If your South African business deals with anything international, the foreign exchange market isn't just financial jargon. It's the real-world, global marketplace where your profits and costs are hammered out every single day. Getting to grips with forex in South Africa is fundamental for growth, allowing you to turn currency volatility from a risk into a real strategic advantage.

Let's break down this dynamic environment, starting from the ground up.

Your Guide to the South African Forex Market

Picture a massive, constantly shifting marketplace. But instead of goods, currencies are being bought and sold. That’s the foreign exchange (forex) market in a nutshell. For a business in South Africa, this isn't some abstract theory; it's a practical reality that shapes everything from paying overseas suppliers to getting paid by international clients.

At the very centre of it all is the exchange rate—the value of the South African Rand (ZAR) against other global currencies like the US Dollar (USD), Euro (EUR), or British Pound (GBP). This rate is never still. It moves every second, pushed and pulled by the forces of supply and demand.

The Role of the South African Rand

The ZAR holds a unique position as a leading emerging market currency. Unlike the major currencies from highly developed economies, its value can be more sensitive to changes in global investor mood.

When international markets feel optimistic, investors often look for higher returns in places like South Africa, which can strengthen the Rand. On the flip side, when uncertainty creeps in, they tend to pull back to "safe-haven" currencies like the dollar, causing the ZAR to weaken.

This volatility has a direct impact on your business:

- For Importers: A weaker Rand means you need to spend more ZAR to get the same amount of foreign currency. This drives up the cost of your imported goods and can seriously squeeze your profit margins.

- For Exporters: A weaker Rand can actually work in your favour. Your products become cheaper for overseas buyers, which could boost your sales. The catch? It also makes your revenue less predictable.

Navigating the Market Landscape

Understanding these movements is the first step. Every single international transaction your company makes is a forex transaction. The price you pay for that foreign currency—or the amount of Rand you get back for it—lands squarely on your bottom line. Anything from local interest rates set by the South African Reserve Bank to global commodity prices can cause these shifts.

The core challenge for any South African business operating globally is managing this currency exposure. Without a clear strategy, you are essentially gambling on currency movements, which can undermine even the most successful business operations.

To get a fuller picture of the economic environment and the business potential here, it's worth exploring the broad outsourcing opportunities in South Africa, as these trends can also influence local market dynamics. By mastering the fundamentals of forex, you can start making informed decisions that protect your capital and build a genuine competitive edge.

Understanding What Drives the Rand's Value

The South African Rand (ZAR) is notoriously volatile, often making headlines in the world of forex South Africa. For any business operating here, this isn't just news—it directly impacts your bottom line. Getting a handle on why the Rand’s value swings so much is the first step to managing its effect on your finances.

Imagine the Rand’s value is a boat on the ocean. Its journey is shaped by a mix of powerful local currents and unpredictable global weather. These forces are always at play, deciding whether the Rand strengthens or weakens against major currencies like the US Dollar.

From domestic economic policies to the mood of international investors, a whole ecosystem of factors is at work. Let's break down the biggest drivers.

The Engine Room: Economic Fundamentals

At the very core of the Rand's valuation are South Africa's key economic indicators. Think of these as the vital signs that tell the world how healthy and stable our economy is.

Here are the big ones:

- Interest Rates: The South African Reserve Bank (SARB) wields significant influence through its interest rate decisions. Higher rates tend to attract foreign investors looking for better returns, which boosts demand for the ZAR and strengthens it. When rates are cut, the opposite often happens.

- Inflation Figures: High inflation is like a slow leak, eroding the currency's buying power. If South Africa's inflation climbs faster than that of our major trading partners, the Rand typically weakens because it buys fewer goods and services.

- Economic Growth (GDP): Gross Domestic Product is the scorecard for our economic output. Strong, steady GDP growth signals a robust economy, which builds investor confidence and helps support a stronger Rand.

These fundamentals don't operate in a vacuum; they’re all interconnected, painting a picture of financial stability that global markets scrutinise constantly.

South Africa's Link to Global Commodities

South Africa's economy is deeply rooted in its wealth of natural resources. We're a major exporter of high-value commodities like gold, platinum, and coal, and this ties the Rand's fate directly to global commodity prices.

