If your South African business deals with suppliers, contractors, or partners across the globe, you know that paying them is rarely straightforward. It’s not just a simple bank transfer. You’re wading through a complex world of regulations, unpredictable exchange rates, and fees that aren't always what they seem. Let's break down how to get a handle on these challenges and keep your hard-earned money from disappearing into thin air.

The Real Cost of Sending Money Internationally from SA

Sending money out of South Africa is a strategic part of your business, but it's loaded with potential traps. Many businesses just stick with their main bank for these payments, completely unaware of how much it's really costing them. The true expense is a cocktail of factors that quietly chip away at your profit margins.

It's not just about the transfer fee listed on your statement. The real damage comes from a mix of padded exchange rates and the sheer administrative headache of it all. For a business that needs to settle several international invoices every month, these "small" costs stack up fast.

Getting to Grips with the Rules

Every single international payment leaving South Africa falls under a strict set of rules, mainly managed by the South African Reserve Bank (SARB). These regulations exist to control capital outflow and keep the country's finances stable. For your business, this means extra paperwork and a careful, compliant approach.

The scale of these transfers is huge. We're talking about annual remittance outflows from South Africa of around $4 billion, which covers both personal and business payments. To keep this in check, SARB has set up specific limits and demands thorough checks, especially for electronic transfers. You can get a better sense of these measures from the official SARB media release.

So, what does this mean for you in practice? You need to be ready for:

- Know Your Business (KYB) Checks: This is non-negotiable. You’ll have to provide comprehensive company documents to prove your business is legitimate.

- Proving the Payment's Purpose: Don't be surprised if you're asked for supporting documents, like the supplier's invoice, to show the payment is for a valid business reason.

- Keeping an Eye on Allowances: Businesses generally have more flexibility than individuals, but you still need to be aware of your allowances and track your payments to stay compliant.

The Hidden Costs: Fees and Rate Spreads

Beyond the red tape, the biggest hit to your finances comes from how traditional payment providers structure their costs. I've seen it countless times: banks advertise "low fees" but make their real money on the exchange rate spread. This is the gap between the real mid-market rate (the one you see on Google) and the less favourable rate they actually give you.

Here's the bottom line: The exchange rate you get is almost always more important than the transfer fee. A seemingly tiny percentage difference on a large payment can cost you thousands of Rands—much more than a flat fee ever would.

Think about it. You need to pay a supplier $10,000 USD. Your bank might quote you a rate with a 2% markup. That small percentage is real money—Rands that are no longer in your business. This is precisely why finding a payment partner who is transparent and offers rates close to the real mid-market rate is one of the smartest financial moves you can make.

Before we move on, let's summarise the key elements you need to manage.

Key Factors for International Business Payments from SA

| Factor | What It Means for Your Business |

|---|---|

| SARB Compliance | You must adhere to strict regulations, which often involves providing detailed documentation (KYB) and justifying each payment's purpose (e.g., invoices). |

| Exchange Rate Spread | This hidden cost, the difference between the mid-market rate and the rate you're offered, can significantly impact the final amount your recipient gets. |

| Transfer Fees | These are the explicit fees charged per transaction. While important, they are often less impactful than a poor exchange rate. |

| Administrative Burden | The time and resources your team spends managing compliance, tracking payments, and reconciling accounts is a real, though often unmeasured, cost. |

| Payment Speed | Slow transfers can strain supplier relationships and disrupt your supply chain. Look for providers who can offer faster settlement times. |

Navigating these factors effectively is the difference between a smooth, cost-effective international payment process and one that constantly drains your resources.

Getting Compliant and Setting Up Your Account

Before a single rand leaves your business account for an overseas payment, there’s a crucial first step: getting set up and fully compliant. I know it can feel like just another administrative hurdle, but trust me, getting this right from the start is fundamental. It’s what protects your business from financial crime and keeps you on the right side of South African law.

