For any South African business working with international suppliers or clients, sending money overseas can feel like a slow, expensive headache. We’ve all been there—stuck with the high fees, confusing exchange rates, and sluggish processing times that come with traditional banking. It's a process that creates more friction than it should.

Why Foreign Payments Are a Challenge for South African Businesses

As a business in South Africa, sending money abroad means you're not just making a payment; you're navigating a labyrinth of regulations and trying to predict costs that never seem straightforward. For too long, the only real option was to use old-school banking systems that simply weren't designed for the speed today's global commerce requires.

This outdated approach comes with a familiar set of problems. Even the South African Reserve Bank (SARB) has pointed out that high costs, slow speeds, and a general lack of clarity are major hurdles in our region's cross-border payment landscape. It's exactly these issues that global initiatives are now trying to fix. If you want to dive deeper, the SARB's official publication has some great insights into how payment infrastructures are evolving.

The Old Way vs The New Way

For many companies, these pain points are a daily reality. Hidden markups on currency exchange rates quietly eat into your profit margins on every single international invoice. A transfer that takes days to clear can mean delayed shipments and stressed supplier relationships. On top of that, trying to make sense of complex compliance rules can feel like a full-time job you never signed up for.

The real cost of a foreign money transfer isn't just the fee you see on the statement. It's the hidden currency conversion markups, the administrative hours wasted, and the opportunities lost due to slow payments.

This is where the new wave of fintech solutions like Zaro comes in. They were built from the ground up to solve these exact problems, offering a clear, fast, and efficient alternative. When you put the old and new ways side-by-side, it's easy to see why so many businesses are making the switch.

Thinking about the differences, a few things really stand out:

- Exchange Rates: Banks often build a hefty spread into the mid-market rate, which is a hidden cost. Modern platforms, on the other hand, give you access to the real rate with a simple, upfront fee.

- Transfer Speed: An international bank transfer can easily take up to five business days. In contrast, a fintech platform can often get the same payment delivered in just 24-48 hours.

- Compliance: Instead of leaving you to figure it out alone, fintech platforms automate a lot of the SARB documentation and reporting, guiding you through the process step by step.

Traditional Banks vs Modern Fintech for Foreign Transfers

To truly understand the difference, let’s break down how these two approaches stack up when it comes to the features that matter most for your business.

| Feature | Traditional Banks | Modern Fintech Platform |

|---|---|---|

| Exchange Rate | Often includes a hidden markup or "spread" | Provides access to the real mid-market rate |

| Fees | Multiple fees (transfer, correspondent, receiving) | Typically a single, transparent, low percentage fee |

| Speed | 3-5 business days, sometimes longer | Often within 24-48 hours |

| Transparency | Low; final cost is often unclear upfront | High; you see the exact rate and fee before you send |

| Compliance | Manual, requires you to handle most paperwork | Automated and guided process, simplifying SARB reporting |

| User Experience | Often complex, branch visits may be needed | Fully digital, intuitive online platform |

The comparison makes it clear: while banks have been the go-to for decades, their model for international payments wasn't built for the efficiency and transparency modern businesses need. Fintech platforms are closing that gap by putting speed, clarity, and control back in your hands.

Getting Your International Payment Account Set Up

Jumping into a new platform to handle your company’s overseas payments might seem like a chore, but it’s actually quite straightforward. The initial onboarding is designed to be quick, though a little preparation can make all the difference between getting it done in minutes versus facing frustrating delays.

Think of it like getting your ducks in a row before a big meeting. Before you even start the sign-up process, it’s a good idea to gather your essential business documents. This isn’t just about ticking boxes; it’s a critical step for staying compliant and keeping your account secure right from the start.

Nailing the Verification Process

To get your account verified without a single hitch, you’ll need a few key documents ready to go. This verification, often called Know Your Business (KYB), is how financial platforms confirm your company's identity – it’s a legal requirement, not just a formality.

Here’s a practical checklist of what you should have on hand:

- Company Registration Papers: Your official CIPC (Companies and Intellectual Property Commission) registration certificate is a must-have.

- Proof of Business Address: A recent utility bill or a bank statement works perfectly, just make sure it’s less than three months old and clearly shows your business's physical address.

