Getting Started With FSCA Search FSP: Your Financial Safety Toolkit

Verifying financial providers is a critical step for South Africans engaging with the financial sector. Failing to do so can expose you to scams and other costly mistakes. This guide, informed by discussions with compliance professionals and investors, provides the knowledge you need to navigate the FSCA Search FSP process with confidence. It’s your essential toolkit for financial safety.

Why Verify? Protecting Your Financial Future

South Africa’s financial landscape is complex. It’s crucial to ensure that the individuals and companies handling your finances are legitimate and authorized. The FSCA Search FSP database is a vital resource, enabling you to verify the credentials of Financial Service Providers (FSPs). This helps protect you from fraud and ensures you’re working with credible professionals, allowing you to make informed decisions and mitigate potential risks.

The Financial Sector Conduct Authority (FSCA) in South Africa plays a vital role in ensuring a fair and stable financial market. As of their 2023/2024 Integrated Report, the FSCA regulated over 6,000 authorized FSPs across various sectors, including banking, insurance, retirement funds, and credit providers. Find more detailed statistics here.

Unpacking the FSCA Database: Features and Benefits

The FSCA database is user-friendly, yet many are unaware of its full potential. Beyond simply verifying FSP registration, the database offers a wealth of information. This includes details about the services an FSP is authorized to provide, past enforcement actions, and contact information.

The FSCA website also provides educational resources. These resources empower consumers to understand their rights and make informed financial decisions.

Real Stories, Real Impact: How Verification Saves

Many stories demonstrate how the FSCA Search FSP database has prevented financial loss. For instance, one investor was about to commit a significant sum to a seemingly reputable advisor. A quick search revealed the advisor's license had been suspended due to misconduct, preventing a potentially devastating loss. These examples highlight the importance of FSCA verification. By taking these proactive steps, you protect yourself and contribute to a more secure financial environment for all.

