Sending Money Abroad from South Africa? Your 2025 Guide

Need to send money internationally from South Africa? This guide simplifies international money transfers by showcasing eight leading services available in South Africa for 2025. We'll help you identify the ideal platform to manage supplier payments, overseas expenses, or any cross-border transaction, saving you time and money. Find the most secure, efficient, and affordable option for your international money transfer South Africa needs with our breakdown of Zaro, Wise, WorldRemit, Western Union, Mukuru, PayPal, MoneyGram, and Remitly.

1. Zaro

For South African businesses wrestling with the complexities and costs of international money transfers, Zaro emerges as a game-changer. This innovative fintech platform offers a streamlined and significantly more affordable solution compared to traditional banking methods. Zaro prioritizes speed and cost-effectiveness, making it a compelling option for SMEs, exporters, CFOs, and BPO businesses operating within South Africa. By leveraging real, zero-spread exchange rates and eliminating SWIFT fees entirely, Zaro provides significant savings and predictable costs, a stark contrast to the often hidden markups and fluctuating fees associated with traditional banks.

Imagine a South African exporter regularly sending payments to suppliers in the US. With Zaro, they bypass the hefty SWIFT fees and unfavorable exchange rates imposed by banks. Instead, they benefit from the true mid-market exchange rate, resulting in substantial savings over time. Similarly, a South African BPO company receiving payments from international clients can utilize Zaro's dual currency accounts (ZAR and USD) to simplify fund management and minimize conversion costs. The platform's enterprise-grade security features, including multi-user access and customizable team permissions, ensure secure and controlled financial operations. Furthermore, Zaro issues debit cards in both ZAR and USD, enabling businesses to access competitive foreign exchange rates directly when making purchases abroad, further optimizing expenses.

Zaro’s streamlined Know Your Business (KYB) onboarding process ensures quick and compliant account setup. While pricing information isn't readily available on the website, the emphasis on zero-spread exchange rates and the absence of SWIFT fees strongly suggests significant cost advantages over traditional banking. The platform focuses on automating compliance and centralizing account management, effectively reducing operational overhead for businesses. Implementation is designed to be straightforward, although specific technical requirements are not detailed publicly.

Pros:

- Zero spread on exchange rates: Pay the real spot rate with no markup or hidden costs.

- No SWIFT fees: Eliminating traditional high banking charges on international transfers.

- Enterprise-grade security: Multi-user access and customizable team permissions.

- Convenient dual currency accounts (ZAR and USD): For seamless funding and payments.

- Issued debit cards in ZAR and USD: To leverage low FX rates for international purchases.

Cons:

- Currently available primarily for South African businesses: Limiting broader geographic accessibility.

- As a fintech startup: Some users might prefer waiting for wider adoption and additional country support.

While Zaro’s current focus on South African businesses might be a limitation for some, its innovative approach to international money transfers makes it a highly valuable tool for companies operating within the ZA region. For South African businesses seeking transparent, secure, and cost-effective international money transfer solutions, Zaro deserves serious consideration. You can learn more and explore their offerings on their website: https://www.usezaro.com

2. Wise (formerly TransferWise)

Wise has established itself as a leading platform for international money transfers, particularly appealing to South African businesses and individuals seeking cost-effective solutions. For South Africans engaged in international trade or needing to send/receive money across borders, Wise offers a compelling alternative to traditional banking systems, often plagued by high fees and unfavourable exchange rates. Their commitment to transparent pricing and user-friendly platform makes navigating the complexities of international finance simpler. Whether you're a small export business dealing with overseas clients or a CFO managing cross-border payments, Wise presents a valuable tool for streamlining your financial operations.

Wise stands out for its use of the mid-market exchange rate – the real exchange rate you find on Google or Reuters – and charges a transparent, upfront fee. This translates to significant savings, especially when compared to traditional banks which often hide markups within their exchange rates. The multi-currency account feature is particularly beneficial for South African businesses working with multiple international currencies, allowing them to hold and manage funds in different currencies within a single account. For example, a BPO business in South Africa outsourcing to the United States can receive USD payments directly into their Wise account, hold those funds, and then convert them to ZAR when needed, all at competitive rates. Moreover, Wise offers fast transfer speeds, with some transfers completing within minutes, crucial for businesses requiring agility in their financial transactions.