It’s a straightforward relationship. When prices for our key exports are high, the country earns more foreign currency. This foreign cash needs to be converted into ZAR for local use, which drives up demand for the Rand and lifts its value. But if commodity prices slump, so does the Rand.

This makes the ZAR what's known as a "commodity currency." Its performance can almost act as a barometer for the global resources sector, making it extra sensitive to shifts in international trade and industrial demand.

We see these dynamics playing out in real-time. The USD/ZAR exchange rate, for example, has seen significant movement recently. Some analysts are forecasting the Rand to trade around 17.74 by the quarter's end, with a potential slide to 18.13 within a year, driven by inflation and those very commodity price shifts. You can track currency performance trends to see these changes unfold.

The Impact of Sentiment and Stability

Beyond the hard numbers, the Rand is swayed by something far less tangible but just as potent: investor sentiment. As an emerging market currency, the ZAR is highly sensitive to perceptions of risk.

Political headlines, both at home and abroad, can cause the currency's value to change in a heartbeat. A stable political climate is a magnet for foreign investment, which strengthens the ZAR. On the other hand, whispers of political instability or social unrest can trigger a "flight to safety," where investors pull their money out, causing the Rand's value to plummet.

Global events also play a huge role. Geopolitical tensions or policy shifts in major economies like the US can dramatically alter the appetite for risk, with a direct knock-on effect for forex in South Africa.

Getting to Grips with South Africa’s Forex Rules

Successfully handling foreign exchange in South Africa is about more than just timing the market right; it's about knowing the rules of the game. The country's forex landscape is carefully governed to protect our economic stability, and for any business involved in cross-border trade, understanding this framework is absolutely essential.

Think of the regulatory environment as the traffic laws of our financial highways. They’re not there to create roadblocks, but to ensure every transaction flows smoothly and safely. For any business dealing with forex South Africa, getting comfortable with these regulations is a cornerstone of a solid financial strategy.

The entire system revolves around managing the flow of capital in and out of the country—a process known as exchange control. While not unique to South Africa, our rules have been specifically shaped by our own economic history and goals. Let's break down who the main players are and what they mean for your business.

The South African Reserve Bank (SARB): The Architect of Policy

At the very top of the regulatory pyramid sits the South African Reserve Bank (SARB). As the ultimate authority on all things exchange control, the SARB’s primary job is to maintain financial stability, and managing the nation’s foreign currency reserves is a massive part of that.

The SARB is responsible for the big-picture policies that dictate how money moves across our borders. This includes setting the rules for:

- International Payments: Defining the approvals and paperwork needed to pay your overseas suppliers.

- Receiving Foreign Income: Outlining the procedures for bringing export revenue back into the country.

- Offshore Investments: Setting the allowances for both companies and individuals to invest abroad.

In practical terms, this means every single one of your international transactions has to be SARB-compliant. It might sound intimidating, but it’s a standard process that a good financial partner can help you handle without any fuss.

The Financial Sector Conduct Authority (FSCA): The Market Watchdog

While the SARB sets the overarching policy, the Financial Sector Conduct Authority (FSCA) zooms in on market conduct and consumer protection. It’s best to think of the FSCA as the industry referee, making sure that financial service providers—from forex brokers to payment platforms—are playing fair and being transparent.

The FSCA’s work is vital for building trust in the market. By licensing and supervising these providers, it ensures they stick to strict operational standards.

For any business choosing a forex partner, the very first step in your due diligence should be confirming they are licensed by the FSCA. This oversight provides a critical layer of security, protecting your funds and giving you peace of mind that you're working with a legitimate organisation.

The FSCA’s recent work in regulating crypto assets as financial products shows just how it adapts to protect the market. A cornerstone of these regulations is robust identity verification in forex compliance, a critical process for preventing financial crime and ensuring market integrity.

What Compliance Looks Like in Practice

So, how do these rules affect your day-to-day business? It all boils down to one word: transparency. Every cross-border payment needs a legitimate reason behind it, and you need the documents to prove it.

- For Import Payments: You’ll almost always need a commercial invoice to show you are paying for actual goods or services.

