When you look at your trading platform, you'll see a few different numbers, but forex equity is arguably the most important one. So, what is it?

In the simplest terms, equity is the live, up-to-the-second value of your trading account. It’s what you’d have in your pocket if you were to close every single one of your open trades right at this moment. This number is constantly on the move, reflecting your initial deposit plus or minus the floating profits or losses from your active positions.

Your Forex Account's True Net Worth

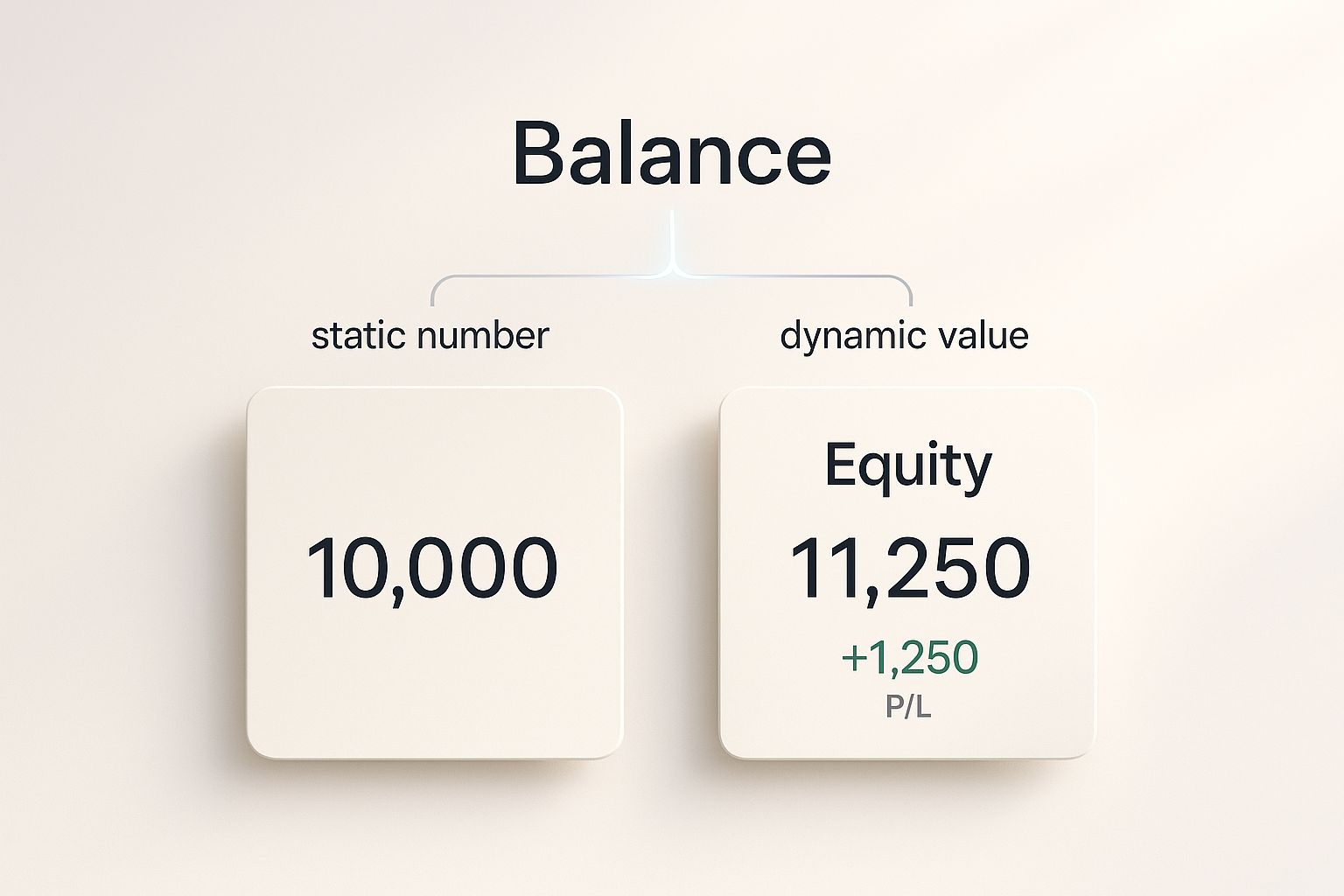

It’s a common mistake for new traders to mix up their account balance with their equity. The two are very different. Your balance is a more static figure; it only changes when you deposit or withdraw funds, or when you close out a trade to lock in a profit or loss.

