Beyond Bank Rates: Securing Your Export Profits from FX Volatility

For South African exporters, landing a major international deal is only half the battle. The other half is protecting your hard-earned revenue from the notorious volatility of the Rand (ZAR). You've meticulously priced your goods in USD or EUR, but by the time payment clears, an unfavorable exchange rate swing can slash your profit margins, disrupt cash flow, and make future budgeting a high-stakes guessing game. This uncertainty is a significant barrier to growth.

However, treating FX risk as an unavoidable cost of doing business is a mistake. Proactive FX risk management is no longer a complex practice reserved for multinational treasuries. Modern tools and clear strategies now empower businesses of all sizes to take control of their foreign currency exposure and secure their financial future.

This article provides a comprehensive roundup of seven distinct fx risk management strategies, moving from foundational financial instruments to sophisticated operational frameworks. We will provide specific, actionable details on how South African exporters can implement each one, ensuring that the price you quote is the revenue you realize. By leveraging these techniques, especially when paired with a transparent payments platform like Zaro that offers real exchange rates, you can build a resilient financial operation that thrives on the global stage.

1. Currency Forward Contracts: Locking in Certainty

For a South African exporter with confirmed future foreign currency receipts, a forward contract is one of the most direct and effective fx risk management strategies. This financial instrument allows you to lock in an exchange rate for a future transaction. By agreeing today to exchange a specific amount of foreign currency (like USD or EUR) for ZAR at a predetermined rate on a future date, you eliminate the risk of the rand strengthening against your income currency. This transforms a variable revenue stream into a fixed, predictable amount, making financial planning and budgeting far more accurate.

How It Works in Practice

The implementation is straightforward. Imagine a Cape Town-based wine exporter secures an order to sell $500,000 worth of wine to a US distributor, with payment due in 90 days. Instead of waiting and hoping the ZAR/USD rate is favorable upon payment, the exporter can enter into a forward contract with their bank to sell $500,000 at a fixed rate, for instance, 18.50 ZAR per USD. This guarantees them exactly R9.25 million in 90 days, regardless of market volatility. Similarly, a local software company can use forwards to hedge its quarterly €100,000 subscription revenue from European clients, ensuring stable ZAR income for operational planning.

When to Use This Strategy

Forward contracts are ideal for managing transactional exposures tied to specific, confirmed commercial activities. Use them when you have a high degree of certainty about the amount and timing of a future foreign currency cash flow. This applies perfectly to signed sales contracts, confirmed purchase orders, or recurring subscription payments. By locking in the rate, you protect your profit margins from being eroded by adverse currency movements, providing crucial stability for your business.

Actionable Tips for Exporters

To make the most of this tool, consider these practical steps:

- Align Maturity Dates: Match your forward contract’s maturity date as closely as possible with your expected payment receipt date. A timing mismatch could expose you to unfavorable spot rate movements for a short period.

- Implement Layered Hedging: Consider hedging only a portion, such as 70-80 percent, of your expected revenue with forwards. This approach secures the bulk of your income while leaving a small portion open, allowing you to benefit from any potentially favorable ZAR movements.

- Establish a Transparent Baseline: Before executing a forward with your financial partner, use a platform like Zaro to receive your foreign currency. This ensures you start negotiations from the real, mid-market spot rate, giving you a transparent baseline for a better-priced forward contract.

2. Currency Options: Flexible Protection with Upside Potential

For businesses facing uncertain foreign currency cash flows, currency options are one of the most versatile fx risk management strategies. Unlike a forward contract that locks you in, an option grants you the right, but not the obligation, to exchange a specific amount of currency at a predetermined rate (the strike price) on or before a future date. This acts like an insurance policy; you pay an upfront premium for protection against unfavorable exchange rate movements while retaining the ability to benefit if the market moves in your favor.

How It Works in Practice

Consider a Johannesburg-based consulting firm bidding for a large project in Europe, with a potential fee of €250,000. The outcome of the bid is uncertain. To protect their potential ZAR revenue, the firm could purchase a "put" option, giving them the right to sell €250,000 at a strike price of, for example, 20.50 ZAR per EUR. If they win the contract and the rand strengthens to 19.80, they can exercise their option to sell at 20.50. However, if the rand weakens to 21.50, they can let the option expire and convert their euros at the more favorable market rate, capturing the upside.

