Understanding MT4 Swap Fees Without The Confusion

Let's discuss MT4 swap fees, a topic that can often seem unnecessarily complex, particularly for traders in South Africa. These fees, also known as rollover or overnight fees, are charged when a trade is held open past a specific time, typically 5 pm EST. This effectively means "rolling over" the position to the next trading day.

Why Do Swap Fees Exist?

Think of it like borrowing money to buy a house. Interest is paid on that loan. Similarly, in forex trading, one currency is essentially borrowed to purchase another. The MT4 swap fee reflects the interest rate differential between the two currencies. Interestingly, if a low-interest currency is borrowed to buy a high-interest one, a swap might actually be earned.

How Are MT4 Swap Fees Calculated?

The calculation involves several key factors: the current interest rates of both currencies in the pair, the trade volume (measured in lots), and whether the position is long or short. For example, if trading USD/ZAR and holding a long position overnight, ZAR is essentially being borrowed to buy USD. The swap fee will depend on the difference between the South African Reserve Bank's repo rate and the US Federal Reserve's interest rate.

Swap Fees in the South African Context

The MT4 swap fee is a crucial element within the Southern African trading landscape. While specific regional swap fees aren't extensively documented, South African traders often utilize global benchmarks like those provided by MT4's swap calculations. For example, the swap fee for holding a position in EUR/USD can fluctuate considerably based on whether the position is long or short.

Practical Examples of Swap Fees

Consider a few examples. Suppose a trader is long 1 lot of EUR/USD. If the swap rate is -2 points, a small fee will be paid each night the position is held. Conversely, if the swap rate is +2 points, a small amount will be earned. This emphasizes the importance of understanding swap rates before entering a trade, especially for swing traders or those who hold positions for longer periods.

The influence of the South African Reserve Bank (SARB) policies, such as repo rate adjustments, can indirectly affect swap fees on ZAR pairs. A repo rate hike might make ZAR more attractive, potentially altering the USD/ZAR swap rate. This highlights how local market dynamics can significantly impact overall trading expenses. Staying informed about both global and local economic news is essential for effective MT4 swap fee management. You can explore swap calculations further here.

What Really Drives Your Swap Costs As A South African Trader

Understanding the basics of MT4 swap fees is important. As a South African trader, however, you need to look beyond the fundamentals. Several underlying factors significantly affect your actual swap costs beyond just the interest rate differential. These often-overlooked elements can make a substantial difference to your bottom line.

The JIBAR Effect and Global Influences

One key factor influencing swap costs in South Africa is the Johannesburg Interbank Agreed Rate (JIBAR). This benchmark reflects the interest rate at which banks lend and borrow money among themselves. While it doesn't directly determine your MT4 swap fees, JIBAR influences the overall financial landscape in South Africa.

Fluctuations in the 3M JIBAR, for example, can indirectly affect swap rates by impacting market conditions. Historical data on swap fees in the ZA region may not be readily available. Traders can, however, use global swap rate benchmarks to get an estimate of their potential costs.

Global central bank decisions, even those seemingly unrelated to the Rand, also have ripple effects across the forex market. Explore this topic further here.

Central Bank Decisions and Your Wallet

Decisions made by the US Federal Reserve, the European Central Bank, and other major central banks influence global interest rates. These, in turn, have an impact on the swap rates you see on your MT4 platform, even when trading pairs not directly involving the ZAR.

A surprise rate hike by the Fed, for example, can strengthen the USD. This impacts pairs like USD/ZAR and indirectly influences swap rates on other currency pairs. This interconnectedness of global markets highlights the need for South African traders to stay up-to-date on international monetary policy.

Seasonal Swings and Economic Events

Swap rates aren't static. They change based on various factors, including seasonal trends and economic events. Certain times of the year, like quarter-ends or year-ends, might experience increased demand for specific currencies. This can lead to temporary rises in swap rates.

Economic data releases, political instability, or even natural disasters can also cause fluctuations in swap rates. This means that the timing of your overnight positions becomes crucial. Holding a position over a weekend, for example, might result in a triple swap charge. This can significantly impact your trading costs.

Real-World Examples From SA Traders

Successful South African traders understand the importance of these often hidden factors. They actively monitor JIBAR, global central bank announcements, and economic calendars to anticipate potential swap rate changes.