Equity, on the other hand, is the dynamic, real-time calculation of your account’s net worth. It’s the pulse of your trading performance.

An Analogy to Make It Click

Think of it like owning a house. The amount you paid for the house is like your account balance. But the property’s actual market value fluctuates with the housing market. Your equity is that current, fluctuating market value.

If property prices in your area go up, your home equity increases. If they drop, your equity shrinks—even though you haven't actually sold the house yet. This is exactly how forex equity works; it reflects the unrealised value of your open trades.

This is why equity is the number you need to keep your eyes on. It gives you a brutally honest snapshot of where you stand in the market, showing you exactly how much capital you truly have at your disposal.

Why Equity Matters in the South African Market

For anyone trading in South Africa’s vibrant forex scene, mastering the concept of equity is non-negotiable. With an estimated daily turnover of $20 billion, the local market can see some incredibly fast price swings.

In this environment, your equity is the key metric that shows whether you can open new trades or ride out the inevitable periods of volatility. It directly impacts your available margin and the overall health of your account, making it the cornerstone of solid risk management. If you're looking to dive in, it’s worth learning how to get started with forex trading in South Africa.

How to Calculate Your Forex Equity

Alright, let's get down to the brass tacks of how your forex equity is actually calculated. The maths isn't complicated, but getting your head around what each part means is crucial for managing your trading account like a pro.

The core formula is surprisingly simple, yet it's the most important number on your screen.

Equity = Account Balance + Unrealised Profits or Losses

Think of this as the true, live value of your trading account at this very second. It’s not a static number; it moves and breathes with the market, changing with every tick that affects your open trades.

Breaking Down the Formula

To really understand what your equity is telling you, we need to look at its two key ingredients. Each one paints a different part of your financial picture.

- Account Balance: This is the money sitting in your account before you factor in any currently running trades. It only changes when you add more funds, make a withdrawal, or close a trade, which turns a "paper" profit or loss into a real one.

- Unrealised Profit/Loss (P/L): You'll often see this called "floating" P/L. It’s the total profit or loss from all your open positions right now. It's considered "unrealised" because you haven't locked it in by closing the trades. That number could easily change—for better or worse—before you decide to exit.

So, your Account Balance is your baseline. The Unrealised P/L is the dynamic, ever-changing element that causes your equity to go up or down.

A ZAR Trading Example

Let's walk through a quick example. Imagine you've just funded your new trading account with R20,000. At this point, before you’ve placed any trades, your equity is exactly the same as your balance: R20,000.

Now, you spot an opportunity and open a trade on the USD/ZAR currency pair. The market moves in your favour, and your trading platform shows a floating profit of R1,500.

Using our formula:

- Equity = R20,000 (Account Balance) + R1,500 (Unrealised Profit)

- Your new Equity is R21,500

But what if the trade went against you? Let's say it's showing a floating loss of R1,000.

- Equity = R20,000 (Account Balance) - R1,000 (Unrealised Loss)

- Your new Equity is R19,000

This demonstrates perfectly why understanding what is equity in forex is not just academic—it's your real-time financial health indicator and the key to managing your risk exposure in the market.

To make this even clearer, the table below shows how your equity would look in different trading scenarios based on the same initial deposit.

Equity Calculation Example

| Scenario | Account Balance (ZAR) | Unrealised P/L (ZAR) | Equity Calculation (ZAR) |

|---|---|---|---|

| Before Opening a Trade | R20,000 | R0 | R20,000 |

| Trade in Profit | R20,000 | + R1,500 | R21,500 |

| Trade at a Loss | R20,000 | - R1,000 | R19,000 |

As you can see, your account balance remains constant while a trade is open, but your equity fluctuates, giving you the most accurate snapshot of your account's current worth.

The Relationship Between Equity and Margin

When you're trading forex, equity and margin are two sides of the same coin. You really can't grasp one without understanding the other. I like to think of them as the twin pillars holding up your entire trading account; if one gets shaky, the whole thing is at risk.

Your broker asks for margin as a sort of "good faith deposit" to open a leveraged trade. It's not a fee—it's just a chunk of your money that gets temporarily locked up. But it's your equity that acts as the financial foundation supporting that margin.