- For Export Receipts: You are required to declare funds received from international clients and convert them to Rand within a set timeframe.

These rules aren't meant to be hurdles. They exist to stop illegal activities like money laundering and to give the SARB a clear picture of the country's balance of payments.

Key Regulatory Bodies and Their Functions in SA Forex

To make things clearer, here’s a quick summary of the main authorities governing forex in South Africa and what they do.

| Regulatory Body | Primary Role | Relevance for Businesses |

|---|---|---|

| South African Reserve Bank (SARB) | Sets national exchange control policies and manages foreign currency reserves to ensure financial stability. | All international payments and receipts must adhere to SARB regulations and reporting requirements. |

| Financial Sector Conduct Authority (FSCA) | Supervises financial institutions, including forex providers, to ensure fair conduct and protect consumers. | Your chosen forex provider must be licensed by the FSCA, which guarantees they meet high operational standards. |

| South African Revenue Service (SARS) | Manages tax implications of foreign exchange transactions, including profit/loss reporting and cross-border tax compliance. | Businesses must accurately report forex gains or losses and ensure all international transactions comply with tax laws. |

Understanding these roles helps you see how each piece of the puzzle fits together to create a secure and well-regulated market. Partnering with a modern payment platform often simplifies this, as they can help automate the reporting and documentation, turning a potential compliance headache into a smooth part of your workflow.

Risks and Opportunities in the Forex Market

For any South African business trading internationally, the forex market is a classic double-edged sword. On one side, you have serious operational challenges. On the other, for those who are prepared, there are genuine opportunities for growth.

Getting your head around this duality is the first step. It's how you turn currency exposure from a constant source of stress into a real competitive advantage.

The biggest risk, without a doubt, is currency volatility. The South African Rand (ZAR) is notorious for its ups and downs, which can hit your profitability directly and immediately. This isn’t just some abstract economic theory; it’s a daily headache that can throw financial forecasts completely off track and quietly eat away at your margins.

But where there's risk, there's always opportunity. Smart forex management, especially when backed by the right financial tools, helps businesses not just shield themselves from the bad, but actually take advantage of favourable market swings.

Navigating the Key Forex Challenges

The hurdles businesses run into in the forex South Africa market tend to fall into a few common buckets. Each one needs a specific game plan to soften the blow and keep your operations humming.

The most obvious challenge is simply dealing with how a bouncing Rand impacts your day-to-day business.

For Importers: Let's say you've agreed to pay a US supplier $10,000 for a shipment. When you make the deal, the rate is R18.00/USD, so you budget for R180,000. But by the time you need to pay, the Rand has weakened to R18.50/USD. Suddenly, that same $10,000 invoice costs you R185,000. That extra R5,000 just vanished from your profit.

For Exporters: The tables are turned, but the uncertainty is the same. You sell your product to a European customer for €50,000. At an exchange rate of R20.00/EUR, you're banking on receiving R1,000,000. But what if the Rand unexpectedly strengthens to R19.20/EUR? Your income drops to R960,000, leaving you with an R40,000 shortfall.

Beyond volatility, businesses are often fighting against the high costs baked into old-school cross-border payment systems. Banks are known for charging hefty transaction fees and hiding wide, opaque markups in their exchange rates. It means you almost never get the real market rate, making it incredibly tough to figure out the true cost of your international payments.

Uncovering the Opportunities in Currency Movements

While the risks are very real, it’s a huge mistake to see the forex market only as a threat. A more proactive mindset can unlock opportunities that give your business a serious boost on the global stage.

A weaker Rand, for example, isn’t always bad news. It can make South African goods and services much more affordable for international buyers. This could be just the thing to increase your export sales or even break into entirely new markets. If most of your costs are in ZAR, a weaker currency can make you dramatically more competitive.

On the flip side, a stronger Rand brings its own advantages.

For businesses that import machinery, technology, or raw materials, a strengthening ZAR directly cuts down on capital expenditure and input costs. This can make it much easier to afford that equipment upgrade you've been eyeing, improving efficiency and making your entire operation more productive.

