At its heart, commodity trading is simpler than it sounds. You’re essentially picking a market—let's say gold or maize—choosing how you want to trade it (like through a futures contract or an ETF), and then opening an account with a broker to place your buy or sell orders.

But before you jump in, the absolute key is to get a solid grasp of what makes these prices tick. Don't commit a single Rand until you understand the forces at play.

Your Starting Point in Commodity Trading

Diving into commodities can feel like a big step, but for a South African business, it's a powerful way to manage risk and even grow your capital. We're talking about trading the very raw materials and agricultural products that form the backbone of our economy.

These aren't just abstract numbers on a screen; they are the real-world building blocks of global commerce. Think about it from a local SME perspective: it's the price of fuel for your bakkies, the cost of maize for your food products, or the value of the platinum mined right here in our country.

Getting a Feel for What Moves the Market

Unlike shares, commodities don't have earnings reports or P/E ratios. Their value is shaped by the raw, powerful forces of global supply and demand. It’s economics in its purest form.

- The Supply Side: This covers everything from drought in the Free State impacting maize yields to political instability in the Middle East disrupting oil pipelines.

- The Demand Side: Think about how rapid economic growth in China drives up demand for industrial metals or how the global shift to electric vehicles is boosting the need for copper and platinum group metals.

- The Rand Factor: Most commodities are priced in U.S. dollars. This means a weaker Rand makes it more expensive for us to buy oil or wheat, directly influencing the local price you see and pay.

Before placing any trades, it’s smart to get a handle on the bigger picture. Keeping up with the latest economic and financial market updates provides crucial context that can make or break your trading decisions.

South African traders have access to a wide range of commodities. Here's a quick look at the main categories to help you understand the landscape.

Key Commodity Types for South African Traders

| Commodity Category | Examples | Primary Market Driver |

|---|---|---|

| Agricultural | Maize (White & Yellow), Wheat, Soybeans, Sugar | Weather, Harvest Yields, Global Food Demand, Biofuel Policies |

| Energy | Crude Oil (Brent), Natural Gas, Coal | Geopolitics, OPEC decisions, Economic Growth, Alternative Energy Trends |

| Metals (Precious) | Gold, Platinum, Palladium, Silver | Economic Uncertainty, Inflation, Interest Rates, Industrial Use |

| Metals (Industrial) | Copper, Iron Ore, Aluminium | Global Manufacturing Output (especially China), Construction, Infrastructure Spending |

Understanding these drivers is the first step towards developing a sound trading strategy.

Your Entry Points to the Market

The good news? You don't need a silo to store maize or a vault for gold bars. Modern financial markets give you several clever ways to get involved.

The beauty of today's markets is that you can gain exposure to commodity prices without ever touching the physical product. Your entire focus is on speculating on price movements or hedging your business against them using financial instruments.

Just look at our neighbour, Zambia, for a real-world example of how these markets work. In May 2025, Zambia's trade surplus more than tripled to K1.5 billion. This was largely because their exports, driven by commodities, jumped 13.1% to hit K30.2 billion. It’s a perfect illustration of just how dynamic and responsive these markets can be.

Getting to Grips with the South African Commodities Market

Before you can trade commodities successfully, you need to understand the local playing field. South Africa's market isn't just a carbon copy of the global one; it has its own unique rhythm. It’s driven by our economy, our resources, and the major players right here at home.

Our economy was built on commodities. When you learn how to trade here, you're tapping into the very engine of the nation's wealth. This gives you a massive advantage—we're not just watching market trends from a distance; we live and breathe them every day.

The JSE: The Heart of the Action

The Johannesburg Stock Exchange (JSE) is the centre of our formal market. For decades, it’s been the go-to place for trading everything from agricultural products to precious metals. The JSE offers a regulated, transparent space for trading commodity derivatives.

This means you’re not physically buying gold bars or storing maize in a silo. Instead, you're dealing with standardised contracts, like futures and options, whose value is tied to the underlying commodity's price. This setup provides liquidity and lets you speculate on price movements or hedge your business risks far more efficiently.

The JSE's commodity derivatives market is where the heavy hitters—from mining giants to agricultural co-ops—come to manage their price exposure. Getting to know this ecosystem is your first critical step.