- Director and Shareholder IDs: You’ll need a clear, valid copy of the identity document for every director and any major shareholders.

Expert Tip: Take a moment to scan your documents into high-quality PDFs before you begin. Having clear, legible digital copies ready to upload can genuinely slash your verification time from a few days down to a matter of hours.

Once your documents are submitted and your business profile gets the green light, the last step is to link your company’s South African bank account. This is how you’ll fund your Zaro wallet with ZAR to start making payments. It’s a simple process, usually just an EFT from your business account to the new Zaro account details provided.

Getting this initial setup done right lays a secure and compliant foundation for every international money transfer you’ll make.

Getting Your First International Payment Sent

Right, your Zaro account is topped up and ready to go. This is where you’ll really feel the difference between the old way of doing things and using a modern platform. What used to be a mountain of paperwork and opaque fees now boils down to just a few clicks.

First things first: you need to set up who you're paying. We call them beneficiaries.

Adding Your Beneficiary and Getting the Details Right

Adding a new person or business to pay is straightforward, but it’s one of those times when you need to be precise. Get this part wrong, and you’re looking at frustrating delays.

You'll need their full business name and address, plus their banking details. For almost any international payment, that means having their SWIFT/BIC code and their IBAN (International Bank Account Number). I can't stress this enough: double-check every single digit. A simple typo can cause the payment to fail and bounce back, which costs you both time and money.

Locking in Your Rate and Sending the Money

Let's run through a quick, practical example. Say you have an invoice for $1,000 to pay a supplier in the US.

Once you’ve saved their details, you just punch in the payment amount – $1,000 USD. Instantly, the platform will show you a live exchange rate, calculating the exact Rand equivalent you'll pay, along with a clear, upfront fee. No guesswork involved.