Mastering Your FSCA Search FSP Process Like A Pro

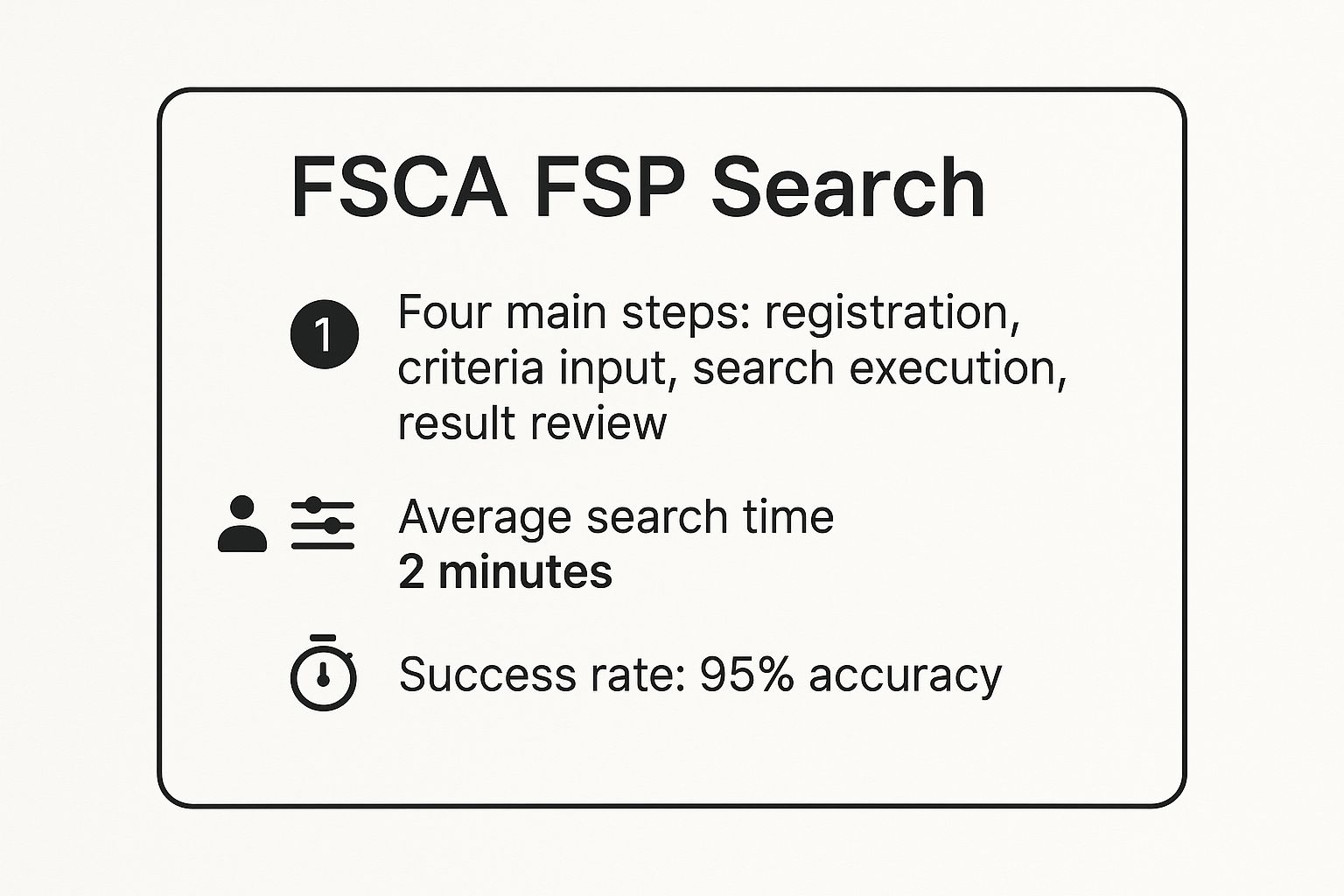

The infographic above summarizes key data points of the FSCA FSP search process. It highlights the four main steps, average search time, and expected accuracy. This information is crucial for quickly and accurately verifying a financial service provider in South Africa.

This visualization shows that the FSCA search FSP process is generally quick and effective. Most searches are completed within two minutes and boast a 95% accuracy rate. This reinforces the importance of using this tool for verification. Let's explore how to maximize your search efficiency and become an FSCA search pro.

Streamlining Your FSCA Search: Advanced Techniques

Using the FSCA database effectively is paramount for verifying financial service providers. Whether you're searching by company name, FSP number, or individual representative credentials, understanding the search function's nuances can save valuable time and ensure accurate results.

Using specific keywords, like the full company name or the exact FSP number, yields more precise results than generic terms. Using the advanced search filters, such as specifying the province or city, helps refine your search further. This is especially helpful when dealing with common company names.

Troubleshooting Your Search: When Things Go Wrong

Sometimes, searches don't yield the expected results. This can be frustrating, but understanding potential problems and their solutions can help. One common issue is misspelling the company name or FSP number. Double-checking for errors is a simple yet effective solution.

Occasionally, the issue is more complex. The provider's registration might not be up-to-date, or they might have been deregistered. In these cases, contacting the FSCA directly can provide clarity.

To help choose the right search strategy, consult the table below:

FSCA Search Methods Comparison

This table compares different FSCA database search methods, showing when to use each approach and its advantages.

| Search Method | Best Used For | Information Provided | Typical Use Case |

|---|---|---|---|

| FSP Number | Precise identification of a specific provider | FSP registration details, contact information, authorized business activities | Verifying the legitimacy of a known FSP |

| Company Name | Locating providers by their registered business name | List of FSPs matching the name, including their FSP numbers and other details | Finding an FSP when you know their company name but not their FSP number |

| Individual Representative | Finding information about a specific representative associated with an FSP | Individual's registration details, including their link to a specific FSP | Verifying the credentials of an individual financial advisor |

This comparison highlights the importance of choosing the right search method based on the information you have and what you want to find. Using the FSP number offers the most direct route to specific provider details.

Interpreting Search Results: Decoding the Data

Once you have your search results, interpreting the provided information correctly is crucial. This involves understanding the various data fields and verifying multiple credentials simultaneously.

Pay close attention to the FSP's authorized business activities and their registration status. These fields offer crucial insight into the provider's legitimacy and the services they're authorized to offer. Setting up ongoing monitoring for your current providers allows you to stay informed about any changes to their status.

Optimizing Your Workflow: Mobile Search and Bookmarks

Streamlining your workflow with mobile-friendly search tips and bookmarking strategies is beneficial for busy professionals. The FSCA website is mobile-friendly, enabling searches on the go.

Bookmarking frequently accessed pages, such as the FSP search page or individual provider profiles, saves time and effort. This provides quick access to vital information whenever you need it, integrating the FSCA search process into your financial due diligence routine.