These traders might adjust their position sizing, choose specific brokers with better swap policies, or even use hedging strategies to reduce the effects of higher swap costs. This proactive approach allows them to turn potential costs into profit opportunities by taking advantage of favourable swap conditions. For example, a trader anticipating a drop in swap rates might hold a position longer to benefit from lower overnight charges. By understanding these market dynamics, South African traders can gain a competitive advantage and improve their overall profitability.

Calculate MT4 Swap Fees Like A Professional Trader

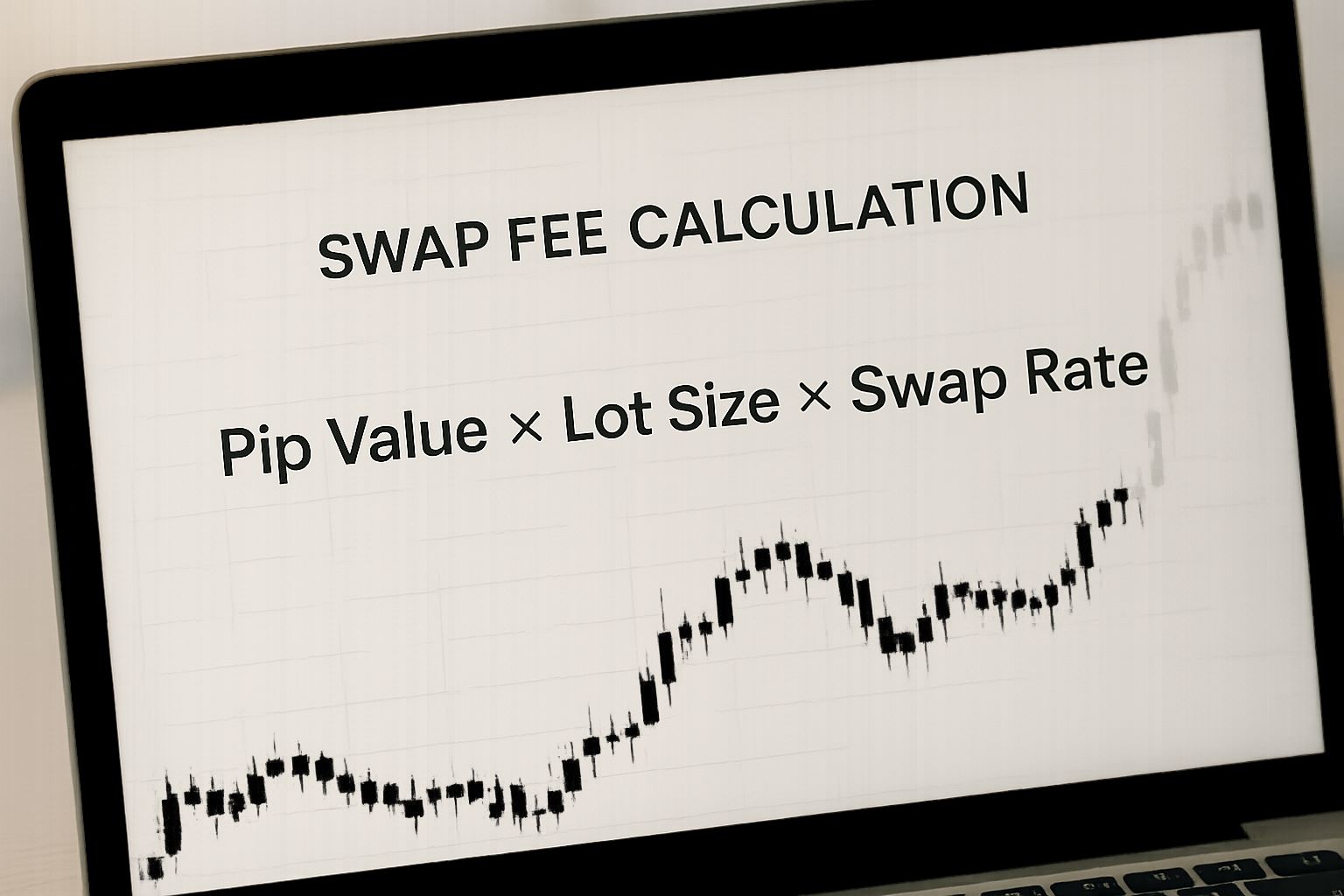

The infographic above illustrates the core swap fee calculation: pip value × lot size × swap rate, set against a candlestick chart. This straightforward formula is fundamental to understanding overnight costs in forex trading. The key takeaway? Even small swap rates can accumulate significantly depending on your position size and trade duration. This underscores the importance of accurate swap calculations.

