Right, let's get down to the brass tacks of calculating profit and loss in forex. It all starts with understanding the 'pip'.

For most currency pairs you’ll encounter, like the EUR/USD, a pip is the change in the fourth decimal place. So, if the price shifts from 1.0750 to 1.0751, that’s a tidy one-pip move. Simple enough.

However, things are a bit different when the Japanese Yen (JPY) is involved. For any pair with the Yen, such as USD/JPY, you’re looking at the second decimal place instead. A move from 157.30 to 157.31 is a one-pip gain.

What a Pip in Forex Actually Means

Before we jump into the formulas, you need a gut-level feel for what a pip represents. The term itself is an acronym for "percentage in point," but what it really is, is the smallest standard unit of movement for a currency pair. Think of it like the cents that make up a rand—it’s the fundamental unit we all use to talk about price changes, whether you're trading from Johannesburg or Tokyo.

This tiny measurement is the bedrock of every single trade you'll place. It's how you'll calculate your potential profits and, just as importantly, your risk. For us here in South Africa, if you're watching the USD/ZAR and it moves from 18.5020 to 18.5070, that's a 50-pip jump. While that might not sound like much, the actual rand value of that move is dictated by the size of your position.

The Role of Pips in Trading

Getting comfortable with pips is about more than just reading a price quote. It's central to how you actually manage your trades.

Managing Your Risk: When you set a stop-loss or a take-profit level, you're placing it a certain number of pips away from your entry price. Knowing the monetary value of each pip tells you exactly how much capital you're putting on the line.

Calculating Your P/L: The profit or loss you make is a straightforward calculation: the number of pips the price moved in your favour (or against you), multiplied by the value of each one of those pips.

Sizing Up Your Strategy: Experienced traders often gauge their performance by the average number of pips they make per trade. This gives them a consistent way to see if a strategy is working, no matter how large or small their positions were.

At the end of the day, a pip is the universal language of the forex market. Mastering it turns abstract price wiggles on a chart into real, tangible numbers in your account. It's the critical link between the market's movement and your bottom line.

Calculating Pip Value for Major Currency Pairs

Knowing what a pip is conceptually is the first step, but understanding its real-world rand and cent value is what truly impacts your trading account. Before you ever hit the 'buy' or 'sell' button, you need to be able to calculate the value of a single pip movement. This calculation is fundamental because it defines your potential profit or loss on any given trade.

Let's walk through the universal formula. It might seem a bit intimidating at first glance, but it's actually quite simple once you see it in action.

The go-to formula for finding a pip's value is:

(Pip in Decimal Form / Exchange Rate) * Lot Size = Pip Value

This formula is your key to unlocking pip values for any currency pair. It's particularly straightforward when you're trading pairs where the US dollar is the second currency listed (the "quote" currency), such as EUR/USD or GBP/USD.

Putting the Formula to Work

Let's imagine you're eyeing a trade on the EUR/USD. The current exchange rate is 1.0800, and you're planning to trade a standard lot, which is 100,000 units of the base currency (in this case, the Euro).

For most pairs, a single pip is represented as 0.0001. So, let's plug these figures into our formula:

(0.0001 / 1.0800) * 100,000 = €9.259

What this tells us is that one pip is worth €9.259. To get the value in US dollars, we just multiply this by the exchange rate: €9.259 * 1.0800 = $10. It’s a neat little trick – for any pair where the USD is the quote currency, the pip value for a standard lot will always be $10.

My Advice: Commit these standard values to memory. It’s a massive time-saver. For pairs quoted in USD:

- A standard lot (100,000 units) = $10 per pip.

- A mini lot (10,000 units) = $1 per pip.

- A micro lot (1,000 units) = $0.10 per pip.