South Africa’s Star Commodities

While you can trade dozens of commodities, a few titans dominate our local landscape, thanks to our incredible natural resources and agricultural strength. Focusing on these can give you a home-ground advantage.

- Precious Metals: South Africa is a global powerhouse in platinum group metals (PGMs) and gold. Their prices are sensitive to global economic health, industrial demand (especially PGMs for catalytic converters), and their role as "safe-haven" assets when markets get shaky.

- Agricultural Staples: White and yellow maize are the cornerstones of our farming market. Their prices are deeply affected by local weather, rainfall in the Maize Triangle, and demand across the region.

- Industrial Metals: As a major producer of iron ore, manganese, and chrome, our fortunes are linked to global industrial and construction activity, especially demand from big economies like China.

Start with what you know. If your business is in agriculture, you already have an intuitive feel for what affects maize prices. If you're in manufacturing, you see the impact of metal prices firsthand. Use this insider knowledge—it’s your edge.

This direct connection is crucial. For instance, trade dynamics in neighbouring countries often send ripple effects through our market. A great example is the trade relationship between the UK and Zambia, where shifting demand creates real market movements. In the year leading up to Q1 2025, UK imports of Zambian metal ores and scrap jumped by 26.7%, while fruit and vegetable imports rocketed by 63%. These figures, detailed in the UK government's factsheet on Zambia trade and investment, show just how fast international demand can change a commodity's value.

What Really Moves Our Market?

Beyond global supply and demand, a few local factors put immense pressure on commodity prices in South Africa. You absolutely must keep these on your radar.

The Rand’s Rollercoaster Ride

Most major commodities are priced in U.S. dollars, which creates a classic inverse relationship:

- A weaker Rand (ZAR) makes dollar-priced commodities like gold or oil more expensive locally, pushing their ZAR price up.

- A stronger Rand (ZAR) does the opposite, often lowering the local price.

Sometimes, this currency effect can be a bigger price driver than the commodity's actual supply and demand.

Mining and Labour News

For metals, local production numbers are everything. News about mine output, operational problems, or labour talks can send immediate shockwaves through platinum and gold prices. A strike at a major mine, for example, can squeeze global supply overnight and cause a sharp price spike.

The FSCA Watching Over Everything

The Financial Sector Conduct Authority (FSCA) is the official watchdog of our financial markets. It makes sure brokers operate fairly and protects you from bad practices. Never, ever use a platform that isn't FSCA-regulated. It's your most basic layer of security and confirms you're dealing with a legitimate, accountable business.

Choosing Your Trading Tools and Platforms

Picking the right tools isn't just a small detail; it’s the very foundation of your trading operation. Your success really hinges on having a setup that lines up with your capital, how much risk you’re comfortable with, and your business goals. This is where we get practical, breaking down the actual instruments you can use and how to pick a platform that works for you, not against you.

For a South African SME, the choice of trading instrument is a critical first step. Each one offers a different way to get exposure to commodity prices, and they all come with their own set of pros and cons.

Comparing Your Trading Options

Let's unpack the most common ways to trade and see how they stack up for a small business.

Before you jump in, it's worth getting a clear picture of what's available. The table below compares the most common instruments, giving you a quick overview of what might fit your business best.

Comparing Commodity Trading Instruments for SMEs

| Instrument | Best For | Capital Requirement | Risk Level |

|---|---|---|---|

| Futures Contracts | Direct market exposure and hedging | High (margin required) | High |

| Options on Futures | More flexible strategies with defined risk | Moderate (premium) | High |

| Exchange-Traded Funds (ETFs) | Beginners, diversification | Low | Low to Moderate |

| Contracts for Difference (CFDs) | Speculating on price movements | Low (leverage) | Very High |

As you can see, there’s no one-size-fits-all solution. For an SME just starting out, ETFs often provide the most balanced entry point, blending accessibility with more manageable risk. They allow you to get a feel for the market without the high-stakes pressure of futures or CFDs.

Selecting the Right Trading Platform

Once you've got an idea of what you want to trade, you need to decide where. Your broker is your gateway to the market, and choosing the right one is non-negotiable. Not all platforms are created equal, and the wrong choice can expose you to unnecessary risks and eat into your profits with high costs.