Understanding FSP Categories: What Those Numbers Really Mean

The numbers attached to Financial Service Providers (FSPs) in search results might appear random, but they're actually quite important. These category codes explain the services each FSP is legally allowed to provide. Understanding these codes offers valuable insight into their qualifications and protects your financial interests.

Decoding the Categories: A Closer Look

When using the FSCA search FSP tool, understanding these categories is just as crucial as the search itself. A Category I license typically indicates an advisory role. These providers can offer financial advice and recommendations, but they don't directly manage your funds. They act much like a financial coach, guiding your strategy but not executing the transactions themselves.

Category IIA, on the other hand, signifies intermediary services. These providers connect you with financial product providers and facilitate transactions. However, they don't offer direct financial advice. Think of them like real estate agents: they link buyers and sellers but don't own the property itself.

Other categories represent specialized licenses for specific sectors, such as insurance or retirement fund administration. Each category has a distinct scope, ensuring providers operate within their area of expertise.

Matching Qualifications With Your Needs

Knowing the difference between these categories is paramount to choosing the right FSP for your specific financial goals. If you’re looking for comprehensive financial planning, a Category I advisor would likely be the best fit. If you already have a plan and just need help with transactions, a Category IIA intermediary could be more suitable.

For instance, consider retirement planning. A Category I advisor could develop a personalized strategy tailored to your financial objectives and risk tolerance. Then, a Category IIA intermediary could help implement that strategy, selecting the appropriate products and handling the paperwork.

Protecting Your Interests: The Importance of Category Compliance

Choosing an FSP operating within their authorized scope is critical for both your investment security and legal protection. A provider working outside their designated category exposes you to unnecessary risks and could invalidate agreements. For example, accepting investment advice from a Category IIA intermediary who isn't licensed to offer such advice could lead to poor investment decisions and legal difficulties.

Understanding these codes equips you to ask the right questions when conducting due diligence. If a provider offers services outside their designated category, it should raise a red flag and prompt further investigation. This proactive approach can prevent potential fraud and ensures you receive services from qualified professionals. By understanding FSP categories and using the FSCA search FSP tool for thorough verification, you build a strong foundation for your financial security.

Why South Africa's Financial Landscape Demands Thorough Verification

South Africa's financial sector is a vibrant and complex hub, offering a wide range of investment and growth opportunities. However, this dynamic environment also presents certain risks. Thorough verification, particularly through the FSCA search FSP process, is essential for navigating this landscape safely and responsibly. It's a crucial step for protecting yourself against potential fraud.

Navigating the Regulatory Landscape: Consumer Protection and Obligations

South Africa's regulators strive to balance financial innovation with consumer protection. The Financial Sector Conduct Authority (FSCA) plays a vital role in this, setting industry standards and overseeing the conduct of Financial Service Providers (FSPs). This framework establishes responsibilities for both providers and consumers, emphasizing a shared commitment to a secure financial ecosystem.

FSPs must adhere to strict compliance rules. Consumers are encouraged to actively verify the credentials of anyone they're considering entrusting with their finances. This shared responsibility helps build a stronger and more transparent financial system.

Furthermore, international standards significantly influence South Africa's financial practices. This alignment with global best practices ensures consumers benefit from a regulatory structure informed by international experience and expertise. South Africa’s unique economic considerations have also shaped its consumer protection measures, tailoring them to the specific needs of the local market.

South Africa's financial sector is a leader in Africa, boasting a domestic credit-to-GDP ratio of 129%. This figure significantly outpaces other prominent African economies like Egypt (27%), Nigeria (12%), and Kenya (33%). This highlights the depth and breadth of credit penetration within the South African economy. Learn more about this.

Fintech Trends and The Evolving Need for Verification

Emerging fintech trends are rapidly reshaping the financial landscape, and this has a direct impact on verification procedures. The growth of digital platforms and mobile money demands robust online verification processes. Traditional verification methods must adapt to this digital age, ensuring consumers can easily confirm the legitimacy of online financial services.

The increasing interconnectedness of global finance also necessitates greater diligence, especially with cross-border transactions. FSCA verification becomes even more crucial when engaging with international providers.

The Depth of South Africa's Markets: A Call for Due Diligence

The diverse range of investment options and financial products available in South Africa's markets underscores the importance of due diligence. Consumers should carefully research the credentials and authorizations of any financial service providers they are considering.

