Trying to run a global business with single-currency accounting is like trying to navigate international waters with only a local map. You'll quickly find yourself lost, making costly mistakes and missing out on huge opportunities. This is where modern multi currency accounting software steps in, automating the complexity and giving you the financial clarity you need to compete on a global stage.

Why Modern Businesses Need Multi Currency Accounting Software

For any South African business with clients, suppliers, or even investments overseas, leaning on manual conversions just isn't a long-term solution. Spreadsheets and old-school methods quickly create a tangled mess of financial data that’s not just difficult to manage, but also ripe for expensive errors.

Think about the sheer volume of work. Every single international invoice, payment, and expense report requires a currency conversion. When you're handling this manually, the process isn't just slow—it's incredibly risky.

The Pitfalls of Manual Conversion

Without a proper system, your finance team is forced to constantly juggle exchange rates that can, and do, change by the minute. This opens the door to several serious problems:

- Costly Errors: A tiny mistake in a conversion rate might seem small, but it can lead to you undercharging a major client or overpaying a key supplier. Those "small" errors add up and hit your bottom line hard.

- Wasted Time: Your finance experts end up spending countless hours tracking rates, calculating conversions, and reconciling different currency accounts. This is time they should be spending on strategic financial planning, not tedious admin.

- Financial Blind Spots: It becomes nearly impossible to get a clear, real-time picture of your company's true financial health. This turns crucial activities like cash flow forecasting and budgeting into little more than a guessing game.

Here's a quick comparison to see just how stark the difference is between the old way and the new.

Manual vs Automated Multi Currency Accounting

| Feature | Manual Method (e.g., Spreadsheets) | Multi Currency Accounting Software |

|---|---|---|

| Exchange Rate Updates | Manual lookup and data entry for every transaction. Highly prone to error and outdated rates. | Automatically fetches real-time exchange rates, ensuring accuracy for every transaction. |

| Reporting | Consolidated reports are time-consuming to build and often inaccurate. Creating multi-currency reports is a nightmare. | Instantly generates consolidated financial reports in your home currency with a single click. |

| Gains & Losses | Realised and unrealised gains/losses from currency fluctuations must be calculated by hand. It's complex and often forgotten. | Automatically calculates and records gains and losses from currency fluctuations, simplifying compliance. |

| Efficiency | Extremely slow and labour-intensive. Diverts skilled staff to low-value, repetitive tasks. | Dramatically improves efficiency by automating the entire process, freeing up your team for strategic work. |

As you can see, the value of dedicated software goes far beyond simple convenience; it’s about accuracy, efficiency, and strategic insight.

In an interconnected economy, being able to handle multiple currencies isn’t just a nice-to-have feature. It’s a fundamental requirement for growth and financial stability.

The South African market certainly reflects this reality. Our local accounting software scene is mature, with powerful tools like Sage being used by a huge number of businesses. A major driver for this widespread adoption is its robust multi-currency functionality, which is mission-critical for any company involved in international trade.

Ultimately, multi currency accounting software completely changes the game. It acts like a financial GPS for your global operations, automatically handling conversions, managing the financial impact of rate fluctuations, and delivering the clear, consolidated reports you need to confidently expand your business beyond our borders.

Understanding Core Multi-Currency Concepts

Before you can truly appreciate what multi-currency accounting software does, you need to get a handle on a few key ideas. These aren't just dry accounting terms; they're the real-world financial dynamics that directly affect your profit margins. Let's break them down in simple terms, no finance degree required.

Imagine your business has a "home" currency. For any South African company, this will almost always be the South African Rand (ZAR). This is your base currency. It’s the currency you use for your official financial statements and how you ultimately measure your performance. Every transaction, no matter the currency it started in, eventually gets converted back to ZAR for your main reports.

Now, think of every other currency you work with—the US Dollar, the Euro, the British Pound—as a foreign currency. These are the currencies you use when you transact internationally. When you bill a client in London, for instance, you'll likely send them an invoice in Pounds (£). That transaction lives in a foreign currency until the payment is received and accounted for back in your ZAR books.

Exchange Rates and Their Impact

So, what connects your home base (ZAR) to all these foreign currencies? The exchange rate. It's simply the value of one currency compared to another, and as we all know, it’s always on the move. These constant fluctuations are precisely where financial risk comes from, but it's also what good software is built to handle for you. The constant movement of exchange rates creates two key outcomes: realised and unrealised gains or losses.

A realised gain or loss is concrete. It’s the actual profit or loss you make on a finished transaction because the exchange rate moved between invoicing and payment. An unrealised gain or loss is a "paper" profit or loss on an open transaction, like an unpaid invoice.

