If you want to genuinely save money in your business, you have to know exactly where every single rand is going. Forget about just hacking away at your budget. The real starting point is a thorough expense audit. This isn’t about making blind cuts; it’s about getting the financial clarity you need to make smart decisions that don't stifle your growth.

Your Starting Point for Sustainable Business Savings

So, where do you even begin? It’s a question every South African business owner I’ve ever met has asked, especially when the economy gets tough. The secret isn't a dramatic, slash-and-burn approach. Instead, it’s a methodical, honest look at your finances that turns a dreaded task into a powerful review of your company's health.

The idea is to get granular. You need to pick apart every line item on your expense sheet—from the big stuff like supplier contracts and rent, right down to the small, nagging costs like software subscriptions and stationery. Once you have this bird's-eye view, you can start sorting everything out.

Categorise Your Expenses for Clarity

Start by grouping your costs into simple, practical buckets. This isn't just a job for your bookkeeper; it's a strategic move that will immediately show you where to focus your energy.

Essential Costs: These are the absolute must-haves, the non-negotiables that keep your doors open. Think rent for your office or workshop, core staff salaries, and the raw materials you can't do without. You can't get rid of them, but you can almost always find ways to make them more efficient—maybe by renegotiating a lease or finding a better deal on materials.

Optimisable Costs: Now, this is where the real magic happens. This category is packed with potential savings. We're talking about your marketing budget, the software tools you use, and those variable supplier fees. The goal here is to ask one simple question for each: "What's the return on investment (ROI)?" From there, you can find ways to get the same, or even better, results for less money.

Unnecessary Costs: I like to call these the "financial leaks." They’re the forgotten costs bleeding your business dry. Think of those unused software licences, subscriptions for services you no longer need, or memberships that aren't delivering any value. Cutting these out gives you an instant cash flow boost with zero negative impact on your business.

An honest, detailed expense audit is the bedrock of any successful cost-saving plan. It moves you from just reacting to financial pressure to proactively managing your money. You’re back in control.