When to Use This Strategy

Options are ideal for managing contingent exposures where the timing or certainty of a foreign currency cash flow is unknown. This makes them perfect for situations like bidding on international contracts, provisional sales orders, or any scenario where a forward contract’s rigid obligation would be too risky. You use an option when you need to protect your downside risk on a potential transaction without forfeiting the potential gains from a favorable currency swing.

Actionable Tips for Exporters

To effectively use options, consider these targeted actions:

- Match Expiry to a Key Date: Align your option's expiry date with a critical business deadline, such as the date a tender will be awarded or a contingent sales agreement will be finalized.

- Manage Premium Costs with Collars: To reduce the upfront cost of an option, consider a "collar" strategy. This involves simultaneously buying a put option (to set a floor rate) and selling a call option (to set a ceiling rate), which can significantly lower or even eliminate the net premium paid.

- Use for Tenders and Bids: Prioritize options when bidding for foreign contracts. This allows you to price your bid competitively, knowing your minimum ZAR revenue is protected if you win the work.

3. Natural Hedging: Structuring for Inherent Stability

Natural hedging is one of the most organic fx risk management strategies an exporter can adopt. Instead of relying solely on financial instruments, this approach involves strategically structuring your business operations to create an inherent offset to currency risk. By matching your foreign currency revenues with costs in the same currency, you naturally reduce your net exposure. This operational alignment means that if the ZAR strengthens against your USD income, the ZAR cost of your USD-denominated expenses also decreases, cushioning the impact on your bottom line.

How It Works in Practice

This strategy is about making deliberate operational choices. For example, a South African software company earning significant revenue in British Pounds (GBP) from UK clients might decide to set up a small customer support or sales office in London. The salaries and operational costs for that office would be paid in GBP, directly using the revenue earned in that currency. Similarly, a major mining house that prices its commodity sales in USD can choose to finance its large-scale equipment purchases in USD, ensuring a major capital outlay is perfectly matched against its primary income stream.

When to Use This Strategy

Natural hedging is a long-term, strategic approach, not a quick fix. It is best suited for businesses with substantial and consistent foreign currency cash flows that can be predictably matched against operational or capital expenses. If you have a permanent business footprint or a significant, ongoing cost base that could be shifted to a foreign currency, this strategy is ideal. It embeds risk management directly into your business model, providing a structural defence against currency volatility rather than a tactical one.

Actionable Tips for Exporters

To effectively implement a natural hedge, consider these operational steps:

- Map Your Currency Flows: Begin with a comprehensive audit of all your revenue and expense streams. Identify every point where you earn foreign currency and look for corresponding opportunities to incur costs in that same currency.

- Source Strategically: If you export heavily to the Eurozone, investigate sourcing components, software, or even marketing services from European suppliers to create a natural EUR cost base that offsets your EUR revenue.

- Align Debt with Income: When financing major projects or assets that support your export activities, evaluate taking on debt denominated in your main export currency. This matches your loan repayments directly to your income currency.

- Balance Risk vs. Efficiency: Always weigh the benefits of a natural hedge against operational costs. While paying for a service in USD may reduce FX risk, it should not be done if a local ZAR-based alternative is significantly more efficient or cost-effective.

4. Currency Swaps: Aligning Debt with Revenue

For companies with long-term foreign currency commitments, a currency swap is one of the more sophisticated fx risk management strategies. This agreement involves two parties exchanging principal amounts in different currencies at the start and then re-exchanging them at maturity. Throughout the life of the swap, they also exchange interest payments. This allows a company to effectively transform the currency of its debt or assets to better align with its revenue streams, mitigating long-term balance sheet risk.

How It Works in Practice

Imagine a Johannesburg-based engineering firm secures a five-year infrastructure project in the UK, funded by a ZAR-denominated loan. The project, however, will generate revenue in British Pounds (GBP). To hedge against the risk of the ZAR/GBP rate moving unfavorably over five years, the firm can enter a currency swap. They swap their ZAR loan principal for a GBP equivalent with a counterparty and agree to pay GBP-based interest while receiving ZAR-based interest. This allows them to use their GBP project revenue to service the debt and use the received ZAR payments to cover their original loan obligations, creating a natural hedge.

