taking wild punts; it's about making calculated, informed decisions time and time again. Guesswork and gut feelings are a fast track to draining your account. This is precisely why a forex profit calculator is such a crucial part of any serious trader's arsenal—it turns abstract market speculation into tangible figures. You stop hoping for a profitable trade and start planning for one.

The biggest advantage is simple: clarity. You get to see the exact risk and reward on the table before committing any capital. This means you can set practical profit targets and, even more critically, place your stop-loss orders based on real monetary values, not just some random price level on a chart.

From Strategy to Execution

Think of a profit calculator as the final checkpoint between your trading idea and the live market. It forces you to answer the tough questions that determine if a trade is even worth considering:

- Is the potential profit really worth the amount I'm putting on the line?

- How would a 50-pip move in USD/ZAR actually impact my account balance in Rands?

- Is this position size right for my account and my personal risk tolerance?

By making you define these variables upfront, the calculator instills a sense of discipline. This structured approach is a powerful antidote to the emotional rollercoaster of trading, helping you sidestep impulsive decisions driven by fear or greed. It’s not unlike how successful businesses use tools like budgeting and forecasting to guide their financial decisions; for a trader, the profit calculator serves that same vital purpose.

Essential for the South African Market

This kind of precision is absolutely vital when you're trading in a dynamic market. In 2025, South Africa is the clear forex trading leader in Africa. Local traders are handling a massive $2.21 billion in daily forex volumes—far more than any other nation on the continent. This growth is being driven by easy-to-use mobile platforms and a surge in forex education, especially in hubs like Cape Town and Pretoria.

For South African traders who are constantly dealing with the ZAR's notorious volatility, a forex profit calculator isn't just a nice-to-have. It's a fundamental tool for survival and growth. It gives you the foresight needed to manage those sharp, unpredictable price swings instead of being caught out by them.

Getting to Grips with Your Forex Calculation Inputs

Any forex profit calculator is only as good as the numbers you feed it. Think of it like a recipe—miss a key ingredient or get the measurements wrong, and the final dish just won't be right. Nailing these core inputs is the first real step to making trade projections you can actually trust.

First up, and it might seem obvious, is your account currency. For most of us trading in South Africa, this will be the South African Rand (ZAR). Setting this correctly means your profit or loss shows up in Rands, saving you the headache of doing mental currency conversions later on.

Then, of course, you have the currency pair. This is what you’re actually trading, whether it's a major like EUR/USD or something closer to home, like USD/ZAR. The specific pair you choose is a big deal because it directly affects the value of each price movement, which we call a pip.

What Is a Lot Size and Why Does It Matter So Much?

The single most important variable you have control over is the lot size, sometimes called the position size. This is all about the volume of your trade. It dictates how much you stand to win or lose from every tick of the market. A bigger lot size means each pip movement carries more weight, magnifying both gains and losses.

This is where so many new traders trip up. They focus on the potential reward without fully respecting the risk. Understanding the standard trade sizes is absolutely essential for managing your money properly.

For anyone serious about trading, knowing these sizes by heart is non-negotiable.

How Lot Sizes Impact Your Trade Value

| Lot Size Type | Units of Currency | Typical Pip Value (for USD-based pairs) |

|---|---|---|

| Standard | 100,000 | ~$10 per pip |

| Mini | 10,000 | ~$1 per pip |

| Micro | 1,000 | ~$0.10 per pip |

| Nano | 100 | ~$0.01 per pip |

Choosing the right lot size isn't about chasing the biggest possible profit; it's about what your account can handle if the trade goes against you. One of the classic mistakes is picking a lot size that's way too big for your capital, which can turn a small market dip into a massive blow to your account.

The bottom line is this: your lot size is your exposure. A 10-pip move on a USD/ZAR trade feels completely different on a micro lot versus a standard lot. A profit calculator shows you exactly what that difference looks like in Rands before you put any real money on the line.

Finally, you’ll need your planned entry price and your exit price (also known as your take-profit level). The gap between these two numbers, measured in pips, is the heart of the whole calculation. Once you plug these figures in alongside your chosen lot size, the calculator can give you a precise financial outcome, turning a vague trading idea into a solid, actionable plan.

Getting Your Hands Dirty: Manual Pip and Position Size Calculations

Sure, a forex profit calculator is a fantastic shortcut, but there's a real edge in knowing how to crunch the numbers yourself. When you can do the maths on your own, you're not just blindly trusting a tool; you're developing a much deeper feel for the market and how your trades actually work. It's an empowering skill that lets you double-check outputs and make quick risk assessments on the fly, even when a calculator isn't handy.

