The SA forex exchange is essentially a vast, 24/7 digital marketplace where the South African Rand (ZAR) is traded against other world currencies. For any business involved in cross-border trade, getting a handle on this market is non-negotiable. Why? Because it directly dictates the cost of importing goods, paying overseas suppliers, or converting international revenue back into Rands.

How the SA Forex Exchange Really Works

Think of a bustling farmers' market, but instead of trading fruits and vegetables, the vendors are swapping currencies. That’s a simple way to picture the South African forex exchange. It's not one single building but a decentralised network where participants buy, sell, and speculate on currencies around the clock.

At its core, every transaction involves a currency pair, like the ZAR/USD. If you're an importer buying goods from the US, you are essentially selling Rands to buy US Dollars. The "price" you pay is the exchange rate at that very moment.

The Main Players in the Marketplace

This market isn't just for businesses; it's a complex ecosystem with several key players, each with a different motivation. Understanding who they are helps to demystify why exchange rates jump around and where your money actually goes during a transaction.

The main participants in the SA forex exchange include:

- Commercial Banks: These are the heavyweights, trading massive volumes for themselves and their clients (like your business). They act as market makers, setting the bid and ask prices you often see.

- The South African Reserve Bank (SARB): As the country's central bank, the SARB isn't in it for profit. It steps in to maintain market stability, using its policies to manage currency reserves and stop the Rand from swinging too wildly.

- Corporations and Businesses: Companies like yours are in the market every day. You're converting currency to pay international invoices, receive payments from foreign customers, or manage financial exposure across different countries.

- Investment Managers and Hedge Funds: These players treat currencies as an asset class. They speculate on future price movements to generate returns for their investors, and their high-volume trades can definitely nudge short-term rates.

The constant tug-of-war between these groups creates liquidity—the ease with which a currency can be bought or sold without causing a major price shift. The ZAR is one of the most traded emerging market currencies, which generally means there’s a ready buyer for every seller.

Why This Market Matters to Your Business

For a South African business operating on the global stage, the forex market isn't some abstract financial concept. It’s a very real factor that hits your bottom line. Every single time you transact across borders, you’re plugging into this massive, dynamic market.

A fluctuating exchange rate can turn a profitable import deal into a loss overnight.

Let’s say you agree to pay a supplier $10,000 when the rate is R18.00/USD. Your cost is a straightforward R180,000. But if the Rand weakens to R18.50/USD by the time the payment is due, that same invoice suddenly costs you R185,000. That’s a R5,000 loss purely from market movement.

This is exactly why getting a clear view of the SA forex exchange is the first step toward making smarter financial decisions. It gives you the foundation you need to navigate fees, manage risk, and ultimately protect your profits when doing business abroad.

Here is the rewritten section, crafted to sound like it was written by an experienced human expert.

The South African Reserve Bank's Market Influence

When you think about the South African forex market, it’s easy to picture a hectic trading floor filled with commercial banks and large corporations. But there’s another major player in the room, one that isn't there to turn a profit: the South African Reserve Bank (SARB). The SARB acts as both a referee and a heavyweight contender, and its main goal is to keep the economy stable and protect the value of our Rand.

Every time your business sends money overseas or gets paid by a client abroad, you're playing by the SARB’s rules. They literally write the rulebook for all foreign exchange in the country. This isn't just about bureaucracy; it's about creating a fair and transparent system that supports South Africa's economic health.

Shaping Stability Through Policy

So, how does the SARB actually steer the ship? One of its most powerful tools is managing the country's official gold and foreign exchange reserves. Think of these reserves as the nation's financial shock absorber. By stepping into the market to buy or sell foreign currency, like US Dollars, the SARB can directly influence the supply and demand for the Rand. This helps iron out the kind of extreme volatility that can give businesses a serious headache.

For your company, this intervention is a game-changer. A more stable currency translates into more predictable import costs and more reliable export revenues. The SARB isn't trying to create an artificial exchange rate, but rather to prevent the wild, unpredictable swings that can completely derail a company's budget. It’s all about building a more secure environment for international trade and maintaining confidence in the ZAR.

The SARB’s role is not to set a specific price for the Rand, but to maintain an orderly market. Its interventions are designed to curb excessive fluctuations, not to artificially fix the currency's value against others.