Features:

- Mid-market exchange rates: Get the real exchange rate, saving you money compared to banks.

- Transparent fee structure: Know exactly what you're paying upfront, no hidden charges.

- Multi-currency account: Hold and manage money in over 50 currencies.

- Fast transfers: Speed up your international payments with quick processing times.

- Regulated by the FSCA: Provides peace of mind knowing your funds are handled securely under South African regulatory oversight.

- Mobile app: Manage your transfers on the go with their user-friendly app.

Pros:

- Among the lowest fees in the market: Makes international money transfers more affordable.

- Transparent pricing: No surprises with hidden fees or unfavorable exchange rates.

- User-friendly platform: Easily navigate the platform and manage your transfers.

- Quick transfer times: Receive and send money faster compared to traditional banking methods.

Cons:

- Limited cash pickup options: May not be suitable for all recipient scenarios.

- Some transfer limitations from South Africa: Certain currencies or transfer types might have limitations for South African users, so it's crucial to check their website for specific details.

- Not all currencies supported: While Wise supports a wide range of currencies, it's advisable to confirm availability for your specific needs.

Implementation Tips:

Setting up a Wise account is straightforward. Visit the Wise website and follow the registration process. You’ll need to provide identification for verification purposes, a standard procedure for financial institutions. Once your account is verified, you can initiate transfers by specifying the recipient, amount, and currency. The platform will clearly display the applicable fees and the amount your recipient will receive before you confirm the transfer.

Wise deserves its place on this list because it provides a transparent, cost-effective, and user-friendly solution for international money transfers in South Africa. It is particularly beneficial for businesses and individuals looking to avoid the high fees and opaque exchange rates often associated with traditional banks. While it has some limitations regarding cash pickup and certain currency pairings, its overall value proposition for international money transfer south africa makes it a strong contender.

