So, you’re ready to take the leap and start your own business in South Africa? It’s an exciting step, and thankfully, getting your company officially registered is more straightforward than many people think. The whole process is handled online through the Companies and Intellectual Property Commission (CIPC), taking you from a great idea to a formal, legal entity.

Your Guide to Starting a Business in South Africa

Registering your company is the first real, concrete step on your entrepreneurial path. It’s more than just paperwork; it’s what separates your personal assets from your business debts, gives you credibility in the market, and ensures you’re operating above board. In South Africa, the CIPC is the official gateway for this.

The journey can seem a bit intimidating at first glance, but it really boils down to a few key phases: making some initial decisions, getting your paperwork in order, and then completing the online application.

The Core Registration Stages

Let's break it down. Before you even log into a website, you need to decide on the right business structure. For most new ventures, this will be a Private Company, commonly known as a (Pty) Ltd. After that, you'll need to come up with a unique company name that isn't already taken. Once CIPC gives your name the green light, you’ll gather the required documents, like certified ID copies for everyone who will be a director.

The final piece of the puzzle is working through the CIPC online portal to lodge your application and pay the fees. Getting these stages right from the start saves a lot of headaches and potential delays down the line.

Thinking about it this way makes the whole thing feel much more manageable. You’re not alone in this, either. The entrepreneurial spirit in South Africa is alive and well. In 2022, a staggering 434,024 new limited liability companies were registered, which speaks volumes about our vibrant startup culture. This translates to a new business density rate of 11.05 per 1,000 working-age people. It’s a clear sign that many others are embarking on this same exciting journey. You can dive deeper into these trends with data from the World Bank on South African business registration.

To help you get a bird's-eye view of the road ahead, here’s a quick summary of what to expect at each phase.

Quick Guide to Company Registration Stages

This table outlines the main phases you'll go through. Think of it as your high-level roadmap, from making those first critical decisions to getting your final registration certificate and staying compliant.

| Stage | Key Action | Primary Consideration |

|---|---|---|

| 1. Foundational Decisions | Choose your company type (e.g., Pty Ltd) and brainstorm a unique, compliant name. | How will your chosen structure affect your personal liability, tax, and future growth? |

| 2. Preparation & Paperwork | Gather certified ID copies of all directors and finalise the company's MOI. | Is all your documentation current and correctly certified to avoid rejection? |

| 3. CIPC Online Submission | Create a CIPC account, complete the online application forms, and upload documents. | Have you double-checked all details for accuracy before submitting to prevent delays? |

| 4. Finalisation & Compliance | Pay the required CIPC fees and wait for your registration certificate (COR 14.3). | What are your immediate obligations after registration, such as opening a bank account? |

Understanding these stages helps you prepare properly, ensuring you have everything you need when you need it. Now, let’s get into the specifics of each step.

Choosing the Right Company Structure

Before you dive into the paperwork, take a step back. The very first—and arguably most critical—decision you'll make is choosing the legal structure for your new venture. This isn't just a box-ticking exercise; it fundamentally shapes how you'll operate, how you're taxed, your personal liability, and your ability to grow and attract investors. It’s about matching your business's legal DNA with your long-term ambitions.

It's also helpful to know the broader context you're stepping into. In South Africa, entrepreneurial activity is a key economic driver. A good metric for this is the "new business density," which measures the rate of new formal company registrations. In 2022, this figure stood at 11.05 new companies per 1,000 adults. Knowing this gives you a sense of the competitive landscape. You can dig deeper into these trends by exploring data on new business registrations in South Africa.

Now, let's break down the most common business structures in South Africa to help you find the perfect fit.

Sole Proprietorship: The Simplest Start

This is often the default choice for anyone going it alone—think freelance writers, independent consultants, or home bakers. A Sole Proprietorship is the path of least resistance. Why? Because you and the business are legally one and the same. There's no complex registration process to get started.

- The Upside: It's incredibly cheap and easy to launch. You call all the shots, and all the profits are yours to keep without any corporate red tape.

- The Downside: This simplicity comes at a cost. The biggest risk is unlimited personal liability. If your business racks up debt or gets sued, your personal assets—your home, your car, your savings—are on the line.

It's a fantastic structure for testing a low-risk idea or running a small, one-person operation. But as soon as you think about scaling, hiring, or taking on significant financial risk, you'll want to consider other options.

