When you're looking for the best South African forex trading platforms, it boils down to a few critical things. You need a broker that's regulated by our own Financial Sector Conduct Authority (FSCA), offers ZAR accounts, keeps spreads tight, and provides solid, reliable technology like MT4 or MT5. Honestly, picking a locally regulated broker is the most important decision you'll make to keep your funds safe and ensure you're getting a fair shake.

Why Forex Trading Is Booming in South Africa

Not too long ago, forex trading felt like something that only happened in the exclusive world of high finance. Today, it’s a different story. The global currency market is now right at our fingertips, accessible from a smartphone, and it has opened up a whole new world for South Africans looking to take more control of their financial futures.

This explosion in popularity isn’t just a fluke. It’s a mix of easy-to-use technology meeting tough economic times head-on. For many people, forex trading has become more than just a way to speculate—it's a genuine effort to build an alternative income stream when the local economy feels uncertain.

The Rise of the Everyday Trader

The face of the modern South African forex trader might surprise you. They aren't all financial whizzes. They’re students, small business owners, nine-to-fivers, and even retirees, all empowered by trading apps that are surprisingly simple to use. These platforms have torn down the old barriers, making it possible for anyone to get into global markets with a relatively small amount of money.

This accessibility couldn't have come at a more crucial moment. In 2025, even with significant economic headwinds, South Africa's retail forex market has seen incredible growth. Local brokers are signing up new clients at a record pace, and trading apps are consistently in the top 10 downloads. This is happening while the national unemployment rate hovers at a staggering 32.9%, a reality that's pushed many to look at forex as a potential way to make ends meet. You can read more about this phenomenon in this detailed report on South Africa's forex market growth.

Navigating This New World Safely

With so many people getting involved, understanding the ins and outs of South African forex trading platforms is more important than ever. The ease of getting started can sometimes hide the real risks involved, which makes choosing the right platform your first and best line of defence.

Think of it this way: choosing the right platform is like building the foundation of a house. It’s not about flashy gimmicks, but about solid protection, clear costs, and technology that won’t let you down when you need it most.

This guide is here to walk you through this exciting but often confusing space. We're going to break down the essentials so you can trade safely and with confidence.

Here’s what we’ll cover:

- FSCA Regulation: We’ll explain why dealing with a broker licensed by the Financial Sector Conduct Authority (FSCA) is the one rule you should never break. It's all about protecting your money.

- Platform Comparison: You'll learn what to look for when comparing platforms—things that actually matter, like fees, the assets you can trade, and decent customer support.

- Making an Informed Choice: Our aim is to give you the knowledge you need to pick a platform that fits your own financial goals and how much risk you're comfortable with.

How Forex Trading Actually Works for South Africans

At its core, forex trading isn't as complicated as it first appears. If you’ve ever swapped Rands for Dollars before an overseas trip, you've already had a taste of the foreign exchange market. You were selling your ZAR to buy USD, hoping for a good rate.

Forex trading platforms simply take this everyday transaction and place it onto a massive, digital stage. Instead of going to the bank to exchange physical cash, you’re speculating on the future movement of one currency’s value against another. The goal is to profit from the constant push and pull of exchange rates, which are influenced by everything from economic reports to geopolitical events.

And the scale of this market is truly immense. South Africa is the powerhouse of forex trading in Africa, with daily foreign exchange turnover topping $20 billion. A huge chunk of this growth is driven by ordinary South Africans using online and mobile platforms to trade. You can get more great insights into Africa's expanding forex landscape on contentworks.agency.

Understanding Currency Pairs

In the world of forex, no currency stands alone. They are always traded in pairs, like the US Dollar versus our South African Rand (USD/ZAR). The first currency in the pair is called the base currency, and the second one is the quote currency.

The price you see for a pair simply shows you how much of the quote currency you need to buy one unit of the base. So, if the USD/ZAR is trading at 18.50, it means you'll need R18.50 to get your hands on a single US Dollar.

For a South African trader, you’ll mainly come across three types of pairs:

- Major Pairs: These are the big leagues, pairing the US Dollar with another global heavyweight like the Euro (EUR/USD) or the British Pound (GBP/USD). They see the most action worldwide.