The FSCA search FSP tool is a valuable resource for informed decision-making. It empowers consumers to choose providers that align with their individual financial goals and risk tolerance. This proactive approach fosters trust and promotes overall financial stability within the South African economy.

Reading Between The Lines: Enforcement Actions In Your Search Results

So, you've conducted your FSCA search FSP and found your provider. But what if the results reveal enforcement actions or compliance issues? This is where careful consideration becomes essential. Understanding these potential red flags can protect you from providers currently under regulatory scrutiny.

Decoding Enforcement Actions: What They Mean For You

Enforcement actions are not necessarily a sign that a provider is untrustworthy, but they do warrant a deeper look. They indicate that the Financial Sector Conduct Authority (FSCA) has identified potential concerns regarding the provider's conduct. These actions can vary significantly.

These actions can range from warnings and reprimands to more serious consequences like fines and license suspensions. The severity of the action will often be reflected in the search results.

A simple warning might appear as a note on the provider’s profile. More serious actions, such as license suspensions, will be clearly displayed, often with accompanying details about the specific infraction.

The FSCA actively utilizes administrative sanctions to maintain compliance within the financial sector. For example, in early 2024, significant fines were levied against FSPs for non-compliance with the Financial Intelligence Centre Act (FIC Act), particularly regarding client identification and anti-money laundering protocols. Learn more about FSCA fines. This highlights the FSCA's dedication to enforcing regulations.

Protecting Yourself: What To Do When You Find Enforcement Actions

Finding enforcement actions against your current provider can be concerning. Start by understanding the implications of these administrative penalties for your existing relationship with the provider. A warning might not necessitate immediate action, while a suspension certainly requires a prompt response.

Consider seeking professional guidance. Honest conversations with compliance experts or obtaining legal counsel can be invaluable. These professionals can clarify the specific impact of the enforcement action and recommend the best course of action, which could involve switching to a compliant alternative provider.

Ongoing Monitoring: Staying Ahead of Regulatory Changes

Even if your FSCA search FSP shows a clean record today, continuous monitoring of your providers' compliance status is paramount. Regulatory environments can change, and a provider's standing can shift accordingly.

Regularly checking for regulatory updates and setting up alerts can keep you well-informed. Developing a robust monitoring strategy is essential. This could include periodic FSCA searches, subscribing to official FSCA updates, and staying abreast of industry news.

Think of this process as a financial health check. Regular monitoring can contribute to ensuring your long-term financial well-being and allows you to make informed decisions, protect yourself from potential risks, and build a stronger financial foundation.

Spotting Red Flags: When Your FSCA Search FSP Results Raise Concerns

Even with FSCA search FSP results, hidden warning signs can exist. Savvy South African investors understand the importance of looking beyond the surface. This section helps you identify subtle inconsistencies, recognize scams targeting those relying on basic verification, and understand how even authorized providers can operate outside their licensed scope.

Subtle Inconsistencies: More Than Meets the Eye

Sometimes, FSCA search FSP results appear legitimate at first glance. However, closer inspection can reveal inconsistencies. For example, a listed address might be a residential property or a virtual office. This raises questions about the provider's actual operational presence. Another red flag is a mismatch between registered business activities and the services offered. If an FSP is authorized to sell insurance but promotes investment schemes, proceed with extreme caution.

Sophisticated Scams: Targeting the Unwary

Fraudsters exploit the trust placed in basic FSCA verification. They might use slightly altered company names or FSP numbers similar to legitimate entities, hoping to deceive unsuspecting individuals. Always double-check the details. Confirm the FSP number directly with the provider through official contact channels, instead of relying solely on online information. Be wary of unsolicited communication, especially if they pressure you into quick investments.

Beyond the Basics: Verification Techniques for Complete Due Diligence

Effective due diligence goes beyond a simple FSCA search. Investigate the company's history and check online reviews and testimonials. Remember that these can be manipulated. Look for news articles or legal cases involving the provider. Contacting the FSCA directly to confirm the provider's status and inquire about past complaints is crucial.

