The South African International Transfer Landscape

In our increasingly globalized world, sending money internationally from South Africa is more important than ever. Whether it's individuals supporting family members living abroad, businesses paying international suppliers, or South Africans investing in opportunities overseas, international money transfers play a significant role. To truly understand this landscape, we need to examine its impact on individuals, businesses, and the South African economy as a whole.

Historically, remittance inflows to South Africa, while representing a small percentage of the overall GDP (0.24% in 2020), are crucial for supporting families and contributing to the country's balance of payments. Even seemingly small percentages can have a significant impact on individual lives. Find more detailed statistics here.

From Traditional Banking to Digital Transfers

The methods used for sending money internationally have undergone a dramatic transformation. Traditionally, South Africans relied primarily on established banks like Standard Bank, ABSA, and Nedbank. However, the emergence of digital transfer platforms such as Wise and WorldRemit has changed the way we send and receive money across borders.

This shift is driven by a growing demand for faster, more affordable, and user-friendly transfer options. Services like Mukuru, for example, cater specifically to individuals sending money to other African countries.

Navigating the Reserve Bank Regulations

The South African Reserve Bank (SARB) plays a vital role in regulating international money transfers. The SARB sets limits on the amount of money individuals can send abroad each year. These regulations, while sometimes seen as complex, are in place to maintain financial stability and prevent illicit financial flows.

These regulations, specifically the Single Discretionary Allowance (SDA) of R1 million and the Foreign Investment Allowance (FIA) of R10 million, have a direct impact on how South Africans manage their international finances. For businesses, efficient and cost-effective communication is vital. Understanding the SMS marketing cost can be invaluable for effective business communication. Understanding these regulations and the required documentation is essential for ensuring a smooth and compliant transfer process.