A great trading platform should feel like a dependable business partner. It needs to be reliable, transparent, and equipped with the tools you need to execute your strategy effectively. Anything less is a liability.

To make an informed decision, focus on these core criteria:

- FSCA Regulation is a Must: Your number one priority is ensuring the broker is regulated by South Africa's Financial Sector Conduct Authority (FSCA). This is your primary layer of protection, confirming the broker adheres to strict standards of fairness and security. Don't even consider an unregulated broker.

- Transparent Fees and Costs: Look for a crystal-clear fee structure. What are the commissions per trade? Are there spreads? What about account inactivity or withdrawal fees? Hidden costs can quickly bleed your account dry.

- Range of Commodities: Does the platform offer the markets you actually want to trade? If you're focused on local agricultural products like maize, make sure your broker provides access to JSE-listed derivatives.

- Platform Usability and Support: The platform itself should be intuitive and stable. You don’t want to be fighting a confusing interface when you need to act fast. Just as important, check the quality of their customer support—is it responsive and available when you actually need it?

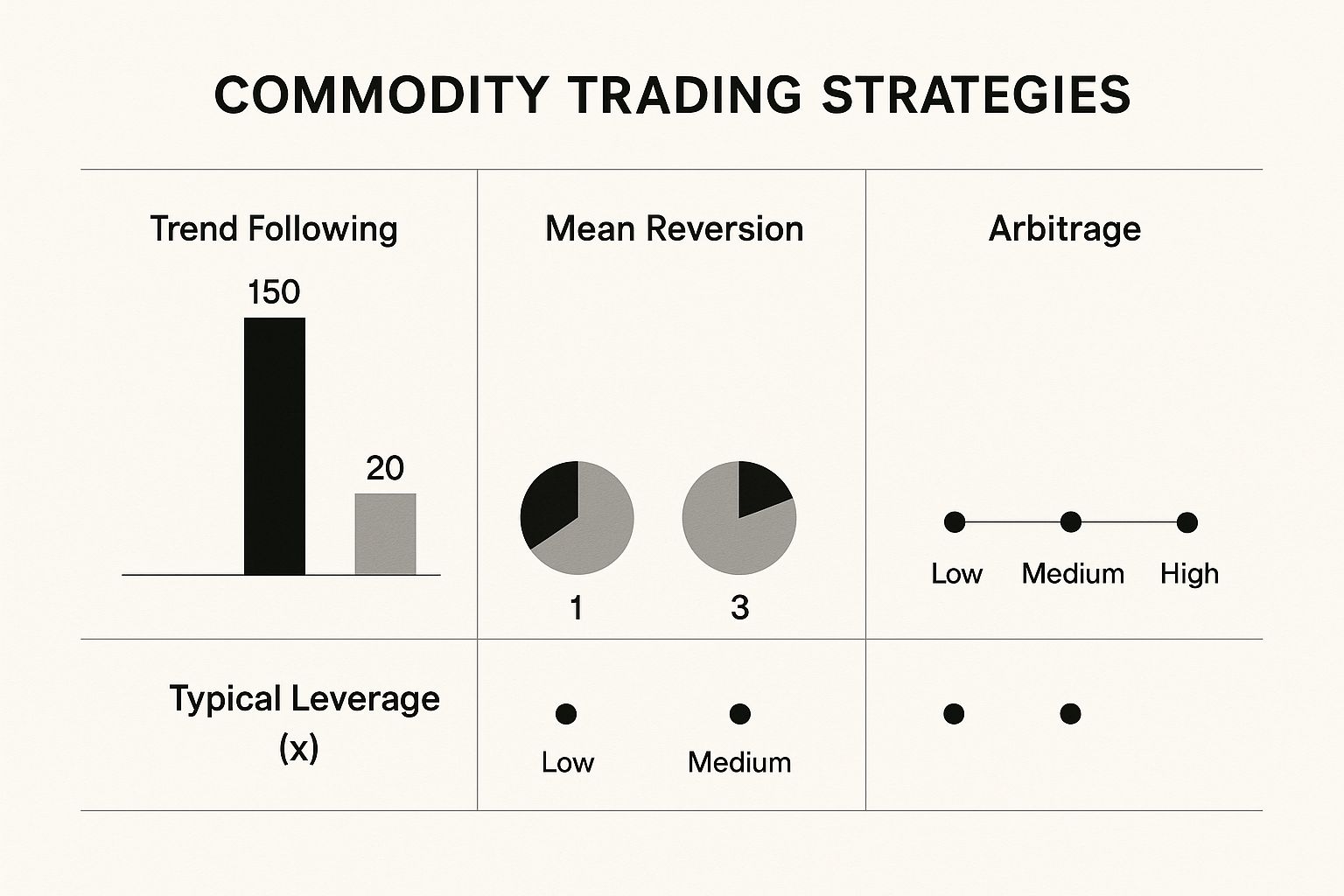

The image below gives you a clearer picture of how different trading approaches work in practice.

As the visual shows, higher-risk strategies often involve shorter holding periods and greater leverage, which really reinforces the need to align your approach with your personal risk appetite.

The Broader Market Context

Finally, your choice of tools should also be informed by the wider economic environment, especially in emerging markets across the continent. Growth in neighbouring markets can signal huge opportunities.

For example, Zambia's commodities market is set for some serious expansion, with a projected market value of US$20.36 billion in 2025. That growth is expected to continue, reaching an estimated US$23.81 billion by 2030, largely driven by rising interest from local investors.

You can discover more about Zambia's market growth on Statista, which highlights the increasing sophistication and potential within the region's commodity sector. Keeping an eye on these trends helps you position your trading strategy for what's coming next, not just what's happening today.

Building Your Personal Trading Strategy

Jumping into the market without a plan is like trying to navigate the N1 blindfolded. You might get lucky, but the odds are seriously stacked against you. A solid trading strategy is your personal playbook—it dictates what you do, when you do it, and why. This discipline is what separates the consistent traders from the gamblers.

Think of your strategy as a filter. It helps you cut through all the market noise and make decisions based on logic, not emotion. And trust me, emotion is the biggest enemy of your trading capital.