The whole process hinges on what’s known as Know Your Business (KYB). Think of it as a detailed identity check for your company. Financial authorities mandate this to clamp down on money laundering and fraud, so it's absolutely non-negotiable. While it might sound daunting, a smooth KYB process is actually your first line of defence.

What the KYB Document Checklist Really Means

From my experience, the biggest delay in getting started is not having your paperwork in order. If you gather everything upfront, the whole setup moves so much faster. While different providers might have slight variations, the core documents required for a South African business are pretty standard.

Here’s what you should have ready to go:

- Company Registration Documents: These are your official CIPC papers that prove your business is a legitimate, registered entity in South Africa.

- Proof of Business Address: A utility bill or bank statement showing your company’s physical address is perfect, as long as it’s less than three months old.

- Director and Shareholder Information: You'll need certified ID documents (like a South African ID or passport) for all directors and key shareholders—specifically, anyone who owns 25% or more of the company.

- Tax Information: Have your company’s VAT registration number and other tax details handy. This is vital for reporting and compliance.

This isn't just bureaucratic red tape. Each document confirms a piece of the puzzle, from verifying your company's existence to identifying the people behind it. This is what helps financial platforms meet their Anti-Money Laundering (AML) obligations and protects the integrity of the entire financial system.

The Old Way vs. The New Way

In the past, opening a business account for international payments with a traditional bank was a painfully slow, paper-heavy process. It often meant multiple trips to a branch, carrying stacks of certified documents, and then waiting... sometimes for weeks. For a growing business, that kind of delay is a real bottleneck when you have urgent supplier invoices to settle.

For any modern business, time is money. The sluggish pace of traditional bank onboarding can directly impact your ability to seize opportunities and maintain good supplier relationships. A two-week delay could mean missing a critical shipment or getting hit with late payment penalties.

This is where modern fintech platforms have completely changed the game. Digital-first providers like Zaro have built their entire onboarding process online. You can upload digital copies of your documents right from your desk, and verification is often completed in a matter of days, not weeks.

Imagine this scenario: a Cape Town design agency needs to pay a freelance developer in the US. With a bank, they could easily spend the first week just getting documents certified and delivered. Using a platform like Zaro, they could upload everything on a Monday morning and potentially have their account verified and ready to transact by Wednesday. That speed is a massive advantage for any agile business.

Why Compliance Is Your Friend

It's easy to look at compliance as a frustrating obstacle, but it’s far better to see it as a safeguard. A solid KYB process ensures that the platform you're on is a secure network of properly vetted businesses. This dramatically reduces the risk of your company getting tangled up in a fraudulent transaction by accident.

Ultimately, a smooth and efficient setup does more than just get you started. It sets the tone for your entire experience with sending currency abroad. When you can get verified quickly and securely, you can focus on what really matters: managing your international payments effectively and growing your global business.

Finding the Best FX Rates to Fund Your Account

Alright, your account is verified and ready to go. The next step is a big one: funding it. This isn’t just about shuffling money from one place to another. It's about strategically converting your ZAR for an international payment without getting hammered by bad exchange rates and hidden fees. How you handle this part has a direct impact on your bottom line.

The way you fund your account affects both how quickly the money moves and how much it costs you. A standard bank transfer might seem straightforward, but the real game is won or lost on the foreign exchange (FX) rate you lock in. This is where so many businesses, especially when they first start sending currency abroad, unknowingly lose a lot of money.

The Mid-Market Rate Myth

Ever looked up an exchange rate on Google—say, ZAR to EUR—and then felt completely baffled by the different, much worse rate your bank offers? What you see online is the mid-market rate. Think of it as the 'real' exchange rate, the live midpoint between what buyers and sellers are trading a currency for on the open market. It's the cleanest rate out there, but it’s almost never the one you actually get.

Your bank and most traditional payment services don't offer you this rate. Instead, they bake in a markup or a "spread." This is a hidden percentage they add on top, which is pure profit for them. A few percentage points might not sound like a big deal, but it can take a serious bite out of your payment.

