At its core, supplier payment automation is about using smart technology to handle the entire journey of paying your suppliers. Think of it as taking the whole process—from the moment an invoice lands on your desk to the final reconciliation—and making it digital and smooth. It transforms accounts payable from a time-consuming cost centre into a strategic part of your business.

Leaving Manual Payments in the Past

Picture your finance team freed from the mountains of paper invoices, the endless chase for approvals, and the tedious task of manually typing in every single payment. This isn’t some distant dream; it's the reality that supplier payment automation makes possible. For far too long, businesses have just accepted the headaches of traditional accounts payable (AP) as a cost of doing business.

Relying on the old, manual way of paying suppliers is a bit like sending an urgent message by post when you could just send a text. It's slow, unreliable, and things can easily get lost. Your team gets an invoice, prints it, hunts for a physical signature, manually enters the details into the accounting system, and then schedules the payment, all while hoping nothing was missed.

The Frustrations of the Old Way

This outdated method is a constant source of operational chaos and financial risk. The pain isn't just felt in the finance department; it ripples throughout the entire organisation, right up to the executive team.

These persistent issues usually include:

- High Risk of Human Error: When people enter data by hand, mistakes are bound to happen. This can mean anything from incorrect payment amounts to mistyped banking details, leading to frustrating and costly fixes.

- Late Payment Penalties: Slow, paper-based approval chains are a recipe for delays, which often result in late fees and can damage your company's creditworthiness.

- Strained Supplier Relationships: Nobody likes to be paid late. Consistently failing to pay on time creates friction, erodes trust, and could mean you get less favourable terms down the line.

- Lack of Visibility: Without a single, clear system, trying to track payment statuses or manage cash flow becomes a guessing game based on old, unreliable information.

For many growing businesses, especially in South Africa’s dynamic economy, the manual AP process is a major roadblock to scaling up. It eats up valuable employee time that could be much better spent on strategic financial planning and fuelling growth.

Embracing a Modern Solution

Supplier payment automation isn’t just about installing another piece of software. It’s a fundamental shift in how your business handles its financial commitments. It directly tackles these frustrations by creating a workflow that is seamless, transparent, and incredibly efficient.

By automating the entire lifecycle of an invoice, from its arrival to the final payment, you get rid of the bottlenecks and risks that come with manual systems. For South African businesses wanting to compete effectively, this shift is becoming essential. Efficiency and strong supplier partnerships are simply non-negotiable, and this guide will walk you through how to make this crucial transition.

How Supplier Payment Automation Actually Works

To really get what makes this such a game-changer, we need to look under the bonnet. Supplier payment automation isn't some kind of black magic; it's a smart, technology-driven workflow that swaps out slow manual tasks for digital efficiency. It follows the entire journey of an invoice, from the second it lands on your desk (or in your inbox) until the final payment is made and perfectly reconciled in your books.

Think of it like an automated assembly line for your accounts payable department. Instead of one person physically carrying a part from one station to the next, a conveyor belt moves it along while specialised robots handle specific jobs with precision. The whole process is faster, far more reliable, and gives you a consistent result every single time.

From Invoice Receipt to Payment Execution

This automated workflow is best understood as a series of connected stages. Each step is designed to handle a specific part of the process, guaranteeing accuracy and speed before handing the invoice off to the next stage. It’s a seamless flow from beginning to end.