This dynamic environment has fuelled some incredible growth. The South African foreign exchange market was recently valued at around USD 3.86 billion, a figure that speaks volumes about the rising number of ZAR transactions. With a projected growth rate of 6.58% a year, the market is on track to hit nearly USD 6.85 billion in the near future. This reflects growing investor interest and our country's vital role in global trade. You can dive deeper into the numbers by exploring more data on South Africa's forex market growth.

Turning Exposure into Advantage

The secret to thriving here is to stop being reactive and start being strategic. Don't just accept currency swings as an unavoidable cost of doing business—actively manage your exposure.

Modern fintech platforms like Zaro give you a powerful way to do exactly that. By giving you access to real exchange rates with zero spread, they cut out the hidden costs that eat into your profits. On top of that, features that let you hold both ZAR and USD balances put you back in control. You decide when to convert your funds, allowing you to time your transactions much more effectively.

This changes everything. Currency management goes from being a defensive chore to a smart tool for optimising cash flow and making your finances far more predictable.

Smarter Strategies for Cross-Border Payments

Getting a handle on the South African forex market isn't just about watching the Rand go up and down. For any business that pays international suppliers or gets paid by overseas clients, it's about building a smart, proactive strategy to protect your profits. The old way of doing things is slow and expensive; it’s time to look at financial tools that give you a real competitive edge.

The first thing to get right is a concept that the big banks tend to keep a bit fuzzy: the mid-market rate. Think of it as the 'real' exchange rate—the perfect middle ground between what buyers are willing to pay and what sellers are asking for a currency. It's the rate you'll see on Google or Reuters, but it's almost never the rate your business actually gets.

Exposing the Hidden Costs in Traditional Payments

When you send money overseas through a traditional bank, they don’t give you the mid-market rate. Instead, they offer you a rate with a hidden markup, often called a "spread." This spread is pure profit for the bank, and it can silently drain thousands of Rands from your business over time.

On top of that, you get stung with hefty SWIFT fees and other administrative charges that make the final cost a guessing game. This lack of clarity makes it a nightmare to forecast your expenses accurately. You're effectively paying a premium for an outdated system that chips away at your profits with every single transaction.

Building a Defensive Financial Wall with Simple Hedging

One of the best ways to protect your business from currency volatility is through hedging. It might sound like complex financial jargon, but the idea is actually very straightforward: you lock in a future exchange rate today to get rid of any uncertainty down the line.

A brilliant tool for this is a forward contract. Let's say you know you need to pay a US supplier $50,000 in three months. Instead of crossing your fingers and hoping the Rand doesn't weaken, a forward contract lets you agree on an exchange rate right now for that future payment.

- Benefit: You get total certainty. The rate is locked in, no matter what the market does. This makes your budgeting airtight and protects your profit margin from any nasty surprises.

Suddenly, currency risk is no longer a scary, unknown variable. It becomes a fixed, manageable cost.

Protecting your business isn't just about managing market risks; it's also about understanding the bigger economic picture. The Rand's stability is partially shored up by our country's financial buffers.

For example, South Africa's foreign exchange reserves were recently sitting at around $47.9 billion, which is enough to cover about 5.4 months of imports. These reserves are crucial for stabilising the ZAR and ensuring there's enough liquidity for international trade—all of which affects investor confidence. You can dig into more insights on South Africa's economic stability on ceicdata.com.