My Take: A Sole Proprietorship is a great launchpad, but it’s not a long-term vehicle for growth. I always advise clients to see it as a temporary stage before graduating to a structure that offers proper legal protection.

Partnership: Two Heads Are Better Than One?

When you team up with one or more people to run a business, you've got a Partnership. This is a common setup for professional services, like two accountants starting a firm or a pair of architects joining forces. Like a sole prop, it’s relatively straightforward to set up from a legal standpoint.

But don't let the ease of setup fool you. A formal partnership agreement is non-negotiable in my book. This document should clearly spell out who is responsible for what, how profits (and losses) will be split, and the exit strategy if one partner wants out. Without it, you’re inviting disputes down the road.

Crucially, you're still facing personal liability. In most partnerships, you are personally responsible for all business debts, even those created by your partner without your knowledge.

Private Company (Pty) Ltd: The Professional Standard

For any entrepreneur serious about building a scalable, lasting business, the Private Company, or (Pty) Ltd, is the gold standard. Whether you're a tech startup eyeing venture capital or a manufacturer planning to export, this structure provides the credibility and protection you need.

Registering a (Pty) Ltd creates a separate legal entity. This is the game-changer. It builds a legal wall between your personal finances and the business's finances. If the company fails, your personal assets are protected. Understanding this structure is at the heart of learning how to register a company in South Africa properly.

Comparing South African Business Structures

Choosing an entity can feel overwhelming, so I've put together a table to compare the key features of the most common structures at a glance. This should help clarify which path makes the most sense for your specific situation.

| Feature | Sole Proprietorship | Partnership | Private Company (Pty) Ltd |

|---|---|---|---|

| Legal Personality | No separate legal entity | No separate legal entity | Separate legal entity |

| Personal Liability | Unlimited | Unlimited (for all partners) | Limited to your investment |

| Taxation | Taxed in your personal capacity | Profits taxed in each partner's hands | Taxed at the corporate rate |

| Growth Potential | Limited | Moderate | High (can issue shares) |

| Best For | Freelancers, low-risk ventures | Small teams, professional services | Startups, growing businesses |

Ultimately, the right choice boils down to your tolerance for risk, your plans for growth, and whether you'll be operating alone or with others. A (Pty) Ltd generally offers the most protection and flexibility for an ambitious business.

Getting Your Ducks in a Row: Documents and Your Company Name

Alright, you've picked your company structure. Now for the crucial prep work. Getting your documents and company name sorted out before you start the official application is the single best thing you can do to avoid headaches with the CIPC.

Think of it like this: you're building your application toolkit. Having everything ready to go makes the final submission process so much smoother. The bedrock of this whole process is having the correct identification for every director. This is a non-negotiable step and, honestly, where a lot of people trip up.

Sorting Out Director and Company Details

For every single director, you'll need a clear, certified copy of their South African ID book or card. If you have any foreign directors, a certified copy of their passport is what's needed.

And when I say certified, I mean it. The copy has to be stamped and signed by a Commissioner of Oaths, and crucially, it needs to be recent – we're talking within the last three months.

You’ll also need to have these details on hand for each director:

- A valid residential address (with proof).

- Their phone number and email address.

- The company’s physical address in South Africa—this is where your business will officially operate from.

I can't stress this enough: a common pitfall is submitting expired or badly scanned certified documents. Double-check that the certification date is clear, correct, and recent. This tiny detail can mean the difference between a swift approval and a rejection that sends you right back to the start.

Choosing and Reserving Your Company Name

Picking a name for your business isn't just a creative task; it's a legal one. The name has to be unique and can't be too similar to any other registered business or trademark. If it's likely to confuse the public, the CIPC will simply reject it.

Before you fall in love with a name, your first move should be to use the CIPC’s public name search tool. It's a quick way to check for obvious conflicts. For instance, if you’re keen on "Quantum Tech Solutions," you should also search for "Quantum Tech" and "Quantum Solutions" just to see what pops up.

Got a few unique options? Great. You can now submit a name reservation application (that's Form CoR 9.1) on the CIPC portal. This part has a small fee, usually around R50. If your name gets the green light, it's reserved for you for six months, which gives you more than enough time to get the rest of the registration done.

What’s a Memorandum of Incorporation (MOI)?

The Memorandum of Incorporation (MOI) is essentially the constitution for your company. It sets out the rules of the game—the rights, responsibilities, and duties of your shareholders and directors.