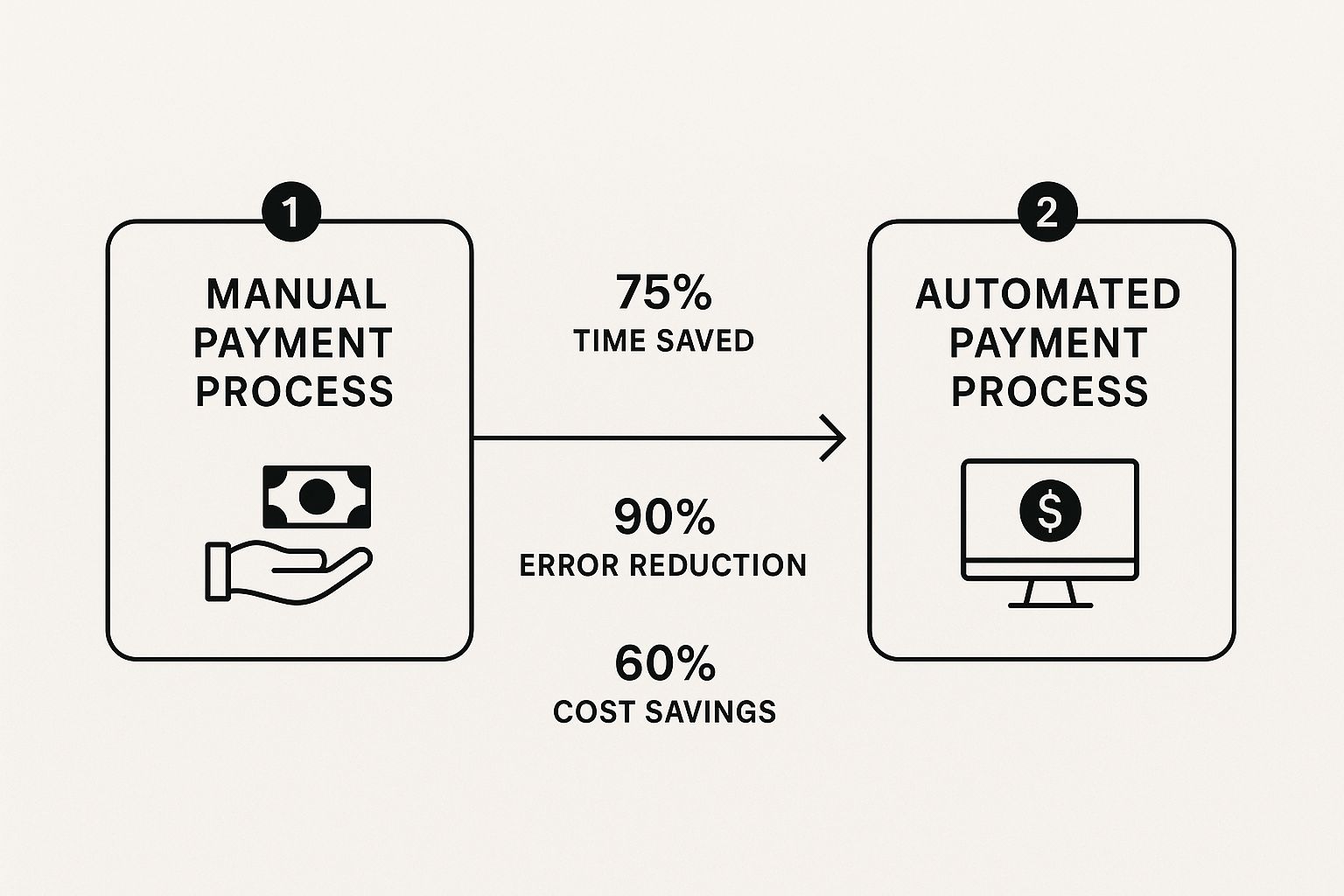

This visual really drives home the difference between sticking with manual methods and making the switch to automation, highlighting key wins in time, accuracy, and cost.

As you can see, the move to automation brings some serious gains. Businesses are saving huge amounts of time, cutting out expensive mistakes, and bringing down their overall operational costs. Here’s a breakdown of how the system pulls it off.

1. Automated Invoice Capture

It all starts the moment an invoice arrives. Instead of someone having to manually open emails, download PDFs, or scan stacks of paper, the system takes over. Using technology like Optical Character Recognition (OCR), the platform automatically “reads” every invoice, whether it's a digital file or a scanned paper copy.

2. Intelligent Data Extraction

Once the invoice is captured, the system gets to work extracting all the crucial information. It intelligently pulls out the supplier’s name, invoice number, date, line-item details, and the total amount due. This step alone wipes out one of the single biggest sources of human error: manual data entry.

3. Automated Three-Way Matching

For any purchases linked to a purchase order (PO), the system performs an automated three-way match. It instantly cross-references the invoice against the original PO and the goods received note (GRN). If all three documents line up perfectly, the invoice is approved for payment without anyone needing to lift a finger. This automated check drastically cuts down on mismatches.