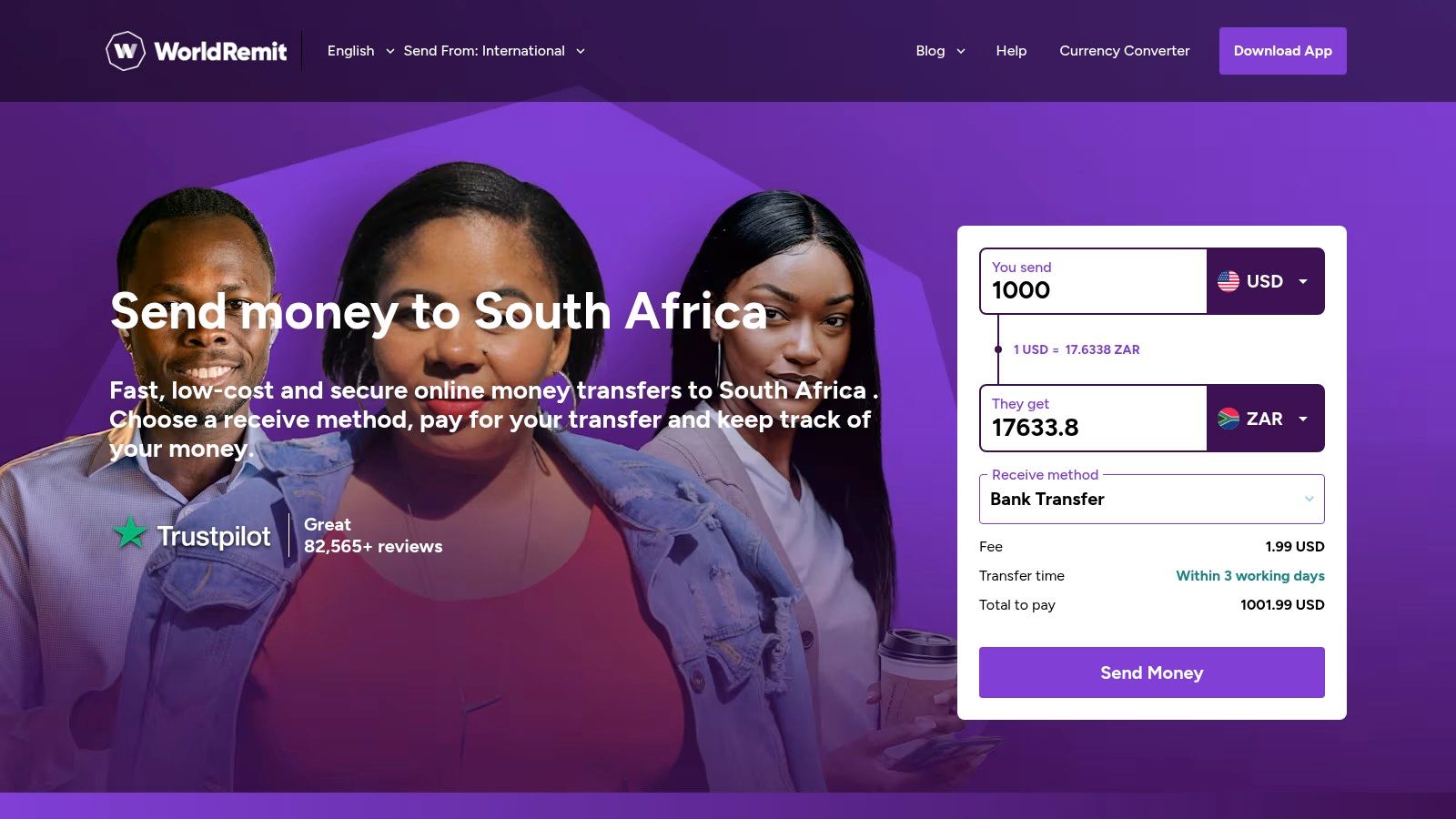

3. WorldRemit

WorldRemit is a leading digital money transfer service catering specifically to the needs of individuals sending money abroad. For South Africans looking to conduct international money transfers, particularly to other African countries, WorldRemit offers a compelling solution. Its focus on remittances makes it an ideal choice for regular smaller transfers, such as supporting family members or paying for services overseas. While its strengths lie in its extensive network across Africa and convenient mobile platform, understanding its fee structure and exchange rates is crucial before making a transfer. This makes it a valuable tool for South African businesses managing cross-border payments, especially those with operations or clients in other African nations. BPO businesses operating in South Africa can also benefit from its quick and easy transfer methods for paying remote workers.

WorldRemit differentiates itself by offering various payout options, including bank deposits, mobile money (essential in many African markets), airtime top-up, and cash pickup. This flexibility allows you to choose the most convenient method for the recipient. For example, a South African business paying freelancers in Kenya can use mobile money, while another sending funds to a supplier in Nigeria might opt for a bank transfer. This platform offers real-time tracking, giving you and your recipient visibility over the transfer's progress, adding a layer of transparency and security that is crucial for international transactions. Processing times are also a significant advantage, with many transfers completed within minutes, particularly for mobile money and airtime top-ups. This speed can be a critical factor for time-sensitive payments.

While WorldRemit shines with its broad network and African focus, it's important to consider the associated costs. While often competitive for African corridors, exchange rates and fees can vary significantly depending on the destination and payout method. For South African SMEs and CFOs seeking FX transparency, it's essential to compare WorldRemit's offerings with other specialized services before committing to a large transfer. The platform's user-friendly mobile app simplifies the transfer process, offering a convenient solution for those regularly sending money overseas. While the first transfer often comes with a discount for new users, it's crucial to analyze the long-term costs based on your specific transfer needs. Some users have reported occasional delays in the verification process, which is something to keep in mind if time is of the essence.

Key Features for South African Users:

- Multiple payout methods: Bank transfers, mobile money, airtime top-up, and cash pickup.

- Strong African network: Excellent coverage across numerous African countries.

- Real-time tracking: Monitor your transfers every step of the way.

- Fast processing: Many transfers are completed within minutes.

- User-friendly mobile app: Manage your international money transfers on the go.

Website: https://www.worldremit.com/en/south-africa

WorldRemit earns its place on this list by providing a convenient and reliable platform for international money transfers from South Africa, particularly to other African nations. Its strengths lie in its extensive network, multiple payout options, and fast processing times. However, users should carefully consider the fees and exchange rates associated with their specific transfer requirements. This makes WorldRemit a practical and valuable option for individuals and businesses needing to send money abroad, especially within the African continent.

4. Western Union

Western Union is a well-known name in international money transfers, and for South African businesses engaged in cross-border transactions, it offers a reliable, albeit sometimes pricey, option. Its extensive global network makes it particularly appealing for sending money to locations with limited banking infrastructure, a key consideration for businesses dealing with suppliers or clients in remote areas. For South African companies operating across the African continent, this widespread reach can prove invaluable.

