Sending money from South Africa to another country isn't just a simple transaction; it's the lifeblood of international trade. At its core, an international currency transfer is the process of moving funds across borders, which means converting one currency (like our Rand) into another (say, US Dollars or Euros).

For any South African business operating on the global stage, this is a daily reality. It's how you pay your overseas suppliers, get paid by international clients, and manage your global operations.

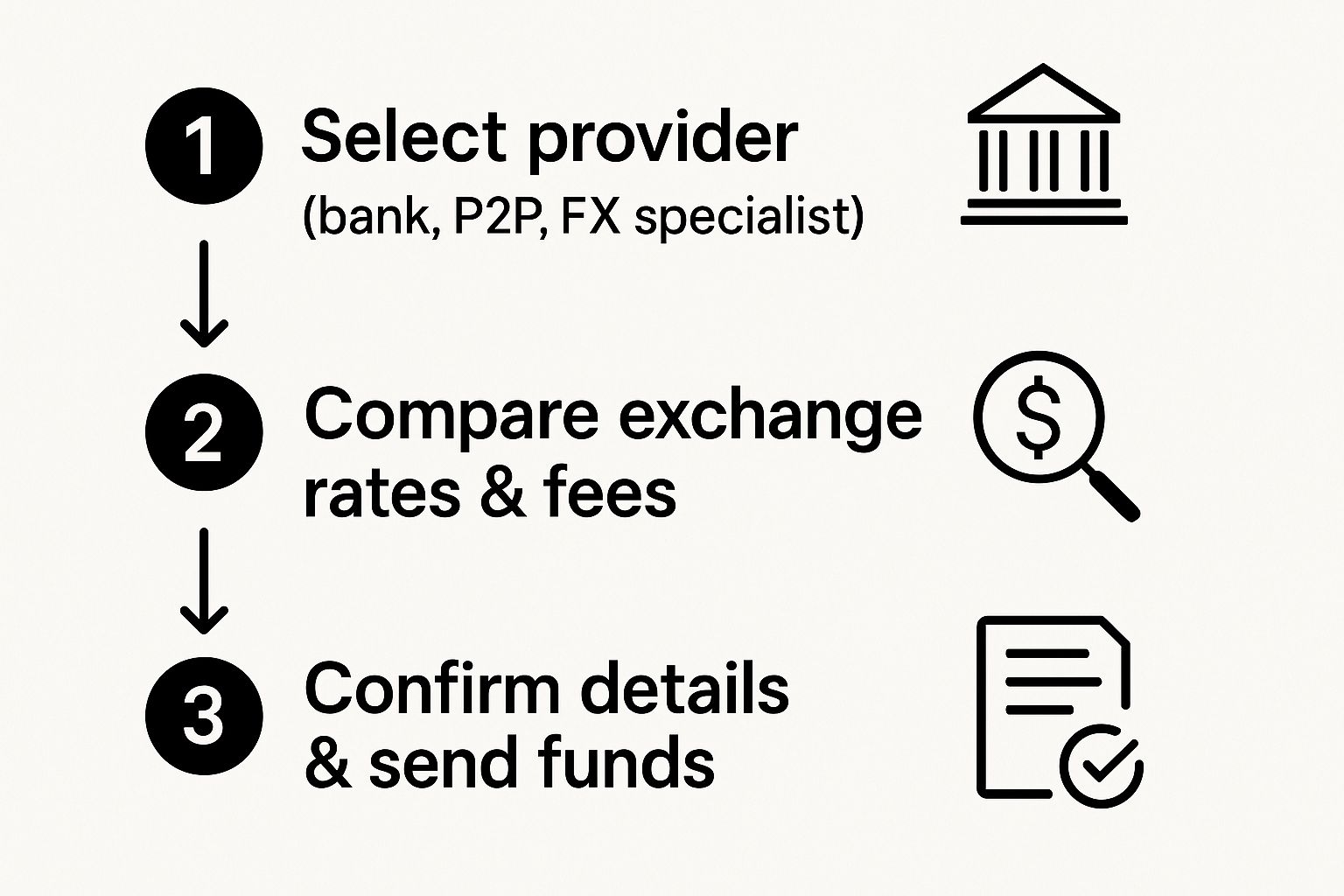

Decoding Your First International Currency Transfer

If you're running a business in South Africa, moving money across borders can feel like navigating a maze. Whether you're a Cape Town wholesaler paying a supplier in China or a Johannesburg tech firm getting paid by a client in Europe, every cent counts. The speed and cost of these transfers directly hit your bottom line.