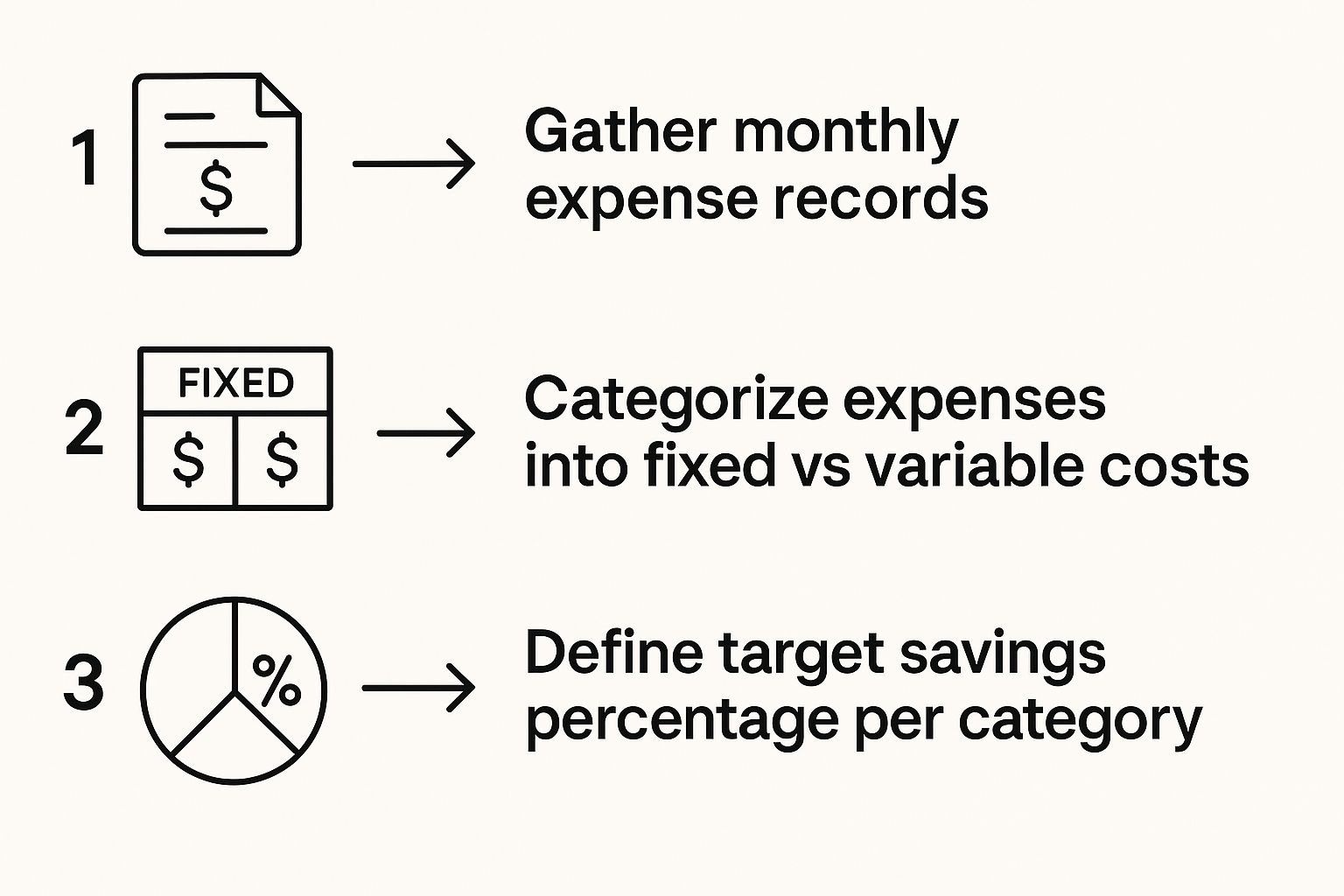

This initial deep dive lays the groundwork for every other saving strategy you'll implement. It tells you exactly where the money is going and where the opportunities lie. The diagram below shows a straightforward process to get you started.

By following this kind of logical flow, you can methodically work your way through your expenses, category by category, ensuring every cut you make is strategic and built to last.

Cut Operational Costs with Smart Automation

Repetitive, manual tasks are the silent profit killers in any business. They eat up valuable employee hours that could be spent on growing the company, innovating, or simply talking to customers. One of the most powerful ways to save money in a business is to tackle these operational drains head-on with smart automation.

This isn't about replacing your team with robots. Far from it. It’s about being strategic—identifying those monotonous, time-sucking workflows and letting clever tools handle them for you. Just think about the hours your team spends sending invoice reminders, chasing late payments, or copying and pasting data from one spreadsheet to another. These are prime candidates for automation.

For South African businesses, the potential savings are huge. Automating tasks across different departments can slash expenses by making everything run more smoothly. In fact, recent analysis points to significant cost reductions simply from consolidating overlapping activities, like centralising the buying of office supplies to get bulk discounts. By having one person manage all purchases, businesses cut out redundant spending and gain better control over staff costs. You can dig into more of these practical cost-cutting methods from Lamna's analysis.

Identifying Automation Opportunities

The first move is to figure out which daily operations are ready for a tech upgrade. The good news? You don't need a massive budget or an in-house IT wizard to get started. Many modern software tools are built specifically for small to medium businesses and are surprisingly affordable.

Look for tasks that are:

- Highly Repetitive: Anything done over and over again, like weekly reporting or data entry.

- Rule-Based: Processes that follow a clear "if this, then that" logic. For instance, if a new customer signs up, an automated welcome email goes out.

- Time-Consuming but Low-Value: Activities that take up a lot of time but don't directly bring in revenue, such as organising digital files or scheduling meetings.