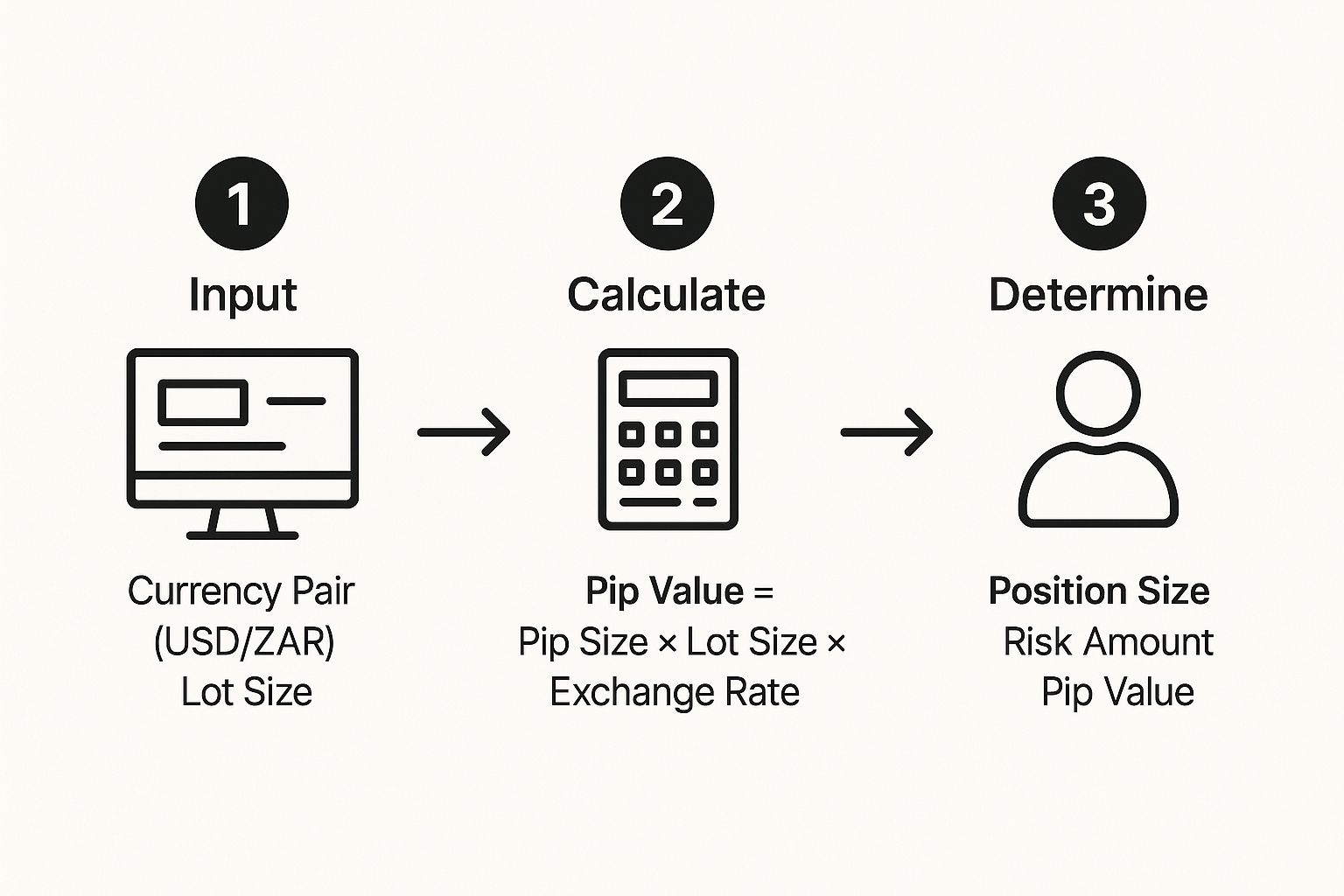

At the heart of it all are two critical pieces of the puzzle: the pip value and your position size. The pip value tells you exactly what a single pip movement is worth in cold, hard cash (in your account's currency). Your position size, which is based on your lot size, determines the scale of your trade.

This quick guide breaks down how these elements fit together, using a popular pair like USD/ZAR as an example.

As you can see, everything flows logically. You start with your basic trade inputs, calculate the value of a single pip, and then determine your final position size based on the risk you're willing to take.

How to Pin Down the Pip Value

The value of a pip isn't a one-size-fits-all number. It’s dynamic, shifting with the currency pair you're trading and its current exchange rate. While the formula is pretty simple, how you apply it depends on the structure of the pair.

When USD is the Quote Currency (like EUR/USD or GBP/USD): This is as easy as it gets. The pip value is fixed. A standard lot (100,000 units) gives you a pip value of $10. For a mini lot (10,000 units), it's $1, and for a micro lot (1,000 units), it's $0.10. Simple.