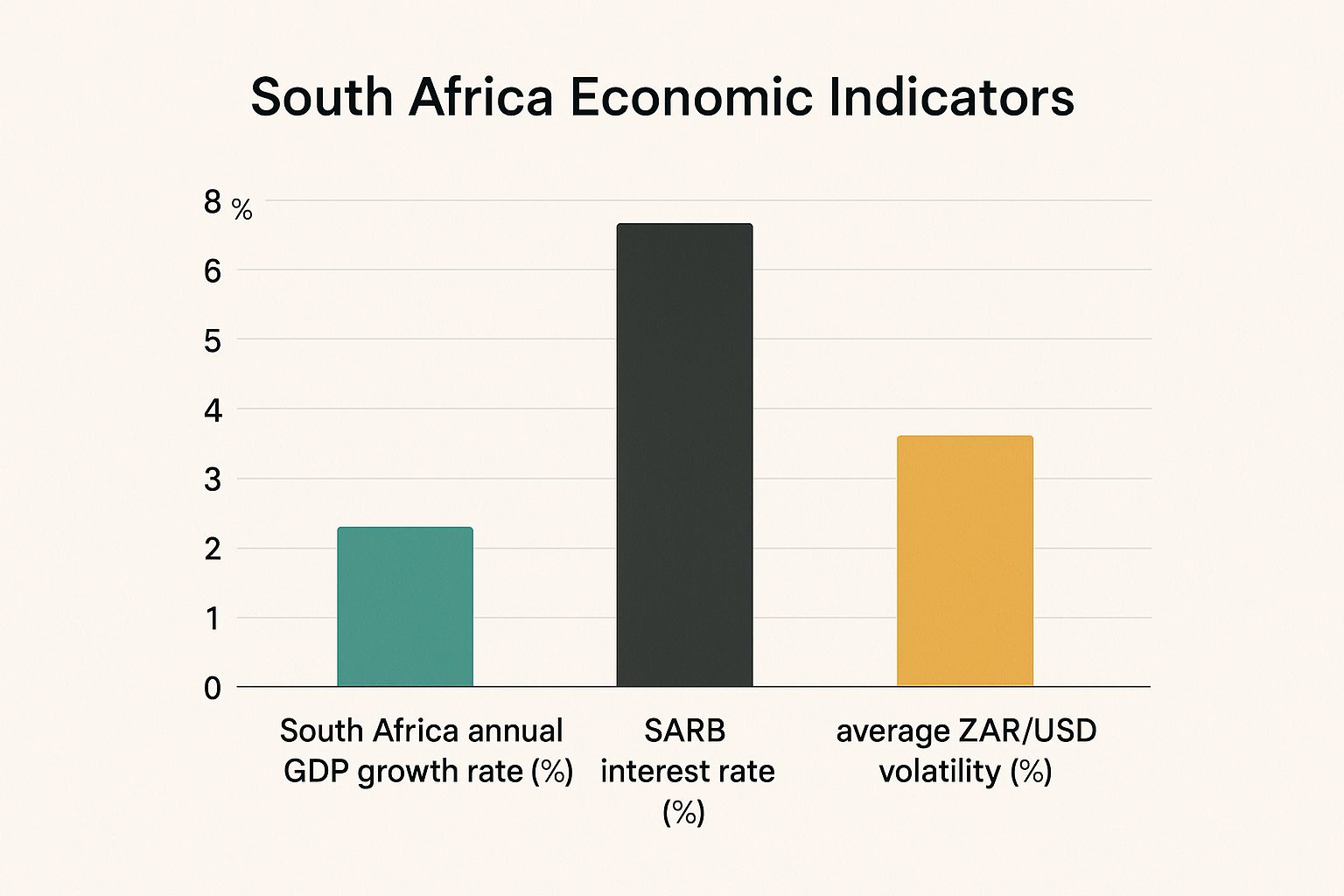

The image below gives you a snapshot of some of the key economic indicators that shape our forex environment.

This data shows how things like economic growth, interest rates, and currency movements are all connected, painting a picture of the dynamic conditions South African businesses have to navigate every day.

The Modern Alternative for International Payments

The good news is, you're no longer stuck with high fees and poor exchange rates. Modern fintech platforms have completely changed the game, offering a much smarter and more affordable way for South African businesses to manage international payments.

Let's look at a straight comparison of the old way versus a modern solution.