Two Sides of the Market Analysis Coin

To build a strategy that actually works, you need a way to analyse the markets and form an opinion on where prices are heading. There are two primary schools of thought here, and I've found the most successful traders blend elements of both.

Fundamental analysis is all about the "why." It digs into the real-world economic forces of supply and demand that drive commodity prices.

- Trading maize? You’d be glued to weather reports in the Free State, tracking global grain demand, and keeping an eye on import/export data.

- Focused on platinum? You’d analyse vehicle manufacturing numbers (for catalytic converters), mining output from Rustenburg, and the overall health of the global economy.

This approach gives you the bigger picture and helps you understand the true underlying value of a commodity.

Technical analysis, on the other hand, focuses purely on the "what." It ignores the fundamentals and instead studies price charts and trading volumes to spot patterns and trends. The core idea is that all known information is already baked into the price. Here, you'll use tools like moving averages, trend lines, and support/resistance levels to pinpoint potential entry and exit points.

A lot of traders get hung up on the fundamental vs. technical debate. The reality is, you don’t have to choose. Use fundamental analysis to decide which commodity to trade, and technical analysis to decide when to execute the trade.

Crafting Your Trading Plan

A trading plan is a formal document that outlines every single aspect of your trading activity. It's your business plan for the market. Having this written down forces you to be clear-headed and keeps you accountable, especially when market volatility is testing your nerve. A crucial part of building a resilient strategy is understanding how to spread your investments to manage risk. For a deeper dive, it’s worth exploring various portfolio diversification strategies.

Your plan needs to be incredibly detailed and specific, leaving zero room for guesswork when you're in a live trade.

Essential Components of Your Plan

Here’s a breakdown of what your personal trading plan must cover. No excuses.

Your Trading Goals: Are you aiming for capital growth, hedging your business's input costs, or generating a secondary income? Be specific. "Make money" is not a goal; "achieve a 15% annual return" is.

Markets to Trade: Don't try to be an expert in everything. Start by focusing on just one or two commodities you understand well. Maybe it’s gold because of its close relationship with the Rand, or perhaps maize because it's so central to our local economy.

Entry Rules: What specific conditions must be met before you enter a trade? This could be a technical signal (e.g., "price crosses above the 50-day moving average") or a fundamental one (e.g., "OPEC announces a production cut"). Write it down.