- Minor Pairs: Think of these as major currencies facing off against each other, but with the US Dollar sitting on the sidelines. A classic example is the Euro versus the British Pound (EUR/GBP).

- Exotic Pairs: This is where our Rand often enters the picture. An exotic pair matches a major currency with the currency of a growing economy, such as USD/ZAR or GBP/ZAR.

Key Trading Concepts Explained Simply

As you start exploring South African forex trading platforms, you’ll bump into a few essential terms. Getting a handle on them is non-negotiable for managing your trades and, more importantly, your risk.

Think of these concepts as the dashboard in your car. You don’t need to be a mechanic to drive, but you absolutely have to know what the speedometer, fuel gauge, and warning lights are telling you to get to your destination safely.

Here are the must-knows, broken down:

- Pips: A ‘pip’ stands for "percentage in point." It's the smallest standardised move a currency pair's price can make. For most pairs, it’s the fourth number after the decimal (e.g., 0.0001), but for ZAR pairs, it's usually the second. This tiny unit is how you'll measure your profits and losses.

- Leverage: This is a powerful tool offered by brokers that lets you control a large trading position with a relatively small amount of your own money. For instance, with 100:1 leverage, just R1,000 of your capital can control a R100,000 position. But be warned: while it can massively boost your profits, it equally amplifies your losses. It's a double-edged sword that demands respect and careful risk management.

- Margin: This is the money you need in your account to open a leveraged trade. It's not a fee; think of it as a good-faith deposit that your broker holds while your position is active. In our leverage example, the R1,000 you put up is your margin.

These concepts all come together on the trading platform, allowing you to act on your belief that a currency will either go up or down. When local economic news hits, for example, you might see the Rand move sharply against the Dollar, creating potential opportunities for traders who correctly predicted which way it would go.

Why FSCA Regulation Is Your Best Protection

When you step into the world of online trading, trust is everything. It's the bedrock of your financial safety, and that's precisely where the Financial Sector Conduct Authority (FSCA) comes in. Think of them as the chief guardian for traders right here in South Africa.

With so many South African forex trading platforms out there, it’s easy to feel a bit lost. But here’s a pro tip: making FSCA regulation your number one priority instantly cuts through the noise. An FSCA licence isn't just a badge a broker puts on their website; it's a rock-solid promise to play by a strict set of rules designed to protect you and your money. Honestly, it’s the single most important thing to look for.

What FSCA Regulation Guarantees You

Imagine the FSCA as a financial watchdog with real teeth. When a broker gets their approval, they're held to a standard that directly benefits you as a trader. You get critical protections that are simply non-existent with offshore or, worse, completely unregulated brokers.

So, what does this protection actually look like?

- Segregated Funds: This is a big one. Regulated brokers must keep your trading capital in a bank account that is completely separate from their own company funds. This means they can't dip into your money to pay their running costs, giving you crucial protection if they ever hit financial trouble.

- Fair Trading Practices: The FSCA keeps a close eye on brokers to ensure they offer transparent pricing and execute your trades fairly. This helps shut down dodgy practices like price manipulation or unfair requotes that can eat into your profits.

- A Clear Path for Disputes: If you ever run into a serious problem with an FSCA-regulated broker, you aren’t on your own. You have an official channel to sort things out by filing a complaint directly with the FSCA, which has the authority to investigate and enforce a fair outcome.

This strong regulatory framework has done wonders for building confidence among local traders. The oversight from the FSCA has brought a new level of security and transparency, encouraging everyone from student entrepreneurs to people seeking an alternative income to dip their toes into the forex market. You can learn more about how regulation fosters a safer trading environment in South Africa.

How to Verify a Broker's Licence Yourself

Never, ever just take a broker's word for it. Checking their FSCA licence is a quick and essential step that you absolutely should do yourself. It only takes a couple of minutes and gives you total peace of mind.

Here’s how to do it:

- Find the FSP Number: Look for the broker’s Financial Service Provider (FSP) number. It should be easy to find, usually in the footer of their website.