The bank’s approach hasn't always been the same. It's evolved quite a bit. In the past, the SARB often used the forward market to offer forward cover, which are contracts that let businesses lock in a future exchange rate to shield themselves from currency risk. When reserves were low, it even took out foreign currency loans to prop up the nation's finances, paying back the last of these loans in June 2010.

A huge turning point was the end of the dual exchange rate system in March 1995, which finally merged the financial and commercial Rand into a single currency. After that, the SARB got busy strengthening its own position, actively buying up foreign exchange from the market. This move dramatically slashed its net open foreign currency position from a staggering high of US$25.8 billion. For a deeper dive into these historical shifts, the Bank for International Settlements has a detailed report that’s well worth a read.

What SARB's Influence Means for You

Okay, so this isn't just a lesson in economics. Understanding what the SARB does has very real, practical consequences for your business. Its policies and actions shape the entire SA forex exchange landscape.

Here’s a quick rundown of how the SARB’s work affects your bottom line:

- Exchange Control Regulations: These are the rules of the road for moving money across South Africa's borders. The SARB sets the requirements for documentation, transaction limits, and how you report your cross-border payments.

- Interest Rate Decisions: When the SARB's Monetary Policy Committee adjusts the repo rate, it sends ripples across the entire economy. A rate hike can make the Rand more attractive to foreign investors and strengthen it, while a cut can have the opposite effect.

- Market Confidence: A central bank with healthy foreign reserves and clear, sensible policies inspires confidence. This international confidence is a vital ingredient for a stable and resilient currency, making South Africa a more attractive place to do business.

Ultimately, by guiding the market toward stability and setting clear regulatory goalposts, the SARB creates the very field on which all forex transactions are played. For any business involved in global trade, getting a handle on the SARB's influence is the first step toward anticipating market movements and making smarter financial decisions.

Finding the True Cost of Your Forex Payments

When you’re sending money overseas, you've probably seen claims like "zero fees" or "free transfers." Traditional banks and some payment providers love using these phrases in their marketing. While they sound great on the surface, they often mask the real, and sometimes substantial, costs of making international payments. To get a clear picture of what you're actually paying, you need to look past the advertised transfer fee and dig into the hidden charges.

The biggest culprit is the exchange rate markup, sometimes called the spread. Think of it this way: your bank buys currency at a wholesale price—the real, mid-market rate. But when they sell that currency to you, they don’t give you that same rate. Instead, they add their own percentage on top, and that markup is pure profit for them and a direct cost to your business.

It’s a clever way to charge a hefty fee without ever having to list it on your statement. A seemingly small markup of 2-5%, which is fairly standard with traditional banks, can easily add thousands of Rands to a large international invoice. This is the single biggest reason why the amount of money you send isn't what your supplier actually receives after it's been converted.

Uncovering the Real Fees in a Forex Transaction

To shed some light on this, let's break down all the costs—both the ones you see and the ones you don't—that can pile up during a typical international payment.

| Fee Component | Description | Typical Cost Range |

|---|---|---|

| Exchange Rate Markup | The percentage added to the real mid-market exchange rate. This is the primary hidden fee. | 1% - 5%+ |

| Transfer Fee | An explicit, upfront fee charged for processing the international payment. | R150 - R600 |

| SWIFT Fees | Charges from intermediary banks that handle the payment as it moves through the global network. | R250 - R750 per transaction |

| Receiving Bank Fees | A fee charged by the recipient’s bank simply to accept and process the incoming funds. | R100 - R500 |

By the time your payment navigates this maze of charges, the "true cost" can be shockingly higher than what you were led to believe. This is why just looking at the upfront transfer fee doesn't give you the full story.

Looking Beyond the Markup

While the spread is usually the biggest cost, it’s not the only one. Several other charges can chip away at your funds, especially if you're relying on older banking systems.

These additional costs often include:

- SWIFT Fees: When your money travels through the global SWIFT network, it often hops between several intermediary banks. Each one can take a slice of the pie, with fees ranging from R250 to R750 per transaction. Worse still, these fees are notoriously hard to predict.

- Administrative Charges: Some banks still apply flat administrative or "processing" fees just to handle the paperwork and compliance checks tied to an international transfer.

- Receiving Bank Fees: Even after your payment has been sent and converted, your supplier’s bank might charge them a fee just to deposit the funds into their account. This directly reduces the final amount your partner gets.