This matching process is a critical checkpoint. It confirms you’re only paying for what you ordered and actually received, acting as a powerful first line of defence against overpayments and fraud.

4. Smart Approval Workflows

What about invoices that need a human eye, like a non-PO expense? The system uses pre-set rules to automatically route it to the right person or department. Approvers get an instant notification and can review and sign off on invoices straight from their email or a mobile app. No more chasing paper trails or waiting for physical signatures.

5. Secure Payment Execution

After the final green light, the payment is scheduled and processed automatically. The system can handle a variety of payment methods, from standard EFTs to instant payments, making sure your suppliers are paid securely and on time, every time. All the transaction details are then synced back to your accounting software, making reconciliation a breeze.

Manual vs Automated Supplier Payments: A Clear Comparison

The difference between the old way of doing things and modern supplier payment automation is night and day. When you see them side-by-side, the operational benefits become crystal clear.

This table highlights the key operational differences between traditional, manual payment processes and a fully automated system, showing the direct impact on efficiency, cost, and accuracy.

| Process Step | Manual Approach (The Old Way) | Automated Approach (The New Way) |

|---|---|---|

| Invoice Receipt | Manually received via post or email, then printed and sorted. | Automatically captured from a dedicated email or supplier portal. |

| Data Entry | An employee manually types invoice data into the accounting system. | AI and OCR technology extract and populate all data fields instantly. |

| Verification | Someone manually searches for and matches the PO and GRN. | The system performs an automated three-way match in seconds. |

| Approval | The invoice is physically walked around or emailed for signatures. | Invoices are digitally routed to approvers based on preset rules. |

| Payment | Payments are created one-by-one in the banking portal. | Approved payments are batched and executed securely and on schedule. |

| Reconciliation | Manual reconciliation of payments against bank statements. | The system automatically syncs payment data with the ERP. |

Looking at this comparison, it’s easy to see how automation doesn’t just speed things up—it fundamentally transforms the entire accounts payable function from a cost centre into a strategic, efficient part of the business.

Unlocking the Benefits of Automated Supplier Payments

Switching to an automated system is about far more than just getting payments out the door faster. It’s a strategic move that delivers powerful, compounding benefits right across your business. Think of it less as buying a new tool and more like upgrading your company’s entire financial engine.

Switching to an automated system is about far more than just getting payments out the door faster. It’s a strategic move that delivers powerful, compounding benefits right across your business. Think of it less as buying a new tool and more like upgrading your company’s entire financial engine.

The real value of supplier payment automation isn’t in one single feature, but in how multiple small improvements work together to create a massive impact. From saving money to building stronger partnerships, these benefits tackle the very issues that hold back growing businesses. Let's look at the five key areas where this change makes a tangible difference.

Enhanced Financial Control

Manual systems often leave finance teams flying blind. Without a single, centralised view, getting a real-time picture of your cash flow is almost impossible. This forces you to make critical decisions based on outdated or incomplete information, which is a risky game to play.

Automation flips this on its head by giving you live dashboards and detailed reports. At any moment, you can see exactly which invoices are pending, which are approved, and what your payment obligations look like for the coming weeks. This clarity allows for precise cash flow forecasting and smarter financial management, putting you firmly in control of your company's liquidity.

With a real-time overview of liabilities, you can move from reactive payment processing to proactive cash management, optimising working capital and making smarter financial decisions.

Significant Cost Reductions

The costs of a manual accounts payable process are often hidden in plain sight. You’ve got labour hours spent on data entry, printing and paper costs, courier fees for invoices, and those dreaded late payment penalties. While each might seem small, together they add up to a significant drain on your resources.

Automation attacks these costs directly. By eliminating manual tasks, you dramatically cut down on labour expenses—one study found that automating can lower the cost of processing a single invoice by over 80%. Better yet, by ensuring payments are always on time, you can start capturing early payment discounts, turning your AP department from a cost centre into a genuine value generator.

Stronger Supplier Relationships

Your suppliers are critical partners, and how you pay them speaks volumes about that relationship. Late or inaccurate payments create friction, erode trust, and can easily lead to less favourable terms for your business down the line.

