The real exchange rate formula is a bit of a mouthful, but the concept behind it is simple and powerful. It takes the exchange rate you see on the news (the nominal rate) and adjusts it for the price differences between two countries. In short, it tells you what your money is really worth when you spend it somewhere else.

What the Real Exchange Rate Reveals About Your Business

Let's cut through the jargon. The real exchange rate (RER) is the true measure of your currency's muscle, showing you what a "basket" of South African goods can actually buy you in another country, say the United States. It filters out the day-to-day market noise to give you a much clearer picture of your actual purchasing power.

Think of it this way. The nominal exchange rate is the sticker price you see on a bureau de change board, like 18.50 ZAR for one USD. But the real exchange rate is the final, all-in cost after you factor in that a Big Mac, a pair of jeans, or a new laptop might be cheaper or more expensive in Mzansi compared to Manhattan.

It answers the crucial question for any business trading internationally: "After accounting for local prices, how many American products can I get for the price of one South African product?"

To get a better sense of this, let's quickly compare the two concepts.

Nominal vs Real Exchange Rate at a Glance

This table breaks down the fundamental differences between the nominal and real exchange rates, highlighting what each one measures and its primary use.

| Feature | Nominal Exchange Rate | Real Exchange Rate |

|---|---|---|

| What It Measures | The direct price of one currency in terms of another. | The relative price of goods and services between two countries. |

| Accounts for Inflation? | No, it ignores price levels. | Yes, it adjusts for differences in inflation. |

| Main Use | Quick currency conversions and daily forex trading. | Assessing international competitiveness and purchasing power. |

| Analogy | The "sticker price" of a currency. | The "true cost" or "value for money" of a currency. |

Essentially, the nominal rate is for quick conversions, while the real rate gives you the strategic insight needed for long-term business planning.

Why It Matters for South African Businesses

Understanding the real exchange rate isn’t just an academic exercise—it’s a vital indicator of your business’s international competitiveness. It helps you look past the surface-level numbers and understand the underlying economic forces at play.

Here’s what it means in practical terms:

- A "high" or "strong" RER means the rand is likely overvalued. While this makes foreign goods seem cheaper for South Africans, it makes your exports more expensive for international customers. This can put a real squeeze on your ability to compete on price in global markets.

- A "low" or "weak" RER means the rand is probably undervalued. This is often good news for exporters, as it makes your products more affordable and attractive to foreign buyers, potentially unlocking new sales and markets.

The real exchange rate provides a vital pulse check on a nation's trade health. It's the difference between seeing a price tag and understanding the actual cost of doing business globally.

This dynamic isn't just theory; it's a central part of South Africa's economic story. The country’s real exchange rate has seen significant swings, reflecting major shifts in both local and global economic climates. For example, between 1990 and 2004, as domestic inflation fell and stabilised, the gap between the nominal and real exchange rates narrowed, pointing to a more consistent and predictable monetary environment.

You can dive deeper into the historical volatility of the rand’s real exchange rate in detailed analyses from the GTAC. This history shows just how deeply the RER is tied to national economic policy and stability. For any South African exporter, getting to grips with this concept is the first step toward building a truly resilient international strategy.

Breaking Down the Real Exchange Rate Formula

To really get a handle on international trade, you have to look past the daily ups and downs of the currency markets. That’s where the real exchange rate formula comes in. It’s a powerful tool that cuts through all the noise to show you what a currency is actually worth in terms of purchasing power.

At its heart, the formula is surprisingly simple.

It looks like this:

Real Exchange Rate (RER) = (Nominal Exchange Rate × Domestic Price Level) / Foreign Price Level

Let's unpack what each of those moving parts really means. Think of it like building something from a kit—each component is straightforward on its own, but together they create a complete picture of economic reality.

The Three Core Components

Nominal Exchange Rate (E): This is the one you’re probably most familiar with. It's the simple, straightforward rate you see on the news or at a foreign exchange booth—how many South African Rands it takes to buy one US Dollar, for instance. It’s just the surface-level price tag.