Let's make this real. Say you invoice a client in the US for $1,000. On the day you send the invoice, the exchange rate is R18.50 to the dollar. In your books, you've recorded an expected income of R18,500.

- Realised Gain: A week later, your client pays. The Rand has weakened to R19.00/$. The $1,000 payment now lands in your account as R19,000. That extra R500 is a realised gain.

- Realised Loss: What if the Rand strengthened to R18.20/$ by the time they paid? Your $1,000 is now worth only R18,200. You've just experienced a R300 realised loss.

Unrealised figures work the same way but for outstanding amounts. While that $1,000 invoice is unpaid, your financial reports will reflect an "unrealised" gain or loss every time the rate changes, giving you a snapshot of what you stand to gain or lose if it were settled that day.

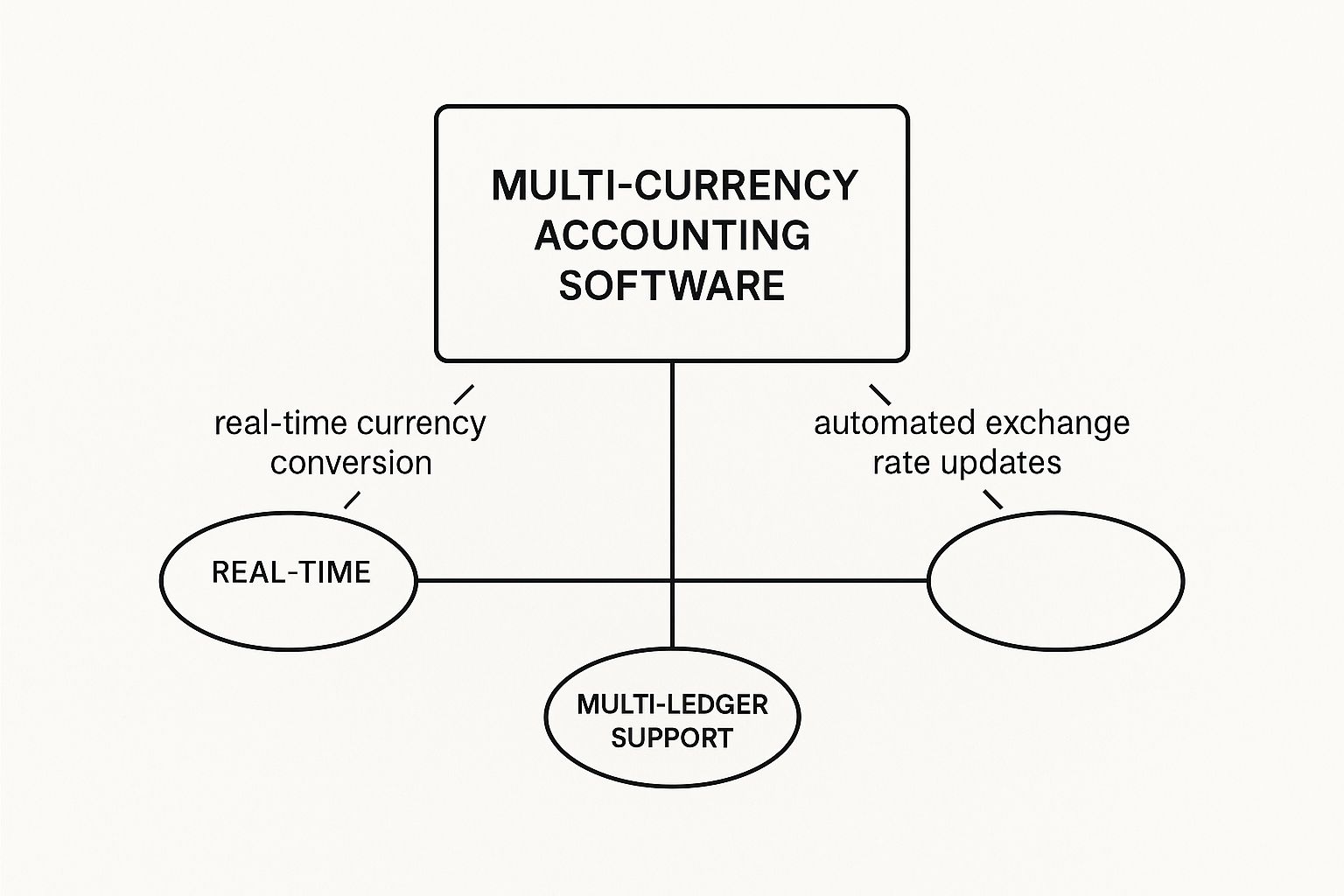

This is where the right software becomes your best friend, as this visual explains.