Supplier payment automation builds trust through consistency and transparency. When suppliers know they’ll be paid on time, every time, it solidifies your reputation as a reliable partner. This is why accounts payable automation is becoming a strategic priority for South African companies looking to improve their operations. Many modern platforms also include self-service portals where suppliers can upload their own invoices and track payment statuses, which reduces their need to chase your AP team and builds a stronger, more collaborative relationship. You can find more insights on the latest AP trends from Serrala.

Improved Security and Fraud Prevention

Let’s be honest: manual payment systems are a magnet for fraud, both internal and external. Paper invoices can be easily duplicated or altered, and without systematic checks, it’s far too easy for suspicious activity to slip through the cracks.

Automation introduces robust security protocols that manual processes simply can’t compete with. The system can automatically flag duplicate invoice numbers or amounts, enforce strict spending limits, and create an unchangeable audit trail for every single transaction. This combination of automated checks and balances drastically reduces the risk of fraudulent payments and costly human errors, protecting your company’s assets.

Increased Team Productivity

Your finance team has valuable analytical skills that are completely wasted on chasing approvals and keying in data. When they’re buried in paperwork, they have no time for the strategic work that actually drives the business forward.

By automating these tedious tasks, you free up your AP team to focus on higher-value activities. They can finally dedicate their time to financial analysis, budget forecasting, negotiating better terms with suppliers, and finding new cost-saving opportunities. This shift doesn't just boost morale; it transforms your finance department into a more strategic asset for the entire company.

Why Digital Payments Are Exploding in South Africa

To really get why supplier payment automation is catching on so fast, we need to zoom out and look at the bigger picture of financial technology in South Africa. This isn't just about individual businesses trying to work smarter; it's about the powerful new infrastructure that’s making it all possible. The country's entire payment system is getting a massive upgrade, creating the perfect conditions for automation to flourish.

Think of it this way: for years, businesses were trying to run a high-speed train on old, rickety tracks. The traditional Electronic Funds Transfer (EFT) system was slow and worked in batches, which held everyone back.

Now, South Africa has essentially built a modern, high-speed rail network for money. This new foundation is what makes advanced supplier payment automation not just a nice-to-have, but a genuine competitive edge.

The Rise of Real-Time Payments

The biggest game-changer has been the shift to real-time payments. These systems let money move between bank accounts instantly, 24/7, completely sidestepping the old delays. The South African Reserve Bank has been a major force behind this evolution, championing the modern payment rails that make it all happen.

This new infrastructure has opened the door for instant B2B transactions, something that was just a dream for most companies a few years ago. The power to send and receive money in seconds changes everything, from how you manage cash flow to the trust you build with your suppliers. When you can pay a crucial supplier on the spot to get goods released, you gain a level of business agility that was previously out of reach.

The availability of instant payment infrastructure is the bedrock upon which modern supplier payment automation is built. It provides the speed and reliability needed to make automated, touchless payment cycles a reality.

The growth here is staggering. The South African real-time payments industry is on track for a compound annual growth rate (CAGR) of 37.97% between 2019 and 2033. This isn't just a niche trend; it reflects a fundamental shift in how businesses and consumers think about money, accelerated by e-commerce and the broader move towards a cashless society. You can explore the full details in this report on the real-time payments market in South Africa.

Connecting Infrastructure to Business Automation

So, how does this big-picture progress translate to your company's accounts payable department? It’s surprisingly direct: supplier payment automation platforms are built to plug straight into these new, faster payment rails.

This direct connection unlocks some serious advantages:

- True Immediacy: You’re not just automating the approval steps anymore. You can now automate the final payment itself, with funds settling instantly.

- Enhanced Certainty: Payments are confirmed in real-time. This gets rid of the anxious waiting game of traditional EFT windows and drastically cuts the risk of failed payments.

- Greater Flexibility: Businesses can schedule payments with pinpoint accuracy, holding onto their cash until the last possible moment while still ensuring every supplier is paid on time.

This powerful mix—smart automation software running on top of a robust national payment system—is what’s really fuelling the explosion in digital B2B payments. For South African businesses, the message is clear: the tools are finally here to leave slow, manual payment processes in the past for good.

Here is the rewritten section, designed to sound like an experienced human expert.

Your Roadmap to Implementing an Automation System

Thinking about switching to supplier payment automation? It can feel like a massive undertaking, but it doesn't have to be a painful, rip-and-replace project. The secret is to treat it less like a disruptive overhaul and more like a series of well-planned upgrades to your financial engine.