Western Union's strength lies in its expansive network of over 500,000 agent locations globally, enabling cash pickups in almost every country. This is particularly advantageous for South African SMEs working with partners who may not have readily accessible bank accounts. Imagine a South African export company needing to quickly pay a supplier in a rural part of another African country. Western Union’s cash pickup option provides a practical solution, facilitating timely payments and maintaining crucial business relationships. They offer multiple transfer options – online, in-person through their agent network (including partnerships with major South African retailers and banks), and via their mobile app. Real-time transfers are available for numerous destinations, providing speed and efficiency for urgent transactions. A robust money transfer tracking system allows both sender and receiver to monitor the transfer's progress, adding an extra layer of security and peace of mind.

While Western Union's global reach and cash pickup options are significant advantages, it's essential to be aware of the associated costs. Their fees are generally higher compared to newer, digital-first international money transfer providers. The exchange rates offered may also be less competitive. For larger transactions, these higher fees can significantly impact a company’s bottom line. Additionally, while functional, the website and app experience may not be as seamless and user-friendly as some of its more modern competitors. CFOs in South Africa looking for optimal FX transparency might find the fee structure less transparent compared to some online platforms.

For South African BPO businesses outsourcing to South Africa or managing international payroll, Western Union's diverse payout options could be beneficial, particularly when dealing with employees who prefer cash payments. However, for larger payroll transactions, the higher fees might make other providers a more cost-effective choice.

Key Features and Benefits for South African Businesses:

- Unmatched Global Reach: Ideal for businesses operating across Africa or other regions with limited banking infrastructure.

- Instant Cash Pickup: Facilitates swift payments to recipients without bank accounts.

- Multiple Transfer Options: Flexibility for businesses to choose the method that suits their needs.

- Transfer Tracking: Enhanced security and transparency for both sender and recipient.

Implementation Tip: Compare Western Union's fees and exchange rates with other providers before initiating a transfer, especially for larger sums. While the convenience and reach are unmatched, ensuring cost-effectiveness is crucial for businesses.

5. Mukuru

Mukuru earns its place on this list of international money transfer options from South Africa due to its deep understanding of the African market and its specialized services tailored to the region. If you frequently send money to other African countries, particularly within Southern Africa, Mukuru offers a compelling solution, especially for transfers involving recipients who may not have traditional bank accounts. This makes it a valuable tool for South African businesses with operations or clients in other African nations, as well as individuals sending remittances to family and friends.

Mukuru distinguishes itself with its focus on accessibility and affordability for international money transfers within Africa. They offer multiple payout options catering to varying needs, including cash collection, direct bank deposits, and mobile wallet transfers. This flexibility is crucial in a continent where access to formal banking services can be limited. Their USSD service further expands accessibility, enabling customers without smartphones or reliable internet access to send and receive money. The Mukuru Card provides recipients with a convenient way to access transferred funds, offering an alternative to traditional banking.

For South African businesses, particularly SMEs and exporters working within Africa, Mukuru's deep understanding of local markets provides a significant advantage. Their extensive agent network throughout Southern Africa facilitates smooth transactions and offers reliable support for both senders and recipients. This local expertise can be invaluable in navigating the complexities of cross-border payments within the region. CFOs seeking greater FX transparency will appreciate Mukuru's focus on clear pricing and dedicated customer support. BPO businesses outsourcing to South Africa, or those managing cross-border payroll within Africa, could also find Mukuru's services beneficial for streamlined and cost-effective salary payments.

Features:

- Specialized in African corridors: Mukuru's expertise in African markets allows them to offer tailored services and competitive rates for transfers within the continent.

- Multiple payout options: Choose from cash collection, bank deposit, and mobile wallet transfers based on the recipient's needs.

- USSD service: Enables transactions for customers without smartphones or consistent internet access.

- Mukuru Card: Provides recipients with a convenient way to access and manage their funds.

- Extensive agent network: Offers widespread access and reliable support across Southern Africa.

Pros:

- Competitive rates for African corridors: Often offers better rates than larger international transfer services for transfers within Africa.

- Services designed for African market needs: Caters specifically to the unique requirements of the African market, including options for the unbanked.

- Strong focus on customer education and support: Provides resources and assistance to help customers navigate the process.