As you can see, the software pulls everything together: real-time conversions, automatic rate updates, and separate ledgers for each currency, all to give you a clear, accurate financial picture. Getting your head around these basics—base vs. foreign currency, and realised vs. unrealised results—is the first step to understanding just how much time and trouble this kind of automation can save you.

Essential Features of Top Accounting Software

Alright, now that we've covered the financial concepts, let's get practical. What should you actually look for when choosing multi-currency accounting software? Think of these features as the non-negotiables—the core components of a high-performance engine. Without them, your global operations will sputter and stall.

The right platform does more than just crunch numbers. It gives you automated intelligence that safeguards your profit margins from the chaos of currency fluctuations. These core functions work together, turning a messy pile of foreign transactions into clear, manageable financial data you can actually use.

Automated Exchange Rate Updates

Having to manually look up exchange rates for every single transaction is a surefire recipe for mistakes. It’s tedious, time-consuming, and incredibly risky. The best software takes this danger off the table completely by automatically fetching live exchange rates. This ensures every invoice, payment, and expense is recorded using the most accurate rate available at that very moment.

- Here's a real-world example: Imagine a Cape Town design agency quotes a project for a client in Germany. The quote is in Euros. Overnight, the ZAR/EUR exchange rate shifts significantly. Because their software provides automatic updates, the final invoice accurately reflects this change, preventing them from accidentally undercharging by thousands of Rands. Simple, but crucial.

Automatic Foreign Exchange Gain and Loss Calculation

As we touched on earlier, a currency's value is always moving. Every time the exchange rate shifts between the day you send an invoice and the day you get paid, you either make or lose a little bit of money. Trying to calculate this manually is a nightmare and often gets missed, leading to some seriously skewed financial reports.

Top-tier software handles this entire process for you. It tracks the rate when the transaction happened and the rate when it was settled, then automatically posts the realised gain or loss to the right account. Your books stay perfectly balanced and compliant, all without you lifting a finger.

This one feature is an absolute game-changer for financial accuracy. It turns a horribly complex accounting task into a seamless, automated background process. The result? Your profit and loss statements always show the true picture of how your business is performing.

Real-Time Financial Reporting

How is your business really doing across all currencies, right now? With spreadsheets and manual methods, that question is almost impossible to answer quickly. A standout feature of modern multi-currency accounting software is the power to generate consolidated financial reports in your home currency (ZAR) instantly.

With just a couple of clicks, you can see a complete snapshot of your company's financial health. It combines all your foreign currency activities into a single, easy-to-read view. This lets you make faster, smarter strategic decisions based on data that's minutes old, not weeks out of date.

Multi-Currency Invoicing and Bank Feeds

Finally, the software must empower you to operate just as easily in other currencies as you do in Rands. At a minimum, this means you should be able to:

- Create and send professional-looking invoices in your client's local currency.

- Connect to your foreign currency bank accounts to automatically pull in and reconcile transactions.

This kind of functionality is a key reason for the growing adoption of advanced digital tools in the country. South Africa's Information and Communications Technology (ICT) market was valued at over $35 billion in 2023. This growth is partly fuelled by the need for scalable, cloud-based financial solutions that can handle global business. You can explore more about this market expansion and its key drivers.

Here is the rewritten section, crafted to sound like it was written by an experienced human expert.

What Are the Real Strategic Wins of a Multi-Currency System?

Looking past the specific features, you'll find that bringing a proper multi-currency system into your business offers some serious strategic advantages. It can genuinely change the way you grow. The magic isn't just in what the software does on a daily basis, but what it unlocks for your future. It shifts your financial operations from a defensive, reactive headache into a powerful engine for global expansion.

This isn't just another software upgrade; it's about pouring the concrete for a foundation that can support real international success. Once you remove the constant low-grade anxiety that comes with manual currency conversions, you free up incredible amounts of mental energy and resources to chase bigger, more exciting goals.

A Quick Story: Taking a Business Global

Let's imagine a small design agency in Cape Town. They've built a fantastic reputation locally and, through word-of-mouth, they land their first big contract with a client in the United States. It's a massive win, but it immediately throws them into a world of new financial puzzles. How do they price their services in US Dollars? How do they accept a wire transfer and, crucially, how do they accurately report their profit back home in Rands?

Before they invested in multi-currency accounting software, this would have been a nightmare. They'd be at the mercy of their bank's less-than-ideal exchange rates and would burn hours trying to make the USD payment fit into their ZAR-based books. The risk of making a mistake and eating into their hard-earned profit would be huge.

But with the right software, the story changes completely.