When to Use This Strategy

Currency swaps are best suited for managing strategic, long-term balance sheet exposures rather than short-term transactions. Use this strategy when your business has significant foreign-denominated assets or liabilities, such as financing foreign subsidiaries or undertaking multi-year international contracts. It is an excellent tool for companies looking to access more favorable interest rates in foreign capital markets while neutralizing the associated currency risk on both the principal and interest payments.

Actionable Tips for Exporters

To effectively deploy this powerful hedging tool, keep these points in mind:

- Align Swap Terms: Ensure the swap's duration, principal amounts, and payment dates precisely match the underlying asset or liability you are hedging. Any mismatch can create new exposure gaps.

- Evaluate Counterparty Risk: A swap is a long-term contract, making your counterparty's financial health critical. Conduct thorough due diligence to ensure they can meet their obligations for the entire term of the agreement.

- Plan for Contingencies: Understand the terms for early termination. Market conditions or business needs can change, and knowing the potential costs and procedures for unwinding a swap is crucial risk management.

- Monitor Collateral Needs: Be aware of any collateral or margining requirements stipulated in the swap agreement, as these can impact your liquidity over the life of the contract, especially under new regulations.

5. Netting and Multilateral Netting: Consolidating for Efficiency

For South African businesses with extensive international operations, netting is a sophisticated cash management technique that can significantly streamline currency dealings. This approach involves consolidating multiple currency exposures across different divisions or transactions to reduce the net amount that requires active hedging. By leveraging natural offsets within your company's global cash flows, you can implement one of the most cost-effective fx risk management strategies, minimizing transaction volumes and associated bank fees.

How It Works in Practice

Imagine a Johannesburg-based automotive parts manufacturer. The company imports components from a German supplier, creating a payable of €500,000, while also exporting finished goods to a customer in France, generating a receivable of €800,000. Both transactions are due in the same settlement period. Instead of making two separate, large transactions (buying €500k and selling €800k), the company’s treasury team can net these positions. The result is a single net exposure: a receivable of €300,000. This is the only amount that needs to be managed and converted to ZAR, dramatically reducing risk and transaction costs.

When to Use This Strategy

Netting is most effective for businesses with a significant volume of two-way, intra-company, or third-party cash flows in the same foreign currency. It is particularly valuable for corporations with multiple international subsidiaries or a complex supply chain involving both foreign payables and receivables. Implementing this strategy requires a centralized treasury function or a robust system capable of tracking and consolidating these flows accurately. It transforms disparate transactions into a single, manageable net position.

Actionable Tips for Exporters

To effectively implement a netting program, focus on process and systems:

- Implement a Centralized System: Use a treasury management system (TMS) or a dedicated financial platform to get a clear, consolidated view of all foreign currency payables and receivables across the entire organization.

- Establish Clear Policies: Create a formal netting policy that outlines the process, participants, settlement timing, and the internal exchange rate methodology. This ensures all divisions operate consistently and transparently.

- Ensure Regulatory Compliance: Thoroughly check the legal, tax, and exchange control regulations in South Africa and any other relevant jurisdiction. Netting arrangements can have complex cross-border implications that must be managed carefully.

- Reconcile and Audit Regularly: Conduct frequent reconciliations and audits of your netting calculations to ensure accuracy and prevent errors. This builds trust in the system and validates the savings achieved.