The single biggest factor determining the cost of sending currency abroad is not the flat transfer fee but the FX spread. A 1.5% spread on a R500,000 payment to a supplier costs you R7,500—money that simply vanishes before your transfer even begins.

Getting your head around this is crucial. It’s why platforms like Zaro exist. They’re built on the idea of giving businesses access to the real spot exchange rate with zero spread. That transparency means the rate you see is the rate you get, ensuring more of your money actually gets where it needs to go.

A Real-World Payment Scenario

Let's make this real. Imagine your Cape Town-based e-commerce business needs to pay a German supplier €10,000 for new stock. You check the mid-market rate and see it's sitting at 20.00 ZAR to 1 EUR.

- At the mid-market rate: The payment should cost you exactly R200,000 (€10,000 x 20.00). Simple.

But then you go to your business bank. They aren't offering 20.00. Their rate is 20.35 ZAR to 1 EUR. That 35-cent difference is their spread.

- At the bank's marked-up rate: Your cost suddenly jumps to R203,500 (€10,000 x 20.35).

That's an extra R3,500 you just lost on one transaction. If you make a payment like this every month, that's R42,000 a year gone, just on the FX spread for a single supplier. Now, imagine that across all your international suppliers. The numbers add up incredibly fast.

Strategies for Securing Favourable Rates

Just accepting the first rate you're given is an expensive habit. To really get smart about sending currency abroad, you need to be proactive.

Here’s how you can hunt down better rates and protect your capital:

- Demand Transparency: Always partner with a provider that shows you the mid-market rate right next to the rate they’re offering. If they’re cagey about showing you their spread, that’s a massive red flag.

- Use Rate Alerts: Most modern platforms let you set up alerts for your target exchange rate. If a payment isn’t urgent, you can wait for the market to move in your favour and lock in a better price.

- Lock in Your Rate: The currency market is always moving. When you spot a good rate, a good platform will let you lock it in for a set period (like 24-48 hours). This protects you from a sudden dip in the market while you get the payment details sorted.

By stepping away from the murky, old-school model of traditional banks and embracing transparent fintech platforms, you take back control. You're no longer just accepting whatever rate you're handed. Instead, you become an active manager of your company's foreign exchange, armed with the right tools and information to make sharp, cost-saving decisions. This shift in mindset is key to mastering your international payment strategy.

Making Your First International Payment with Zaro

Okay, so your account is funded and you’ve cleared compliance. This is where all the prep work pays off. It’s time to actually send the money abroad, and you’re about to see just how different a modern payment platform is from the old way of doing things.

Forget wrestling with a clunky bank portal. When you log in, you'll see a clean dashboard showing your ZAR and foreign currency balances right there. This is your command centre for making a smooth international payment.

Let’s walk through a real-world example to see how it works in practice.

Kicking Off Your Payment

Imagine your Johannesburg-based consultancy needs to pay a marketing agency in the UK an invoice for £5,000. The payment is due, and you want it handled quickly and without any hidden costs.

Your first move is to add the UK agency as a new beneficiary. This is a quick, one-time setup for each international partner, and it saves a ton of time on future payments. You'll just need their key details:

- Company Name and Address: The agency’s official registered name and physical address.

- Bank Account Details: For a UK payment, this means their IBAN (International Bank Account Number) and SWIFT/BIC code. These are standard across the UK and Europe.

- Reason for Payment: You’ll choose a category like "Marketing Services" from a dropdown menu and upload the matching invoice. This is a crucial step for SARB compliance, creating a neat, auditable paper trail for the transaction.