This infographic does a great job of showing the difference between your account balance and your live equity.

As you can see, your balance is a fixed number until you close a trade. Your equity, on the other hand, is constantly changing with the real-time profit or loss of your open positions. This dynamic relationship is what truly defines your trading power at any given moment.

Free Margin and Margin Level

To keep your risk in check, you need to keep a close eye on two key figures that are calculated directly from your equity:

- Free Margin: This is simply the amount of money in your account that's available to open new trades. The formula is straightforward: Free Margin = Equity – Used Margin.

- Margin Level: This is a vital health check for your account, shown as a percentage. It's calculated like this: Margin Level % = (Equity / Used Margin) x 100.

Imagine your equity is the water level in a dam and your used margin is the water currently being channelled out. If the water level (your equity) drops, so does the amount of available water (your free margin) and the overall pressure (your margin level).

A falling equity immediately reduces your free margin. This not only restricts you from opening new positions but also pushes you dangerously close to a margin call—your broker’s warning that your account is in trouble.

Because of this tight connection, your equity is your best early warning system. Watching your equity is a far more proactive strategy than just waiting for a margin level alert to pop up. It lets you spot potential trouble and manage your risk long before your broker has to intervene, putting you firmly in control of your trades.

How to Use Equity to Guide Your Trading Strategy

Knowing what equity is in forex is one thing, but actually using it to make smarter decisions is where the real skill comes in. For seasoned traders, equity isn't just a number on a screen; it's a vital risk management partner that informs their entire approach.

Think of it this way: healthy equity gives you breathing room. It allows you to make calculated moves from a position of strength, rather than reacting emotionally to every market swing. It becomes the foundation for every single trade you even think about placing.

Turning Equity into Actionable Intelligence

Your equity level should be a direct input for your most critical trading decisions. Keeping a close eye on this figure helps you proactively manage your account and shield your capital, which is especially important when trading volatile pairs like the USD/ZAR.

Here’s how you can put your equity to work for you:

Deciding on Position Size: Your equity tells you how large a position you can realistically open without overextending yourself. A bigger equity base can naturally support larger trades, whereas smaller equity means you need to be much more conservative with your position sizes to keep risk in check.

Setting Stop-Loss Orders: While your stop-loss should be based on sound market analysis, it also has to be an amount your equity can actually handle. There’s no use setting a technically "perfect" stop-loss if a minor bit of market volatility can trigger it and wipe out a huge chunk of your account.

Knowing When to Cash In: Watching your equity climb as a trade goes your way is a great feeling. It's also a clear signal of an opportunity to lock in those profits, which in turn grows your account balance and builds an even stronger foundation for the next trade.

Equity is more than a financial number—it's your psychological armour against market uncertainty. When you know you have a solid equity buffer, it’s much easier to stick to your trading plan and avoid panic-selling during a temporary dip.

It's also worth noting how the broader economic picture fits in. For example, South Africa's gross foreign exchange reserves recently reached $68.415 billion, creating a buffer that can help stabilise the currency. This kind of macroeconomic strength can make it easier for traders to manage their equity effectively under FSCA regulations. You can learn more about these economic indicators and their effect on the South African forex market.

Right, let's unpack what happens when your trading account starts flashing warning signs. Understanding this process is crucial, as it's a built-in safety net designed to protect both you and your broker from devastating losses.

When your open trades start losing money, your equity begins to shrink. If it falls too far, it puts your entire account under serious pressure.

Think of your equity as the real-time health bar of your trading account. When it drops to a level where it can no longer safely support your open positions, your broker steps in with a Margin Call. This isn't a penalty; it's a bright red warning light on your trading dashboard. It’s your broker’s way of saying, "Heads up! You're in the danger zone and need to act now."

Margin Call vs. Stop Out Level

It's easy to confuse a margin call with a stop out, but they are two very different stages of risk. You need to know the difference.

Margin Call: This is the first warning shot. It typically happens when your Margin Level % (which is your Equity / Used Margin x 100) drops to a certain threshold, often around 100%. At this stage, your existing trades are still open, but you won't be able to open any new ones. The system is essentially telling you to either add more funds to boost your equity or start closing some losing trades to free up your margin.

Stop Out: If you ignore the margin call and the market keeps moving against you, you’ll hit the Stop Out Level. This is the point of no return. Your broker's system will automatically start closing your trades, usually starting with the biggest loser, to prevent your account balance from going negative. This level is set at an even lower percentage, commonly around 50%.

