Thinking about opening a forex account for your South African business? The good news is, it's a completely digital process these days. You just need to pick a regulated provider, get your FICA documents in order for verification, and fund the account. Most of the time, you can get it all sorted within 24 hours and be ready to tap into global currency markets.

Why a Forex Account Is No Longer a "Nice-to-Have" for SA Businesses

For any South African company working internationally, dealing with foreign exchange is a daily reality, not some niche financial activity. It's become a core part of staying competitive. Whether you're paying overseas suppliers, getting paid by international clients, or managing foreign investments, you're exposed to currency fluctuations.

This is where a dedicated forex account changes the game. It's a powerful way to diversify your holdings and build a buffer against the Rand's infamous volatility. Keeping a portion of your cash reserves in stronger currencies like the US Dollar or Euro can be a smart hedge, protecting your company's buying power when the local economy hits a rough patch.

Digital Platforms Are Changing the Game

Thankfully, the old days of endless paperwork and trips to the bank are over. The whole process has moved online, and this ease of access is a huge reason more businesses are taking control of their foreign exchange.

- It's simply more accessible: Modern online platforms mean you can open an account and make trades from your office or home, totally removing the old gatekeepers.

- The fees are clearer: Unlike traditional banks that often hide their markups in the exchange rate, reputable fintech providers show you exactly what you're paying with real-time rates and transparent fees.

- You can trust the system: South Africa's Financial Sector Conduct Authority (FSCA) has a robust regulatory framework in place. This gives you peace of mind knowing your funds are held with a legitimate, regulated institution.

The numbers back this up. Forex trading is a massive market for South Africans, largely because technology has made it so much easier to get involved. As pointed out in market analysis by CMTrading.com, South Africans are actually the most active traders on the continent, using digital platforms to manage their exposure to international currency pairs.

The bottom line: For a South African business, a forex account is a practical tool for managing currency risk, smoothing out cash flow, and operating more effectively in the global market. It puts you in the driver's seat.

Your Pre-Launch Checklist Before Opening an Account

Before you jump into any application, a bit of prep work can save you a world of frustration. Trust me, having your documents and key information ready beforehand is the difference between a smooth sign-up and a process that drags on for days.

First things first, and this is non-negotiable: make sure your chosen provider is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. Think of this as your business's primary safety net. An FSCA licence is your assurance that the provider meets strict standards for protecting client funds and operating responsibly.

Getting Your FICA and KYB Documents in Order

With that crucial check out of the way, it’s time to gather your paperwork. For any South African business looking to open a forex account, these documents are essential for meeting FICA (Financial Intelligence Centre Act) and Know Your Business (KYB) requirements.

To make this as simple as possible, here's a quick rundown of what you'll need to have on hand.

- Company Registration Documents: These are your CIPC papers that prove your business is a legitimate, registered entity in South Africa.

- Proof of Business Address: A utility bill from the last three months or a current lease agreement works perfectly to confirm your physical location.

- Director and Shareholder Information: You’ll need certified ID copies (a valid SA ID or passport) for every director and significant shareholder.

- Your SARS Tax Number: This is a standard requirement for all financial compliance and reporting.

To help you get organised, I’ve put together a simple table that summarises everything you'll need. Think of it as your mission-critical checklist.

Essential Checklist for Opening Your Forex Account

| Item Category | Specific Document/Information Needed | Why It's Required |

|---|---|---|

| Business Identity | Official CIPC Registration Documents | To confirm your company is a legal, registered entity in South Africa. |

| Business Location | Utility Bill (under 3 months old) or Lease Agreement | To verify your company's physical operating address as required by FICA. |

| Key Individuals | Certified ID Copies for Directors & Shareholders | To identify the people who own and control the business (KYB compliance). |

| Tax Compliance | SARS Tax Number | To ensure your account is correctly set up for tax reporting purposes. |

Having these items sorted and ready to go is the single best thing you can do to fast-track your application. It shows the provider you're organised and serious about compliance, which always makes for a smoother process.