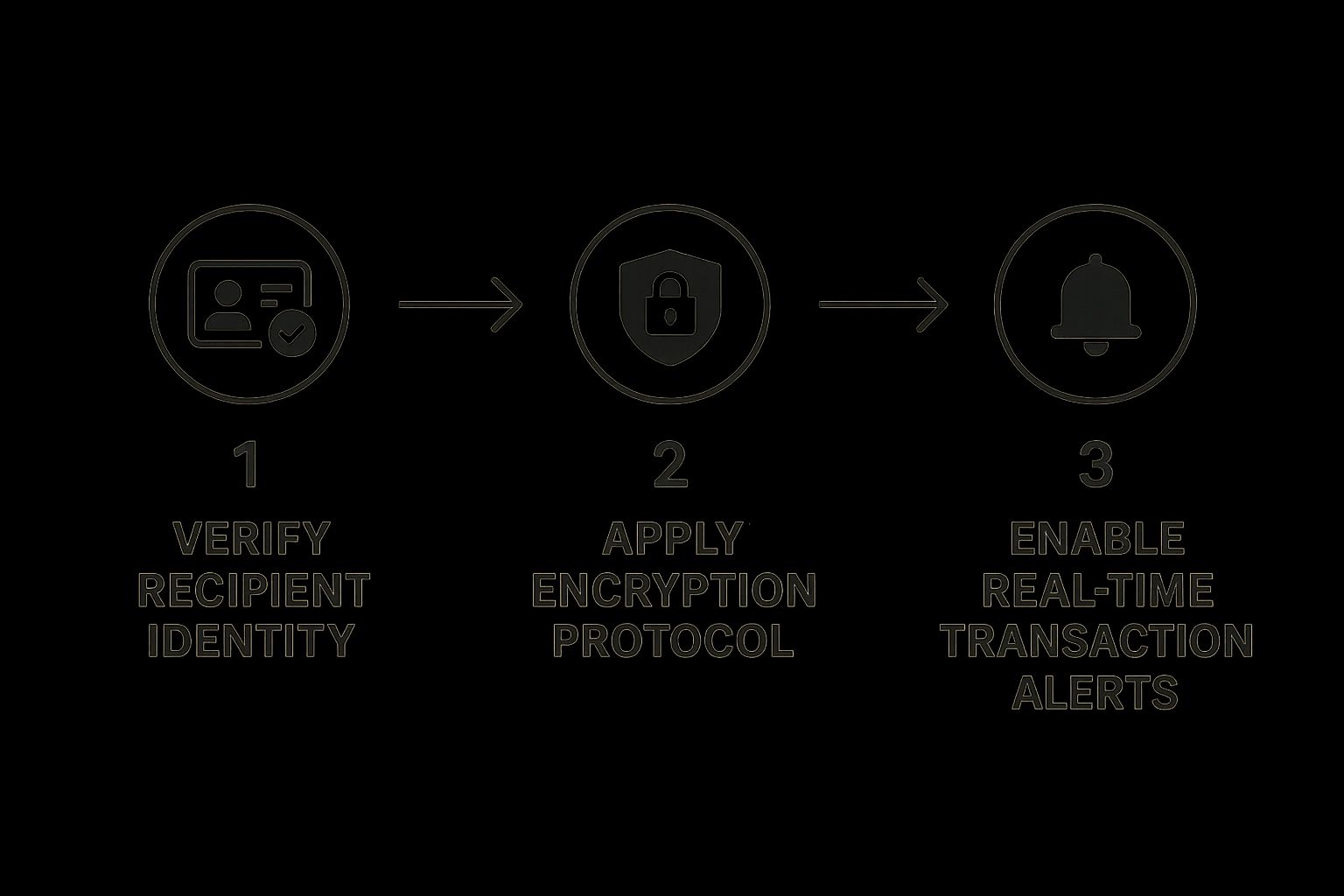

Unlike sending sensitive bank details over a risky email chain, a platform like Zaro keeps all this beneficiary information securely encrypted within your account.

Locking in Your Rate and Giving It a Final Check

With the beneficiary added, you just need to enter the payment amount: £5,000. The platform instantly shows you a live, mid-market exchange rate. What you see is what you get—no hidden spreads, no surprises. You’ll see the exact ZAR amount that will be debited to cover the £5,000 payment.