As you can see, calculating the total cost is the only reliable way to compare different SA forex exchange providers and find a partner who offers genuine value.

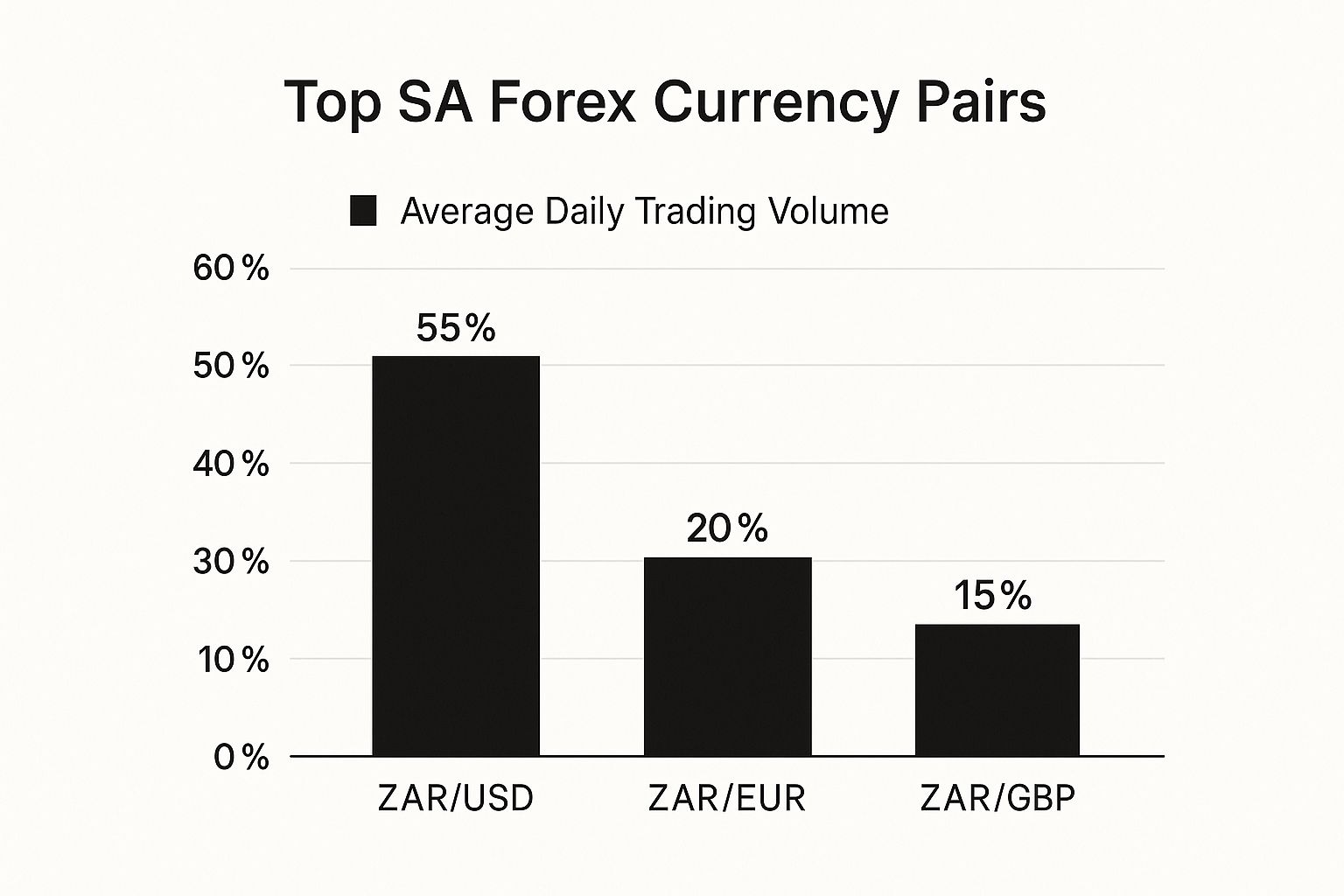

To give you a sense of the local market, the infographic below shows which currency pairs are most frequently traded with the South African Rand.

This data shows that the ZAR/USD pair dominates trading, which means it usually has the highest liquidity. In practical terms, this can lead to tighter spreads compared to less common currency pairs.