Manual Calculation: Taking Control of Your Costs

As a South African trader, calculating these fees manually helps you manage your trading capital. This involves converting swap points (provided by your broker) into Rand values.

Step 1: Determine the Pip Value: This represents the monetary value of a single pip movement in your chosen currency pair. For instance, in USD/ZAR, a pip value might be R0.10.

Step 2: Obtain the Swap Rate: Your MT4 platform displays the swap rate in points for both long and short positions. Suppose the long swap rate for USD/ZAR is -2 points.

Step 3: Factor in Your Lot Size: If trading 1 standard lot (100,000 units), multiply the swap rate by the pip value and the lot size: (-2 points) × (R0.10/point) × 1 lot = -R20. This translates to a R20 nightly swap fee.

Step 4: Account for Weekend Rollovers: Many brokers implement a triple swap charge on Wednesdays (or Thursdays for Friday rollover). Be aware of this to avoid surprises.

To help visualize the differences between calculation methods, let's examine the following comparison:

MT4 Swap Fee Calculation Comparison

| Calculation Method | Accuracy Level | Time Required | Best For | Tools Needed |

|---|---|---|---|---|

| Manual Calculation | High (if done correctly) | Several minutes | Understanding the underlying mechanics | Calculator, Broker Swap Rates |

| MT4 Built-in Tools | High | Seconds | Quick checks, real-time data | MT4 Platform |

| Online Swap Calculators | Variable (can be inaccurate) | Seconds | Quick estimates (use with caution) | Internet Access, Calculator (for verification) |

This table highlights the strengths and weaknesses of each method. While manual calculation provides a deep understanding, MT4's built-in tools offer speed and convenience. Online calculators can be useful for quick checks, but their accuracy should always be verified.

Leveraging MT4's Built-in Tools

Manual calculations are vital for understanding the principles, but MT4 offers tools to simplify the process. Right-clicking a currency pair in the "Market Watch" window and selecting "Specification" displays current swap rates. These rates are dynamic, reflecting real-time interest rate differentials and market conditions. This provides quick access to current swap information.

Swap Calculators: Friend or Foe?

Numerous online swap calculators exist, but their reliability varies. Some overlook weekend rollovers or broker-specific adjustments, causing inaccurate projections. Professional traders often cross-reference these calculators with their broker’s provided rates.

Choosing the Right Tools for You

The best approach combines manual understanding with platform tools. By grasping the core calculations, you can verify information from calculators and your MT4 platform, ensuring accuracy and protecting your profits.

Example: USD/ZAR Swap Calculation

Imagine going long on 0.5 lots of USD/ZAR. Your broker quotes a long swap rate of -3 points, and the pip value is R0.10. Your nightly swap fee is: (-3 points) * (R0.10/point) * 0.5 lots = -R15. Remember the triple charge for Wednesday's rollover. This example highlights the significance of these calculations, especially for positions held over multiple days.

Turn Swap Fees Into Trading Advantages

What if those pesky MT4 swap fees could become a source of profit instead of a drain on your trading account? South African traders are discovering how to turn this potential expense into an additional income stream. This shift from cost avoidance to profit generation is a key differentiator between consistently profitable traders and those who struggle.

Carry Trading: Profiting From Interest Rate Differentials

One effective strategy is carry trading. This involves buying a currency with a high interest rate and simultaneously selling a currency with a low interest rate. The trader then profits from the difference, also known as the interest rate differential. For example, buying the South African Rand (ZAR) against the Japanese Yen (JPY) could be profitable if the ZAR offers a significantly higher interest rate. Holding this position overnight could generate a positive swap, boosting overall profits.