- Visit the FSCA Website: Head over to the official FSCA public search portal.

- Enter the FSP Number: Pop the FSP number into the search bar and hit "Submit."

- Review the Details: The results will show the broker's official registered name, trading name, and status. Make sure the name matches the platform you're looking at and that their licence is marked as "Authorised."

Choosing an unregulated broker is like navigating a storm without a life jacket. It might seem fine when the seas are calm, but you have zero protection when things go wrong. An FSCA-regulated broker provides the safety net you need to trade with confidence.

Comparing the Best South African Forex Trading Platforms

Picking the right trading platform is probably the most hands-on decision you'll make when you start trading forex. It’s easy to get distracted by flashy ads, but what really matters are the features that affect your trading experience and, of course, your money. It’s not about finding the one "best" platform for everyone; it's about finding the one that fits your style, your budget, and your goals.

To do this, we need to look under the bonnet at a few key things: the real cost of trading, the variety of assets you can actually trade, how reliable the technology is, and whether you can get help when you need it. Let's break it down.

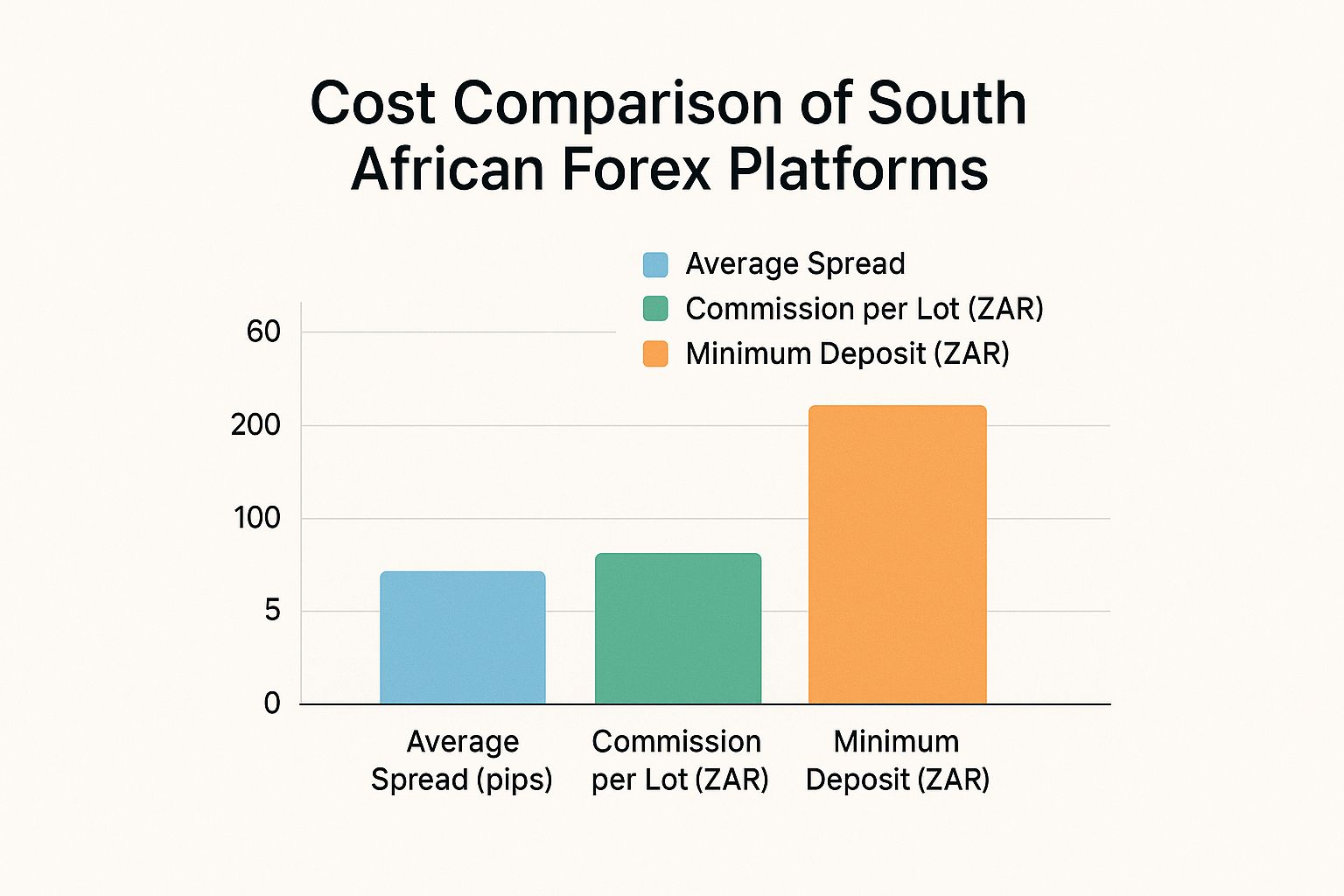

Decoding the Costs: Spreads and Commissions

The first cost you’ll always see is the spread – that tiny difference between the buy and sell price of a currency pair. Just think of it as the broker's built-in fee for handling your trade. A tighter, lower spread means more of the market’s movement goes into your pocket. Simple as that.

But the spread isn't the whole picture. Some platforms, especially those advertising super-tight or even zero spreads, will charge a commission for each trade instead. This is a flat fee, usually based on your trade size (a 'lot'), that you pay when you open and close a position. You absolutely have to understand how these two costs work together.

For instance, one broker might offer a razor-thin spread of 0.1 pips on EUR/USD but charge a R50 commission per lot. Another might have a wider spread of 1.2 pips but charge zero commission. Neither one is automatically better. If you plan on making lots of small, quick trades, the zero-commission model might save you money. But if you’re making larger, less frequent trades, paying a commission for that tighter spread could be far more cost-effective.

Evaluating Trading Instruments and Platform Tech