Walking Through the Account Opening Process

Got your documents sorted? Great. The good news is that the actual application to open a forex account is the easy part. Providers like Zaro have moved the whole thing online, so you can get it done from your desk.

You’ll kick things off with a standard online application form. It's nothing you haven't seen before – just be ready to plug in your business's key details like its trading name, registration number, physical address, and all the relevant tax info. This is also where you'll need the personal details for the directors and major shareholders, which is why getting those ID copies ready beforehand saves a lot of hassle.

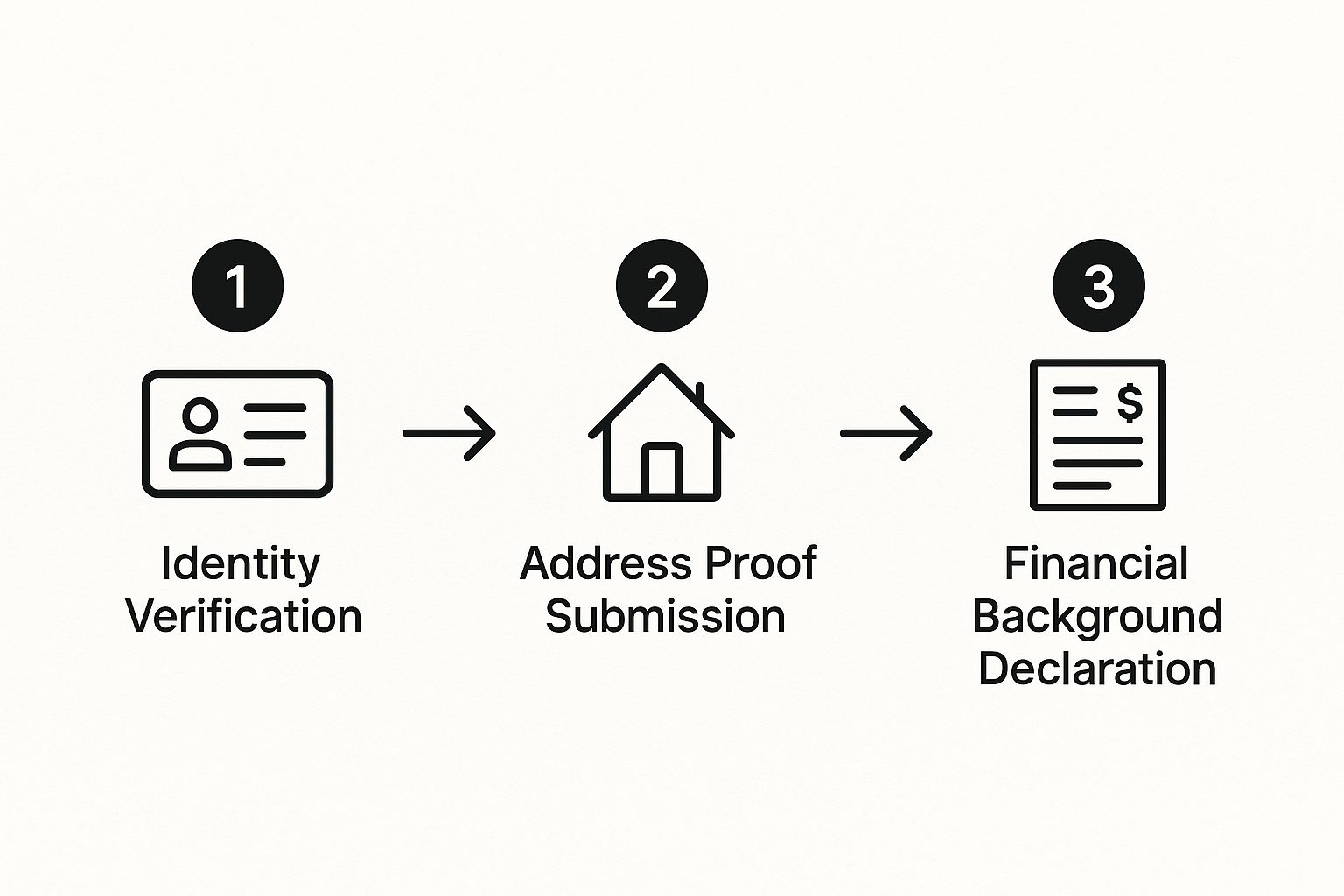

Getting Your Documents Verified

Once the form is done, you move on to the FICA and "Know Your Business" (KYB) verification. This is the official compliance checkpoint where you’ll upload all the documents we talked about earlier. It’s a non-negotiable step designed to prevent financial fraud and make sure your business is exactly who it says it is.

The whole flow is pretty logical: they confirm your identity, your business's operational base, and its financial health. This infographic gives you a good visual summary of what to expect.

As you can see, it's a clear path from A to B.

A recent bank statement is a classic requirement for proof of address. If you're not sure about the specifics, there are great guides on how to get your bank statement easily that make sure you have the right document in the correct format. Getting this right the first time can save you from frustrating back-and-forths.

A Quick Tip From Experience: Before you hit "upload," give every document a final once-over. Is it crystal clear? Can you read every single word? A blurry ID or a poorly scanned utility bill is the number one reason applications get delayed.

This whole verification dance is crucial for keeping South Africa’s financial system secure. The local forex market is booming—it's currently valued at around USD 3.86 billion and is expected to grow by 6.58% annually. That kind of growth is only possible because of tight regulation from the SARB and National Treasury, so compliance is everything.

After you've submitted everything, the provider's compliance team takes over. With a platform like Zaro, they're usually pretty quick. You can expect to get the green light within a business day, confirming your account is officially open and ready to be funded.

Getting Funds Into Your Account and Making That First Trade