Breaking the process down into manageable steps makes the whole thing feel achievable. This roadmap will guide you from the initial "what-if" stage all the way to ongoing fine-tuning, helping you confidently steer your business towards a smarter, more secure accounts payable future.

1. Take a Hard Look at Your Current AP Process

Before you can build something better, you need a brutally honest picture of what you have now. Get your team together and map out your entire accounts payable workflow. Follow an invoice from the moment it lands on someone's desk (or inbox) to the final payment reconciliation. Don't skip a single step, touchpoint, or manual approval loop.

The goal here is to find the friction.

- Where are the constant delays? Is it chasing approvals? Finding lost invoices?

- Which tasks are eating up most of your team's day?

- What's causing the most errors or supplier disputes?

This honest assessment creates your baseline. It's the "before" picture that helps you build a rock-solid business case for making a change.

2. Set Clear Goals and Choose the Right Solution

Once you know your pain points, you can set some real, measurable goals. Don't just aim for "better." Get specific. Do you want to cut invoice processing time by 50%? Wipe out late payment fees for good? Or maybe you just need a clearer view of your cash flow. These goals become your compass for finding the right software.

Let's be clear: not all automation platforms are the same. As you look at different vendors, find one that actually solves your specific problems. It needs to play nicely with the accounting software you already use and have security features that let you sleep at night.

Think of it like choosing a partner, not just buying a product. The best providers stick with you, offering solid support during the setup and beyond. They make sure both your team and your suppliers are comfortable with the new way of doing things.

3. Plan Your Integration and Data Migration

A smooth launch is all in the planning. Sit down with your chosen vendor and hash out a detailed implementation plan. You'll need to map out exactly how the new system will talk to your existing ERP or accounting software. This is critical for keeping financial data flowing seamlessly.

Then there's the data migration. This is where you move all your existing supplier details, outstanding invoices, and payment history into the new system. Taking the time to get this right—cleaning up the data before you move it—will save you from countless headaches down the road. It ensures your new, shiny system starts with reliable information from day one.

4. Get Your Team and Suppliers on Board

People naturally resist change, so clear communication and proper training are non-negotiable. Run training sessions for your finance team so they feel confident, not intimidated, by the new tools. Make sure to frame it as a positive: automation isn't about replacing them, it's about freeing them from boring, repetitive tasks so they can focus on more strategic work.

At the same time, you need a plan for your suppliers. Let them know what's happening and why it's good for them, too—things like faster, more reliable payments and a self-service portal where they can check an invoice's status themselves. A little bit of guidance and support goes a long way in making the transition smooth and keeping your supplier relationships strong.

5. Go Live, Then Monitor and Optimise

Flipping the switch is just the beginning. The first few weeks after going live are your chance to see how the system performs in the real world. Use the platform's reporting tools to track your progress against the goals you set back in step two. Are invoice processing times actually down? How are the approval cycles looking? Are you seeing the cost savings you expected?

The data will show you where you can make things even better. Maybe an approval workflow needs a small tweak, or a few people need a bit more training on a specific feature. This cycle of continuous monitoring and refining is what ensures you get the absolute best return on your investment in supplier payment automation.

The Future of Payments and How Zaro Is Leading

The world of B2B payments is on the brink of a major shift. While getting your current processes automated is a huge win for efficiency, the real future is about embracing the new ways people and businesses actually want to handle money. The convenience and security of digital wallets or instant mobile payments aren't just for consumers anymore—they're setting a new standard for business-to-business transactions.

Think about it. There's a huge difference between how you pay for a coffee and how your business pays a supplier invoice. The future of supplier payment automation is all about closing that gap, making B2B payments feel as simple and instant as tapping your phone. We're moving beyond traditional EFTs into a more connected, real-time financial world.

For businesses in South Africa, this isn't some far-off trend; it's happening right now. Technologies that power instant, secure, and mobile-first payments are becoming the backbone of modern commerce. The companies that get on board first will have a serious competitive edge.

Embracing Next-Generation Payment Methods

The next wave of payment technology is all about bringing consumer-grade simplicity into the corporate space. It’s about meeting your suppliers where they are and giving them the payment options they already use and trust every day.