How to Calculate Your All-In Cost

So, how do you cut through the marketing noise and find out what you’re really paying? The formula is actually quite simple, but it means you have to ask your provider for the right information. Before you agree to any transfer, you need two things: the real mid-market exchange rate and the exact rate you are being offered. A quick search on Google or Reuters will give you the mid-market rate in seconds.

Once you have both rates, you can work out your real cost.

Example Calculation:

Let's imagine your business needs to pay an international supplier $10,000.

- The Real Rate: You check online and see the mid-market rate is R18.50 per USD.

- Your Bank's Quoted Rate: Your bank offers you a rate of R18.90 per USD.

- The Hidden Cost: The difference between the two rates (R0.40) is the bank's markup. For a $10,000 transfer, this hidden fee comes to a staggering R4,000 (R0.40 x 10,000).

- The Stated Fee: On top of that, the bank charges a R500 "international transfer fee."

- Total Cost: Your true, all-in cost for this single transaction is R4,500.

This straightforward calculation pulls back the curtain on those "low fee" promises. By demanding full transparency and always comparing the all-in cost, you can make smarter financial decisions that protect your bottom line. It’s precisely this lack of transparency that modern solutions like Zaro are built to solve, offering the real rate with no hidden markups.

Why the Rand's Volatility Matters to You

The South African Rand (ZAR) is anything but a quiet, sideline currency. In fact, it's one of the most actively traded emerging market currencies on the planet. Billions of dollars worth of Rand are bought and sold every single day, and that high level of activity—what we call liquidity—is a real double-edged sword for any business operating here.

On one hand, high trading volumes mean it’s usually easy to exchange large sums without single-handedly causing a market shock. But on the other, the Rand is notoriously volatile. Its value can swing dramatically based on global news, a snippet of local economic data, or even a single policy announcement from the Reserve Bank.

For any business involved in cross-border trade, getting a handle on this volatility isn't just an academic exercise. It's fundamental to protecting your profit margins.

The Scale of Daily Forex Trading

To really appreciate why the Rand moves so much, you need to understand the sheer scale of the SA forex exchange. It's an incredibly dynamic market where daily trading volumes often surge into the tens of billions of US dollars, reflecting a constant flow of capital for trade, investment, and speculation.

A look at the historical data tells the story. For example, the total daily average turnover for the foreign exchange market in South Africa rocketed to a record high of USD 27.64 billion back in March 2014. While the numbers naturally fluctuate—rand-specific trades averaged USD 1.15 billion daily in July 2018—they consistently show a highly active marketplace. If you’re interested, you can explore more historical trade turnover data to see these trends for yourself.

This massive volume means the Rand is deeply sensitive to shifts in global investor sentiment, often acting as a barometer for the market's appetite for risk.

Why Volatility is a Business Risk

So, what do these wild market swings actually mean for your business in practical terms? Let’s walk through a common scenario.

Imagine you're an importer and you've agreed to pay a European supplier €50,000 for a shipment of goods, with payment due in 30 days.

- When you place the order: The exchange rate is a decent R19.50/EUR. You budget for a cost of R975,000.

- When payment is due (30 days later): A gloomy economic report comes out, and the Rand weakens to R20.10/EUR.

- The new cost: That same €50,000 invoice now costs you R1,005,000.

Just like that, your business is down R30,000. This wasn't due to poor sales or operational issues; it was purely down to the currency market's movement. This is exchange rate risk in action, and it can silently eat away at profits, wreck your budgets, and even strain relationships with suppliers.

The core challenge for businesses is that currency volatility is unpredictable. A favourable rate today can become a significant liability tomorrow, turning a profitable deal into a loss before you’ve even received the goods.

And this risk isn't just for importers. Exporters face the exact same problem, just in reverse. If you're expecting a payment of $100,000 from a US client and the Rand suddenly strengthens, the final amount that lands in your ZAR account could be a lot less than you'd planned for.

Ultimately, navigating the SA forex exchange requires more than just finding a provider to send money. It demands a real strategy to manage this built-in volatility. By understanding the forces that drive the Rand's value, you can start to time your payments more effectively and use tools that shield your business from those sudden and costly rate changes.