When USD is the Base Currency (like USD/ZAR or USD/JPY): This is where it gets interesting, as the pip value will fluctuate with the exchange rate. The formula you need is:

Pip Value = (Pip in decimal form / Exchange Rate) * Lot SizeFor Cross-Currency Pairs (like EUR/GBP): These require an extra step. You first calculate the pip value in the quote currency (in this case, GBP) and then convert it back to your account currency, like USD or ZAR.

A Quick Tip from Experience: Always remember how your pair is quoted. For most pairs like EUR/USD, a pip is the fourth decimal place (0.0001). For Yen pairs like USD/JPY, it's the second decimal place (0.01). Getting this wrong can throw your entire risk calculation off.

A Real-World USD/ZAR Example

Let's walk through a practical scenario. The forex market in South Africa is buzzing, and with the Rand often showing significant volatility—like weakening to 17.3526 against the US Dollar—traders have to be on top of their game. You can actually read more about how local market dynamics are fuelling this growth on Newzimbabwe.com. Precise risk management in these conditions isn't optional; it's essential.

So, let's say you're looking to trade one mini lot (10,000 units) of USD/ZAR at that exact rate.

Here's how you'd break it down:

First, gather your variables:

- Pip in decimal form: 0.0001

- Exchange Rate: 17.3526

- Lot Size: 10,000

Next, plug them into the formula:

Pip Value = (0.0001 / 17.3526) * 10,000Pip Value = $0.5762

And there you have it. The result, $0.5762, is the key number. It means that for every single pip the USD/ZAR rate moves, your position will gain or lose that amount. This isn't just academic; it’s the bedrock of your trade. Now you can set your stop-loss and take-profit levels with financial precision instead of just taking a guess.

A Practical Walkthrough of a Profit Calculation

Theory is great, but putting it into practice is what really counts. Let's walk through a real-world example to connect all the dots, showing you exactly how a trade's potential profit is calculated from start to finish. This is precisely what a good forex profit calculator does for you in seconds.

For this scenario, let's imagine we're trading a popular major pair, EUR/USD, and our trading account is denominated in South African Rands (ZAR).

Setting Up the Hypothetical Trade

Before placing any trade, you need a plan. The first part of that plan is defining the key variables. These are the exact numbers you'd punch into a calculator to see the potential outcome before you put a single Rand at risk.

Here’s our setup:

- Currency Pair: EUR/USD

- Action: Buy (going long)

- Lot Size: 0.10 (this is a mini lot)

- Entry Price: 1.0725

- Take-Profit Price: 1.0775

With these parameters, we’re aiming to profit from a rise in the EUR/USD exchange rate. The distance between where we get in and where we plan to get out is where our profit lives.

By setting specific entry and exit points, we shift from just hoping for the best to making a structured, strategic decision. It's the difference between gambling and running a business.

Now, let's turn that price movement into a solid number. We need to calculate the difference in pips, which is pretty straightforward for most currency pairs.

Profit in Pips = Exit Price - Entry Price1.0775 - 1.0725 = 0.0050

Since the pip for EUR/USD is the fourth decimal place, our trade is targeting a 50-pip profit. That's a great start, but what does 50 pips actually mean for our account balance in Rands?

Converting Pips into Monetary Value

This is where it all comes together. The abstract concept of "pips" is about to become real money in your account. To do this, we figure out the pip value and then convert it into ZAR.

Because USD is the quote currency in our EUR/USD pair, the pip value for a mini lot (0.10) is a fixed $1 per pip. This keeps the first part of our calculation nice and simple.

Profit in USD = Pips Gained × Pip Value50 pips × $1/pip = $50

So, our trade has a potential gross profit of $50. But we're not done yet. The final step is to see how this translates into our ZAR-funded account. Let's assume the USD/ZAR exchange rate is currently 18.2500.

Profit in ZAR = Profit in USD × USD/ZAR Exchange Rate$50 × 18.2500 = ZAR 912.50

And there we have it. A successful 50-pip trade on a mini lot of EUR/USD would net us a gross profit of ZAR 912.50. This complete walkthrough shows how a forex profit calculator takes a simple trade idea and gives you a clear, actionable financial figure to work with.

Accounting for the Real Costs of Trading

That first number a profit calculator spits out? That's your gross profit. It’s a great starting point, but it's not what you actually get to keep. To get a real sense of what lands in your account, you have to subtract the costs of doing business.

Ignoring these costs is a classic rookie mistake. Every single trade you place has expenses attached, usually in the form of spreads and commissions. Think of them as the toll you pay to access the forex superhighway.