6. Dynamic Hedging: Adapting to Market Realities

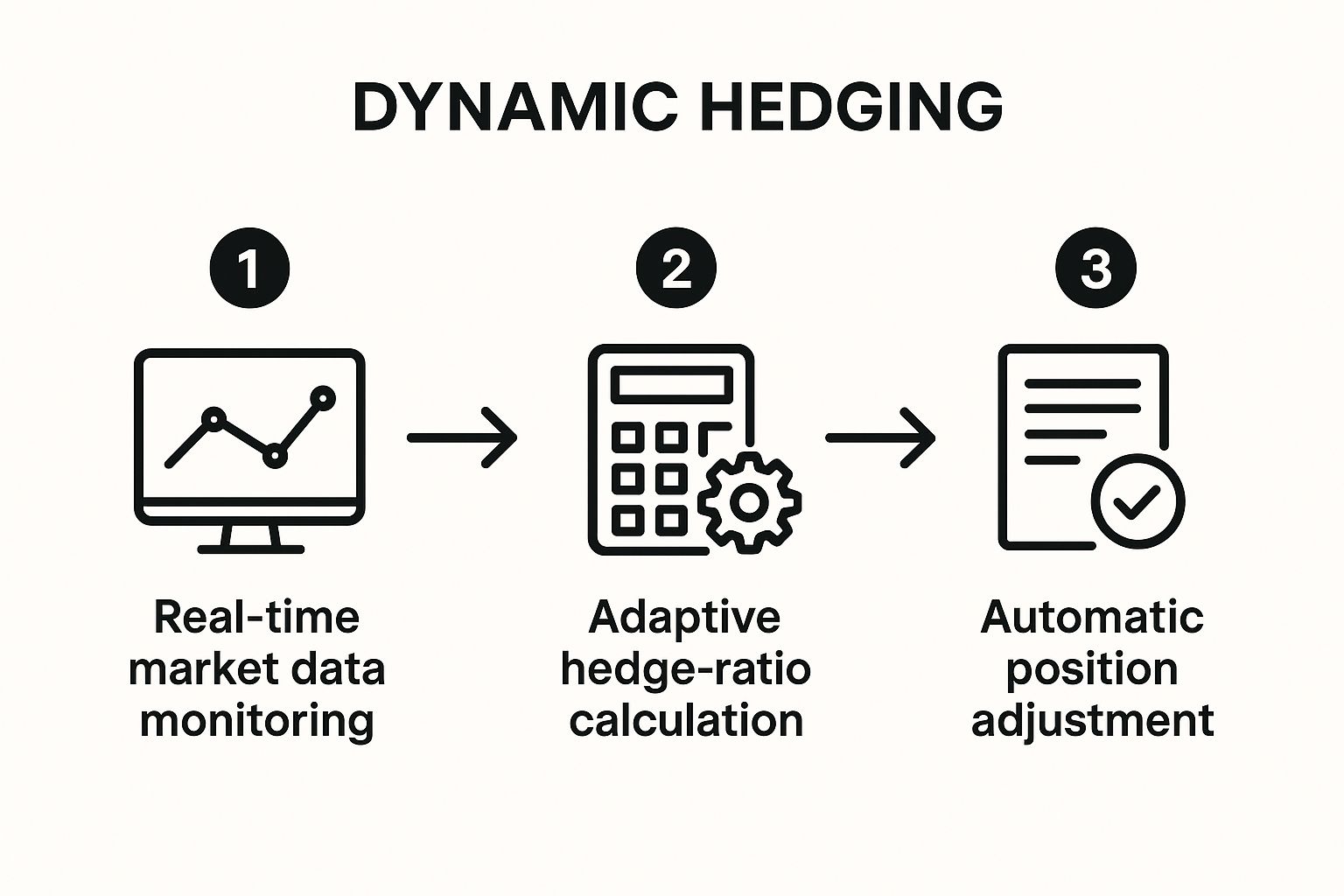

For businesses with complex and continuous foreign currency exposures, a static hedge may not be optimal. Dynamic hedging is a sophisticated fx risk management strategy that involves continuously adjusting your hedge positions in response to changing market conditions. Instead of locking in a single rate for a fixed amount, this adaptive approach uses quantitative models to alter the level of hedging based on factors like currency volatility, market trends, and your company's evolving risk appetite, balancing risk mitigation with cost efficiency.

The following infographic breaks down the continuous feedback loop at the heart of dynamic hedging, showing how data flows from market monitoring to position adjustment.

This constant adjustment cycle allows a business to react swiftly to changing market dynamics, rather than being locked into a rigid and potentially costly position.