Hedging Swap Costs: Balancing Your Portfolio

Even if carry trading isn't your main focus, understanding how to hedge your swap costs is essential. Holding multiple positions can offset negative swap fees. A negative swap on a long USD/ZAR position, for instance, could be balanced by a positive swap on another currency pair. This portfolio approach helps minimize overnight costs and protect your trading capital.

Timing Your Entries: Minimizing Overnight Charges

The timing of your trades has a significant impact on swap fees. Holding positions over weekends, particularly from Wednesday to Thursday (or Thursday to Friday depending on your broker), often results in a triple swap charge. Careful entry and exit planning can help you avoid this and retain more of your profits. This is especially important for swing traders in the ZA region.

Identifying Positive Swap Opportunities: Turning the Tables

Many traders don't realize they can actually earn positive swaps. By carefully analyzing your broker's swap rates, you can identify opportunities to earn interest simply by holding certain positions overnight. This requires actively monitoring interest rate differentials and your broker's swap policies. For example, a short position on a particular currency pair might generate a positive swap, creating a unique profit opportunity.

Understanding MT4 swap fees is crucial for South African traders because of their direct impact on profitability. For example, holding a long position in USD/ZAR might incur a negative swap rate, eroding profits over time. Traders often use swap calculators to estimate potential costs. These tools provide valuable insights into charges based on factors like pip value, swap rate, and holding duration. By managing these costs effectively, traders can optimize their strategies and enhance their performance in the forex market.

Real Case Studies: From Theory to Practice

Successful traders in South Africa demonstrate the effectiveness of active swap management. Some have added hundreds of Rands to their monthly profits by implementing these techniques. Their experiences show that by actively managing swap fees, you can transform them from a potential cost into a distinct advantage. This proactive approach requires discipline and market awareness, but the results can be substantial.

From Cost Burden to Profit Centre: A Mindset Shift

Turning swap fees into trading advantages requires a change in perspective. Instead of seeing them as an unavoidable expense, consider them a dynamic market element you can use to boost your returns. This strategic mindset, combined with the techniques discussed above, can significantly improve your trading performance in the South African market.

Find The Best Swap Rates Among SA Brokers

When trading with a MetaTrader 4 (MT4) platform, it's important to remember that not all brokers offer the same swap fees. These variations can significantly affect your trading profits, especially in South Africa. Choosing the wrong broker could cost you hundreds of Rands every month. This section explores how to navigate the often-complex world of MT4 swap fees within the South African brokerage landscape.

Decoding SA Broker Swap Policies

FSCA-regulated brokers in South Africa employ various approaches to setting their overnight charges. Some brokers might offer tighter spreads, but balance this with higher swap fees. Others may advertise low swap rates but have wider spreads or hidden commissions. It's vital to look beyond the advertised rates and compare the actual swap policies. This comparison is particularly important for South African traders, as holding a position overnight, especially on Rand pairs like USD/ZAR, can quickly become costly if swap rates are high.

Hidden Costs and the Spread-Swap Relationship

Be cautious of brokers advertising extremely low swap rates without disclosing other potential costs. Some might increase their spreads during rollover periods, effectively canceling out any perceived savings on the swap fee. This hidden cost often catches traders unaware. For instance, a broker offering a zero swap might widen its spread by 2 pips during rollover, negating the zero-swap benefit. Always consider the combined cost of spreads and swaps.

Islamic Accounts: True Swap-Free Trading?

Many South African traders opt for Islamic accounts, designed to comply with Sharia law’s prohibition of interest payments. However, not all "Islamic" accounts are truly swap-free. Some brokers may charge an administration fee or a commission on overnight positions in these accounts. Before opening an Islamic account, carefully review the terms and conditions. Look for transparent information about overnight charges and hidden fees.

Comparing Local Broker Offerings: A Practical Approach

To identify the best swap rates, create a spreadsheet listing FSCA-regulated brokers operating in South Africa. Include columns for common currency pairs like EUR/USD and USD/ZAR, noting the long and short swap rates for each. Also, document whether the broker offers a genuine Islamic account and its specific terms. This direct comparison will reveal significant differences that might otherwise be overlooked. This is particularly important for South African traders engaged in swing trading or holding long-term positions, where swap fees accumulate over time.