So, your Zaro account is verified and ready to go. Excellent. Now for the exciting part: funding it and actually placing your first trade. This is where the rubber meets the road.

Thankfully, getting money into your Zaro account is a pretty painless process, especially for us here in South Africa.

The go-to method for most local businesses is a good old-fashioned Electronic Funds Transfer (EFT). It's familiar, it’s secure, and it connects directly with your business bank account. You’re not dealing with weird third-party gateways, and the fees are usually much lower than paying by card. It’s reliable and straightforward.

What’s the Best Way to Fund Your Account?

While an EFT is the most common route, you do have a few other options depending on your needs.

- Credit or Debit Cards: Need the money in your account now? A card payment is the quickest way to do it. The funds often clear almost instantly. Just be aware that your bank might charge a higher processing fee for this convenience.

- E-wallets (Skrill, Neteller, etc.): These are also very fast and add a layer of separation between your bank and the trading account. It's a solid choice, but make sure you’ve double-checked their fee schedule for both putting money in and taking it out.

A quick note for those in the crypto space: If you're holding Bitcoin, you'll first need to convert it to Rands in your bank account before you can make an EFT. Getting comfortable with how to transfer bitcoins to your bank account is a necessary step before you can fund your Zaro profile.

Don't Forget SARB Regulations! Remember the South African Reserve Bank's exchange controls. As a resident, you have a R1 million Single Discretionary Allowance annually and a R10 million Foreign Investment Allowance (the latter needs a tax clearance certificate). Keep these figures in your mind when you're moving capital offshore.

Placing a Small, Confidence-Building First Trade

With your account loaded, it’s time to dip your toes in the water. That first trade isn't about hitting the jackpot; it’s about getting a feel for the platform and seeing how it all works in real-time.

Let’s run through a quick, practical example using a pair every South African business knows well: USD/ZAR.

If your analysis suggests the US Dollar is about to get stronger against the Rand, you’d place a ‘buy’ order. On the flip side, if you think the Rand is gaining momentum, you’d place a ‘sell’ order.

Before you commit, get to know these two essential concepts:

- Lot Size: This is simply the size of your trade. I always tell beginners to start with a micro lot (0.01). This keeps your financial risk incredibly low while you’re still learning the ropes.