The system lets them whip up a professional invoice in USD in just a few clicks. When the payment lands, it's automatically recorded. The software uses a real-time exchange rate to figure out the exact ZAR equivalent, neatly booking any realised gain or loss from the currency fluctuation.

That simple, automated step gave them total financial clarity. They knew their precise profit margin on the project, with no guesswork involved.

From a Simple Tool to a Growth Engine

That newfound confidence was the game-changer. With solid, accurate data and a smooth workflow, the agency suddenly felt ready to chase more international clients. The software wasn't just a tool for a single transaction; it became the platform that powered their global ambitions.

For any business, the strategic advantages really boil down to these key areas:

- Dramatically Better Financial Accuracy: Automating conversions and gain/loss calculations gives you a true, up-to-the-minute picture of your financial health. This completely gets rid of the blind spots and "best guesses" that come with using manual spreadsheets.

- Slashed Administrative Burden: Your finance team can finally stop drowning in manual data entry and reconciliation. This frees them up to focus on work that actually adds value, like analysing performance and helping with strategic planning.

- Sharper Cash Flow Visibility: You can properly forecast your cash flow across different currencies. This helps you make much smarter decisions about when to exchange funds and how to manage your international payments.

- The Confidence to Go Bigger: With a reliable system managing the numbers, the fear of financial complexity is no longer a barrier. You can confidently step into new markets without hesitation.

How to Choose the Right Software for Your Business

Picking the right multi-currency accounting software isn’t about finding a one-size-fits-all "best" platform. It’s about finding the best fit for your business. What works wonders for a huge multinational corporation could be complete overkill for a growing export business just finding its feet. The first and most important step is to look inwards and get crystal clear on your own needs.

https://www.youtube.com/embed/xDpx-Dwo2sg

Start by sizing up your global operations. How many different currencies are you juggling on a regular basis? What’s your typical monthly volume of international transactions? Answering these questions gives you a solid baseline. A business handling five different currencies with hundreds of payments each month is going to need a much more powerful system than a freelancer who sends a handful of US dollar invoices.

Define Your Core Requirements

Before you even book your first demo, sit down and make a list of your non-negotiables. This simple exercise will help you cut through all the marketing fluff and focus on the features that will actually make a difference to your business.

- Currency Needs: List every single foreign currency you work with. Are you planning to expand into new markets and add more currencies soon?

- Transaction Volume: Get a rough estimate of how many foreign currency invoices, bills, and payments you process each month.

- Integrations: What other tools does this software need to talk to? Think about your e-commerce store (like Shopify), your CRM, or your inventory system. Good integration saves you from hours of soul-destroying manual data entry.

- Team Access: How many people on your team need to use the software? Will you need different permission levels to control who can see sensitive data or approve payments?

Doing this groundwork is essential for making a smart investment. It’s no surprise that the enterprise software market, which includes these financial tools, is booming. Revenues are expected to reach around USD 1.12 billion by 2025 as more South African companies realise the power and flexibility of cloud-based systems. You can discover more about this trend in enterprise software to understand the bigger picture.

Key Evaluation Criteria

With your requirements list in hand, you’re ready to start evaluating potential providers. Beyond the flashy features, there are a few critical factors that will determine whether this software becomes a trusted partner or a long-term headache.

When you're comparing your options, it's helpful to have a structured way to think through each one. The checklist below is designed to guide you through the key areas, ensuring you don't miss anything important.

Software Evaluation Checklist

| Evaluation Area | Key Questions to Ask | Your Notes |

|---|---|---|

| Scalability & Cost | Can the software grow with my business? What are the pricing tiers, and what triggers a move to a more expensive plan? Are there hidden fees? | |

| Security | What security measures are in place (e.g., encryption, two-factor authentication)? Where is our data stored, and who has access to it? | |

| Ease of Use | Is the interface intuitive? How steep is the learning curve for my team? Can we get a free trial to test it out? | |

| Customer Support | What support channels are available (phone, email, chat)? What are their typical response times? Are they in a similar time zone? | |

| Integration | Does it connect seamlessly with our existing tools? How complex is the integration process? | |

| Reporting | Can it generate the specific financial reports we need (e.g., unrealised gains/losses, P&L by currency)? Are reports customisable? |

Using a checklist like this helps you make an objective comparison instead of getting swayed by a slick sales pitch. It forces you to think about not just today's problems, but tomorrow's challenges as well.

A great multi-currency platform should not just solve today’s problems; it should be a scalable partner that grows alongside your business, providing security and support every step of the way.

Security, in particular, is non-negotiable. You're dealing with sensitive financial data, so look for bank-level encryption and robust data protection as a bare minimum.