Transfer Methods That Actually Work for South Africans

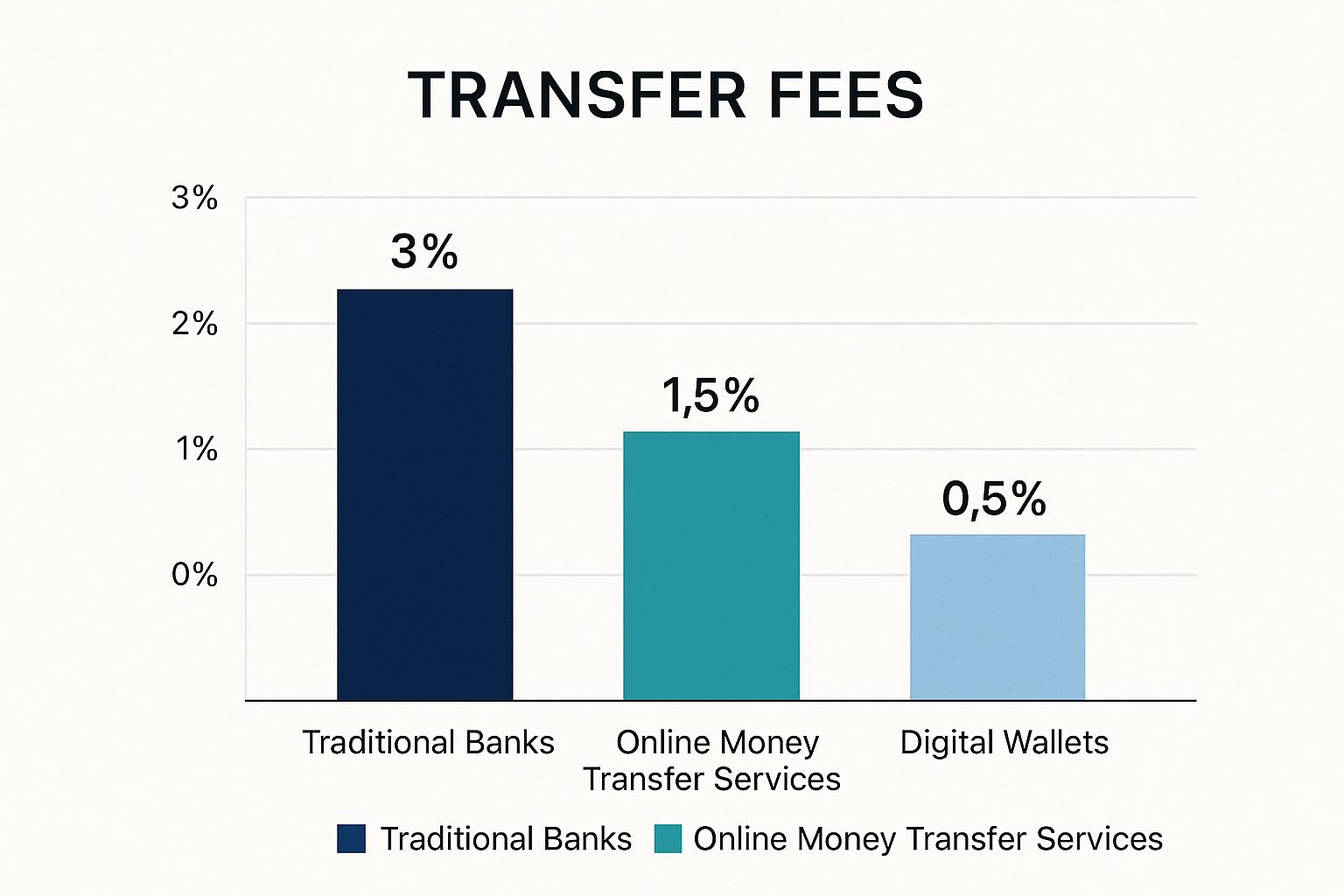

The infographic above illustrates the differences in transfer fees between traditional banks, online money transfer services, and digital wallets. Traditional banks often charge significantly higher fees (3%) compared to online services (1.5%) and digital wallets (0.5%). This considerable difference highlights the potential cost savings for South Africans using modern transfer methods for international remittances.

Traditional Banks vs. Fintech Platforms

Traditional bank transfers, while a familiar option, can be expensive and time-consuming for international transfers. Banks like Standard Bank, ABSA, and Nedbank typically impose higher fees, including SWIFT and correspondent bank charges. Furthermore, banks often offer less favorable exchange rates compared to specialized providers. This can result in a substantial portion of your funds being lost to fees and unfavorable exchange rates. However, for larger transactions or situations requiring stricter regulatory compliance, banks can provide a sense of security and established processes.

Fintech platforms like Wise, WorldRemit, and Mukuru offer faster and more affordable international money transfers, especially for smaller amounts. These platforms typically have transparent fee structures, competitive exchange rates, and faster processing times than traditional banks. Wise, for example, utilizes a peer-to-peer system to bypass traditional banking networks and offer more competitive exchange rates. WorldRemit and Mukuru are particularly beneficial for sending money to other African countries, providing specialized services and convenient local payout options.

Money Transfer Operators and Cryptocurrency

Money transfer operators, such as Western Union and MoneyGram, provide a convenient method for sending money quickly to numerous global locations. These services boast widespread accessibility, with physical branches in many areas. However, this convenience comes at a price, as they generally charge higher fees than online platforms and may offer less favorable exchange rates. They are a viable choice when speed and accessibility are paramount, particularly for recipients without bank accounts.

Cryptocurrency transfers are an emerging option for international money transfers. They offer the potential for lower fees and faster transfer times but are subject to volatile exchange rates and complex regulations. Both the sender and the recipient need a good understanding of cryptocurrency and digital wallets. This makes it a better fit for tech-savvy individuals comfortable with the associated risks and complexities. The South African digital remittances market is projected to reach US$513.44 million by 2025, indicating a growing trend towards digital transfer platforms. Explore this topic further.