Before you hit confirm, you get a clear summary screen. This is your final once-over, and it's probably the most critical part of the entire process.

My Advice: Never, ever skip this final review. It’s your last chance to spot a mistake. Double-check the beneficiary's account number and the payment amount. A single typo can lead to serious delays or, in the worst-case scenario, lost funds. It pays to be paranoid here.

This summary lays everything out for you:

- The total ZAR amount being sent.

- The live exchange rate you’ve locked in.

- The final GBP amount your beneficiary will receive.

- A transparent line item for any small transaction fees.

This kind of clarity completely removes the usual guesswork. You know exactly what the payment costs and precisely what your supplier gets. When you're happy, you confirm the payment.

This graphic really highlights the security layers—from verification to real-time alerts—that make sure your money is monitored and protected every step of the way.

Tracking the Transaction to Completion

Once you’ve sent the payment, the agonising wait typical of old-school wire transfers is a thing of the past. Modern platforms give you real-time tracking, much like you’d track a package delivery. You can see when the payment is processed, when it leaves your account, and when it’s credited to the beneficiary’s bank.

This brings a whole new level of control to your finance team. If a supplier calls asking about their payment, you can give them a confident, precise update instead of the dreaded, "I'll have to check with the bank."

The platform will even send you an email notification the moment the funds arrive, closing the loop on the transaction.

What used to be an opaque, multi-day headache becomes a simple, trackable task you can knock out in minutes. This frees you up to focus on what actually matters: running your business, not chasing down payments.

Making Your International Payments Work Smarter, Not Harder

Just getting your money from A to B is one thing. But turning that process into a well-oiled machine? That’s where the smart businesses find their edge. Once you’ve got the hang of the basics, it's time to stop just making payments and start optimising them. This goes way beyond chasing a decent exchange rate—it's about adopting strategies that actively cut costs and give your team back its most precious resource: time.

If you’re a South African business juggling suppliers from London to Lisbon, you know the admin can feel relentless. Modern payment platforms are built specifically to take that weight off your shoulders. Let's dig into a few powerful features that can completely change the game for how you manage your global payables.

Move Beyond Paying Invoice by Invoice

Too often, managing international payments is a reactive scramble. An invoice hits your inbox, and you rush to get it paid. A far better way is to get ahead of the curve. Planning your payments in advance doesn't just calm the chaos; it can lead to real savings and give you much better control over your cash flow.

Two features, in particular, help you make this shift:

- Future-Dated Payments: Got an invoice that isn't due for another 30 days? There's no reason to send the money today. With future-dating, you can set up the payment to go out on its actual due date. This simple move keeps cash in your business for longer, which is great for your working capital. Even better, it gives you a window to watch the currency markets and lock in a great FX rate before the payment is ever sent.

- Bulk Payments: Is your month-end a blur of processing ten, twenty, or even more international invoices, one by painstaking one? This is where bulk payments become your best friend. Instead of endless manual entry, you upload a single file with all the payment details. The platform then handles all the transfers at once. You’ve just turned hours of tedious work into one simple action, slashing admin time and the risk of a costly typo.

I've seen businesses transform their month-end chaos into a streamlined, strategic process. By combining future-dating with bulk payments, they can schedule an entire month's worth of supplier payments in a single afternoon. It’s a total game-changer.

The Real-World Cost Advantage

The convenience is obvious, but let's talk about what really hits the bottom line: the money. Switching from your old-school bank for international transfers isn't just about making life easier; it's a direct boost to your company’s profitability. The savings come from two places: lower (or no) fees and, critically, much better exchange rates.

Let's put some numbers to it. Imagine a typical South African business sending a total of $100,000 USD overseas throughout the year. This could be split across multiple payments for software subscriptions, international freelancers, or imported stock.

Here’s a quick look at how the costs might compare between a traditional bank and a modern platform.