A classic example I see all the time is customer follow-up. Instead of someone on your sales team manually emailing every new lead, an automated email sequence can nurture them along. This alone can free up hours every single week. On the finance side, accounting software can automate invoicing and payment reminders, which not only cuts down on admin but also gets cash into your bank account faster.

Key Takeaway: Automation isn’t about getting rid of jobs; it's about getting rid of the tedious parts of jobs. This frees up your people to focus on the high-impact, strategic work that actually pushes the business forward.

Practical Automation for Immediate Impact

Putting these ideas into action doesn't have to be some massive, complicated project. You can start small, see the results, and then build from there.

Here are a few quick wins to consider:

- Automated Invoicing: Use accounting software to automatically generate and send invoices when a project hits a milestone or for monthly retainers. It’s a simple change that ensures you get paid on time and with far less hassle.

- Social Media Scheduling: Platforms like Buffer or Hootsuite let you plan and schedule your social media content in one go. This keeps your brand visible without the daily scramble to post something.

- Customer Service Chatbots: A basic chatbot on your website can handle common questions 24/7. Your customers get instant answers, and your support team can focus on solving the trickier problems that need a human touch.

By strategically automating these everyday operational tasks, you're not just trimming your budget—you're building a more efficient, resilient, and scalable business from the ground up.

Optimise Your Tech Stack for Maximum ROI

Is your company's technology a well-oiled machine or a quiet financial drain? It's a question worth asking. So many businesses are unknowingly bleeding cash on fragmented software, redundant subscriptions, and outdated hardware. When you're looking for ways to save money, a great place to start is with the tools you use every single day.

The goal is to get everything working together efficiently. Bringing your technology into a single, integrated ecosystem can unlock massive savings. A central platform means you can stop paying for multiple, overlapping software licences, which in turn lowers hardware maintenance and drastically reduces your total cost of ownership (TCO). This isn't just about trimming the fat; it improves operations, gives your customers a better experience, and can even open up new ways to make money.

Unify and Conquer Your Tech Costs

The core idea here is to break down the silos. Think about a typical retail business for a moment. They might have one system for the point-of-sale, another for inventory, a third for online orders, and maybe a fourth for customer relationship management. Each one comes with its own price tag, its own support team, and its own data that rarely, if ever, talks to the others.

Bringing all these functions under one roof creates immediate financial and operational wins. The retail sector in South Africa, for instance, stands to gain enormously from this. By moving from scattered point-of-sale systems to a unified retail management platform, businesses can lower their total cost of ownership by around 22%. This comes from cutting out redundant software fees, hardware maintenance, and the support costs you'd pay for each separate system. You can get a better sense of these savings by reading Shopify's in-depth look at cost-cutting strategies.

A unified tech stack does more than just save you money on licences. It gives you a single source of truth for your business data, which leads to smarter decisions, fewer errors, and a more connected team.

A platform like Shopify, for example, lets a business manage everything from in-store sales to online marketing from a single dashboard.

As you can see, a unified platform centralises your entire retail operation. It’s a key move for reducing complexity and cost. When you integrate these different parts of your business, you don't just save money—you also create a much smoother experience for both your staff and your customers.

Beyond Software: The Hardware Advantage

This thinking goes beyond just your software. Managing a fleet of different computers, printers, and payment terminals from various suppliers is a logistical and financial nightmare. Standardising your hardware, on the other hand, comes with some serious perks:

- Bulk Purchase Discounts: Buying the same model of equipment often gets you much better pricing from suppliers.

- Simplified Maintenance: Your IT support only needs to know their way around one type of device, which cuts down on training and repair times.

- Reduced Consumable Costs: Using the same printers means you can buy ink or toner in bulk, leading to even more savings.

By taking a hard look at your entire tech ecosystem—from the software you pay for to the hardware you use—you can turn a major expense into a lean, efficient engine for growth.