This guide is here to cut through the confusion. We'll pull back the curtain on how these payments actually work, expose the hidden costs that can eat into your profits, and give you a clear map for handling the complex regulations. Think of it as your go-to playbook for making smarter, cheaper, and fully compliant international payments.

The Ever-Changing World of Cross-Border Payments

The way we send money internationally is constantly evolving, with a major push to make the whole system better, faster, and cheaper. For businesses in South Africa and across the continent, this is a space to watch closely.

During a G20 meeting in Cape Town in early 2025, leaders like South African Reserve Bank Governor Lesetja Kganyago tackled this very issue head-on. They pointed out that despite global efforts, cross-border payments are still too slow and expensive. This highlights a real need for better infrastructure and smarter regulations. To get a deeper dive, you can explore more on the future of cross-border payments in South Africa and see what's being done.

This drive for improvement directly affects how your business operates. As new technologies and rules come into play, getting a firm grip on the basics of an international currency transfer is more critical than ever.

An international currency transfer is more than just a transaction; it's a vital link in your global supply chain. Every percentage point saved on fees and exchange rates translates directly to your profit margin.

To kick things off, let's break down the essential pieces of any cross-border payment. Understanding these components is the first step to making sure your money moves quickly, affordably, and securely.

Key Factors in an International Currency Transfer

This table summarises the core components you need to get right for any international payment.

| Component | What It Means for Your Business | Key Consideration |

|---|---|---|

| Exchange Rate | The rate at which your Rands are converted to a foreign currency. This is the biggest factor affecting the final cost. | Is the rate competitive? Does it include a hidden markup (spread)? |

| Transfer Fees | The upfront cost charged by the bank or provider to process the payment. This can be a flat fee or a percentage. | Are the fees transparent? Are there any hidden charges from intermediary banks? |

| Recipient Details | The bank account information for the person or company you are paying, such as their IBAN, SWIFT/BIC code, and address. | Are all details 100% accurate? A small typo can cause major delays or a failed transfer. |

| Regulations & Compliance | The rules set by authorities like the South African Reserve Bank (SARB) that govern cross-border payments. | Do you have the necessary documentation (e.g., invoices) to prove the payment's legitimacy? |

Getting these four elements right from the very beginning is the secret to successful global operations. It turns a potential headache into a smooth, predictable part of doing business.

How Your Money Travels Across Borders

Ever wondered what actually happens when you send money overseas? It’s a bit like sending a valuable package through a global courier network. You hand it over on your end, but it doesn't just teleport to the destination. Instead, it passes through a series of hubs and checkpoints, each playing a crucial role in its journey. Understanding this path helps to demystify why some transfers take longer and cost more than others.

When you initiate a payment from your South African bank, you're kicking off a surprisingly complex process. Your funds don’t just fly directly from your account to your supplier's in another country. First, your local bank has to communicate with a bank in the destination country, and more often than not, they don’t have a direct line to each other.

This is where the real journey begins. To bridge that gap, banks rely on a well-established system built on partnerships and communication networks that have been the backbone of global trade for decades.

The Role of Correspondent Banks

To get your money where it needs to go, your bank in South Africa works with what are known as correspondent banks. Think of them as the major international airports in our courier analogy. They are essentially intermediary banks in other countries that have established relationships with one another.

So, if your bank in Johannesburg needs to send US Dollars to a supplier in America but doesn't have its own branch there, it will use a US-based correspondent bank it partners with. Your Rands are first converted to Dollars, and then the payment instruction is passed along this chain.

A typical journey might look like this:

- Your Bank (South Africa): Kicks off the transfer and converts your ZAR.

- Correspondent Bank 1 (e.g., in London): Might act as a clearinghouse for European currencies.

- Correspondent Bank 2 (e.g., in New York): Receives the instruction and preps the funds for the final bank.

- Recipient’s Bank (USA): Finally gets the funds and credits your supplier’s account.

Each of these "stops" can add time and, crucially, costs. These intermediary banks often deduct their own processing fees directly from the money being sent, which means your recipient can sometimes get less than you originally intended. Research shows these fees can be anything from $15 to $50 per intermediary, slowly chipping away at your payment.

SWIFT: The Global Financial Messaging System

So, how do all these banks talk to each other securely? They use the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. It's important to know that SWIFT doesn’t actually move the money itself. It’s more like a highly secure messaging service—think of it as the postal service for banks.