The most common cost you'll always encounter is the spread. It's the tiny difference between the buy (ask) price and the sell (bid) price for any currency pair. You always buy a little higher and sell a little lower; that gap is how your broker makes money and it's your first, immediate cost on any position.

Factoring in Spreads and Commissions

Let's jump back to our EUR/USD trade example. Initially, we calculated a gross profit of ZAR 912.50. Now, let's inject a dose of reality by adding in the typical costs.

Say your broker's spread on EUR/USD is 1.5 pips. On our 0.10 lot (mini lot), where each pip was worth roughly $1, that spread instantly costs us $1.50. It's gone before the trade even has a chance to move in our favour.

On top of that, some brokers charge a commission, often a set fee per lot. Let's assume there's a commission of $3.50 per standard lot. Since we only traded a mini lot (0.10), our fee would be proportional, say $1.00 total for opening and closing the trade.

Let's run the numbers again:

- Gross Profit: $50.00

- Spread Cost: -$1.50

- Commission Cost: -$1.00

- Net Profit (USD): $47.50

Now, we convert this more accurate profit back into Rands using our original 18.2500 exchange rate.

$47.50 × 18.2500 = ZAR 866.88

Suddenly, our take-home profit is ZAR 45.62 less than we first thought. On one trade, that might seem small. But imagine that cost multiplied across hundreds of trades a year. It adds up, and it directly eats into your performance.

Choosing a broker with consistently tight spreads and low, clear commissions is one of the smartest things you can do to protect your bottom line. Always run your calculations with these costs included to get a true picture of your trading results.

Once you have a handle on your net trading profits, the next step is understanding the tax implications. It’s wise to learn how to figure capital gains to ensure you’re managing your finances correctly and staying compliant.

Answering Your Forex Profit Calculation Questions

Even with the best tools on your desk, questions are bound to pop up. When you're running numbers through a forex profit calculator, a few common queries often surface, especially when your live results don't perfectly line up with your projections. Let's tackle some of the most frequent questions traders ask.

Think of this as the fine print of profit calculation—the small but crucial details that can make a massive difference in how you plan and analyse your trades. My goal here is to clear up any lingering confusion so you can use these calculators with total confidence.

Can I Use a Forex Profit Calculator for Any Currency Pair?

Absolutely. Any decent forex profit calculator is built to handle the full spectrum of pairs, from the big players like EUR/USD right through to more exotic pairs like the USD/ZAR. The only real requirement is that the tool can access real-time exchange rates for the specific pair you're trading.

For exotic pairs, the pip value calculation can get a bit more complex due to bigger swings in exchange rates and thinner liquidity. This is where a reliable calculator becomes not just helpful, but essential.

A Quick Tip from Experience: Always double-check two things: that your calculator supports the pair you're trading, and that you've set your account currency correctly. This is vital to ensure the final profit or loss figure is shown in your own currency, like Rands.

Why Does My Final Profit Differ from the Calculator’s Estimate?

It's a common scenario: your trade closes, and the final number is slightly off from what the calculator predicted. Nine times out of ten, the culprit is slippage.

Slippage is simply the small difference between the price you expected to trade at and the price you actually got. It happens all the time, especially in fast-moving, volatile markets where prices can jump in the blink of an eye.

A few other things can also throw off the estimate:

- Fluctuating Spreads: The spread might widen between the moment you calculate and the moment you execute, particularly around big news releases.

- Commission Structures: The calculator might be using a generic commission rate that doesn't perfectly match your broker's specific fee structure.

- Overnight Swaps: If you hold a position overnight, your account will be charged or credited with swap fees. These aren't typically factored into a simple profit calculation.

Bottom line: treat the calculator as a powerful planning tool for getting a very close estimate, not as a guarantee of a fixed outcome.

How Do I Calculate Profit for Short Positions?

The process is exactly the same, just in reverse. When you go short (sell), you're banking on the price going down. So, you make a profit when your exit price is lower than your entry price.

You plug these numbers into the calculator just like you would for a long trade. The formula working behind the scenes doesn't change. A profitable short trade will still give you a positive result because you're subtracting a smaller number (your exit price) from a larger one (your entry price), which correctly reflects your gain.

Do I Need to Factor Leverage into a Profit Calculator?

Nope, you don't input leverage directly into a profit calculator. While leverage is what gives you the power to open a larger position (your lot size) than your capital would normally allow, it doesn't actually change the profit and loss mechanics of that position.

The calculator only cares about the total value of your position, which is determined by the lot size you choose. Your final profit or loss is always based on the full size of that trade, not on the margin you used to open it.

For South African businesses, managing forex isn't just about trading—it's about making efficient international payments without hidden costs. Zaro offers real exchange rates with zero spread, eliminating the markups that erode your profits. See how our platform can simplify your cross-border transactions at https://www.usezaro.com.