- Options for unbanked customers: Offers accessible solutions for those without traditional bank accounts.

Cons:

- Limited global coverage outside Africa: Not suitable for transfers outside the African continent.

- Digital platform not as advanced as some competitors: While functional, the online platform may not offer the same level of sophistication as some global providers.

- Transfer speeds can vary depending on destination: Transfer times can fluctuate depending on the specific countries involved.

Website: https://www.mukuru.com/za/

While pricing information isn't readily available on the website and requires a quote based on specific transfer details, Mukuru is generally considered a cost-effective option for international money transfer south africa within the African continent. Setting up an account is straightforward and involves standard KYC (Know Your Customer) procedures. Compared to global players like Wise or WorldRemit, Mukuru shines when your focus is specifically on African corridors, offering localized service and tailored solutions for this market. If your international money transfer needs extend beyond Africa, however, you might need to consider alternative providers for those transactions.

6. PayPal

PayPal is a well-known online payment platform that also offers international money transfer South Africa services, enabling users to send money to over 200 countries. For South African businesses, particularly those involved in e-commerce or dealing with international clients, PayPal can be a convenient option for receiving and sending payments. While it offers a familiar and user-friendly interface, it's important to be aware of its limitations and fee structure compared to other international money transfer services available in South Africa.

For small and medium-sized South African export companies, PayPal can facilitate cross-border transactions with relative ease. The ability to send to anyone with an email address simplifies the payment process, and its wide acceptance by online merchants globally makes it a practical choice for both business-to-business (B2B) and business-to-consumer (B2C) transactions. BPO businesses outsourcing to South Africa can also utilize PayPal for seamless payment processing to their South African workforce.

One key feature for South African users is the integration with FNB bank accounts. This allows for easier deposits and withdrawals, although it limits withdrawal options compared to other countries where PayPal offers broader bank integration. While convenient, this FNB exclusivity can be a constraint for businesses banking with other institutions. CFOs looking for FX transparency should carefully consider PayPal's exchange rates, which can be less favorable than specialized money transfer services. The fees, while transparent, are also generally higher.

Setting up a PayPal account is straightforward. You'll need to provide your personal and financial information, link your FNB bank account, and verify your identity. The mobile app provides convenient access for on-the-go transfers and account management.

Pros:

- Widely recognized and trusted globally: This makes it easier to conduct business internationally, as many customers and vendors are familiar with and trust PayPal.

- Easy to use for recipients already on PayPal: Transfers are quick and simple when both parties have existing PayPal accounts.

- Good for business payments and e-commerce: Its integration with online platforms and buyer/seller protection policies make it a popular choice for online businesses.

- Strong security features: PayPal employs advanced security measures to protect user accounts and transactions.

Cons:

- Higher fees and less favorable exchange rates than specialized money transfer services: This can impact profitability, particularly for businesses making frequent international transfers.

- South African PayPal accounts have more restrictions than in other countries: Limited bank integration and other features can be frustrating for South African users.

- Withdrawal to local banks limited to FNB partnership: This restricts access for users who bank with other institutions.

- Customer service can be difficult to reach: Getting assistance can sometimes be challenging, which can be problematic if issues arise.

Website: https://www.paypal.com/za/home

Despite its limitations, PayPal earns its spot on this list due to its global recognition, ease of use for online transactions, and integration with FNB. However, South African businesses should carefully consider the fees and exchange rates and explore alternative solutions if cost-effectiveness is a primary concern. For businesses prioritizing convenience and widespread acceptance over optimal exchange rates, PayPal remains a viable option for international money transfer South Africa.

7. MoneyGram

MoneyGram is a well-established player in the international money transfer South Africa market, offering a blend of digital and traditional transfer methods that cater to a broad range of needs. This makes it a practical option for South African businesses, particularly those dealing with international clients or suppliers in regions with limited banking access. Whether you need to pay a supplier in a remote location or send funds to a family member abroad, MoneyGram's extensive network makes it possible. It's particularly relevant for SMEs and CFOs seeking practical, albeit not always the cheapest, solutions for international transfers.

One of MoneyGram's key strengths lies in its vast global agent network, comprising banks, post offices, and retail locations. This allows recipients to collect cash physically, which is invaluable when dealing with countries where bank accounts are not commonplace. For South African export companies working with businesses in developing markets, this feature can be a significant advantage. BPO businesses with outsourced staff in regions with limited banking infrastructure will also find this useful. This extensive reach distinguishes MoneyGram from some digital-only providers and justifies its place on this list.