It sends payment orders from one institution to another using a standardised system of codes. When you see a SWIFT or BIC code required for your transfer, that's the unique address ensuring the payment instruction goes to exactly the right place.

Key Takeaway: The traditional banking system for an international currency transfer is a relay race. Your money is the baton, passed from your bank to one or more correspondent banks via SWIFT messages, before it finally reaches the finish line—your recipient's account.

This whole process, while reliable, is the main reason why many international bank transfers take a typical 2-5 business days to complete. Every step in the chain needs processing, verification, and settlement.

Understanding this flow is crucial for any business because your initial choice of provider dictates the costs and complexities you'll face down the line. Many modern fintech solutions manage to sidestep parts of this old correspondent banking network. They often use their own internal networks to settle funds, which is why they can offer faster and cheaper transfers. It’s a powerful reminder to compare not just the visible fees, but the underlying method your provider uses to move your money across borders.

Uncovering the True Cost of Sending Money Abroad

When you need to send money overseas, the first thing most people look at is the advertised transfer fee. It’s right there in black and white, making it seem like the main cost. But focusing only on that upfront number is a classic—and often expensive—mistake.

The real cost, the one that truly eats into your funds, is usually hidden away in the exchange rate you’re offered.

Think of it like booking a flight. The ticket price is the transfer fee—it’s obvious and easy to compare. But the hidden costs like baggage fees, seat selection, and on-board snacks? That’s the exchange rate margin. These are the expenses that determine the true cost of your journey, and they can add up fast if you aren't paying attention.

To make smart financial decisions for your business, you have to get a handle on the total cost of every transfer. That means looking beyond the obvious fee and understanding the two key parts that make up the real price.

The Visible Cost: The Transaction Fee

The most straightforward cost is the transaction fee, sometimes called a sending fee. This is the flat amount or percentage that a bank or provider charges to simply process your payment.

For many traditional South African banks, this fee for an international transfer can be quite steep, often ranging from R250 to over R500. While it’s an important number, it's often used as a marketing gimmick. A provider might flash a "low R150 transfer fee" to get you in the door, but this is only a tiny piece of the financial puzzle. A low transaction fee means nothing if the hidden cost is sky-high.

The Hidden Cost: The Exchange Rate Margin

Here’s where the real money is made (and lost). The single biggest expense in almost every international transfer is the exchange rate margin.

This "spread," as it's often called, is the difference between the 'real' exchange rate and the less favourable rate your provider gives you.

The Mid-Market Rate: This is the genuine exchange rate that banks use to trade currencies between themselves. It’s the rate you see on Google or Reuters—the perfect midpoint between what buyers are willing to pay and what sellers are willing to accept.

Your Customer Rate: This is the rate a provider actually offers you. It’s almost always the mid-market rate with a markup added on top. That markup is pure profit for the provider.

The exchange rate margin is essentially an invisible fee. A provider offering a rate that's even just 1-2% worse than the mid-market rate can cost you far, far more than any flat transaction fee.

Let’s run the numbers with a practical example to see how this hidden cost can sting your bottom line.

A Practical Cost Breakdown

Imagine your South African business needs to pay a US supplier R100,000. On the day you make the payment, the live mid-market exchange rate is R18.00 to $1 USD.

You get quotes from two different providers, and this is where it gets interesting.

Comparing Provider Costs for a R100,000 Transfer to USD

Here’s a side-by-side look at how a traditional bank stacks up against a specialist forex provider. Notice how the small details make a massive difference to the final amount received.

| Provider Type | Advertised Fee | Exchange Rate Offered | Hidden Margin Cost | Total Cost | USD Received |

|---|---|---|---|---|---|

| Traditional Bank | R350 | R18.36 (2% markup) | R2,000 | R2,350 | $5,446.62 |

| Forex Specialist | R150 | R18.09 (0.5% markup) | R500 | R650 | $5,527.91 |

In this scenario, if you only looked at the advertised fees, you'd think you're only saving R200 with the specialist. But the real story is in the exchange rate. The bank’s less favourable rate costs you an extra R1,500 in hidden margin.

All told, using the bank would have cost your business R1,700 more, and your supplier would have received over $81 less. Now, imagine that difference on larger or more frequent payments. Those seemingly small percentages can easily add up to tens of thousands of Rands in lost capital over the course of a year.