While you can pay a lawyer to draft a custom MOI, most new businesses just use the standard CIPC version. It's simple, straightforward, and perfectly fine for most private companies.

The best part? It's built right into the online registration process, making it much easier for entrepreneurs to figure out how to register a company in South Africa. Using the standard MOI ensures you're compliant with the Companies Act from day one, without the added legal fees.

Navigating the CIPC Online Registration Portal

Alright, you’ve got your documents sorted and a winning company name. Now for the main event: getting to grips with the CIPC's online portal. This is where the magic happens and your business officially comes to life. It might look a bit intimidating at first, but it’s a self-service platform designed to put you in the driver’s seat.

The whole process is run by the Companies and Intellectual Property Commission (CIPC) under the Companies Act of 2008. They've automated a lot over the years to speed things up. One interesting quirk of this automation: if you submit an application late in December, you might get a registration number right away, but the official incorporation date could tick over into the new year. It’s just how their processing schedule works. You can read up on these modernised CIPC procedures on their official site.

Getting Set Up with a CIPC Customer Account

First things first, you can't do anything without a CIPC customer account. Think of it as your personal dashboard for everything from reserving a name to filing your annual returns down the line.

Setting one up is pretty straightforward. Head over to their e-Services portal and fill in your personal details. Once you’re done, they’ll give you a customer code. Guard this code with your life—you’ll need it to log in and, more importantly, to make payments.

Speaking of payments, the CIPC portal runs on a pre-paid system. This is a crucial step that trips up a lot of first-timers. You have to deposit money into your virtual CIPC account before you can pay for anything.

Kicking Off the Company Registration

With your account funded, it's time to actually register the company. This means filling out the electronic version of Form CoR 15.1. The online wizard will walk you through entering all the details you’ve already prepared.

You’ll be asked for:

- Company Info: Your reserved company name and its registered physical address.

- Director Details: The full personal information for every director, including ID numbers and contact info.

- Share Structure: The number of authorised shares. For most small businesses just starting, 1,000 shares is a perfectly standard and sensible number.

My best advice here? Slow down. Double-check, and then triple-check, every single field. A simple typo in an ID number is an incredibly common mistake, and it can throw a serious spanner in the works, causing long delays.

An Expert Tip: The system will prompt you to choose a Memorandum of Incorporation (MOI). Honestly, for more than 95% of new ventures, the "Standard MOI" is the way to go. It’s fully compliant with the Companies Act and saves you from unnecessary complexity and legal fees.

The Final Stretch: Uploading Documents and Paying

Once you’ve filled in all the forms, you're on the home stretch. The system will now ask you to upload your supporting documents. This is where those certified ID copies and your proof of address come in. Make sure your scans are crystal clear and easy to read.

This is the CIPC homepage, your starting point for everything.

As you can see, the layout points you straight to "Online Services" and "Customer Registration," which is exactly where you need to be.

After your documents are successfully uploaded, you’ll be taken to the payment screen. The system automatically deducts the fees (it's around R125 for a standard private company) from the balance in your pre-funded CIPC account.

And with that, your application is officially in the queue. Now, all you can do is wait. Keep a close eye on your email, as the CIPC will send you notifications to update you on your application's progress.

So, you're holding your company registration certificate. It’s a fantastic feeling, isn't it? You've officially brought your business to life as a legal entity in South Africa. But this is where the real work begins. Think of it as the starting line, not the finish line.

It's a bit like getting the keys to a new house. You own it, but you still need to get the lights on and the water running before you can properly move in. Your new company needs the same kind of setup to operate legally and efficiently.

Get a Business Bank Account Sorted—Immediately

First things first: open a dedicated business bank account. I can't stress this enough; it’s non-negotiable. Your company is its own legal person, and its money must be kept completely separate from your personal finances. Mixing them up is a recipe for accounting chaos and could even put your limited liability protection at risk.

To get an account opened, a bank will need to see a few key documents:

- Your Company Registration Documents: This is mainly your COR 14.3 (the Registration Certificate) and your Memorandum of Incorporation (MOI).

- Proof of Address: You'll need one for the business premises and for each director.

- Certified ID Copies: Make sure you have these for all directors and anyone holding a significant number of shares.

Having a separate account from day one just makes life easier. It simplifies your bookkeeping and makes you look far more professional to clients, suppliers, and especially the South African Revenue Service (SARS).