MoneyGram offers multiple ways to send money: online through their website, via their mobile app, or in person at an agent location. This flexibility allows users to choose the method most convenient for them. While their online and mobile app options offer speed and convenience, their physical locations provide a more personal approach for those who prefer it. The MoneyGram Plus Rewards program offers benefits to frequent users, such as discounted fees, making it potentially attractive for businesses with regular international transfer needs. Their real-time transfer tracking system provides transparency and peace of mind.

While MoneyGram's wide reach and cash pickup options are significant advantages, it's important to be aware of its drawbacks. Fees tend to be higher compared to digital-first international money transfer providers, and their exchange rates might not be as competitive as those offered by specialist currency exchange services. Maximum sending limits can also apply, which could be restrictive for larger transactions. Finally, using their in-person services can involve queuing, which can be time-consuming. For larger sums or regular transfers, CFOs looking for FX transparency should compare MoneyGram's offering with specialist FX providers to ensure they're getting the best rates.

Key Features:

- Extensive agent network for cash pickups globally

- Online and mobile app transfer options

- Real-time transfers to many destinations

- Plus Rewards program for frequent users

- Transfer tracking system

Pros:

- Wide global reach with cash pickup options

- No recipient bank account needed for cash collection

- Fast transfer speeds, often within minutes

- Multiple ways to send money (online, in-person, via app)

Cons:

- Higher fees than digital-first providers

- Exchange rates less competitive than specialist services

- Maximum sending limits may apply

- In-person service can involve queuing

Website: https://www.moneygram.com/mgo/za/en/

8. Remitly: A Digital Solution for International Money Transfers from South Africa

Remitly is a rapidly growing digital money transfer service making waves in the international money transfer South Africa landscape. Designed for speed and transparency, Remitly offers a compelling option for businesses and individuals needing to send money abroad, particularly for those prioritising clear pricing and a user-friendly experience. This newcomer to the South African market is focused on providing fast, secure, and affordable international money transfers, making it a noteworthy contender for your business needs.

How Remitly Works for South African Businesses:

Remitly caters to a variety of use cases for South African businesses:

- Paying international suppliers: Small and medium-sized export companies can use Remitly to efficiently pay suppliers abroad, benefiting from competitive exchange rates and transparent fees. This is particularly relevant for businesses working with suppliers in countries where Remitly has a strong presence.

- Managing offshore teams: BPO businesses outsourcing to South Africa, or South African businesses with international teams, can utilize Remitly for payroll and other cross-border payments. The speed and reliability of transfers ensure timely payments, boosting employee satisfaction.

- Cross-border investments and transactions: For businesses engaging in international investments or other cross-border transactions, Remitly provides a secure and convenient platform for transferring funds.

Features and Benefits:

Remitly distinguishes itself with its focus on user experience and transparent pricing:

- Choice of Speed and Cost: You can choose between Express and Economy transfer options. Express delivers funds quicker at a slightly higher cost, while Economy provides a more cost-effective solution for less time-sensitive transfers. This flexibility allows businesses to balance speed and cost based on their specific needs.

- Transparent Pricing: Remitly emphasizes upfront pricing and its "price promise guarantee," eliminating hidden fees. This transparency is particularly valuable for CFOs in South Africa seeking better FX transparency and control over international transaction costs.

- Real-time Tracking and Notifications: Monitor your transfer's progress with real-time tracking and notifications. This feature provides peace of mind and allows for proactive communication with recipients.

- Multiple Payout Methods: Remitly offers various payout methods, including bank deposit, cash pickup, and mobile money, providing flexibility for recipients based on their location and preferences.

- User-Friendly Mobile App: Remitly’s mobile app has garnered positive reviews for its ease of use and intuitive interface. Managing transfers on the go simplifies the process, making it convenient for busy business owners and executives.

Pros and Cons:

While Remitly offers several advantages, it's essential to consider the potential drawbacks:

Pros:

- User-friendly mobile app with good ratings

- Competitive exchange rates compared to traditional banks

- Strong customer service with 24/7 support

- Clear delivery time estimates

Cons:

- Relatively newer to the South African market, with infrastructure still developing

- Coverage may not be as extensive as some well-established competitors like WorldRemit or TransferWise (now Wise)

- Transfer limits may be lower for new customers until the verification process is completed, which can take time.