Adopt a Growth Mindset for Long-Term Financial Health

Cutting costs is crucial, but it's only half the battle. If all you’re doing is playing defence, you’ll never get ahead. The real secret to lasting financial health lies in playing the long game—adopting a growth mindset.

This means seeing certain expenses not as costs, but as smart investments that will fuel future efficiency and build resilience. It’s about shifting your thinking from "What can we cut right now?" to "Where can we invest today to make our business stronger tomorrow?" Many of South Africa's most successful SMEs are already thriving by putting their money where it matters most: into their people and their processes.

Investing in People and Technology

It’s a common mistake to think that saving money requires a total spending freeze. In my experience, some of the most profound savings actually come from strategic investments in your two most valuable assets: your team and your technology.

Think about it. Upskilling your employees isn’t just a nice-to-have that boosts morale. It creates a more capable workforce that can solve problems faster and innovate from within. An employee trained in digital marketing can wring more value out of every rand spent on advertising. A team member who understands data analysis might uncover operational efficiencies you never knew existed.

The same goes for technology. Investing in tools like automation or artificial intelligence (AI) can take repetitive, low-value tasks off your team's plate, freeing them up to focus on work that actually grows the business. This isn't some far-off theory; it's a practical way to boost productivity without simply throwing more people at a problem.

True cost management isn't about sacrificing your competitive edge for a quick win. It's about building a business so efficient and innovative that it operates with a healthier bottom line by design.

Cultivating a Culture of Innovation

And this forward-thinking approach is clearly working. Despite a tough economy, small businesses in South Africa have shown incredible grit. A recent report revealed that 83% of small firms saw their revenue grow over the past year, and a staggering 90% feel optimistic about their future.

Their investment plans tell the whole story. According to the Xero State of Small Business Report, their priorities are:

- 42% planning to invest in staff upskilling

- 39% planning to invest in new technologies like AI

This data drives home a critical point: an innovative culture is your most powerful tool for long-term financial management. When your team feels empowered to adapt, pivot, and experiment, your business becomes inherently more resilient. This fosters an environment where continuous improvement isn't just a buzzword—it's how you operate, leading to sustained savings and a formidable competitive advantage. By investing wisely today, you're not just spending money; you're securing a stronger, more profitable tomorrow.

Master Supplier Negotiations and Procurement

Your supplier relationships are a hidden goldmine for savings. I see it all the time: businesses accept initial quotes and renewal terms without a second thought, leaving a significant amount of money on the table. Learning how to save money in your business means treating procurement not as a simple transaction, but as a core strategic function.

This isn't about abstract theory; it's about practical tactics for renegotiating contracts and refining how you buy goods and services. The first move is always to arm yourself with information. Before you even think about picking up the phone, you need a crystal-clear picture of what you’re currently paying and what the market rate actually is.

Build Your Case with Benchmarking

Never walk into a negotiation blind. Your confidence, and ultimately your success, hangs on the homework you do beforehand. Start by pulling all your current supplier invoices and contracts to map out your spending patterns.

Next, you need to do a bit of digging to find out what your competitors or similar businesses are likely paying for the same things. This isn't always straightforward, but you can find clues in industry forums, by chatting with others in your network, or simply by getting a few quotes from alternative suppliers. This data is your ammunition.

For example, if you find out you’re paying 15% more for your packaging materials than the industry average, you now have a solid, data-backed reason to open a conversation with your current supplier.

A negotiation based on data isn't a confrontation; it's a collaborative discussion about finding fair market value. You're not just asking for a random discount—you're showing them you’ve done your research.

Proven Strategies for Better Deals

Once you have your benchmarks, you can approach your suppliers with a clear objective. Remember, good suppliers want to keep your business. They are often far more flexible than you might think, especially if you’ve been a reliable customer.

Here are a few proven strategies to bring to the table:

- Play the Loyalty and Volume Cards: Have you been a loyal customer for years? Use that history to your advantage. Frame the conversation around a long-term partnership. Likewise, if your order volumes have grown, it’s perfectly reasonable to ask for pricing that reflects your new status as a bigger client.