Exit Rules: How are you getting out? This is a two-part answer. You need a rule for taking profits (a profit target) and, far more importantly, a rule for cutting losses (a stop-loss). For example: "I will exit my trade if the price falls 2% below my entry point, no exceptions."

Position Sizing: This is your most critical risk management rule, period. It determines how much capital you'll risk on a single trade. A common and very sensible rule is to never risk more than 1-2% of your total trading capital on any one position. This ensures that a string of losses won't wipe you out.

Right, you’ve done the homework. You’ve got your strategy mapped out and a solid trading plan in hand. Now it’s time to step into the ring and actually place a trade.

This is where the theory becomes real. It can feel a bit nerve-wracking at first, but remember, every trade is simply the final step in a clear, disciplined process you’ve already worked through.

Putting on a trade is more than just hitting a “buy” or “sell” button. It's about using the right tools to get in and out of the market in a way that perfectly matches your strategy. This means really getting to grips with the different order types your broker offers and knowing exactly when to deploy each one.

Getting to Know Your Order Types

Think of order types as specific instructions you give your broker. Each one has a distinct job, giving you precise control over how and when your trade gets filled. Mastering these is fundamental to trading commodities effectively.

Here are the essential orders you absolutely need to understand:

Market Order: This is the most basic command: "Get me in or out right now at whatever the current price is." It’s a guarantee you’ll get your trade filled instantly, but you have no control over the exact price. In a fast-moving market, this can lead to what’s known as ‘slippage’ – getting a worse price than you expected.

Limit Order: This order puts you in control of the price. You’re telling your broker, "Buy or sell only at this specific price or better." A buy limit will only be filled at your price or lower, and a sell limit at your price or higher. It guarantees your price, but there's no guarantee the trade will ever be filled if the market doesn't reach your level.

Stop Order: This is your primary risk management tool, often called a stop-loss order. It’s an instruction that lies dormant until a certain price is hit, at which point it becomes a market order. For instance, "If the price of gold drops to R35,000, sell my position immediately to cut my losses."

Honestly, knowing the difference here is not optional. A trader who only uses market orders is basically flying blind. In contrast, a trader who has mastered limit and stop orders can execute their game plan with surgical precision.

Your First Trade: A Practical Walkthrough

Let’s put this into a real-world scenario. Imagine you’ve been analysing the platinum market and your research points to a potential upward move, maybe driven by strong manufacturing data out of China. Your trading plan signals it’s time to look for a long entry.

Pinpoint Your Entry: Your chart analysis highlights a key resistance level at R18,000 per ounce. You decide you only want to enter if the price shows real strength by breaking convincingly above this point.

Place the Order: Instead of being glued to your screen all day waiting for the breakout, you place a buy stop order at R18,050. What this does is simple: if the price rallies and hits R18,050, your trade is automatically triggered, buying you into the market just as it gathers momentum.

Set Your Safety Nets: This is the most crucial part. Your plan strictly states that you will risk no more than 2% of your capital on any single trade. Based on your position size, let's say this works out to a maximum loss of R2,000. You immediately place a stop-loss order at the price level that corresponds to that R2,000 risk.

Define Your Exit Strategy: You also need a plan to take profits. You set a take-profit order (which is a type of limit order) at your target of R19,000. If the trade goes your way and platinum hits this price, your position is automatically closed, banking your profits for you.

See what happened there? You’ve used different order types to automate your entire trade from entry to exit, all based on your pre-defined plan. Now you can get on with running your business, knowing your risk is capped and your profit target is in place.

The Golden Rule of Managing Risk

If you take only one thing away from this entire guide, let it be this: Your first job as a trader is not to make money; it is to protect the capital you have.

Without capital, you’re out of the game. This discipline is the single biggest thing that separates professional traders from the amateurs who inevitably blow up their accounts.

Successful commodity trading is a marathon, not a sprint. The only way to stay in the race is by obsessively managing your risk on every single trade. One big loss can wipe out a dozen small wins.

This isn’t just a friendly tip; it’s a rule for survival. The number one reason new traders fail is because they take ridiculously oversized risks. They might get lucky once or twice, but sooner or later, the market will hand them a loss so big it takes them out for good.