Navigating South African Forex Regulations

Sending money overseas from South Africa isn't just a simple bank transaction. It’s a regulated activity, and getting it right means understanding the rules of the game set by the South African Reserve Bank (SARB). The term "forex regulations" might sound a bit heavy, but once you grasp the basics, you'll find it's all quite manageable.

For any South African business with international suppliers or clients, compliance is non-negotiable. The SARB’s exchange control regulations exist to monitor the money flowing in and out of the country, which is crucial for maintaining economic stability. Your bank or forex provider is what's known as an Authorised Dealer, and it's their job to enforce these rules by reporting your transactions.

This simply means that for every international payment, you need to have your paperwork in order to prove it's a legitimate business expense. Think of it as a system designed to protect the economy from unlawful financial activities by ensuring every cross-border payment has a valid commercial reason behind it.

Understanding Your Allowances

The SARB has specific allowances for how much money can be moved abroad. While most business payments are tied to trade, it helps to know about the individual allowances, as they provide useful context.

You’ll often hear about two main allowances for individuals:

- Single Discretionary Allowance (SDA): This lets a South African resident send up to R1 million overseas per calendar year for almost any legal reason, without needing a tax clearance certificate.

- Foreign Investment Allowance (FIA): For larger sums, this allowance permits an individual to transfer up to R10 million abroad annually. This, however, requires a Tax Compliance Status (TCS) check from SARS.

It's important to remember that these are personal allowances. When your business is paying an overseas supplier, these limits don't apply. Instead, the focus shifts entirely to proving the payment is for a legitimate trade activity through supporting documents.

The Paperwork You'll Definitely Need

When your business makes an international payment for goods or services, your Authorised Dealer will ask for specific documents before they can process it. This is the most critical part of staying compliant. The goal is simple: create a clear paper trail that justifies the payment.

While the exact list might change slightly depending on the payment, you should always be ready with the following:

- A Commercial Invoice: This is the cornerstone of your application. It must be a proper invoice from your supplier that clearly shows what you bought, how much it cost, and their bank details.

- Tax Compliance Status (TCS): For larger or more unusual payments, you’ll need to prove to your Authorised Dealer that your business’s tax affairs are up to date with SARS.

- Transport Documents (for goods): If you're importing physical products, you may also need to provide a Bill of Lading or an Air Waybill. This acts as proof that the goods have actually been shipped.

Getting these documents sorted out before you even start the transfer process will save you from frustrating delays and the risk of your payment being rejected.

Compliance is Key: Treat your documentation as a non-negotiable part of every single international payment. The most common reason for a transfer to get stuck is simply a failure to provide the correct paperwork to the Authorised Dealer.

Avoiding Common Compliance Pitfalls

Navigating these rules is much easier when you know what to watch out for. Being proactive about compliance, rather than just reacting when a problem pops up, is the secret to keeping your international payments flowing smoothly.

Here’s a quick checklist to keep you on the right side of the regulations:

- Match Your Paperwork: Make sure the amount you're sending is an exact match for the amount on the supplier's invoice. Any discrepancy is an immediate red flag.

- Keep Good Records: Hold onto a complete file of all invoices and supporting documents for every international transfer you make. The SARB can ask to see these records at any time.

- Don't Split Payments to Avoid Scrutiny: It might seem clever to break a large payment into smaller ones to fly under the radar, but this is strictly against the rules and can lead to serious penalties.

- Talk to Your Provider: If you're ever unsure about what's needed for a particular payment, just ask your bank or forex specialist. It’s their job to guide you.

By getting a handle on these principles and preparing your documents properly, you can make every international currency transfer an efficient, lawful, and stress-free part of doing business.