Domestic Price Level (P): This piece represents the average cost of a standard "basket" of goods and services right here in South Africa. We typically use the Consumer Price Index (CPI) as a proxy for this, as it gives us a solid measure of inflation and the general cost of living.

Foreign Price Level (P*): Just like the domestic one, this is the average cost of the same basket of goods and services, but in the other country you’re comparing to (like the United States). And again, the US CPI is the go-to metric here.

The real magic happens when you bring these three elements together. The formula takes the simple nominal rate and adjusts it for the different inflation rates between the two countries. What you're left with is a much truer, more meaningful comparison of value.

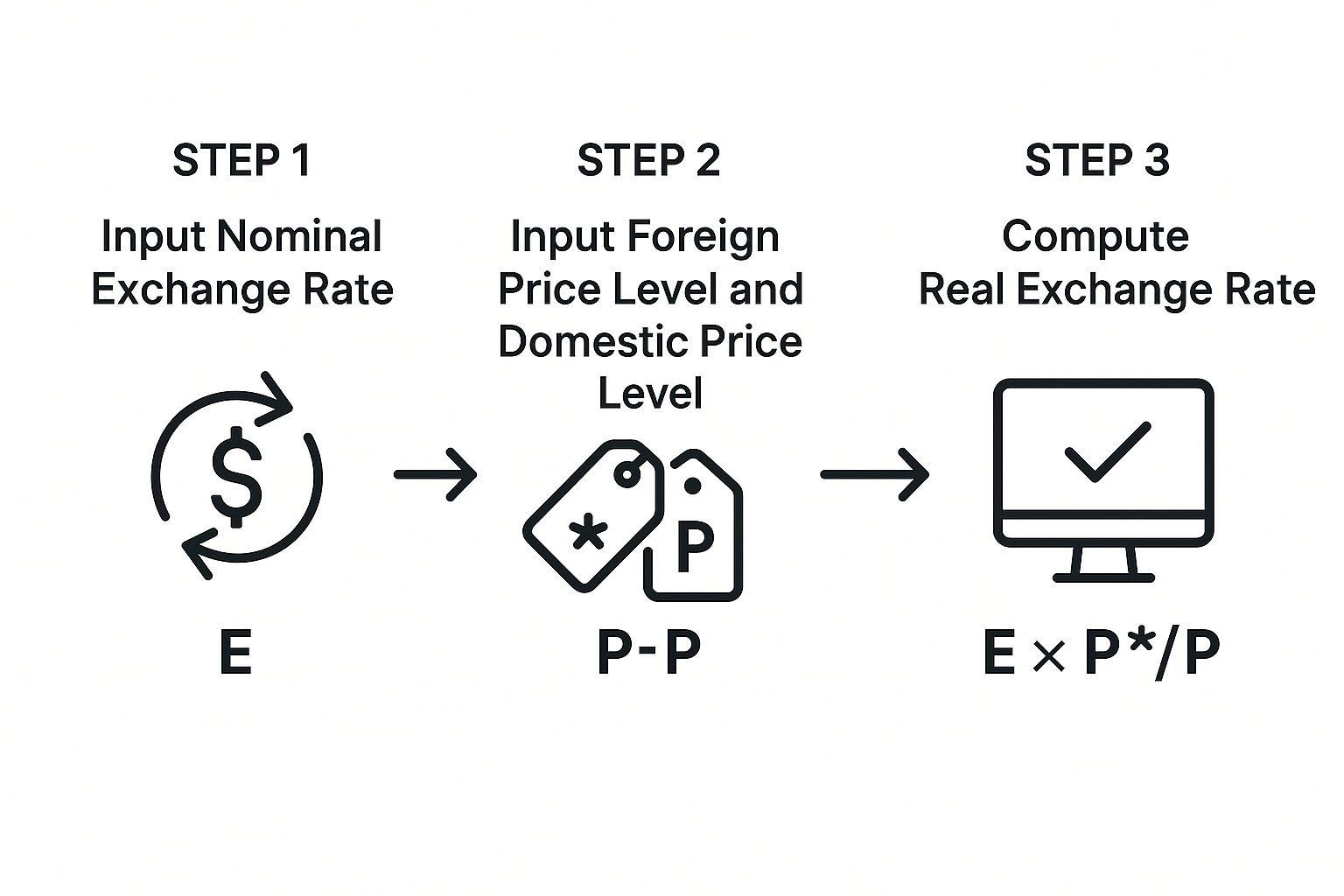

The image below shows how these inputs come together to calculate the real exchange rate.

This calculation moves us from a basic currency conversion to a far more insightful measure of relative prices.

Putting the Formula into Practice

Let's make this real. When we're looking at the South African Rand (ZAR) versus the US Dollar (USD), we can slot their respective CPI figures into the formula. It now becomes: Real Exchange Rate = Nominal Exchange Rate (ZAR/USD) × (CPI_US / CPI_ZA).

For example, imagine the nominal exchange rate is 18 ZAR to 1 USD. Let's say the US CPI is at 110, and South Africa's CPI is at 120.

The calculation would be: 18 × (110 / 120) = 16.5.

You can find more detailed examples of this calculation and what it means on sites like Investopedia.

That result of 16.5 is a big deal. It tells us that once you account for inflation, the rand's actual purchasing power is stronger than the nominal rate of 18 would have you believe. In other words, that basket of goods is relatively cheaper in the US than the headline exchange rate suggests.

Getting your head around this calculation isn't just for academics. For any South African business, particularly if you’re an exporter, this is a vital signal of your international competitiveness. A lower real exchange rate means your goods are more attractively priced on the world stage, which can open up massive opportunities for growth and expansion into new markets.

Let’s Calculate the ZAR to USD Real Exchange Rate