How Foreign Exchange Reserves Create Stability

Foreign exchange reserves can feel like a pretty abstract economic concept, but they have a very real impact on your business's bottom line. Think of them as South Africa’s national safety net, a massive savings account held in foreign currencies (like the US Dollar) and gold by the South African Reserve Bank (SARB). Their main job is to act as a powerful buffer, protecting the Rand when the economic seas get rough.

When global markets become volatile or investors get nervous, the SARB can step into the SA forex exchange. By selling some of its foreign currency reserves to buy Rands, it props up our currency's value and prevents it from spiralling downwards. This intervention is all about maintaining stability and building confidence in the ZAR.

For any business involved in cross-border trade, this stability is priceless. It translates to less guesswork, more predictable costs when paying international suppliers, and more reliable income from your foreign sales. In short, a stable currency environment lets you focus on running your business, not on reacting to wild market swings.

The Link Between Reserves and Confidence

Healthy, growing foreign reserves send a powerful message to the rest of the world. It’s a clear signal that South Africa has the financial firepower to cover its international debts and defend the Rand if necessary. This reassurance makes foreign investors far more comfortable bringing their money into the country, which in turn strengthens the economy and supports the currency.

You can see this confidence reflected in the numbers. While South Africa’s foreign exchange reserves averaged around USD 36.7 billion between 1998 and mid-2025, they shot up to an all-time high of USD 69.16 billion in July 2025. This shows a much stronger financial position. You can discover more about South Africa's reserve trends and see how these figures tell a story of growing resilience.

Having a strong reserve position like this provides a crucial backstop that benefits every single business trading across borders.

A robust reserve portfolio is like a strong foundation for a house. You don't see it every day, but it provides the essential stability needed to weather storms, ensuring a safer environment for everyone inside.

What This Means for Your Business Payments

So, how does all this high-level economic policy actually help when you need to make an international payment? The connection is surprisingly direct.

- More Predictable Exchange Rates: When the SARB can step in to calm extreme volatility, the exchange rates you get are less likely to jump around erratically from one day to the next.

- Reduced Hedging Costs: In a more stable market, the financial tools used to protect against currency risk, like forward contracts, often become cheaper.

- Enhanced Supplier Confidence: Your international suppliers are watching the currency markets too. A stable Rand gives them more confidence in doing business with you, which helps build stronger, more reliable trade relationships.

Ultimately, a well-managed reserve system makes for a healthier and more predictable SA forex exchange. This gives businesses like yours the certainty you need to turn a potential financial headache into just another manageable part of your global strategy.

A Smarter Way to Make International Payments

If you do business globally, you're likely all too familiar with the headaches of the SA forex exchange. Hidden markups, frustrating settlement delays, and confusing fee structures often feel like an unavoidable cost of doing business.

But what if you could sidestep those traditional roadblocks entirely? There’s a better way, built on modern technology that puts speed, transparency, and real cost-effectiveness first. This isn't just about finding a bank with slightly better rates. It's about fundamentally changing how you move money by getting access to the real exchange rate, the one banks use between themselves.

Platforms like Zaro were created to do just that. By cutting out the costly intermediaries and opaque fees that chip away at your profits, they turn forex from a dreaded cost centre into a smooth, predictable part of your business operations.

The Old Way Versus the New Way

To really grasp the difference, let’s walk through a common scenario. Imagine your business needs to pay a $20,000 invoice to a supplier in the United States.

| Feature | Traditional Bank | Modern Platform (like Zaro) |

|---|---|---|

| Exchange Rate | You're offered a marked-up rate, often 2-4% above the real one. | You get the real, mid-market exchange rate with no spread. |

| Hidden Fees | That markup silently costs you thousands of Rands. | There are zero hidden markup fees. What you see is what you pay. |

| Transfer Fees | You'll likely pay SWIFT network fees and admin charges. | No SWIFT fees. |

| Speed | Transfers can take 3-5 business days to finally land. | Payments can arrive within hours or by the next business day. |

| Total Cost | High, unpredictable, and often a nasty surprise. | Low, completely transparent, and known before you hit 'send'. |

The difference is staggering. With the bank, a 3% markup on that $20,000 payment instantly costs you $600—that's over R11,000—before they've even added their other fees. A transparent platform puts that money straight back into your pocket, improving your cash flow and making your business more competitive.

Making a Payment, Step by Step

Switching to a better system is far simpler than you might think. The entire process is designed to be clear and efficient, removing the bureaucratic hoops common with old-school international transfers.