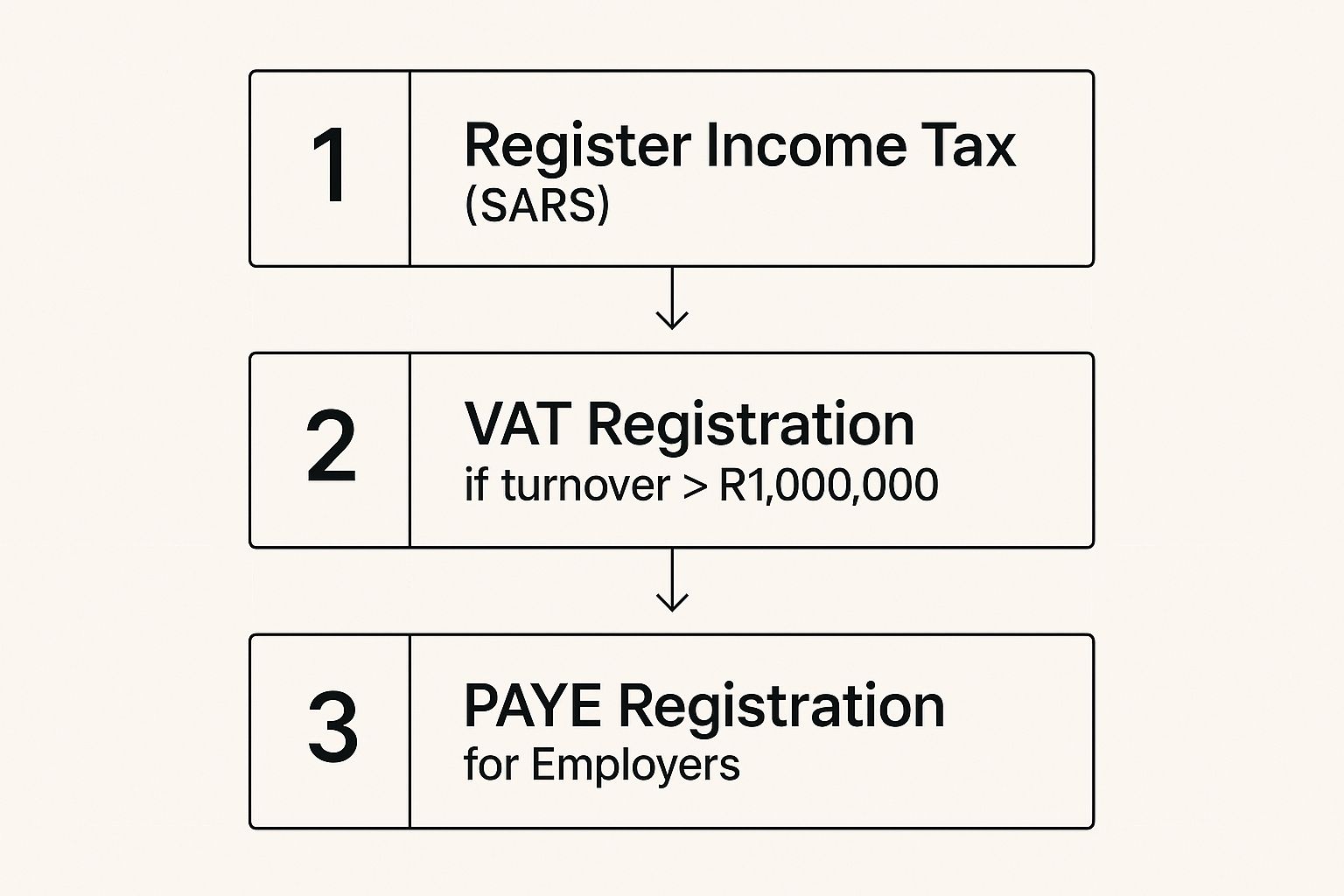

Get Right with SARS

Speaking of SARS, they should be your next stop. Just because you're registered with the CIPC doesn't mean you're automatically on the taxman's radar. You need to proactively register for the specific tax types that apply to your business.

- Income Tax: Every single company needs a tax number. You can handle this application yourself through SARS eFiling.

- Value-Added Tax (VAT): This becomes mandatory once your turnover hits (or is likely to hit) R1 million in any 12-month period. You can also choose to register voluntarily if your turnover is over R50,000, which can sometimes be beneficial.

