When you're trading forex, it's easy to get lost in charts and percentages. But what really matters is how those tiny market movements translate into actual Rands and cents. That's where a pip value calculator comes in—it's the tool that instantly tells you the monetary worth of a single pip for your specific trade.

It takes the guesswork out of the equation, turning an abstract risk into a hard number you can use to manage your account effectively.

Why Pip Value Is Your Most Critical Trading Metric

Before you even think about placing your next trade, you need to get a firm grip on the one metric that quietly controls your potential profit or loss: the pip value. This isn't just about memorising a definition. It’s about truly understanding how the smallest market flickers can lead to significant financial outcomes, especially when you're using leverage.

For any serious trader in South Africa, this concept is absolutely non-negotiable.

The Foundation of Smart Risk Management

Knowing the exact ZAR value of a pip is what turns abstract risk management theory into a concrete, actionable plan. It’s the difference between blindly hoping for the best and knowing precisely how much you stand to lose, down to the last Rand.

This clarity is the bedrock of disciplined trading. It empowers you to set stop-losses and take-profits that are based on real numbers, not just a gut feeling. If you ignore pip value, you're essentially trading blind to the actual financial stakes of each position.

This is why a pip value calculator becomes such an essential part of any trader's toolkit. Here in South Africa, it's particularly crucial when trading pairs that involve the Rand. For instance, a single pip move in USD/ZAR on a standard lot (100,000 units) has a specific ZAR value, making this calculation a must-do for local traders. You can see detailed breakdowns of how these trading calculations work to get a better feel for the mechanics.

Key Takeaway: The whole point of calculating pip value is to quantify your risk. It lets you know exactly how much capital you're putting on the line before you enter a trade, which is the cornerstone of professional trading.

Ultimately, mastering pip value helps take the emotion out of your trading decisions. It allows you to:

- Set Precise Stop-Loss Levels: You can determine exactly where to place your stop-loss to risk a specific amount of ZAR.

- Calculate Accurate Position Sizes: Adjust your trade size so it aligns perfectly with your personal risk tolerance, no matter how volatile the market gets.

- Define Realistic Profit Targets: You'll understand the real monetary gain tied to your take-profit levels, helping you set achievable goals.

Getting to Grips with the Pip Value Formula

Ever wondered what’s going on under the bonnet of an online pip calculator? While they're incredibly handy for getting a quick number, truly understanding the maths behind them is a game-changer. It helps you double-check the figures and gives you a much deeper feel for how your trades actually work.

The formula itself isn't some complex bit of algebra. It's actually quite straightforward, built on just three core pieces of information: the size of a single pip, the pair's current exchange rate, and how big your position is (your lot size). Putting these together is what turns a tiny price tick into real money in your account.

The Go-To Pip Value Formula

For any trader wanting to move beyond just pointing and clicking, knowing how to calculate a pip's value is fundamental. It’s a core piece of the trading puzzle.

Here's the classic formula you'll see everywhere:

Pip Value = (One Pip / Exchange Rate) × Lot Size

Let's quickly unpack that:

- One Pip: This is the standardised smallest move a currency pair can make. For most pairs, like EUR/USD or GBP/USD, it’s 0.0001. When the Japanese Yen (JPY) is involved, it's a bit different at 0.01.

- Exchange Rate: Simply the current market price for the currency pair you're looking at.

- Lot Size: This is the size of your trade in currency units. A standard lot is 100,000 units, a mini lot is 10,000, and a micro lot is 1,000.

A Quick Heads-Up: This formula spits out the pip value in the quote currency—that’s the second currency in the pair (e.g., the 'ZAR' in USD/ZAR). You’ll often need to do one last conversion to see what that means for your account currency.

Let's Work Through a USD/ZAR Example

Putting this into practice makes it much clearer. Let's say you're looking to trade a standard lot of USD/ZAR and the exchange rate is sitting at 18.2500.

First, we line up our numbers:

- One Pip: 0.0001

- Exchange Rate: 18.2500

- Lot Size: 100,000 units (for a standard lot)

Now, we just pop them into the formula:

Pip Value = (0.0001 / 18.2500) × 100,000

This gives us a pip value of approximately 54.79 ZAR.