The key is a clean, user-friendly interface that gives you full control.

As you can see, the focus is on what matters to a business: speed, low costs, and proper controls.

A typical payment journey is refreshingly straightforward:

- Fund Your Account: First, you securely move funds into your dedicated ZAR or USD account with a simple local bank transfer.

- Lock In Your Rate: Next, enter the amount you need to send. The platform instantly shows you the live, real-time exchange rate and the final converted amount. No hidden markups, no surprises.

- Enter Beneficiary Details: Add your supplier's bank details. The system saves them, so future payments are just a click away.

- Send and Track: Finally, confirm the payment. Both you and your recipient get notifications, and you can track the funds in real-time until they arrive safely.

This simple, four-step process eliminates friction, freeing up your finance team from tedious admin work.

The Business Benefits of a Smarter Approach

Moving to a modern forex solution delivers real, tangible advantages that go well beyond saving on a single transaction. It strengthens your entire operation.

When you get rid of hidden fees and payment delays, you build stronger, more reliable relationships with your overseas partners. Paying suppliers on time, every time, with the full amount they expect, builds trust and makes you the kind of customer people want to work with.

The core benefits are hard to ignore:

- Improved Cash Flow: Faster payments mean your money isn't stuck in limbo for days. You can put your capital to work much more effectively.

- Reduced Admin Work: With automated compliance, saved beneficiary lists, and clear transaction histories, the hours spent on manual data entry and reconciliation just melt away.

- Stronger Supplier Relationships: Punctual, reliable payments make you a preferred business partner. This can lead to better terms, priority service, and more collaborative opportunities down the line.

- Enhanced Financial Predictability: Knowing your exact costs upfront takes all the guesswork out of the SA forex exchange, allowing for much more accurate budgeting and financial forecasting.

Your Questions About SA Forex, Answered

Venturing into international payments can feel like navigating a maze. There are always questions. Here, we'll tackle some of the most common ones we hear from South African businesses, giving you the clear, straightforward answers you need to move forward with confidence.

What Is The Best Time To Make An International Payment?

This is the million-dollar question, isn't it? The truth is, there’s no magic hour or perfect day that works for everyone. The SA forex exchange is a living, breathing thing, reacting in real-time to global news, economic reports, and general market moods. This means rates are always on the move.

Instead of trying to perfectly "time the market"—a task that trips up even the pros—a much smarter approach is to lock in a good rate the moment you see one. Modern platforms give you a live view of the rate, letting you pull the trigger instantly without any guesswork. The best strategy is simple: plan your payments ahead of time and act when the numbers make sense for your budget.

How Can I Protect My Business From Rand Volatility?

Ah, the infamous Rand rollercoaster. Shielding your business from its ups and downs is absolutely key to maintaining financial predictability. One of the most effective ways to do this is to work with a service that shows you the transparent, real-time exchange rate. This simple step helps you sidestep the hidden markups that only make things worse when the market takes a turn.

Bigger companies sometimes use complex tools like forward contracts to secure a rate for a future payment. For most small and medium-sized businesses, however, the most practical and powerful strategy is to find a payment partner who offers both speed and transparency. This lets you settle invoices quickly, before the market has a chance to swing against you.

At its heart, managing volatility is all about reducing uncertainty. When you know your exact costs upfront and can send money swiftly, you dramatically shrink your exposure to unpredictable market shifts. Currency risk goes from being a major headache to just another manageable part of doing business.

Are 'Zero Fee' Forex Transfers Really Free?

In a word: no. "Zero fee" is almost always a marketing hook, not a reflection of the actual cost. It’s a clever way to distract you from where the real charge is hidden: in the exchange rate markup. While you won't see a line item for a "transfer fee," the provider pockets a profit by giving you a rate that's worse than the one they're getting themselves.

To figure out what you’re really paying, you have to compare the rate you’re offered against the live mid-market rate. A provider that gives you direct access to the real SA forex exchange rate and charges a small, clear fee is almost always more transparent and far cheaper than one shouting about "free" transfers. Always do the maths on your total cost before you click send.

Ready to get rid of hidden fees and unpredictable waits in your international payments? With Zaro, you get the real exchange rate, crystal-clear costs, and seriously fast transfers. Take control of your global payments today.