- Negotiate Payment Terms: A price cut isn't the only way to win. Ask for more favourable payment terms, like extending your payment window from 30 to 60 days. This won't lower the invoice total, but it can dramatically improve your cash flow and give you some much-needed breathing room.

- Look for Bulk-Buy Discounts: For non-perishable items or services you use consistently, ask about discounts for buying in larger quantities or paying for a year upfront. A 5-10% discount for an annual software subscription, for instance, is a common and easy win.

Diversify to Reduce Risk and Increase Power

Putting all your eggs in one supplier's basket is a massive business risk. What happens if they hike their prices overnight, run into production issues, or worse, go out of business? Diversifying your supplier base is a crucial defensive move.

By maintaining relationships with at least two or three suppliers for your essential goods, you not only shield your business from disruption but also massively strengthen your negotiating position. When it's time for a contract renewal, having a ready-to-go alternative gives you incredible bargaining power. It keeps everyone honest and ensures you continue to get competitive pricing and top-notch service. This is how you build a resilient supply chain that actively boosts your bottom line.

Frequently Asked Questions About Business Savings

Deciding to get serious about your business's bottom line is one thing; knowing where to start is another. It's a journey that often brings up a lot of questions. Let's tackle some of the most common ones we hear from South African business owners, with practical advice to clear things up.

How Soon Can I Expect to See Savings?

This is usually the first question on everyone's mind, and the honest answer is: it depends on what you do.

Some cost-cutting moves give you an almost immediate cash flow bump. Think about cancelling those software subscriptions nobody's used for months or successfully renegotiating terms with a key supplier. These are quick wins. You’ll see the impact on your very next bank statement, which is great for building momentum.

But the biggest savings often come from bigger, more strategic plays. Investing in new automation software or overhauling your entire tech stack will likely have an upfront cost. The real payoff here is long-term, showing up as dramatically reduced labour hours and smoother, more efficient operations down the line. A smart strategy has a healthy mix of both—quick wins to free up cash now and bigger investments that will pay dividends for years.

Should I Cut My Marketing Budget First?

When the pressure is on, the marketing budget often seems like the first and easiest thing to chop. I'm going to tell you right now: resist that urge.

Cutting your marketing spend is a classic knee-jerk reaction. It's like trying to save petrol by turning off your car's engine—sure, you'll save a little in the short term, but you're not going to get anywhere. Slashing the budget that brings in new business can do serious, lasting damage.

Instead of just cutting, get smarter. Shift your mindset from "spending less" to "spending wisely."

The goal isn’t to stop spending on marketing; it’s to stop wasting money on marketing that doesn’t work. This is where relentless tracking and a deep dive into your data become your most valuable tools.

Find out which channels are actually delivering leads and sales, and double down on them. If your data shows that one particular social media campaign is bringing in high-value customers, that's where your money should go. At the same time, you can lean into highly effective, low-cost strategies like search engine optimisation (SEO) or targeted email marketing campaigns, which often deliver an incredible return on investment.

What Is the Biggest Cost-Cutting Mistake?

By far, the most damaging mistake a business can make is cutting expenses that are fundamental to the quality of its product or its ability to grow.

Think of it like trying to make your signature dish cheaper by leaving out the key ingredients. You might save a few rand, but you'll end up with a product nobody wants and a damaged reputation.

This classic error looks like slashing the budget for essential staff training, getting rid of software your team relies on every day, or opting for cheaper, lower-quality raw materials. This is where a proper expense analysis, like we talked about earlier, becomes your shield. It helps you see the clear difference between organisational ‘fat’—the stuff you can absolutely live without—and the ‘muscle’ that makes your business strong.

By truly understanding which costs are just weighing you down and which are essential to your success, you can cut with surgical precision. This way, you protect the very things that make your company great while trimming away what’s holding you back.