Choosing the Right Transfer Provider for Your Business

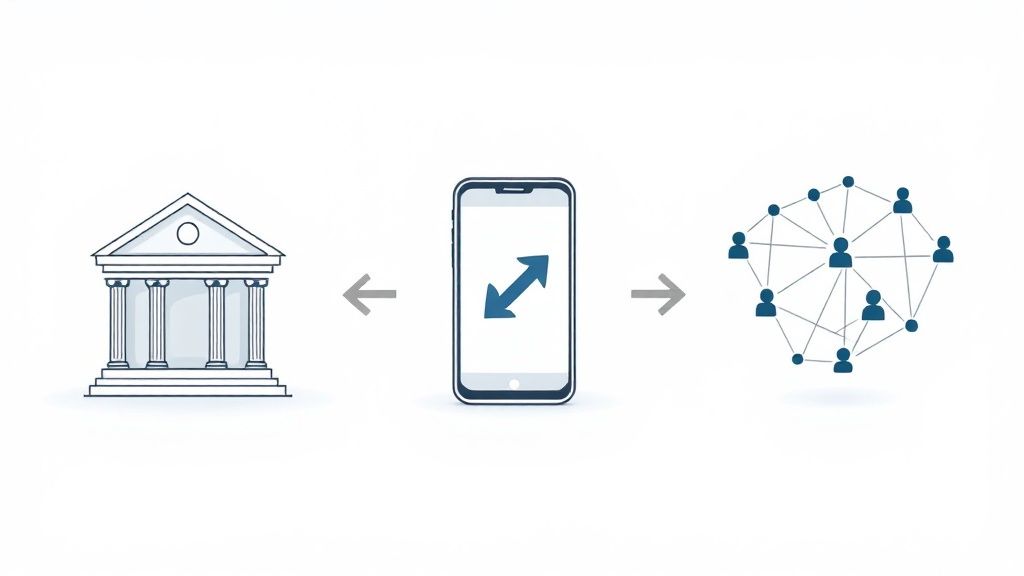

Picking a partner for your international currency transfers is a critical financial decision for your business. It's not just an administrative task; your choice directly impacts your costs, the speed of your payments, and how efficiently you operate on a global scale.

The market really boils down to two camps: your traditional, high-street bank or a specialised forex provider. Each comes with its own pros and cons, and getting a clear handle on them is the key to picking a partner that actually fits your business's needs—not one that just slowly chips away at your profits.

This is more important than ever. The global remittance market is booming, with cross-border payments into countries like South Africa growing every year. In 2025, global remittance flows hit around $958 billion, and South Africa is a major player in this space. This growth is largely fuelled by digital platforms making transfers faster and cheaper, a shift that local businesses can and should be taking advantage of. If you want to dive deeper into the numbers, you can explore more money transfer industry statistics to see just how much fintech is changing the game.

The Familiar Path: Traditional Banks

For most businesses, the bank is the default option. It’s familiar, you already have a relationship there, and keeping all your finances under one roof feels convenient and secure. And for some, that simplicity is appealing.

The problem? That convenience usually comes with a hefty price tag. Banks are well-known for offering pretty uncompetitive exchange rates, hiding significant margins that reduce the final amount your recipient gets. Their fee structures can also be a maze of high upfront costs and surprise intermediary bank fees that get skimmed off along the way.

- Pros: It’s familiar, it’s integrated with your existing accounts, and they have a solid reputation for security.

- Cons: Poor exchange rates, high and often opaque fees, slow transfer times (think 2-5 business days), and a general lack of transparency on the total cost.

Honestly, banks are usually only the best fit for businesses making very infrequent, low-value transfers where cost isn't the primary concern.

The Specialist Alternative: Forex Providers

This is where things get interesting. Specialised forex providers and modern fintech platforms have one job: to move money across borders as efficiently as possible. Their entire business is built on beating the banks at their own game by offering better exchange rates and lower fees.

How do they do it? They typically use smarter, more modern payment networks, avoiding the clunky and expensive SWIFT system that banks rely on. This lets them offer exchange rates much closer to the real mid-market rate and push payments through much faster—sometimes even on the same day. Plus, they tend to be far more transparent, showing you exactly what you'll pay before you hit "send."

A forex specialist's biggest draw is simple: they save you money. By shrinking the exchange rate margin, they can put thousands of Rands back into your business on large or regular transactions, directly improving your bottom line.

Many of these specialists also offer incredibly useful tools for managing currency risk. Think forward contracts that let you lock in an exchange rate for a future date, protecting you from nasty surprises if the market moves against you.

Making the Strategic Choice

So, which one is right for you? It all comes down to your business’s specific needs. To make a smart choice, you need to weigh up your options against a clear set of criteria.

A simple evaluation framework can cut through the noise and help you compare providers apples-to-apples, ensuring you find a partner that genuinely adds value.

| Evaluation Criteria | What to Look For in a Provider |

|---|---|

| Exchange Rates | How close is their rate to the live mid-market rate? This is where your biggest savings will come from. |

| Fees and Transparency | Are all costs laid out clearly upfront? Don't be afraid to ask about hidden charges or intermediary fees. |

| Transfer Speed | How quickly will the funds arrive? Look for providers that offer same-day or next-day settlement. |

| Hedging Tools | Can they help you manage risk? Look for tools like forward contracts or market orders to protect against volatility. |

| Customer Support | Is there a real expert you can talk to when you need help with a transaction or a compliance query? |

By looking past the default option of your bank and taking the time to properly investigate specialist providers, you can transform your international payments from a frustrating cost centre into a real strategic advantage.