Theory is one thing, but let's get our hands dirty and put the real exchange rate formula to work. We're going to walk through a calculation for the South African Rand (ZAR) against the US Dollar (USD), using simple, clear numbers to show you exactly how it functions in the real world.

This example will help cement your understanding. More importantly, it will show you how to look beyond the daily market rates and interpret what the final number truly means for your business.

First, We Gather Our Data

Before we can crunch the numbers, we need to pull together three key pieces of information. For this example, let's work with the following hypothetical figures:

- Nominal Exchange Rate (E): 18.50 ZAR/USD. This is the rate you see on the news or a currency converter—the standard "sticker price" for the currency pair.

- Domestic Price Level (P): 125. We'll use South Africa's Consumer Price Index (CPI) as a stand-in for local prices.

- Foreign Price Level (P*): 115. Likewise, we'll use the CPI from the United States to represent prices over there.

With these three variables on hand, we have everything we need to find the real exchange rate and uncover the rand's true purchasing power.

The Step-by-Step Calculation

Alright, let's plug these values into the formula we covered earlier:

Real Exchange Rate = Nominal Exchange Rate × (Foreign CPI / Domestic CPI)

Here's how it breaks down:

- Start with the Nominal Rate: We begin with 18.50.

- Figure out the Price Ratio: Next, we divide the US CPI (115) by the SA CPI (125). This gives us 0.92. This little number is a powerful comparison of inflation between the two countries.

- Multiply to Find the RER: Finally, we multiply our nominal rate by the price ratio: 18.50 × 0.92 = 17.02.

So, our real exchange rate is 17.02. This number tells a much more interesting story than the 18.50 we started with.

So, What Does This Result Mean? The calculated real exchange rate of 17.02 is lower than the nominal rate of 18.50. This signals that once you account for the difference in local prices (specifically, higher relative inflation in South Africa), US goods are actually more expensive for a South African buyer than the headline rate suggests. Your rand doesn't stretch as far in the US as you might think at first glance.