Getting Started with Remitly:

Setting up an account with Remitly is typically straightforward. You’ll need to provide some personal and financial information for verification purposes. Be aware that initial transfer limits may apply until your account is fully verified. Take advantage of any first-transfer promotions for new customers.

Why Remitly Deserves its Place on this List:

Remitly's focus on transparency, user-friendliness, and competitive pricing makes it a valuable addition to the list of international money transfer options available in South Africa. While its network might not be as expansive as some older players, its commitment to customer service and technological innovation positions it as a strong contender, especially for businesses seeking a modern and efficient digital solution.

Remitly Website

Top 8 International Money Transfer Services Comparison

| Provider | Core Features / Security | User Experience / Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| 🏆 Zaro | Zero spread FX, no SWIFT fees, dual ZAR/USD accounts, bank-level security | Streamlined KYB, multi-user access ★★★★ | Transparent, no hidden fees 💰💰💰 | South African SMEs, exporters, CFOs 👥 | Issued debit cards, enterprise controls ✨ | Low cost, zero spread |

| Wise | Mid-market rates, multi-currency acct, FSCA regulated | Fast transfers, user-friendly app ★★★★ | Low fees, transparent pricing 💰💰 | Broad personal & business users 👥 | Multi-currency holding, fast transfers | Competitive pricing |

| WorldRemit | Multiple payout methods, strong Africa coverage | Real-time tracking, good support ★★★ | Competitive for African corridors 💰💰 | Individuals sending small remittances 👥 | Cash pickup/mobile money, wide payout options | Moderate fees |

| Western Union | Extensive global network, cash pickup worldwide | Instant cash pickup, trusted brand ★★★ | Higher fees, less competitive FX 💰 | Recipients needing cash pickup 👥 | Largest agent network, flexible delivery | Higher fees |

| Mukuru | African corridors specialist, USSD service | Designed for unbanked users ★★★ | Competitive rates in Africa 💰💰 | African consumers, unbanked users 👥 | USSD access, Mukuru Card, agent network | Affordable for Africa |

| PayPal | Bank integration (FNB), buyer & seller protection | Easy e-commerce payments ★★★ | Higher fees, limited SA features 💰 | Online merchants, business users 👥 | Wide merchant acceptance | Higher fees & FX margins |

| MoneyGram | Global agent network, rewards program | Fast, multiple sending options ★★★ | Higher fees, less competitive FX 💰 | Cash pickup users, broad demographics 👥 | Rewards program, in-person & digital service | Moderate to high fees |

| Remitly | Express & Economy options, price guarantee | User-friendly, 24/7 support ★★★★ | Competitive vs banks 💰 | New customers, budget conscious 👥 | Transfer speed choice, transparent pricing | Affordable with options |

Choosing the Right International Money Transfer Service

Navigating the world of international money transfer from South Africa can feel complex, but with the right tools and information, it doesn't have to be. This article has explored eight key players in the market – Zaro, Wise, WorldRemit, Western Union, Mukuru, PayPal, MoneyGram, and Remitly – each offering a unique blend of features and benefits. The most important takeaways are to carefully compare exchange rates, factor in all fees (including hidden ones!), consider the speed of transfer required for your transactions, and prioritize reliable customer support. For South African businesses, especially SMEs, exporters, BPOs, and CFOs seeking FX transparency, these factors can significantly impact your bottom line.

When choosing a service for international money transfers, security and reliability are paramount. For more insights on secure online transfer options, see this article on trusted online money transfer platforms from CLDY. Your choice will ultimately depend on your specific business needs. If you prioritize speed and low fees for smaller transactions, a service like Wise or WorldRemit might be a good fit. For larger transfers, or those requiring robust business features, platforms like Zaro or PayPal might be more suitable. Always research and compare multiple options before making a decision.

Ultimately, efficient and cost-effective international money transfer is crucial for success in today’s globalized economy. Streamline your financial operations and unlock new possibilities for your business by selecting the right tool for your international money transfer needs in South Africa. Looking for a seamless and transparent way to manage your international payments? Explore Zaro, a platform designed for efficient and cost-effective cross-border transactions. Visit Zaro today to learn more.