So, for every single pip the market moves on your standard lot trade, your position's value will change by about R54.79. Once you get your head around this, you’ll be able to use any pip value calculator with far more confidence.

Using a Pip Calculator for Flawless Execution

Knowing how to calculate pips by hand is great for understanding the mechanics of forex, but when you're in the live market, speed and accuracy are everything. This is where a dedicated online pip value calculator really shines. It's an essential tool that helps you execute trades flawlessly, eliminating the risk of a costly manual error when the pressure is on.

A good calculator lets you plug in your specific trade details—the currency pair, your position size, and your account's base currency—to give you an instant, precise result. This immediate feedback is what you need to make smart, fast trading decisions.

Nailing Your Trade Details

To get a reliable result from the calculator, you have to feed it the right information. It sounds simple, but this is where many traders slip up, and it can completely throw off their risk assessment.

One of the most common mix-ups is confusing lot sizes with the actual number of units. You need to be exact.

- Standard Lot: 100,000 units

- Mini Lot: 10,000 units

- Micro Lot: 1,000 units

If you're a South African trader, remember to set your account currency to ZAR. This is a crucial step. It ensures the pip value you see is in Rands, so you know exactly how a move will impact your account balance.

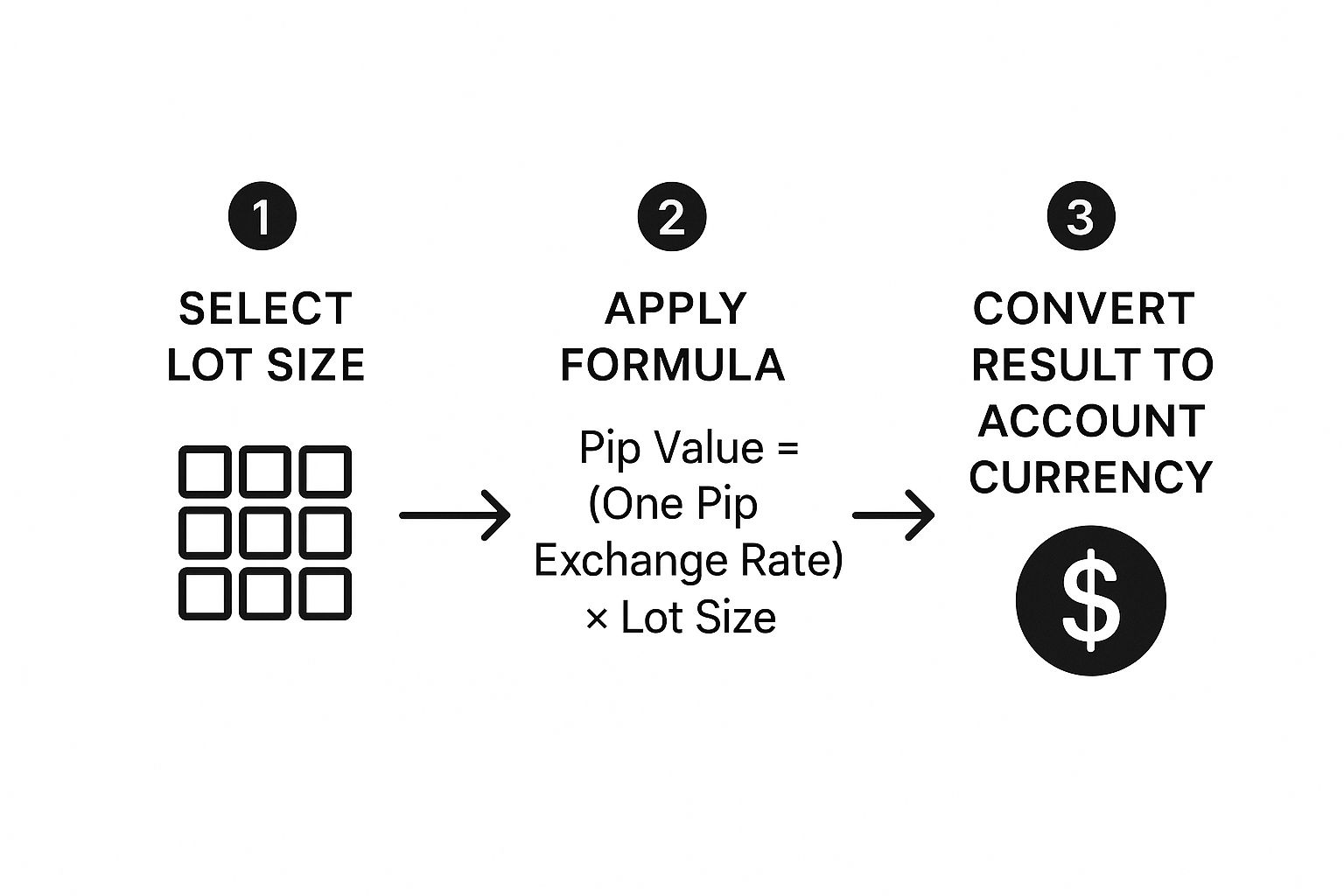

This visual breaks down how a calculator automates the whole process, from your inputs to a final, converted pip value.

It really shows how the tool handles the complex formula and currency conversion for you, delivering a number you can act on immediately.

A Quick Practical Example

Let’s say you’re looking to trade GBP/USD with a mini lot (10,000 units) and your Zaro account is denominated in ZAR. You’d simply punch these details into the calculator.

The tool instantly processes the information and gives you the precise pip value in South African Rands. Making this a standard part of your pre-trade routine helps build discipline and consistency.

By making this a non-negotiable step in your pre-trade checklist, you ensure every single position you open is perfectly sized and aligns with your risk management strategy.

This principle of using the right tool for the job extends beyond just forex. For crypto traders, something like a Bitcoin transaction fee calculator is just as critical for managing costs effectively. The core idea is the same: use specialised tools to make accurate financial decisions. Integrating a pip value calculator into your workflow means you're always trading with confidence and clarity.

From Pips to Profit: A Practical Guide to Risk Management