Got Questions About International Transfers? We've Got Answers.

When it comes to sending money overseas, a lot of questions can pop up. As a South African business owner or finance manager, you need straight answers to protect your bottom line. Getting these details right from the start means your payments aren't just compliant, but also as cheap and quick as they can be.

Think of this section as your quick-reference guide. We’re tackling the most common queries we hear from businesses just like yours, offering straightforward advice to help you master your global transactions.

What Is the Cheapest Way to Send Money Internationally from South Africa?

There's no single "cheapest" way that works for every single payment. The best deal really depends on the amount you’re sending, the currencies involved, and where the money is going. That said, as a general rule, you’ll find that specialised forex providers and modern fintech platforms consistently beat the prices offered by traditional banks.

Why? It all comes down to the total cost. The trick is to look past the advertised transfer fee and scrutinise the exchange rate margin. For business-sized transactions, even a tiny difference in the rate can mean saving thousands of Rands.

To find the most affordable option for your next international currency transfer, you should always:

- Get quotes from a few different providers for the same payment.

- Compare the customer exchange rate you’re offered against the live mid-market rate.

- Work out the total cost by adding the upfront fee to the hidden cost baked into the exchange rate margin.

A provider with a slightly higher fee but a much better exchange rate will almost always be the cheaper choice overall.

How Long Does an International Currency Transfer Take?

Transfer times can be all over the map, from a few minutes to more than five business days. The speed of your payment really hinges on the provider you use and the payment network they rely on.

Modern fintech providers often get funds delivered within the same business day, sometimes even instantly. They pull this off by using their own internal networks of local bank accounts, which lets them sidestep the slower, more traditional banking systems.

On the other hand, transfers made through traditional banks using the SWIFT network typically take between 2-5 business days. This is because the payment instruction has to hop between several intermediary banks before it reaches its final destination, and each stop adds time. Don’t forget that the destination country's banking hours and public holidays can also cause delays, so it's always smart to check the provider's estimated delivery time before you hit send.

What Documents Do I Need for a Business Transfer from South Africa?

For any business payment leaving the country, following the South African Reserve Bank (SARB) rules is non-negotiable. Your authorised dealer—whether that’s your bank or forex provider—is legally required to collect supporting documents to prove the transaction is legitimate.

This paperwork creates a clear audit trail and is a must for every single transfer. The most common documents you’ll need are:

- A Valid Commercial Invoice: This is the big one. It has to be an official invoice from your overseas supplier that clearly states what you bought, the total cost, and their full banking details.

- A Valid Tax Clearance Certificate: Depending on the payment amount and what it’s for, your provider might need to see that you have a valid tax compliance status from SARS.

- Customs or Transport Documents: If you’re paying for imported goods, you may also need to show proof of shipment, like a Bill of Lading.

To avoid frustrating delays, always check the specific requirements with your provider before you start the payment process.

A quick tip: The number one reason a business transfer gets delayed or rejected is incomplete or incorrect paperwork. Keeping your documents organised is the secret to a smooth process.

What Is the Difference Between the Mid-Market and Customer Rate?

Getting your head around this is the key to managing your international payment costs. These two rates represent completely different things in the world of forex.

The mid-market rate is what you could call the "real" or "wholesale" exchange rate. It’s the midpoint between what buyers are willing to pay and what sellers are asking for a currency on the global market. This is the rate banks and big financial institutions use to trade with each other. You can easily find it on platforms like Google or Reuters.

The customer rate, however, is the retail rate you’re offered by a bank or forex provider. This rate almost always includes a markup or "spread" that's added on top of the mid-market rate—that’s how they make their profit. Your goal as a business is to find a provider offering a customer rate that’s as close to the mid-market rate as possible. A smaller margin means lower costs for you and more foreign currency arriving on the other side.

Ready to stop overpaying on international transfers? Zaro gives your South African business access to real exchange rates with zero hidden markups. Our platform removes the complexity and high costs of traditional banking, empowering you to send and receive global payments transparently and efficiently. See how much you can save at https://www.usezaro.com.