Choosing the Right Method for You

The optimal method for international money transfer from South Africa depends on individual needs and priorities. Key factors to consider include the transfer amount, destination country, urgency, and familiarity with different technologies.

To help you choose, let's compare some popular options:

Introduction to Table: The following table provides a comparison of popular money transfer methods from South Africa, outlining their speed, cost, accessibility, and ideal use cases.

| Transfer Method | Speed | Cost | Accessibility | Best For |

|---|---|---|---|---|

| Traditional Banks | Slow (3-5 business days) | High (3%+) | Wide (Most South Africans have bank accounts) | Large sums, regulatory compliance |

| Fintech Platforms (Wise, WorldRemit, Mukuru) | Fast (1-2 business days or less) | Low (0.5%-1.5%) | Increasing (Requires internet access) | Smaller amounts, frequent transfers, competitive exchange rates |

| Money Transfer Operators (Western Union, MoneyGram) | Very Fast (Minutes to hours) | High (Varies but generally higher than online platforms) | Very Wide (Numerous physical locations) | Speed, accessibility, recipients without bank accounts |

| Cryptocurrency | Fast (Minutes to hours) | Low (Potentially very low) | Limited (Requires technical knowledge and digital wallets) | Tech-savvy users, accepting volatility |

Conclusion of Table: As you can see, each method has its advantages and disadvantages. Fintech platforms often provide the best balance of speed, cost, and convenience for smaller, regular transfers. Traditional banks or specialized foreign exchange services might be more suitable for larger amounts or more complex circumstances. Understanding the strengths and weaknesses of each method allows you to make informed decisions based on your specific requirements.

Decoding the True Cost of Your International Transfers

Sending money internationally from South Africa often involves more than just the advertised transfer fee. This section unpacks the various factors contributing to the total cost of your international money transfer. Understanding these hidden costs will empower you to make informed decisions and potentially save significantly.

The Rand's Volatility and Its Impact

The South African rand's fluctuating value against major currencies like the US dollar, British pound, and Euro plays a crucial role in the final cost of your transfer. This volatility can work for or against you. A weaker rand means you'll receive less of the target currency, effectively increasing the transfer cost. Conversely, a stronger rand results in receiving more of the target currency.

The rand's volatility against major currencies, especially the US dollar, significantly impacts international money transfers. As of early 2025, the rand weakened against the dollar, moving from around R17 to just under R19. This affects both exporters and importers. Exporters benefit from a weaker rand, while importers face higher costs.

For individuals and businesses making international transfers, understanding the associated fees is crucial. This includes upfront fees like SWIFT or processing fees, and the less obvious exchange rate 'spread' charged by providers. Managing these costs is essential for mitigating the impact of currency fluctuations. Discover more insights about managing currency exchange fees.

Unmasking the Hidden Fees

Many providers advertise low upfront fees to attract customers. However, hidden costs often affect the final amount received by your recipient. To compare different services effectively, explore a list of trusted platforms for online money transfer.

The Four Key Cost Components

Understanding these four components is essential for calculating the true cost of an international money transfer:

Upfront Transfer Fees: The fee charged by the provider for initiating the transfer. It's typically a fixed amount or a percentage of the transfer sum.

Exchange Rate Margins: Providers often add a margin to the mid-market exchange rate, profiting from the currency conversion. This margin can substantially impact the final amount received.

Intermediary Bank Charges: Some transfers, especially those through traditional banks, may involve intermediary banks. Each can deduct its own fees, reducing the final amount.

Recipient Bank Fees: The recipient's bank might also charge fees for receiving the transfer. These vary depending on the bank and country.

Strategies for Saving Money

By understanding the true cost of international money transfers from South Africa, you can minimize expenses. Strategies include comparing exchange rates, timing your transfers strategically, and considering different transfer methods. Even small adjustments can lead to significant savings over time.