Interpreting the Real Exchange Rate

This calculation is more than just an academic exercise; it's a practical tool for sizing up your international competitiveness.

A core economic theory known as Purchasing Power Parity (PPP) suggests that, in the long run, the real exchange rate should drift towards 1. This would mean a basket of goods costs the same in both countries. Of course, the real world is complicated by things like shipping costs and trade barriers, so this rarely happens perfectly.

That's why the real exchange rate is such a vital, realistic measure of a currency's current value and a country’s trade position. You can explore more on this topic with the IMF's explanation of the real exchange rate.

For services like Zaro, which give businesses access to real exchange rates without hidden markups, this concept is everything. It empowers you to make genuinely informed decisions based not just on fluctuating nominal rates, but on a much deeper understanding of your currency's actual global purchasing power.

How the RER Shapes Your Export Strategy

For anyone exporting from South Africa, the real exchange rate is much more than just a number spat out by a formula. Think of it as a critical signal from the global market, one that directly impacts your competitiveness and, ultimately, your bottom line.

Grasping how it works is the difference between simply reacting to market shifts and proactively building a strategy that can weather them. The real exchange rate tells you, in practical terms, whether your products look like a bargain or a luxury item to international buyers. That knowledge changes everything.

Let's walk through a couple of real-world scenarios to see exactly how this plays out.

When the Rand Is "Strong" or Overvalued

First, let's imagine the real exchange rate is high. This is what we call a "strong" rand, meaning it's overvalued compared to the currencies of the countries you're selling to.

Now, a strong rand might sound like good news, but for an exporter, it’s a serious headwind. Here’s why:

- Your products get more expensive overseas. A Western Cape wine farmer exporting to Europe will suddenly find their Chardonnay has a higher price tag in Euros. This makes it a lot tougher to compete against local French wines or even imports from places like Chile.

- Your profit margins get squeezed. To stay in the game, you might be forced to slash your export prices. That decision cuts straight into your profits.

- Sales can start to dry up. Naturally, higher prices often lead to less demand from your international customers, which can bring your growth plans to a screeching halt.

In this kind of environment, you'd need to shift gears. Your strategy might focus more on marketing the premium quality and unique story of your brand rather than competing on price alone. Or, you could pivot to target markets where consumers are less sensitive to price.

When the Rand Is "Weak" or Undervalued

Now, let's flip the coin. A low real exchange rate means the rand is "weak" or undervalued. For anyone selling goods and services abroad, this is usually a massive advantage.

A weaker rand makes your products much cheaper for buyers using foreign currency. That same bottle of South African wine now looks like a fantastic deal on a European shelf, making it far more appealing to shoppers.

This creates some incredible opportunities. You can:

- Aggressively push into new markets.

- Steal market share from your competitors.

- Boost your profit margins in ZAR, even while keeping your foreign prices competitive.

A stable and competitive real exchange rate is the bedrock of a predictable export environment. It allows businesses to plan, invest, and grow with confidence.

At the end of the day, it’s the stability of the real exchange rate that truly matters for long-term planning. Wild swings create uncertainty, making it incredibly difficult for exporters to forecast revenue or manage costs. This kind of volatility is a huge deterrent to making the long-term investments needed for growth.

This is why the South African Reserve Bank (SARB) keeps a close eye on the RER. It's a key indicator they use to guide policy, aiming for a stable environment that supports sustainable economic growth. You can dive deeper into the SARB's perspective on the real exchange rate and competitiveness in their quarterly bulletin analyses.

This is precisely where platforms like Zaro come in. By giving you access to real exchange rates without hidden markups, they give you the clarity you need to act on these insights and build a truly resilient and profitable export business.

Economic Forces That Drive the Real Exchange Rate

The real exchange rate doesn’t exist in a vacuum. It’s a dynamic figure, constantly being pushed and pulled by powerful economic forces. For a South African business owner, getting to grips with these drivers gives you a clearer view of the landscape, helping you anticipate potential shifts and what they might mean for your bottom line.