Traditional Bank vs Zaro: A Cost Comparison

| Cost Factor | Traditional Bank | Zaro Platform |

|---|---|---|

| Exchange Rate Markup | ~2.5% on average (hidden cost) | 0% (real mid-market rate) |

| SWIFT/Wire Fees | R250 - R500 per transaction | R0 |

| Receiving Bank Fees | Often charged on incoming wires | None |

| Annual Cost on $100k | ~$2,500+ in FX markup + fees | R0 in FX markup + fees |

The difference is stark. That $2,500 (which is roughly R47,000 at today's rates) lost to hidden FX markups and fees with a bank is pure profit that could be reinvested right back into growing your business. For companies sending larger amounts, those savings can easily climb into the hundreds of thousands of Rands each year.

This isn’t a minor operational tweak; it’s a significant financial decision. Moving your payments to a transparent, low-cost platform like Zaro directly tackles the hidden costs that eat away at your margins. It ensures that when you're sending currency abroad, more of your money actually gets where it needs to go. The case for upgrading your payment strategy is undeniable.

Common Questions on Sending Currency Abroad

Let's wrap up by tackling some of the questions I hear most often from South African businesses venturing into international payments. Getting your head around these points upfront can save you a lot of headaches down the road.

Navigating the world of foreign exchange for the first time brings up a lot of "what ifs" and "how-tos." Here are some straight answers to help you get started, whether you're paying an overseas supplier, a remote contractor, or a global partner.

What Are the SARB Limits for Business Payments?

This is a big one, and it's a common point of confusion. Many business owners are familiar with the R1 million discretionary allowance, but that’s for individuals. It typically doesn't apply to legitimate business transactions.

When your company sends money overseas to pay for imported goods or services, the transfer is cleared based on the documents you provide. In most cases, a valid supplier invoice is all the justification you need. A good payment platform will have a simple, built-in process for you to upload this paperwork, making compliance a seamless part of the workflow.

This documentation creates the clear, auditable trail required by the South African Reserve Bank (SARB) for business-related foreign exchange.

How Long Does an International Payment Take?

The time it takes for your money to arrive can vary wildly, and it's a critical factor that can make or break a supplier relationship.

- Traditional Bank Wires: Using the old-school SWIFT network, you can expect funds to land in 3 to 7 business days. The tracking is often poor, leaving both you and your supplier in the dark until the money finally shows up.

- Modern Payment Platforms: These services use more direct payment rails and can often complete a transfer in just 1 to 2 business days. More importantly, they give you real-time tracking, so you have full visibility from the moment you hit "send."

The difference between a two-day and a seven-day payment cycle is huge. Faster, trackable payments build trust with your international partners and eliminate those frustrating "Where's the money?" phone calls.

Can I Hold Foreign Currency in South Africa?

Yes, you can, and for any business dealing with multiple currencies, this can be a powerful strategy. Specialised providers now allow South African businesses to open and manage multi-currency accounts right here at home.

This means you can hold balances in currencies like USD, EUR, or GBP. Imagine you get paid by an American client in dollars and also need to pay a supplier in dollars. Holding those funds in a USD account is a game-changer. You completely sidestep the cost and hassle of converting funds back and forth between ZAR and other currencies every time a transaction happens.

What Is the Best Way to Avoid High Forex Fees?

The single most effective way to cut your costs is to stop using providers that hide their fees in the exchange rate. Your goal should be to find a partner who gives you transparent pricing and an FX rate that’s as close as possible to the real mid-market rate.

Your standard business bank is almost always the most expensive place to make international payments. Their model often relies on baking a significant markup into the exchange rate they offer you. A dedicated specialist, on the other hand, builds their entire business on providing better rates and lower fees—they will nearly always be more cost-effective.

Always push for transparency. Look for a provider that shows you the mid-market rate and is completely upfront about their charges. That's the only way to know you're not unknowingly losing money every time you're sending currency abroad.

Ready to stop overpaying on international transfers and take control of your global payments? Zaro offers South African businesses access to real exchange rates with zero markup and no hidden fees. See how much you can save and simplify your workflow.