How It Works in Practice

Consider a large South African mining company that exports manganese, priced in USD, with revenue flowing throughout the year. Instead of hedging 100% of expected sales, their treasury team might implement a dynamic model. When ZAR/USD volatility is low, the model may only hedge 50% of forecast revenues, leaving room to benefit from favourable ZAR weakness. If market volatility spikes, the model automatically increases the hedge ratio to 80% or 90% using a mix of forwards and options to protect profit margins more aggressively.

When to Use This Strategy

Dynamic hedging is best suited for larger corporations with significant, ongoing, and somewhat unpredictable foreign currency cash flows. It is ideal for organisations that have the internal resources and analytical capabilities to develop, backtest, and manage quantitative models. Use this strategy when your goal is not just to eliminate risk but to actively manage and optimise the cost and effectiveness of your hedging program in a constantly shifting market environment.

Actionable Tips for Exporters

To effectively implement a dynamic hedging policy, follow these critical steps:

- Start with Simple Rules: Begin with a straightforward, rule-based model (e.g., "if implied volatility rises above 15%, increase hedge ratio by 10%") before graduating to more complex statistical models.

- Backtest Your Models: Before going live, rigorously test your strategy using historical market data. This helps you understand how it would have performed during past periods of stress and stability, validating its logic.

- Maintain Human Oversight: Technology should support, not replace, human expertise. Ensure that an experienced treasury professional oversees the system, understands its decisions, and can intervene if market conditions diverge from model assumptions.

- Incorporate Transaction Costs: Frequent adjustments can incur significant transaction costs. Your optimisation algorithm must factor in the cost of trading to ensure that the benefits of adjusting the hedge outweigh the expenses.

7. Cross-Currency Interest Rate Swaps: A Dual-Threat Defense

For South African companies managing complex international financing, a cross-currency interest rate swap is one of the most sophisticated fx risk management strategies available. This derivative instrument allows two parties to exchange both principal and interest payments on a loan in one currency for equivalent payments in another currency. It uniquely addresses both foreign exchange risk on the principal amount and interest rate risk on the coupon payments, making it a powerful tool for aligning long-term assets and liabilities.

How It Works in Practice

Imagine a large South African infrastructure company secures a 10-year, $50 million loan from an international development bank at a floating interest rate based on SOFR. However, its project revenues will be in ZAR. To eliminate uncertainty, the company can enter into a cross-currency swap. It would exchange the initial $50 million principal for an equivalent ZAR amount at the current spot rate. Over the 10 years, it would pay fixed ZAR interest payments to its swap counterparty and, in return, receive floating USD interest payments, which it uses to service its original loan. At maturity, they swap the principal amounts back, completely insulating the company from both ZAR/USD volatility and US interest rate fluctuations.

When to Use This Strategy

This advanced strategy is best suited for corporations with significant, long-term foreign currency assets or liabilities that have mismatched interest rate structures. Use it when you need to transform the currency and interest rate profile of your balance sheet, for example, converting a floating-rate USD liability into a fixed-rate ZAR liability to match local revenue streams. This is not for hedging simple trade transactions but for strategic balance sheet management in large-scale international financing or investment scenarios.

Actionable Tips for Exporters

Given their complexity, these swaps require careful management. Consider these essential steps:

- Reserve for Sophisticated Treasury Functions: These are not standard hedging tools. Their implementation and ongoing management should only be handled by a dedicated treasury department with deep expertise in financial derivatives.

- Mitigate Counterparty Risk: A swap’s value depends on your counterparty fulfilling their obligations for many years. Insist on a Credit Support Annex (CSA), which requires collateral to be posted if the swap’s value moves significantly against one party.

- Implement Regular Mark-to-Market Valuation: The value of the swap will fluctuate with currency and interest rates. You must perform regular mark-to-market valuations for accurate financial reporting and risk monitoring.

- Establish a Transparent Baseline: For the initial and final principal exchanges, benchmark the spot rates using a platform like Zaro. This ensures you start from a fair, transparent mid-market rate, preventing hidden costs from being built into the swap's pricing.