- Stop-Loss: This is your safety net. It’s an order you set to automatically close your trade if the market moves against you to a certain point. Seriously, never place a trade without a stop-loss.

Making that first small trade is a huge milestone. It takes everything from the theoretical and makes it practical. This is the first real step toward managing your company's currency risk like a pro.

Common Mistakes New South African Traders Make

It’s easy to get caught up in the excitement of the forex market, but that initial rush can lead to some expensive lessons if you're not prepared. I've seen countless new traders in South Africa, full of enthusiasm, stumble over the same few hurdles right after they open a forex account.

Let's talk about the biggest one first: the siren song of unregulated offshore brokers. They'll flash promises of massive bonuses or impossibly high leverage to draw you in. The problem? Without regulation from our own FSCA, your money has absolutely zero protection. It's a high-stakes gamble you really don't want to take.

Another classic rookie error is going all-in with too much leverage. Sure, it can magnify your gains, but it's a double-edged sword that magnifies losses just as brutally. Using 100:1 leverage on your first few trades is the financial equivalent of trying to tame a lion on your first day at the zoo. One wrong move, and your entire account could be wiped out.

Overlooking Local Regulations

So many new traders completely forget that forex trading in South Africa has its own set of rules. A big one is ignoring the offshore allowances set by the South African Reserve Bank (SARB). Pushing past your R1 million discretionary allowance without getting the proper clearance is a surefire way to land yourself in a world of compliance trouble.

Here's something to remember: a successful trading journey isn't about dodging every single loss—that's impossible. It's about having a solid plan to manage the losses you inevitably take.

Trading without a clear risk management strategy is just gambling. This means setting hard rules, like never risking more than a tiny fraction (think 1-2%) of your capital on any single trade. It's this discipline that separates the traders who stick around from those who flame out in a few months.

South Africa is a giant in the continental forex scene, with daily trading volumes often exceeding $20 billion. That kind of activity creates incredible opportunities. But you have to respect the market and its rules. If you're curious about the broader African forex landscape, you can explore the 2025 outlook on contentworks.agency for more insights.

Still Have Questions About Forex Accounts in SA?

It’s completely normal to have a few lingering questions before you dive in. After all, you’re dealing with your business’s hard-earned money. Let's walk through some of the most common queries we get from South African business owners just like you.

How Does SARS Tax Forex Profits?

This is a big one, and for good reason. Any profit you make from foreign exchange is viewed as income by SARS, which means it’s subject to your business's income tax rate.

The key here is meticulous record-keeping. You need a clear paper trail of every single transaction—both the wins and the losses. This isn't just for compliance; your losses can often be offset against your gains, which can make a real difference to your tax bill. My best advice? Always run this by a tax professional who understands the nuances of forex.

What’s a Realistic Minimum Deposit to Get Started?

You'll see a massive range out there. Some providers want a hefty deposit, while others will let you get started with a surprisingly small amount.

But the question isn't really what the provider's minimum is. It's about what you need to operate effectively. Trying to manage international payments or a trading strategy with just R1,000 in your account is incredibly difficult and leaves you no room to manoeuvre. A few thousand Rands is a much more practical starting point, giving you the flexibility to handle real-world transactions without stress.

Expert Tip: Think of your initial deposit as your operational capital, not just an entry fee. It needs to be substantial enough to support your business's international payment needs without every small market fluctuation putting your account at risk.

Is It Safe to Use an International Provider If They're FSCA-Regulated?

Yes, absolutely. This is a crucial layer of security for your business.

When an international provider earns a licence from South Africa's Financial Sector Conduct Authority (FSCA), they're agreeing to play by our rules. This means they are held to the same high standards as any local company. The FSCA licence is your peace of mind—it confirms they must keep your funds separate from their own and follow strict operational rules, protecting you no matter where their headquarters are.

Ready to take control of your international payments with real exchange rates and zero hidden fees? With Zaro, your South African business can open ZAR and USD accounts, manage global transactions seamlessly, and finally achieve true financial transparency. Get started with Zaro today and see the difference for yourself.