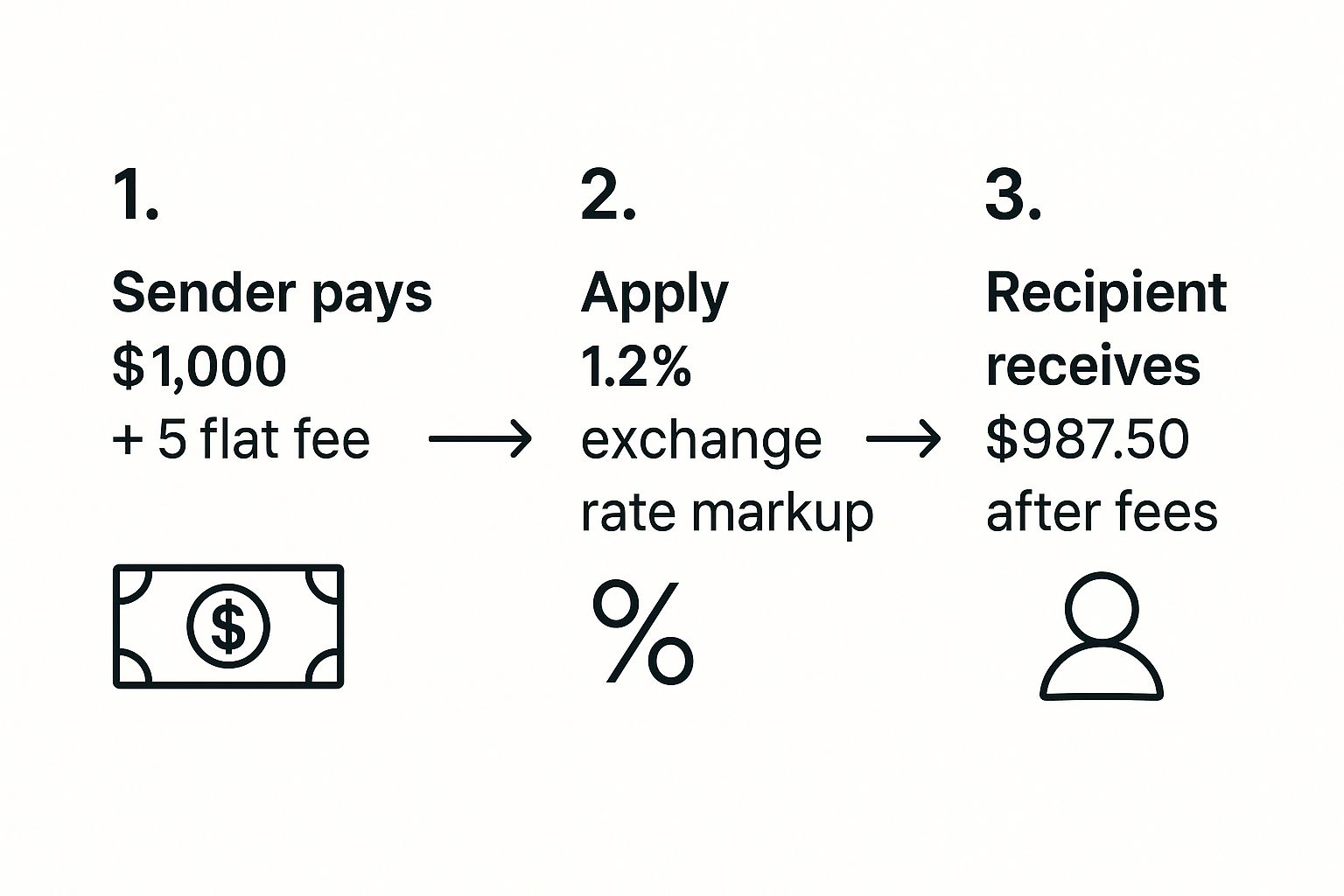

This visual shows just how much small fees and hidden markups can eat into the final amount your supplier receives.

As you can see, even tiny percentage-based markups, when added to flat fees, directly shrink the money that actually lands in their account.

With Zaro, you get a short window to "lock in" the rate you see on screen. This is a game-changer. It means you're protected from the currency market's constant ups and downs while you confirm the payment. Once you hit 'confirm', the funds are taken from your ZAR wallet, converted, and sent on their way.

A Note on Timing: While fintech platforms move at lightning speed, we're still connected to the traditional banking system, which has its own pace. In South Africa, foreign currency transfers can take anywhere from 1 to 5 business days to clear. It’s also worth remembering that daily sending limits can vary quite a bit between banks. If you're curious about the specifics, it's worth reading up on the details of large amount transfers for South Africans to see how different banks stack up.

The moment the payment is sent, you'll get a confirmation. From there, you can track its entire journey right from your dashboard, giving you total peace of mind until your supplier confirms the funds have arrived.

Navigating SARB Compliance and Regulations

When you're sending money out of South Africa, you're not just making a payment—you're working within the rules set by the South African Reserve Bank (SARB). These aren't just arbitrary bits of red tape. They are exchange controls put in place to manage the flow of capital in and out of the country, and for any business, getting to grips with the basics is absolutely essential.

At the core of it all is one simple principle: every payment leaving the country needs a legitimate reason. You can't just send funds abroad without proof of what it's for. This is precisely where a platform like Zaro simplifies things by building the compliance checks right into the payment workflow.

As you set up a transfer to an international supplier, for instance, the system will prompt you to upload the corresponding invoice. It’s a straightforward, integrated step that ensures you're meeting SARB's requirements without having to become a forex expert. Better yet, it creates a digital paper trail for every single transaction, which keeps your records spotless and audit-ready.

Making Allowances and Reporting Easy

While individuals get a Single Discretionary Allowance (SDA), businesses play by a different set of rules that are all about legitimate trade. The fundamental principle, however, is the same: every payment for goods or services needs the right documentation.

The real value of modern fintech isn't about finding ways around regulations; it's about making it effortless to stick to them. By automating document collection and reporting, these platforms remove the administrative headache, so you can concentrate on running your business, not wrestling with compliance forms.

The scale of these international payments is massive. Remittance flows to developing nations worldwide are expected to hit around $690 billion. South Africa is a significant player in this, especially within the Southern African Development Community (SADC), which underscores our country's importance in regional finance. If you're interested in the bigger picture, you can learn more about the evolution of the money transfer market.