7 FX Risk Management Strategies Compared

| Hedging Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Currency Forward Contracts | Moderate 🔄 | Low - no upfront premium ⚡ | Locks in exchange rates, eliminates FX risk 📊 | Planned, predictable cash flows needing certainty 💡 | No upfront cost, customizable, removes FX risk ⭐ |

| Currency Options | High 🔄 | Medium to high - upfront premium ⚡ | Downside protection with upside potential 📊 | Uncertain cash flows, tender bids, or optional hedging 💡 | Provides insurance plus upside benefit ⭐ |

| Natural Hedging | High 🔄 | Operational restructuring ⚡ | Reduced net FX exposure, long-term risk reduction 📊 | Multinationals with global operations structuring costs/revenues 💡 | No transaction costs, no counterparty risk, sustainable ⭐ |

| Currency Swaps | High 🔄 | High - legal and credit resources ⚡ | Long-term hedging, cost-effective foreign financing 📊 | Long-term foreign currency borrowing or capital access 💡 | Access foreign markets, long-term security ⭐ |

| Netting and Multilateral Netting | High 🔄 | High - treasury systems needed ⚡ | Reduced hedging volumes and costs, consolidated exposure 📊 | Large multinationals with multiple subsidiaries 💡 | Lower costs, improved exposure visibility ⭐ |

| Dynamic Hedging | Very High 🔄 | Very high - tech infrastructure ⚡ | Optimized, adaptive risk management 📊 | Firms with volatile exposures needing real-time adjustments 💡 | Maximizes efficiency and effectiveness over time ⭐ |

| Cross-Currency Interest Rate Swaps | Very High 🔄 | Very high - expert teams and systems ⚡ | Combined FX and interest rate risk management 📊 | Complex international financing and asset-liability matching 💡 | Addresses multi-risk, access to better funding ⭐ |

Building a Resilient FX Policy with Zaro

Navigating the volatile world of foreign exchange is not about finding a single silver bullet. It's about meticulously constructing a durable, documented policy that blends the right tools for your unique business reality. The strategies detailed in this article-from the certainty of Currency Forwards and the flexibility of Options to the operational efficiency of Natural Hedging and Netting-provide a powerful toolkit. However, their true value is only unlocked through disciplined implementation and a clear-eyed understanding of your company's financial landscape. The ultimate goal is to transform currency risk from an unpredictable threat into a manageable variable.

From Theory to Actionable Strategy

An effective FX policy is built on a foundation of clarity and purpose. To move from understanding these tools to actively using them, South African exporters should follow a clear, three-step implementation process. This framework ensures your fx risk management strategies are proactive, not reactive.

- 1. Quantify Your Exposure: Begin by meticulously mapping all your foreign currency cash flows. This involves identifying the currency, timing, and amount of all anticipated international payments and receipts. A clear picture of your net exposure is the non-negotiable first step.

- 2. Define Your Risk Appetite: This is the most critical internal step. Formally document your tolerance for currency fluctuations. Your written policy should state precisely at what point you will hedge (e.g., for all invoices over a certain value) and what percentage of that exposure you will cover (e.g., 50%, 80%, or 100%).

- 3. Select the Appropriate Tools: With your exposure quantified and risk appetite defined, you can now select the right strategy for the job. Use forward contracts for locking in rates on confirmed future transactions, consider options when you need to protect against downside risk while retaining upside potential, and implement natural hedging wherever possible to reduce transaction costs.

The Foundational Layer: Transparency and Control

A modern fintech platform is the engine that drives a sophisticated FX policy. Traditional banking systems often obscure the true cost of conversion with hidden spreads and opaque fees, making it difficult to accurately quantify exposure or execute strategies effectively. With Zaro, you gain the essential layer of transparency required for any successful approach: direct access to real, mid-market exchange rates with zero added spread.

By holding funds in both ZAR and USD accounts within the platform, you gain the visibility and control needed to execute natural hedges seamlessly. Furthermore, enterprise-grade controls and multi-user access empower your finance team to implement your formal FX policy with robust governance and clear audit trails. By moving beyond the limitations of legacy systems, South African exporters can finally manage currency with precision. This shift transforms foreign exchange management from a reactive cost center into a powerful strategic advantage, enabling you to compete with confidence on a global scale and protect your hard-earned profit margins.

Ready to build your FX policy on a foundation of transparency and control? Zaro provides South African businesses with multi-currency accounts, access to real exchange rates, and the tools you need to implement effective fx risk management strategies. Take control of your international transactions today.