The following table provides an example of how you can compare brokers:

South African MT4 Broker Swap Rate Comparison

| Broker Name | EUR/USD Long | EUR/USD Short | USD/ZAR Long | USD/ZAR Short | Islamic Account Available |

|---|---|---|---|---|---|

| Broker A | -2.5 | +1.8 | -8 | +5 | Yes (commission-based) |

| Broker B | -1.5 | +2.2 | -6 | +7 | No |

| Broker C | -3.0 | +1.5 | -9 | +4 | Yes (truly swap-free) |

This table demonstrates the range of swap rates within the South African market. Selecting the right broker can significantly impact your trading costs and overall profitability.

Choosing the Right Trading Partner

By thoroughly researching MT4 swap fees and understanding the practices of local brokers, you can select a trading partner that aligns with your strategy. Whether you're a scalper, day trader, or swing trader, optimizing your swap costs will directly improve your bottom line. Choosing the wrong broker can silently drain your trading capital, while the right one can be a key factor in your success as a South African trader.

Key Takeaways For Swap-Smart Trading Success

This section provides a practical roadmap for South African traders looking to master MT4 swap fees. It’s packed with actionable strategies and realistic goals. We’ll cover the most important lessons, providing clear checklists for evaluating swap costs, selecting the right broker, and timing your positions for maximum benefit.

Evaluating Swap Costs: A Checklist For Success

Understanding swap costs is crucial for profitable trading. Here’s a checklist to ensure you’re on the right track:

Know Your Pairs: Understand the typical swap characteristics of your traded currency pairs, especially those involving the South African Rand (ZAR). USD/ZAR swaps, for example, can fluctuate significantly due to interest rate differentials between the US and South Africa.

Calculate Before You Trade: Always calculate potential swap costs before entering a trade. Use manual calculations, MT4's built-in tools, and online calculators (with verification) to accurately project overnight charges. Remember, even small swap rates accumulate, especially with larger lot sizes.

Weekend Rollover Awareness: Be aware of the triple swap charge usually applied on Wednesdays (or Thursdays, depending on your broker) for weekend rollovers. Factor this into your trading plan to avoid surprises.

Choosing the Right Broker: Avoiding Hidden Fees

The right broker can make a significant difference in your overall trading costs. Consider these points:

Compare Swap Policies: Don't just look at headline swap rates. Compare the swap policies of different FSCA-regulated brokers in South Africa for your frequently traded pairs. Go beyond marketing and focus on actual costs.

Uncover Hidden Costs: Be cautious of extremely low swap rates. Some brokers might compensate with wider spreads or other hidden fees, especially during rollovers. Consider the combined cost of spreads and swaps.

Islamic Account Scrutiny: If considering an Islamic account, carefully examine the terms. Not all are truly swap-free; some have administrative fees or commissions. Ensure transparency before committing.

Timing Your Trades: Minimizing Swap Fees

Strategic timing can significantly impact your swap expenses. Here are some key strategies:

Avoid Weekend Rollovers: If possible, minimize holding positions over weekends to avoid the triple swap charge. Adjust your entry and exit strategies accordingly.

Time Your Entries Strategically: Consider the time of day and any scheduled news releases that could affect swap rates. Enter trades when swap conditions are most favorable, especially for overnight positions.

Monitor Interest Rate Announcements: Keep an eye on both South African Reserve Bank (SARB) and global central bank announcements. These can influence swap rates, offering opportunities to minimize costs or capitalize on positive swap situations. A surprise SARB rate hike, for instance, could increase the positive swap on a ZAR-selling position.

Mindset Shift: Viewing Swaps as Opportunities

Swaps aren’t just costs; they can be opportunities. Consider these perspectives:

Embrace Carry Trades: Explore carry trading strategies, particularly with ZAR pairs, where you can profit from interest rate differentials. This turns swap costs into a potential income stream.

Hedge Swap Costs: Balance negative swaps on some positions with positive swaps on others to minimize overall overnight costs. This requires strategic portfolio management.

Identify Positive Swaps: Actively seek opportunities to earn positive swaps. Monitor your broker's swap rates and stay informed about interest rate differentials. This proactive approach can boost profitability.

For South African businesses needing a transparent and cost-effective solution for international payments and foreign exchange, consider Zaro. Zaro offers a platform with real exchange rates, zero spread, and no SWIFT fees, streamlining cross-border transactions and optimizing cash flow.