So, you know a single pip is worth 15 ZAR. That’s a great start, but on its own, it’s just a piece of data. The magic happens when you use that number to protect your trading capital. This is what separates seasoned traders from beginners: they use the pip value to build a solid risk management strategy.

Think of it as the bridge between the tiny price fluctuations you see on your chart and the real-world impact on your account balance. Instead of just jumping into a trade and hoping for the best, a disciplined trader uses the pip value to create a precise plan. This ensures no single bad trade can wipe out their hard-earned gains.

A Real-World Risk Scenario

Let's walk through a common situation. Imagine you're working with a 50,000 ZAR trading account. A fundamental rule for many successful traders is to never risk more than 1% of their capital on a single trade. In this case, your maximum acceptable loss is 500 ZAR.

You've done your homework on the EUR/USD and have a solid entry point in mind. Your technical analysis also points to a logical place to set your stop-loss, which happens to be 25 pips away from your entry price.

Now for the million-rand question: how big should your position be? This is precisely where your pip value calculation becomes the most important tool in your arsenal.

- Maximum Risk: 500 ZAR

- Stop-Loss Distance: 25 pips

To stick to your 1% rule, you need to figure out a trade size where a 25-pip loss translates to exactly 500 ZAR. A quick bit of maths (500 ZAR / 25 pips) tells you that each pip’s value cannot exceed 20 ZAR. From here, you can use a pip calculator to work backwards and find the exact lot size that gives you a 20 ZAR pip value on EUR/USD.

Trader's Insight: This approach takes the emotion and guesswork completely out of position sizing. Your risk tolerance should always dictate your trade size, not the other way around. It’s a foundational habit of consistently profitable traders.

This systematic process isn't just theory; it has real, tangible benefits. In fact, South African traders who consistently use risk management tools like pip calculators have reported reducing their average trading losses by up to 25%. Why? Because it enforces strict, precise risk control on every single position you open.

Understanding pip values allows you to accurately forecast potential profits and, more importantly, potential losses. For a more comprehensive look at your financial performance, a general profit and loss analyzer can also offer a broader perspective. Ultimately, a pip calculator transforms risk from a scary, unknown concept into a variable you can control.

What About Pips for Indices and Commodities?

Sooner or later, you'll probably look beyond forex to trade other popular assets. Think about the JSE Top 40, Gold (XAU), or even Crude Oil. It can feel like a totally different ball game at first, mainly because these instruments don't technically use 'pips' to track their price changes.