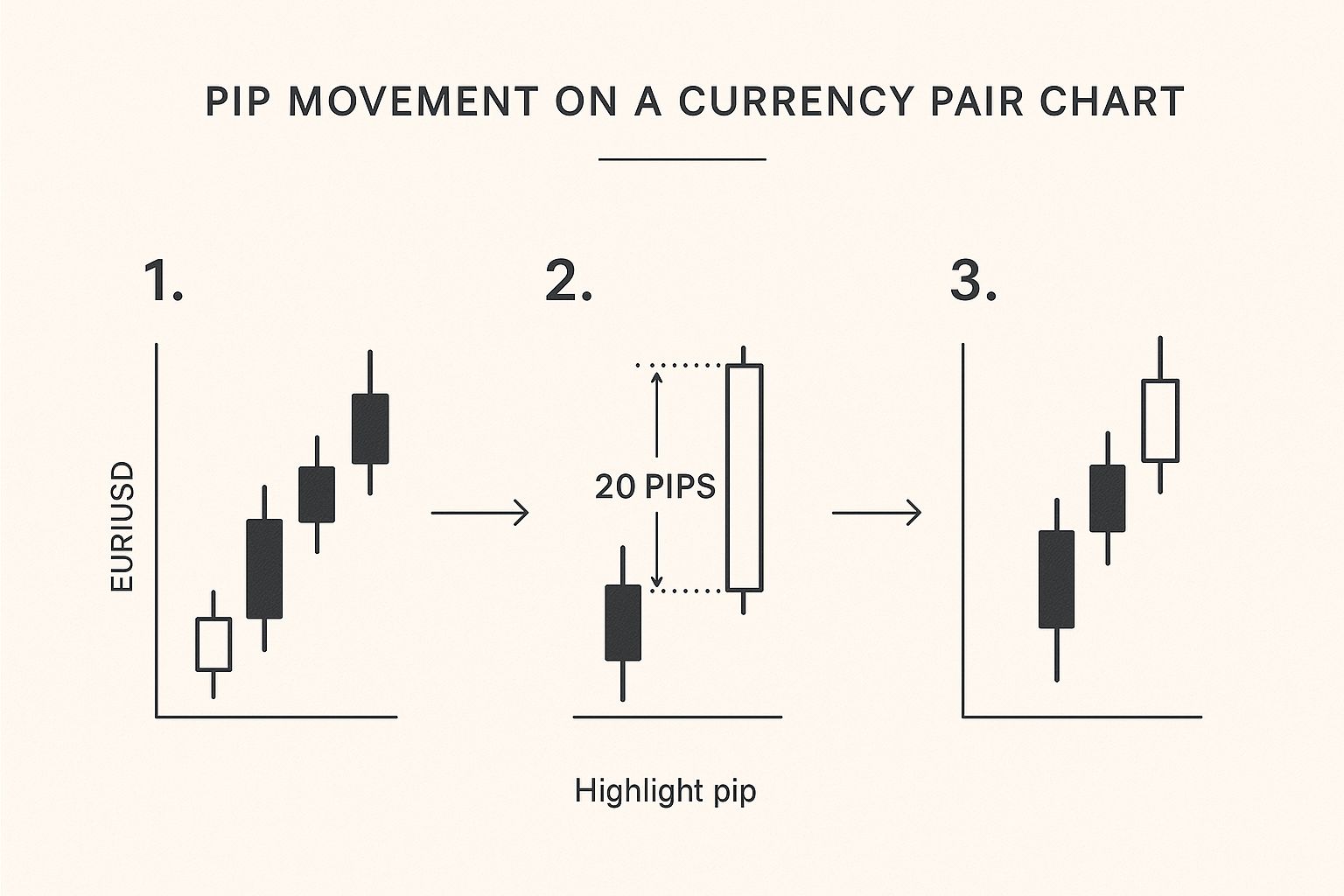

The chart below gives you a great visual for how these tiny price ticks appear in a real trading environment.

As you can see, those small jumps between candlesticks aren't just abstract movements; they represent a specific number of pips. And based on your trade size, those pips have a very real monetary value. This is why learning how to calculate pips is the crucial link between reading a chart and effectively managing your capital.