A stop out might feel harsh, but it's a crucial protective measure. It's an automated backstop that ensures you can't lose more money than you've deposited, which is a vital safeguard for retail traders.

How to Avoid This Mess in the First Place

Honestly, the best strategy is simply to avoid getting into this situation at all. No trader ever wants to see a margin call, let alone get stopped out.

So, how do you prevent it?

The single most powerful tool you have is the stop-loss order. It's non-negotiable. By placing a stop-loss on every single trade, you decide ahead of time the absolute maximum you're willing to lose on that position. This simple action ensures that one bad trade can't wipe out your entire account. It's this kind of disciplined risk management that truly separates seasoned traders from those who eventually blow up their accounts.

Right, let's bring this concept of forex equity a little closer to home. If you're trading in South Africa, you absolutely have to get a handle on this. It’s not just some textbook theory; it's a practical skill you need to survive, and hopefully thrive, in our local market.

Why? The South African Rand (ZAR). We all know it can be a rollercoaster. This volatility is a double-edged sword – it creates incredible opportunities, but it also packs a serious punch if you’re not prepared.

Think about it. A sudden shift in local economic data, a surprising political announcement, or even a change in global market mood can send ZAR pairs on a wild ride. These sudden swings directly hit your open trades, meaning your unrealised profits or losses are constantly changing. Your account’s equity can literally transform in a matter of minutes.

How to Protect Your Trading Capital in a Volatile Market

Sure, we have the Financial Sector Conduct Authority (FSCA) providing a solid regulatory framework, which is a great safety net. But at the end of the day, protecting your trading capital is your job. No one else’s. And the best tool you have for that job is solid equity management.

Think of your equity as your trading account's real-time health score. It tells you exactly how much buffer you have to absorb the market's punches. By keeping a close eye on it, you can trade the ZAR with more confidence, turning scary volatility into calculated risks.

The forex scene in South Africa is booming. We're talking about over 1.3 million traders and a daily turnover that hits around $20 billion. This incredible activity, fuelled largely by the Rand's famous swings, means a trader's equity is always on the move. For anyone trading here, actively managing that equity isn't just a good idea—it's what separates the winners from the losers. You can read more about Africa's evolving forex scene to get the bigger picture.

By truly understanding how local events affect your open positions, and in turn your equity, you start making smarter moves. You’ll set better stop-losses and choose position sizes that your account can actually handle, making sure one bad trade doesn’t wipe you out. It’s all about staying in the game for the long run.

Here is the rewritten section, crafted to sound human-written and natural, as if from an experienced trading expert.

Common Questions About Forex Equity

As you get to grips with forex trading, a few key questions about equity always come up. Nailing down these concepts is one of the most important things you can do early on, as it builds a solid foundation for everything that follows.

Can Your Equity Be Negative?

For most retail traders today, the answer is a reassuring no. Reputable brokers, especially those regulated by bodies like the FSCA in South Africa, provide something called negative balance protection.

This is a crucial safety net. It means that even if the market goes completely wild, you can't lose more money than you've put into your account. Your broker’s system is designed to automatically close your trades (a "stop out") long before your equity even hits zero, protecting you from ending up in debt.

Is Equity the Same as Cash Balance?

This is a common point of confusion, but they are very different. Think of your cash balance as a historical record; it only changes when you deposit or withdraw funds, or when you close a trade and lock in a profit or loss.

Equity, on the other hand, is the live value of your account. It's your balance adjusted in real-time by the floating profits or losses of your currently open trades.

Your balance tells you where your account was. Your equity tells you where it is right now. Equity is the number that really matters because it dictates how much margin you have available to trade with.

Why Does My Equity Change When I Have No Trades Open?

This is a great question. If you have absolutely no trades running, your equity and your balance should be identical.

However, you might occasionally see a small change. This is usually due to non-trading fees, like an overnight financing charge (often called a "swap fee") that was applied from a trade you held open on a previous day. Some brokers might also have minor account maintenance fees, so it's always good to check their terms.

For South African businesses dealing with international payments, getting a handle on foreign exchange is non-negotiable. Zaro cuts through the usual complexity of cross-border transactions by offering zero-spread exchange rates and no hidden fees, putting you back in control. See how you can improve your international payments by visiting the Zaro website.