This evolution centres on a few key technologies:

- Digital Wallets: Platforms like Apple Pay, Samsung Wallet, and Google Pay are no longer just for personal use. Bringing them into B2B payments cuts out unnecessary steps and adds a strong layer of biometric security.

- Request-to-Pay (R2P): This brilliant tech flips the old payment model on its head. Instead of you pushing a payment out, a supplier sends a secure request. All you have to do is approve it with a click, and the transfer happens instantly.

- Instant Bank-to-Bank Transfers: Forget slow, batch-based EFTs. Direct, real-time transfers are becoming the norm, especially for urgent or high-value payments.

These aren't just small tweaks to the system. They represent a complete rethink of how money moves between businesses, with a new focus on speed, security, and a great user experience.

The core idea is simple: the easier you make it for suppliers to get paid, the stronger your business relationships become. This move away from a rigid, one-size-fits-all payment run towards a flexible, multi-option approach is what separates a future-ready finance team from the rest.

How Zaro Puts Your Business Ahead

At Zaro, we don't just watch these trends from the sidelines—we build our platform around them. We get that modern supplier payment automation means giving you the tools to succeed today while also getting you ready for what's coming next. Our mission is to give South African businesses direct access to the most advanced payment technologies out there.

This forward-thinking approach is baked right into our platform. Zaro actively supports integrations with leading digital wallets and makes instant, secure bank-to-bank transfers possible. Here in South Africa, the adoption of these methods is picking up speed. For example, the 'PayShap Request' platform enables instant request-to-pay transactions, and the use of digital wallets for business is growing fast.

One study found that after Apple Pay launched, 20% of all card transactions moved to the new method almost immediately, and payment conversion rates jumped from 77% to 94%. You can get more insights on how South Africa's payment ecosystem is changing on Stitch.money.

By bringing all these capabilities together on a single, secure platform, Zaro makes sure your business isn't just keeping up—it's setting the pace. We provide the enhanced convenience and efficiency that modern enterprises in South Africa need to thrive.

Frequently Asked Questions

Switching up how you handle payments is a big decision, and it’s natural to have questions. Getting clear on the common concerns around supplier payment automation can help you see the path forward and feel good about the benefits for your business, your team, and your partners.

Is Supplier Payment Automation Only For Big Companies?

Not anymore. While massive corporations were the early adopters, today’s cloud-based tools are built to be affordable and scalable for small and medium-sized businesses (SMEs) too. The boost in efficiency, reduction in errors, and tighter financial control are just as valuable, if not more so, for a growing business.

Many platforms now offer flexible pricing plans. This means you can start with the essential features you need right now and add more capabilities as your company expands. It’s an investment that makes sense at every stage.

How Secure Is It, Really?

This is probably one of the most important questions, and rightly so. The truth is, a good automation platform is almost always more secure than old-school manual processing. These systems are designed from the ground up with multiple layers of security.

Think of it like this:

- End-to-end data encryption scrambles your sensitive information so it can't be intercepted.

- Secure cloud hosting with regular backups means your data is safe and recoverable.

- Role-based access controls ensure your team members can only see and do what’s necessary for their job.

- Detailed, unchangeable audit trails log every single action, creating a permanent record.

Beyond just protecting data, automation is a powerful defence against fraud. It can automatically spot duplicate invoices, enforce spending rules, and stick to strict approval workflows. This drastically cuts down the risk of both internal fraud and simple, but costly, human error.

Will Our Suppliers Struggle With a New System?

It’s a valid concern, but most modern platforms are designed with the supplier experience in mind. The best systems include a free and intuitive supplier portal.

This is a game-changer for your vendors. They get a secure place to upload invoices, check on a payment's status in real-time, and even update their own banking details. This self-service ability is usually a huge win for suppliers. It gives them the clarity and control they want, which means far fewer phone calls and emails chasing your accounts payable team for updates. A good rollout plan always includes clear communication to get suppliers on board and show them how it makes their lives easier, too.

Ready to see how fast, secure, and transparent your global payments can be? Zaro gives South African businesses the power to pay suppliers using real exchange rates, with no hidden fees.

Discover a smarter way to manage your international payments with Zaro