Getting to Grips with Pip Calculations for ZAR Pairs

When you start trading currency pairs with the South African Rand, like USD/ZAR or GBP/ZAR, you’ll notice a small but crucial difference in how you calculate your profits and losses. The basic idea is the same, but there’s an extra step involved. This is because the pip value is first worked out in the quote currency, which in this case is the Rand.

To keep your risk management consistent across all your trades, you need to convert that Rand value back into a standard currency, usually US dollars. It might sound a bit fiddly, but once you’ve done it a few times, it becomes second nature. This extra step gives you a clear, universal measure of your potential profit or loss.

This is particularly important given the scale of South Africa's forex market. A pip is the tiniest price movement a currency can make, and for the Rand, which is typically quoted to four decimal places (like USD/ZAR at 18.2550), one pip is a move of 0.0001. Considering the ZAR's well-known volatility and Africa’s daily forex turnover hitting over $20 billion, the value of a single pip can change dramatically based on your trade size. For local traders, getting this calculation right is absolutely essential. Get the full picture on South Africa's expanding forex scene.

Calculating Pip Value for USD/ZAR

Let’s walk through it with a real-world example. Say you're looking at a standard lot (100,000 units) of USD/ZAR, and the current rate is sitting at 18.2550. How do you figure out the pip value?

Many traders get tripped up here by overcomplicating it. They'll try to use the standard formula they learned for major pairs, which leads to confusing results like this:

- (0.0001 / 18.2550) * 100,000 = ZAR 0.5478

- Then they convert it back: ZAR 0.5478 / 18.2550 = $0.03

That tiny $0.03 value immediately screams that something has gone wrong. The actual method is much more direct.

The Trader's Shortcut: When the USD is the base currency (the first one in the pair), the calculation is much simpler. For a standard lot of USD/ZAR, one pip (0.0001) multiplied by the lot size (100,000) gives you a value of 10 ZAR. It's that straightforward.

Converting to a Standardised Value

Now you have the pip value in Rand, which is 10 ZAR. To see what that means for your account in US dollars, you just need to convert it using the current exchange rate.

So, you take your 10 ZAR pip value and divide it by the USD/ZAR exchange rate:

10 ZAR / 18.2550 = $0.5478

There it is. For a standard lot, each pip move is worth about $0.55.

The key thing to remember is that, unlike the fixed $10 pip value you see on pairs like EUR/USD or GBP/USD, the USD value of a pip on a ZAR pair fluctuates with the exchange rate. This is the critical difference. Nailing this calculation isn't just a "nice-to-have"; it’s a must for managing your risk properly when trading our local currency.

What About Pairs With the Japanese Yen?

Japanese Yen (JPY) pairs are a bit of an outlier, and they tend to trip up traders who are new to the forex market. But honestly, once you get the hang of it, the maths is actually simpler.

The main thing to remember is how these pairs are quoted. If you're looking at something like EUR/USD, you’ll see four decimal places. But with JPY pairs, like USD/JPY or GBP/JPY, the price is only quoted to two decimal places.

This small difference changes everything. For these pairs, a pip isn't 0.0001; it's 0.01. So, if the price of USD/JPY moves from 157.30 to 157.31, that's a one-pip move. This quirk actually makes calculating the pip's value a lot more direct.

Calculating Pips for JPY Pairs: A Real-World Example

Let's walk through a quick example to see how this works in practice.

Say you're looking to trade one standard lot (100,000 units) of USD/JPY, and the current exchange rate is sitting at 157.30. What’s one pip worth in this trade?

First, we take the pip value in its decimal form, which we now know is 0.01 for any JPY pair. Then, we just multiply that by our trade size.

- The formula is: (Pip in decimal form) x (Lot Size)

- Plug in the numbers: 0.01 x 100,000 = 1,000 JPY

Simple as that. For a standard lot, one pip is worth a clean 1,000 Yen.