But here’s the key: the fundamental idea of measuring your risk per price move is exactly the same. You’re still asking that crucial question: "If the price shifts by one unit, how much ZAR am I on the hook for?" This ensures your risk management stays sharp, no matter what you’re trading.

Points and Ticks: The New Lingo

Instead of pips, the language just changes a bit depending on what you're trading. It's a small shift that's easy to get the hang of.

- Indices: When you're trading stock market indices like the JSE Top 40 or the S&P 500, the smallest price change is called a point.

- Commodities: For hard assets like Gold, Silver, or Oil, that smallest increment is known as a tick.

A standard forex pip calculator might not handle these assets, but the logic behind the calculation is identical. Your goal is still to figure out the cash value of a single point or tick for the size of the trade you want to place.

Applying the Same Risk Management Logic

Let's say you're sizing up a trade on Gold (XAU/USD). The process should feel very familiar. First, you need to find the tick value – how much a single tick movement is worth in ZAR for your chosen contract size. This info is always available in the contract specifications on your trading platform.

For instance, imagine one tick on your Gold contract is worth R1.50. If you decide to place your stop-loss 100 ticks away from your entry price, your total risk on that trade is R150.

(R1.50 per tick × 100 ticks = R150)

This straightforward calculation allows you to use the very same disciplined risk strategy you’ve honed in forex. You can tweak your position size to make sure that any potential loss never goes beyond your set limit, like that golden rule of risking only 1% of your account on a single trade.

Once you master this concept, you can confidently manage your risk across any asset class you choose.

Common Questions About Pip Values

Even when you think you've got the hang of pips, there are always a few lingering questions that pop up. That’s perfectly normal. Getting straight answers to these is what builds real trading confidence, so let's tackle a few of the most common ones I hear.

Why Is The Pip Value Different For Each Currency Pair?

You've probably noticed that a pip's value isn't a one-size-fits-all number; it changes depending on the currency pair you're trading. It all comes down to the quote currency—that's the second currency in any pair.

A pip's value is always expressed in that quote currency. So, for a pair like GBP/USD, the pip value is in U.S. Dollars. But if you switch to trading USD/ZAR, that value is suddenly in South African Rands. Because every currency has its own unique value on the world stage, the actual monetary worth of a one-pip move will naturally be different for each pair.

This is where a good pip value calculator becomes your best friend. It crunches these numbers instantly and converts the value back into your account's base currency (like ZAR), so you're always looking at a figure that's relevant to your own pocket.

How Does My Account Currency Affect The Pip Value?

This is the final piece of the puzzle and arguably the most important one. Your account's base currency is what makes the pip value real and personal to you. It takes an abstract number and turns it into the rands and cents you actually trade with.

Let's say you're trading EUR/USD and a one-pip move on your trade size is worth $10. If your account is in ZAR, that $10 doesn't mean much until it's converted. A calculator will do that for you, showing you the current equivalent—maybe R180, for example.

This final conversion is absolutely critical for proper risk management. It strips away the guesswork and tells you exactly what a trade is worth—win or lose—in your local currency. That's the only number that really matters to your bottom line.

Is A Pip Calculator All I Need For Risk Management?

A pip value calculator is a brilliant tool, but it's just one piece of the risk management puzzle. Think of it as the tool that answers the "how much?" question—it quantifies the exact monetary value of each pip for your specific trade.

But a true strategy also has to answer the "why" and "when" of taking on risk. A calculator tells you how much you stand to lose; your personal strategy is what keeps those potential losses in check.

A solid risk management plan always includes things like:

- Knowing Your Limits: Sticking to firm rules, like the classic 1-2% rule, where you never risk more than one or two percent of your total account balance on a single trade.

- Setting Smart Stop-Losses: Using real analysis to decide where your stop-loss should be, not just picking a random number out of thin air.

- Staying Disciplined: Never, ever putting more money on the line than you are genuinely prepared to lose. No trade is a sure thing.

Ready to manage your international payments with total clarity and zero fuss? With Zaro, you can hold both ZAR and USD accounts, get the real exchange rate without hidden fees, and handle global transactions smoothly. It's time to stop letting bank markups eat into your profits and start making your business's money work smarter.