And please, don't underestimate the value of good customer support. When you’re stuck on an urgent cross-border payment issue, you need fast, knowledgeable help. Check online reviews and ask vendors directly about their support. Choosing a company with a reputation for excellent support can save you from major stress down the line.

Putting Your New System to Work and Sidestepping Common Traps

Making the jump to a new financial system can feel like a mammoth task, but honestly, with a solid plan, the switch can be far smoother than you think. A well-thought-out approach is your best bet for avoiding the usual headaches and making the most of your new multi-currency accounting software from day one.

The journey starts with moving your data across. This is the perfect moment for a clean slate, ensuring only accurate, up-to-date information makes it into your new system. Before you even think about importing, take some time to give your current records a good "spring clean"—tidy up customer lists, double-check supplier details, and refine your chart of accounts. This bit of upfront housekeeping stops old mistakes from creeping into your powerful new setup.

Your Step-by-Step Implementation Plan

A successful rollout isn't magic; it's just a logical sequence of steps. Think of it like laying the foundation for a house—you can't start putting up walls until the base is solid. Rushing the setup process is just asking for trouble later on.

Here’s a practical roadmap to follow:

- Configure Core Settings: First things first, set your base currency (which will be ZAR for most South African businesses). Then, add all the other foreign currencies you deal with. This is a foundational setting that’s often a real mission to change later, so get it right from the start.

- Migrate Historical Data: Now, you can carefully bring over your customer and supplier lists, along with your opening balances. Most good software providers offer clear instructions or dedicated tools to make this part less painful.

- Connect Bank Feeds: Link up every single one of your bank accounts, both your ZAR and foreign currency accounts. This is the key to automating transaction imports and unlocking the massive time-saving benefits you’re after.

- Train Your Team: Don't forget the people! Make sure everyone who needs to use the software gets proper training. They need to be comfortable with the new ways of creating invoices, logging expenses, and pulling reports.

Here’s a pro tip: for the first month, try running your old and new systems side-by-side. I know it’s double the work, but it’s an invaluable safety net. You can compare the reports from both systems to be 100% sure everything is working as it should before you pull the plug on the old one for good.

Dodging the Common Implementation Stumbles

Even with the best plan in the world, a few common tripwires can catch businesses out. Knowing what they are is half the battle.

One of the biggest blunders we see is using the wrong exchange rates for opening balances. It seems like a small detail, but this one mistake can skew every single one of your future foreign exchange gain/loss reports. Always, always use the official exchange rate from the day you go live.

Another classic error is not thoroughly testing your integrations, like the connection to your online store or CRM. A faulty link can mean lost sales data and hours of frustrating manual clean-up. By taking the time to implement your new system properly, you’re not just installing software—you’re building a rock-solid financial foundation for your global ambitions.

Frequently Asked Questions

As you start exploring the world of multi-currency finance, it’s natural for a few practical questions to pop up. Let's tackle some of the common queries we hear from business owners, clearing up any confusion about how this software works in the real world.

Can I Change My Base Currency in The Software Later?

This is a big one, and the short answer is almost always no. Think of your base currency – for most South African businesses, this will be the Rand (ZAR) – as the foundation of your financial house. Every report, every conversion, and every bit of analysis is built on top of it.

Changing it later isn't like repainting a wall; it's more like trying to replace the foundation of a finished house. In nearly every accounting system, you’d have to start over with a completely new company file. It's crucial to get this right from day one.

How Does The Software Handle VAT on Foreign Invoices?

Thankfully, modern accounting software takes care of this complex task for you. When you issue an invoice in a foreign currency, like Euros or US Dollars, the system automatically calculates the Value-Added Tax (VAT) using the exchange rate at that very moment.

The system instantly records the VAT amount in your base currency (ZAR), ready for your SARS filings. This keeps you compliant locally, while your international client gets a clear invoice in their currency.

This automation is a lifesaver, removing a major compliance headache and a lot of manual work.

Is Cloud or Desktop Software Better for Multi-Currency Needs?

For virtually any business operating internationally today, cloud-based software is the way to go. The biggest advantage is its ability to pull in real-time exchange rates automatically, which is non-negotiable for maintaining accurate books.

Beyond that, cloud solutions let you access your financials from anywhere – a massive plus when you're managing operations across different time zones. It also means your accountant or team members can collaborate with you using the same live data. While some powerful desktop programs still exist, they often rely on manual updates and just can’t match the flexibility and convenience of a good cloud platform.

Ready to eliminate hidden fees and gain full control over your international payments? Zaro offers the fastest, most cost-effective solution for South African businesses, with real exchange rates and zero markups. See how much you can save by visiting Zaro today.