Smart Strategies for Optimising Your International Payments

Once you've got the hang of the basics, it’s time to get a bit more strategic with your international payments. You can move beyond just reacting to invoices as they land and start actively managing your currency risk. This is how you protect your profit margins from the wild swings of the foreign exchange (FX) market.

Essentially, you're turning an unavoidable business cost into a smartly managed part of your financial plan.

A simple but incredibly effective first move is setting up rate alerts. Instead of manually checking the ZAR/USD or ZAR/EUR rate every day, let Zaro do the work for you. Just set an alert for a target rate you’re happy with, and you'll get a notification the moment it hits. This means you can fund your account or lock in a payment at a far more favourable moment, without being glued to the market.

Protecting Your Business from Volatility

For bigger or more frequent payments, you’ll probably want more certainty than a simple rate alert can provide. Let’s say you have to pay a supplier $50,000 in three months. The big worry? The Rand could weaken by then, and that $50,000 invoice could suddenly cost you a whole lot more.

This is a textbook case for using a forward contract. It’s a tool that lets you lock in today’s exchange rate for a payment you need to make down the line.

- You agree on the exchange rate now for a transaction happening in the future.

- It completely removes the risk of the market turning against you.

- Your costs are now predictable, which makes budgeting and cash flow planning a breeze.

Using forward contracts turns your currency exposure from a gamble into a calculated business decision. You’re no longer hoping for a good rate; you’re guaranteeing one.

Keeping Your Records Spotless

Finally, remember that clever payment management doesn't stop once the money is sent. Keeping clean, accurate records for every single transaction is absolutely essential for your accounting and, of course, for SARS.

Every international money transfer should be logged with its matching invoice, the exact exchange rate you secured, and any fees you paid. Beyond just logging the payment, effective account reconciliation is crucial for keeping your books in order.

Using a platform that automatically saves all this information for you is a lifesaver. It creates a clear, audit-ready trail that will save your bookkeeper hours of work and make your financial reporting much less of a headache.

Got Questions About International Payments? We've Got Answers.

Stepping into the world of international payments can feel a bit like learning a new language. There are rules, jargon, and a whole lot of questions. If you're a South African business owner, getting a handle on the specifics of a money transfer foreign transaction is non-negotiable for smart financial management. Let's tackle some of the most common questions we hear from business owners just like you.

What’s Genuinely the Fastest Way to Send Money Abroad?

We all know the drill with traditional banks – you send a payment and then wait. And wait. That process can take anywhere from one to five business days, which feels like an eternity in business.

This is where specialised platforms like Zaro really shine. Because we’re built on modern payment rails and have compliance baked right into our system, we cut out the delays. Most transfers are wrapped up within 24 to 48 hours. For some currency routes, it can be even quicker.

What Paperwork Will I Need for a Business Transfer?

Sending money out of South Africa for business means you have to play by the South African Reserve Bank's (SARB) rules. The big one? You need a valid reason for the payment. This sounds intimidating, but it’s actually quite straightforward.

You'll just need to have your supporting documents ready. Think of things like:

- A commercial invoice from your international supplier.

- A signed contract for services you're paying for.

A good platform will simply ask you to upload these during the payment process. It's less of a hurdle and more of a quick, seamless step to keep everything above board.

If there's one piece of advice I can give, it's this: always be ready to show why you're making a cross-border payment. Keep your invoices and contracts organised, and every international transfer will be a smooth, compliant, and genuinely stress-free experience.

How Do I Actually Get the Best Exchange Rate?

Securing a great exchange rate isn't about luck; it's about avoiding the hidden costs. Most people just accept the rate their bank gives them, not realising it often has a hefty markup baked in.

The smarter move is to use a platform that gives you the real mid-market exchange rate and charges a small, transparent fee on top. That way, you know exactly what you're paying. You can also get tactical by setting up rate alerts to ping you when the ZAR strengthens. For those larger, planned payments, it's worth looking into locking in a rate with a forward contract to protect your budget from market swings.

Ready to take control of your international payments with transparent rates and faster transfers? Zaro gives your business the tools to send and receive money globally without the hidden fees. Get started with Zaro today.