To help you conduct thorough due diligence, we've compiled a checklist outlining key verification points, potential red flags, and recommended actions:

FSP Verification Checklist

Comprehensive checklist showing key verification points, potential red flags, and recommended actions for each verification step.

| Verification Point | What to Check | Red Flag Indicators | Recommended Action |

|---|---|---|---|

| Registered Address | Physical location on Google Maps | Residential address, virtual office, PO Box | Contact the FSP directly to verify the address and operational presence |

| Business Activities | FSCA registered activities | Mismatch between registered activities and services offered | Contact the FSCA to confirm authorized activities |

| FSP Number | Verify the number on the FSCA website | Slightly altered number similar to a legitimate FSP | Contact the FSCA directly to verify the FSP number |

| Online Presence | Website, social media, reviews | Negative reviews, lack of online presence, inconsistent information | Conduct thorough online research and consider the credibility of information sources |

| Contact Information | Phone number, email address | Unresponsive contact channels, generic email addresses | Verify contact information through multiple sources |

| Company History | Registration date, past business activities | Recent incorporation, history of regulatory violations | Research the company's background and check for any past legal issues |

This checklist provides a starting point for your due diligence. Remember to consult with a financial advisor if you have any doubts or concerns.

Recognizing Unauthorized Activities: Staying Within Legal Boundaries

Even authorized providers can operate outside their permitted scope. Verify that the services offered align with the FSP's registered business activities available through the FSCA search FSP database. For example, an FSP licensed for Category I advisory services should not manage investments directly, a function reserved for providers with different authorizations.

Real-World Examples: Learning From Others' Mistakes

Examining real fraud cases and regulatory violations offers valuable lessons. These cases highlight common tactics used by fraudulent operators and the legal ramifications of working with non-compliant entities. Understanding these risks empowers you to make informed decisions and protect yourself from financial harm.

The Legal Implications: Understanding the Risks

Working with non-compliant entities exposes you to significant legal and financial risks. You might lack legal recourse to recover your funds if something goes wrong. Understanding the legal implications reinforces the importance of thorough due diligence and emphasizes the benefits of working exclusively with compliant FSPs.

Building Long-Term Financial Security Through Smart Verification Habits

Successfully navigating South Africa's financial landscape requires more than a single FSCA search FSP check. It demands cultivating smart verification habits for ongoing protection throughout your financial journey. This involves proactively monitoring your financial service providers, regularly reviewing their compliance, and adapting to evolving regulations and market conditions. This section outlines practical frameworks for building these habits and maintaining long-term financial security.

Ongoing Monitoring: Staying Ahead of the Curve

Like regular health check-ups, ongoing FSP monitoring is crucial. Successful investors don't just verify once. They establish verification schedules, performing checks regularly, perhaps quarterly or even more frequently for higher-risk investments. This ensures providers remain compliant and operate within their authorized scope. Also, set up alerts for regulatory changes or enforcement actions. The FSCA website often allows subscribing to updates related to specific FSPs. Google Alerts can notify you of news or legal proceedings involving your providers.

Building Relationships Based on Transparency and Compliance

Seek providers who prioritize transparency and compliance. These providers readily share information about their registration, credentials, and practices. They welcome questions and provide clear answers, fostering trust and accountability. Open communication reduces misunderstandings and keeps you informed about the provider's activities.

Balancing Trust With Verification: A Prudent Approach

While trust is essential in financial relationships, balance it with verification. It's like hiring a contractor: you might trust their expertise, but you still verify their licensing and insurance. Similarly, an FSCA search FSP check and ongoing monitoring are vital safeguards, not signs of distrust, but practical steps toward financial well-being.

Maintaining Detailed Records: Your Due Diligence Documentation

Keep comprehensive records of your verification efforts. This documentation should include FSCA search dates, provider credential copies, conversation notes, and other relevant information. These records demonstrate your due diligence and can be invaluable if disputes or regulatory issues arise.

Adapting to Change: Ensuring Your Financial Security Evolves

The financial landscape constantly changes, with new regulations, products, and technologies. Keep your verification practices current. Stay updated on FSCA regulation changes, be aware of new financial fraud types, and adapt your strategies. This proactive approach protects you from emerging threats and maintains long-term financial stability.

Creating Accountability: Protecting Your Financial Interests

By actively monitoring FSPs, maintaining records, and staying informed, you create accountability in your provider relationships. This empowers you to make informed decisions, protect your financial interests, and ensure robust financial security in a changing world.

For faster, more cost-effective, and transparent cross-border payments, consider Zaro. Streamline your international transactions and experience the difference a modern fintech platform can make.