Traditional Banks vs Modern Solutions for International Payments

The differences are stark when you see them side-by-side. One approach eats into your margins, while the other is designed to protect them.

| Feature | Traditional Banks | Modern Platform |

|---|---|---|

| Exchange Rate | Offers a marked-up rate with a hidden spread, reducing your final value. | Provides the real mid-market exchange rate with zero spread, ensuring maximum value. |

| Fees | Charges high SWIFT fees, intermediary bank fees, and administrative costs. | No SWIFT fees or hidden charges, leading to significant cost savings. |

| Transparency | The final cost is often unclear until the transaction is complete due to opaque markups. | Completely transparent pricing. You see the exact rate and cost upfront. |

| Speed | International payments can take several business days to clear through the SWIFT network. | Transfers are significantly faster, often clearing much more quickly. |

| Control | Limited tools for managing currency exposure and timing transactions effectively. | Allows you to hold ZAR and USD balances, giving you full control to convert funds at the optimal time. |

By making the switch to a modern platform, you’re doing more than just saving money on transactions. You're adopting a more strategic way of managing your finances, giving your business the tools it needs to operate more efficiently on a global scale. It's a shift that puts you firmly back in control, turning a necessary business cost into a real source of competitive strength.

Your Top Forex Questions Answered

If you’re running a business in South Africa, stepping into the world of foreign exchange can feel a bit daunting. Practical questions pop up all the time, and getting clear, straightforward answers is crucial for making smart decisions that protect your bottom line.

Let's cut through the noise and tackle some of the most common queries we hear from businesses navigating international payments, regulations, and the ever-present market swings. My aim here is to give you practical insights that build on what we've already covered and help you solve real-world financial puzzles.

What’s the Best Way to Send Money Overseas from South Africa?

The "best" way to send money abroad really comes down to a balancing act between three things: cost, speed, and transparency. Banks are the traditional go-to, but they often stumble on all three fronts, burying high fees and poor exchange rate markups in the fine print.

This is where modern fintech platforms have really changed the game. They usually offer exchange rates much closer to the real mid-market rate and are upfront about their fees. For a business, they also offer fantastic tools for managing currency risk and simplifying your payment runs.

To figure out the best option for your business, you absolutely have to compare the total cost. That means adding the transaction fees and the hidden cost of the exchange rate spread together. It’s the only way to get the full picture and make sure you aren't leaving money on the table.

Is Forex Trading Legal and Regulated in South Africa?

Yes, absolutely. Forex trading is completely legal in South Africa. Just as importantly, it's tightly regulated by the Financial Sector Conduct Authority (FSCA) to shield consumers and businesses from bad actors.

Any broker offering forex services in the country must hold a license as an Over-the-Counter Derivative Provider (ODP). This isn't optional—it's a strict requirement ensuring they stick to high standards and keep client funds safe.

- Before you start: Always check that your broker is regulated by the FSCA. You should find their license number easily on their website.

- Why does this matter? This regulation is your safety net. It gives you a formal route for complaints if things go wrong and holds the broker accountable to a national authority.

How Does Political News Affect the ZAR Exchange Rate?

The South African Rand (ZAR) is an emerging market currency, which means it’s very sensitive to how investors are feeling. And nothing shapes that sentiment quite like political news. Any event that hints at policy uncertainty or instability can spook global investors, putting them in a "risk-off" mood.

When that happens, they tend to sell off their ZAR-based assets and shift their capital into currencies they see as "safe havens," like the US Dollar. This flood of capital leaving the country increases the supply of Rand on the market, which in turn weakens its value.

On the flip side, positive news—like signs of stable governance, successful economic reforms, or a good credit rating—can boost investor confidence. This attracts foreign investment and strengthens the currency. The ZAR’s value is, in many ways, a barometer for global perceptions of South Africa's political and economic future.

What Are Exchange Controls and How Do They Affect My Business?

Exchange controls are simply the rules of the road for money moving in and out of the country, managed by the South African Reserve Bank (SARB). For businesses, this means there are specific rules and paperwork you need to handle for international transactions.

Here are a couple of common examples:

- Paying for Imports: You’ll need to provide documents like a commercial invoice to prove the payment is for a legitimate trade.

- Receiving Export Revenue: There are regulations on how and when you must bring money earned from international sales back into South Africa.

These controls exist to keep the financial system stable, manage the country’s foreign currency reserves, and stop illicit activities like money laundering. While it might sound like extra admin, a good payment provider can help you handle the compliance side of things, making it a smooth part of your workflow rather than a headache.

Ready to eliminate hidden fees and take control of your international payments? With Zaro, you get access to the real exchange rate with zero spread, making your cross-border transactions faster and more cost-effective. See how much you can save.