Mastering South Africa's Exchange Control Regulations

Navigating international money transfers from South Africa can be complex. Many transfers are delayed or fail due to misunderstandings surrounding exchange control regulations. This section clarifies the South African Reserve Bank (SARB) framework governing your transfers, offering practical advice from compliance and forex professionals.

Understanding Your Allowances: SDA vs. FIA

Two key allowances define your annual transfer limits: the Single Discretionary Allowance (SDA) and the Foreign Investment Allowance (FIA). The SDA permits transfers up to R1 million annually without prior SARB approval. This covers various purposes, including gifts, travel, and supporting family abroad. The FIA, at R10 million annually, requires tax clearance from SARS. The FIA typically covers investments, overseas property purchases, and other significant financial commitments. Understanding the difference between these allowances is vital for smooth transfers.

Documentation Requirements: Ensuring a Seamless Transfer

Documentation requirements vary depending on the transfer amount and purpose. For smaller transfers within your SDA, your South African ID and proof of bank account are usually sufficient. Larger sums, particularly under the FIA, necessitate a Tax Compliance Status (TCS) PIN and a completed MP1423 form. Transferring inherited funds or buying property overseas often requires additional documents, such as a letter from the executor or proof of funds. Preparing the correct documentation upfront saves time and prevents delays.

SARB and SARS Verification: Demystifying the Process

SARB and SARS conduct verification processes, especially for transfers exceeding the SDA. These ensure compliance with exchange control regulations and tax laws. They typically verify your tax status, the source of funds, and the transfer's purpose. Complete and accurate documentation streamlines this process and avoids potential hold-ups.

Common Challenges and Solutions

South Africans often encounter obstacles with international fund transfers. Exceeding annual limits, transferring inherited funds, and navigating overseas property purchases present unique challenges. Exceeding your SDA requires a TCS PIN and completing the relevant SARB documentation before proceeding. Transferring inherited funds often involves providing supporting documents like a letter from the executor. Understanding these potential issues and preparing accordingly will help you navigate the process. While these processes may seem complex, they are designed to protect your interests and ensure regulatory compliance. Understanding the framework and preparing adequately ensures a smooth and successful international money transfer experience. Businesses seeking streamlined international payment management can explore platforms like Zaro, which offer simplified processes and transparent fees.

Your First International Transfer: A Step-by-Step Walkthrough

Making your first international money transfer from South Africa might seem complicated. This guide breaks down the process into manageable steps, offering practical advice to make it easier.

Preparing for Your Transfer: Essential Checklist

Before starting an international transfer from South Africa, gathering the necessary information and documentation is crucial. This preparation ensures a smooth and efficient transfer, much like packing for a trip makes the journey smoother.

Your Details: You'll need your South African ID, proof of address, and bank account details.

Recipient Details: Gather the recipient's full name, address, bank name and address, account number, and the correct international banking codes (SWIFT/BIC, IBAN if applicable). These codes act as a global address for bank accounts, ensuring your money reaches the correct destination.

Transfer Purpose: Clearly state the reason for the transfer (e.g., family support, education fees, investment). This is particularly important for larger transfers.

Tax Clearance Certificate: This certificate is required for transfers exceeding the annual Foreign Investment Allowance (FIA) of R10 million.

Executing Your Transfer: A Step-by-Step Guide

The process for making an international money transfer varies slightly based on the method you choose. Here’s a general overview:

Choose Your Method: Select a method that meets your needs, balancing speed, cost, and accessibility. Options include traditional banks, fintech platforms like Zaro, money transfer operators, and cryptocurrency.

Provide Information: Enter your details, the recipient's details, the transfer amount, and the purpose. Accuracy is vital, as errors can lead to delays or even transfer failure.

Verify and Confirm: Double-check all entered information before confirming the transfer to catch any potential mistakes.

Initiate Transfer: Once confirmed, the transfer process begins, and you'll usually receive a confirmation number or reference ID.