Beyond just the costs, the top South African forex trading platforms give you access to a wide range of markets. You might start with major pairs like EUR/USD, but having the option to trade ZAR pairs (like USD/ZAR), global indices, commodities like gold and oil, or even shares gives you far more opportunities to explore.

The technology you use is just as crucial. Most brokers in South Africa will offer one of two industry-standard platforms:

- MetaTrader 4 (MT4): This is the old faithful of the trading world. MetaTrader 4 is known for being rock-solid, easy to learn, and having a massive community that builds custom indicators and automated trading bots (known as Expert Advisors). It’s a fantastic place to start.

- MetaTrader 5 (MT5): The newer, more powerful version. MetaTrader 5 offers more timeframes, better charting tools, and lets you trade a wider range of markets beyond forex, like stocks and futures, all from one place.

Some brokers also build their own custom platforms, which often look great and are simple to use on a web browser or phone. They can be brilliant for beginners or for checking your trades on the move, but they sometimes lack the deep analytical tools you’d find in MT4 or MT5.

The platform is your cockpit for navigating the markets. It needs to feel right, execute your trades instantly, and give you the tools to make smart decisions. Always take a platform for a test drive with a demo account before putting real money on the line.

To give you a clearer picture, we've put together a table comparing some of the top FSCA-regulated brokers available to South Africans.

Feature Comparison of Leading FSCA-Regulated Forex Brokers

This table breaks down the essential features of popular platforms, focusing on what matters most: regulation, costs, and the tools you get to trade with.

| Broker Name | FSCA Regulated | Minimum Deposit | Typical Spread (EUR/USD) | Trading Platforms | ZAR Account Available |

|---|---|---|---|---|---|

| Broker A | Yes | R1,500 | 1.1 pips | MT4, MT5, WebTrader | Yes |

| Broker B | Yes | R0 | 0.9 pips | MT4, Proprietary App | Yes |

| Broker C | Yes | R4,000 | 0.2 pips + Commission | MT5, cTrader | Yes |

| Broker D | Yes | R750 | 1.5 pips | MT4, MT5 | No (USD Base) |

As you can see, there are clear trade-offs. Brokers with zero or very low minimum deposits might have slightly wider spreads, while those that require a larger initial deposit often provide more competitive trading conditions. It all comes down to what you prioritise.