Of course, you’ll probably want to know what that means in your account's currency. If your trading account is in US dollars, you just need to do a quick conversion. Divide the pip value in JPY by the current USD/JPY exchange rate:

1,000 JPY / 157.30 = $6.35

Here’s a little tip from my own experience: The pip value for JPY pairs is always a fixed Yen amount based on your lot size. This is a huge advantage over something like a ZAR pair, where the pip value constantly fluctuates with the exchange rate. This consistency makes managing your risk much more predictable when you’re trading the Yen; the only variable is the final, quick conversion back to your base currency.

Here is the rewritten section, crafted to sound like it was written by an experienced human expert.

Why Pip Value is a Cornerstone of Your Risk Management

Grasping how to calculate a pip's value is more than just a box-ticking exercise; it's the bedrock of solid risk management. When you can put a rand value on a single pip, you stop gambling and start trading with a clear-headed strategy. This simple skill is what lets you decide your exact financial risk before you even enter a trade.

Think about it this way. You can now set stop-loss and take-profit levels that actually mean something to your account balance. For example, say you're trading USD/ZAR and you've decided you're only willing to risk R1,000 on this particular trade. If you've calculated that each pip is worth R10, the math is simple: your stop-loss has to be 100 pips away from your entry point. No emotion, no guesswork—just disciplined consistency.

It's Not Just Theory, It's How the Pros (and Countries) Operate

This isn't just a concept for retail traders; it’s essential at the highest levels of finance. Just look at South Africa's own foreign exchange reserves. Back in August 2025, the country was sitting on a record $70.42 billion. For the institutions managing that kind of money, a tiny pip movement in a pair like USD/ZAR can swing the portfolio's value by millions of rands. You can bet they're doing these calculations with extreme precision as part of their national currency strategy. You can dive deeper into the trends in South Africa's foreign exchange reserves to see the scale we're talking about.

When you connect a pip's movement to a concrete rand amount, you elevate your trading. You’re no longer just a spectator watching lines on a chart; you're actively managing your capital. That, right there, is the leap from pure speculation to strategic trading, especially when the markets get choppy.

Common Pip Calculation Questions Answered

Even once you've got the formulas down, a few questions tend to crop up again and again. Let's walk through some of the most common sticking points to really solidify your understanding of how pips work in forex trading.

A question I hear all the time is, "Why can't I just use an online pip calculator?" Sure, those tools are handy for a quick look. But relying on them entirely is a rookie mistake.

Knowing how to do the maths yourself is what gives you a true feel for how your risk shifts between different currency pairs and lot sizes. It’s a foundational skill you can't afford to skip if you're serious about trading.

This kind of practical knowledge is more important than ever, especially as forex trading becomes more accessible in South Africa. We're seeing brokers lower the barrier to entry with minimum deposits as low as R200, which is great, but it also means new traders must get a firm grip on how pip values directly impact their account.

The good news is that modern mobile apps and demo accounts let you practice these concepts without putting real capital on the line. For more on how local traders are using these tools, you can read about how South African traders are adapting to new platforms.

What Are Pipettes?

You've probably noticed that some brokers quote prices with five decimal places (or three for JPY pairs). That tiny extra digit at the end is called a pipette.

Think of it as a fraction of a pip—specifically, one-tenth. While they can be relevant for high-frequency or scalping strategies, most day-to-day traders focus on the full pip for their main analysis and risk management.

How Leverage Affects Pip Value

So, where does leverage come into all this? This one trips a lot of people up. Leverage does not change the value of a single pip. A pip is still worth $10 on a standard lot of EUR/USD, no matter what your leverage is.

Here's the key: Leverage is what allows you to control a larger position with a smaller amount of your own money. It magnifies the outcome of each pip's movement. Higher leverage means every pip move—whether it's for you or against you—has a much bigger financial impact on your account balance.

For South African businesses dealing with international payments, getting a handle on foreign exchange is non-negotiable. Zaro provides the quickest and most cost-effective way to manage cross-border transactions by using real exchange rates with zero spread. Stop losing money to hidden fees and take control of your global finances by visiting https://www.usezaro.com.