Tracking Your Transfer and Troubleshooting

After initiating the transfer, tracking its progress is essential. Most providers offer online tracking tools or email/SMS updates, allowing you to monitor the transfer's status and ensure it reaches the recipient.

Regular Monitoring: Check the transfer status periodically to stay informed, even though most transfers proceed without a hitch.

Contact Support: If you encounter problems or unexpected delays, promptly contact your provider's customer support.

Real-World Scenarios: Practical Examples

Let’s explore some practical examples:

Sending money to family in the UK: For smaller, regular transfers, using a fintech platform like Zaro is often the most cost-effective and convenient choice.

Paying for studies in Australia: For larger, one-time payments, researching specialized foreign exchange services or consulting your bank can help minimize fees and secure a favorable exchange rate.

Investing in the US: For substantial investment transfers, consulting a financial advisor and exploring specialized investment platforms is recommended. Ensure you comply with all applicable regulations, including the FIA and tax clearance requirements.

The following table outlines the necessary documentation required for different types and amounts of international money transfers from South Africa.

Required Documentation for International Transfers from South Africa

| Transfer Amount | Transfer Purpose | Documents Required | Processing Time |

|---|---|---|---|

| Up to R1 million | Family support | South African ID, proof of address, recipient's banking details | 1-3 business days |

| R1 million - R10 million | Education fees | South African ID, proof of address, recipient's banking details, proof of tuition fees | 2-5 business days |

| Over R10 million | Investment | South African ID, proof of address, recipient's banking details, Tax Clearance Certificate | 5-10 business days |

This table provides a general overview, and specific requirements might vary based on the provider and the nature of the transfer. Always confirm the necessary documentation with your chosen transfer provider.

Understanding these steps and potential challenges will help ensure a successful international money transfer from South Africa. Planning and selecting the right method can minimize costs and prevent unnecessary delays.

Money-Saving Strategies That Actually Work

Sending money abroad from South Africa? Many people focus on the lowest exchange rate. But real savings come from understanding the entire international money transfer process. Look beyond advertised rates and use smart strategies to maximize your Rands.

Comparing Providers Effectively

Comparing providers based only on the exchange rate can be deceptive. The true cost includes fees like transfer fees, intermediary bank charges, and recipient bank fees. A provider with a good exchange rate might have high transfer fees, canceling out any savings.

Use comparison tools that consider all cost factors. These tools calculate the total cost based on your transfer amount and destination, giving you a more accurate comparison. This is especially important for ZAR to GBP, USD, and EUR transfers, where small differences can have a big impact.

Timing Your Transfers Strategically

The Rand's value fluctuates, affecting how much your recipient receives. Transferring when the Rand is strong can save you money. Monitor exchange rates and use rate alerts. These alerts notify you when your desired exchange rate is reached.

For larger transfers, consider limit orders. You set a target exchange rate, and the transfer happens automatically when the rate is met. This can yield substantial savings, especially in volatile markets.

Optimizing Transfer Amounts

Transfer fees often depend on the amount sent. Some providers have tiered fee structures, with lower fees for larger transfers. Combining smaller transfers into one larger one might save money. But balance this against potential savings from smaller transfers within lower fee brackets.

Some platforms, like Zaro, offer zero spread and no SWIFT fees. This lets you transfer at the actual spot rate, optimizing cash flow and reducing overhead.

Choosing the Right Transfer Method

There's no single "best" method for international transfers from South Africa. The best choice depends on your priorities:

Speed: For fast transfers, consider money transfer operators or fintech platforms, even if fees are slightly higher.

Cost: For budget-conscious transfers, compare fees and rates across banks, fintech platforms, and even cryptocurrency (with its inherent risks).

Convenience: If convenience matters most, choose digital platforms with user-friendly interfaces and easy tracking.

Each transfer is unique. By analyzing your needs and using these strategies, you can significantly reduce the cost of your international money transfers from South Africa.

Are you a South African business looking for better international payment management? Explore Zaro today and transform your cross-border transactions.

Article created using Outrank