The Importance of Reliable Support

Lastly, never, ever overlook customer support. When you have a problem with a deposit, a withdrawal, or a live trade that’s gone sideways, you need to talk to someone fast. Look for brokers who have a proper support team available via live chat, phone, and email—ideally with a local South African presence. Being able to speak to someone who understands FICA, exchange controls, and our local banks can be a lifesaver.

How to Fund Your Account and Manage Your Money

Alright, so you’ve navigated the options and picked one of the top South African forex trading platforms. What's next? The practical bit: getting your capital into the account so you can actually start trading. This step is more important than many people realise. Getting it right from the beginning can save you a lot of headaches and hidden costs down the line.

For us here in South Africa, brokers generally offer a few straightforward ways to fund an account. Each has its own pros and cons, so it’s worth taking a moment to figure out which one fits your situation best.

Common Funding Methods for South African Traders

Any good broker operating in SA will let you deposit funds using methods you already know and trust. You'll typically see these options:

- Electronic Funds Transfer (EFT): This is just a simple bank transfer from your South African bank account straight into the broker's local one. It’s secure, reliable, and brokers rarely charge for it, which is why it's a firm favourite.

- Credit/Debit Cards: Paying with your Visa or Mastercard is another popular route. The big plus here is speed – the funds usually reflect instantly, meaning you can get into the markets right away. Just keep an eye out for any fees your own bank might tack on.

- E-Wallets: Services like Skrill or Neteller are digital wallets that act as a middleman. Many traders love them because they make deposits and withdrawals incredibly fast and convenient.

The Hidden Cost of Currency Conversion

Now, here’s something that trips up a lot of new traders: currency conversion fees. This is one of those sneaky costs that can quietly eat into your profits without you even noticing. If your broker only offers accounts in currencies like USD, EUR, or GBP, you’re going to get hit with conversion fees every single time you deposit and withdraw.

Think about it. You deposit, say, R18,000 into a USD-based account. Your bank has to convert your Rands to Dollars, and they don't do it for free. They use their own retail exchange rate, which always has a markup built in. Then, when you withdraw, the same thing happens in reverse. You lose a slice of your money on the way in and another slice on the way out. Over time, that really adds up.

This is why choosing a broker that offers ZAR-denominated trading accounts is probably one of the smartest moves a South African trader can make. It cuts out the currency conversion costs on your deposits and withdrawals completely. What you send is what you get to trade with.

When you fund a ZAR account, it’s simple: you deposit Rands, your balance is in Rands, and you withdraw Rands. No conversions, no markups, no fuss. It not only saves you money but also makes it far easier to manage your finances. You can focus on your trading strategy instead of worrying about how exchange rate swings are impacting your capital. It’s the same logic that drives businesses to use modern financial tools like Zaro’s real-rate transfers to move money across borders without getting stung by traditional bank fees.

Ultimately, smart money management starts before you even execute your first trade. Choosing a platform with ZAR accounts and using low-cost funding methods like a local EFT are foundational steps. They help protect your capital from being chipped away by unnecessary fees, setting you up for a much healthier and more sustainable trading journey.

Your First Steps to Start Trading Safely

Alright, you’ve got a good handle on how the market operates and what makes a decent trading platform. Now comes the exciting part: turning that knowledge into action. Think of this as the final stage where theory meets practice. It's crucial to remember that forex trading is a marathon, not a sprint. Starting out with a safe, structured approach is the best way to build habits that will serve you well for the long haul.

It’s tempting to jump straight in with real money, but that’s often a fast track to making mistakes you could have easily avoided. The smartest traders, from beginners to seasoned pros, always follow a clear roadmap. Their priority isn't quick profits; it's education and managing risk. This process helps you build real confidence and test your ideas before a single rand is on the line.

Build Your Foundation on a Demo Account

Before you even consider funding a live account, your first port of call must be a risk-free demo account. Any broker worth your time will offer one, and it's probably the most valuable tool you have right now. A demo account throws you into the real, live market with virtual money, letting you experience exactly how prices move without any of the financial risk.