To make sure that doesn’t happen to you, build your trading around these non-negotiable rules:

The 1% Rule: Never, ever risk more than 1% of your total trading capital on a single trade. If you have a R100,000 account, your maximum acceptable loss on any one position should be R1,000. This ensures that even a horrible string of ten consecutive losses won't cripple your account.

Know Your Exit Before You Enter: Always calculate your stop-loss price before you even think about hitting the buy or sell button. Entering a position without a pre-defined exit is not trading; it’s gambling.

Never Widen Your Stop-Loss: When a trade goes against you, it’s incredibly tempting to move your stop-loss further away to "give it more room to breathe." This is a fatal error. Your initial stop was set based on objective analysis; moving it is a purely emotional decision that almost always ends badly.

Managing risk is the most critical skill you will learn. It’s the boring, unglamorous side of trading that actually keeps you in business long enough to become consistently profitable.

Clearing Up Common Questions on Commodity Trading in South Africa

Dipping your toes into the commodity markets always brings up a flurry of questions. It’s a world where knowing the practical ins and outs is just as important as your trading strategy. Let's tackle some of the most common queries I hear from South African business owners just starting out.

Getting these details straight from the beginning helps you build a solid foundation and set realistic expectations for your trading journey.

How Much Capital Do I Need to Start Trading Commodities?

This is the big one, isn't it? And honestly, there's no single magic number. The right amount of starting capital really boils down to what and how you plan to trade.

You can get started with commodity ETFs or CFDs for a relatively small amount—often just a few thousand rand. These products were designed to be accessible. On the other hand, if you're looking to trade futures contracts directly on the JSE, you're playing in a different league. The capital requirements are much steeper, as you'll need to front an initial margin that can easily run into tens of thousands of rand for a single contract.

My Two Cents: The golden rule is simple: only trade with money you can truly afford to lose. Before you even think about funding an account, check the minimum deposit with your chosen FSCA-regulated broker. A smart move is to make sure you have enough capital to absorb a few small losses without it ever threatening your core business.

What Are the Tax Implications for a South African SME?

Getting your head around how the South African Revenue Service (SARS) views your trading profits is non-negotiable. You don't want any nasty surprises come tax season. For a business, how your gains are taxed hinges on your trading frequency and your overall intent.

Frequent Trading: If you're actively buying and selling, SARS will likely see this as a business activity. In that scenario, your profits are treated as business income and taxed at your company's normal income tax rate.

Long-Term Holds: If you buy a commodity asset and hold it for a significant period—say, a gold ETF you keep for a couple of years—the profit could be treated as a capital gain. The effective tax rate on capital gains is generally lower than on business income, so the distinction is crucial.

This is one area where you absolutely shouldn't wing it. I always advise businesses to chat with a tax professional who knows their way around financial markets. They can give you advice that's specific to your company's setup and keep you on the right side of SARS.

Are Commodities a Good Hedge Against Inflation and Rand Weakness?

Yes, absolutely. Historically, commodities have been a reliable shield against these two major risks that every South African business faces. It all comes down to their intrinsic value and how they're priced on the world stage.

Fighting Inflation:

When inflation eats away at the Rand's purchasing power, the price of real, tangible assets tends to climb. Hard commodities like gold and platinum, and even agricultural goods, have a fundamental value that often keeps pace with or beats inflation, helping you preserve your capital's real worth.

Buffering Against a Weaker Rand:

This is where it gets really interesting for us here in SA. Most major commodities, from crude oil to copper, are priced in U.S. dollars. This creates a fantastic, built-in hedge.

- When the Rand weakens against the dollar (meaning the USD/ZAR rate climbs), the Rand value of those dollar-priced commodities automatically increases.

- It’s a simple but powerful mechanism that can insulate your capital from the damage a falling local currency can do.

For these reasons, allocating a slice of your portfolio to commodities is a well-established strategy for any South African business wanting to safeguard its financial health against local economic bumps and currency swings.

Managing international payments for commodities or receiving revenue from overseas often means battling high fees and lousy exchange rates from the banks. Zaro offers a smarter way. We give South African businesses a platform to make and receive global payments using the real exchange rate, with zero spread and no hidden costs. Protect your cash flow and cut your operational expenses by learning more at https://www.usezaro.com.