While the real exchange rate formula is a function of prices, the real story is in what causes those prices and the nominal rate to move in the first place. Several key factors are at play, each telling a part of the bigger economic story.

The Impact of Inflation and Interest Rates

One of the biggest movers is relative inflation. Let’s say South Africa's inflation is running hotter than that of a major trading partner, like the United States. This means our local prices are climbing faster. All else being equal, this erodes the Rand's real value. Your money simply buys less abroad, pushing the real exchange rate down.

Tied closely to this are interest rates. When the South African Reserve Bank (SARB) hikes interest rates, often to cool down inflation, it can make holding Rand-denominated assets more appealing to foreign investors. This inflow of foreign capital boosts demand for the Rand, strengthening the nominal exchange rate and, in turn, affecting the real rate.

Terms of Trade and Government Policies

Another crucial piece of the puzzle is a country's terms of trade. This isn't as complex as it sounds; it just measures the price of our exports relative to the price of our imports. For South Africa, where exports lean heavily on commodities like minerals, a spike in global platinum or gold prices improves our terms of trade. This drives demand for the Rand and strengthens its real value.

Government policies, particularly tariffs, also have a direct impact. A tariff is simply a tax on imported goods, which raises their price tag for local consumers. This can make the real exchange rate appreciate, which sounds good but has the side effect of making our exports less competitive on the world stage.

An important extension of this concept is the Real Effective Exchange Rate (REER). Instead of just comparing the Rand to one other currency, the REER measures it against a weighted basket of currencies from our main trading partners. This gives a much more accurate picture of South Africa's international price competitiveness. You can dive deeper into how this is calculated by reviewing findings from the OECD.

Got Questions About the Real Exchange Rate? We've Got Answers.

Diving into foreign exchange can feel a bit like learning a new language. But once you grasp the key terms, you'll be making smarter decisions in no time. Let's clear up some of the most common questions about the real exchange rate (RER).

What’s the Difference Between the Real Exchange Rate and PPP?

It helps to think of them in terms of time. Purchasing Power Parity (PPP) is the long-game theory. It’s an economic idea suggesting that, over a long enough period, the price for a basket of identical goods should be the same everywhere, which would mean the real exchange rate eventually settles at 1.

The Real Exchange Rate (RER), on the other hand, is your snapshot for right now. It’s a practical measure that tells you how competitive a country’s goods are in the short to medium term. It accounts for all the real-world messiness that PPP theory tends to smooth over, like different inflation rates and shipping costs.

Simply put, the RER is the tool you use today. PPP is the theory that explains where things might head tomorrow.

How Often Should My Business Check the RER?

For most businesses, checking the RER isn't like watching the stock market ticker every hour. You’re not looking for daily blips. Instead, it’s all about tracking the trend over weeks and months.

Watching the medium-term trend is far more valuable than reacting to daily fluctuations. This strategic oversight helps you make informed decisions about pricing, timing international payments, and managing foreign currency risk effectively.

By keeping an eye on these bigger shifts, you can see changes in your competitiveness coming and adjust your export strategy. It's about being strategic, not getting bogged down by market noise.

Can the Real Exchange Rate Be Negative?

Nope, the RER can't be negative. The reason is simple: the real exchange rate formula is just a ratio of positive numbers. You’re dividing the nominal exchange rate by the price levels of two countries (like their CPIs), and all of those figures will be positive.

So, what does a very low RER mean? A number close to zero doesn't signal a negative value. It actually means that local goods are incredibly cheap compared to foreign ones, suggesting the currency is heavily undervalued. For a South African exporter, that’s great news—it’s a clear sign that your products are extremely competitive on the world stage.

Take the guesswork out of your international payments. With Zaro, you get access to the real exchange rate, with zero spread and no hidden fees, giving you the clarity and power to build a more profitable global business. Manage your foreign exchange with confidence by visiting Zaro today.