This is your training ground. Use it to get completely comfortable with your trading platform. Learn how to place different types of orders, figure out how to set your stop-loss and take-profit levels, and get a feel for analysing the charts. More importantly, this is where you can start hammering out a trading strategy. Does your idea actually work? Is it profitable after 50 or 100 simulated trades? Don’t skip this step.

Create Your Personal Trading Plan

A trading plan is essentially your business plan for the markets. It’s a simple set of rules you create for yourself that dictates how you will trade. It doesn't need to be overly complicated, but you absolutely must write it down. This document becomes your guide when the markets get choppy and emotions start running high.

Your trading plan should clearly define a few key things:

- What you will trade: Which currency pairs will you focus on? Maybe the majors like EUR/USD, or something closer to home like USD/ZAR.

- When you will trade: What time of day or which market session (London, New York, Tokyo) fits your schedule and your strategy?

- Your entry and exit rules: What specific signals or conditions must be met before you enter or exit a trade?

- Your risk management rules: This is the big one. How much of your capital will you risk per trade? A solid rule for beginners is to never risk more than 1-2% of your total account balance on any single trade.

Think of your trading plan as your personal constitution. It governs your actions and protects you from making impulsive, fear- or greed-driven decisions that can quickly blow up an account. Stick to it. No exceptions.

With a solid base of knowledge and a written plan, you're in a great position to move forward. The final steps involve picking your regulated broker, checking their credentials, and starting small with real capital. This methodical approach is what separates disciplined traders from gamblers, and it's essential for navigating the forex market responsibly. By taking these initial steps seriously, you're not just learning to trade; you're learning how to manage risk—and that’s the real secret to longevity in this game.

Got Questions? We've Got Answers

Stepping into the world of South African forex trading platforms can feel a bit overwhelming at first. It's only natural to have a few questions. Let's tackle some of the most common ones to help you get started with confidence.

Is Forex Trading Legal in South Africa?

Absolutely. Forex trading is perfectly legal in South Africa, but there’s a crucial catch: you must use a broker regulated by the Financial Sector Conduct Authority (FSCA). Think of the FSCA as your safety net; their oversight ensures the broker operates fairly and transparently.

You also need to be mindful of the South African Reserve Bank (SARB) rules for sending money offshore. The good news is that a properly regulated FSCA broker will guide you through this process, making sure everything is above board.

How Much Money Do I Really Need to Start?

You'll see platforms advertising that you can start with as little as R150. While technically true, it's not a great idea. With leverage, even a tiny market fluctuation can completely wipe out an account that small. It's a recipe for frustration.

A more sensible starting point is somewhere between R3,000 and R15,000. This gives you enough breathing room to manage your risk properly and weather the normal ups and downs of the market.

Before you even think about funding a live account, do yourself a favour: spend a good amount of time on a free demo account. This is where you can practise your strategy and learn the platform's quirks without risking a single rand of your own money.

Do I Have to Pay Tax on Forex Profits?

Yes, any money you make from forex trading is considered income by the South African Revenue Service (SARS). You'll need to declare your profits on your annual tax return.

It's a smart move to keep meticulous records of all your trades—both the wins and the losses. When in doubt, have a chat with a tax professional. They can make sure you're ticking all the right boxes and staying compliant.

Should I Go with an MT4 or MT5 Platform?

This is a classic question, and the best answer really depends on what you plan to do.

- MetaTrader 4 (MT4): This is the old faithful of the trading world. It's incredibly reliable, straightforward, and has been the industry standard for years. If you're just starting out and plan to focus exclusively on currencies, MT4 is a fantastic choice.

- MetaTrader 5 (MT5): The newer, more powerful sibling. MT5 does everything MT4 can do but also gives you access to other markets like stocks, indices, and commodities. It's built for the trader who wants more options under one roof.

Bottom line? If you're a pure forex beginner, MT4 is simple and effective. If you think you might want to branch out into other assets down the line, starting with MT5 gives you that future-proof flexibility.

Ready to manage your business's international payments without the hidden fees? Zaro offers real-rate transfers, eliminating unpredictable bank markups and SWIFT charges. Learn more and optimise your cross-border transactions at usezaro.com.