- Pay-As-You-Earn (PAYE): If you're going to have employees earning above the tax-free threshold, you must register for PAYE. This is the system for deducting tax directly from their salaries and paying it over to SARS.

Getting these SARS registrations done quickly is absolutely critical. Falling behind on your tax obligations can lead to hefty penalties and interest charges that can easily cripple a new venture before it even has a chance to get off the ground.

Your Department of Labour Obligations

If you have staff, your compliance duties don't end with SARS. The Department of Labour requires you to register for two important funds.

The first is the Unemployment Insurance Fund (UIF). This fund provides a safety net for your employees if they become unemployed or are unable to work. You're legally required to register for UIF within seven days of hiring your very first employee.

The second is for the Compensation for Occupational Injuries and Diseases Act (COIDA), which is managed by the Compensation Fund. This is essential, as it protects both you and your team by providing cover for any work-related injuries or illnesses. Every employer has to register and pay an annual fee based on an assessment.

Tying Up the Final Loose Ends

With the big legal and financial tasks out of the way, a few final admin jobs will set you up for long-term success. You’ll need to create and maintain a statutory file, which most people just call a company register. This is a physical or digital folder that must hold your MOI, an up-to-date record of all directors, minutes from any formal meetings, and your share register.

And finally, remember that learning how to register a company in South Africa was just step one. Every single year, on the anniversary of your company's registration date, you must file an Annual Return with the CIPC. Miss this, and you risk having your company flagged for deregistration and eventually shut down. Do yourself a favour and put that date in your calendar right now.

Got Questions About Registering Your Company? We’ve Got Answers

Let's be honest, even the most straightforward guides can leave you with a few nagging questions. It’s a big step, and it’s natural to want to get everything just right.

To help you move forward with confidence, I’ve put together answers to the most common questions I hear from entrepreneurs just starting out. Think of this as a quick-reference cheat sheet to clear up any confusion before it slows you down.

How Long Does Company Registration Actually Take?

This is the big one, and the true answer is: it depends. If you’re using the CIPC’s online portal and every piece of paperwork is spot on, you might be pleasantly surprised by the speed.

Here’s a realistic breakdown:

- Name reservation can take anywhere from 1 to 3 business days.

- Once your name is secured, the final company registration usually takes another 3 to 7 business days.

But, delays can and do happen. The usual culprits are things like a typo in an address, an ID copy that’s been certified for too long (over three months), or even just a period of high traffic on the CIPC’s system. It’s always smart to build a little buffer into your timeline. My advice? Don't sign any major contracts or make financial commitments until that official registration certificate is in your hands.

Key Takeaway: While the process can be quick, plan for about one to two weeks from start to finish. A little patience now can save a lot of headaches later.

What Are the Real Costs Involved?

One of the great things about learning how to register a company in South Africa is that the direct government fees are refreshingly low. You don't need a massive budget just to get your business legally recognised.

At its core, here's what you're looking at for CIPC fees:

- Name Reservation: Around R50.

- Company Registration (Pty Ltd): Roughly R125 if you use the standard Memorandum of Incorporation (MOI).

Of course, there are a few other small costs. You’ll need to get your ID certified by a Commissioner of Oaths, which is typically free at a police station or a small fee elsewhere. If you decide to use a third-party registration agent for convenience, their service fees can run anywhere from a few hundred to several thousand rand. Make sure you account for that if you go that route.

Can a Foreigner Register a Company in South Africa?

Yes, absolutely. A non-South African citizen can be a director and shareholder in a South African company. The CIPC process is designed to handle this.

There are, however, a couple of non-negotiable requirements you'll need to sort out:

- A South African Address: The company must have a registered physical address within South Africa. A P.O. Box won't cut it.

- Valid Identification: Foreign directors must provide a clearly certified copy of their valid passport.

It’s crucial to understand the difference between company ownership and the right to work here. Registering as a director doesn't automatically give you a visa or permission to work in the business day-to-day. That’s a separate process you'll need to undertake with the Department of Home Affairs to secure the correct work visa.

Once your company is registered and you're ready to operate globally, managing international payments efficiently becomes your next challenge. Zaro offers a powerful solution, enabling South African businesses to send and receive money using real exchange rates with zero hidden fees. Avoid the high costs and slow speeds of traditional banks by exploring a smarter way to handle your cross-border finance. Find out how you can save at usezaro.com.